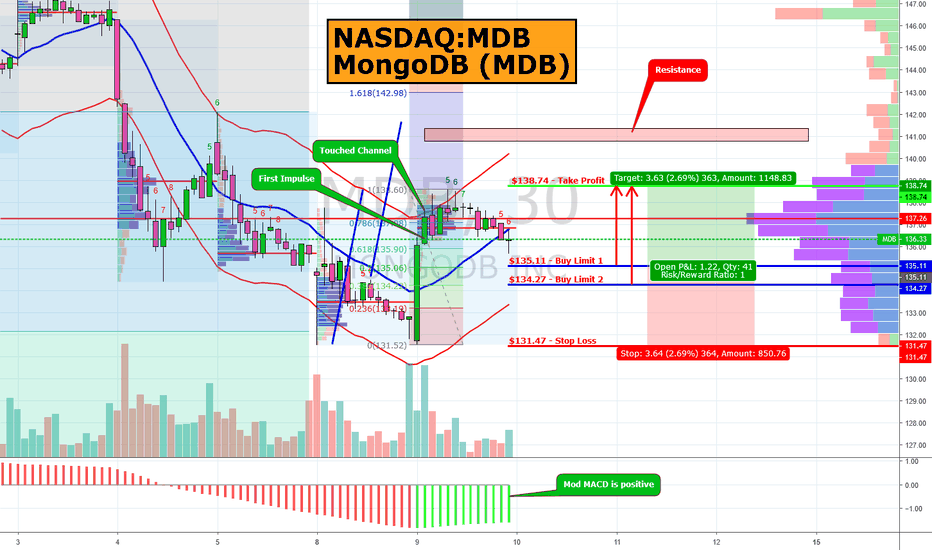

MongoDB, Inc. (MDB)(NASDAQ) Buy Limit $135.11 >>> $138.74NASDAQ:MDB

MongoDB, Inc. (MDB)

Why MongoDB Stock Soared 44.8% in March:

What happened

Shares of MongoDB (NASDAQ: MDB) surged nearly 45% last month, according to data provided by S&P Global Market Intelligence, following the cloud database company's excellent fourth-quarter report.

So what

MongoDB's revenue rocketed 71% higher to $85.5 million, besting Wall Street's expectations of $74 million and representing an acceleration from the company's 57% growth in the third quarter. MongoDB's results were fueled by the torrid growth of its Atlas database-as-a-service offering, which saw sales explode higher by more than 400%.

"MongoDB Atlas, our fully managed global, multi-cloud database service, achieved a major milestone in the fourth quarter, surpassing $100 million in annualized revenue run rate less than three years from launch," CEO Dev Ittycheria said in a press release. "At approximately one-third of our revenue, MongoDB Atlas' tremendous growth highlights its compelling value to enable customers to focus on innovation and offload the operational burden of database management."

Looking ahead, MongoDB expects fiscal 2020 full-year revenue to rise 36% to 39% year over year to a range of $363 million to $371 million.

---

Buy Limit 1 - $135.11

Buy Limit 2 - $134.27

Take Profit - $138.74

Stop Loss - $131.47

------

Take Profit = +2.69%

Stop Loss = -2.69%

526 trade ideas

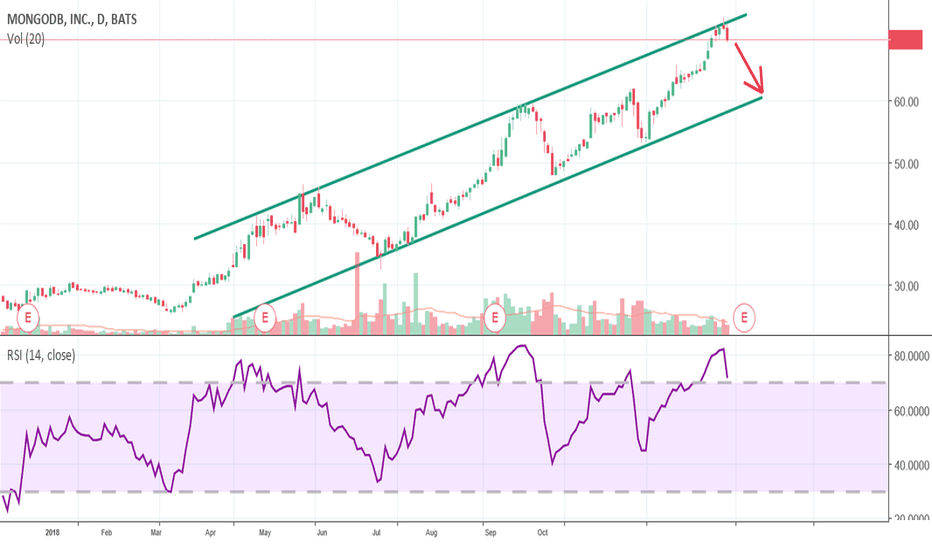

No one shorts Mdb and lives to tell it's tale.lol, honestly, I don't even dare to short mdb.

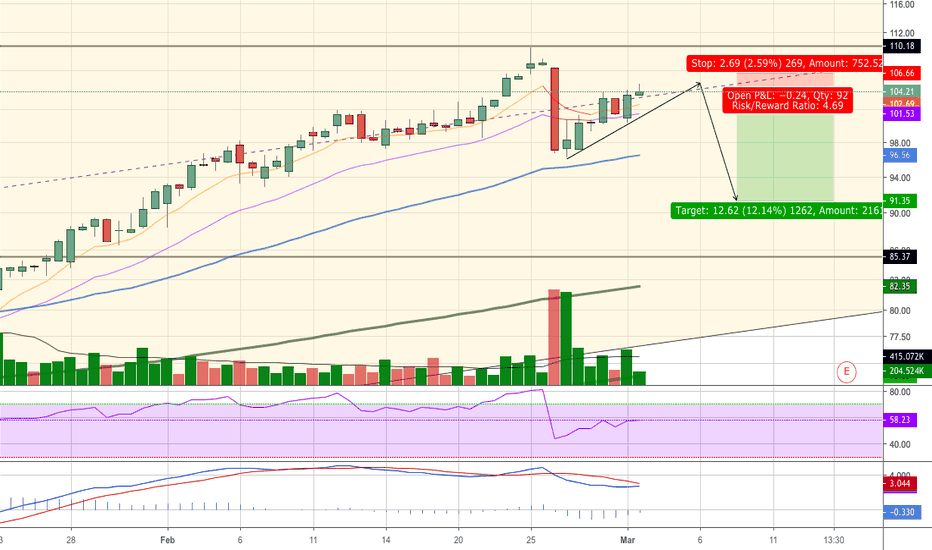

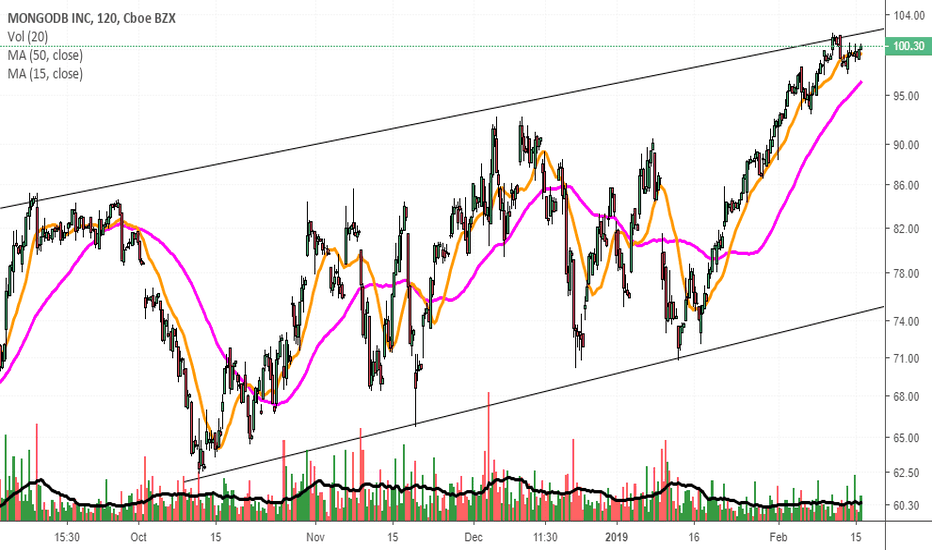

However if i were to start a position, it would be at $150 because the latest analyst pt was around $150s, and the RSi is just so high already, it's gotta reset a bit.

But if there's one stock that doesn't give a shit about the market condition, or spy. that would be MDB.

Literally the only stock to be buying the fucking dip.

Short at $150.

stoploss $151

take profit $147.

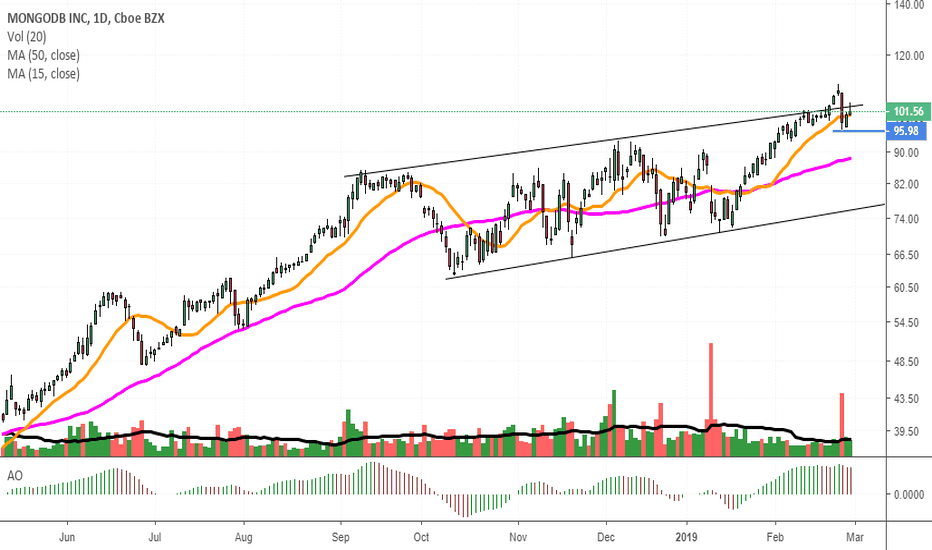

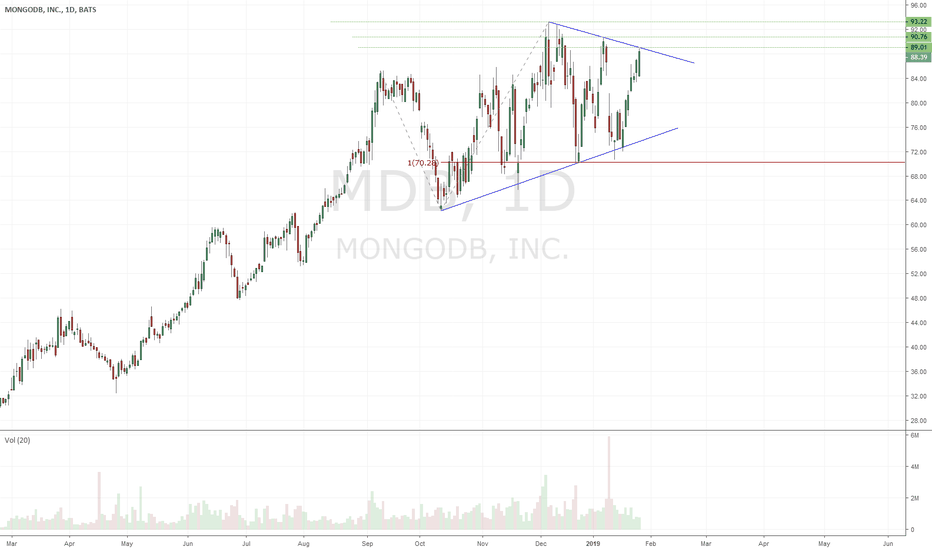

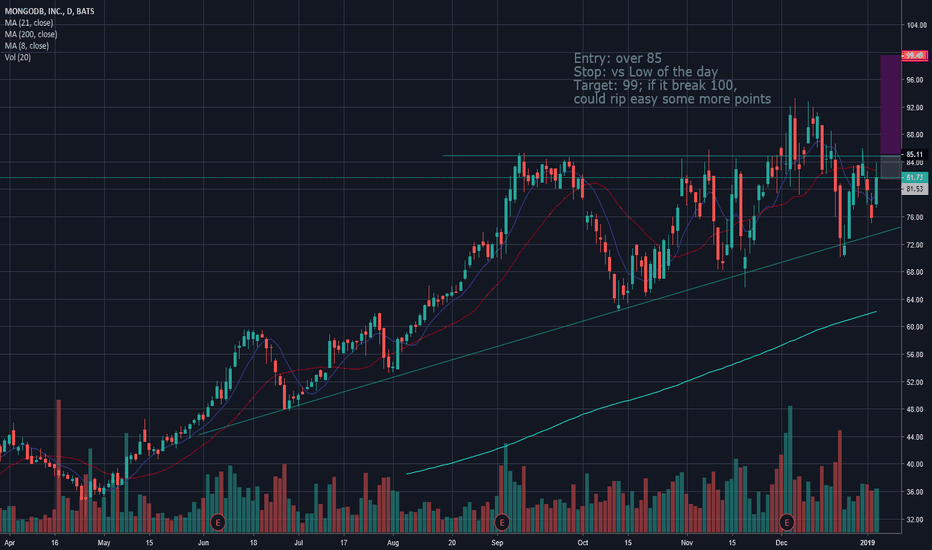

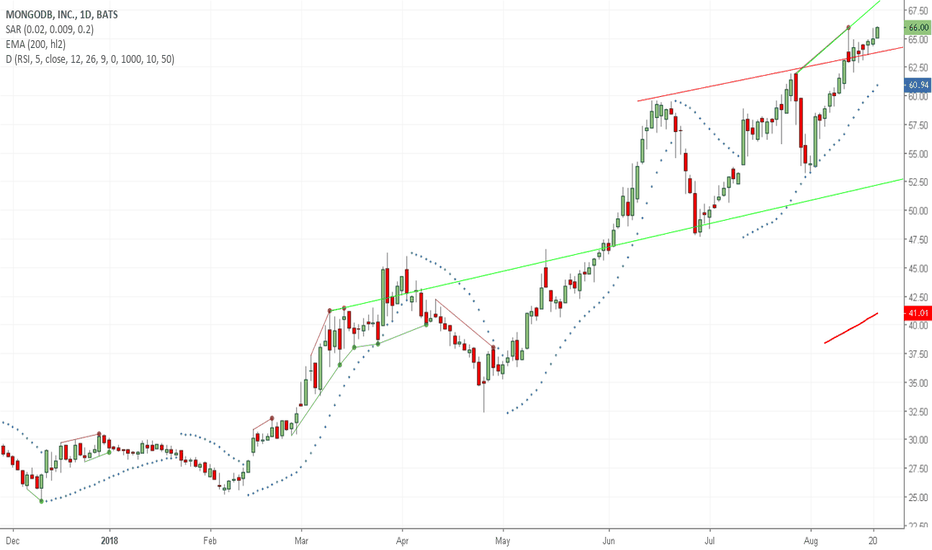

High probability BREAKOUT!!!NASDAQ:MDB is showing a lot of strength. If it tests the resistance, pulls back and goes back up, just like drawn on the chart, then buy as a swing trade above 81.93, with a stop at 79.90; however, if the stock gaps up at the open or breaks through the resistance without any pullback, then I wouldn't chase it.

Please like and comment if you like my ideas. THANK YOU!!!

Please note that this information is not a recommendation to buy or sell. It is to be used for educational purposes only.

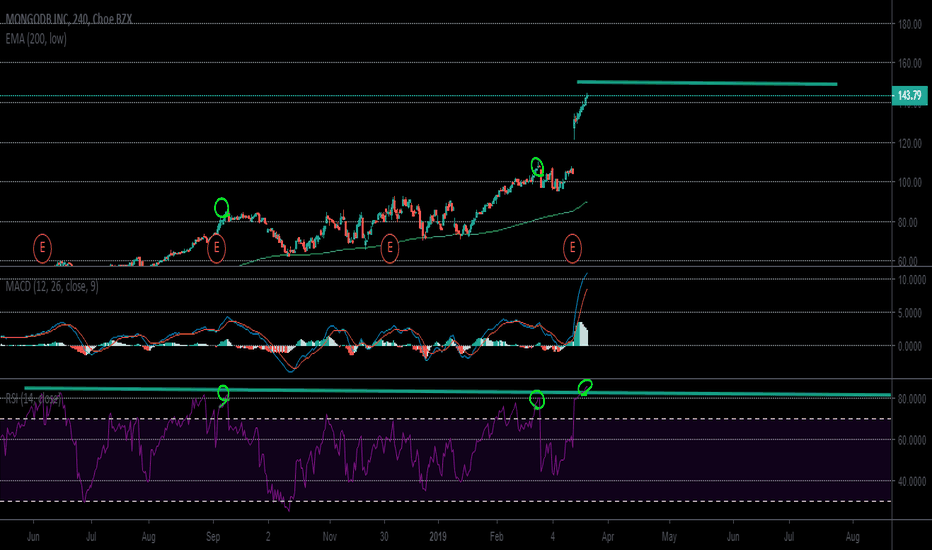

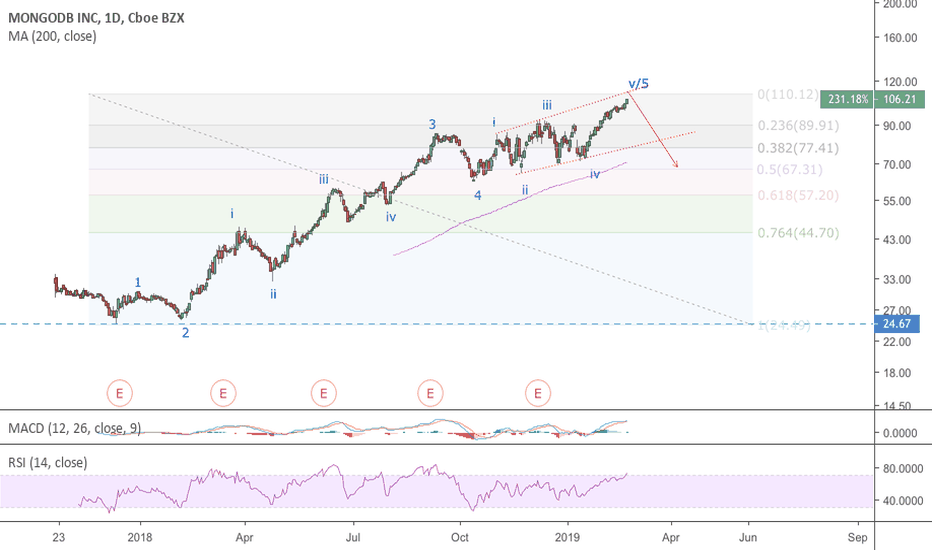

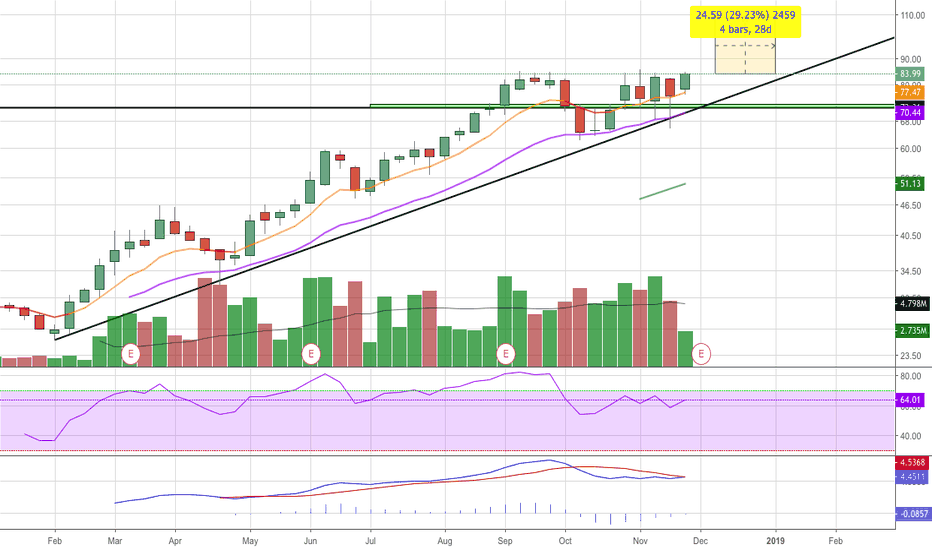

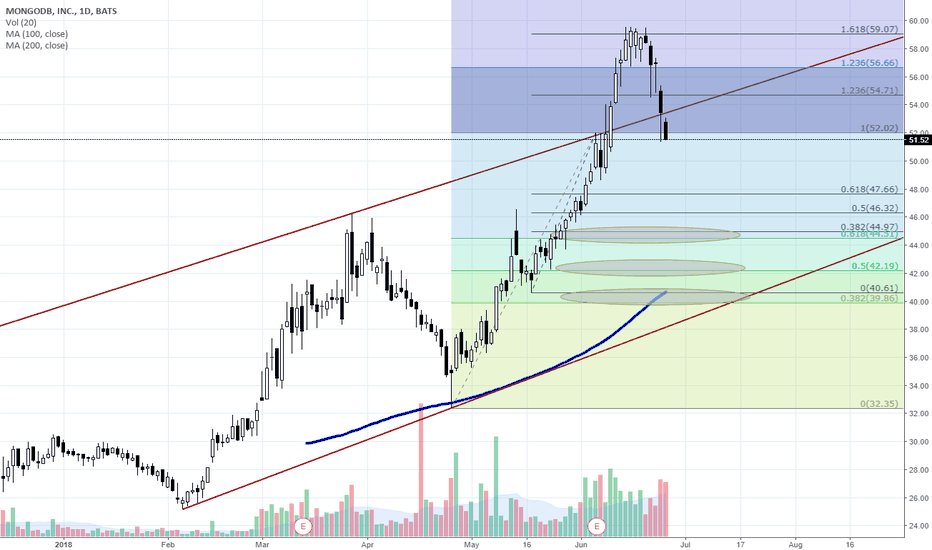

POSSIBLE 20% GAIN ON MDB- FOLLOW SETUPAS we can see, we may be getting a third wave rise after the retracement which would result in a price range between the 2 green horizontal lines- this could result in a +/- 20% ROI in a relatively short amount of time.

OF COURSE, this setup can *easily* be invalided because the company only recently IPO'd and wave analysis is hard, but this one is turning out to look good. I wouldn't enter to try and buy the third wave until we get a great validation entry on a short time frame or a catalyst that allows you to enter in a well timed fashion and favorable RR.

FOLLOW THIS FOR UPDATES! I will be updating as the market plays out.

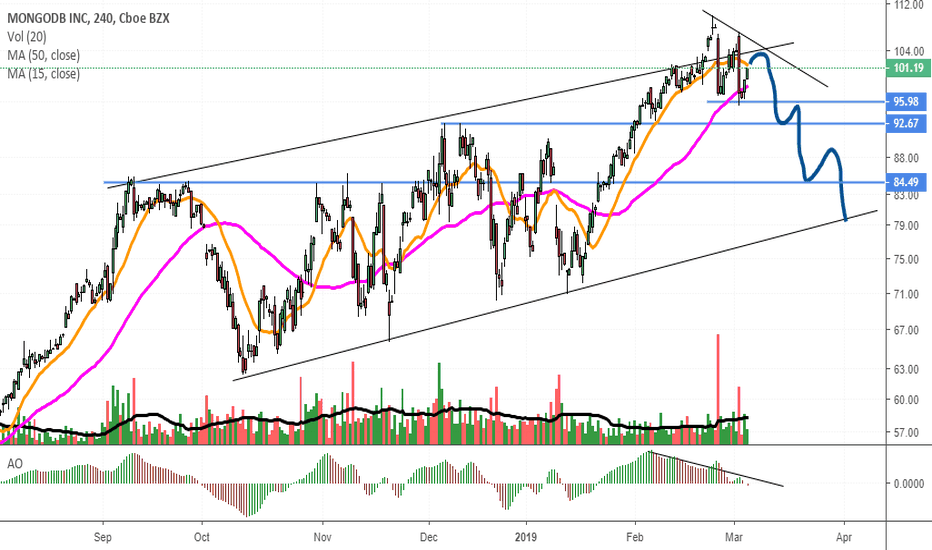

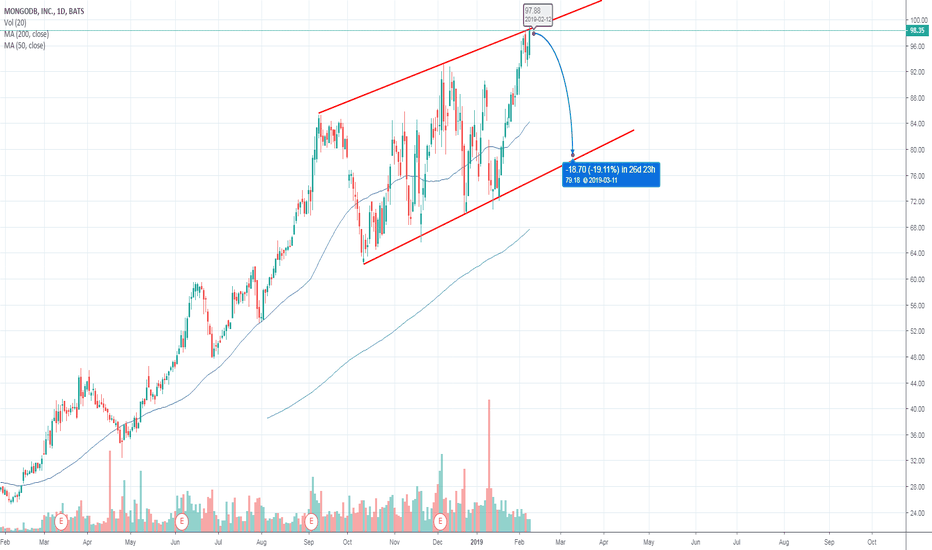

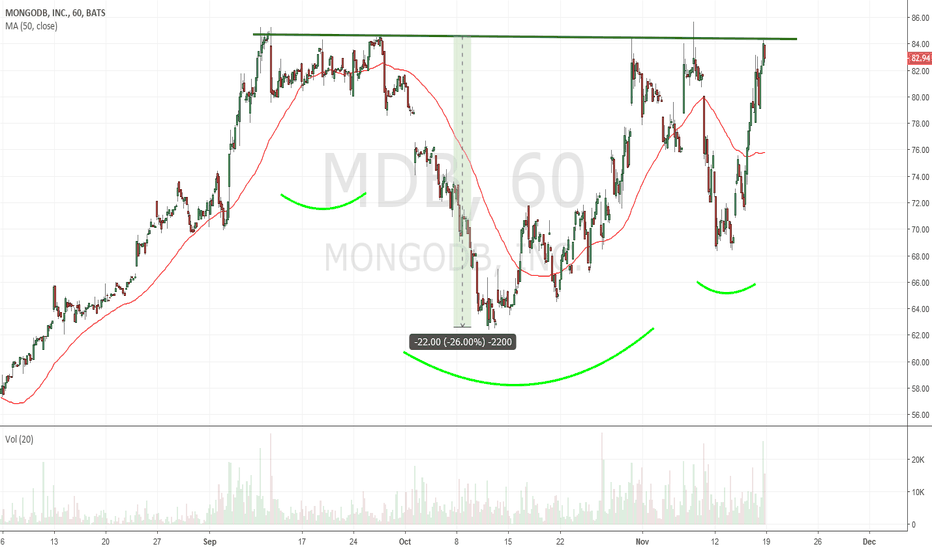

Where I'd like to pick up some MDB shares$MDB is a great company and I like the technology (I'm a software developer). Although I think with today's candle closing near the low, a potential gap down is in the books that could trap people that bought yesterday. So there's a potential to make money with puts or shorting the stock if that gap down does occur. Would be a gap and go.

For at least a couple months, my plan is to initiate a position with shares at each of the three ovals.