21P trade ideas

Aurora upward trend to ATH?Not Trading Advises. only for learning. Appreciate feedback and criticism

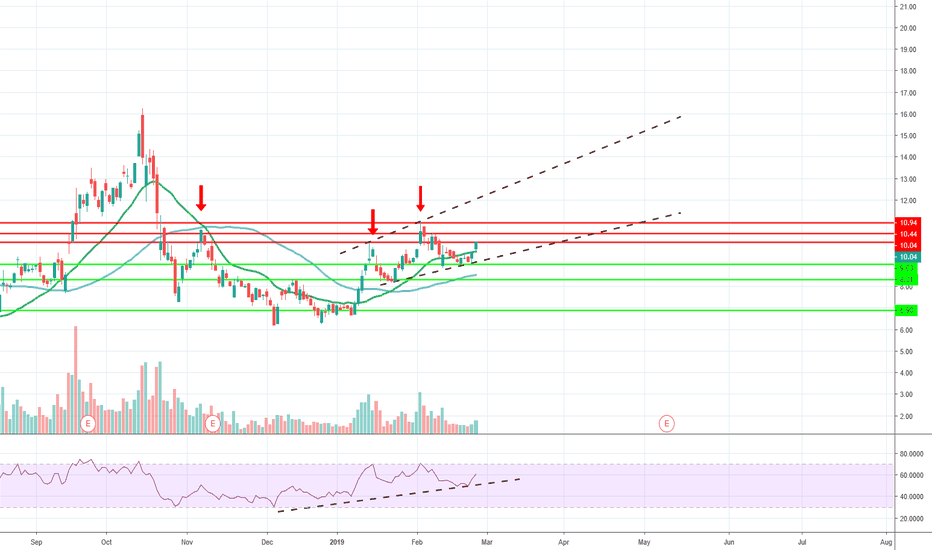

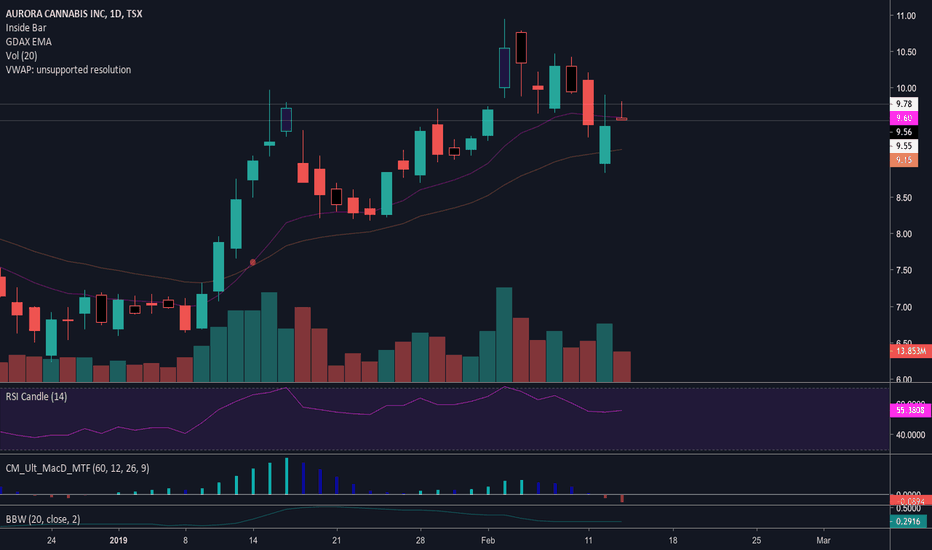

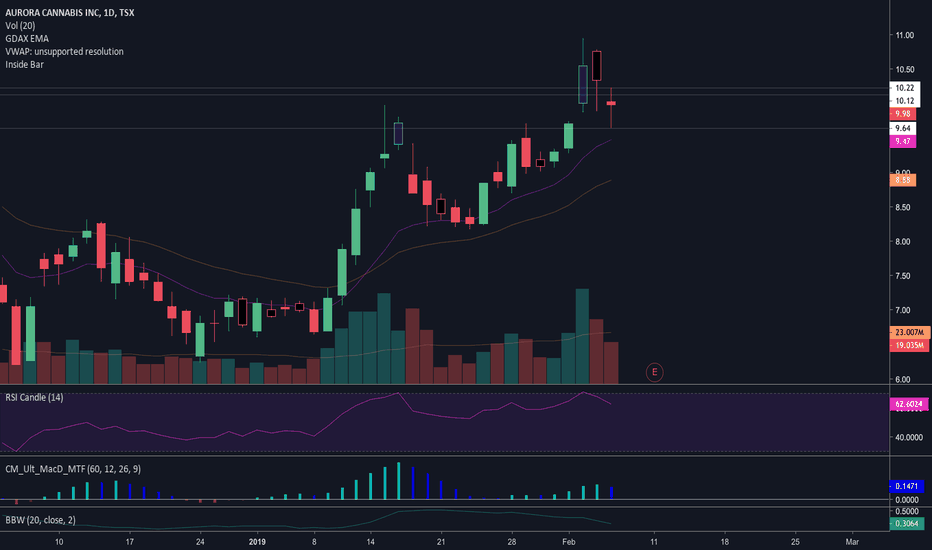

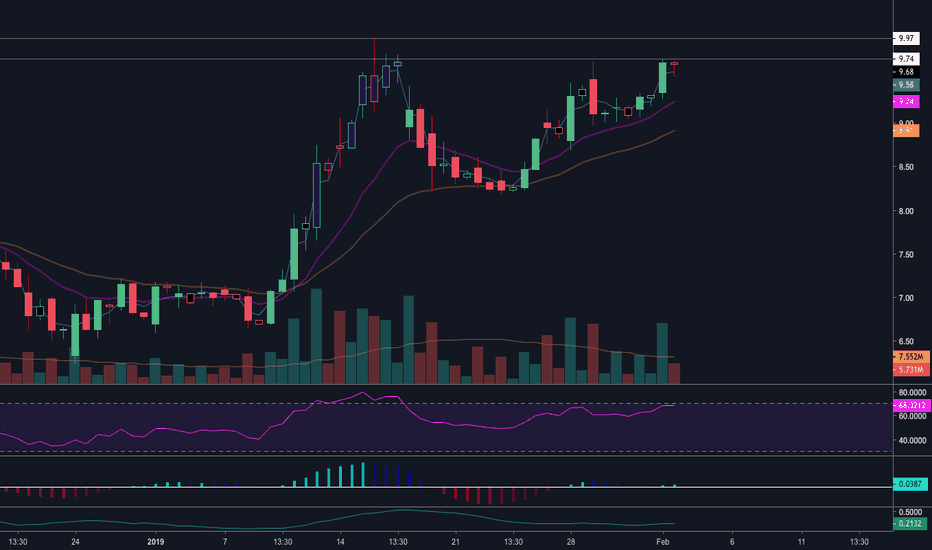

I think Aurora is in a upward trend to its ATH price range based on the following:

• HH & LL

• RSI showing positive signals and positive momentum

• Volume increased

• Structure/Support at $9 Cad, not sure how strong the support is, and if the support is hold at $9, i interpret it as bulls have control over the stock and expect to see higher SP.

• Respecting 200 Ma, and trading over 50 Ma.

• By and large $ 175 millions Cad in revenue Q4/Q1 2019/2020, by and large $700 millions – $ 1.2 Billions Cad Revenue 2020. ( PE 10 on today's price ) and expected to grow in to a Billion dollar quarterly revenue company,

• Aurora is getting traction in the media. Buy rating.

• Cannabis market is getting more love every week, being talked about more and more, many times a week on Yahoo Finance, and Aurora is often mentioned.

• Higher marginal products coming online

Target: $12-$13.

If the price drop under $9 Cad, trade is not viable. ( my rule )

Disclosure: Aurora is my biggest holding, resp 30%. Planing to hold for life if the company continues to grow.

Not Trading Advises.

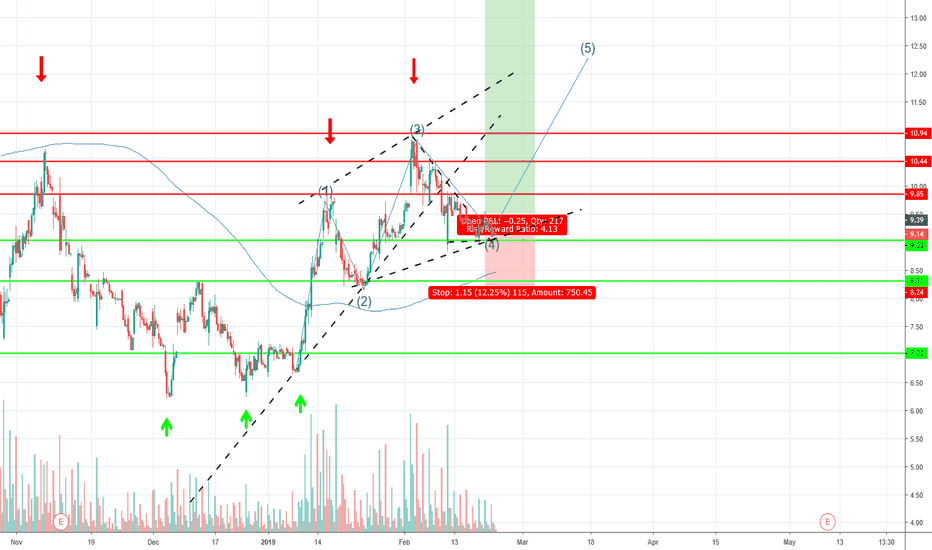

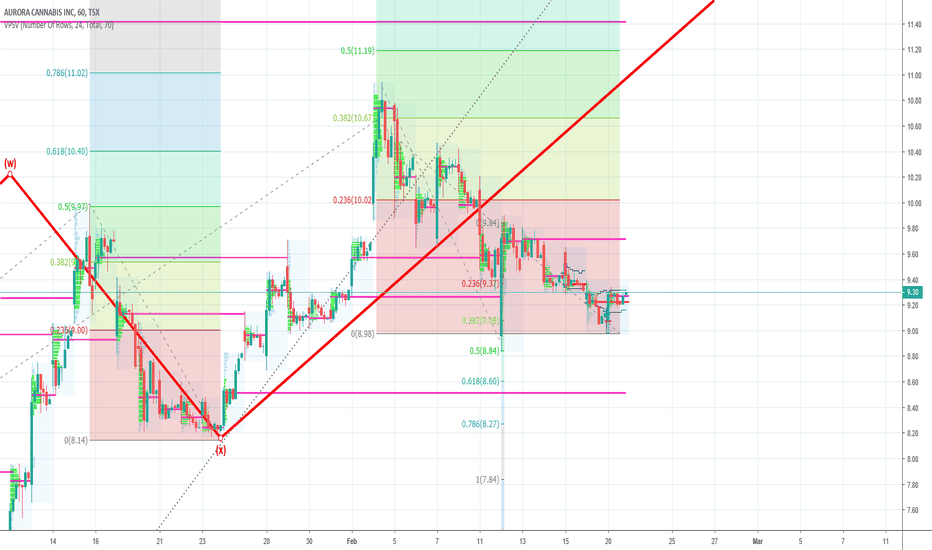

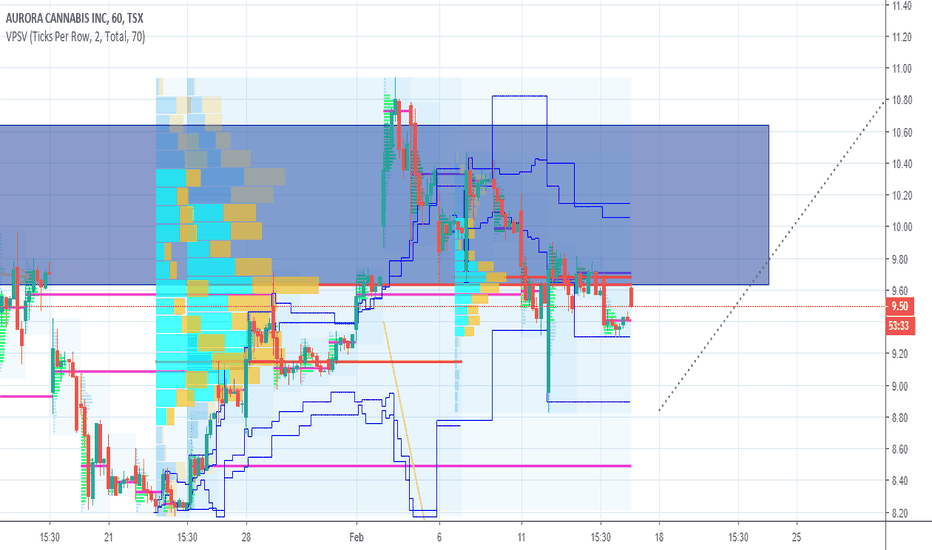

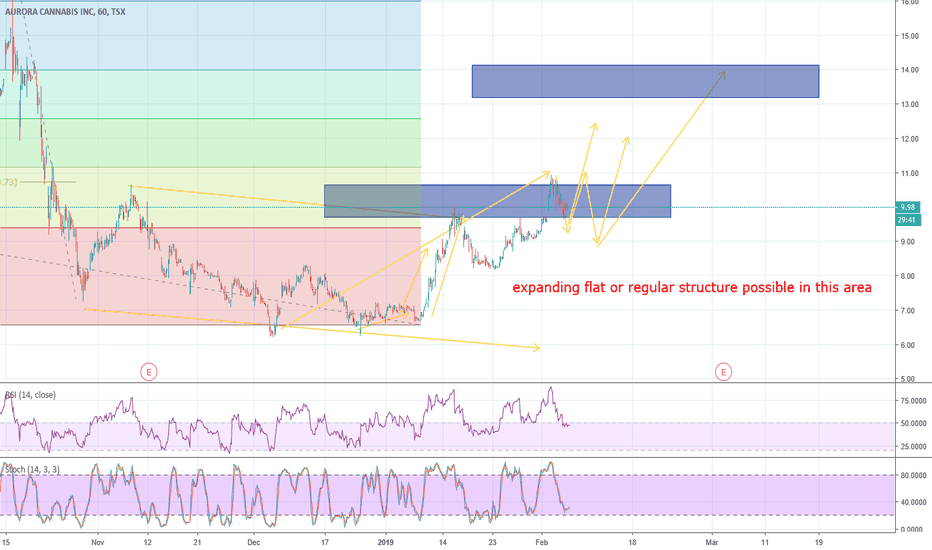

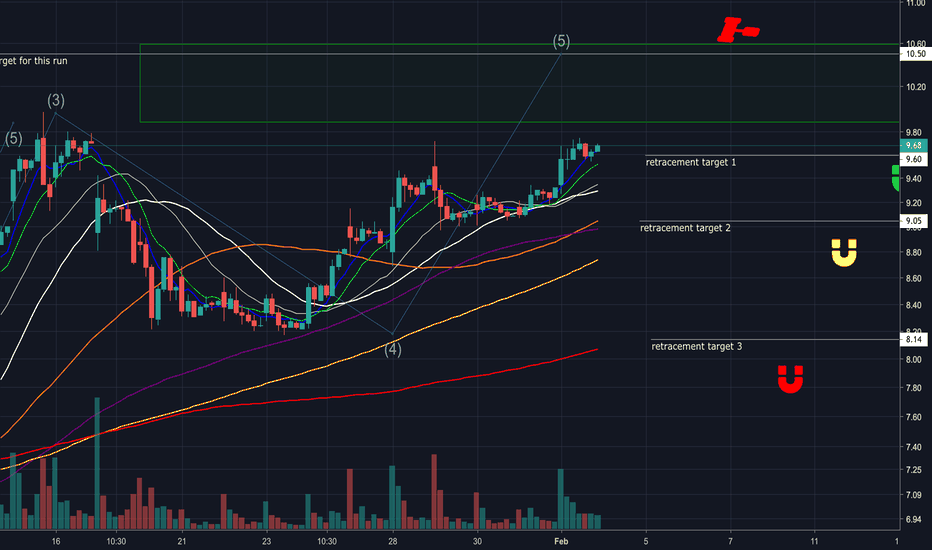

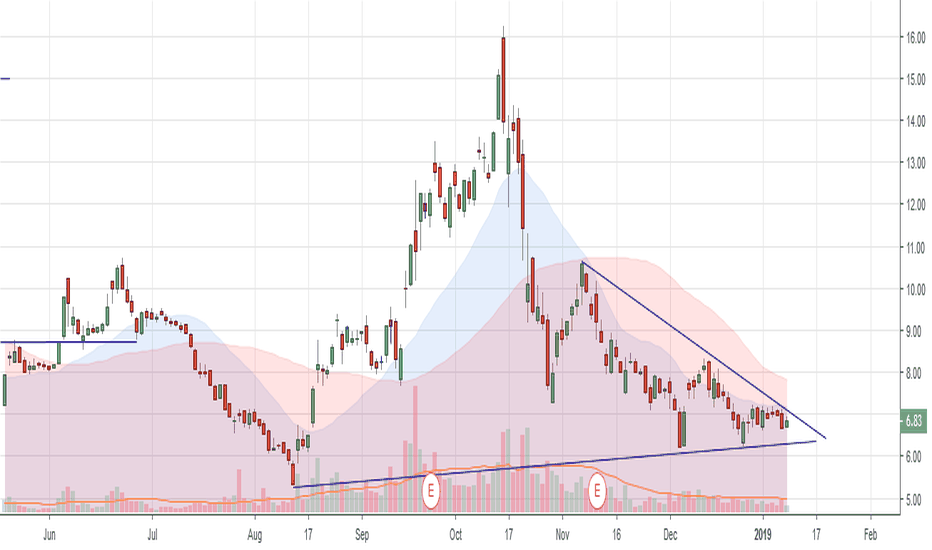

Aurora leg 5I think Aurora will do a wave 5 up. After the first report Aurora look like to have a strong future. And with pension founds and other institutional investor starting to pick up Aurora shares i think the SP will start to reflect it. I hope it will be a steady climb as it for me represent a shift in sentiment and a new type of buyer have come around.

Changed sentiment bull target: $14 cad

Trending range: $8,30-$9,30

Changed sentiment bear: < $8

Not trade advise. For traning

ACB - Preparing the Reversal? Let's see what the fuss is about!

Some interesting things are developing with ACB TSX:ACB so let's get into the meat and potatoes shall we?

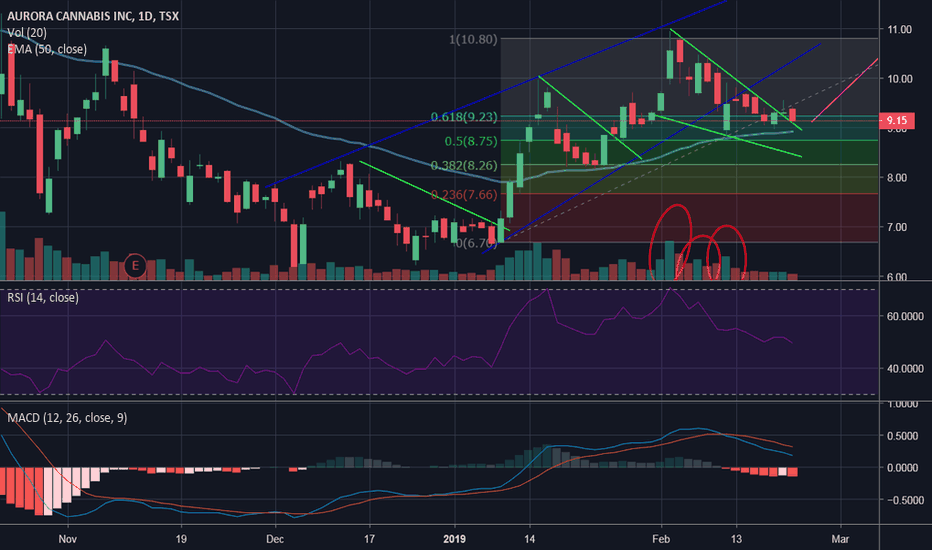

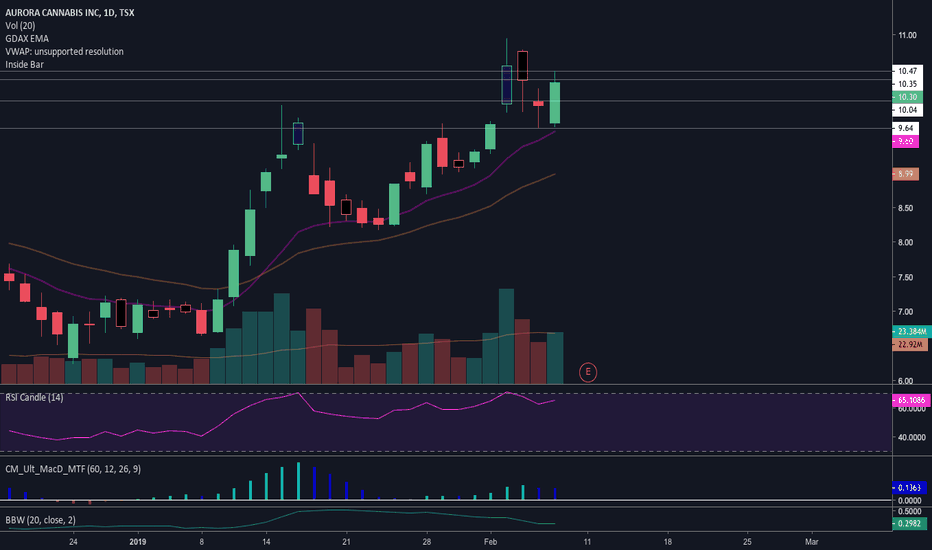

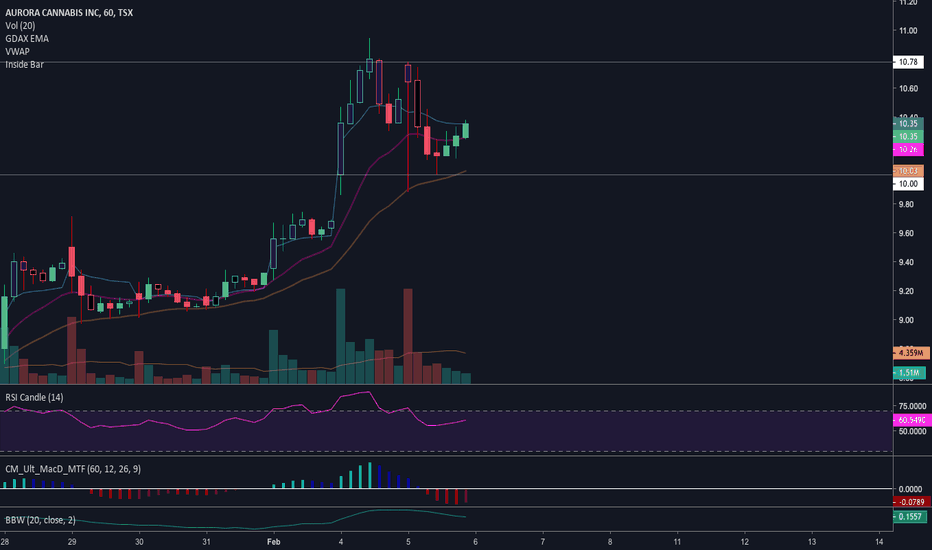

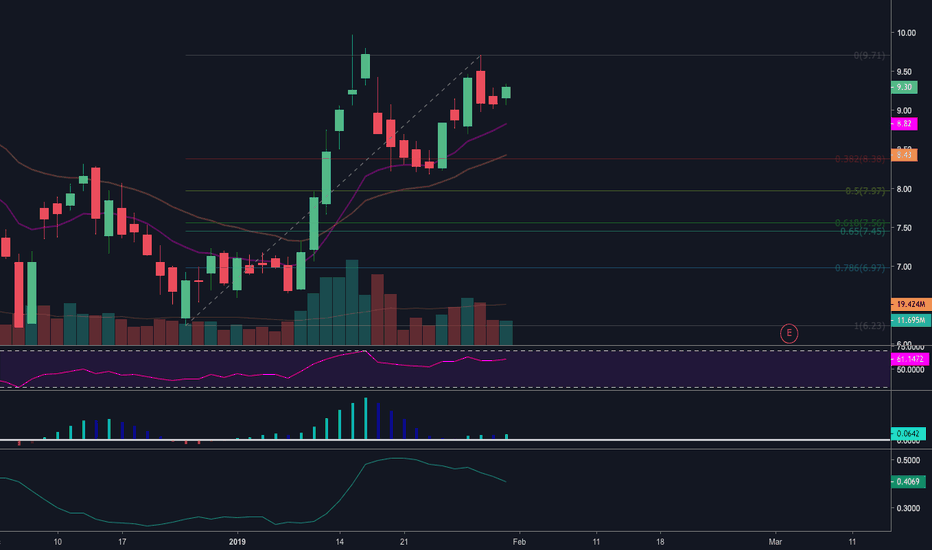

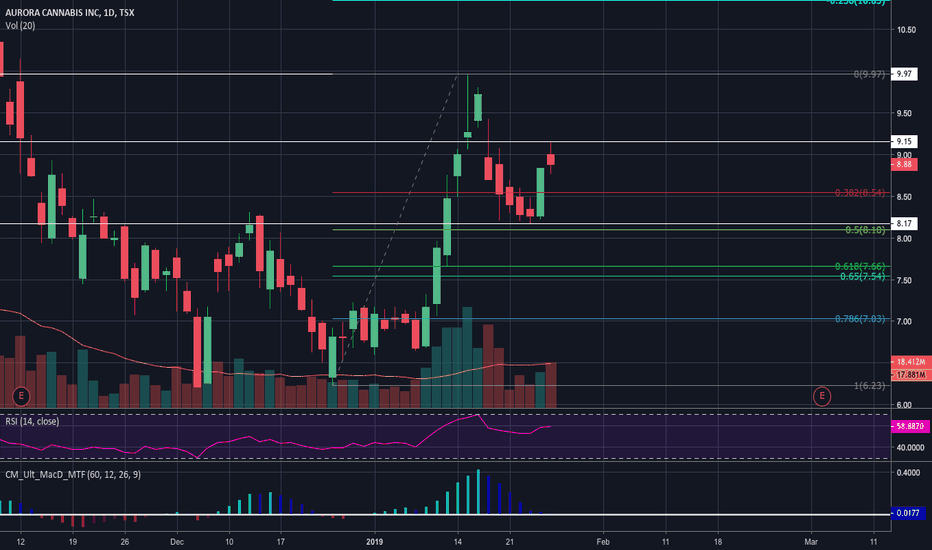

Taking a look at the daily chart, First thing to take a look at is the rising channel show in blue and the serious of falling wedges (bullish indicators) shown in green. Here is my technical argument as to why i see a return to 10-12.50 in the next while. Since the January run we can see price action moving above the 50 EMA in very impressive fashion. Interestingly enough we looking to test the 50 EM once again and in addition you can see Fib. retracement level here at .62.....a very important place to hold. With slowing selling pressure and more buyers volume support (shown in red ovals), we are forming a very nice bullish consolidation pennant forming, with could results in a sharp reversal if price action doesn't drop below the 50 EMA.

My take away is to watch the RSI level carefully as we approach 40. If we levels rebound here, expect some major resistance as we move back towards the blue rising channel.

**Buying and Selling are solely your responsibility and cover all your bases....due your due diligence, never buy because ANYONE tells you to!**

Enjoy the weekend folks!

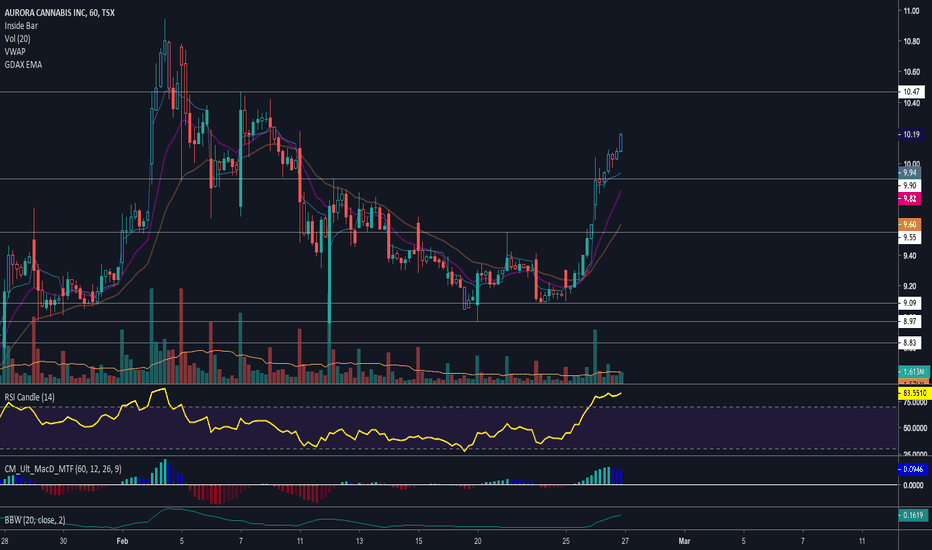

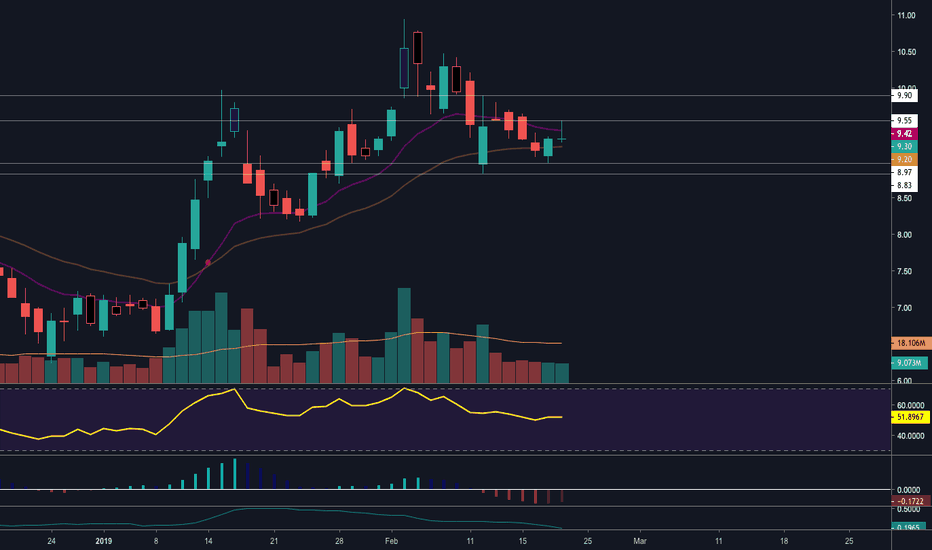

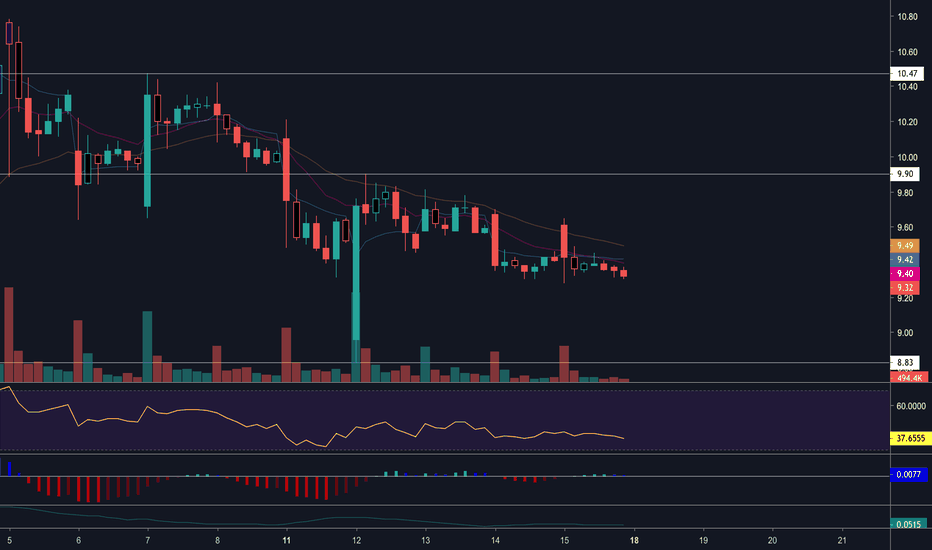

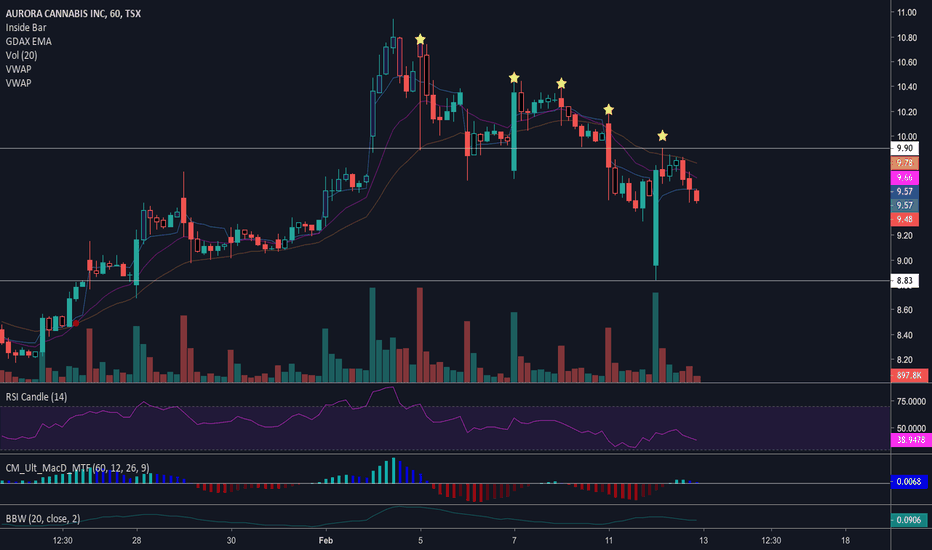

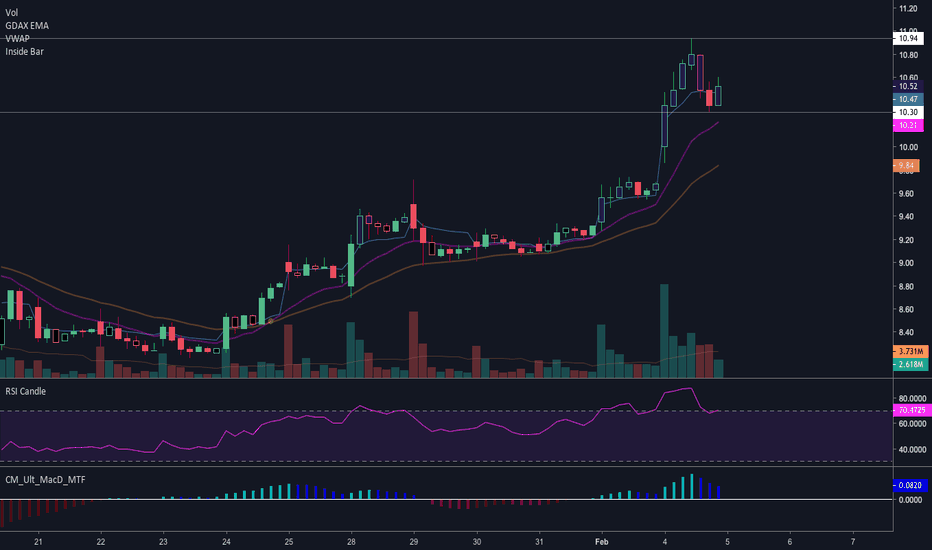

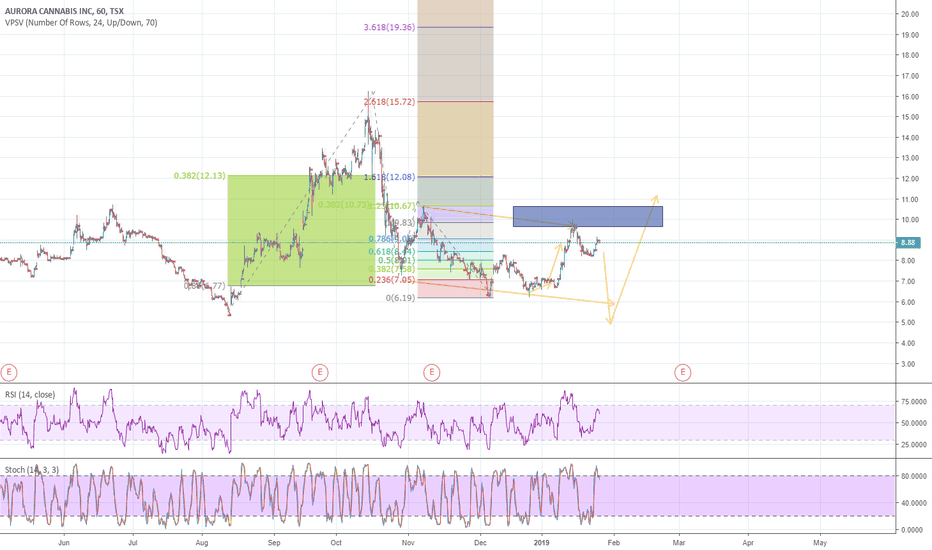

ACB bulls buy earnings dip but downtrend remainsHi, having trouble with the hotel wifi as I'm on vacation skiing in beautiful Lake Louise AB so I'm not doing videos tonight. Aurora bulls bought the gap down open and had a volatile day with a wide trading range. Despite the huge 12% bounce note that every hourly bounce is just a lower high. To change this hourly trend and give us a new daily support level bulls need to hold low of day 8.83 and break high of day 9.90 and 10.00. There's a lot of room here so if bulls cannot break resistance first thing tomorrow morning watch for an hourly equilibrium into the end of the week

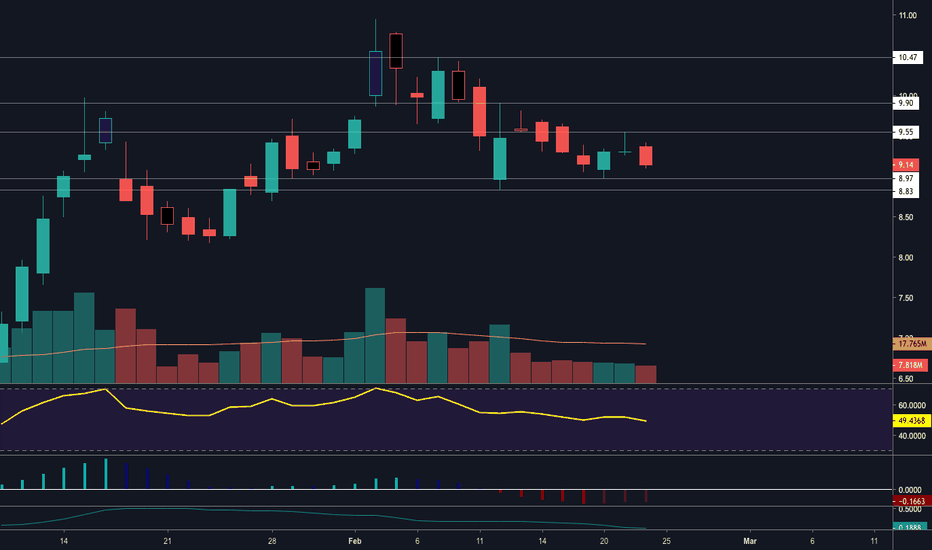

ACB searching for a daily higher lowACB daily consolidation is very healthy, looking for an hourly higher low. Bulls must hold the low of today first thing tomorrow and then make an attempt to break resistance and change the hourly trend in their favour. We are anticipating a lower open tomorrow after seeing weakness in the after hours trading.

ACB watching for low of Friday to holdPotentialy we've set our daily lower high with a bearish reversal candle on the daily chart. Watching for Friday's low to hold, if it does bulls have a chance again at the high of Friday, otherwise I'd be looking for a higher low above the recent low 8.17. Potential bottomfish opportunity there if CGC isn't consolidating significantly as we approach support