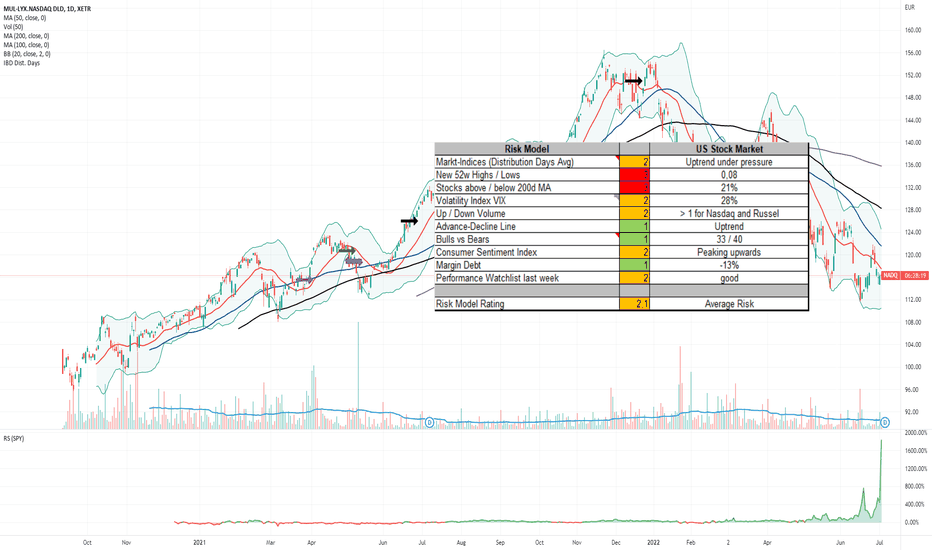

WallStreet-Trading: Risk-Model and WatchlistThe US market ended the first half of 2022 with significant losses to an extend that it makes H1_2022 to the worst first half year since 1970 !!!

The losses in H1_2022 are:

- SP500: 20.6%

- Dow Jones: 15.3%

- NASDAQ: 29.5%

- Russel2000: 23.9%

WHAT NOW?

Stock market analysis over the last five d

Key stats

About MULTI UNITS LUXEMBOURG SICAV - AMUNDI NASDAQ-100 II

Home page

Inception date

Sep 10, 2020

Structure

Luxembourg SICAV

Replication method

Synthetic

Dividend treatment

Distributes

Primary advisor

Amundi Asset Management SASU

ISIN

LU2197908721

The investment objective of the MULTI UNITS LUXEMBOURG Amundi Nasdaq-100 II (the Sub-Fund) is to track both the upward and the downward evolution of the NASDAQ-100 Notional Net Total Return index (the Index)

Related funds

Classification

What's in the fund

Exposure type

Electronic Technology

Technology Services

Retail Trade

Stock breakdown by region

Top 10 holdings

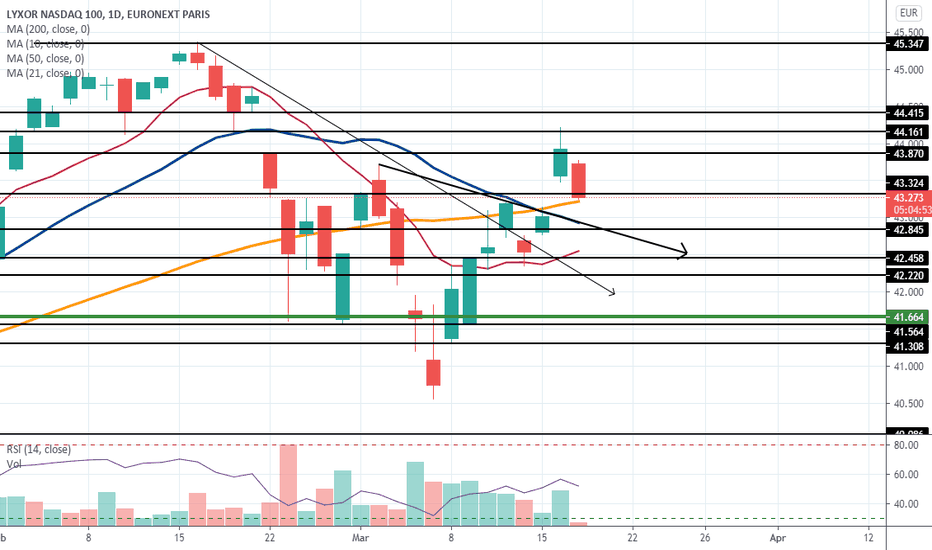

seems like this is a bottoming out process in place ??? All sign of a bottoming out process is there clear volume and uptrend in place since last week

After the 2 trillions package agreed , we shall see a sharp rebound for good , forget about the fundamentals the market doesn't seem to let go of their big tech names , the drop has been subdue compared

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

NADQ assets under management is 895.48 M EUR. AUM is an important metric as it reflects the fund's size and can serve as a gauge of how successful the fund is in attracting investors, which, in its turn, can influence decision-making.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

NADQ invests in stocks. See more details in our Analysis section.

NADQ expense ratio is 0.22%. It's an important metric for helping traders understand the fund's operating costs relative to assets and how expensive it would be to hold the fund.

No, NADQ isn't leveraged, meaning it doesn't use borrowings or financial derivatives to magnify the performance of the underlying assets or index it follows.

Yes, NADQ pays dividends to its holders with the dividend yield of 0.49%.

NADQ shares are issued by SAS Rue la Boétie

NADQ follows the NASDAQ 100 Index. ETFs usually track some benchmark seeking to replicate its performance and guide asset selection and objectives.

The fund started trading on Sep 10, 2020.

The fund's management style is passive, meaning it's aiming to replicate the performance of the underlying index by holding assets in the same proportions as the index. The goal is to match the index's returns.