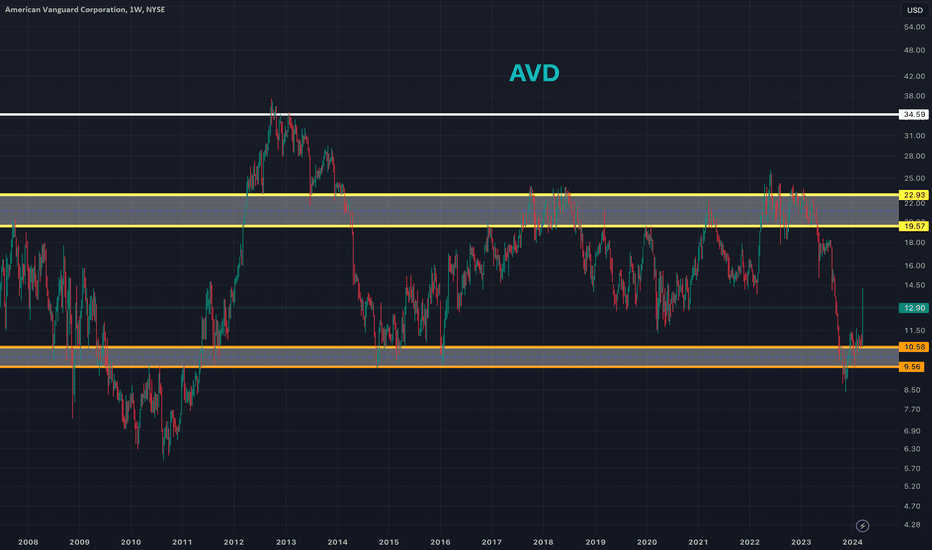

AVD Great Buy Between $9.56 and $10.58.AVD has three simple trading levels and is trading near the lows around $9.56 to $10.58. There are long wicks down to $9.56 and below for the best entry opportunities. I think AVD could present a buy opportunity over the next few weeks or months and I would be willing to buy around $9.56 or lower. F

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−4.40 EUR

−122.04 M EUR

528.69 M EUR

32.29 M

About American Vanguard Corporation

Sector

Industry

CEO

Douglas A. Kaye

Website

Headquarters

Newport Beach

Founded

1969

American Vanguard Corp. is a holding company which engages in the development and marketing of specialty and agricultural products for crop protection and management, turf and ornamentals management, public and animal health. It also acquires and licenses both new and well-established product lines that serve numerous market niches. The company was founded by Herbert A. Kraft and Glenn A. Wintemute in January 1969 and is headquartered in Newport Beach, CA.

Related stocks

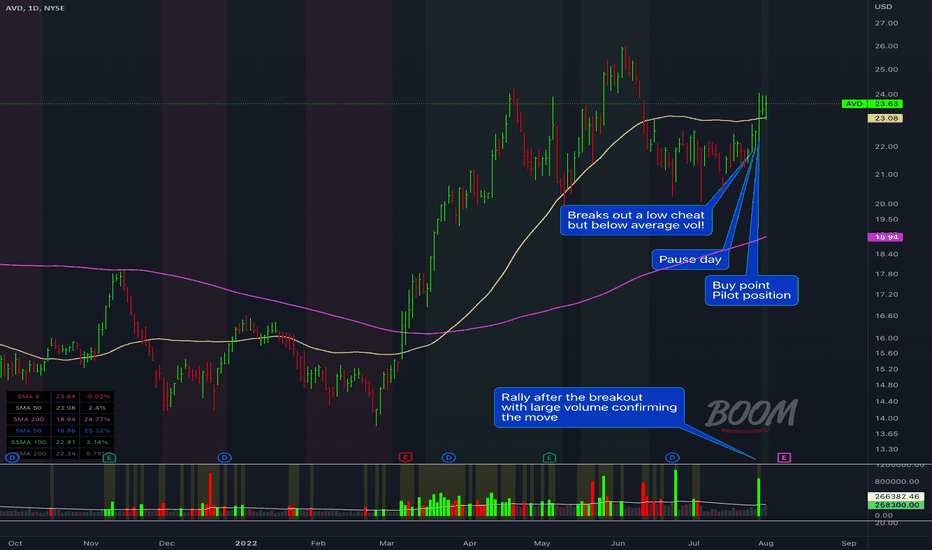

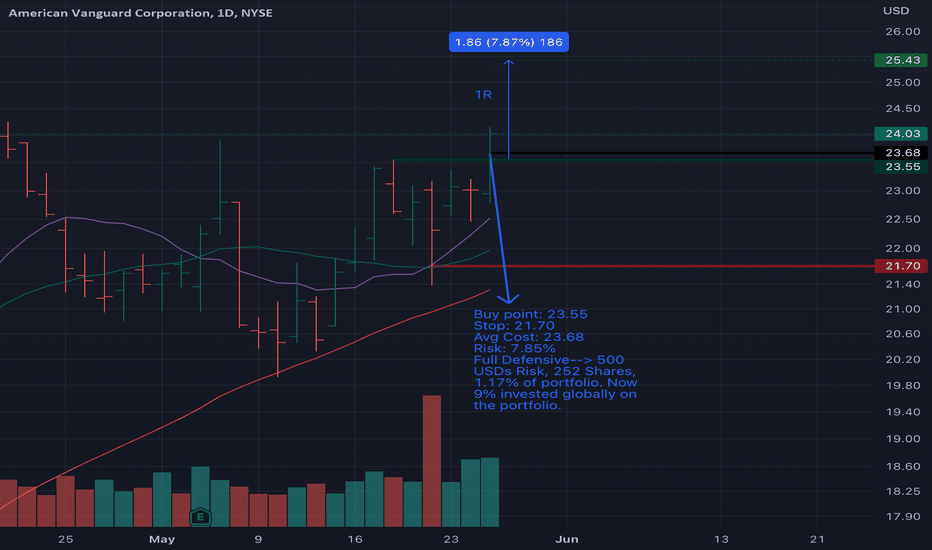

🟩 AVD - setup recapAVD had a nice cheat that set up! It did breakout on 26/7 however it did so on BELOW average volume. This triggered alerts on my end, however due to the low volume I didn not buy. It then paused and subsequently we got a follow on rally whenre I bought the stock (buy price @23.36) that ended with a

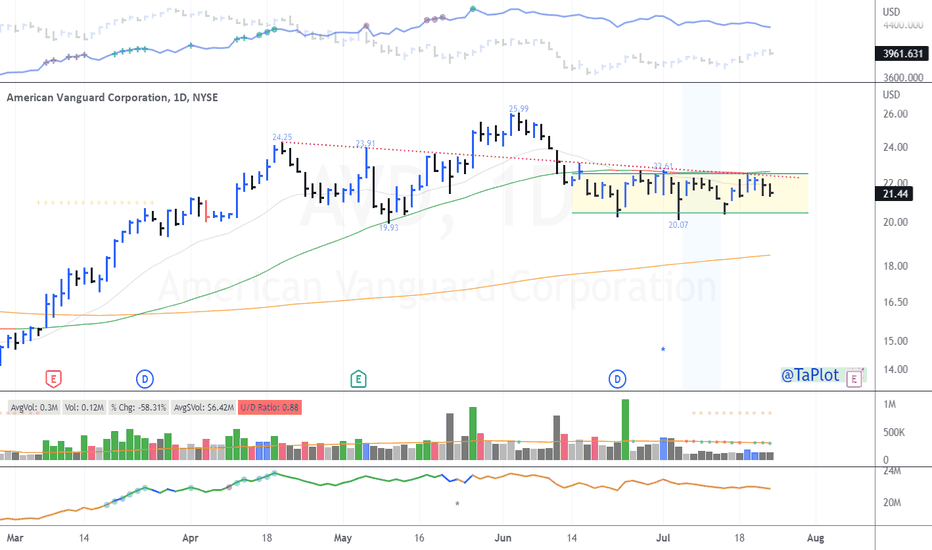

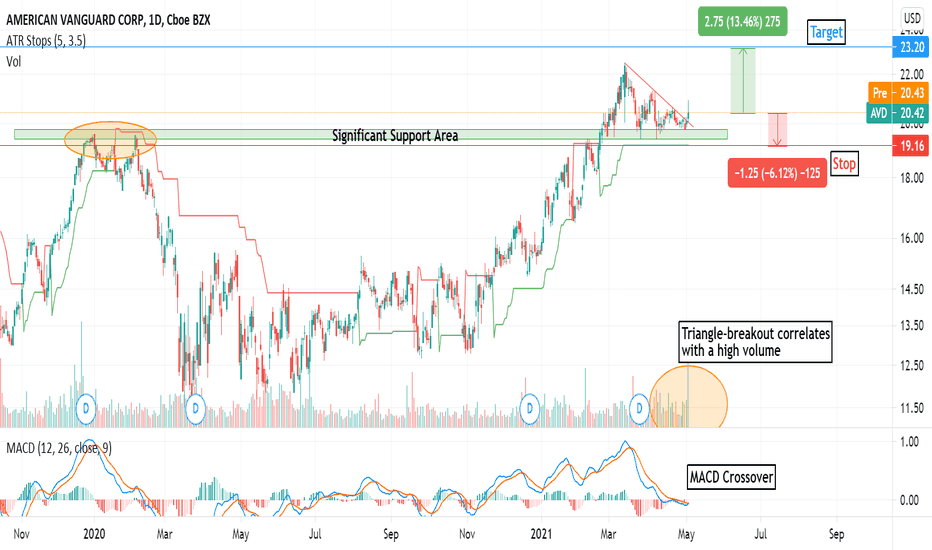

$AVD Consolidating below its 50 MA$AVD in the #ags chemical space held up better than many others in the group.

Its consolidating right below its 50 MA.

A beak upwards through that level could reinstate the uptrend from earlier this year. That will also invalidate the potential head and shoulders top.

AVD Breakout, another pilot position.Added a new pilot position. Now 9% invested with 7 positions ranging from Oil & Gas, Pharma, Education and Chemicals specialty.

Im trying to put a toe in the water with a "Shotgun" approach meaning im adding different small breakout names of different industries. Well see if I get traction from he

$AVD breaking out of its ~14 month base * Broke its historical resistance of $23.55 which dates back to 2006 with tonnes of volume behind the move

Technicals:

* Sector: Basic Materials - Agricultural Inputs

* Relative Strength vs. Sector: 52.33

* Relative Strength vs. SP500: 8.92

* U/D Ratio: 1.61

* Base Depth: 71.26%

* Distance from b

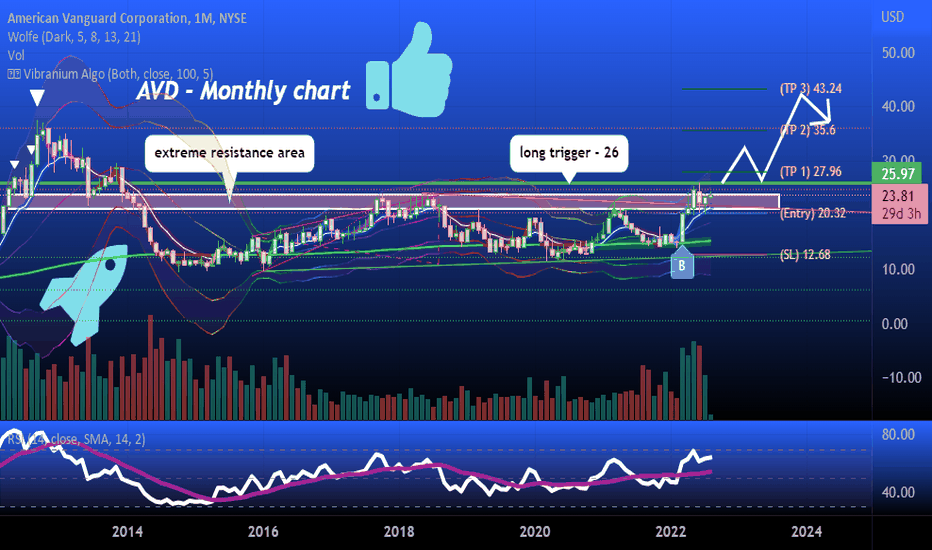

American Vanguard moving higher off old supply.

###TITLE SHOULD SAY "OFF OLD DEMAND ", SORRY ABOUT THE CONFUSION####

Yesterday AVD reported earnings with a beat. If price holds here , it looks like we have nice opportunity. Price also happens to be coming off old demand level. I have a stop at 12.28 with a first target at 13.80 and a

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of AVJ is 3.10 EUR — it hasn't changed in the past 24 hours. Watch AMERICAN VANGUARD CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on GETTEX exchange AMERICAN VANGUARD CORP stocks are traded under the ticker AVJ.

AVJ stock has fallen by −0.16% compared to the previous week, the month change is a −11.17% fall, over the last year AMERICAN VANGUARD CORP has showed a −62.15% decrease.

We've gathered analysts' opinions on AMERICAN VANGUARD CORP future price: according to them, AVJ price has a max estimate of 10.53 EUR and a min estimate of 10.53 EUR. Watch AVJ chart and read a more detailed AMERICAN VANGUARD CORP stock forecast: see what analysts think of AMERICAN VANGUARD CORP and suggest that you do with its stocks.

AVJ stock is 7.33% volatile and has beta coefficient of 0.98. Track AMERICAN VANGUARD CORP stock price on the chart and check out the list of the most volatile stocks — is AMERICAN VANGUARD CORP there?

Today AMERICAN VANGUARD CORP has the market capitalization of 116.17 M, it has decreased by −4.84% over the last week.

Yes, you can track AMERICAN VANGUARD CORP financials in yearly and quarterly reports right on TradingView.

AMERICAN VANGUARD CORP is going to release the next earnings report on Aug 7, 2025. Keep track of upcoming events with our Earnings Calendar.

AVJ earnings for the last quarter are −0.28 EUR per share, whereas the estimation was −0.06 EUR resulting in a −328.57% surprise. The estimated earnings for the next quarter are −0.09 EUR per share. See more details about AMERICAN VANGUARD CORP earnings.

AMERICAN VANGUARD CORP revenue for the last quarter amounts to 107.04 M EUR, despite the estimated figure of 117.39 M EUR. In the next quarter, revenue is expected to reach 107.69 M EUR.

AVJ net income for the last quarter is −7.82 M EUR, while the quarter before that showed −87.35 M EUR of net income which accounts for 91.05% change. Track more AMERICAN VANGUARD CORP financial stats to get the full picture.

Yes, AVJ dividends are paid quarterly. The last dividend per share was 0.03 EUR. As of today, Dividend Yield (TTM)% is 3.09%. Tracking AMERICAN VANGUARD CORP dividends might help you take more informed decisions.

As of Jun 26, 2025, the company has 755 employees. See our rating of the largest employees — is AMERICAN VANGUARD CORP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. AMERICAN VANGUARD CORP EBITDA is −37.82 M EUR, and current EBITDA margin is −5.45%. See more stats in AMERICAN VANGUARD CORP financial statements.

Like other stocks, AVJ shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade AMERICAN VANGUARD CORP stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So AMERICAN VANGUARD CORP technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating AMERICAN VANGUARD CORP stock shows the sell signal. See more of AMERICAN VANGUARD CORP technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.