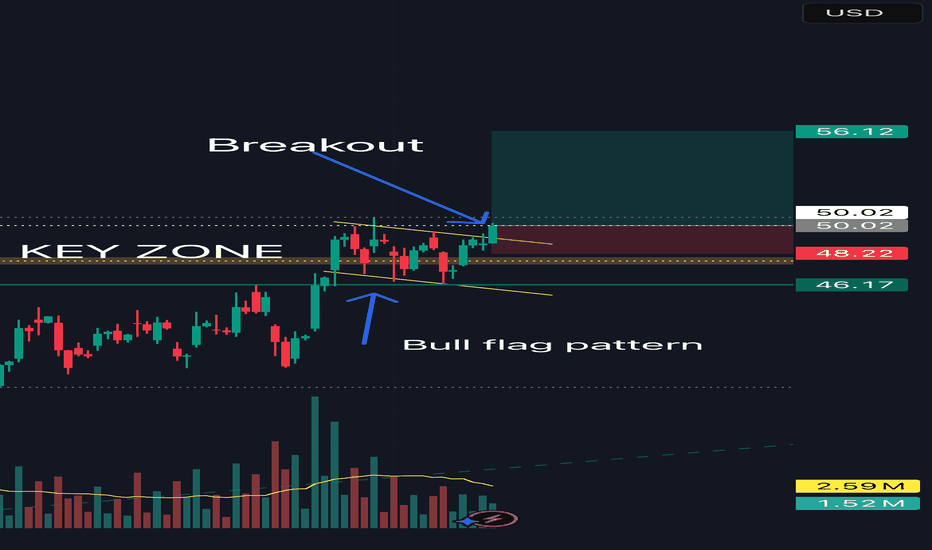

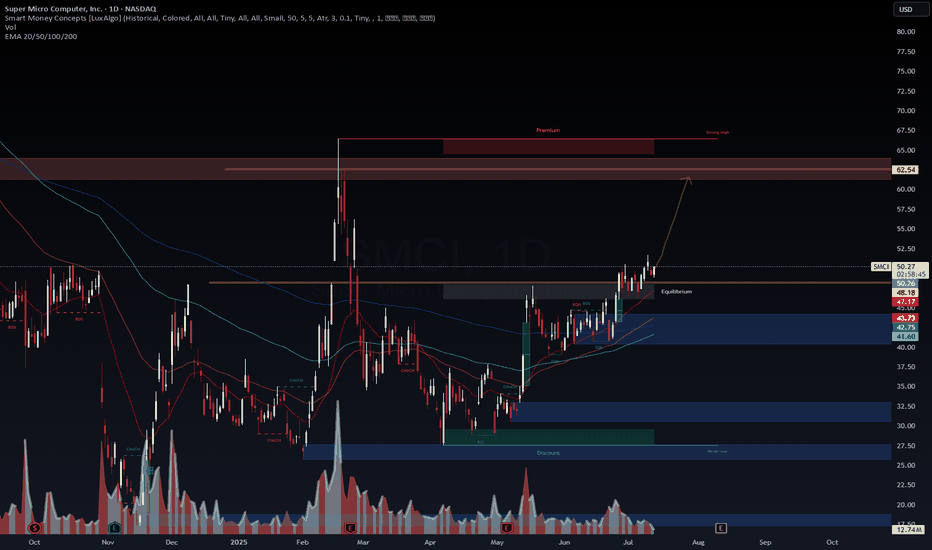

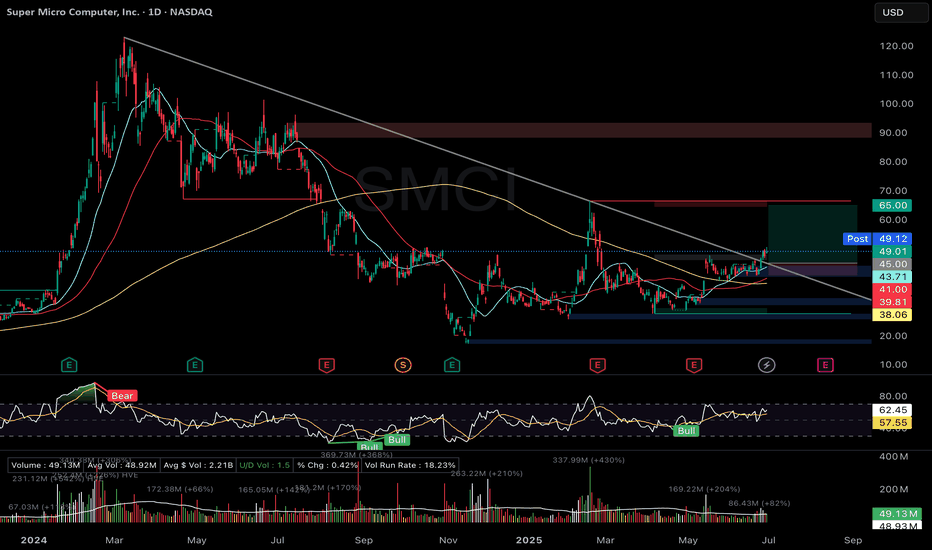

SMCI - Bull Flag Breakout SetupSMCI formed a strong bullish impulse followed by a bull flag pattern.

A breakout above the flag structure may signal continuation if confirmed with strong price action.

Trade Plan:

• Entry: On breakout or retest

• Stop Loss: Below flag support

• TP1: Recent high

• TP2: Measured flagpole exte

Key facts today

Super Micro Computer (SMCI) shares increased by 3.1% in premarket trading, aligning with a broader positive market trend among U.S. chipmakers.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.89 EUR

1.08 B EUR

13.99 B EUR

512.67 M

About Super Micro Computer, Inc.

Sector

Industry

CEO

Charles Liang

Website

Headquarters

San Jose

Founded

1993

FIGI

BBG000R2XTJ5

Super Micro Computer, Inc. engages in the distribution and manufacture of information technology solutions and other computer products. Its products include twin solutions, MP servers, GPU and coprocessor, MicroCloud, AMD solutions, power supplies, SuperServer, storage, motherboards, chassis, super workstations, accessories, SuperRack and server management products. The company was founded by Charles Liang, Yih-Shyan Liaw, Sara Liu, and Chiu-Chu Liu Liang in September 1993 and is headquartered in San Jose, CA.

Related stocks

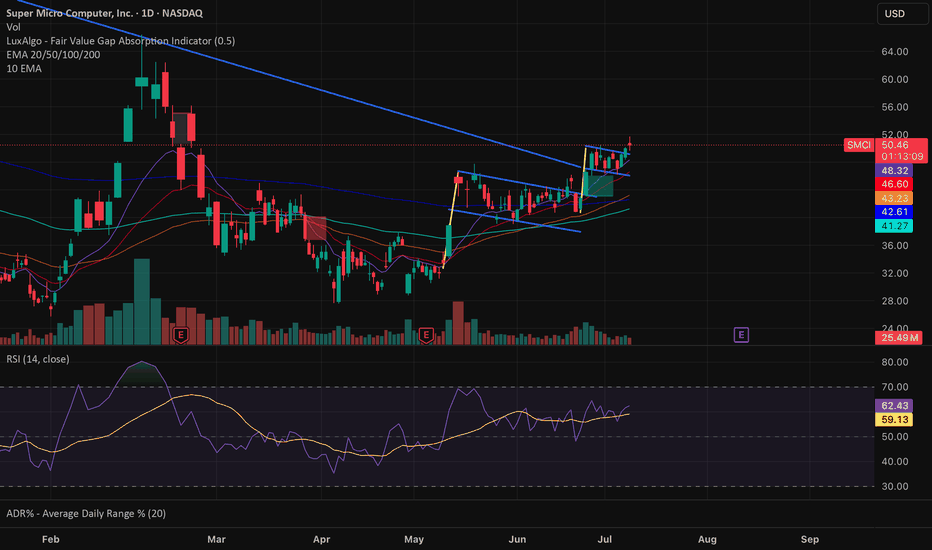

SMCI soon above 50 USD! Big bullish move! Youppi!📍 Bullish Trigger Zone: $50 USD

- 🔑 The $50 level acts as a psychological and technical threshold. A breakout above this resistance could signal a bullish reversal.

- 📈 The current price is around $49.11, so it’s very close to the trigger. A daily close above $50 with strong volume would strength

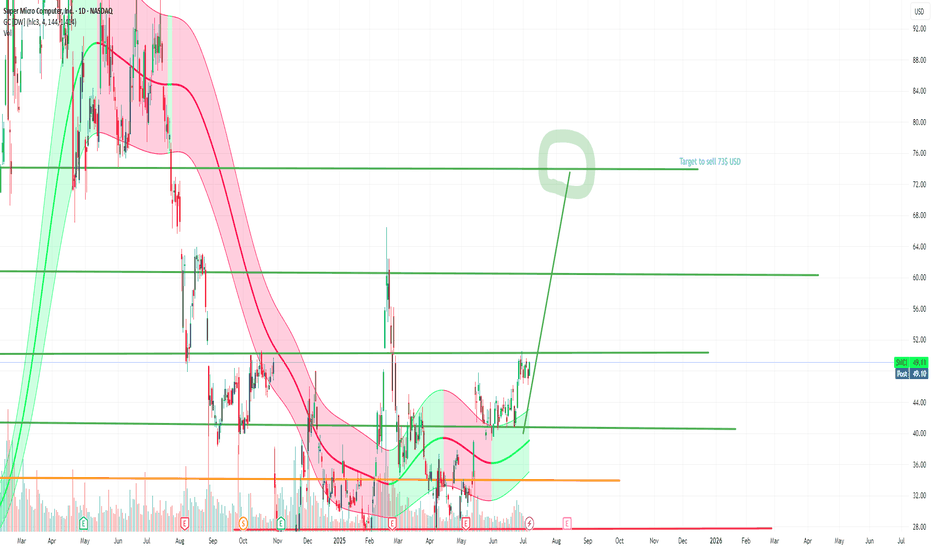

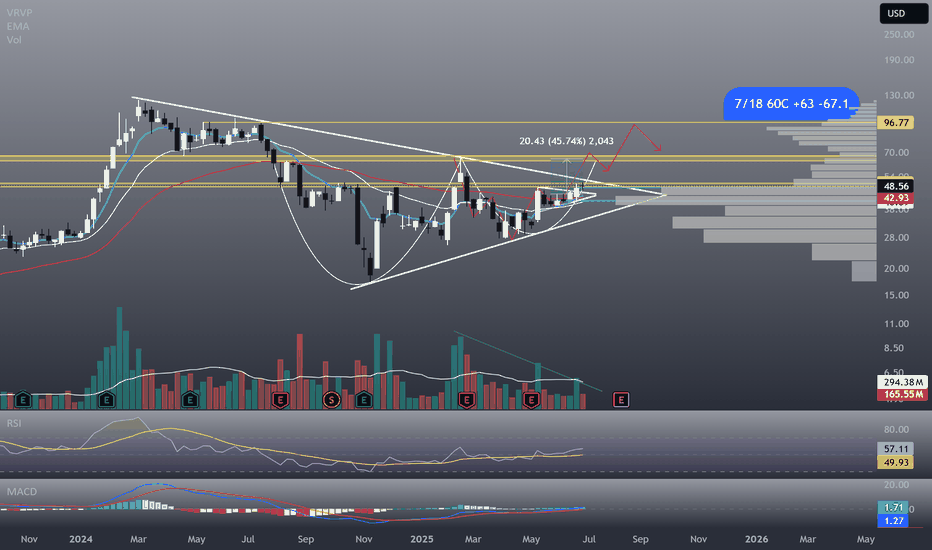

History tends to repeat itselfHistory typically tends to repeat itself. What has happened before can happen again. Take a look at the left side of the chart and you’ll see a picture-perfect breakout pattern: price consolidates, forms higher lows and relatively equal highs, all on high volume, before breaking out. Now, we are wit

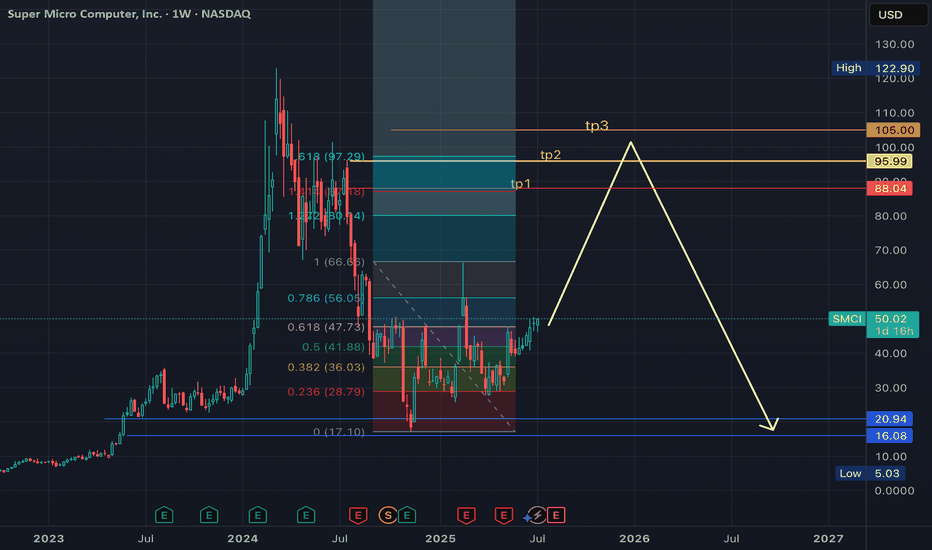

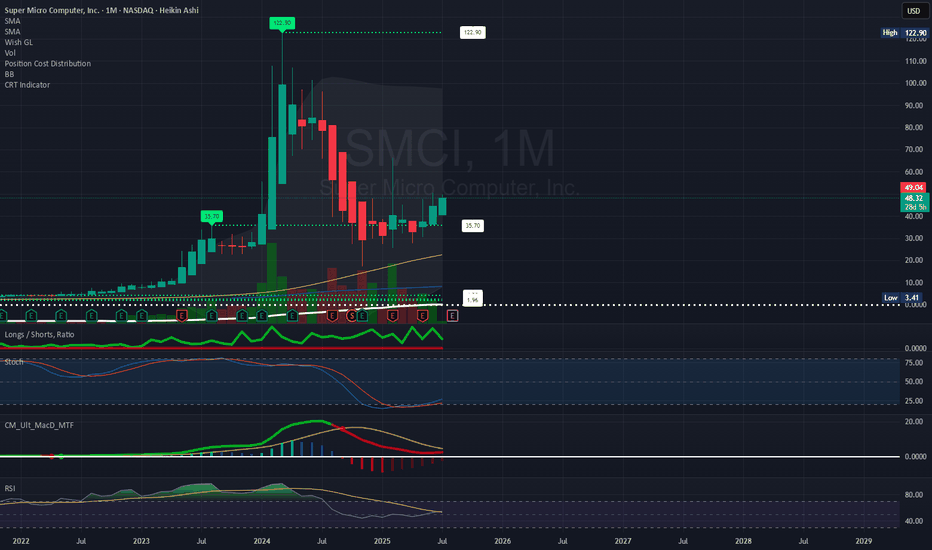

SMCI buy cycle in progress into yr endStrong buy rates on order flow indicating buy-side targets as follows

tp1 = 88

tp2 = 96

tp3 = 105

...by end of 2025

Still expecting strong sell wave sometime by mid-2026 all the way back to 20's as the semiconductor space continues dealing with growing bearish forces. Recent weakness should be se

SMCI bullish setup longSMCI seems well positioned for one of those "face melting' rips in the coming weeks as it normally does. All TA in daily, weekly and monthly timeframes tell thesame tale- Bullish move imminent.

Catalyst- riding on NVDA new Blackwell chip and Tariff news coming in next week, high short interest, VP

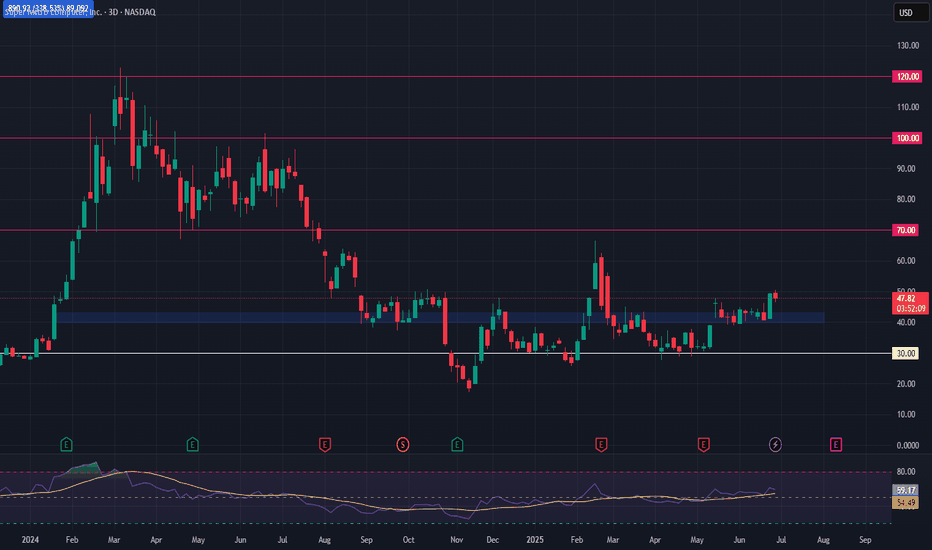

SMCI Long Swing Setup – Positioned for AI-Driven Infrastructure Super Micro Computer, Inc. NASDAQ:SMCI is a critical player in the AI infrastructure boom, supplying high-performance servers to NVIDIA, AMD, and major data centers. With accelerating demand for compute power, SMCI is well-positioned for continued upside.

📌 Trade Setup:

• Entry Zone: Current mark

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SMCI6004752

Super Micro Computer, Inc. 2.25% 15-JUL-2028Yield to maturity

−0.45%

Maturity date

Jul 15, 2028

SMCI6021416

Super Micro Computer, Inc. 0.0% 01-MAR-2029Yield to maturity

−1.10%

Maturity date

Mar 1, 2029

See all MS51 bonds

Frequently Asked Questions

The current price of MS51 is 44.35 EUR — it has increased by 2.71% in the past 24 hours. Watch SUPER MICRO COMPUTER INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on GETTEX exchange SUPER MICRO COMPUTER INC stocks are traded under the ticker MS51.

MS51 stock has risen by 5.11% compared to the previous week, the month change is a 19.08% rise, over the last year SUPER MICRO COMPUTER INC has showed a −48.54% decrease.

We've gathered analysts' opinions on SUPER MICRO COMPUTER INC future price: according to them, MS51 price has a max estimate of 59.89 EUR and a min estimate of 12.83 EUR. Watch MS51 chart and read a more detailed SUPER MICRO COMPUTER INC stock forecast: see what analysts think of SUPER MICRO COMPUTER INC and suggest that you do with its stocks.

MS51 reached its all-time high on Mar 8, 2024 with the price of 112.30 EUR, and its all-time low was 2.80 EUR and was reached on May 12, 2021. View more price dynamics on MS51 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

MS51 stock is 5.01% volatile and has beta coefficient of 3.41. Track SUPER MICRO COMPUTER INC stock price on the chart and check out the list of the most volatile stocks — is SUPER MICRO COMPUTER INC there?

Today SUPER MICRO COMPUTER INC has the market capitalization of 25.45 B, it has increased by 1.37% over the last week.

Yes, you can track SUPER MICRO COMPUTER INC financials in yearly and quarterly reports right on TradingView.

SUPER MICRO COMPUTER INC is going to release the next earnings report on Aug 12, 2025. Keep track of upcoming events with our Earnings Calendar.

MS51 earnings for the last quarter are 0.29 EUR per share, whereas the estimation was 0.38 EUR resulting in a −24.46% surprise. The estimated earnings for the next quarter are 0.38 EUR per share. See more details about SUPER MICRO COMPUTER INC earnings.

SUPER MICRO COMPUTER INC revenue for the last quarter amounts to 4.25 B EUR, despite the estimated figure of 4.63 B EUR. In the next quarter, revenue is expected to reach 5.06 B EUR.

MS51 net income for the last quarter is 100.55 M EUR, while the quarter before that showed 309.69 M EUR of net income which accounts for −67.53% change. Track more SUPER MICRO COMPUTER INC financial stats to get the full picture.

No, MS51 doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 15, 2025, the company has 5.68 K employees. See our rating of the largest employees — is SUPER MICRO COMPUTER INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SUPER MICRO COMPUTER INC EBITDA is 1.31 B EUR, and current EBITDA margin is 8.35%. See more stats in SUPER MICRO COMPUTER INC financial statements.

Like other stocks, MS51 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SUPER MICRO COMPUTER INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SUPER MICRO COMPUTER INC technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SUPER MICRO COMPUTER INC stock shows the buy signal. See more of SUPER MICRO COMPUTER INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.