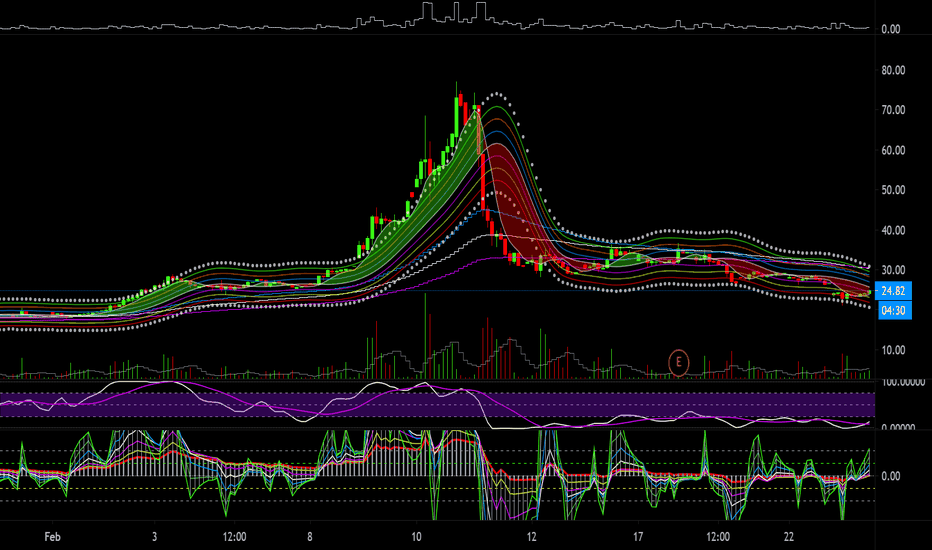

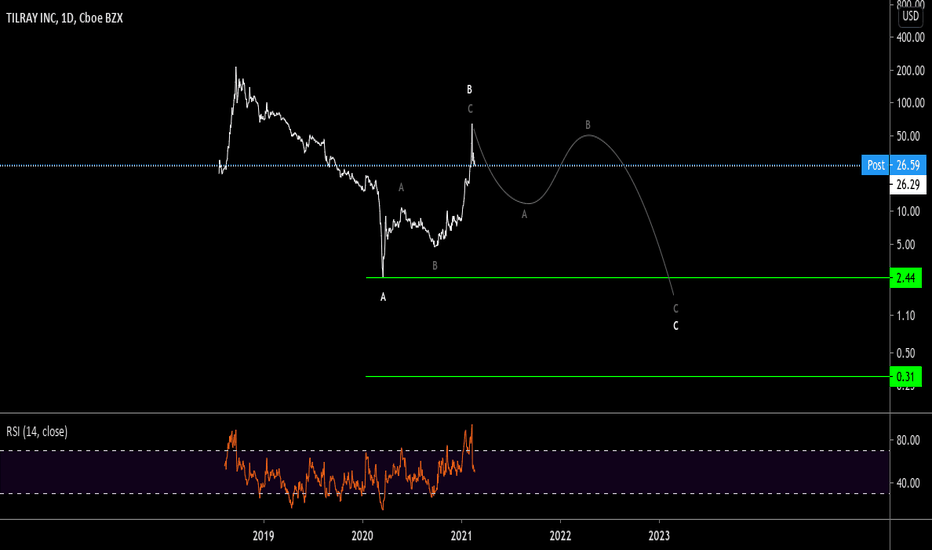

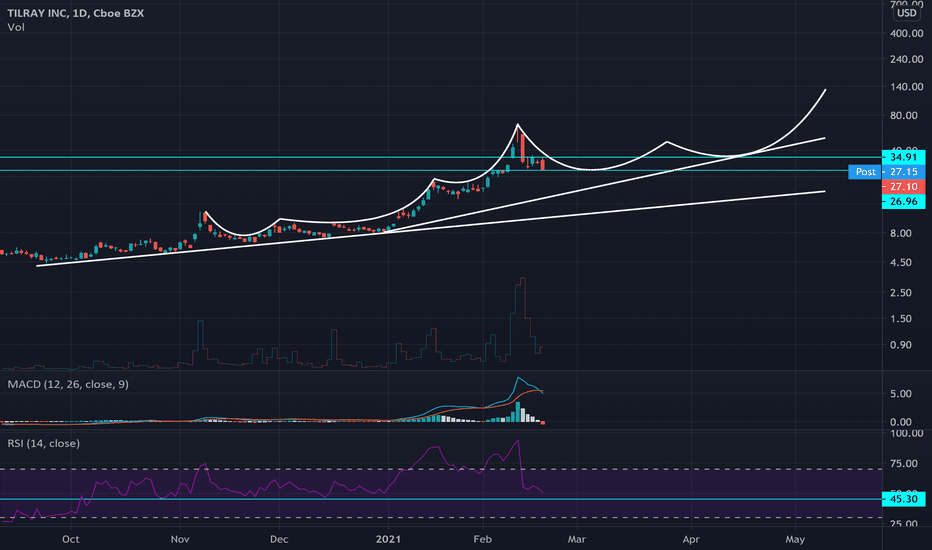

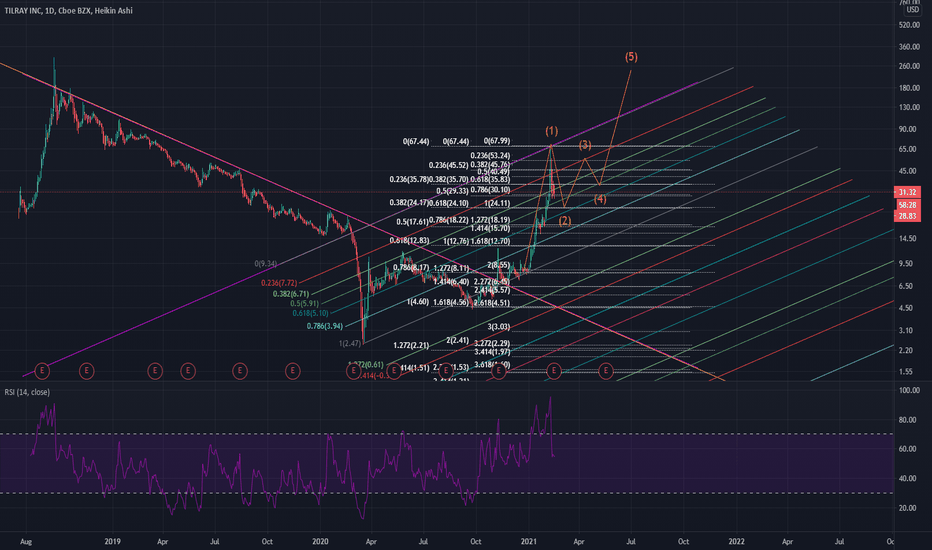

Tilray is down -70% from it's February all time highTilray (TLRY) is down -70% from it's February all time high. Tilray is a Canadian pharmaceutical and cannabis company, incorporated in the United States with primary operations headquartered in Toronto, Ontario. Tilray also has operations in Australia, New Zealand, Germany, Portugal, and Latin America. Do your own due diligence, your risk is 100% your responsibility. You win some or you learn some. Consider being charitable with some of your profit to help humankind. Small incremental steps work : If you double a penny a day for a month it = $5,368,709. Good luck and happy trading friends...

*3x lucky 7s of trading*

7pt Trading compass:

Price action, entry/exit

Volume average/direction

Trend, patterns, momentum

Newsworthy current events

Revenue

Earnings

Balance sheet

7 Common mistakes:

+5% portfolio trades, risk management

Beware of analysts motives

Emotions & Opinions

FOMO : bad timing

Lack of planning & discipline

Forgetting restraint

Obdurate repetitive errors, no adaptation

7 Important tools:

Trading View app!, Brokerage UI

Accurate indicators & settings

Wide screen monitor/s

Trading log (pencil & graph paper)

Big organized desk

Reading books, playing chess

Sorted watch-list

Checkout my indicators:

Fibonacci VIP - volume

Fibonacci MA7 - price

pi RSI - trend momentum

TTC - trend channel

AlertiT - notification

tradingview.sweetlogin.com

2HQ trade ideas

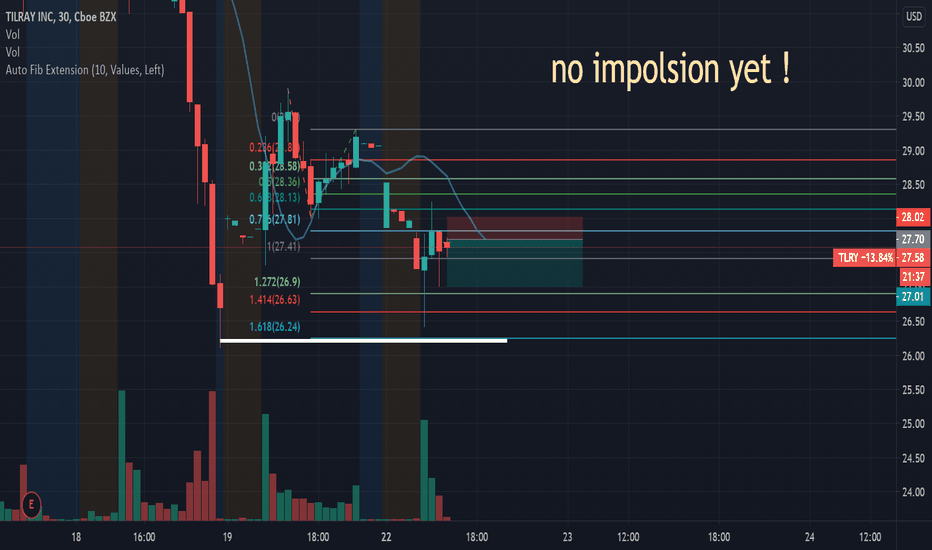

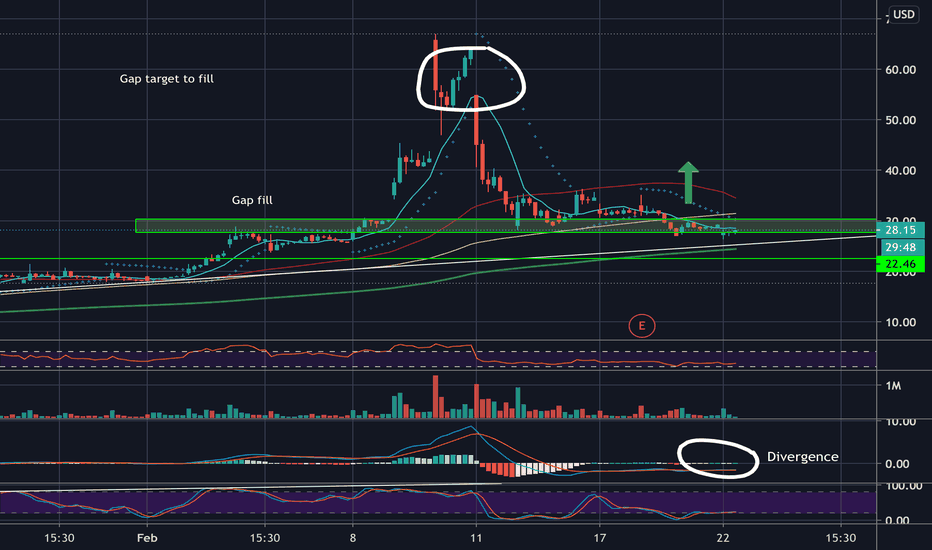

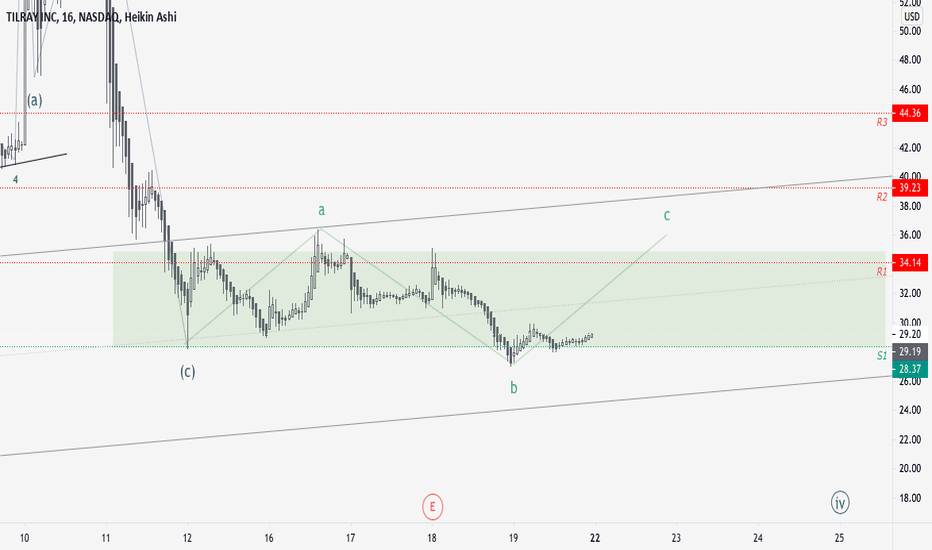

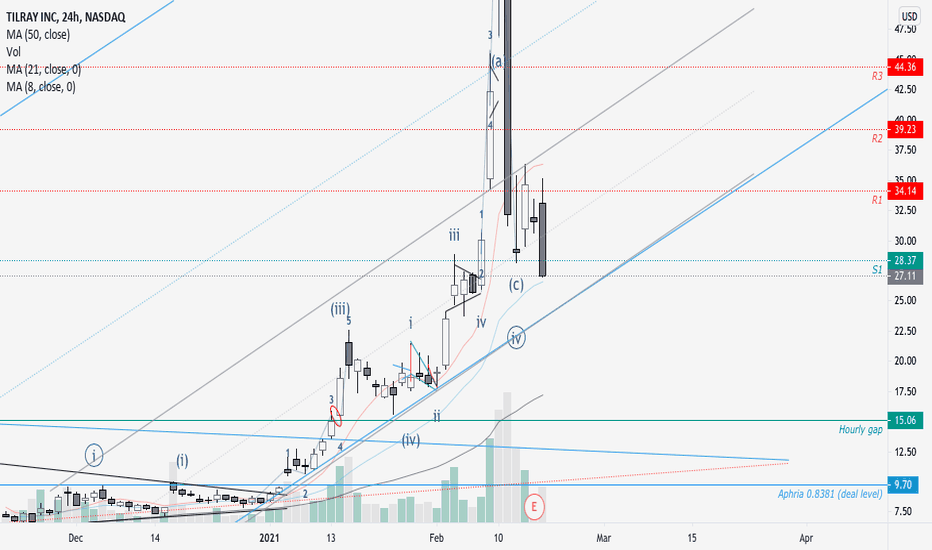

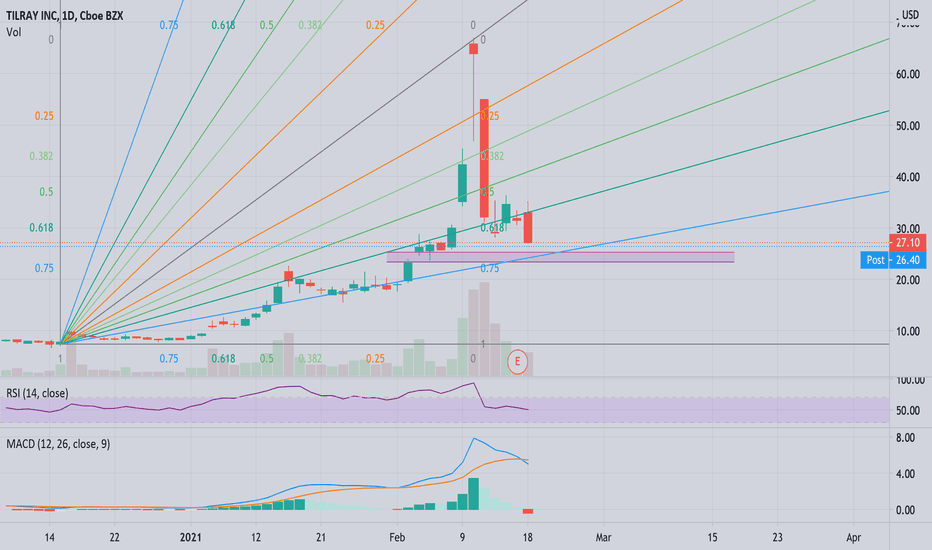

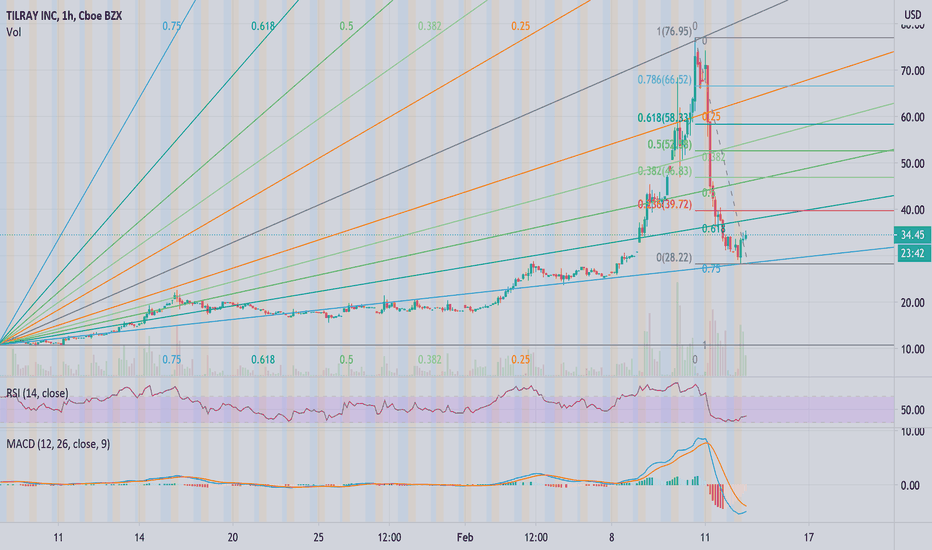

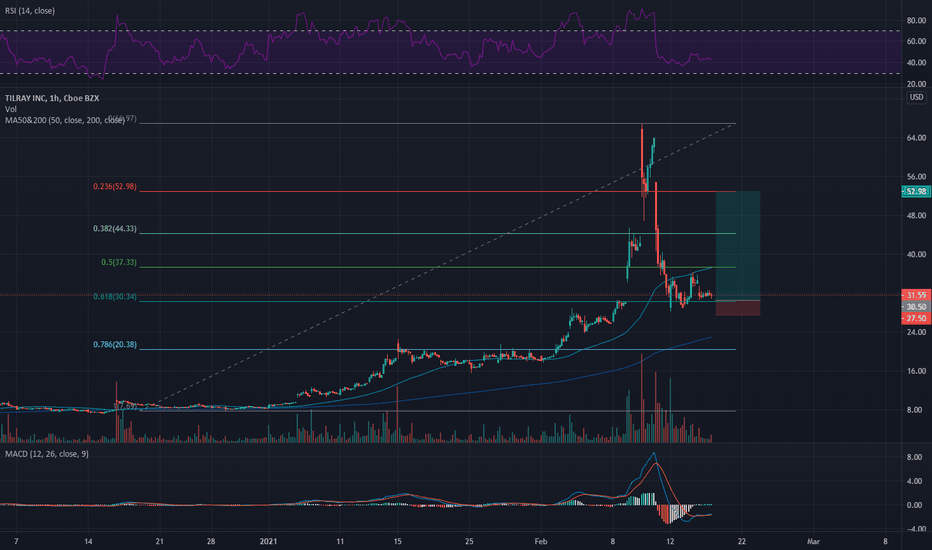

Add to TLRY position- divergenceNice opportunity to further add to our TLRY position with this MACDH divergence on the 1 hr chart.

We can keep a fairly wide stop on this one and hold for the short to medium term up to 60's or longer up 50% to all time highs around 150.

This has been a lovely pullback on this great cannabis stock and we still have merger talk doing the rounds.

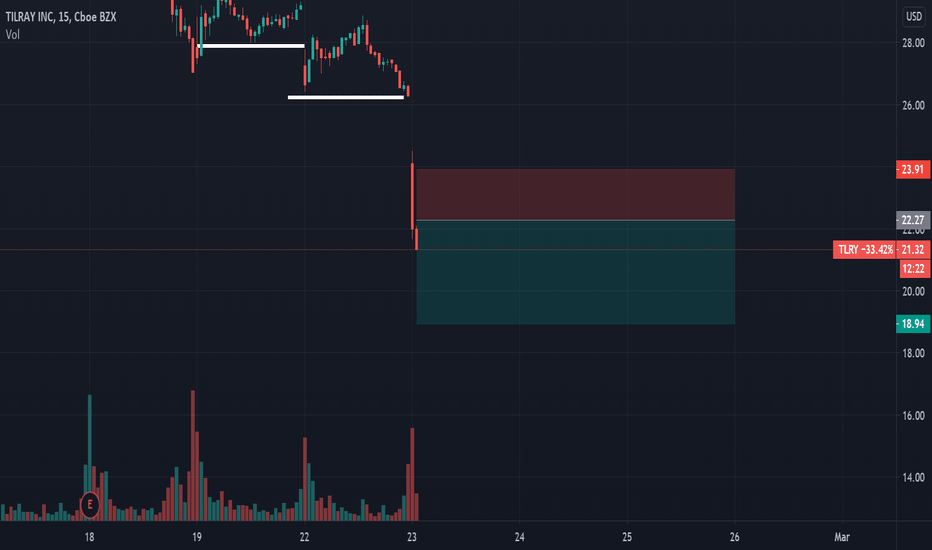

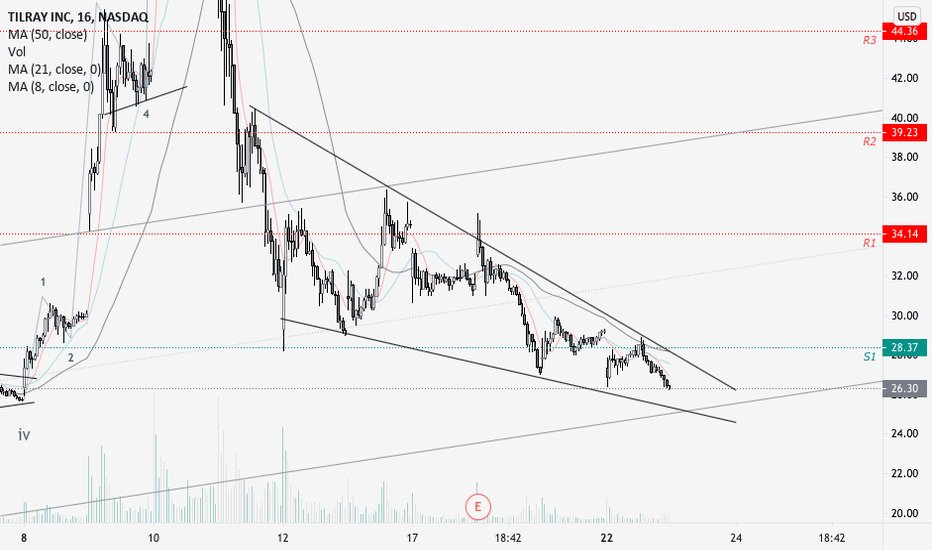

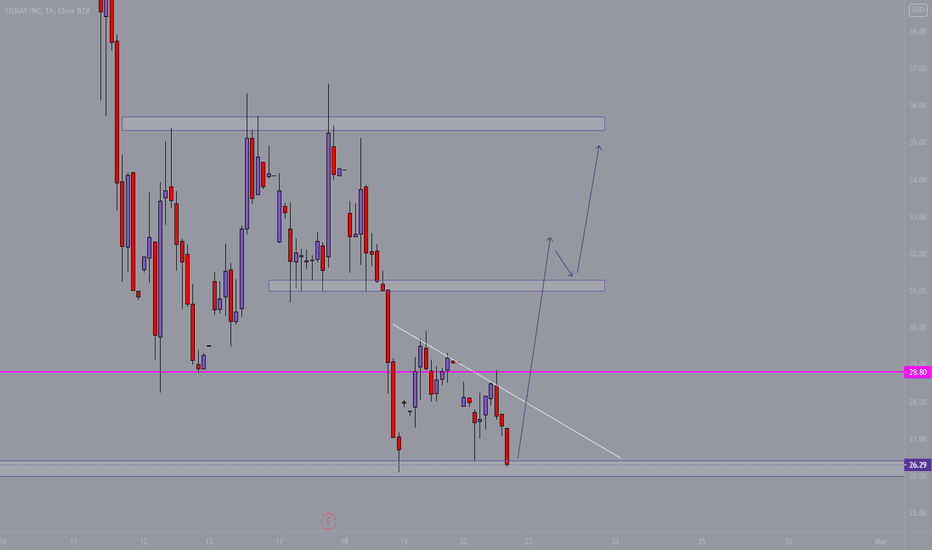

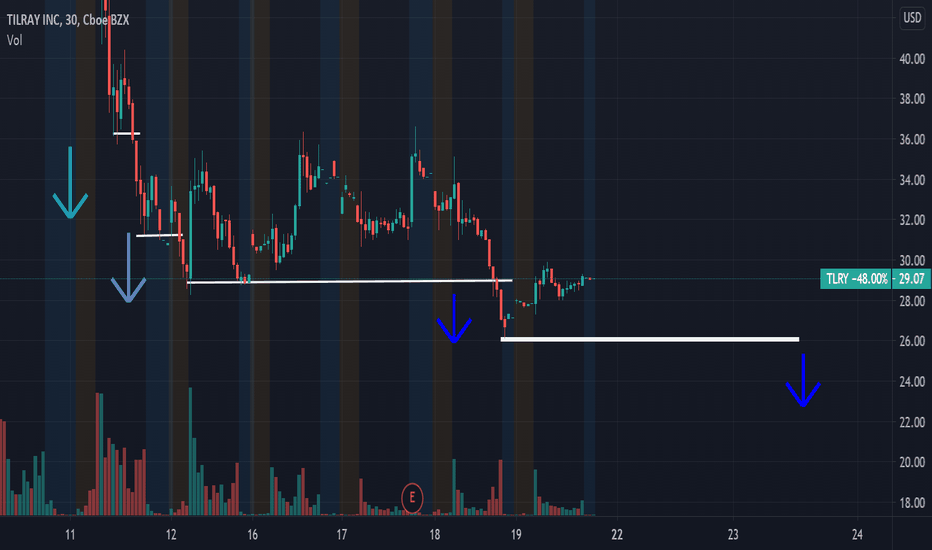

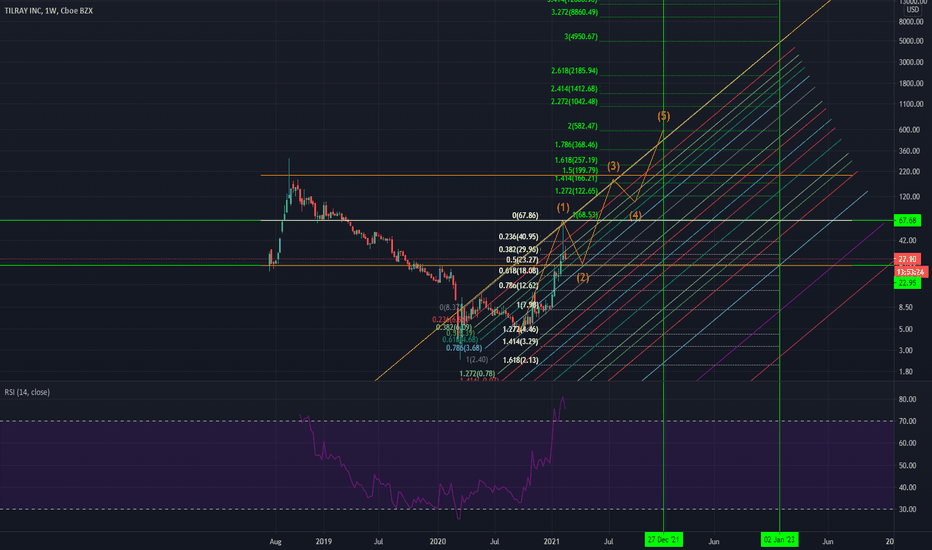

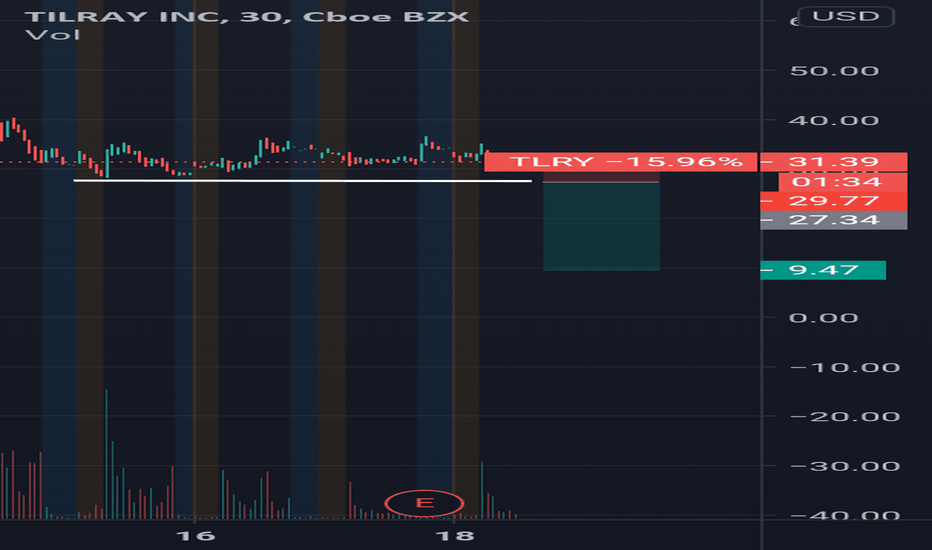

TLRYRange broke. So no range. Downgraded to neutral yesterday, so institutions are out of shares to feed us. Pennies away from daily MA21, super bearish close, so likely to see more downside. MA21 could provide a reasonable bounce, but only if she finds demand there. If not, the MA50 at $17 could be next.

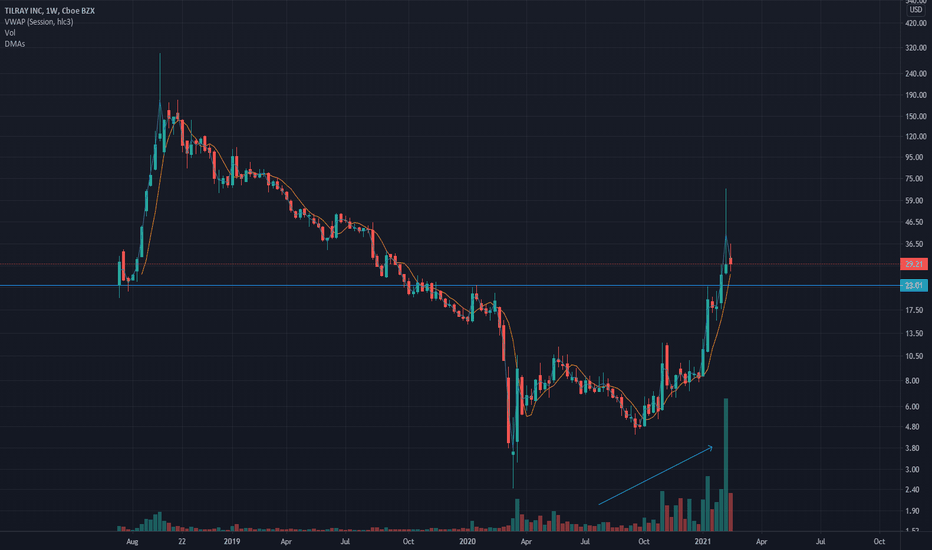

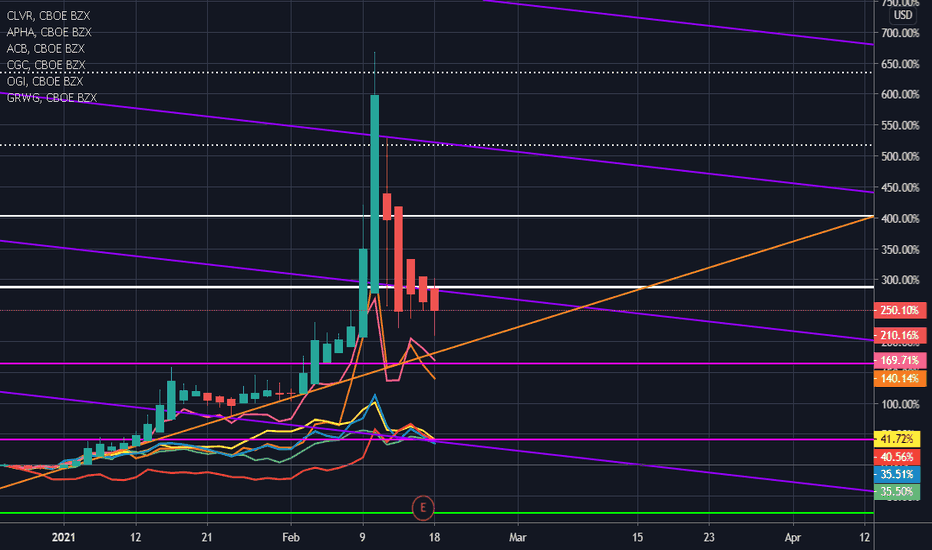

[TLRY] 2021 Cannabis Market Roundup: TLRY and APHA Lead the Way!Cannabis feels so meta sometimes.

TLRY leads a 10x market run and then collapses to the worst performing Cannabis company in 2021 lol.

Man APHA definitely getting the short end of the stick here haha but they'll all make plenty of money slangin drugs together.

Wish I had done a mashup like this a long time ago, lots of fun data.

Here's how I've been betting it:

1. APHA/TLRY (TLRY was my #3 before the merger)

2. CGC

3. ACB

4. OGI

I threw in GRWG and CLVR here too.

GRWG is the shovels and pickaxes of this Green Gold Rush.

CLVR a new entrant that looks promising.

I have some other minor stakes but these are the Gems.

TLRY/APHA leading the pack with OGI coming out of left field recently to supplant ACB and CGC.

With OGI finally blowing up, that makes CGC the best value play right now. At similar value, CGC much better company than ACB.

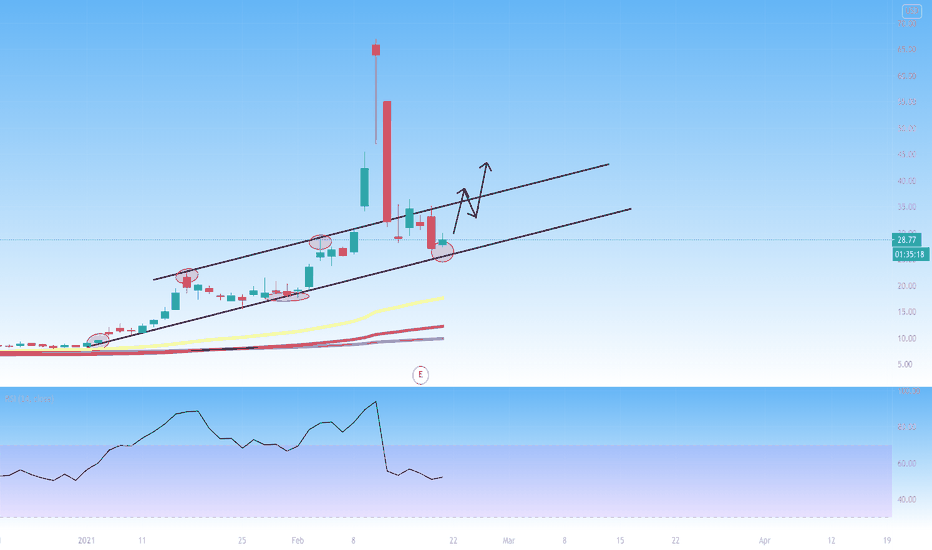

Lookin to pick up another load around $23-$26 and we're back on the hunt for that double top ;).

APHA and TLRY are priced pretty well here, OGI lookin pretty overpriced. Rest are underpriced.

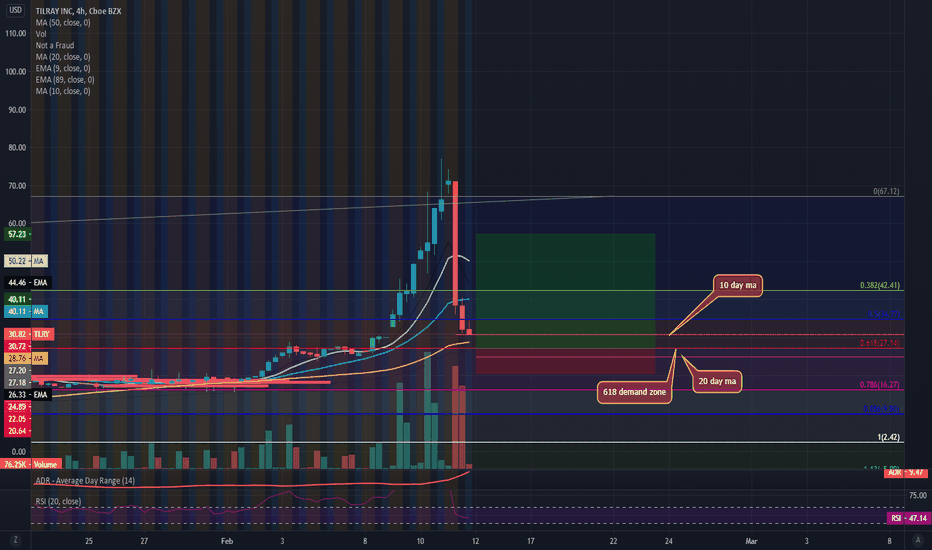

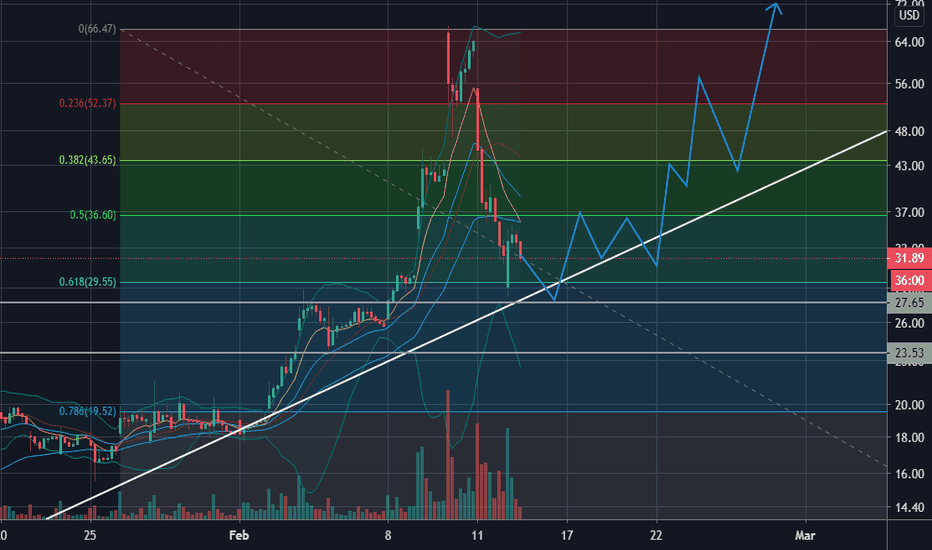

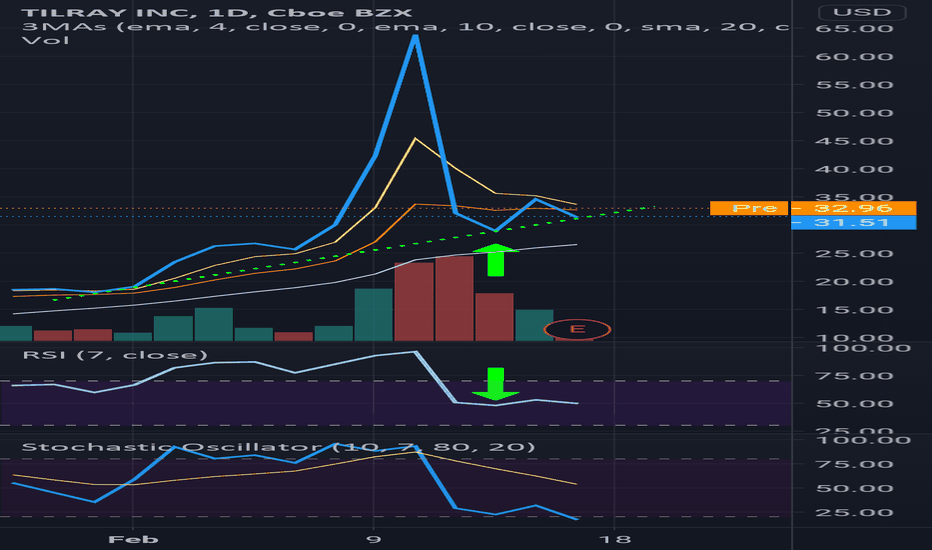

TLRY - swing calls, day trade, or buy stock - great r/rThe green arrows show when price retraced, RSI also dipped below 50 and came back over the next day. If RSI is higher by end of day and price moves over yesterday's high, that signals more upside. Stochastic looks ready for a bounce.

Choose your timeframe and take profits accordingly. My initial stop losses: < yesterday close, < 30. It is better to reenter a trade than to lose too much capital.