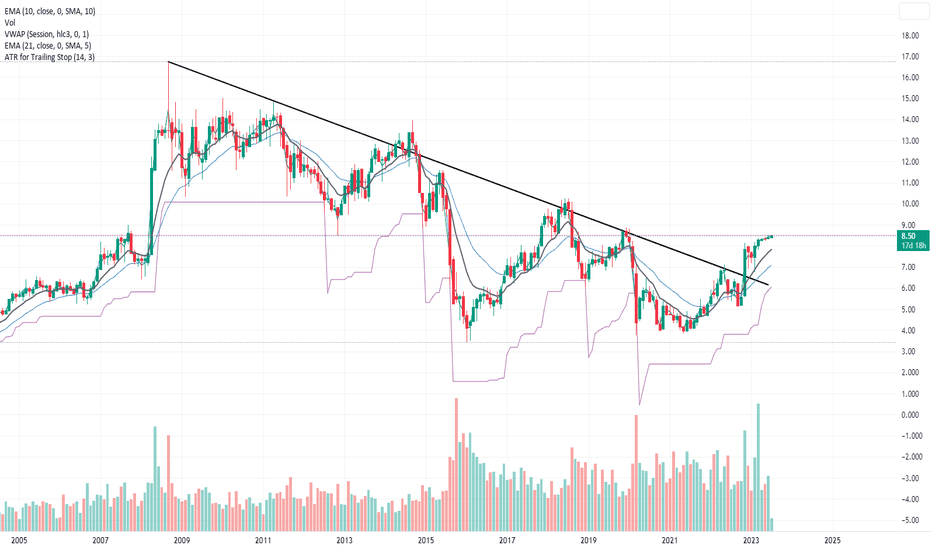

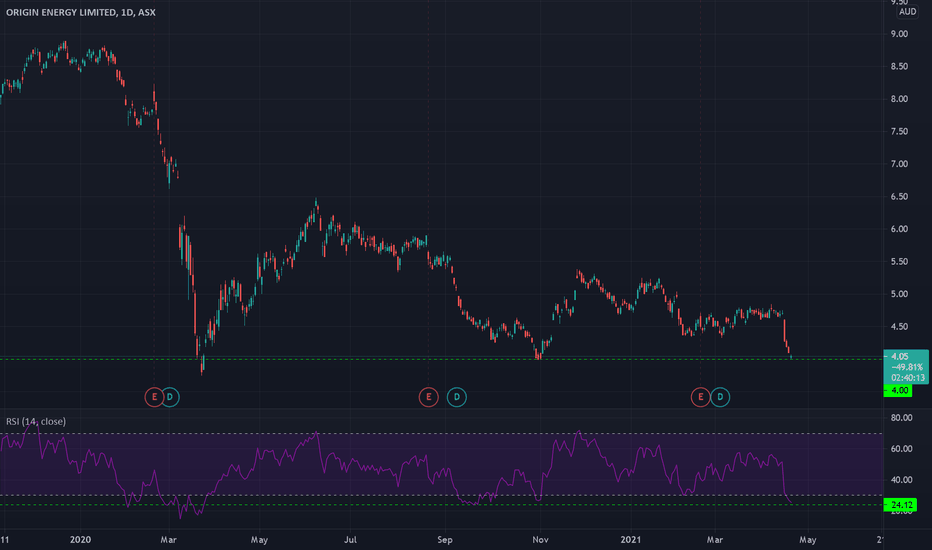

ORG buy on next pullback, trend followORG is looking good on the weekly, holding trendline.

Daily shows earnings disappointment but post divs, price still held 9.50 and is now breaking past the $10 PoC set by that range.

Look for a pullback from here for long entry, partial on ATH, hold the rest for trend follow.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.49 EUR

869.41 M EUR

10.00 B EUR

1.71 B

About ORIGIN ENERGY LIMITED

Sector

Industry

CEO

Frank Calabria

Website

Headquarters

Sydney

Founded

1946

ISIN

AU000000ORG5

FIGI

BBG000C3WNF7

Origin Energy Ltd. is an integrated energy company, which engages in exploration and production of natural gas, electricity generation, wholesale and retail sale of electricity and gas, and sale of liquefied natural gas. It operates through the following business segments: Energy Markets, Integrated Gas, and Corporate. The Energy Markets segment includes energy retailing, power generation and liquid petroleum gas operations. The Integrated Gas segment engages in growth assets business and management of LNG price risk through hedging and trading activities. The Corporate segment engages in various business development and support activities that are not allocated to operating segments. The company was founded on March 4, 1946 and is headquartered in Sydney, Australia.

Related stocks

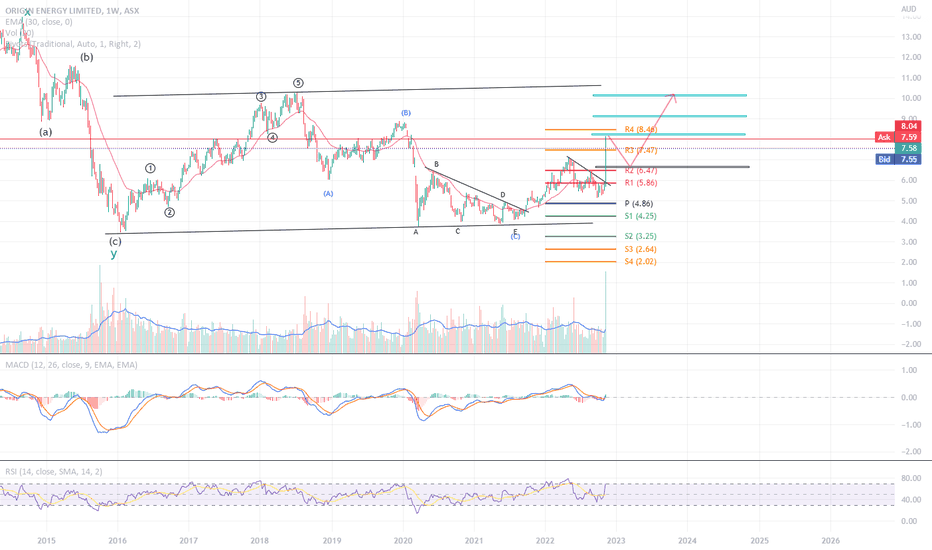

Origin energy👀Excellent stock💎 to hold for long.

Nice breakout with huge volume.

A big gap up in an intermediate time period where gap up trading strategy can be used to go short to buy later.

Once it pullback to 6.47 level, then buy entry trigger.

The same high volume appeared on oct 2015, and the price had

ORG Breakout @ 25 Aug 2021ORG

first time doing a written analysis on ORG

ORG gapped up above the mid-term resistance with average volume --> good price action

If you are not in ORG already, it's best to wait for a formation of a Higher Low (HL) with a retracement and rebound

R is more than 10%

Strategy-to-buy – Suggest t

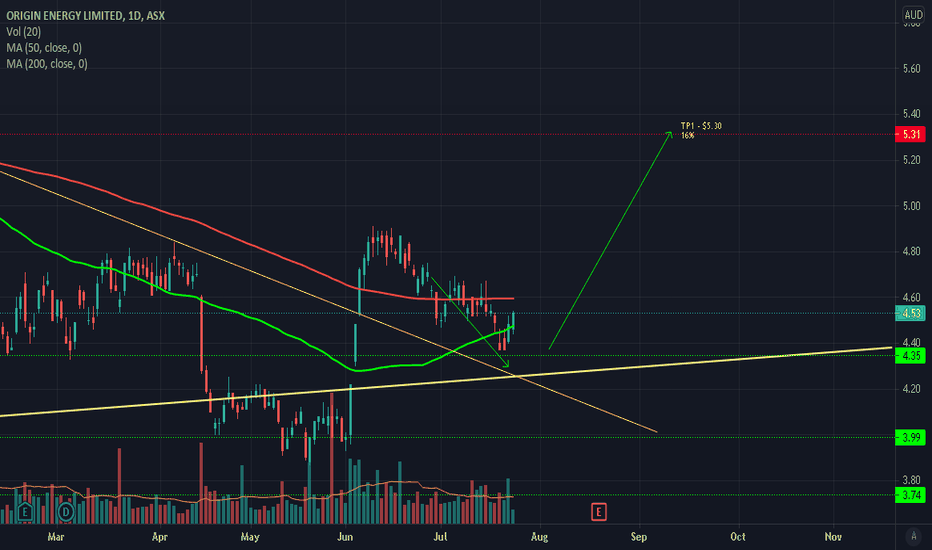

ORG - Potential Buying OpportunityORG has pulled back and is showing support at the current support level. This could be a sign that this pullback may be over and it could potentially move higher. I am targeting the Resistance level of $5.30 with a tight stop below the swing low (potential 22% gain).

Please note these are my own n

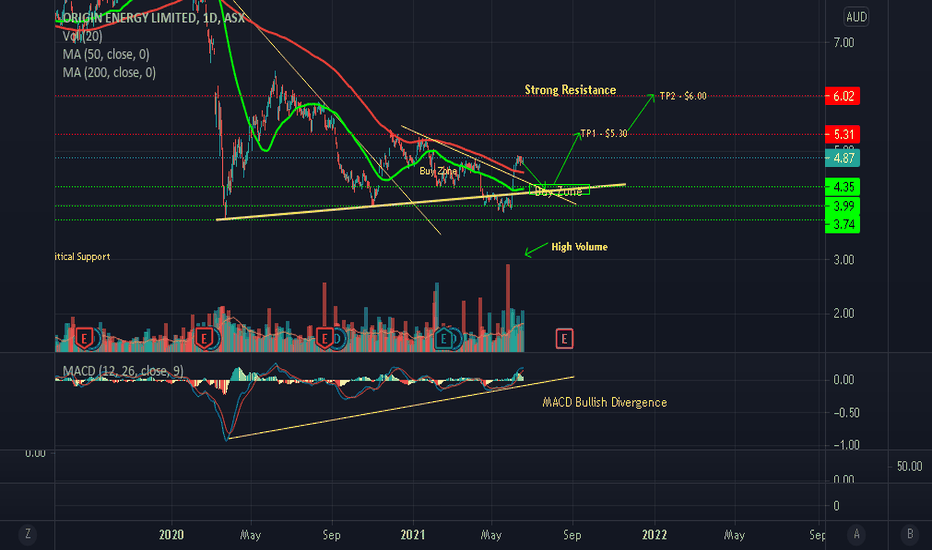

ORG - Bullish Trade PlanORG has bounced off strongly off Support with very High Volume, confirming its Bullish reversal. I expect a little correction to the downside as it looks like it is currently facing some resistance. There is also MACD Bullish Divergence on the Daily Timeframe and I expect a small correction or maybe

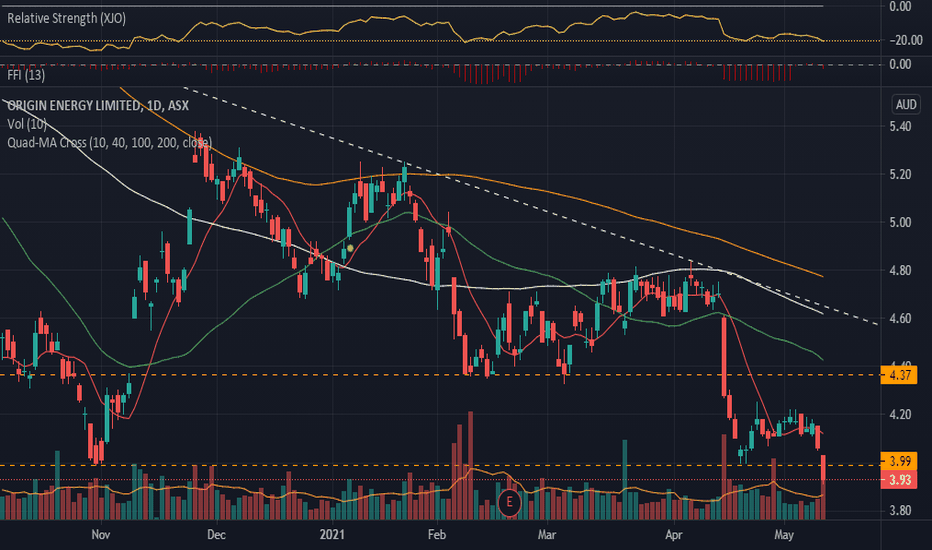

Buying on negative sentiment - bounce playI just bought some ORG, looking for a range bound trade on negative sentiment.

RSI at 25

Target sell price at 20% or 70 RSI

Triple bottom

Stop loss - manual - should be 8% but there could still be divergence that extends past that. If it did diverge I wouldn't sell but look to add more

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where ORL is featured.

Upstream oil: Liquid gold extractors

34 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of ORL is 6.00 EUR — it has decreased by −0.83% in the past 24 hours. Watch ORIGIN ENERGY LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on GETTEX exchange ORIGIN ENERGY LTD stocks are traded under the ticker ORL.

ORL stock hasn't changed in a week, the last month showed zero change in price, over the last year ORIGIN ENERGY LTD has showed a −9.77% decrease.

We've gathered analysts' opinions on ORIGIN ENERGY LTD future price: according to them, ORL price has a max estimate of 6.72 EUR and a min estimate of 5.20 EUR. Watch ORL chart and read a more detailed ORIGIN ENERGY LTD stock forecast: see what analysts think of ORIGIN ENERGY LTD and suggest that you do with its stocks.

ORL stock is 1.68% volatile and has beta coefficient of 0.50. Track ORIGIN ENERGY LTD stock price on the chart and check out the list of the most volatile stocks — is ORIGIN ENERGY LTD there?

Today ORIGIN ENERGY LTD has the market capitalization of 10.36 B, it has decreased by −4.17% over the last week.

Yes, you can track ORIGIN ENERGY LTD financials in yearly and quarterly reports right on TradingView.

ORIGIN ENERGY LTD is going to release the next earnings report on Aug 13, 2025. Keep track of upcoming events with our Earnings Calendar.

ORL earnings for the last half-year are 0.32 EUR per share, whereas the estimation was 0.33 EUR, resulting in a −2.54% surprise. The estimated earnings for the next half-year are 0.20 EUR per share. See more details about ORIGIN ENERGY LTD earnings.

ORIGIN ENERGY LTD revenue for the last half-year amounts to 5.24 B EUR, despite the estimated figure of 5.26 B EUR. In the next half-year revenue is expected to reach 4.67 B EUR.

ORL net income for the last half-year is 607.78 M EUR, while the previous report showed 250.18 M EUR of net income which accounts for 142.94% change. Track more ORIGIN ENERGY LTD financial stats to get the full picture.

ORIGIN ENERGY LTD dividend yield was 5.06% in 2024, and payout ratio reached 67.80%. The year before the numbers were 4.34% and 59.52% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 5, 2025, the company has 5.5 K employees. See our rating of the largest employees — is ORIGIN ENERGY LTD on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ORIGIN ENERGY LTD EBITDA is 965.76 M EUR, and current EBITDA margin is 11.46%. See more stats in ORIGIN ENERGY LTD financial statements.

Like other stocks, ORL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ORIGIN ENERGY LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ORIGIN ENERGY LTD technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ORIGIN ENERGY LTD stock shows the buy signal. See more of ORIGIN ENERGY LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.