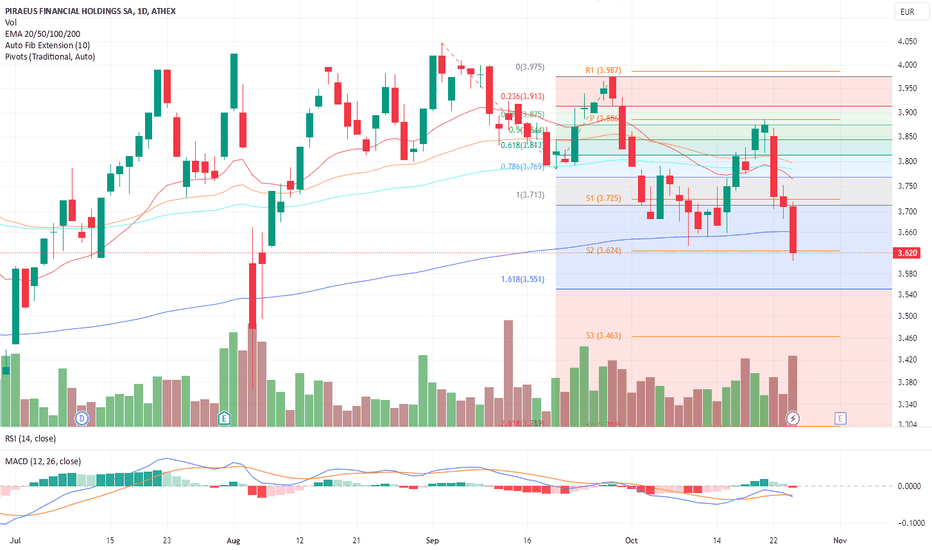

Piraeus Financial Holdings SA Poised for a Potential Rebound -TAPiraeus Financial Holdings SA's recent price movements suggest the stock might be preparing for a positive turnaround, offering an intriguing opportunity for investors. Currently trading around €3.62, the stock finds itself at a critical support level that could act as a strong base for a potential

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.90 EUR

1.07 B EUR

3.91 B EUR

1.25 B

About PIRAEUS FINANCIAL HOLDINGS(CR)

Sector

Industry

CEO

Christos Ioanni Megalou

Website

Headquarters

Athens

Founded

1916

ISIN

GRS014003032

FIGI

BBG000FM2TY1

Piraeus Financial Holdings SA engages in the provision of financial and banking services. It operates through the following segments: Retail Banking, Corporate Banking, Piraeus Financial Markets (PFM), Other and Piraeus Legacy Unit (PLU). The Retail Banking segment includes mass, affluent, private banking, small businesses and public core segments and channels. The Corporate Banking segment includes facilities relating to large corporate, shipping, small and medium scale enterprises, green banking and the agricultural segments. The PFM segment includes the fixed income, foreign exchange, treasury activities as well as the institutional clients. The Other segment includes management related activities which cannot or should not be allocated to specific customer segment. The PLU segment includes the RBU, which is considered to be non-core business, international business as well as real estate owned, non-core Greek subsidiaries and discontinued operations. The company was founded on July 6, 1916 and is headquartered in Athens, Greece.

Related stocks

Jefferies: Maintains "Buy" Rating with a €6.25 Target PriceJefferies: Piraeus' Acquisition of National Insurance Boosts Profitability and Capital Position – Maintains "Buy" Rating with a €6.25 Target Price

The acquisition of 90% of National Insurance by Piraeus Bank for €540 million is a highly strategic move that, according to Jefferies' analysis, will sig

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

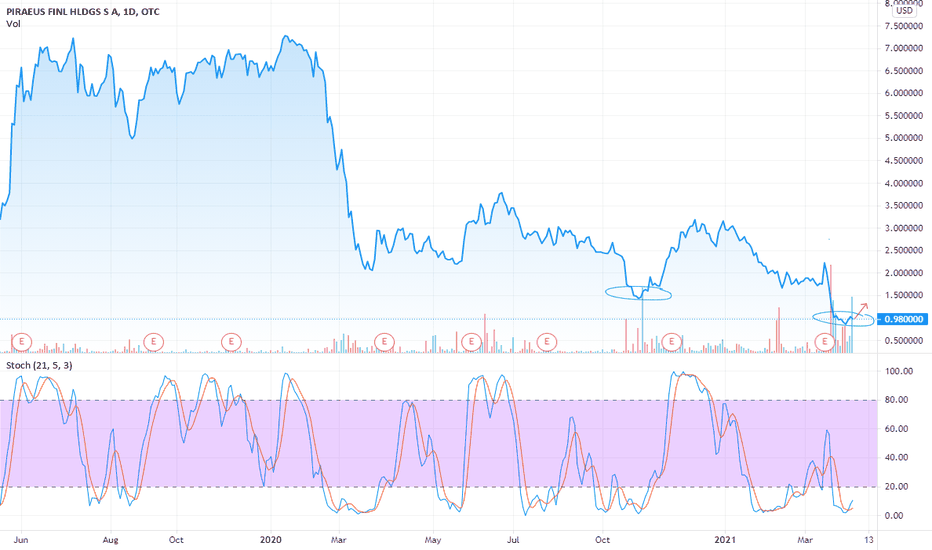

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of BKP is 6.44 EUR — it has decreased by −0.24% in the past 24 hours. Watch PIRAEUS FINANCIAL HOLDINGS SOCIETE ANONYME stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on GETTEX exchange PIRAEUS FINANCIAL HOLDINGS SOCIETE ANONYME stocks are traded under the ticker BKP.

BKP stock has risen by 9.13% compared to the previous week, the month change is a 17.98% rise, over the last year PIRAEUS FINANCIAL HOLDINGS SOCIETE ANONYME has showed a 77.08% increase.

We've gathered analysts' opinions on PIRAEUS FINANCIAL HOLDINGS SOCIETE ANONYME future price: according to them, BKP price has a max estimate of 7.93 EUR and a min estimate of 5.22 EUR. Watch BKP chart and read a more detailed PIRAEUS FINANCIAL HOLDINGS SOCIETE ANONYME stock forecast: see what analysts think of PIRAEUS FINANCIAL HOLDINGS SOCIETE ANONYME and suggest that you do with its stocks.

BKP stock is 2.71% volatile and has beta coefficient of 1.81. Track PIRAEUS FINANCIAL HOLDINGS SOCIETE ANONYME stock price on the chart and check out the list of the most volatile stocks — is PIRAEUS FINANCIAL HOLDINGS SOCIETE ANONYME there?

Today PIRAEUS FINANCIAL HOLDINGS SOCIETE ANONYME has the market capitalization of 8.17 B, it has increased by 6.25% over the last week.

Yes, you can track PIRAEUS FINANCIAL HOLDINGS SOCIETE ANONYME financials in yearly and quarterly reports right on TradingView.

PIRAEUS FINANCIAL HOLDINGS SOCIETE ANONYME is going to release the next earnings report on Jul 30, 2025. Keep track of upcoming events with our Earnings Calendar.

BKP earnings for the last quarter are 0.21 EUR per share, whereas the estimation was 0.21 EUR resulting in a −2.22% surprise. The estimated earnings for the next quarter are 0.20 EUR per share. See more details about PIRAEUS FINANCIAL HOLDINGS SOCIETE ANONYME earnings.

PIRAEUS FINANCIAL HOLDINGS SOCIETE ANONYME revenue for the last quarter amounts to 649.00 M EUR, despite the estimated figure of 657.80 M EUR. In the next quarter, revenue is expected to reach 653.60 M EUR.

BKP net income for the last quarter is 284.00 M EUR, while the quarter before that showed 185.00 M EUR of net income which accounts for 53.51% change. Track more PIRAEUS FINANCIAL HOLDINGS SOCIETE ANONYME financial stats to get the full picture.

PIRAEUS FINANCIAL HOLDINGS SOCIETE ANONYME dividend yield was 7.76% in 2024, and payout ratio reached 34.92%. The year before the numbers were 1.97% and 10.01% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 12, 2025, the company has 7.76 K employees. See our rating of the largest employees — is PIRAEUS FINANCIAL HOLDINGS SOCIETE ANONYME on this list?

Like other stocks, BKP shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PIRAEUS FINANCIAL HOLDINGS SOCIETE ANONYME stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So PIRAEUS FINANCIAL HOLDINGS SOCIETE ANONYME technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating PIRAEUS FINANCIAL HOLDINGS SOCIETE ANONYME stock shows the strong buy signal. See more of PIRAEUS FINANCIAL HOLDINGS SOCIETE ANONYME technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.