Key stats

About DEKA STOXX EUROPE STRONG GROWTH 20 UCITS ETF

Home page

Inception date

Mar 14, 2008

Structure

German Index Fund

Replication method

Physical

Dividend treatment

Distributes

Primary advisor

Deka Investment GmbH

ISIN

DE000ETFL037

The Deka STOXX Europe Strong Growth 20 UCITS ETF is a UCITS IV compliant retail fund that tracks the performance of the STOXX Europe Strong Growth 20 Index (price index). The index tracks the 20 purest growth companies in Europe.

Related funds

Classification

What's in the fund

Exposure type

Producer Manufacturing

Electronic Technology

Health Technology

Consumer Non-Durables

Stock breakdown by region

Top 10 holdings

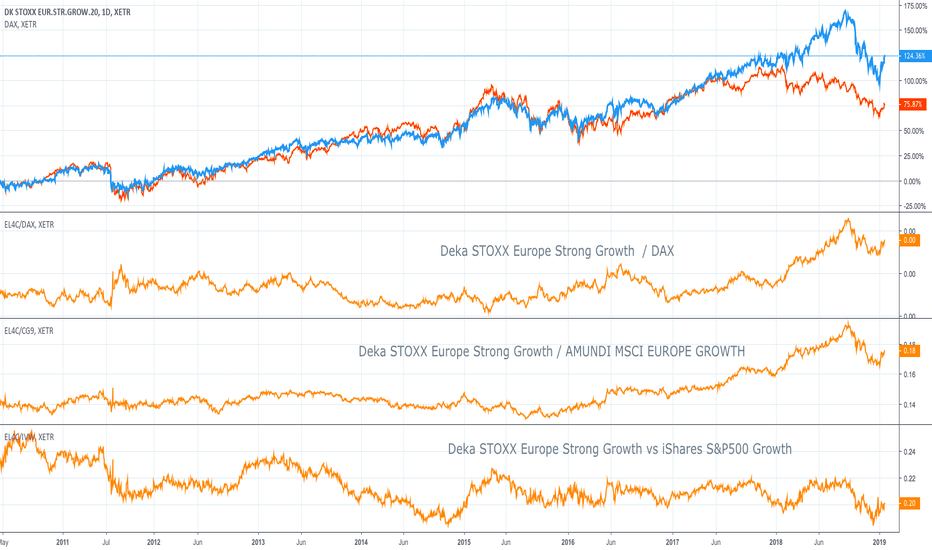

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

EL4C assets under management is 182.53 M EUR. AUM is an important metric as it reflects the fund's size and can serve as a gauge of how successful the fund is in attracting investors, which, in its turn, can influence decision-making.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

EL4C invests in stocks. See more details in our Analysis section.

EL4C expense ratio is 0.65%. It's an important metric for helping traders understand the fund's operating costs relative to assets and how expensive it would be to hold the fund.

No, EL4C isn't leveraged, meaning it doesn't use borrowings or financial derivatives to magnify the performance of the underlying assets or index it follows.

Yes, EL4C pays dividends to its holders with the dividend yield of 0.00%.

EL4C shares are issued by Deutscher Sparkassen-und Giroverband eV

EL4C follows the STOXX Europe Strong Growth 20 Index - EUR. ETFs usually track some benchmark seeking to replicate its performance and guide asset selection and objectives.

The fund started trading on Mar 14, 2008.

The fund's management style is passive, meaning it's aiming to replicate the performance of the underlying index by holding assets in the same proportions as the index. The goal is to match the index's returns.