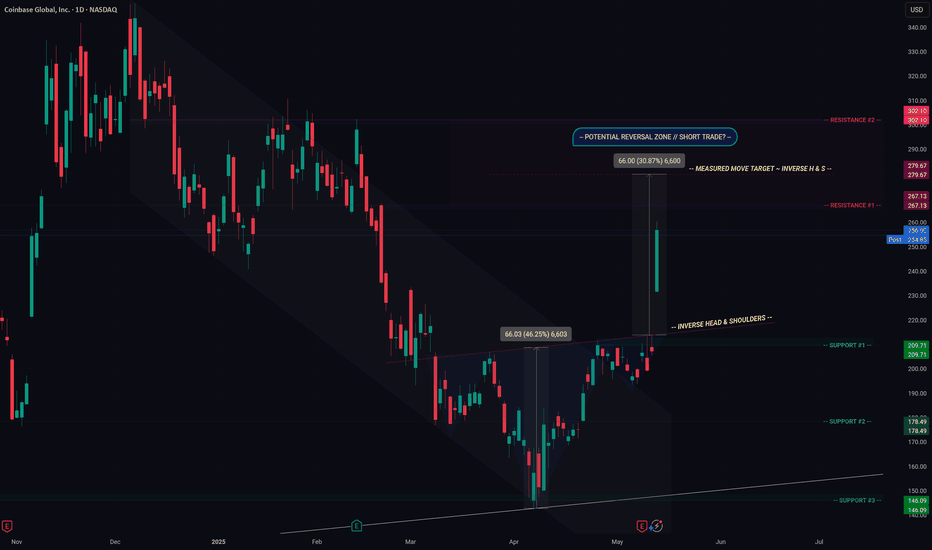

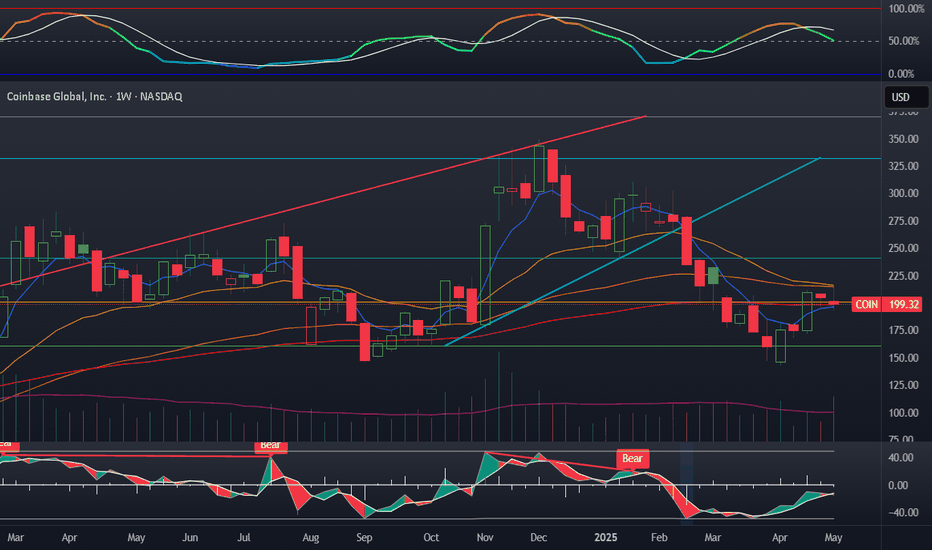

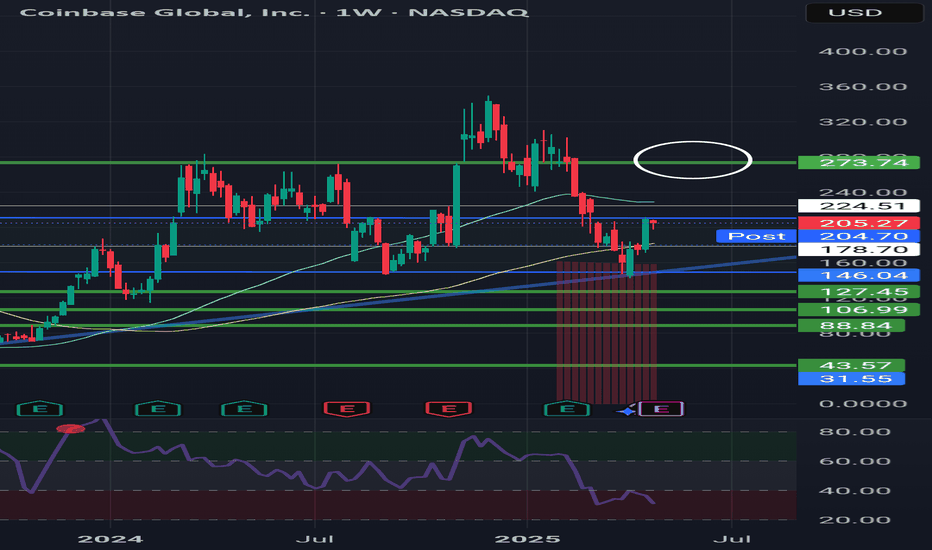

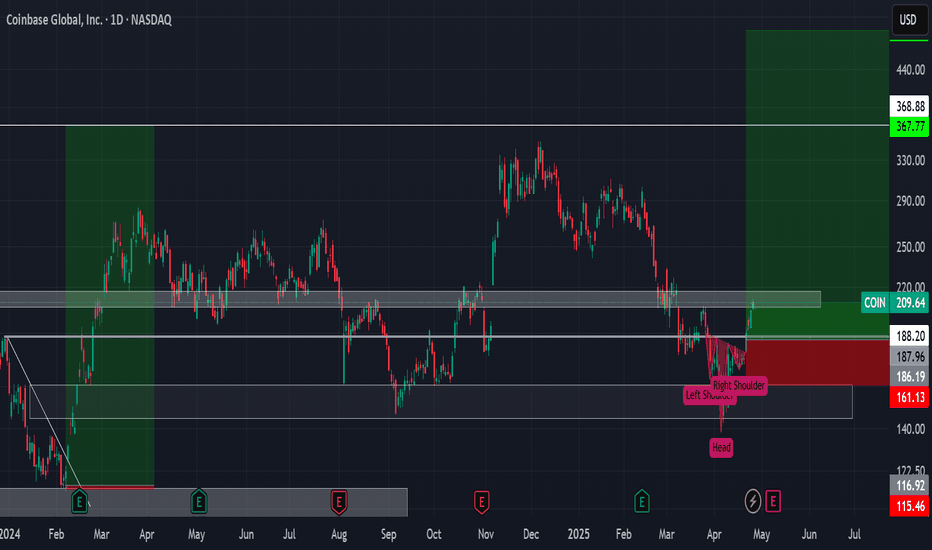

COIN ~ Inverse Head & Shoulders Breakout -- Key Levels- Hello traders! COIN made a massive move today, breaking out of a beautiful Inverse Head & Shoulders pattern. So whats next?

- There are significant resistance levels approaching between $267 and $302 (including the Inverse H&S target level) which could potentially make for a good intraday short trade opportunity.

- Watch for a quick reversal from these levels in the coming days, if you're quick you may be able to catch a short trade.

- Theres no gaurantee that price will bounce from these levels, however this zone will certainly act as significant resistance in the short term.

~ Thanks everyone and best of luck in your trading journey!

1QZ trade ideas

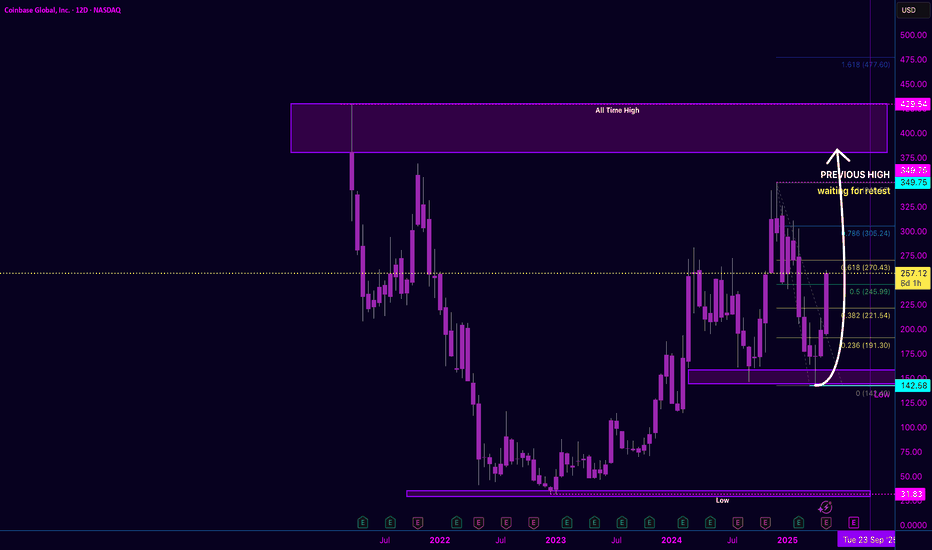

What did I always say? Traders know before the news.

I marked this move way before CNBC dropped the article.

Now they’re saying Coinbase will be added to the S&P 500—but the chart already told the story. Structure was forming, levels were building, and all it needed was a catalyst to push through. That’s why understanding market structure is everything.

News will always come last.

The smart money already knew. 🧠💼

cnb.cx

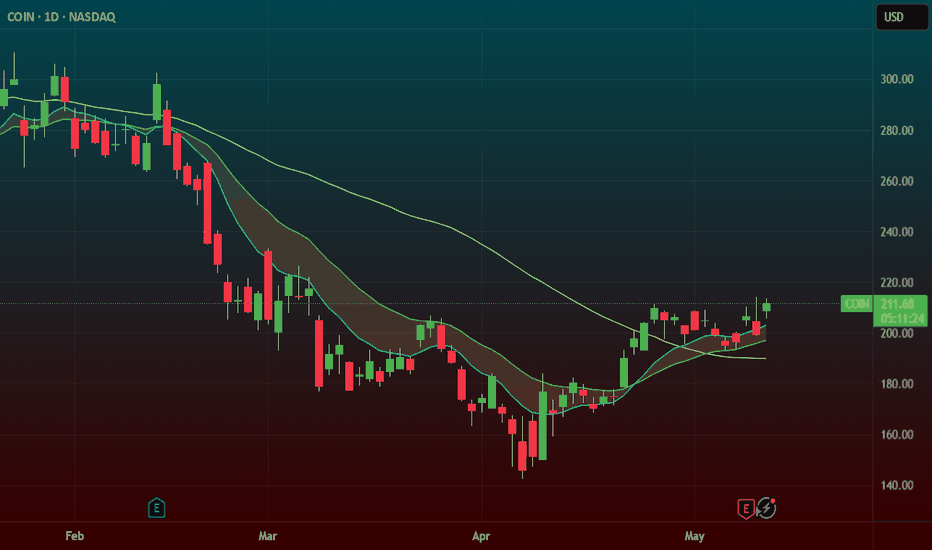

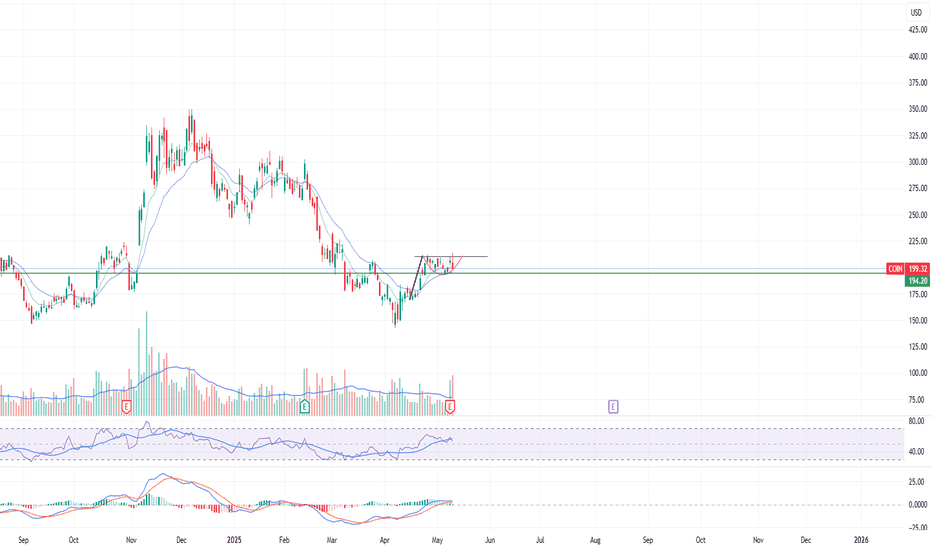

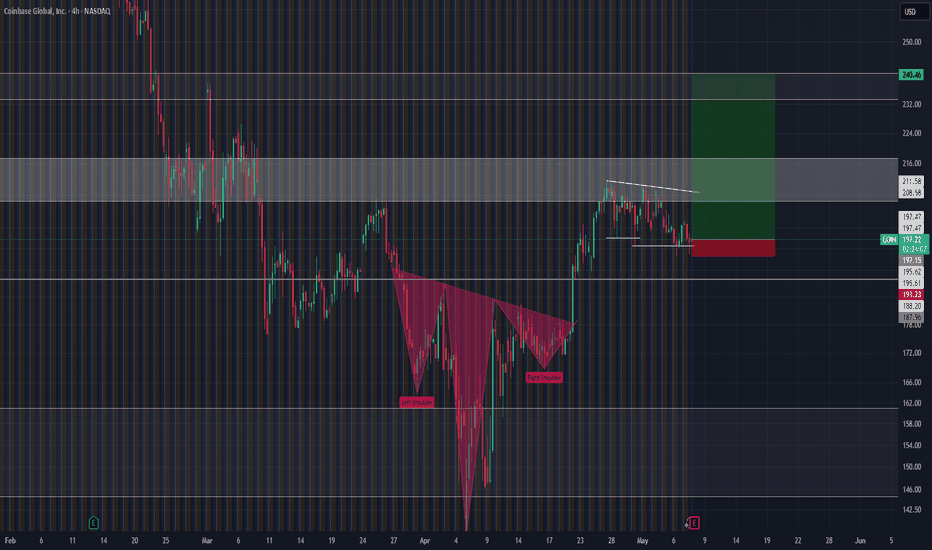

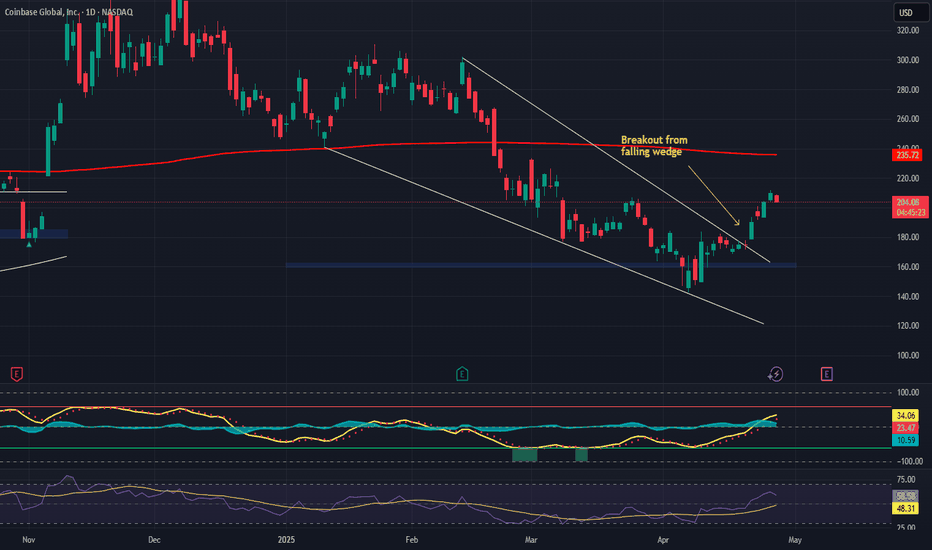

COIN – Base Breakout + Earnings Gap Reversal SetupNASDAQ:COIN – Base Breakout + Earnings Gap Reversal

NASDAQ:COIN – Base Breakout + Earnings Gap Reversal Setup

Coinbase ( NASDAQ:COIN ) is setting up for a powerful move, and I’m watching two key catalysts driving this setup:

🔹 Earnings Gap Down Reversal (Primary Setup)

Despite a sharp gap down post-earnings, buyers stepped in fast, pushing price back up.

This is a classic earnings gap down reversal — a bullish signal of aggressive buying strength.

🔹 Base Breakout Pattern

NASDAQ:COIN has formed a solid base, with a breakout zone around $212 - $214.

Bitcoin ( CRYPTOCAP:BTC ) is ripping to $104,000, and NASDAQ:MSTR has been trending for a month — bullish sector sentiment could fuel NASDAQ:COIN ’s breakout.

🔹 My Trading Plan:

1️⃣ Anticipatory Entry: Looking to build a position near $212 - $214, the breakout zone.

2️⃣ Confirmation Entry: If NASDAQ:COIN breaks and holds above $214 with volume, I’ll size up.

3️⃣ Stop Loss: Placing stops just below yesterday’s low to control risk.

🔹 Why I Love This Setup:

Dual setup = Base Breakout + Earnings Gap Reversal — powerful combo.

Sector strength (BTC & MSTR) adds confidence.

Tight risk with a clear invalidation level (yesterday’s low).

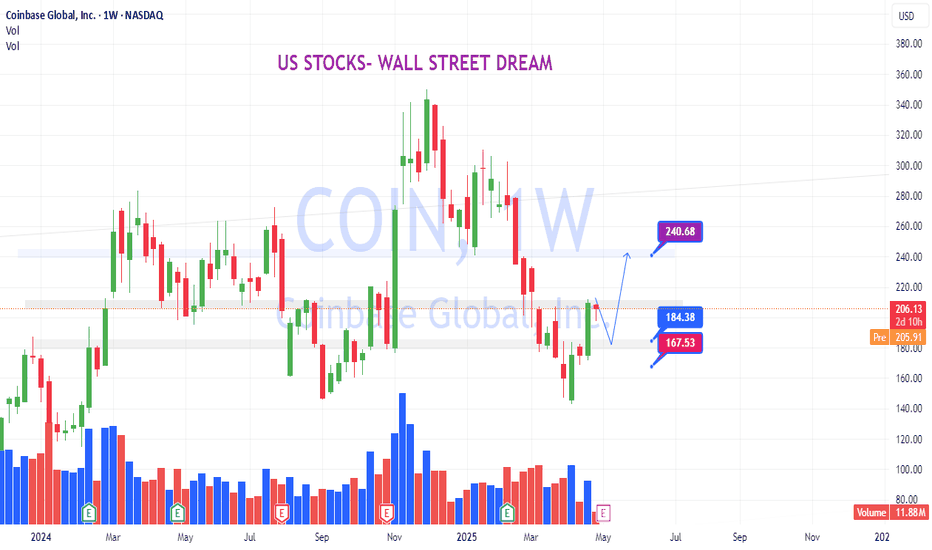

Coin to bounceAs BTC pivots here I have entered another CONL trade. I have avoided the ticker since my big exit around 250$ a while ago. This strong bounce and the retake of the golden fib, with a retest is bullish. Momentum is starting to fire up, and volatility is not in a reset zone. With Bitcoin looking so bullish here I definitely expect some movement from Coin.

My plan:

15$ CSP 6/20 expirations on CONL

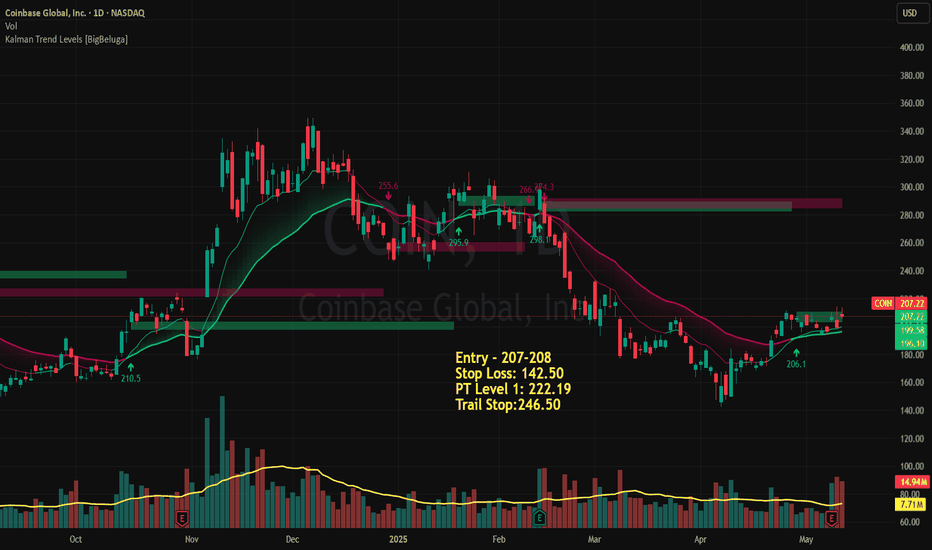

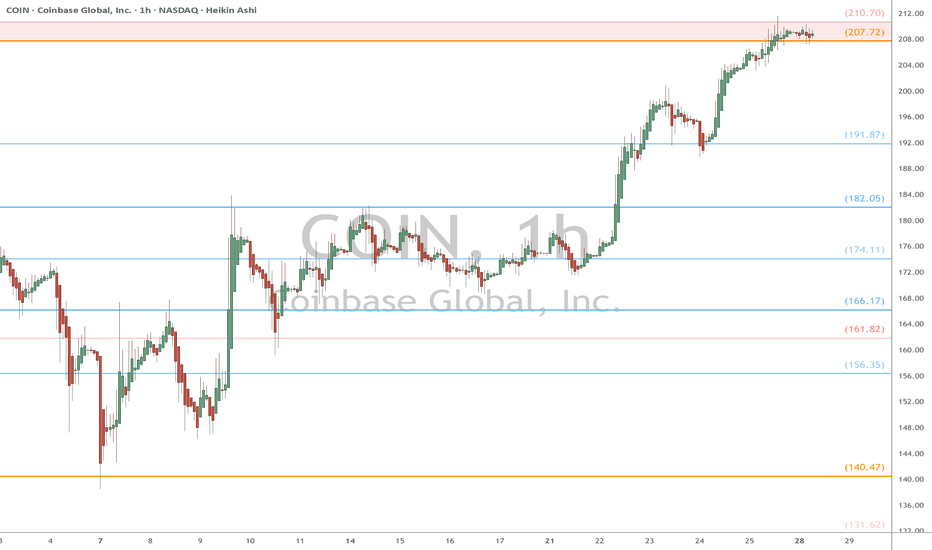

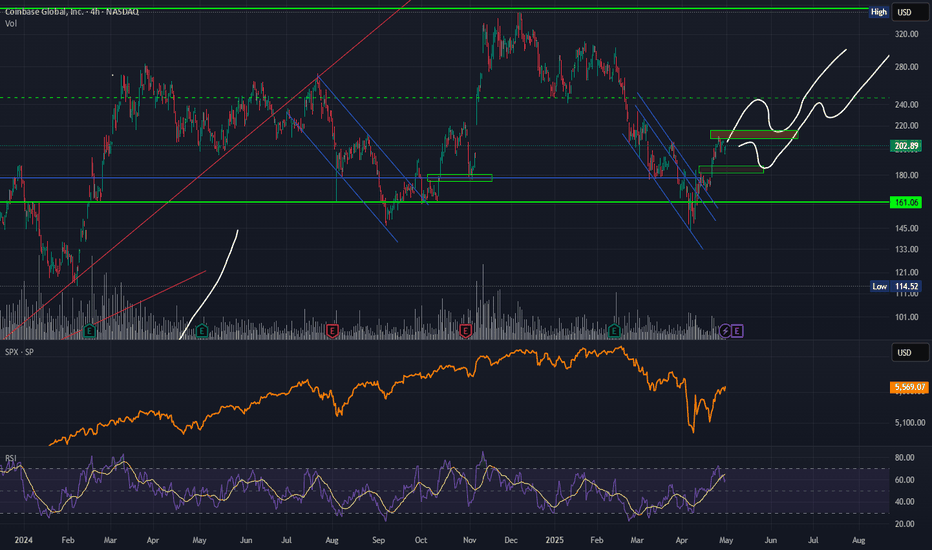

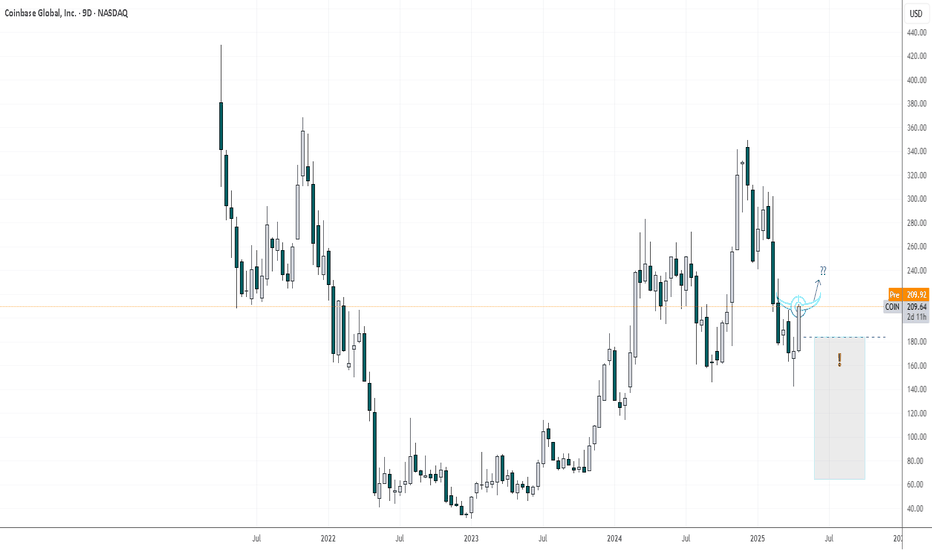

COINBASE – Strategic Setup Before Earnings TonightCOIN is showing a high-conviction technical bounce after a –56.7% drop from December to April. Since hitting the long-term trendline, it has already recovered +41%, and momentum is building fast.

📣 Just Announced: Coinbase is acquiring Deribit for $2.9B, entering the crypto derivatives market — one of the most profitable verticals in the entire industry. This massively strengthens their business model with:

🔹 High-margin futures/options trading

🔹 Diversified income beyond spot trading

🔹 Stronger appeal to institutional clients

💰 Meanwhile, Bitcoin just reclaimed $100K, adding fuel to Coinbase’s Q2 potential.

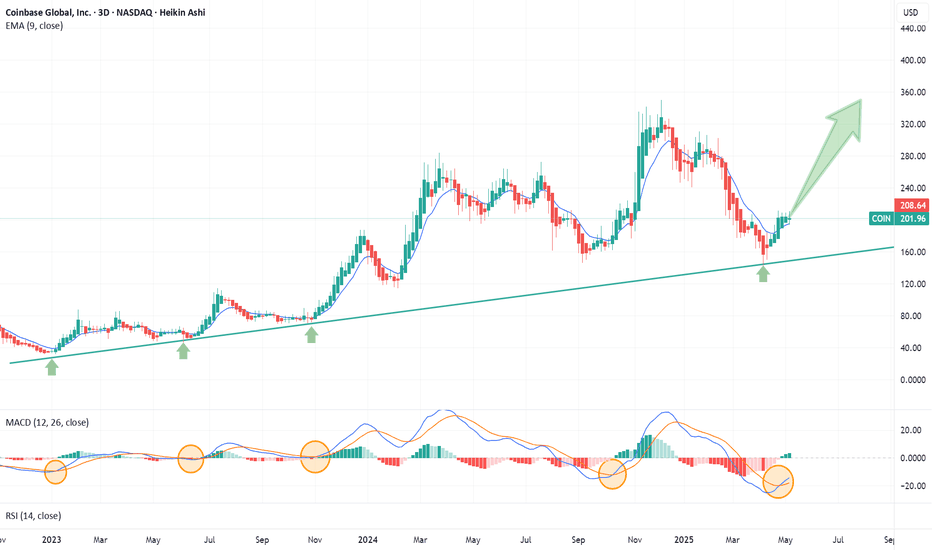

🔍 Technical Setup (3D chart):

✅ Bounce off long-term trendline

✅ MACD bullish crossover (historically reliable for COIN)

✅ Heikin Ashi candles flipping bullish

✅ Still ~70% below recent high — upside potential is real

🧠 Fundamental Picture:

• Q1 earnings expected to be softer due to slower retail volumes

• BUT revenue from staking, USDC interest, and custody remains strong

• If they show signs of recovery in April/May — this could explode to the upside

• ARK Invest is buying dips — institutions are interested here

🎯 Trade Plan:

Entry: $204–208

✔️TP1: $225

✔️TP2: $252

✔️TP3: $285

Stop-Loss Options:

🔸 $178 (short-term invalidation)

🔸 $145 (below trendline & April low — swing structure)

⚠️ This is a high-risk / high-reward setup ahead of earnings. Manage size carefully and avoid overexposure.

Coinbase Strengh Into Earnings (BTC)Coinbase with a clean head and shoulders pattern as we head into earnings after the bell today.

Bitcoin strength as it re-approaches $100k adds fuel to the flame.

Notice the fresh green tag into the cup/right shoulder indicating heavy buying momentum on COIN - wait for a close above the range for confirmation - preferably a momo candle.

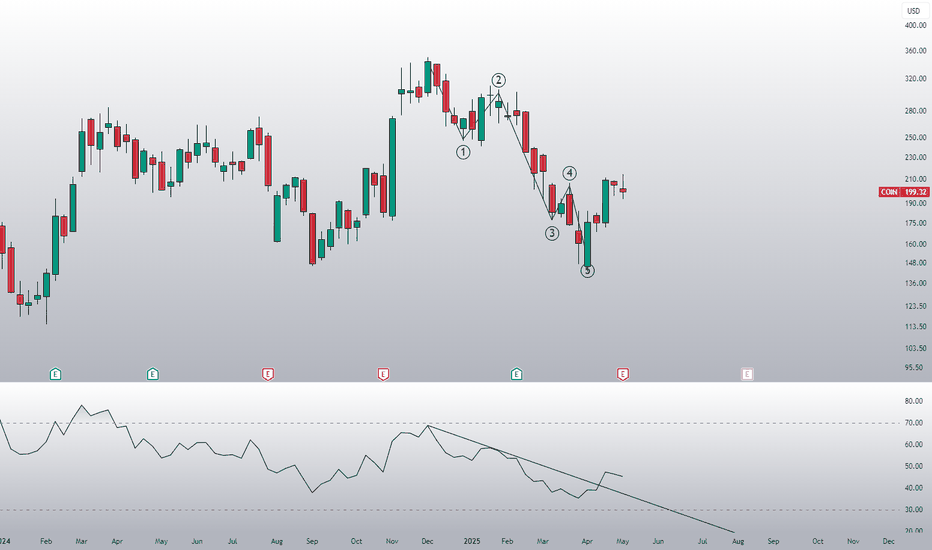

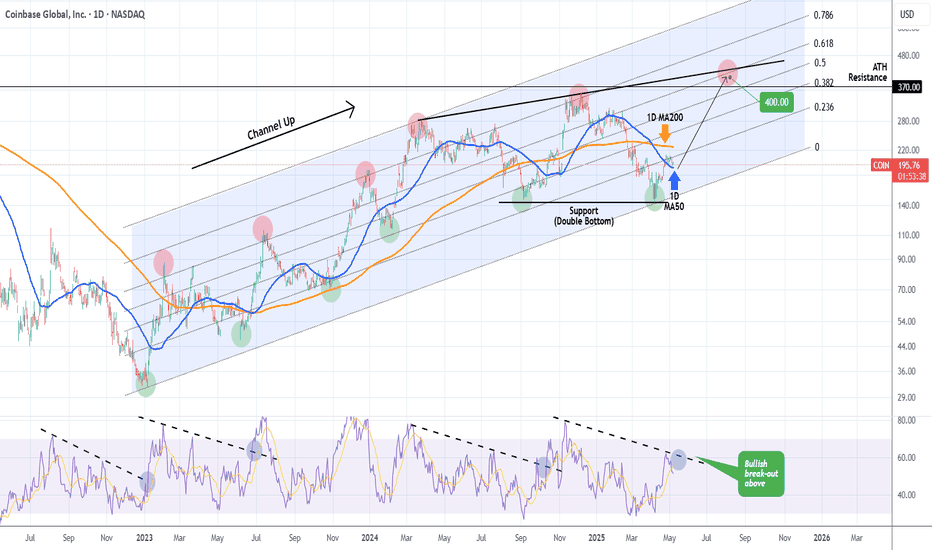

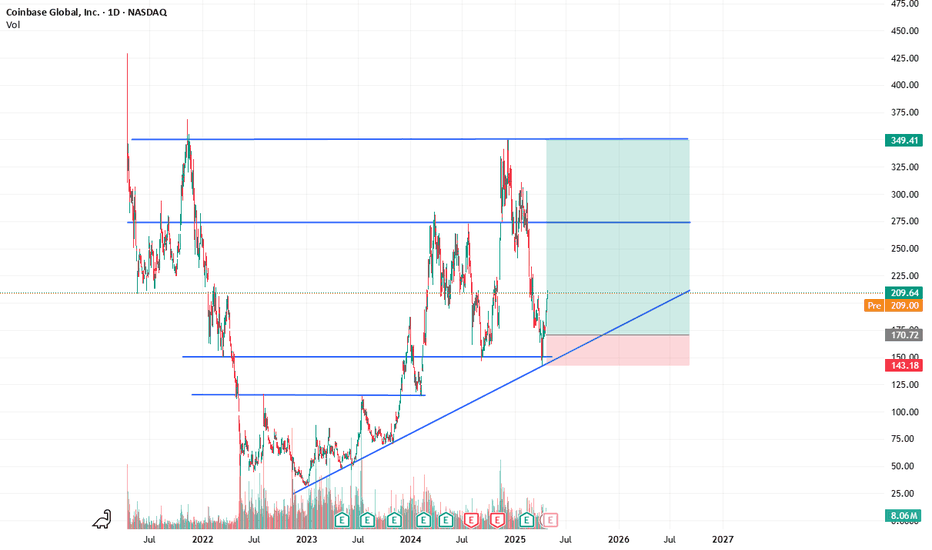

COINBASE Can the 1D MA50 catapult it to $400?Coinbase (COIN) has been trading within a Fibonacci Channel Up ever since the Bull Cycle started on the January 06 2023 market bottom. The price made a Double Bottom on April 07 following the correction from its most recent High in early December.

That is a strong long-term market Support and a clear Demand Level as the stock's immediate rebound showed. The fact that it has currently flipped the 1D MA50 (blue trend-line) into a Support and is consolidating is a clear signal of a Re-accumulation Phase.

A break above its 1D MA200 (orange trend-line) will technically confirm the extension of the new Bullish Leg. The previous High was on the 0.786 Fibonacci Channel level and the one before that on the 1.0 Fib. If this declining rate continues, we should be expecting the next High to just hit the 0.618 Fib.

As a result, we have $400 as a medium-term Target, slightly above the stocks previous All Time High (ATH) at $370.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

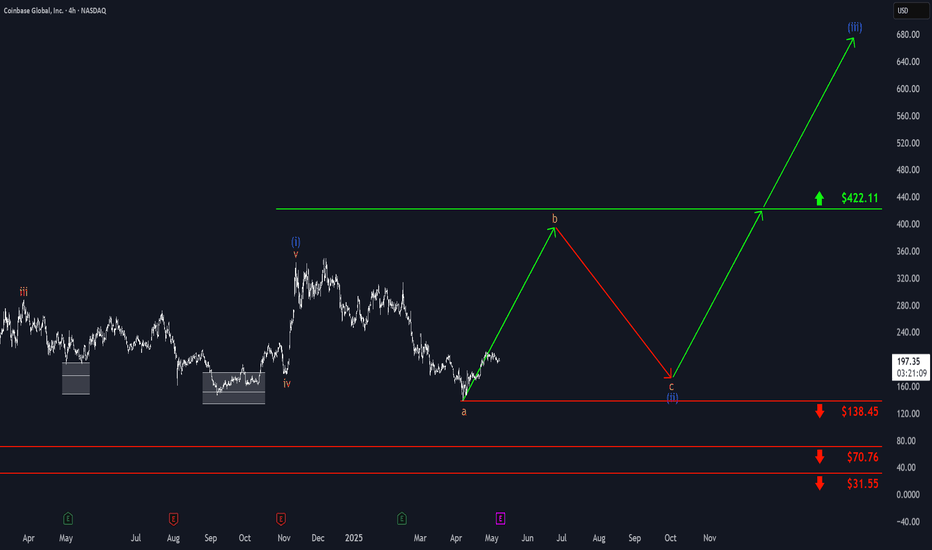

Coinbase: Catching BreathCoinbase is currently catching its breath in a sideways movement. We still attribute more upside potential to the ongoing wave b in orange, expecting it to rise close to the resistance at $422.11. However, wave c should start below this mark and ultimately complete the blue wave (ii) above the support at $138.45. The subsequent blue wave (iii) should then carry the price significantly above the $422.11 mark.

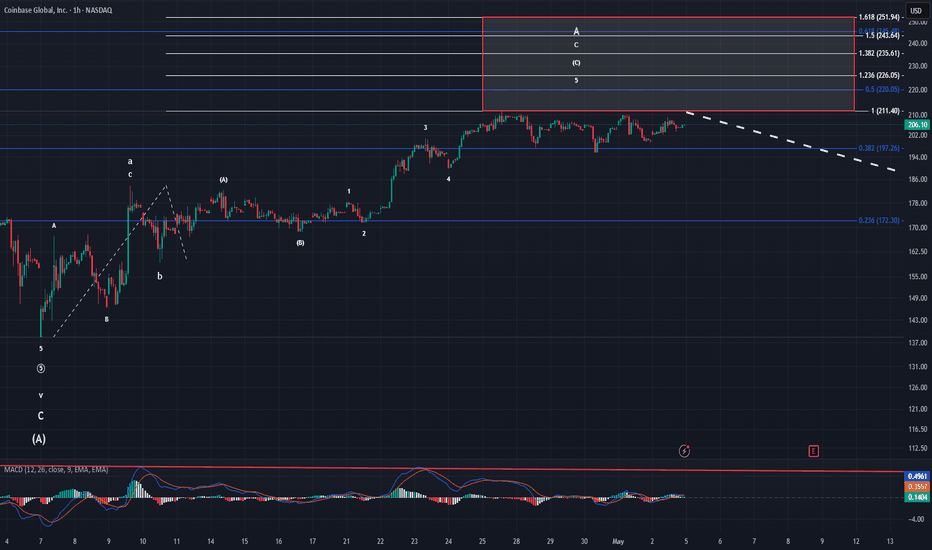

Coinbase UpdatePrice continues to trade sideways. We have already tagged the 1.0, made it in between the 0.382 & 0.5, and have all the required waves in place for a top to be made. Much like Tesla, the only move higher from here in an impulsive wave is an ED. I find it much more likely that a top has already been struck and we have already begun our minor B wave. We could still make another high, but if we do I think it will be minimal and would be as an irregular b wave. Ideally, we will find out what is in store this week.

Once B starts, as of now, I expect price to fall back to the $150-$160's. Like I said, hopefully we start the move lower this week. I imagine minor B will take 2-4 weeks to complete.

Under 400$ is a steal Strong move off 150 support. They had a 180 sell downgrade announced from some clowns today they'll be revising there targets shortly. COIN will be used be everyone and there grandma soon enough. Consumer/government dollars pouring in is insane this company is not going anywhere they also just realsed plans for BTC Yield Fund, offering 4-8% APY to non-US institutional investors through a limited leverage cash-and-carry trade strategy.

I don't think we'll be falling below 178 would be a great entry if your lucky enough.

Coinbase Global (COIN) – Bridging Crypto and Traditional FinanceCompany Snapshot:

Coinbase NASDAQ:COIN is cementing its role as the gateway to the crypto economy, offering secure trading, custody, and institutional-grade financial services—positioning itself for expansion well beyond retail.

Key Catalysts:

Bank Charter Ambitions 🏦

Exploring a bank charter, potentially evolving into a full-service financial institution

Would diversify revenue and boost regulatory credibility, key in the maturing crypto sector

Institutional Growth Momentum 📈

Extending credit to major players like CleanSpark

Building sticky, high-value relationships and reducing retail dependency

Strengthening Financials 💰

14.8% pre-tax margin

39.16% profit contribution margin → Clear operating leverage and path to sustainable, scalable profitability

Trusted Brand Advantage 🛡️

Strong institutional trust + regulatory compliance reputation → defensible moat in a volatile industry

Investment Outlook:

✅ Bullish Above: $160.00–$162.00

🚀 Target Range: $280.00–$290.00

🔑 Thesis: Regulatory expansion + institutional scale-up + financial efficiency = long-term crypto-finance powerhouse

📢 COIN: Not just a crypto exchange—an evolving financial institution for the digital future.

#CryptoFinance #Coinbase #DigitalAssets #Fintech #InstitutionalGrowth #BankingFuture

Coinbase - A lurking giant?Whenever there's activity in the cryptocurrency space, good or bad, NASDAQ:COIN may benefit from heightened transaction rates.

Some like the concept of cryptocurrencies, but not what's involved in purchasing and holding them.

Some prefer selling 'picks and shovels' rather than digging for gold themselves...

In steps platforms like Coinbase, that facilitate a degree of exposure to the cryptocurrency scene without holding coins directly yourself.

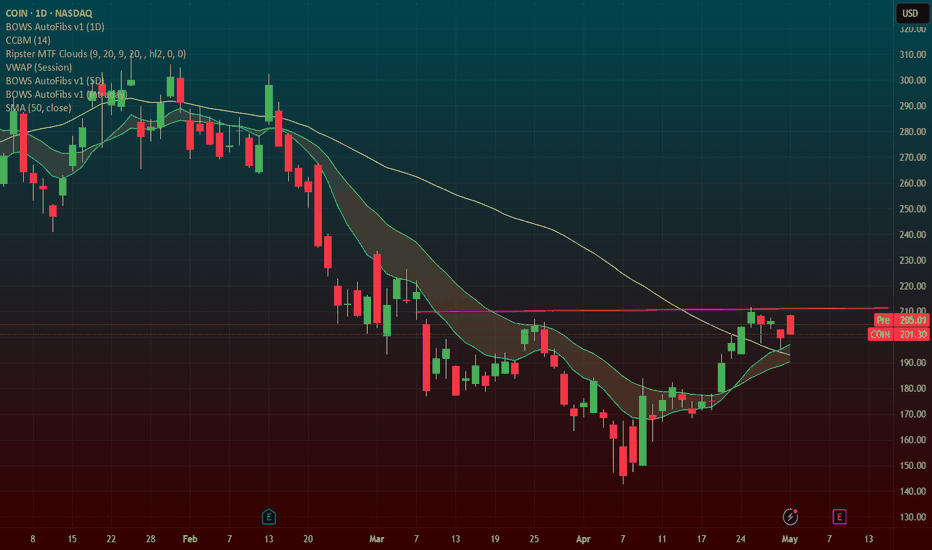

Our Team has identified Bullish potential in COIN should price be able to hold the ~$200.00 region.

We have also identified that significant Bearish continuation risk lurks beneath ~$184.00.

How will Coinbase perform over the coming period? Is there a Bull lurking?

Time will tell...

We're inspired to bring you the latest developments across worldwide markets, helping you look in the right place, at the right time.

Thank you for reading! Stay tuned for further updates, and we look forward to being of service along your trading & investing journey...

Disclaimer: Please note all information contained within this post and all other Bullfinder-official Tradingview content is strictly for informational purposes only and is not intended to be investment advice. Please DYOR & Consult your licensed financial advisors before acting on any information contained within this post, or any other Bullfinder-official TV content.

Strong Coinbase long positionGood price action with firm bounce off the the key historical $150ish support. Stock is still heavily correlated to BTC of course, but barring any crazy crashes this has a lot of room to go higher from a technical standpoint. Can't ask for a much easier chart to draw/trade imo.