UZC trade ideas

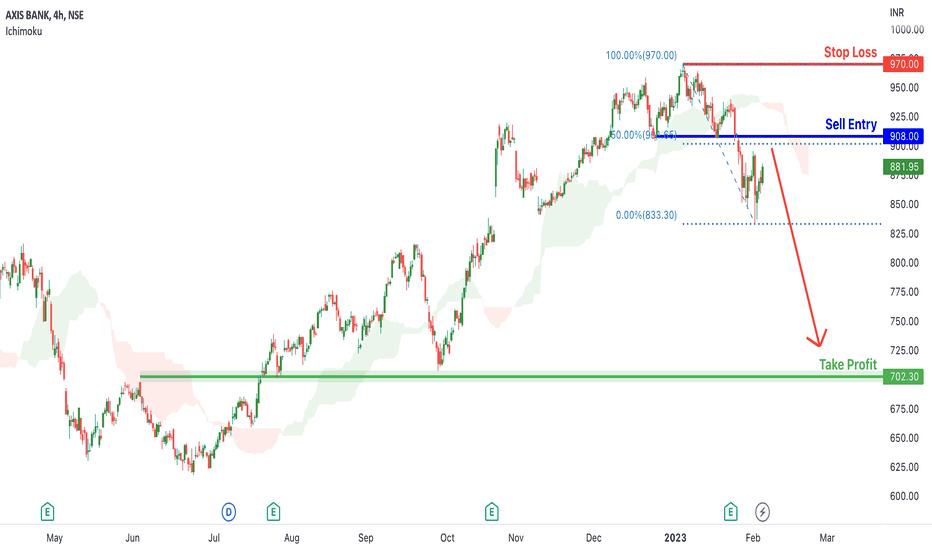

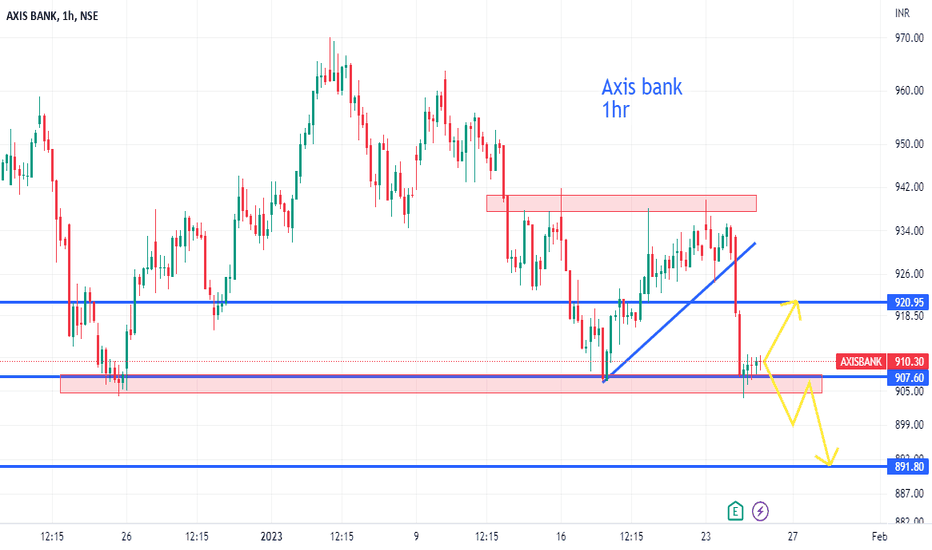

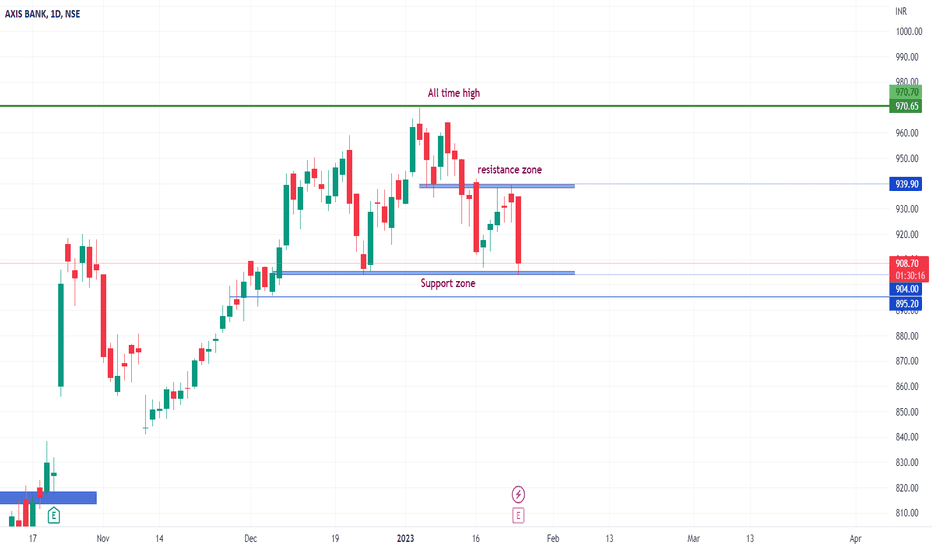

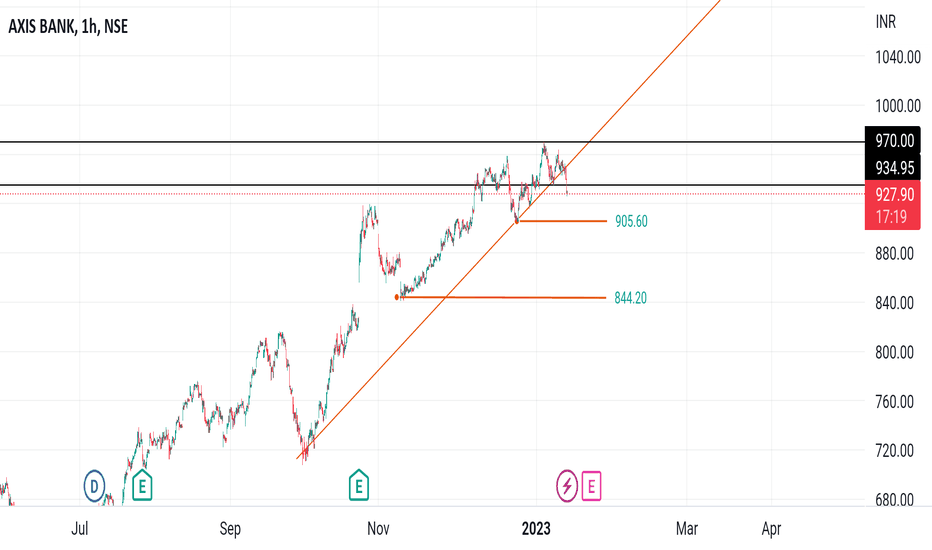

AXISBANK Potential for Bearish Drop | 6th February 2023Looking at the H4 chart, my overall bias for AXISBANK is bearish due to the current price being below the Ichimoku cloud, indicating a bearish market.

Looking for a pullback sell entry at 908.00, where the overlap resistance and 50% Fibonacci line is. Stop loss will be at 970.00, where the recent swing high is. Take profit will be at 702.30, where the overlap support is.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

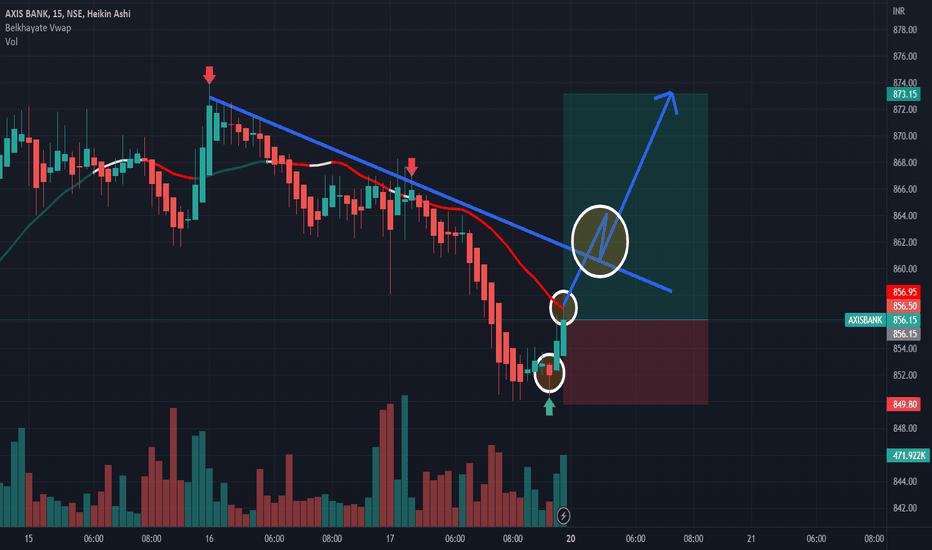

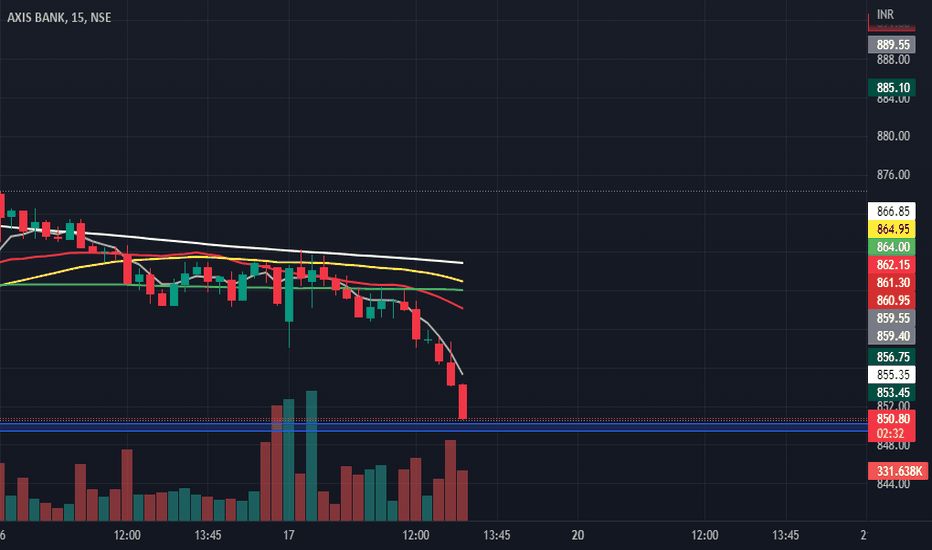

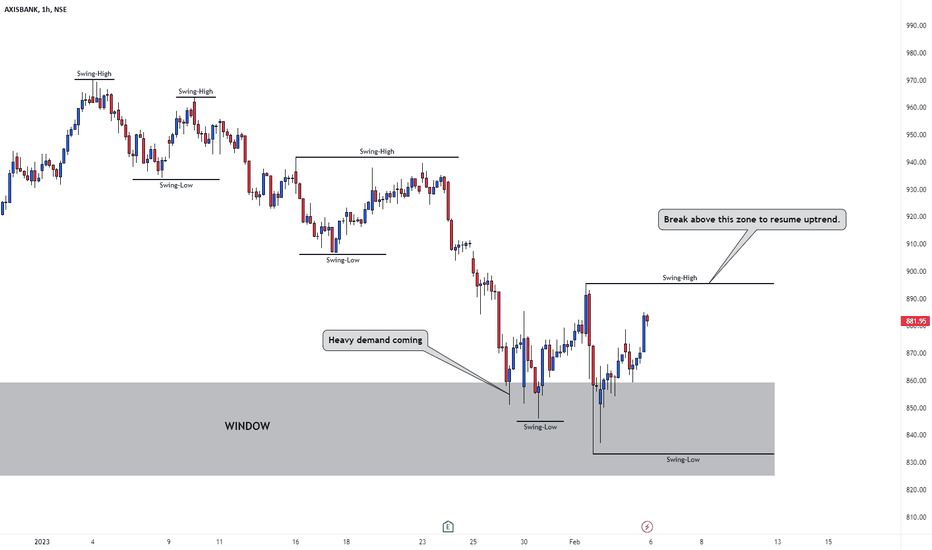

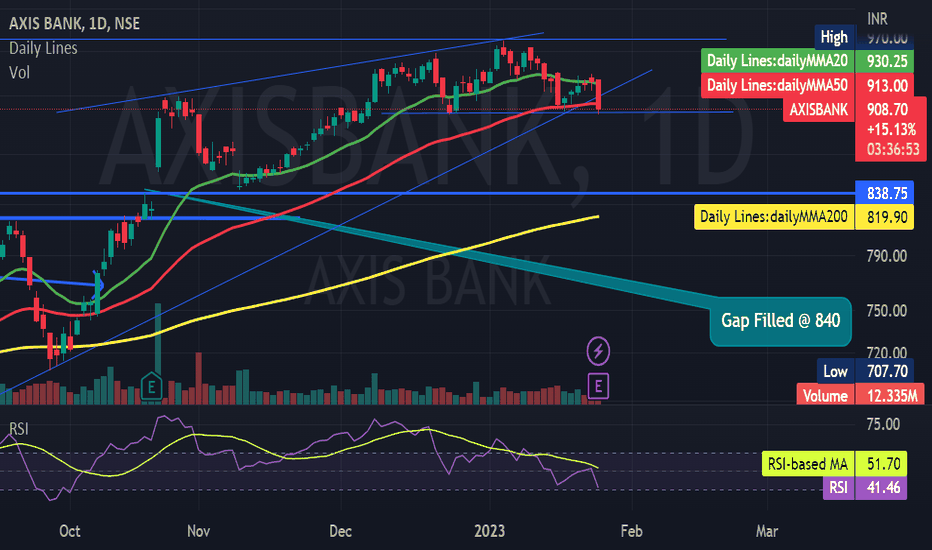

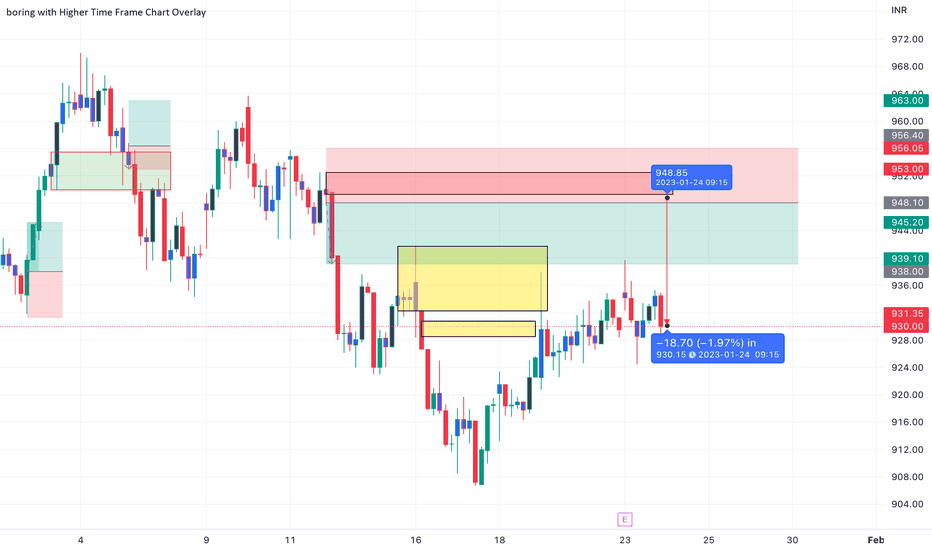

AXISBANK retracement over ??$AXISBANK 's retracement (daily TF) might be over as it is showing signs of strength on it's rising window. We can look for an intraday entry if the price spends some time at the swing high and then breaks out or we can also enter as a swing trade for a target till the recent swing high on daily TF.

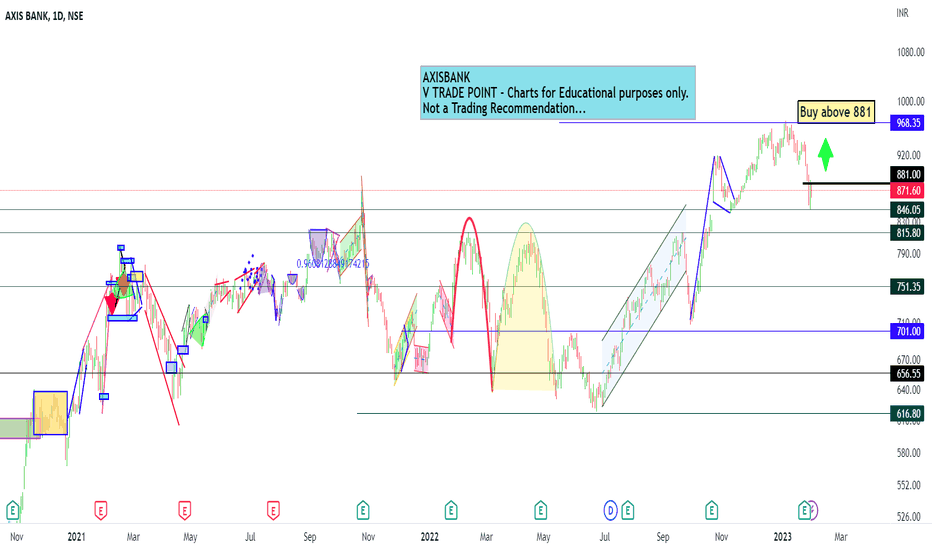

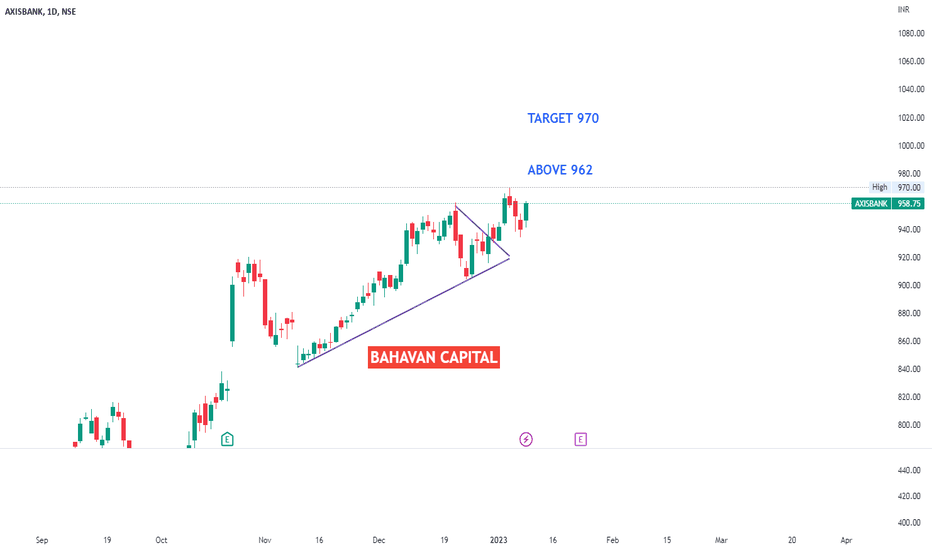

AXIS BANK - DAY CHART - 09.01.2023 - BAHAVAN CAPITALAXIS BANK as per Day Chart Analysis Stock

ABOVE 962 TARGET 970

Today FII Net selling had come down considerably to 203.13 Cr and DII Net Buying increased to 1723.79 Cr.

Nifty Once Breaks the resistance at 18169 then the target is 18240 level.

Bank Nifty Once Breaks the resistance at 42716 then the target is 42932 level

Tomorrow Market trend to be on the positive side..

Happy Profitable Trading to all...

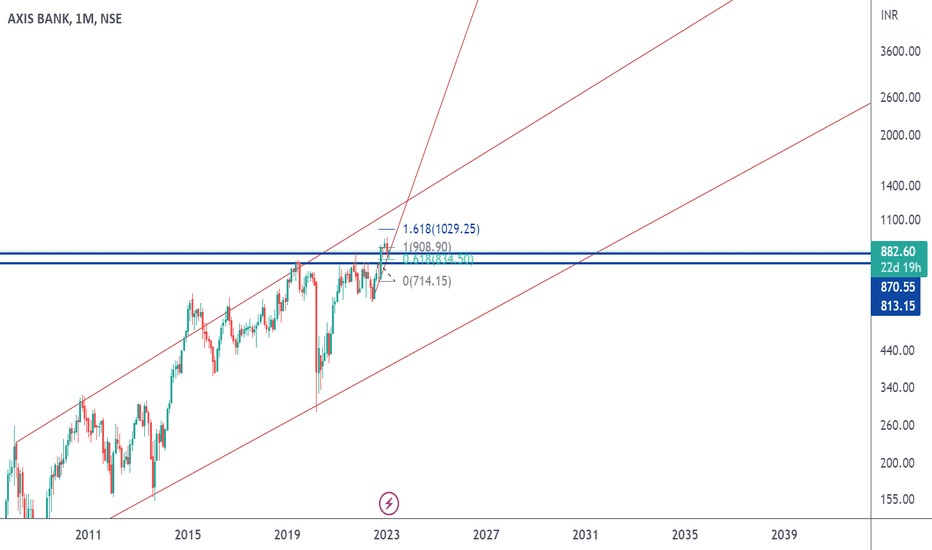

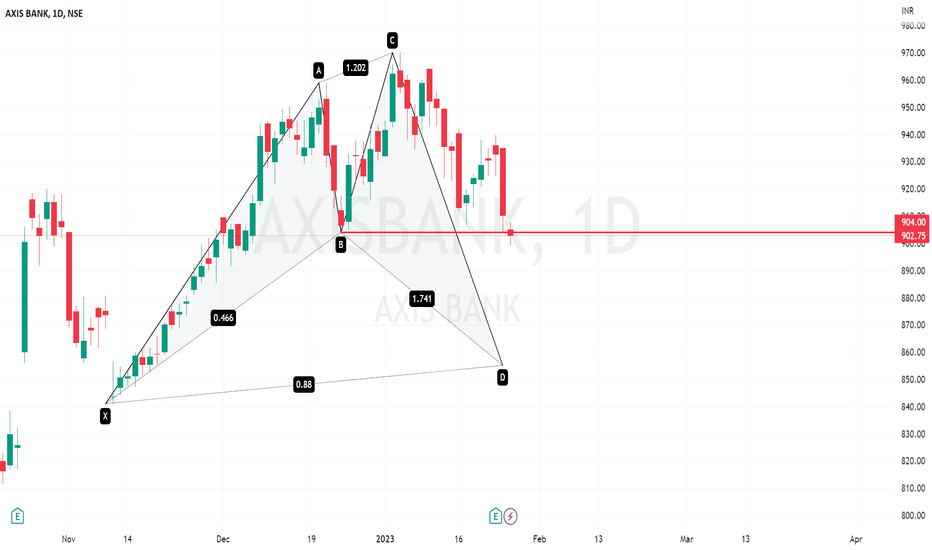

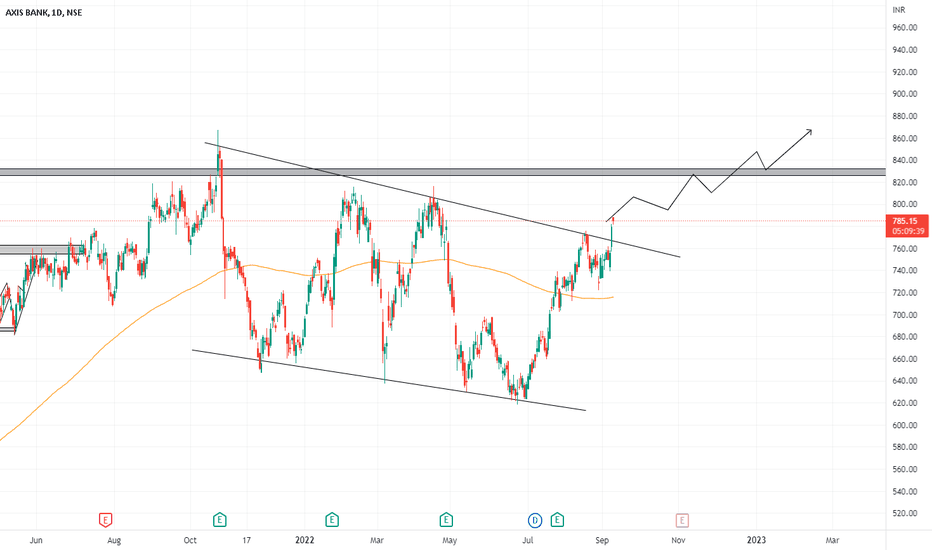

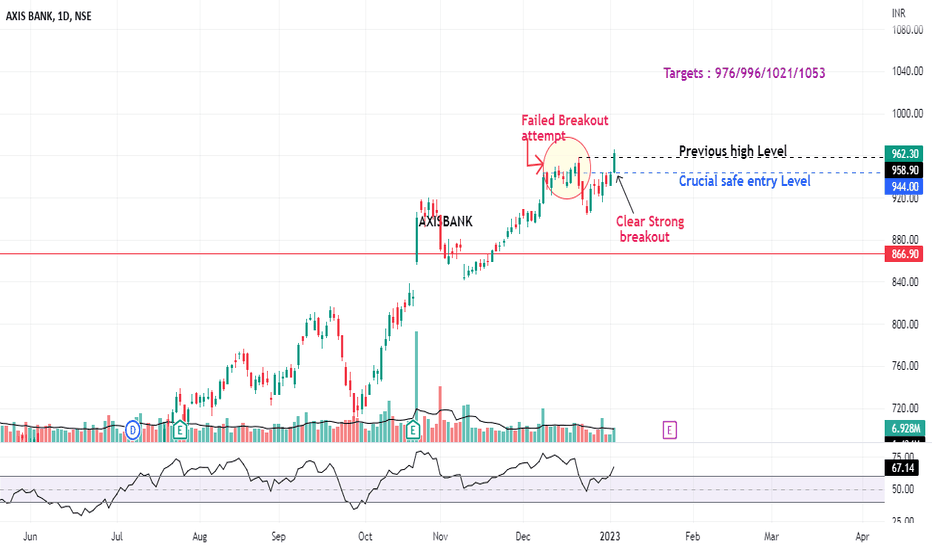

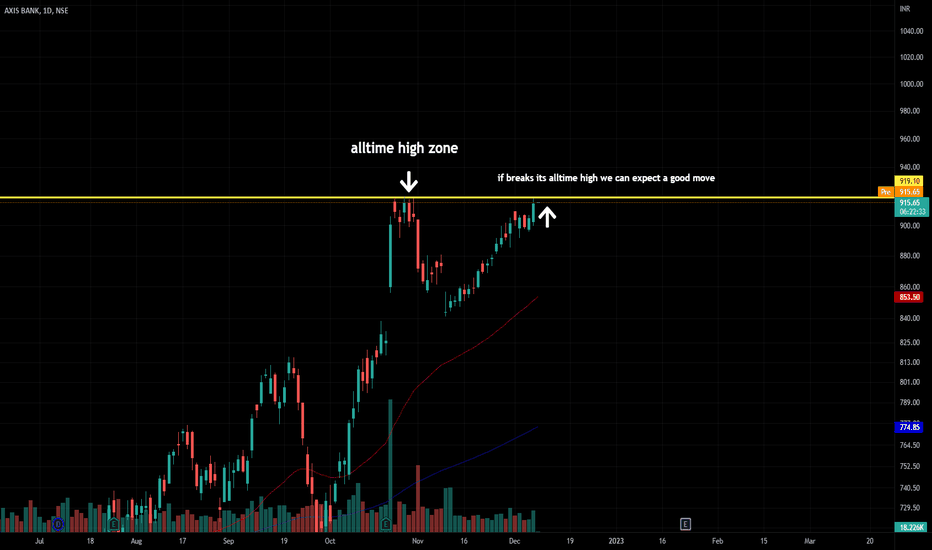

AXISBANK : Trading at 52week high#AXISBANK good strong breakout after 2 failed attempts

>> If it Retraces, accumulate till safe entry levels

>> If it doesnt Retraces, enter above previous high levels

Targets as per Fibonacci

Good Strength in stock

Take 5-10% and Keep trailling

Keep Learning....Keep Growing....Keep Trading

Follow for more Learning

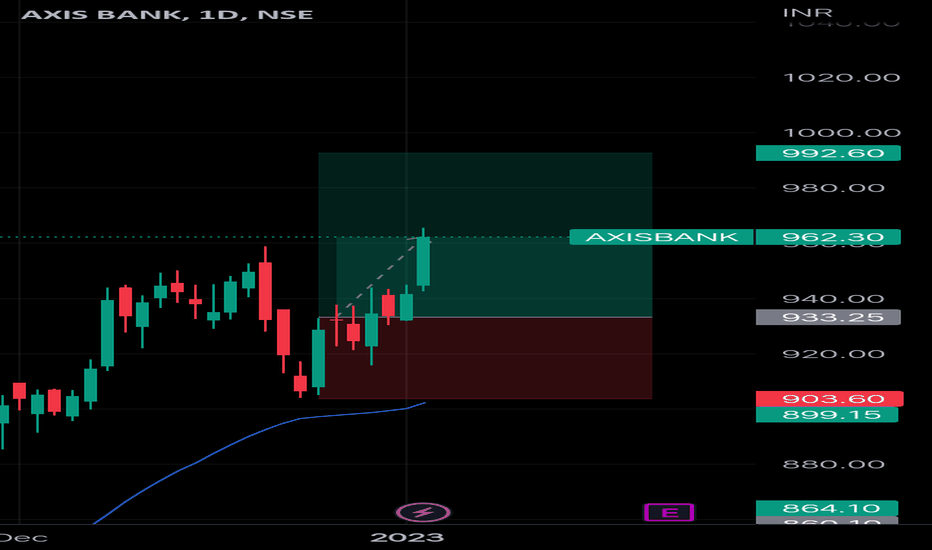

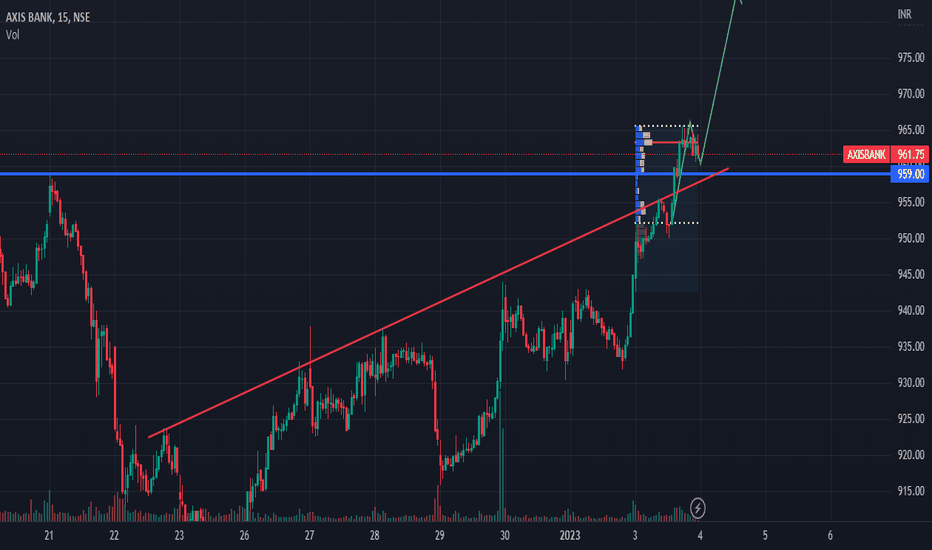

AXISBANK- Breakout Bullish SetupAxis bank has given a breakout from its Resistance zone and volume profile showing high volume traded at a near higher price, it is giving high probability to continue uptrend after a breakout above @965 level.

Entry Level:- Above @965

StopLoss:- Below @958 After breaout of level @965

Target:- 1:1 or 1:2