The Safest Way to Short The Stock MarketIn this video we explain Inverse ETFs as a tool to gain short exposure to the stock market. These can be used as a tool to profit directly from market or as a hedge to protect your stock portfolio in times of market volatility.

Let us know your thoughts in the comments below! Have you ever investe

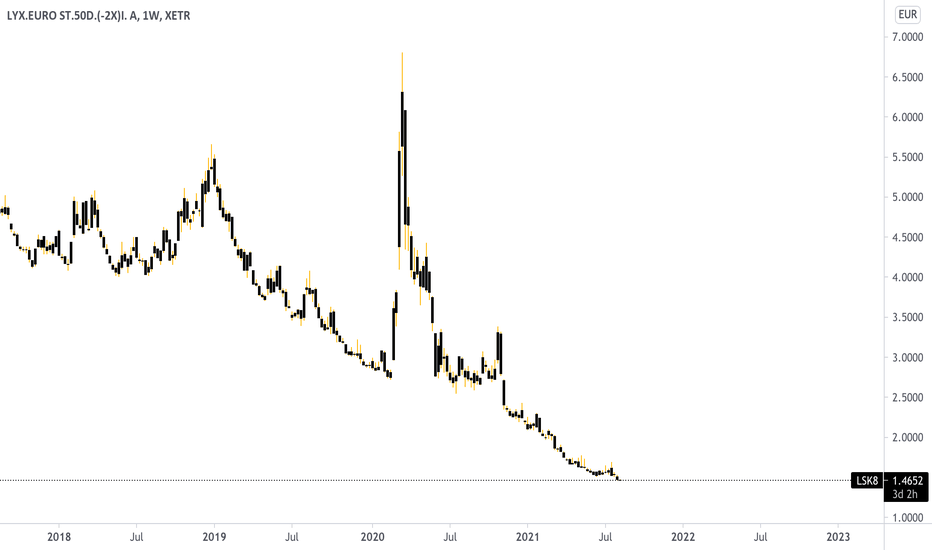

MULTI UNITS FRANCE SICAV - AMUNDI EURO STOXX 50 DAILY (-2X) INVERSE UCITS ETF

No trades

Key stats

About MULTI UNITS FRANCE SICAV - AMUNDI EURO STOXX 50 DAILY (-2X) INVERSE UCITS ETF

Home page

Inception date

Apr 3, 2007

Structure

French SICAV

Replication method

Synthetic

Dividend treatment

Capitalizes

Primary advisor

Amundi Asset Management SASU

ISIN

FR0010424143

The Sub-fund is a passively managed index-tracking fund.The Sub-funds investment objective is to give inverse exposure with daily 2x leverage (positive or negative) to the European equities market, by replicating the performance of the EURO STOXX 50 Daily Double Short index with gross dividends reinvested (the Benchmark Index),

Related funds

Classification

What's in the fund

Exposure type

Electronic Technology

Retail Trade

Finance

Stock breakdown by region

Top 10 holdings

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

LSK8 assets under management is 31.26 M EUR. AUM is an important metric as it reflects the fund's size and can serve as a gauge of how successful the fund is in attracting investors, which, in its turn, can influence decision-making.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

LSK8 invests in stocks. See more details in our Analysis section.

LSK8 expense ratio is 0.60%. It's an important metric for helping traders understand the fund's operating costs relative to assets and how expensive it would be to hold the fund.

LSK8 is an inverse fund, meaning it's structured to generate returns opposite to the trends of the underlying index or assets.

No, LSK8 doesn't pay dividends to its holders.

LSK8 shares are issued by SAS Rue la Boétie

LSK8 follows the Euro STOXX50 Daily Double Short Gross Total Return Index - EUR. ETFs usually track some benchmark seeking to replicate its performance and guide asset selection and objectives.

The fund started trading on Apr 3, 2007.

The fund's management style is passive, meaning it's aiming to replicate the performance of the underlying index by holding assets in the same proportions as the index. The goal is to match the index's returns.