UZC trade ideas

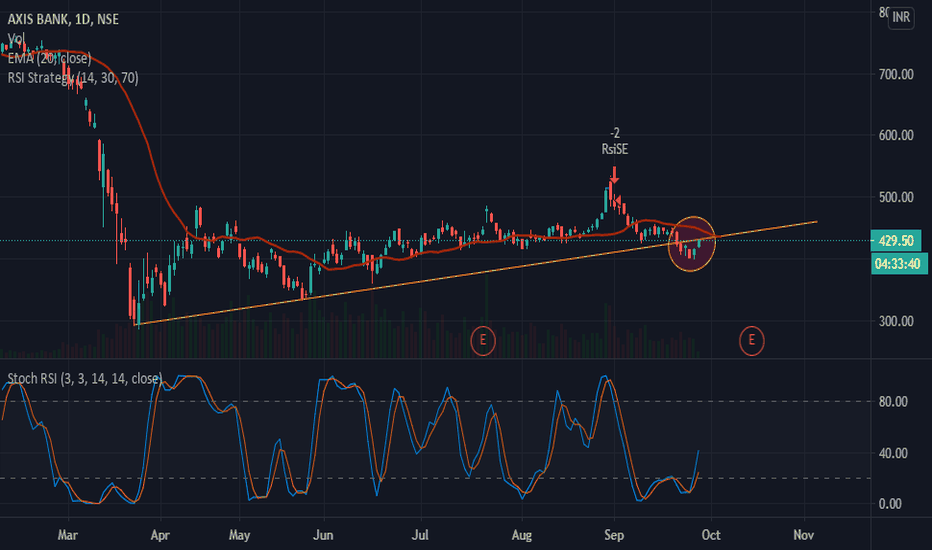

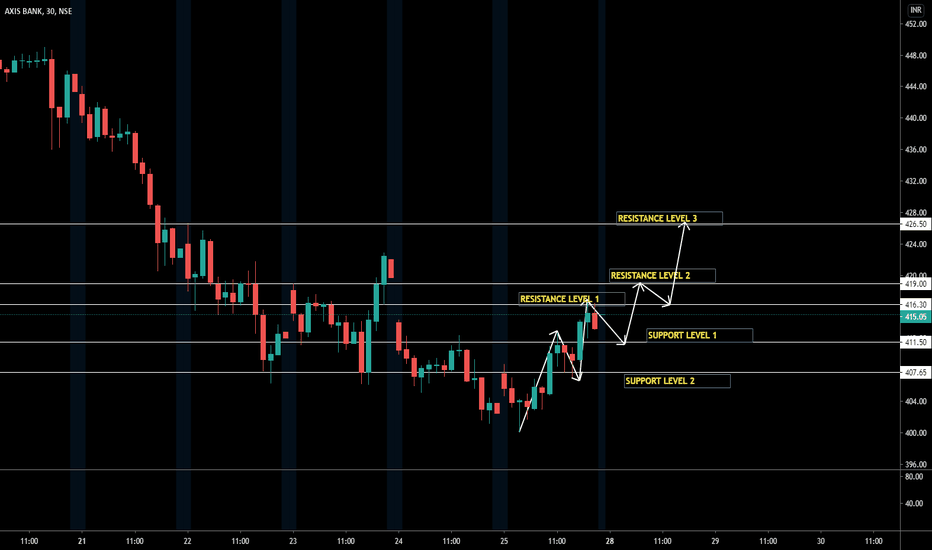

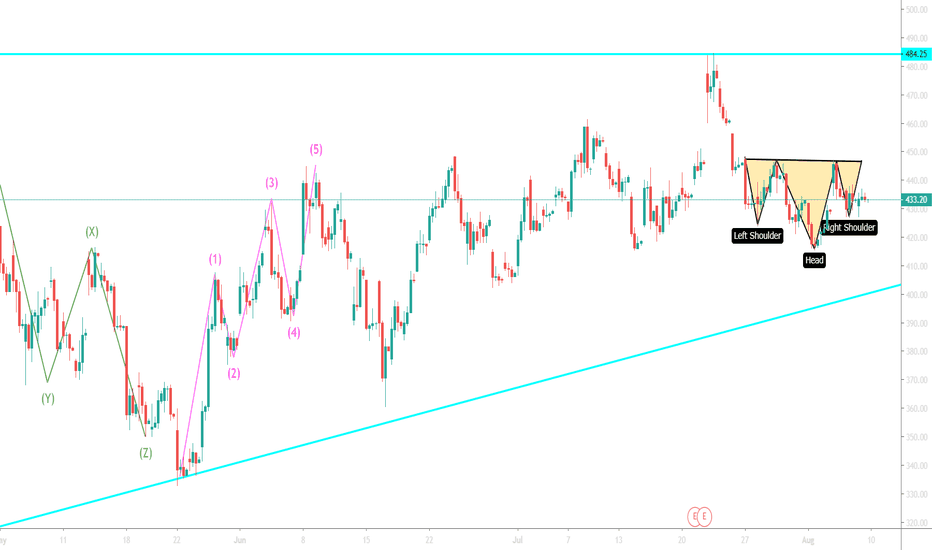

AXISBANK -15 MINUTE - LONGinthe last trading session we can see the axis bank stock has moved around 12.60 rs.

today we are going to see where the stock is headed in the coming days.

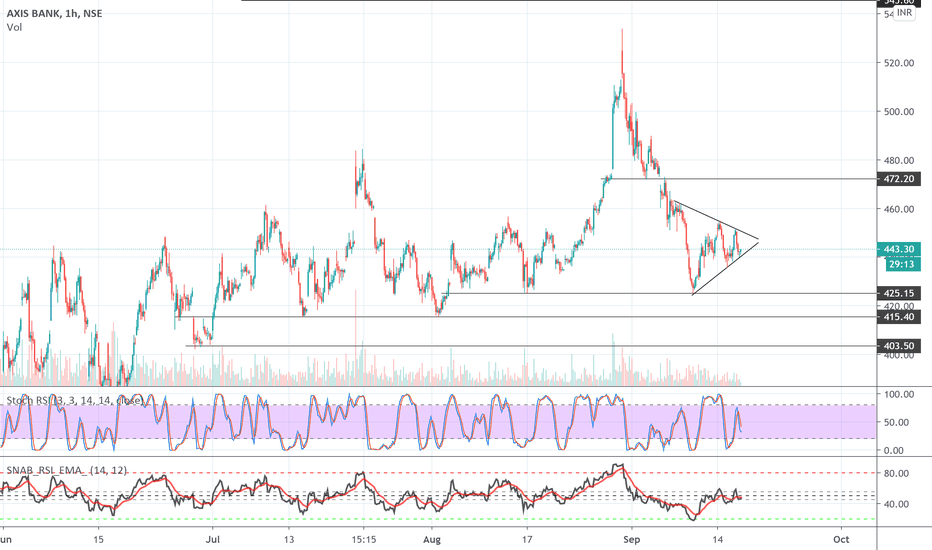

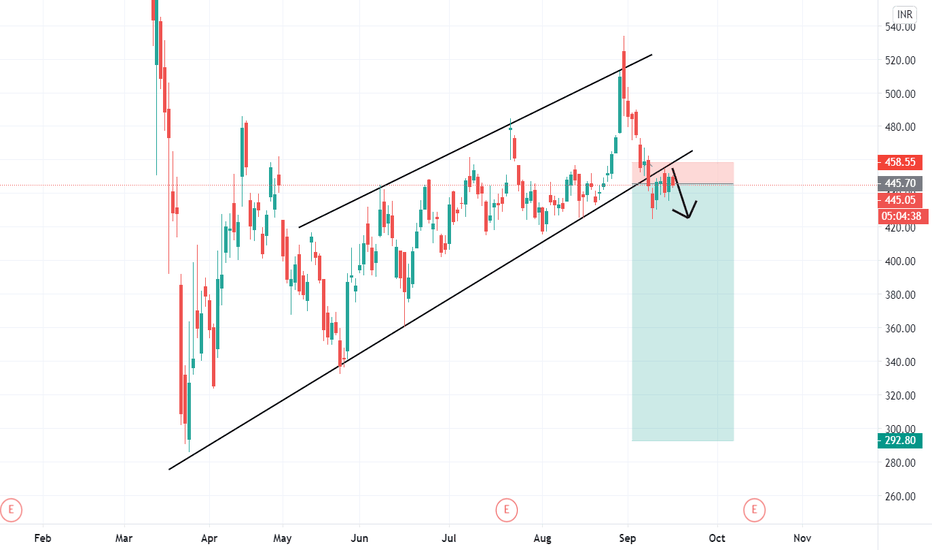

based on the current trend setting up , the stock is expected to come down to 411.50 which is a support level and then move to 419 level which is our resistance level .

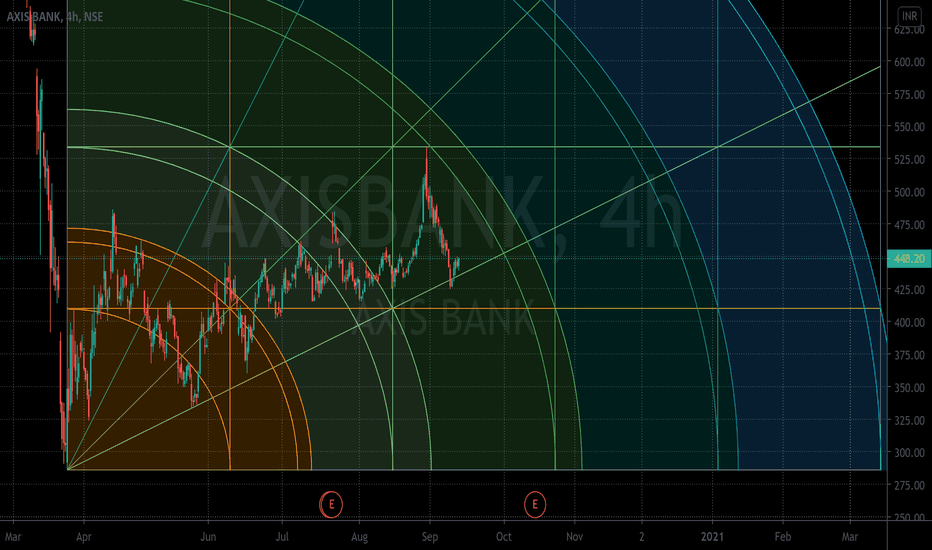

AXIS BANKTHIS ONE IS AGAIN TESTING THOSE LEVELS OF 400, IF IT HOLD THEN CAN LEAD TO 412, 421 AND 428

ELSE ON DOWNSIDE 390, 384, 375, 370

*************************************************************************************************************************************************

Hi all,

Its pleasure to have you all here.

I have started putting these charts as a contribution from my side to all people who are new to business, as I had to struggle a lot without any sources at disposal. So please consider this a just small contribution from my side.

Few Honest Disclosures:

1. Any idea shared is my personal view, its not a recommendation, neither any kind of paid propaganda, so please

do your bit of research.

2. Ideas shared does not mean that I trade all or have position in them, this is just a helping hand to all.

3. I expect no comments or like nor any negativity, as I said its just a small helping hand from my side, please plan your risk and trade as per your capacity.

4. To trade in Cash, options or futures is your sole choice and your own risk

5. I am no expert in Tech Indicators, I believe in support resistance and trendline theory, you may use this as a supplement theory for better results.

6. I work for my own living, this is a hobby which I do sincerely to help anyone who might come across my charts.

***********************************************************************************************************************************************

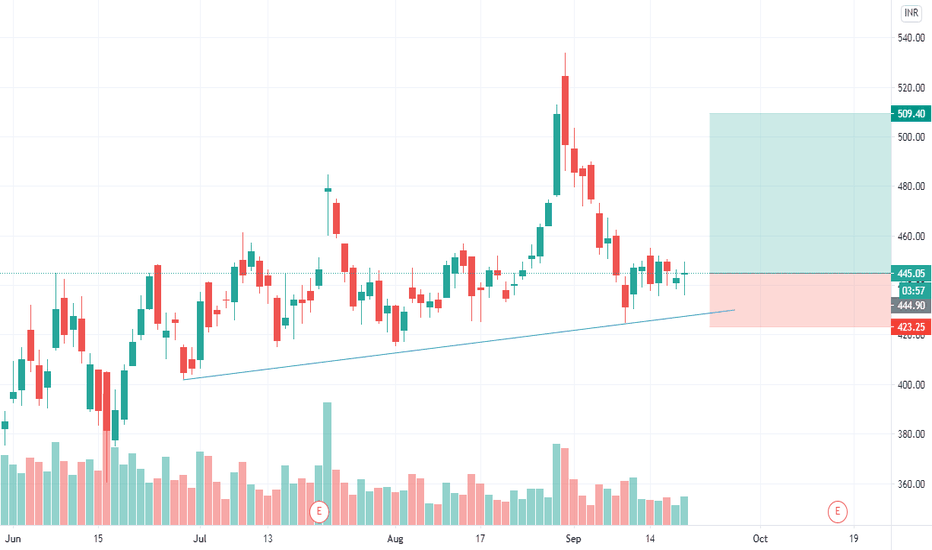

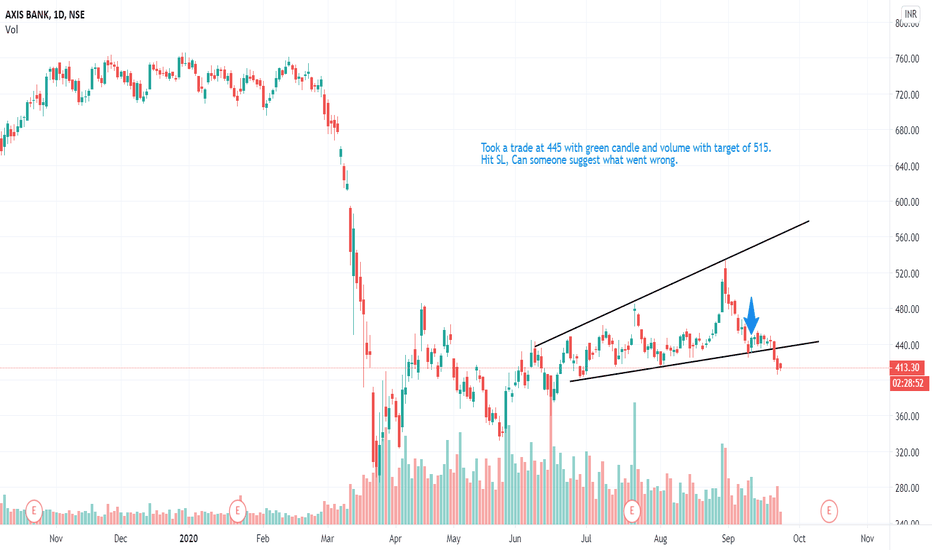

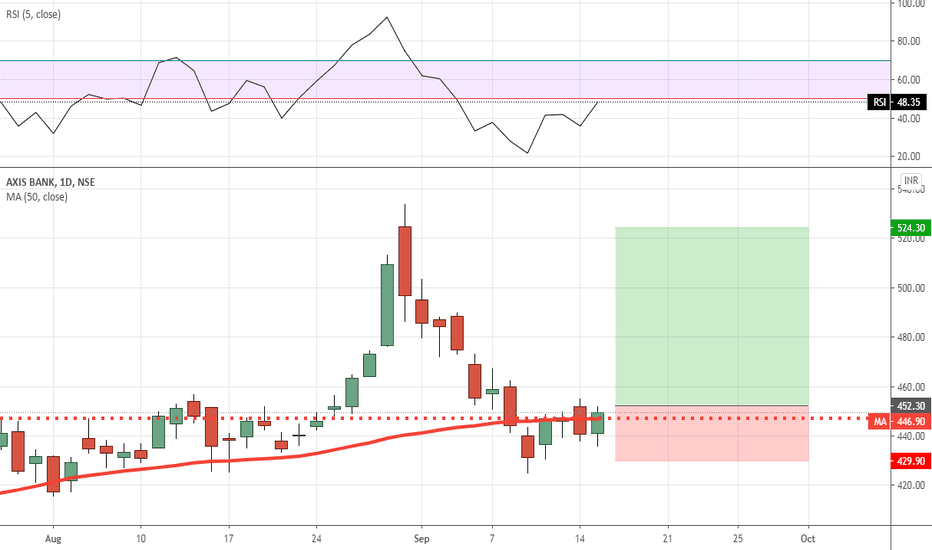

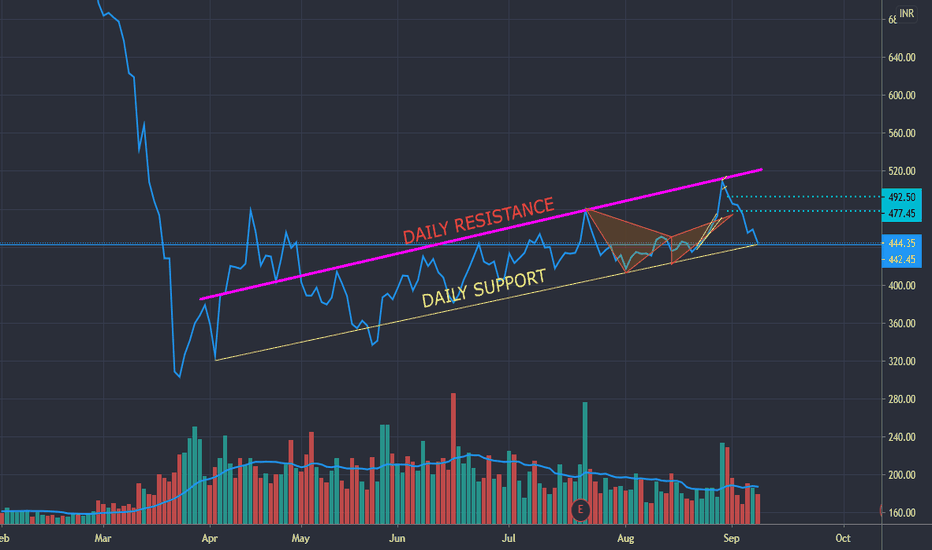

Axis Bank Bear Pennant Breakdown and TargetsAxis Bank has formed a Bearish pattern after a selloff from 533 to 525.

Stock is on the verge of Breakdown. Currently trading at 442 levels which is very important to hold.

Target if Pattern works are 425, 415 and 404.

Pattern invalid if daily closes above 455 levels.

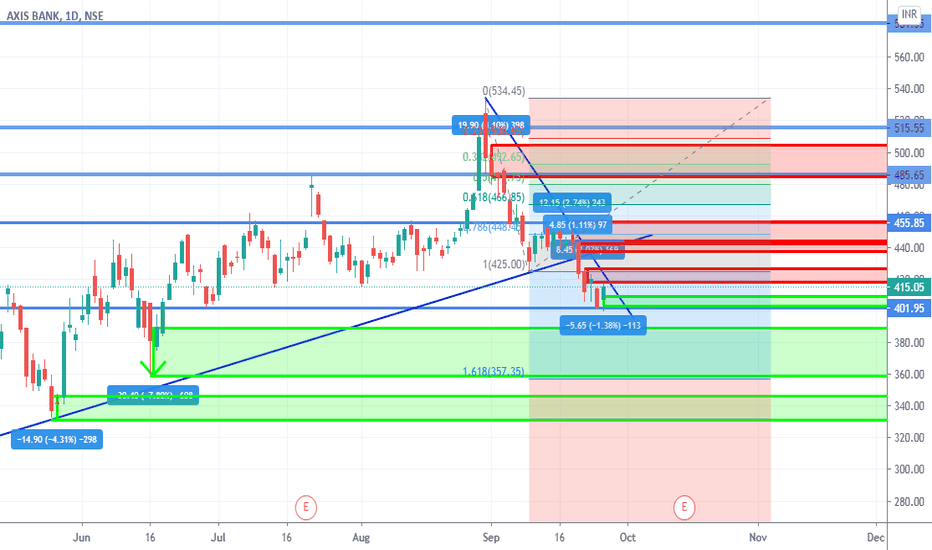

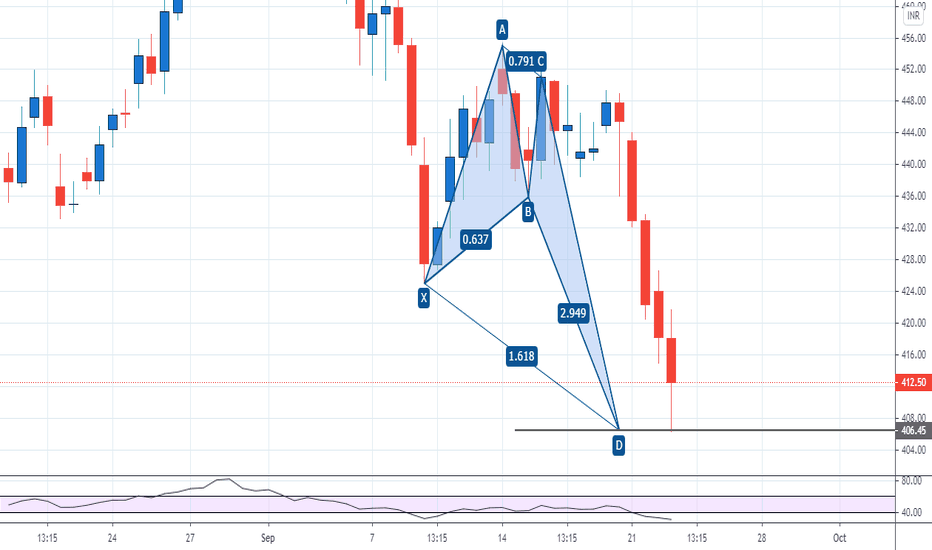

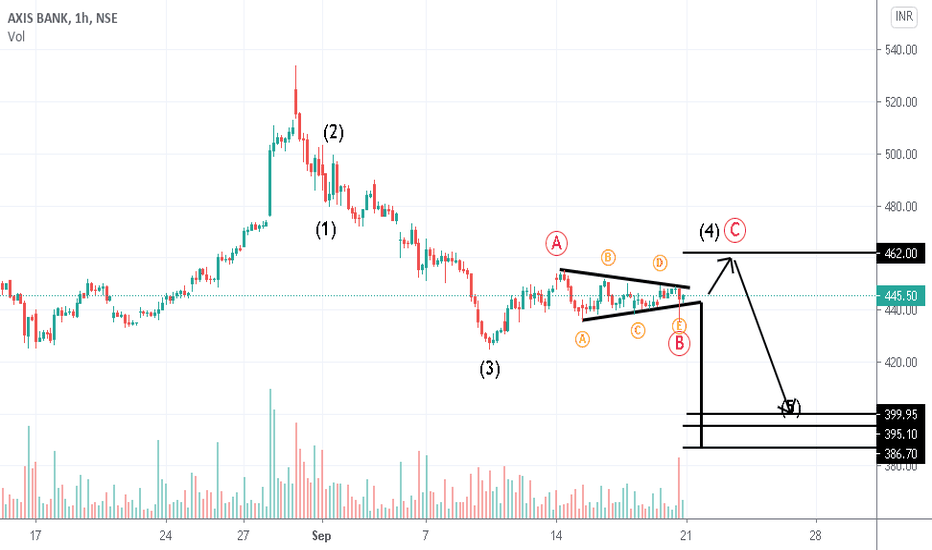

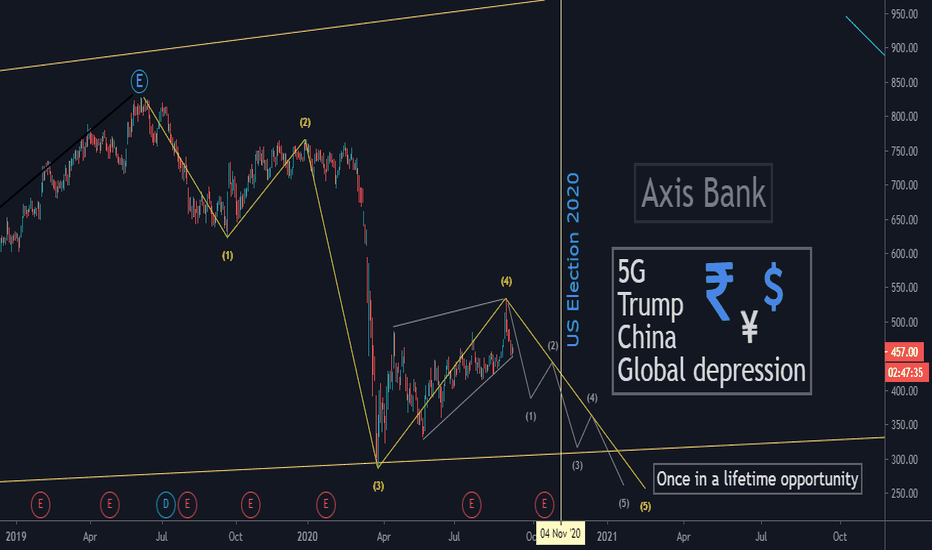

elliott wave analysis of Axis BankDISCLAIMER: There is no guarantee of profits or no exceptions from losses.

The technical analysis provided on the chart is solely the personal views of my research.

You are advised to rely on your own judgments while investing/Trading decisions.

Past performance is not an indicator of future returns. Investment is subject to market risks.

Seek help of your financial advisors before investing/trading.

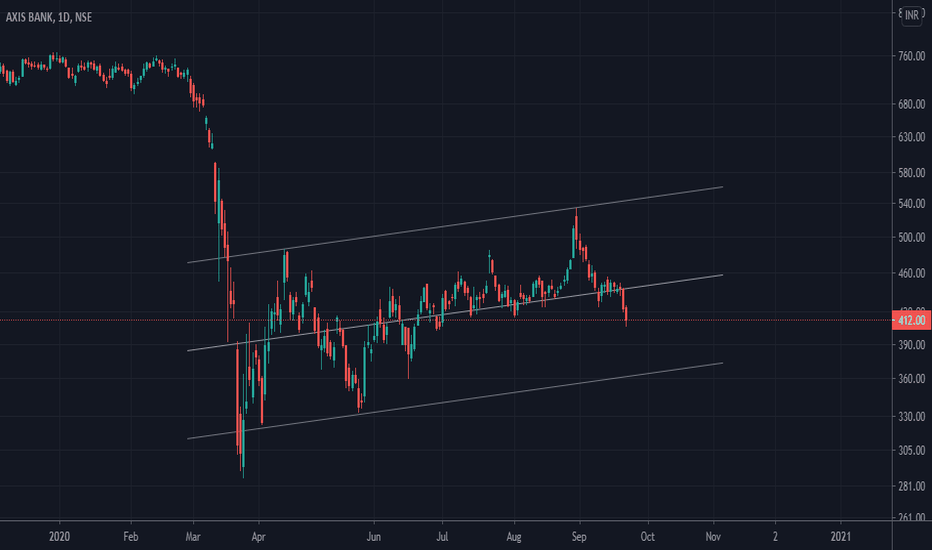

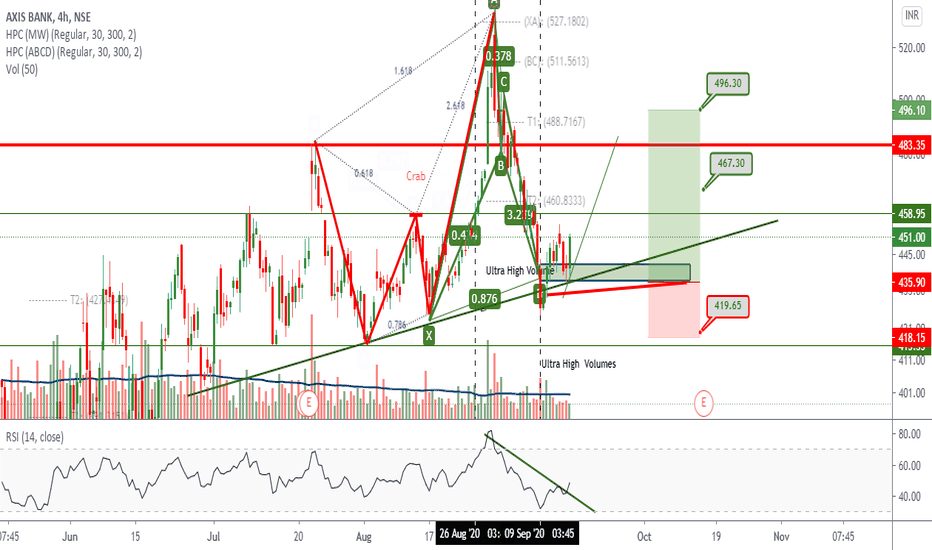

Axis bank Elliott wave analysis 2020 : One time opportunity Stock is in clear bearish trend. Right now we are at the end of 4th correction wave followed by 5th wave.

If we consider global economy than we have us election on 4th November 2020. The result of this election will decide tone of current geopolitics risks for next 5 years specially us china. Before 2025 china has its own agenda "the vision 2025" which is the core reason behind US China India issue we knows as tiktok, pubg ban.

The 5G : who will lead the world in 5g US or China. With whom will India build its 5G infrastructure US or china. this is the core concern of current us, china, India political drama

Which bank will provide investment for that infrastructure for business

Due to corona virus depression banks are already in loss. we can expect unprecedented loan default this year. Legendary investor Warren Buffett is already getting out of banks stocks which he bought in 2007 financial crisis which triggered global recession obviously it came later in India too. He has sold all of his goldman sachs.

At the end of 5th wave we will have once in a life time opportunity to buy this stocks but it will take years to recover only patience investor will make money

Buy low Sell High : Indian stock markets Elliott wave analysis