National Bank of Greece (NBG) - Comprehensive Analysis

In one week from today, the annual general meeting of the shareholders of the National Bank of Greece (NBG) will convene, where, among other matters, they will decide on the distribution of a dividend for the first time in nearly 15 years, amounting to €0.37 (€0.36 net).

NBG is currently attract

1.20 EUR

1.21 B EUR

3.83 B EUR

About NATIONAL BANK (CR)

Sector

Industry

CEO

Paul K. Mylonas

Website

Headquarters

Athens

Founded

1953

FIGI

BBG0120WMYV0

National Bank of Greece SA engages in the provision of commercial banking services. It operates through the following segments: Retail Banking, Corporate & Investment Banking; Special Assets Unit; Global Markets & Asset Management; Insurance; International Banking Operations, and Other. The Retail Banking segment includes all individual customers, professionals, small and medium-sized companies. The Corporate and Investment Banking segment activities include lending to all large and medium-sized companies, shipping finance and investment banking activities. The Special Assets Unit segment manages delinquent, non performing and denounced loans to legal entities. The Global Markets and Asset Management segment involves all treasury activities, private banking, asset management, custody services, private equity and brokerage. The Insurance segment offers insurance products through its subsidiary company, Ethniki Hellenic General Insurance SA. The International Banking Operations segment include traditional commercial banking services, such as commercial and retail credit, trade financing, foreign exchange and taking of deposits. The Other segment includes proprietary real estate management, hotel, and warehousing business as well as unallocated and expense of the group and intersegment eliminations. The company was founded by George Stavros in 1841 and is headquartered in Athens, Greece.

Related stocks

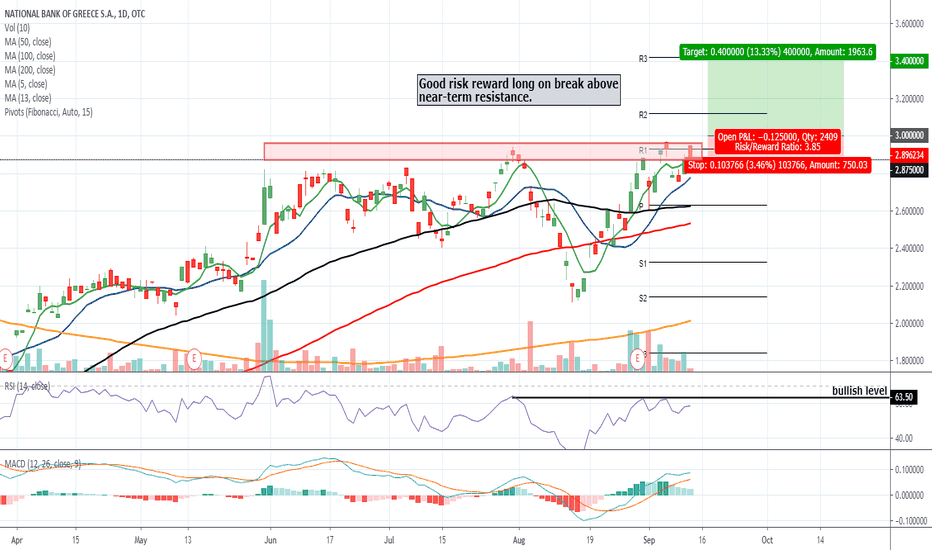

National Bank of Greece bullish above $3 on breakoutNational Bank of Greece SA engages in the provision of commercial banking services. It operates through the following segments: Retail Banking, Corporate & Investment Banking; Special Assets Unit; Global Markets & Asset Management; Insurance; International Banking Operations, and Other. The Retail B

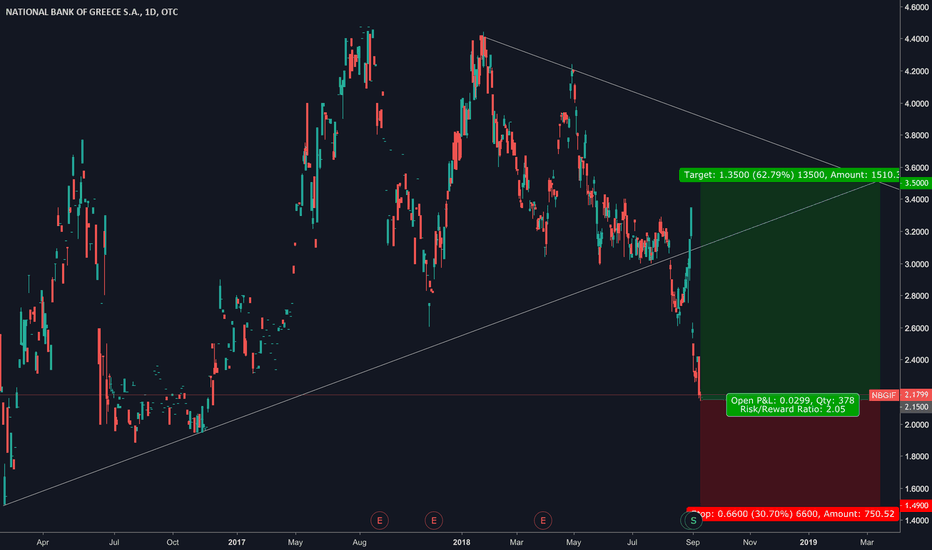

Long NBGIFStory : National Bank of Greece announced a Q2 net loss a couple of days ago which sunk it's share price to an almost all time low - with not much downside left (technically), continued reduction of the bad loans in it's books and a perceived improvement in alignment of Greek policies to the EU expe

See all ideas

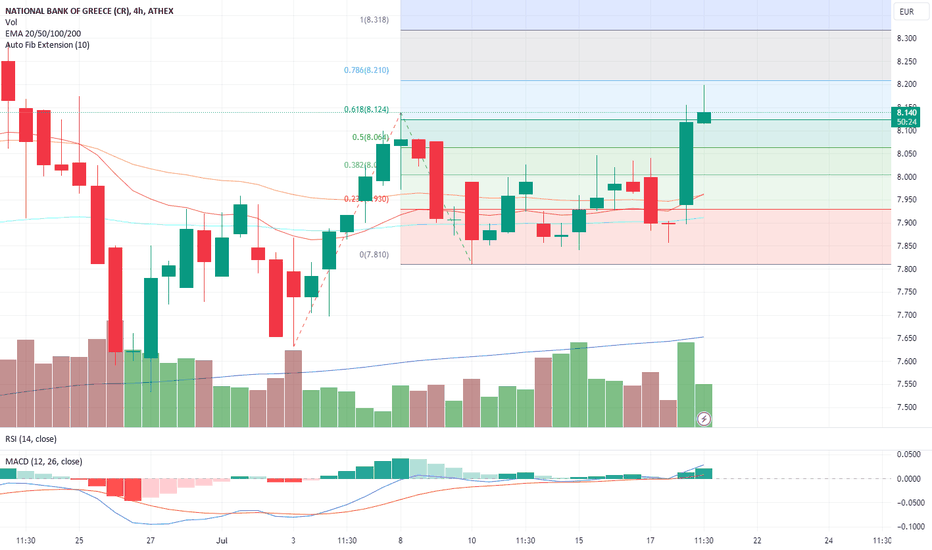

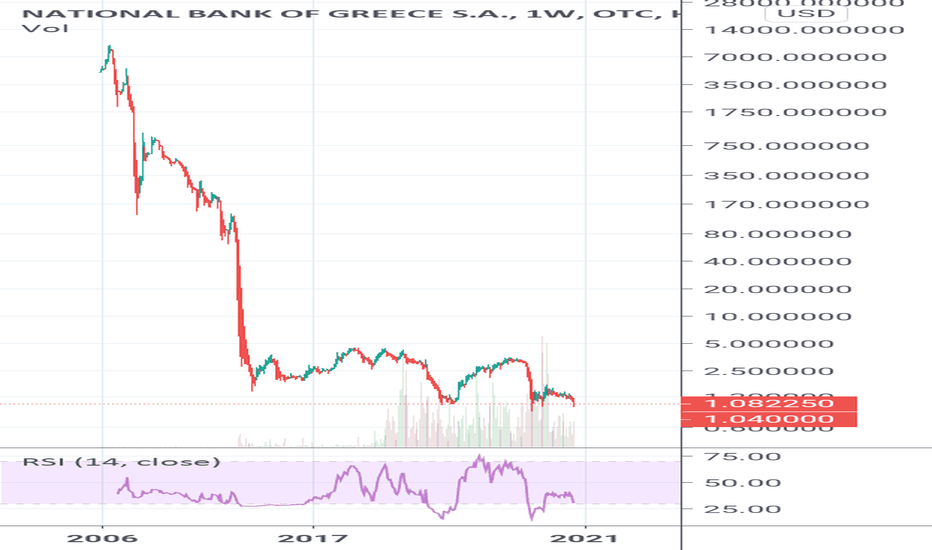

Displays a symbol's price movements over previous years to identify recurring trends.

XS2562483441

NatBkGre 8.75% 27Yield to maturity

6.50%

Maturity date

Jun 2, 2027

XS259534305

NAT.B GREECE 23/34FLR MTNYield to maturity

5.80%

Maturity date

Jan 3, 2034

XS279033418

NAT.B GREECE 24/35 FLRYield to maturity

4.71%

Maturity date

Jun 28, 2035

XS255859293

NAT.B GREECE 22/27 FLRMTNYield to maturity

4.28%

Maturity date

Nov 22, 2027

XS275629863

NAT.B GREECE 24/29FLR MTNYield to maturity

3.46%

Maturity date

Jan 29, 2029

XS294030964

NAT.B GREECE 24/30 FLRYield to maturity

3.24%

Maturity date

Nov 19, 2030

XS223798276

NAT.B GREECE 20/26 FLRYield to maturity

2.82%

Maturity date

Oct 8, 2026

See all NAG bonds