6201 (Toyota Industries Corporation)Toyota Industries Corporation is a Japanese machine maker. Originally, and still actively, a manufacturer of automatic looms, it is the company from which Toyota Motor Corporation developed. It is the world's largest manufacturer of forklift trucks measured by revenues.

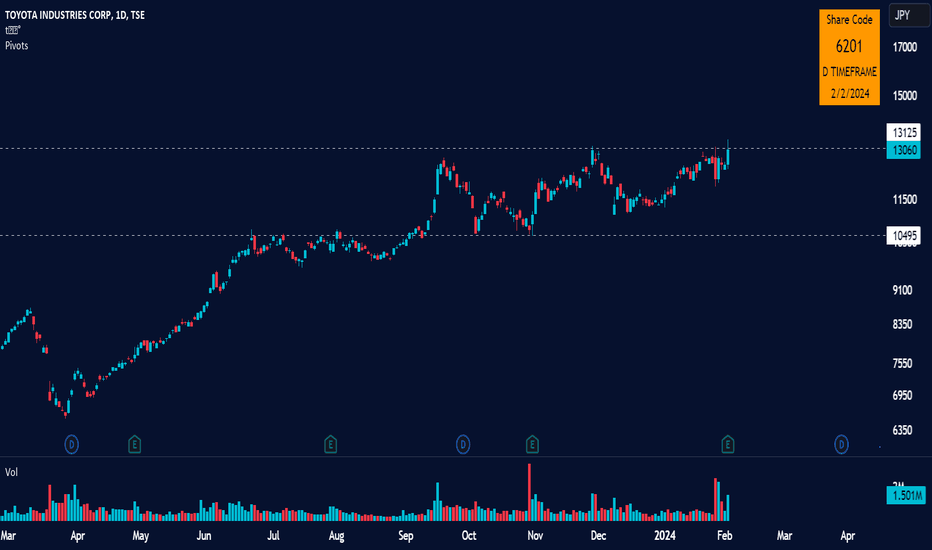

Potential breakout + volume

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.92 EUR

1.62 B EUR

25.17 B EUR

138.80 M

About TOYOTA INDUSTRIES CORP

Sector

Industry

Website

Headquarters

Kariya

Founded

1991

ISIN

JP3634600005

FIGI

BBG00QYTHW93

Toyota Industries Corp. engages in the manufacture and sales of textile machinery, materials handling equipment, automobiles and automobile parts. It operates through the following segments: Automobile, Industrial Vehicle and Textile Machinery. The Automobile segment includes vehicles, engines, castings, compressors for car air conditioners, electronic devices and batteries. The Industrial Vehicle segment includes forklift trucks, warehouse equipment, automated warehouses, aerial work platforms, logistics solutions and sales finance. The Textile Machinery segment includes looms, spinning machines, yarn quality measuring equipment and cotton grading equipment. The company was founded by Sakichi Toyoda on November 18, 1926 and is headquartered in Kariya, Japan.

Related stocks

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US892330AC5

TOYOTA INDS 2028 144AYield to maturity

4.71%

Maturity date

Mar 16, 2028

USJ92628BM7

TOYOTA INDS 18/28 REGSYield to maturity

4.61%

Maturity date

Mar 16, 2028

See all TAH bonds

Frequently Asked Questions

The current price of TAH is 94.65 EUR — it has increased by 0.11% in the past 24 hours. Watch TOYOTA INDUSTRIES CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on GETTEX exchange TOYOTA INDUSTRIES CORP stocks are traded under the ticker TAH.

TAH stock has risen by 0.26% compared to the previous week, the month change is a 1.50% rise, over the last year TOYOTA INDUSTRIES CORP has showed a 36.29% increase.

We've gathered analysts' opinions on TOYOTA INDUSTRIES CORP future price: according to them, TAH price has a max estimate of 116.13 EUR and a min estimate of 78.39 EUR. Watch TAH chart and read a more detailed TOYOTA INDUSTRIES CORP stock forecast: see what analysts think of TOYOTA INDUSTRIES CORP and suggest that you do with its stocks.

TAH stock is 0.11% volatile and has beta coefficient of 1.33. Track TOYOTA INDUSTRIES CORP stock price on the chart and check out the list of the most volatile stocks — is TOYOTA INDUSTRIES CORP there?

Today TOYOTA INDUSTRIES CORP has the market capitalization of 28.52 B, it has decreased by −0.62% over the last week.

Yes, you can track TOYOTA INDUSTRIES CORP financials in yearly and quarterly reports right on TradingView.

TOYOTA INDUSTRIES CORP is going to release the next earnings report on Oct 30, 2025. Keep track of upcoming events with our Earnings Calendar.

TAH earnings for the last quarter are 2.01 EUR per share, whereas the estimation was 1.87 EUR resulting in a 7.15% surprise. The estimated earnings for the next quarter are 0.71 EUR per share. See more details about TOYOTA INDUSTRIES CORP earnings.

TOYOTA INDUSTRIES CORP revenue for the last quarter amounts to 5.83 B EUR, despite the estimated figure of 5.77 B EUR. In the next quarter, revenue is expected to reach 5.81 B EUR.

TAH net income for the last quarter is 603.50 M EUR, while the quarter before that showed 85.84 M EUR of net income which accounts for 603.07% change. Track more TOYOTA INDUSTRIES CORP financial stats to get the full picture.

TOYOTA INDUSTRIES CORP dividend yield was 2.20% in 2024, and payout ratio reached 32.67%. The year before the numbers were 1.53% and 32.57% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 16, 2025, the company has 79.45 K employees. See our rating of the largest employees — is TOYOTA INDUSTRIES CORP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. TOYOTA INDUSTRIES CORP EBITDA is 3.12 B EUR, and current EBITDA margin is 13.45%. See more stats in TOYOTA INDUSTRIES CORP financial statements.

Like other stocks, TAH shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade TOYOTA INDUSTRIES CORP stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So TOYOTA INDUSTRIES CORP technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating TOYOTA INDUSTRIES CORP stock shows the strong buy signal. See more of TOYOTA INDUSTRIES CORP technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.