Key facts today

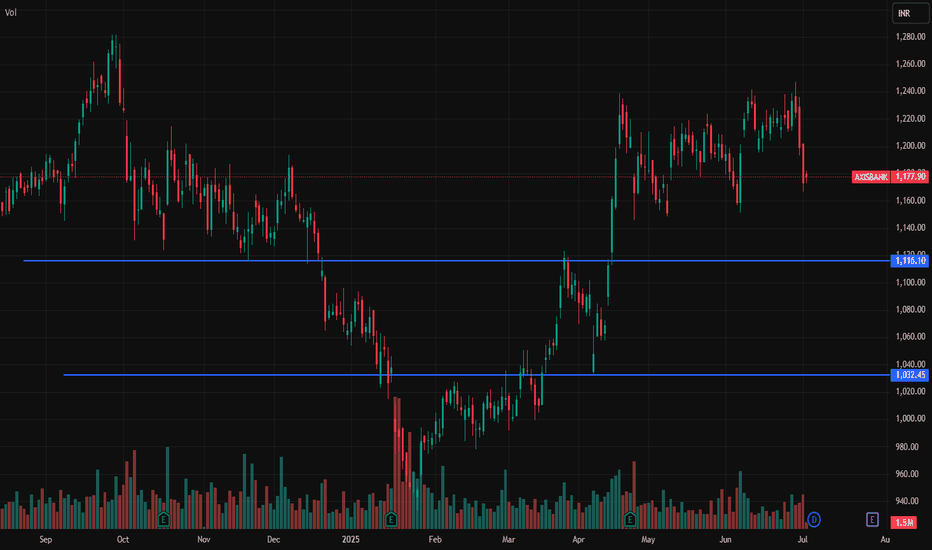

Axis Bank's stock has shown mixed performance, contributing to a slow rise in the banking index, while varied results among private banks are hindering sector momentum.

4.96 EUR

3.07 B EUR

16.97 B EUR

About AXIS BANK LTD

Axis Bank Ltd. engages in the provision of financial solutions to retail, small and medium enterprises, government, and corporate businesses. It operates through the following segments: Treasury, Retail Banking, Corporate or Wholesale Banking, and Other Banking Business. The Treasury segment includes investments in sovereign and corporate debt, equity and mutual funds, trading operations, derivative trading and foreign exchange operations on the proprietary account and for customers and central funding. The Retail Banking segment constitutes lending to individuals or small businesses subject to the orientation, product and granularity criterion and also includes low value individual exposures not exceeding the threshold limit. It also covers liability products, card services, internet banking, ATM services, depository, financial advisory services and NRI services. The Corporate or Wholesale Banking segment involves in corporate relationships, advisory services, placements and syndication, management of public issue, project appraisals, capital market related and cash management services. The Other Banking Business segment encompasses para banking activities such as third party product distribution and other banking transactions. The company was founded on December 3, 1993 and is headquartered in Mumbai, India.

Related stocks

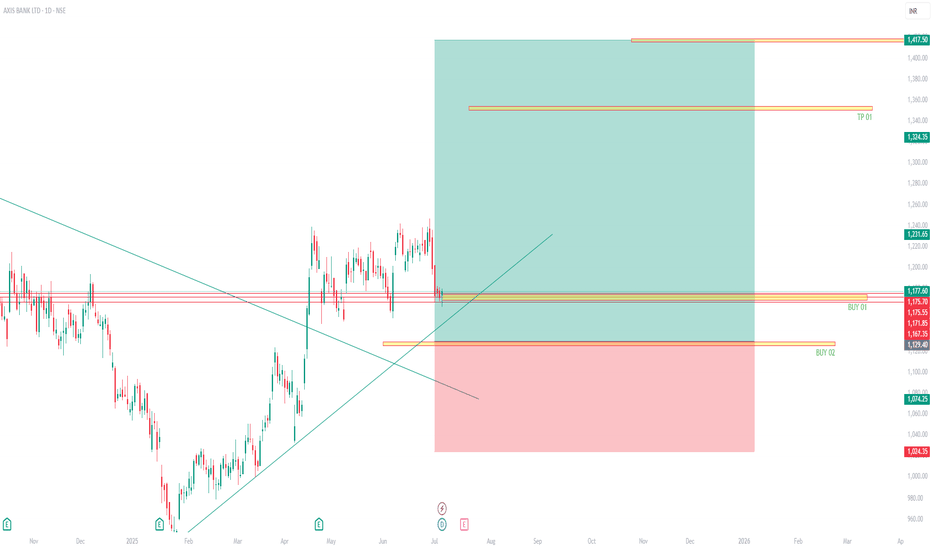

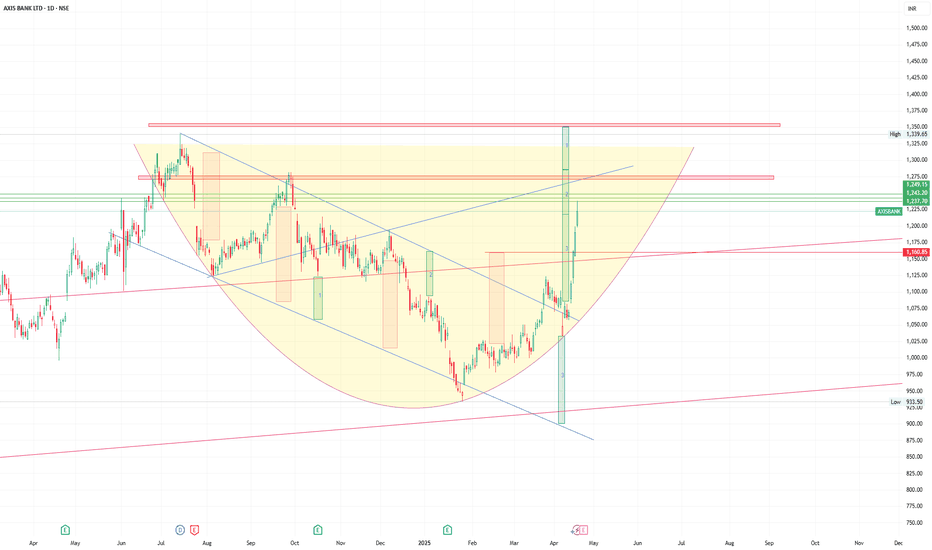

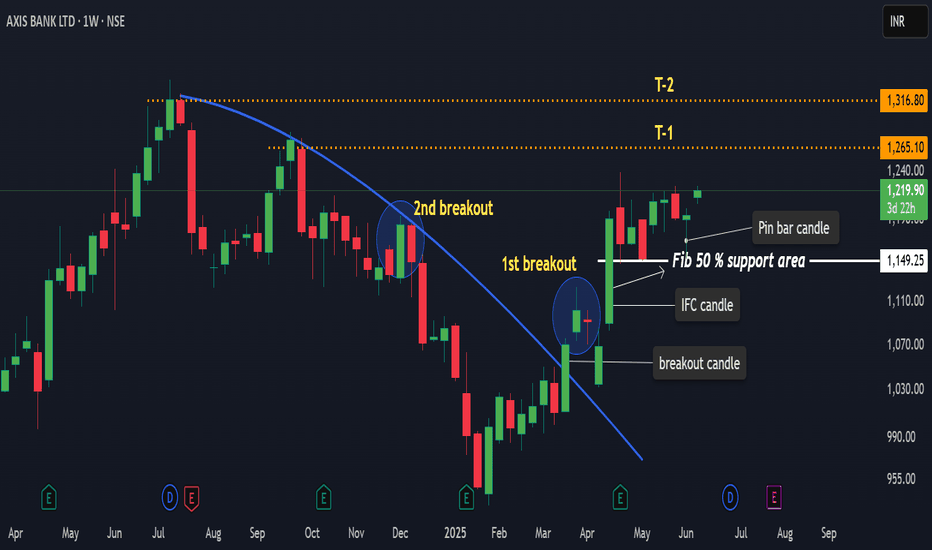

AXIS BANK - FOR SWING TRADEOn a weekly time frame price has given a curve line breakout and currently price is in a range .

Previous week a Pin bar candle has formed in it's Fib 50% level which is also a good support area.

Current price is 1219

This week price can give us a good upside move, if not then price will be in the

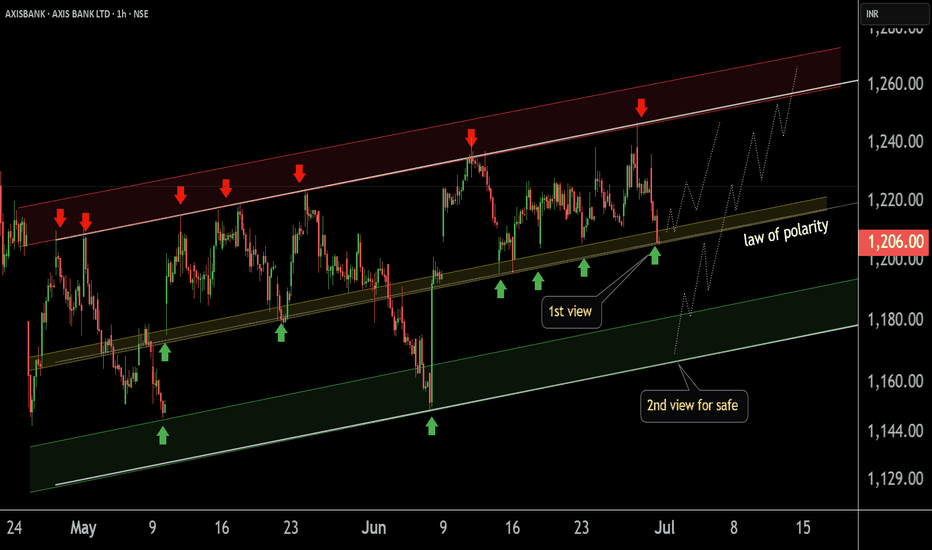

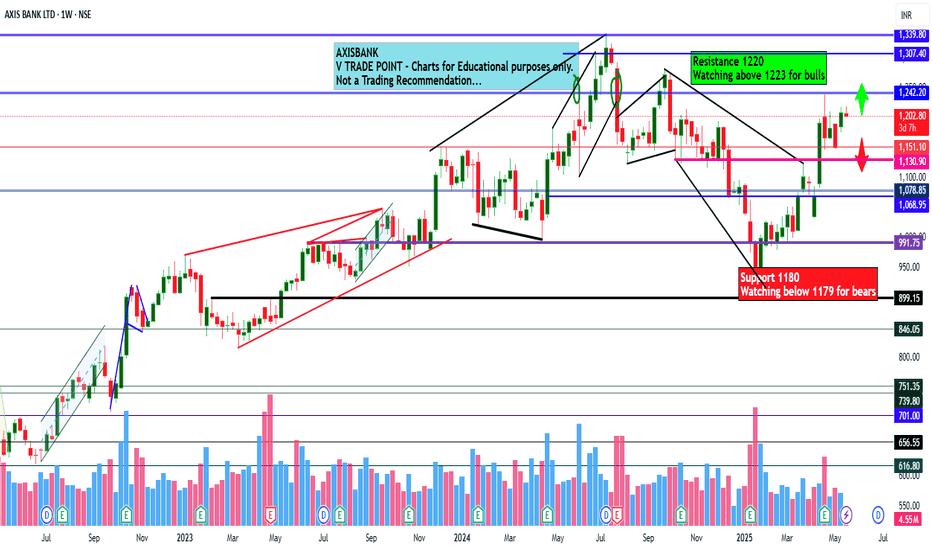

Axis Bank Ltd view for Intraday 22nd May #AXISBANK Axis Bank Ltd view for Intraday 22nd May #AXISBANK

Resistance 1220 Watching above 1223 for upside momentum.

Support area 1180 Below 1180 ignoring upside momentum for intraday

Watching below 1179 for downside movement...

Above 1200 ignoring downside move for intraday

Charts for Educational purpos

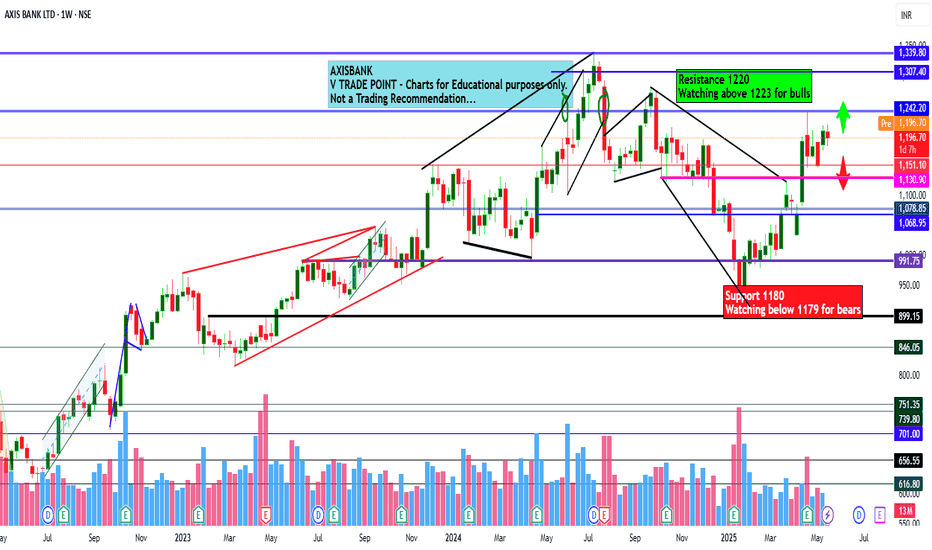

Axis Bank Ltd view for Intraday 20th May #AXISBANK Axis Bank Ltd view for Intraday 20th May #AXISBANK

Resistance 1220 Watching above 1223 for upside momentum.

Support area 1180 Below 1200 ignoring upside momentum for intraday

Watching below 1179 for downside movement...

Above 1200 ignoring downside move for intraday

Charts for Educational purpos

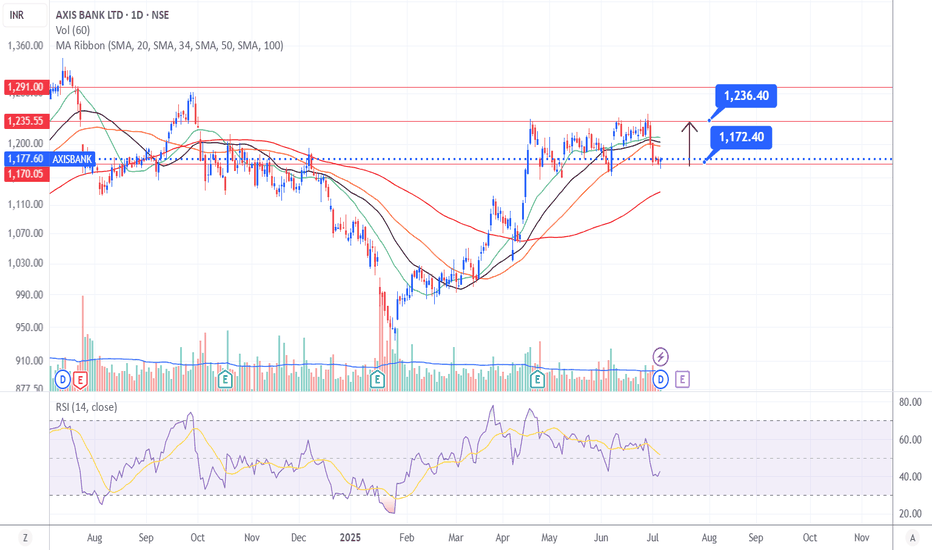

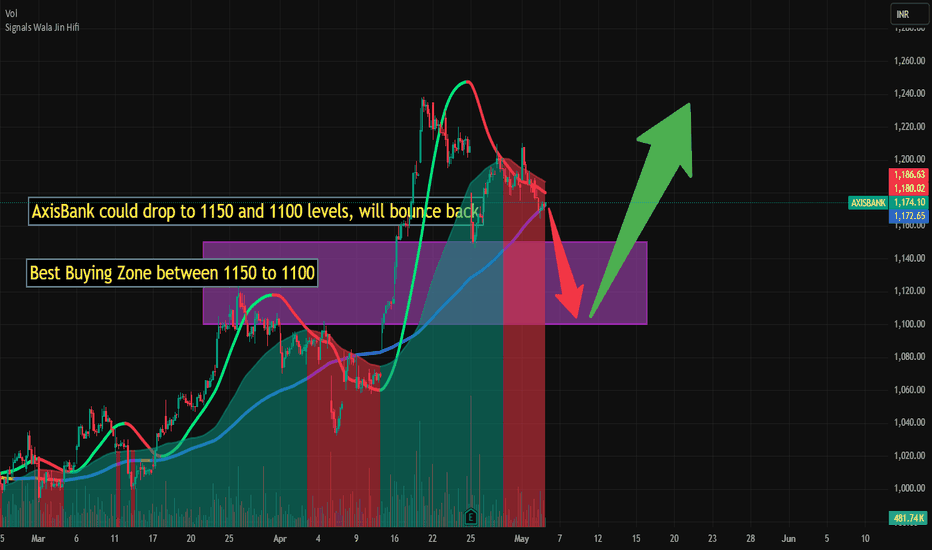

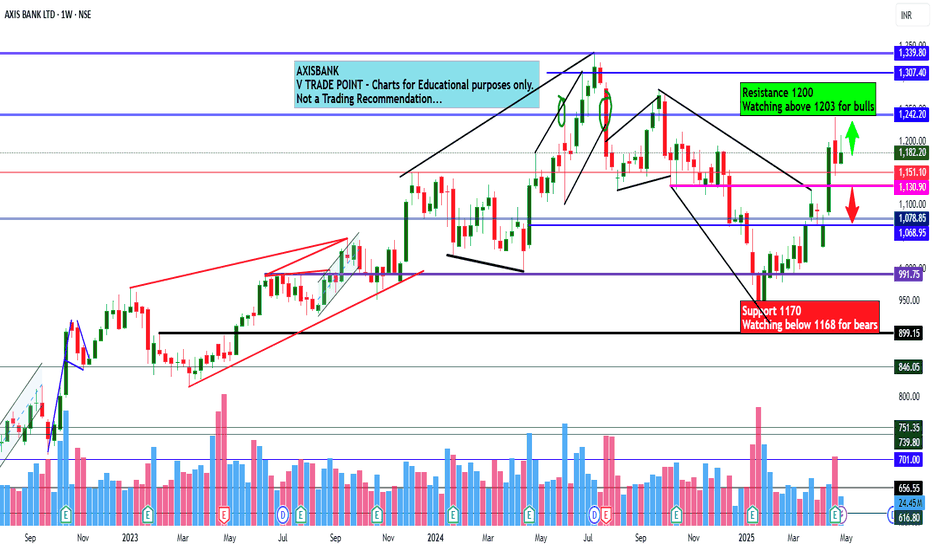

Axis Bank Ltd view for Intraday 5th May #AXISBANK Axis Bank Ltd view for Intraday 5th May #AXISBANK

Resistance 1200-1202 Watching above 1203 for upside movement...

Support area 1170 Below 1180 ignoring upside momentum for intraday

Watching below 1168 for downside movement...

Above 1180 ignoring downside move for intraday

Charts for Educational

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where UZC is featured.

Indian stocks: Racing ahead

46 No. of Symbols

See all sparks