GBPUSD trade ideas

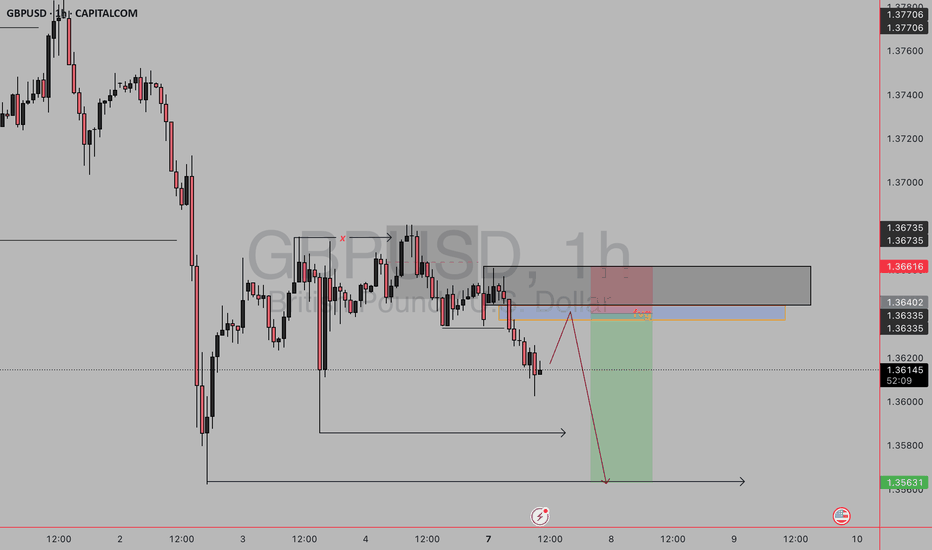

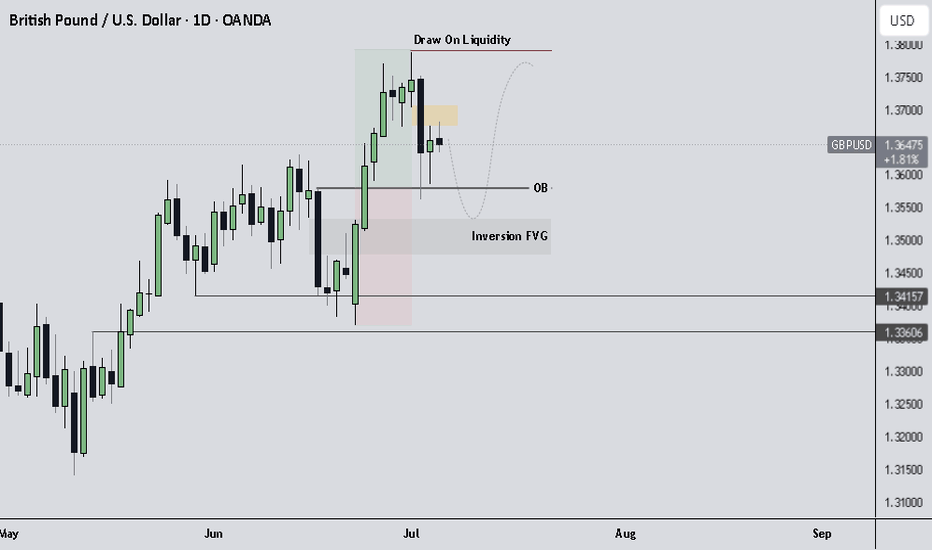

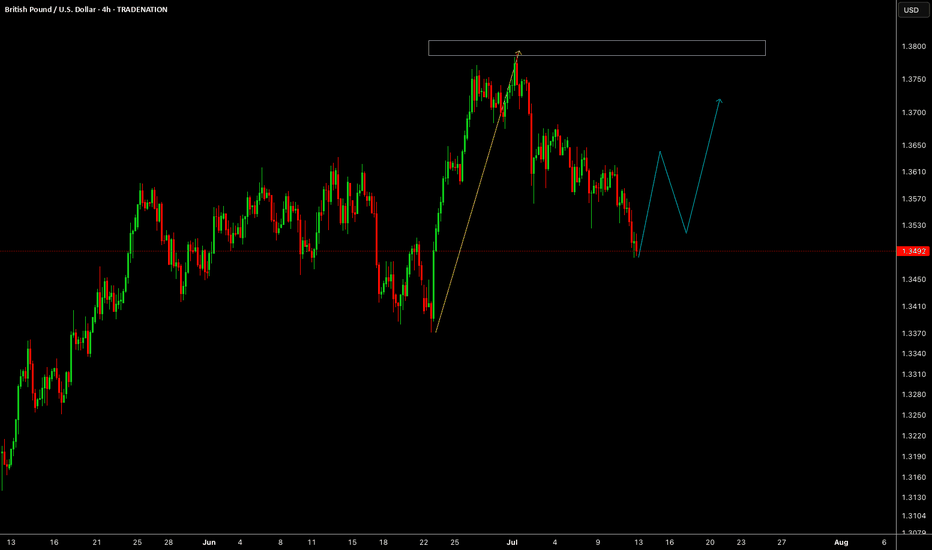

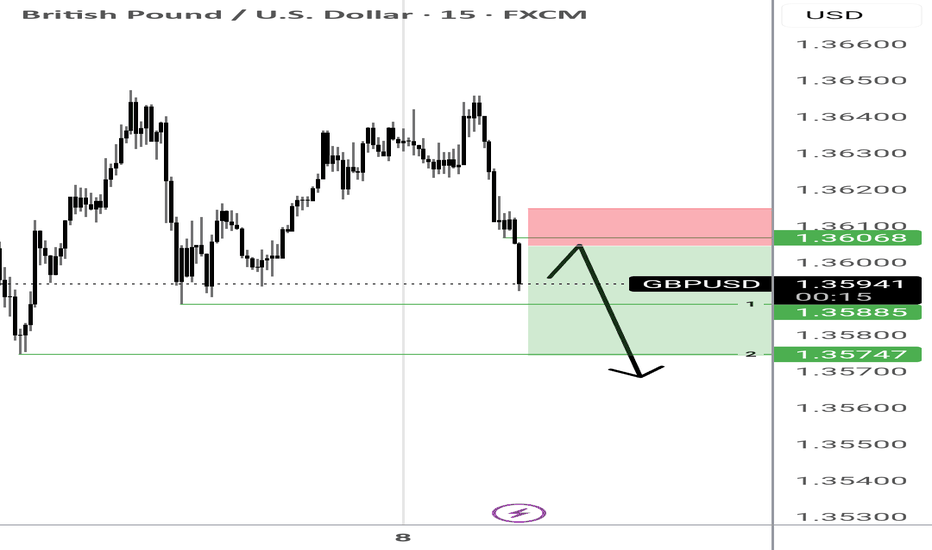

gbpusd sell setup🧠 Setup Summary:

You're anticipating a retracement into a supply zone (marked by the grey box) which contains a Fair Value Gap (FVG) before continuing the bearish move.

🧩 Key Components:

Supply Zone (Grey Box):

A previously mitigated zone where price dropped aggressively.

Likely institutional sell orders remain there.

Fair Value Gap (Orange Zone):

Price moved away fast and left an imbalance.

Your expectation: Price will return here, fill it, and then drop.

Entry Plan:

Sell when price taps into FVG or upper supply zone around 1.36420 – 1.36616.

Confirmation could be a bearish engulfing, liquidity sweep, or BOS on LTF.

Stop Loss: Above the supply zone — around 1.36680.

Take Profit (TP): A major low, likely 1.35631.

Risk-Reward: Strong RR (likely 1:3+), in line with institutional-style trading

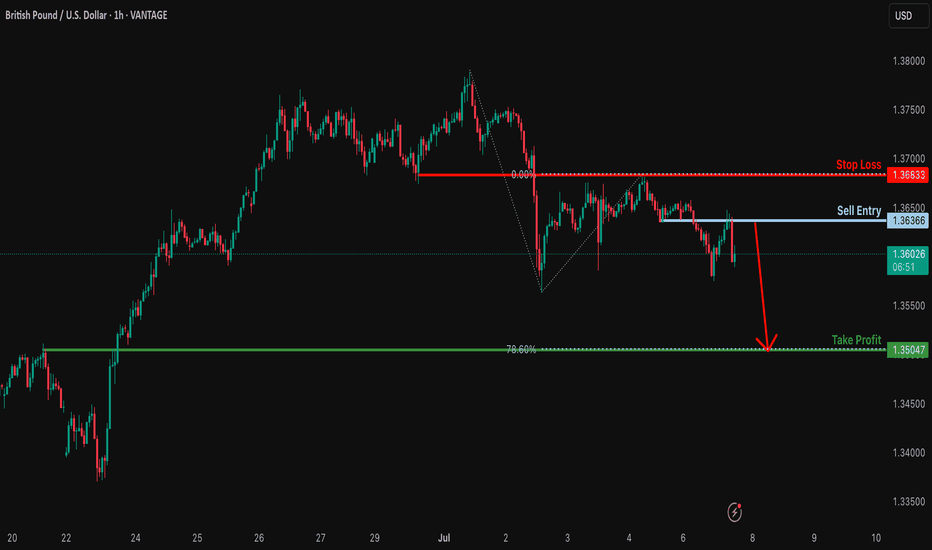

Bearish drop?GBP/USD has rejected off the resistance level which is a pullback resistance and could drop from this level to our take profit.

Entry: 1.3636

Why we like it:

There is a pullback resistance.

Stop loss: 1.3683

Why we like it:

There is a pullback resistance.

Take profit: 1.3604

Why we like it:

There is a pullback support level that aligns with the 78.6% Fibonacci projection.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Ready to Ride the Wave? Let’s Go Long — Together.Market momentum is shifting — and opportunity awaits. This is more than a bullish move; it’s your moment to elevate your trading game. Whether you're just starting or refining your edge, clarity and confidence are key.

If you’re tired of second-guessing setups and want guidance that brings structure and consistency to your trades, now’s the time to level up. I help traders align with the market, build smart systems, and take charge of results — no fluff, just precision.

🚀 Tap into growth with mentorship that works. Let’s go long — on your potential.

#tradingview #forexmentor #buysetup #tradingeducation #marketmomentum #consistencyiskey

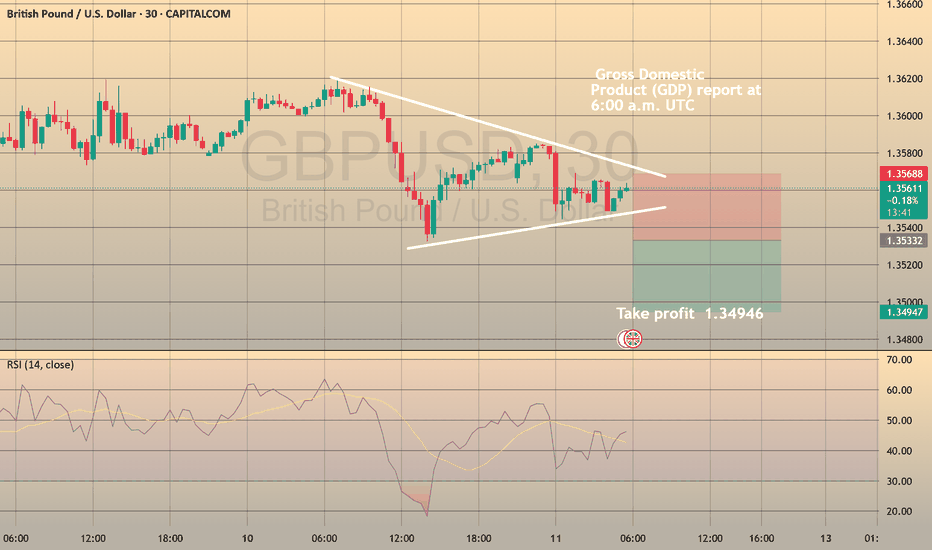

U.K. GDP Report: What It Means for GBPUSD CMCMARKETS:GBPUSD

Today, the U.K. Office for National Statistics (ONS) 📊 will release its monthly Gross Domestic Product (GDP) report 🗓️ at 6:00 a.m. UTC ⏰, likely impacting the British Pound (GBP) and GBP pairs globally 🌍.

🧐 What is GDP, and why does it matter?

GDP (Gross Domestic Product) 💡 measures the total value of all goods and services produced within a country’s economy over a specific period. It is a key indicator of economic health 🏥, influencing central bank decisions, investor sentiment, and currency valuations.

A higher-than-expected GDP 🆙 suggests a strong economy, which can support the currency 💪, while a lower-than-expected GDP 🆘 indicates weakness, often pressuring the currency lower 🔻.

📈 Market Expectations:

The market forecasts UK GDP growth to rise by 0.1% for May 🗓️, but we anticipate the increase may be smaller than expected 📉, implying a potential bearish surprise for GBPUSD.

⚡️ Trade Setup:

🔻 SELL Stop: 1.35330

❌ Stop Loss: 1.35714

✅ Take Profit: 1.34946

Risk-reward ratio: 1:1 ⚖️

🚨 Why Sell Here?

🔸 A weaker-than-expected GDP could lead to a pullback in GBPUSD below 1.3500 🚦.

🔸 Technical levels align with potential downside opportunities.

🔸 Volatility expected during and after the data release — manage risk carefully! ⚠️

📌 Stay tuned for live updates and analysis following the data release!

💬 Support this post if it helps your trading decisions! 🔔

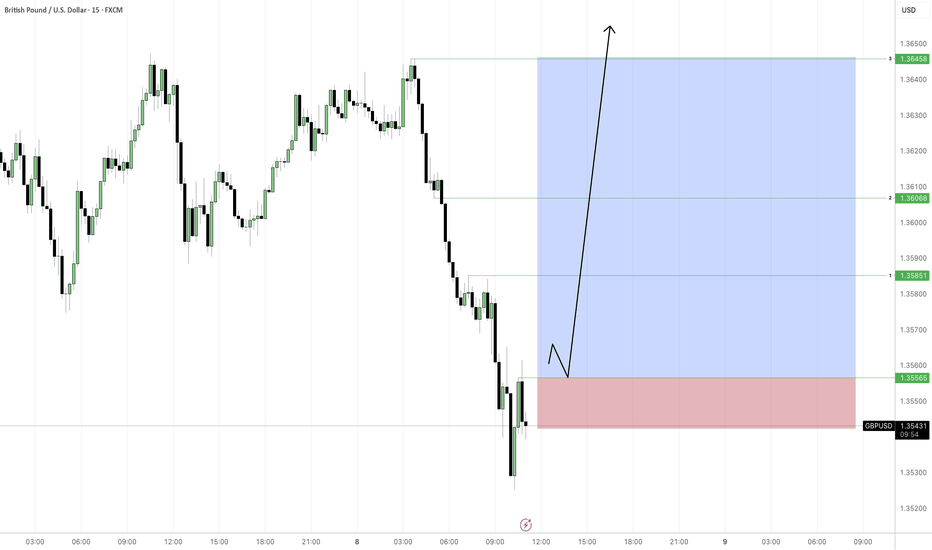

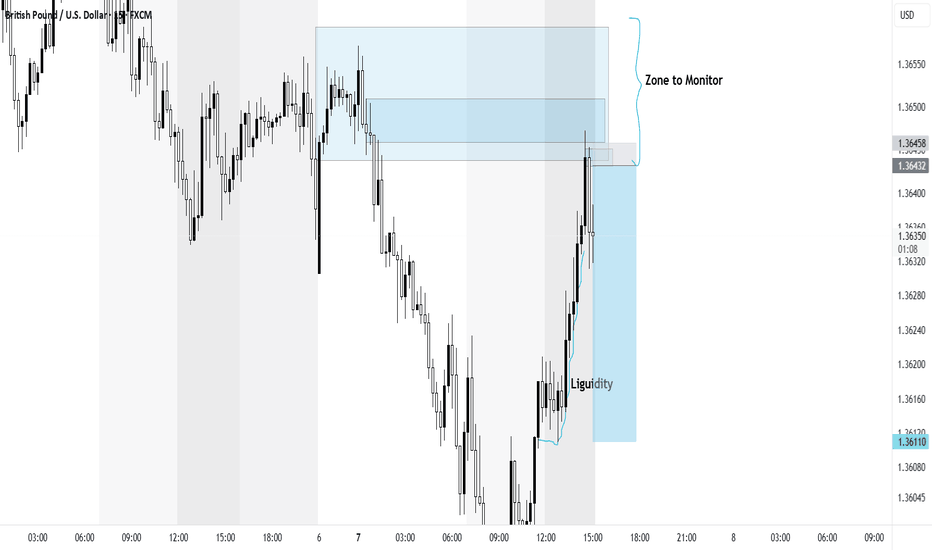

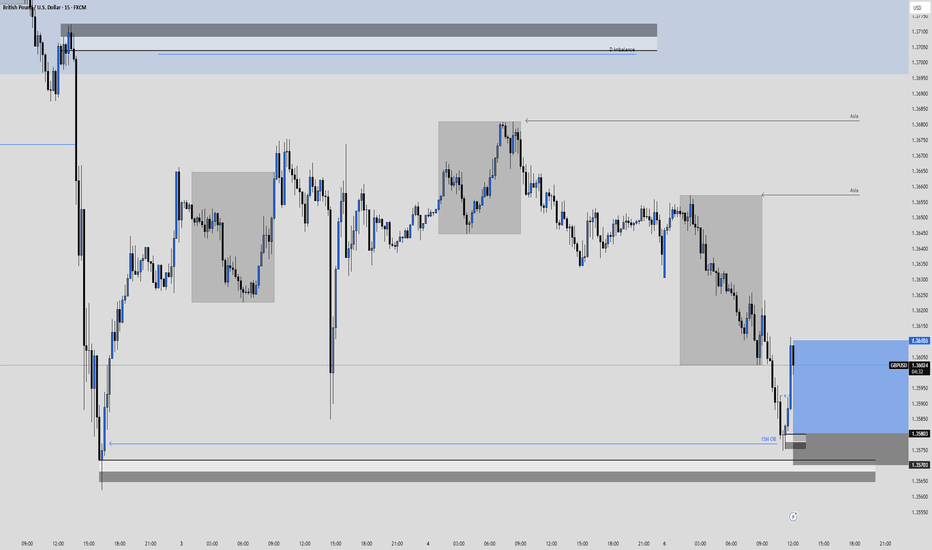

GBPUSDSo we have the liquidity from both sides we have to look on LTF what market is doing especially on That Zone i have marked we are transitioning into the New York time zone we can expects a 30 pip reversal or more as also London time is about to get over

But if it breaks above that zone and grabs liquidity we will look for SMS (shift in market structure on lower TF) otherwise its bearish

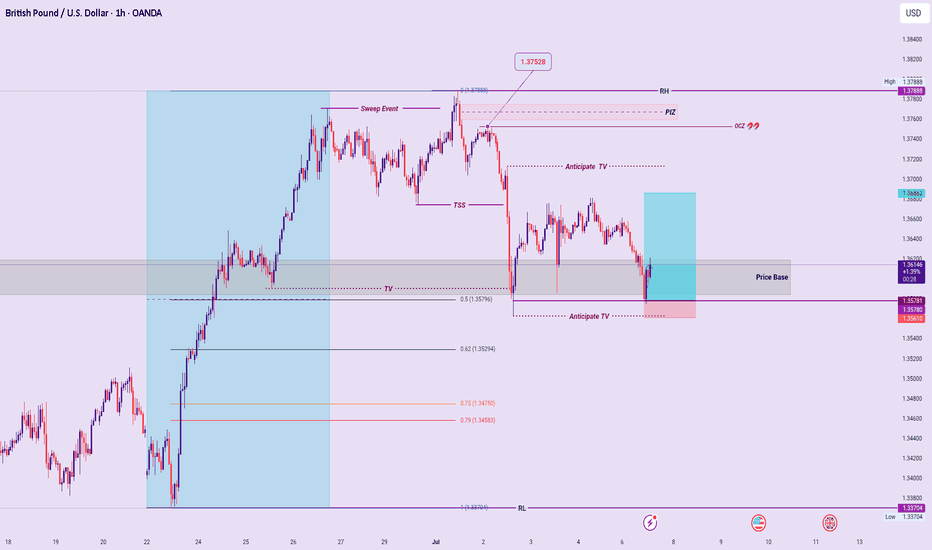

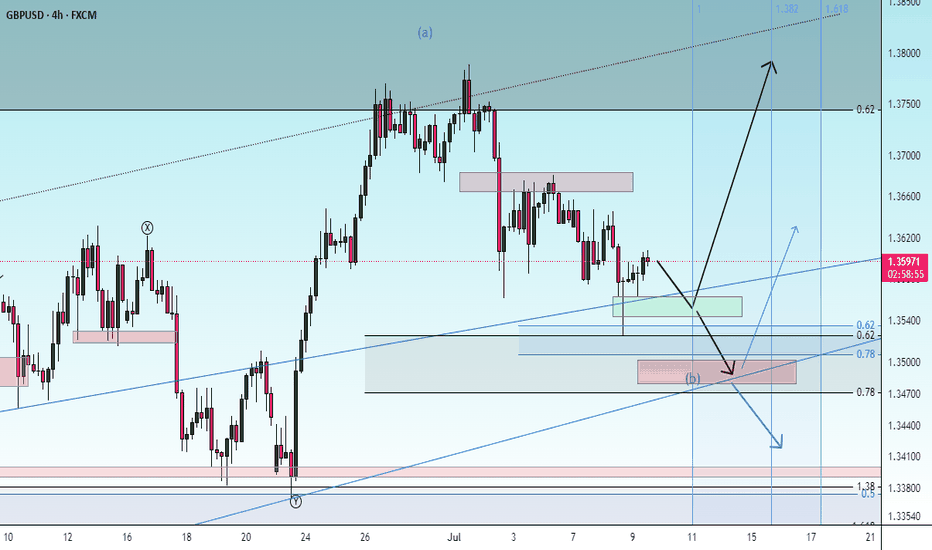

GBPUSD Outlook.Multi-Timeframe Context

Weekly Timeframe

Price is currently sitting on a weekly bullish Order Block (OB).

This higher timeframe demand zone provides the foundation for my bullish bias.

As long as price holds above this OB, I expect continuation to the upside.

🔹 Daily Timeframe

Dropping down to the Daily, we are currently hovering near the 50% level of the Daily dealing range.

Between 01/07/2025 and 03/07/2025, a clear Sell-side Imbalance Buy-side Inefficiency (SIBI) was formed.

This SIBI may act as a short-term bearish pressure, likely to cause a retracement.

📉 Short-Term Expectation

Expecting price to retrace lower, possibly into the midpoint of the Daily bullish OB, which aligns neatly with the Inversion Fair Value Gap (IFVG).

This would create a premium-to-discount transition, ideal for reaccumulation before a continuation move higher.

🔁 Support Array

Weekly OB = long-term bullish demand.

Daily OB midpoint + IFVG confluence = key re-entry or continuation area.

Watching for bullish confirmation once price rebalances through SIBI and taps deeper into discount.

🎯 Target Remains

Draw on Liquidity above 1.37800.

Ultimate target: 1.4000 psychological + structural level.

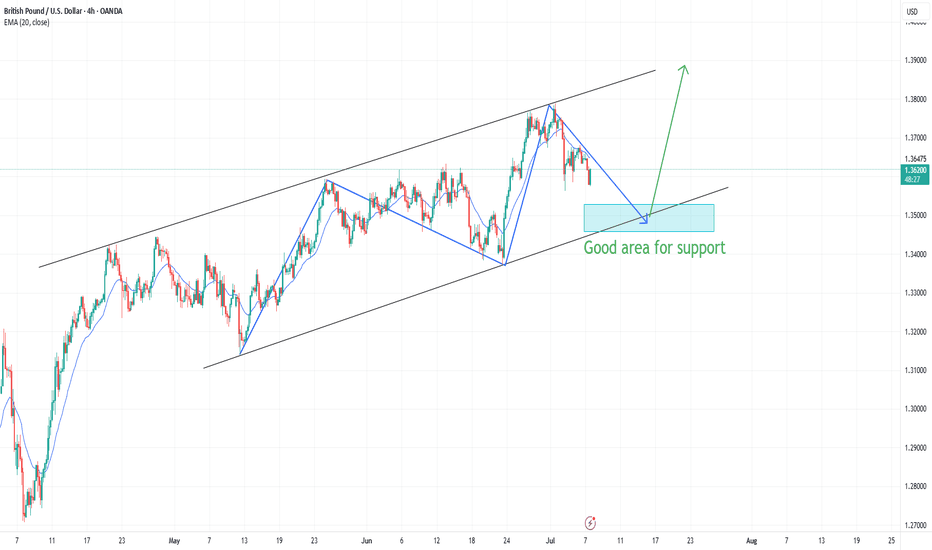

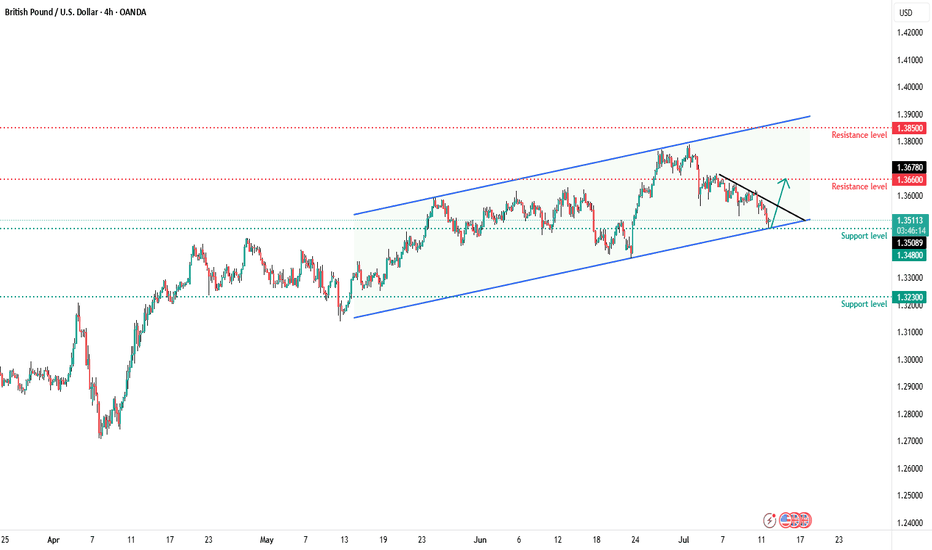

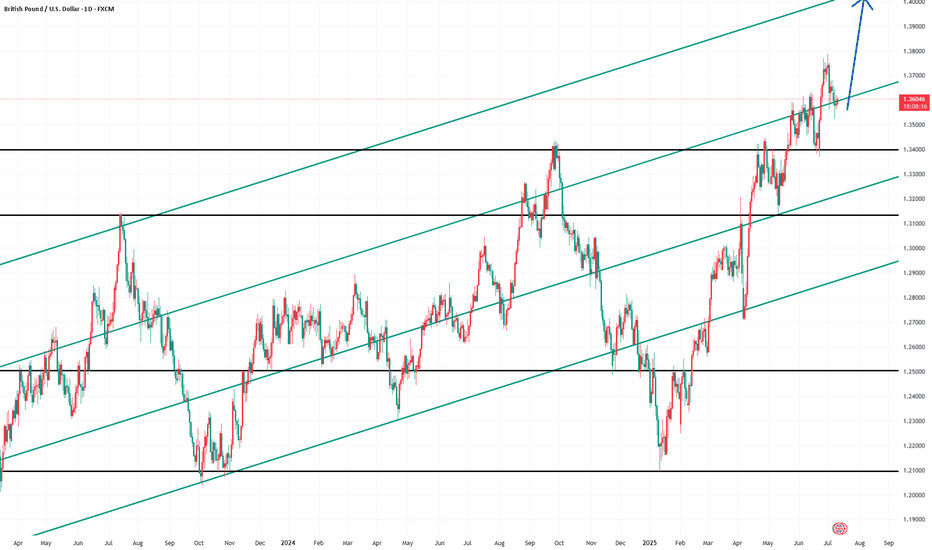

GBPUSDThe main ascending channel ranges between 1.3480 and 1.3880

A smaller rising channel was broken, previously ranging between 1.3620 and 1.3850

📌 Support Levels:

1.3480 (main channel bottom)

1.3400 (previous swing low)

1.3230 (major structural support)

📌 Resistance Levels:

1.3660 (short-term resistance)

1.3850 (channel top)

1.4000 (psychological level)

📈 Expected Move:

Price is currently testing the lower boundary of the main ascending channel. If a bounce occurs from 1.3480, the next upside target is likely 1.3660. A strong breakout above that could aim for 1.3850.

GBPUSD TECHNICAL & ORDER FLOW ANALYSISOur analysis is based on a multi-timeframe top-down approach and fundamental analysis.

Based on our assessment, the price is expected to return to the monthly level.

DISCLAIMER: This analysis may change at any time without notice and is solely intended to assist traders in making independent investment decisions. Please note that this is a prediction, and I have no obligation to act on it, nor should you.

Please support our analysis with a boost or comment!

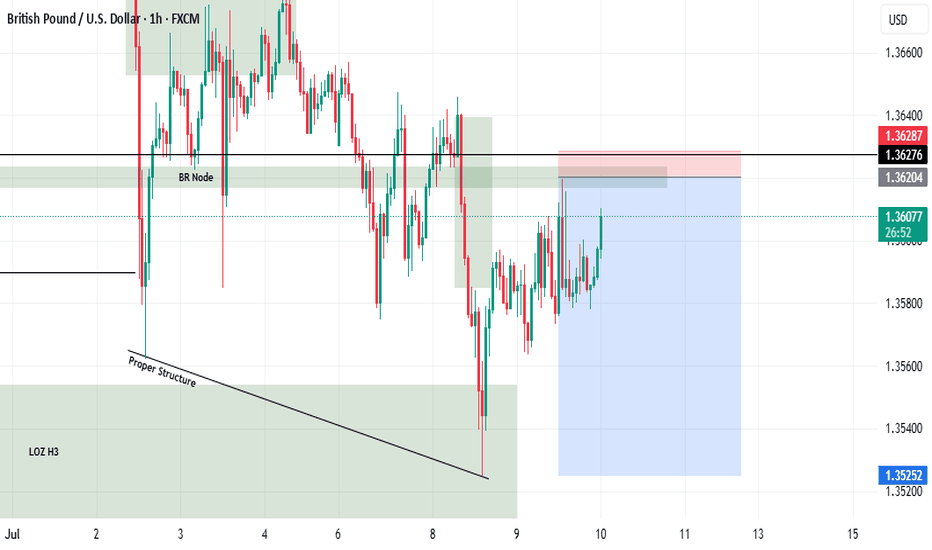

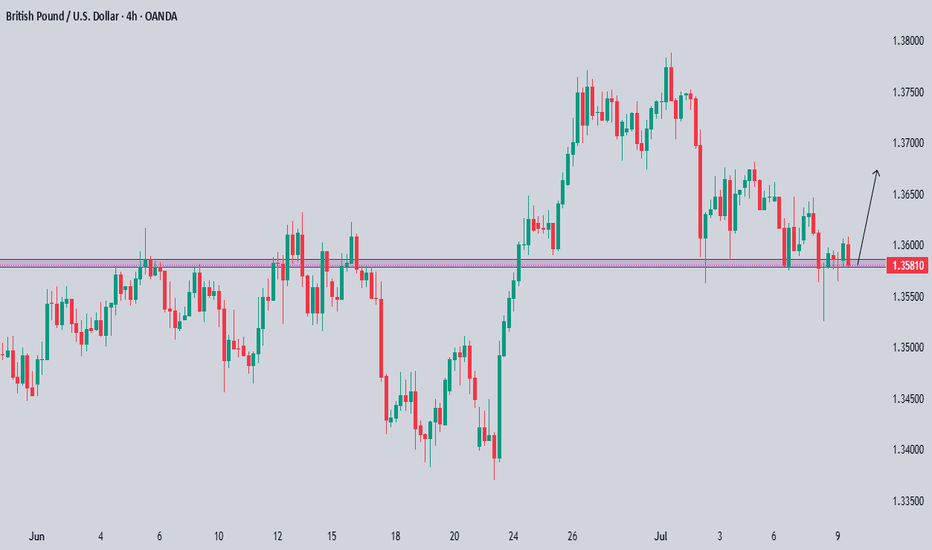

GBPUSD Long Re-entry, 07 JulyAsia Fill & Volume-Based Setup

This is a momentum-driven long based on Asia Fill and a strong bullish shift on LTF, with clear DXY correlation. HTF doesn't offer major confluence, but intraday price action supports the idea.

📍 Entry: Waiting for a retest of the 5m OB left behind after a strong bullish move

📈 Confluence: 1m BOS + 15m Extreme OB + high buyer volume

🔁 Risk: Price may not return to 5m OB – if missed, it's a no-trade

🎯 Target: Asia high (but first 1:3 RR), quick BE if we catch the move

Clean setup with structure and volume in our favor – execution depends on retest.

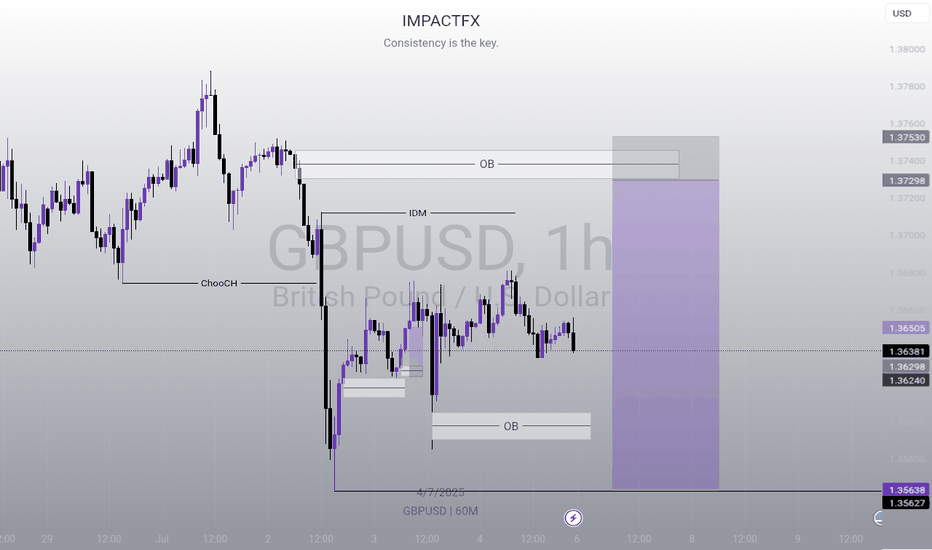

GBPUSD: Bullish Continuation & Long Signal

GBPUSD

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy GBPUSD

Entry - 1.3503

Stop - 1.3453

Take - 1.3608

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

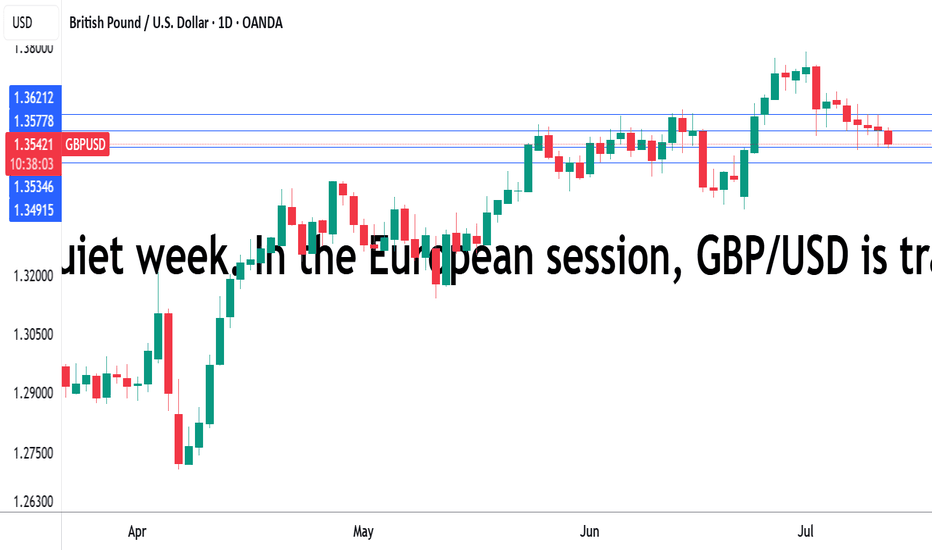

UK GBP contracts, pound dipsThe British pound continues to have a quiet week. In the European session, GBP/USD is trading at 1.3530, down 0.30% on the day.

The UK wrapped up the week on a down note, as GDP contracted in May by 0.1% m/m. This followed a 0.3% decline in April and missed the consensus of 0.1%. The decline was driven by a 1% decline in manufacturing and a 0.6% contraction in construction, which cancelled out a 0.1% expansion in services.

The GDP contractions in April and May point to a weak second quarter of growth, after an impressive 0.7% gain in the first quarter. The economic landscape remains uncertain and the Bank of England has projected weak growth of 1% for 2025. Governor Bailey has said that the rate path will be "gradually downwards" but hasn't hinted as to the timing of the next cut.

The weak GDP data supports the case for an August rate cut, even though headline inflation is running at 3.4% and core inflation at 3.5%, well above the BoE's target of 2%. The money markets have priced in a quarter-point cut in August at 80%, which would lower the cash rate to 4.0%.

The BoE released its financial stability report earlier in the week, noting that the outlook for UK growth over the coming year is "a little weaker and more uncertain". The Bank highlighted President Trump's tariffs and the conflict in the Middle East. The UK has recently signed a trade deal with the US but some tariffs on UK products remain in effect.

GBP/USD is testing support at 1.3534. Below, there is support at 1.3491

The next resistance lines are 1.3577 and 1.3620

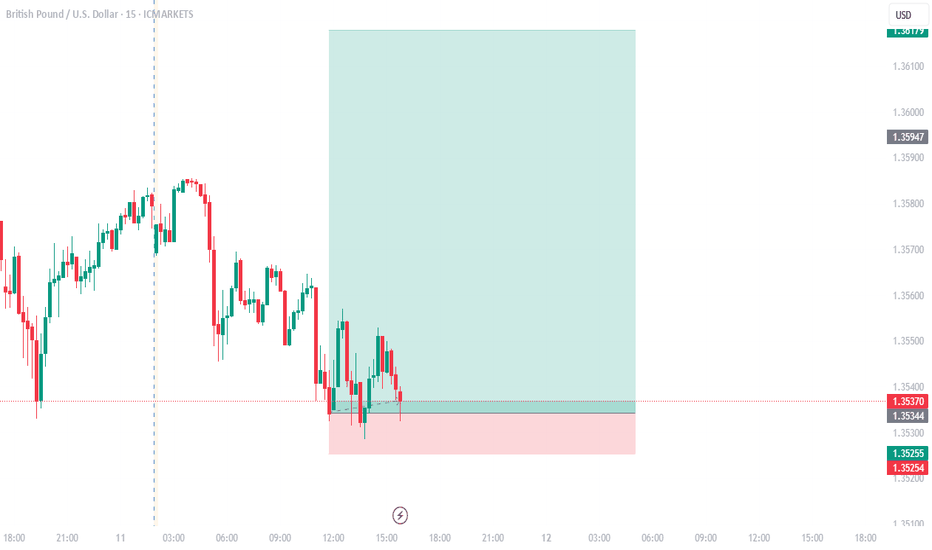

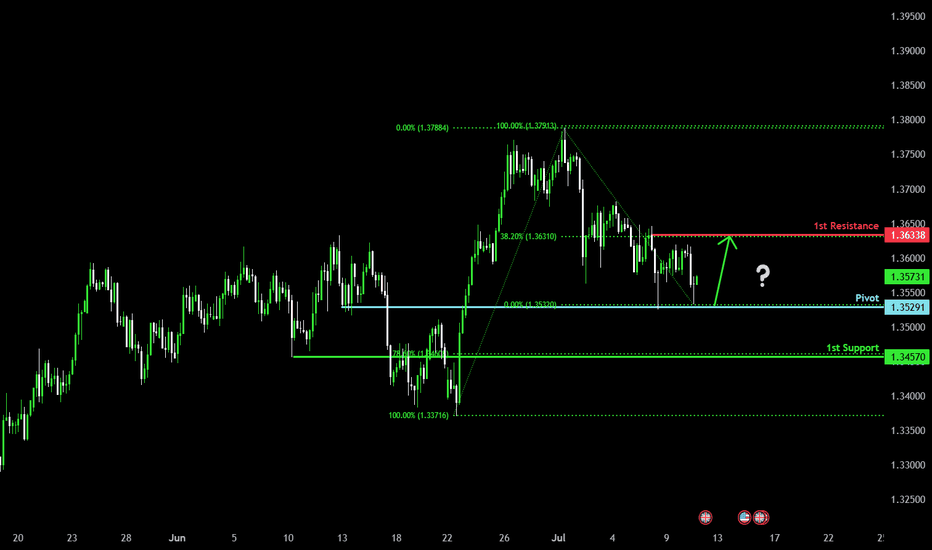

Bullish reversal?The Cable (GBP/USD) has bounced off the pivot and could rise to the 38.2% Fibonacci resistance.

Pivot: 1.3529

1st Support: 1.3457

1st Resistance: 1.3633

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

GBPUSD InsightHello to all our subscribers!

Please feel free to share your personal thoughts in the comments. Don’t forget to hit the boost button and subscribe!

Key Points

- U.S. President Trump revealed letters sent via Truth Social to the leaders of seven countries, including the Philippines and Algeria. Notably, he warned of a 50% tariff on imports from Brazil.

- The June FOMC minutes confirmed that key Fed members are divided on the outlook for rate cuts within the year.

- The U.S. 10-year Treasury yield reversed course and fell for the first time in six sessions, following strong demand in the latest bond auction.

Major Economic Events This Week

+ July 10: Germany – June Consumer Price Index (CPI)

+ July 11: United Kingdom – May Gross Domestic Product (GDP)

GBPUSD Chart Analysis

While the pair recently faced resistance near the 1.38000 level and experienced a pullback, it appears to be regaining momentum, supported by the trendline near 1.36000.

If this support holds and the price moves as expected, a rally toward the 1.40000 level could be anticipated.

However, if the current support fails, the pair could retreat toward the 1.34000 level. Therefore, it is important to closely monitor the price action in the current zone.

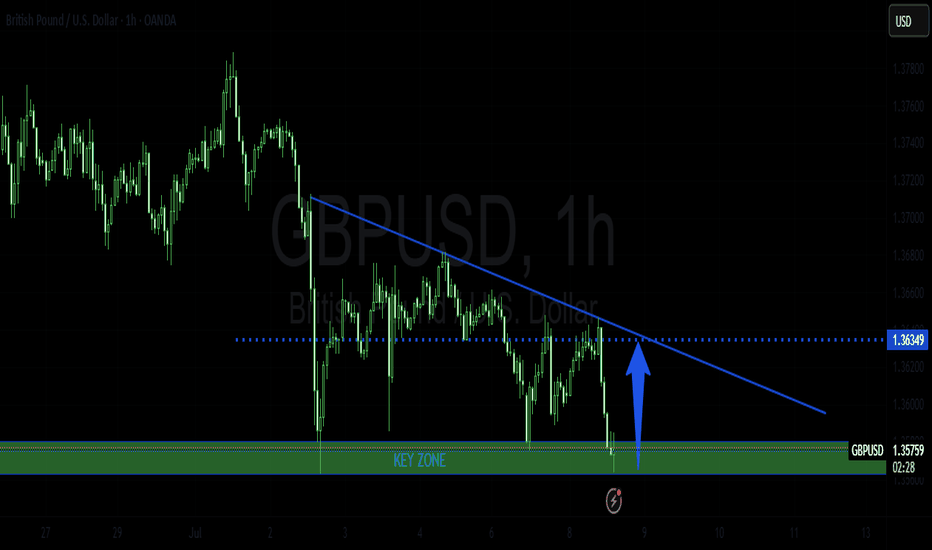

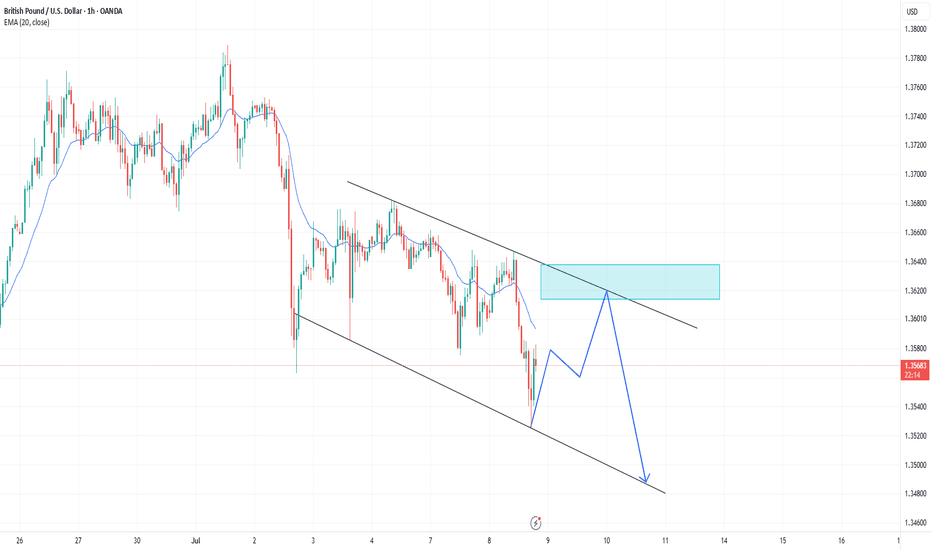

GBPUSD"My current expectation is that the price will continue to move within the descending channel on the 1-hour timeframe. I'm waiting for the price to retest the upper boundary of the channel. If a valid bearish confirmation signal (such as a reversal candlestick pattern) forms at that level, I plan to enter a short position."