UZC trade ideas

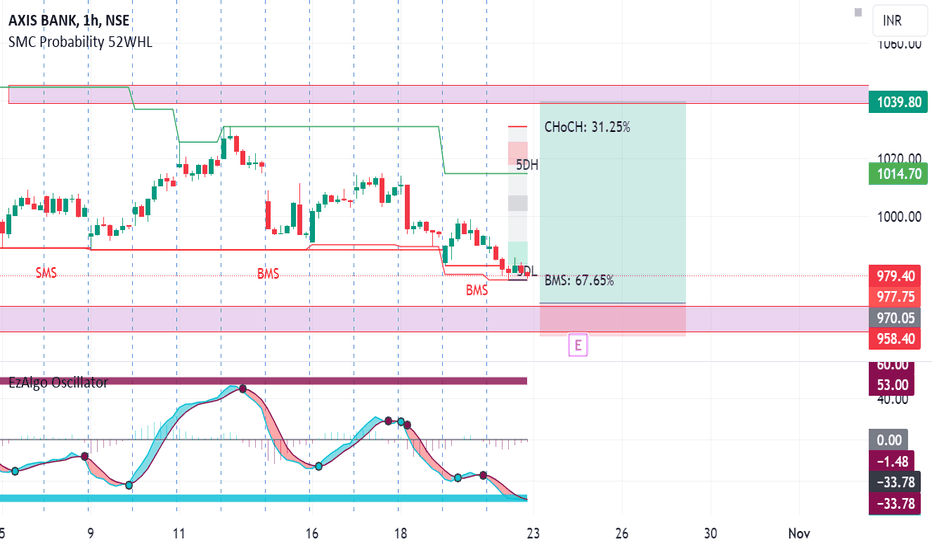

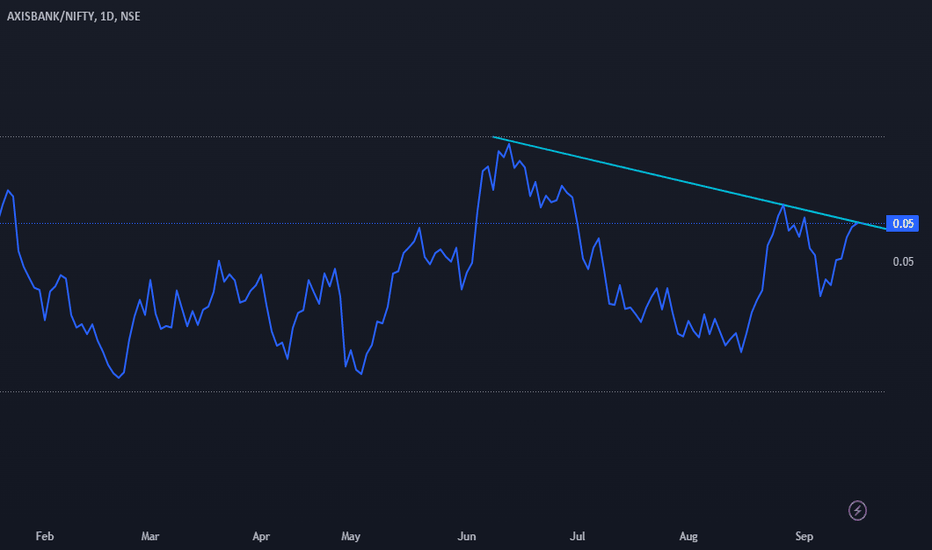

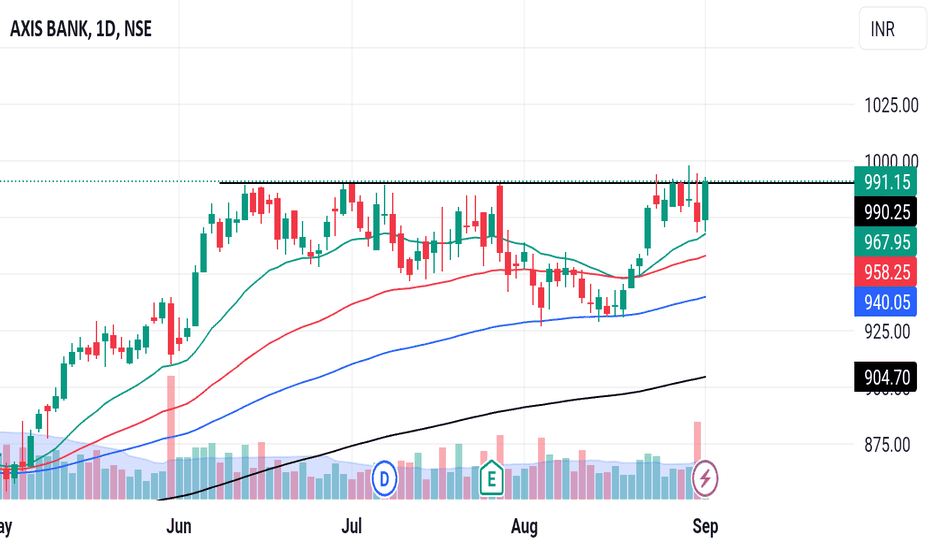

AXIS BANKStocks trading near 5 day Low & 1H POI, its strong Support Zone , indicating a possible breakout

I am not SEBI register Advisor and I am not any trade and tips recommend here, This Idea post on this Channel Only for educational knowledge & learning purpose, I am not provide any trading tips, Before any Trade Advice your Financial Advisor, I am not responsible any profit and loss

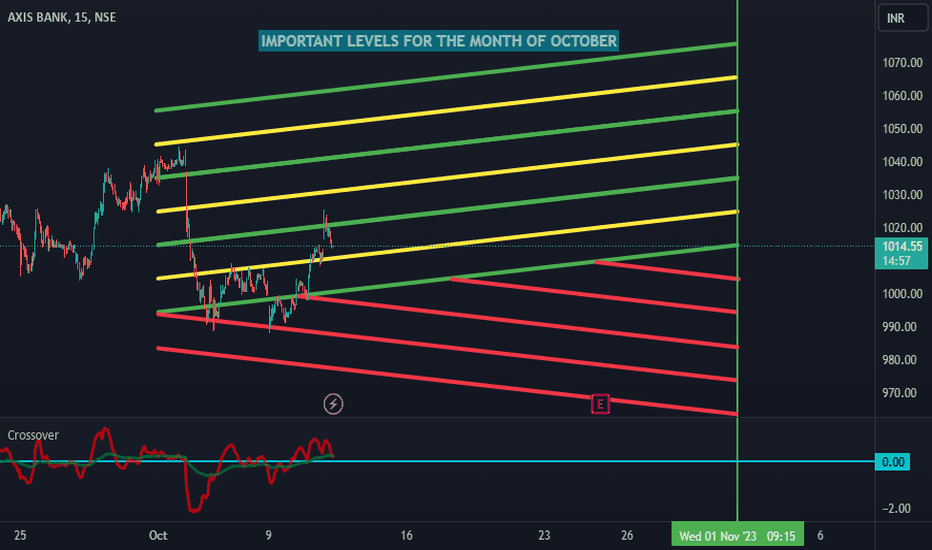

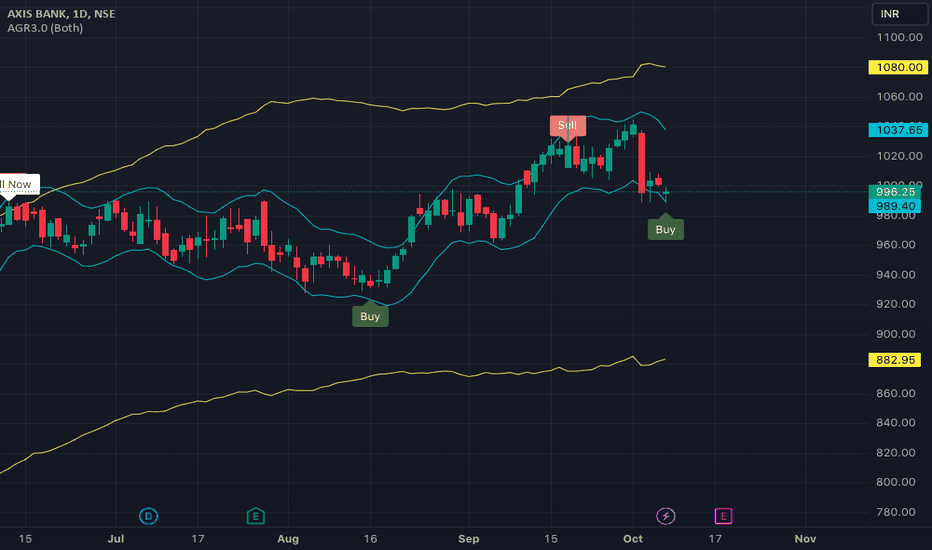

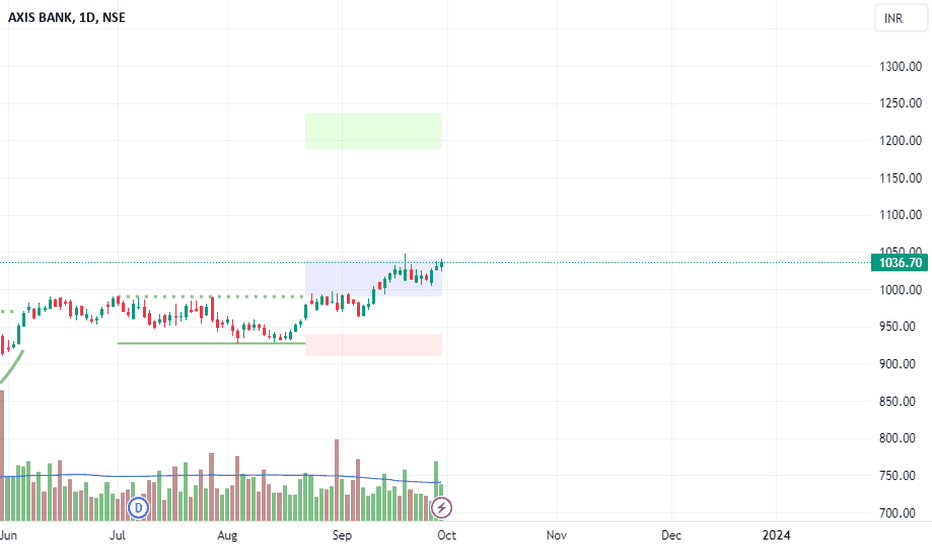

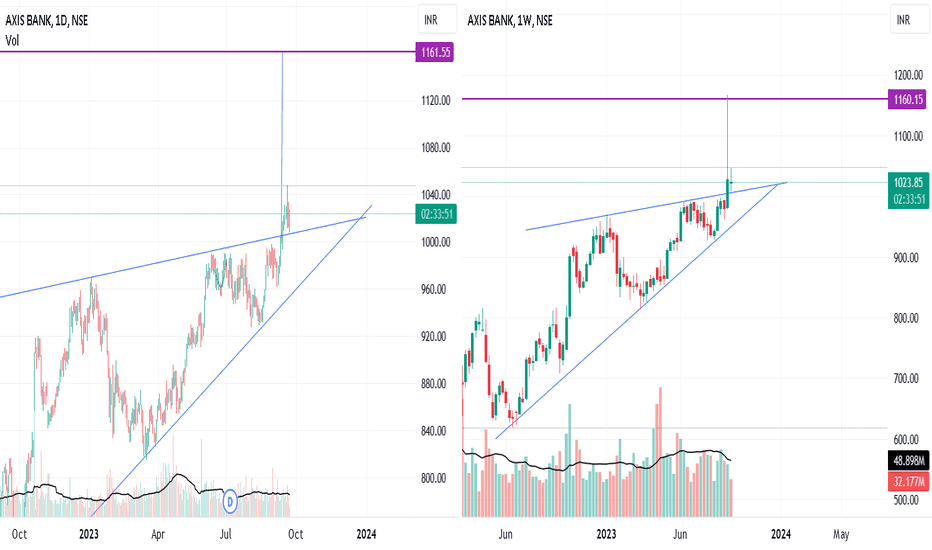

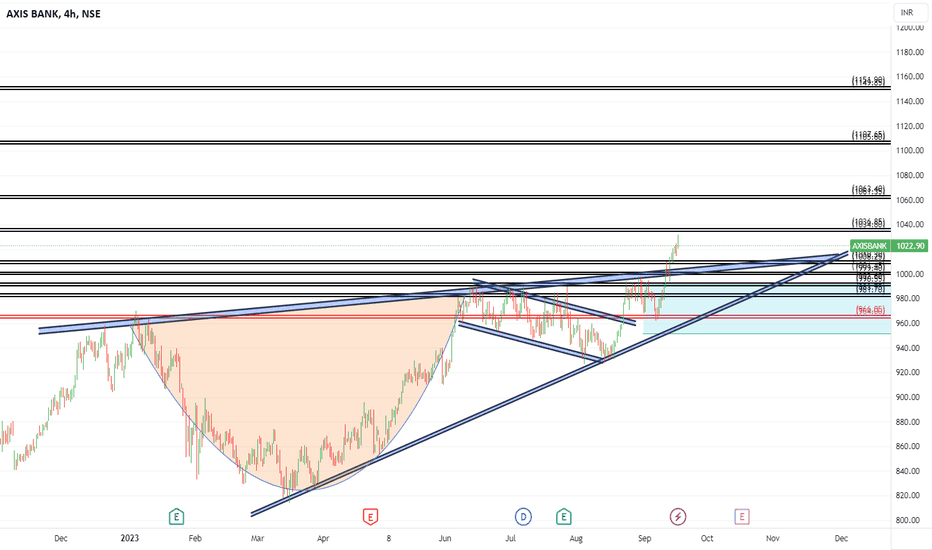

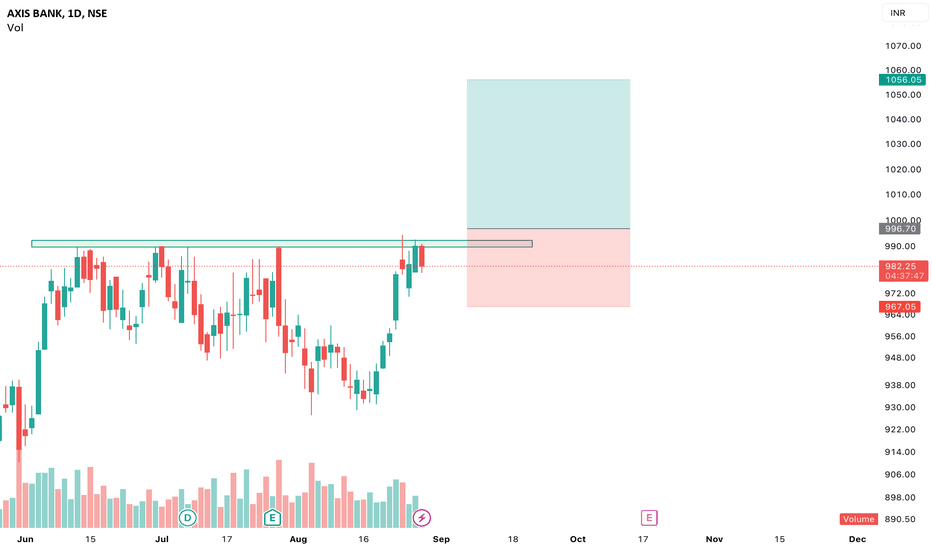

INTRADAY & POSITIONAL LEVELS FOR OCT 23NSE:AXISBANK BSE:AXIS1! NSE:AXISBANK1!

All the Marked levels are valid for the month of October 2023.

Levels marked in green and yellow colour represent the area in which bullish movement is expected.

Levels marked in red colour represent the area where all the bearish movement is expected.

I am expecting bullish / Upside movement from the lower levels .

If in case all levels gets exhausted either on the up side or down side, i will update .

Use these levels with your existing strategy and try to go short or long near or at the levels so that your stoploss can be minimized.

All the best folks.

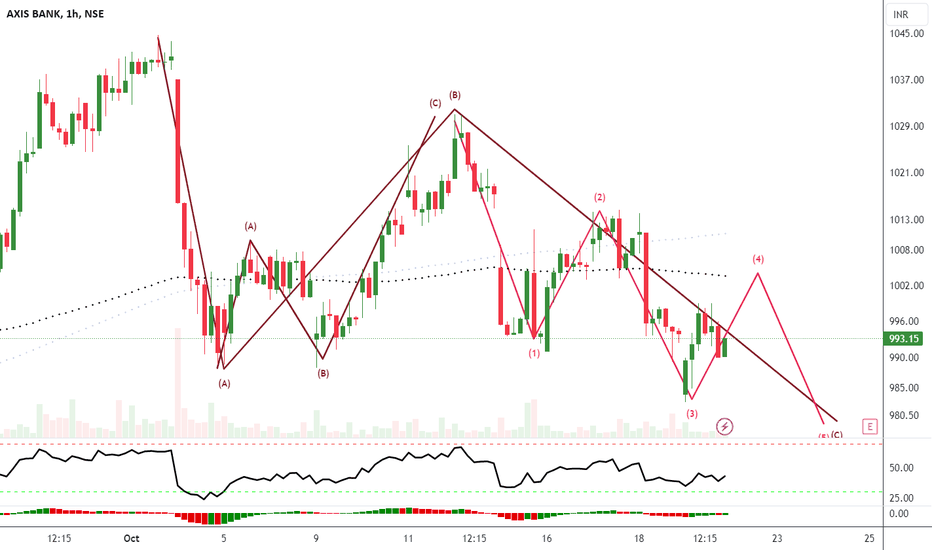

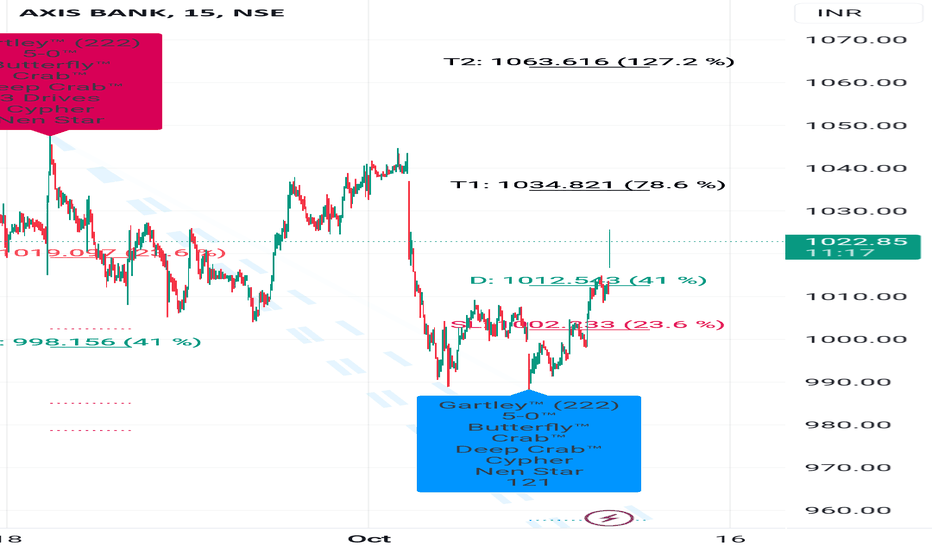

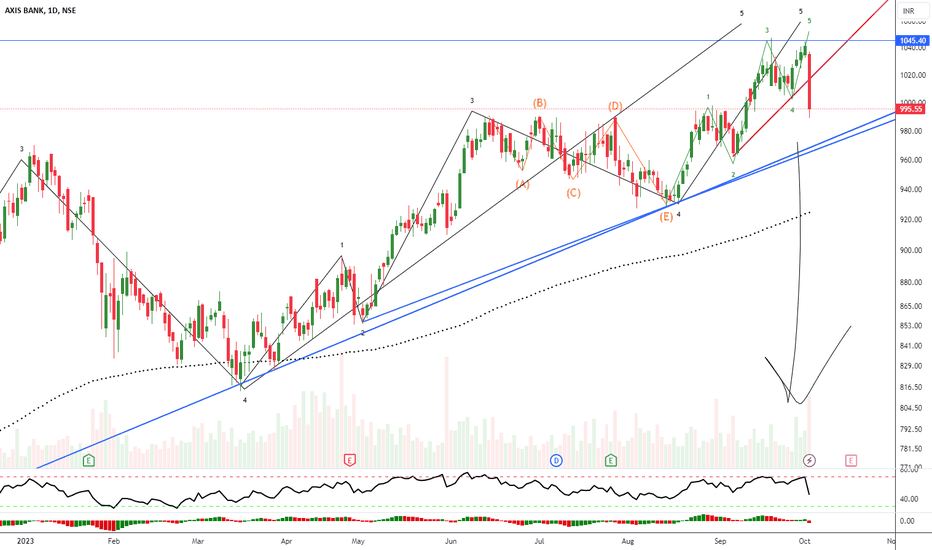

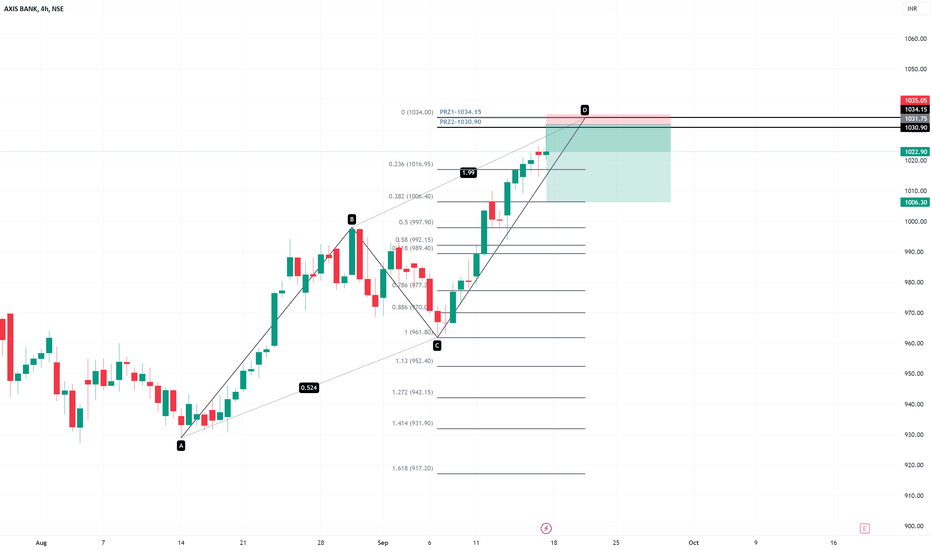

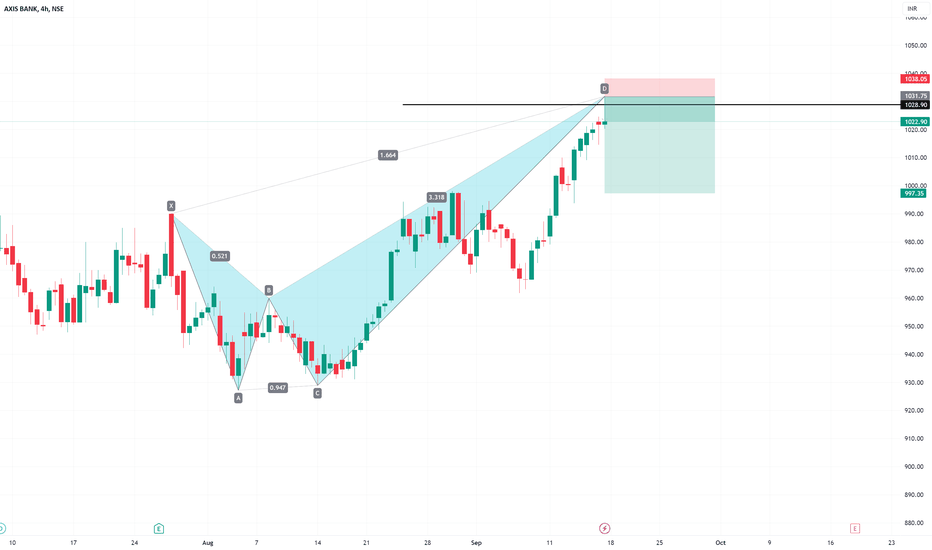

Axis bank looking weak 955 1st LEVEL to watch on downside On Our Harmonic pattern indicator based trade setup take trade as explained below :-

Early trades Buy or sell below/ above 23.6 %, safe trades buy or sell above / below 41% , after taking trade next upside or downside levels will be target ,

When reverse buy or sell signal appear then book profit on Target or trail SL to 23.6 % If trailing SL hit then early trade can be taken above or below 23.6 and safe trade can b taken above/ below 41% ..

Please note:-

It's working on news based and volitile market very well so exit if SL hit

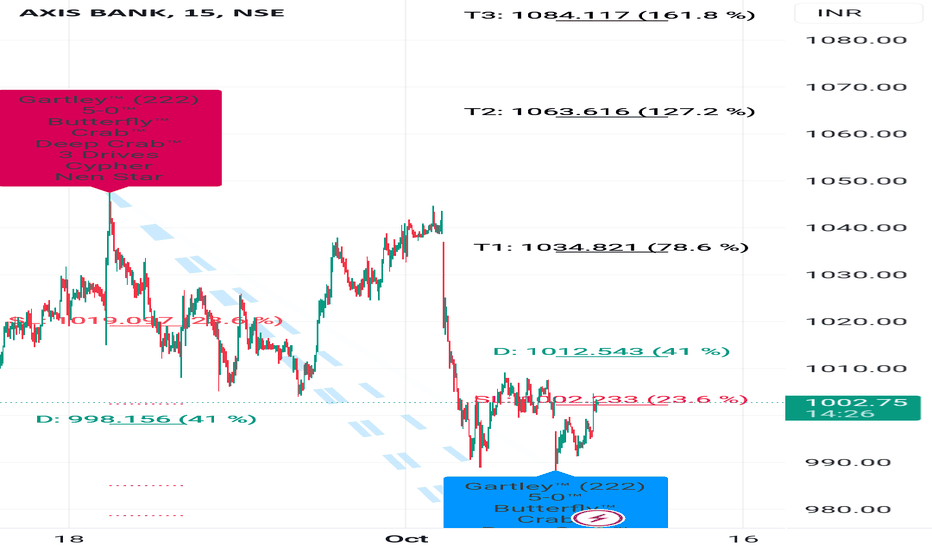

Axisbank more upside pending buying recommended at 1002On Our Harmonic pattern indicator based trade setup take trade as explained below :-

Early trades Buy or sell below/ above 23.6 %, safe trades buy or sell above / below 41% , after taking trade next upside or downside levels will be target ,

When reverse buy or sell signal appear then book profit on Target or trail SL to 23.6 % If trailing SL hit then early trade can be taken above or below 23.6 and safe trade can b taken above/ below 41% ..

Please note:-

It's working on news based and volitile market very well so exit if SL hit

Axis Bank trying to break Upside resistance On Our Harmonic pattern indicator based trade setup take trade as explained below :-

Early trades Buy or sell below/ above 23.6 %, safe trades buy or sell above / below 41% , after taking trade next upside or downside levels will be target ,

When reverse buy or sell signal appear then book profit on Target or trail SL to 23.6 % If trailing SL hit then early trade can be taken above or below 23.6 and safe trade can b taken above/ below 41% ..

Please note:-

It's working on news based and volitile market very well so exit if SL hit

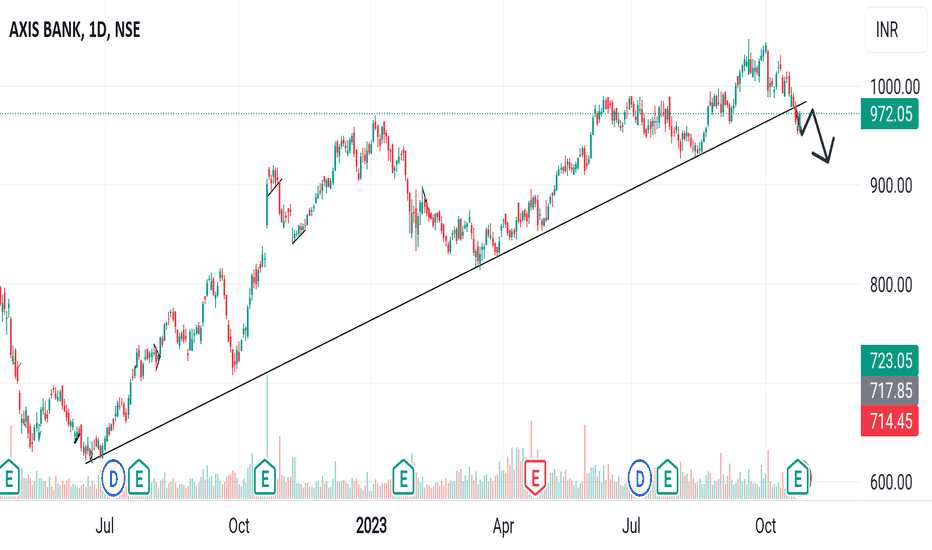

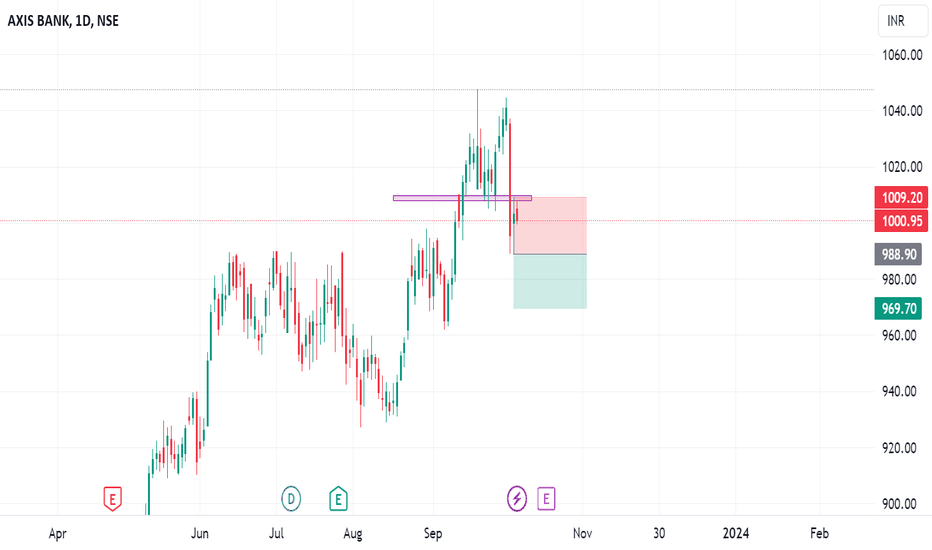

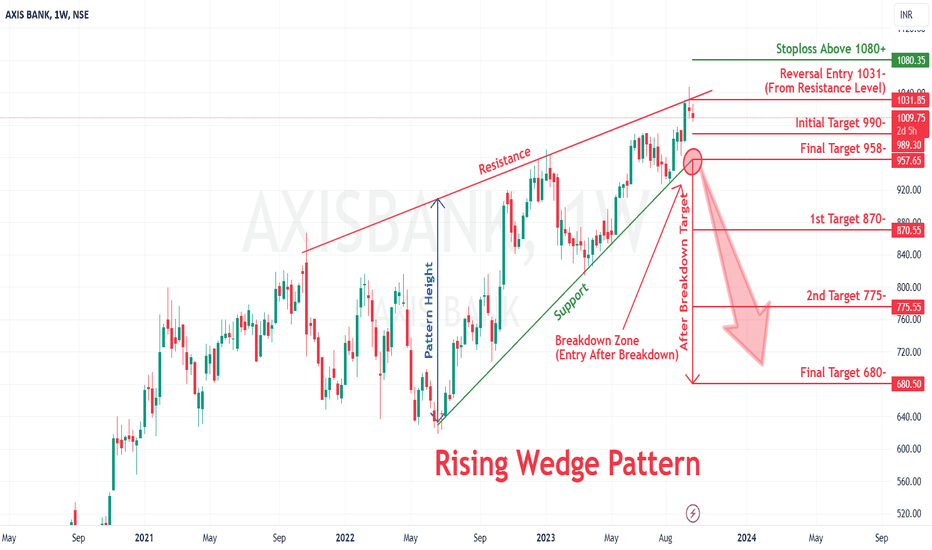

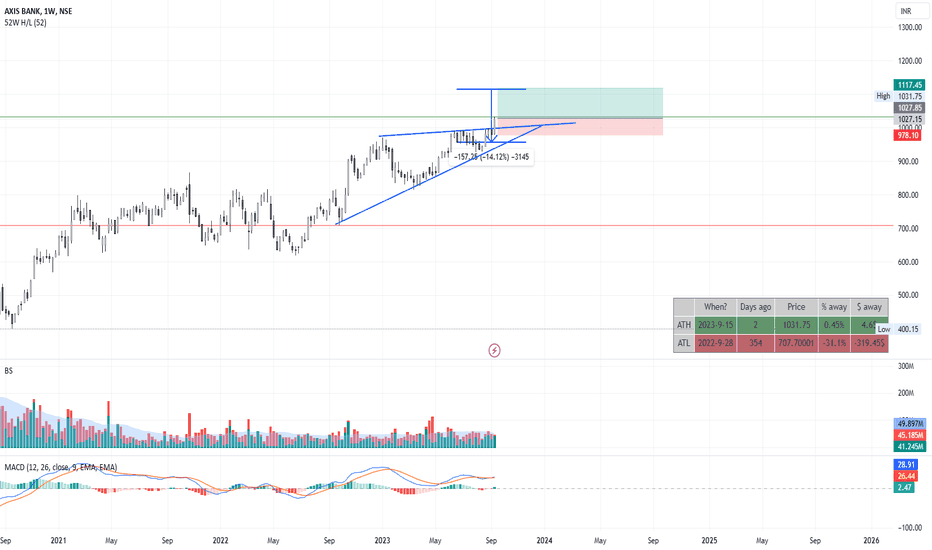

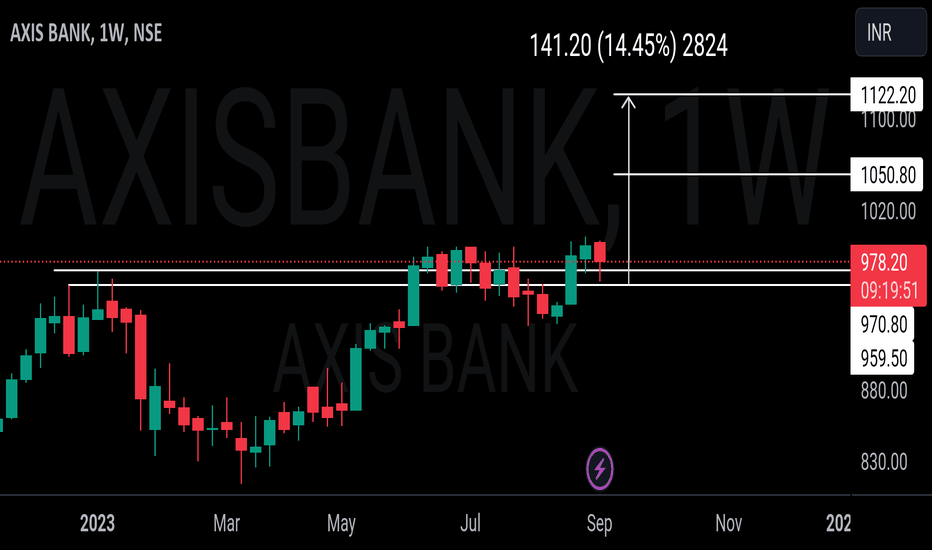

Reversal Rising Wedge pattern in AXISBANKAXIS BANK LTD

Key highlights: 💡⚡

📈 On 1week Time Frame Stock Showing Reversal of Rising Wedge Pattern.

📈 It can give movement upto the Reversal Final target of Below 958-.

📈 There have chances of breakdown of Resistance level too.

📈 After breakdown of Resistance level this stock can gives strong downside rally upto below 680-.

📈 Can Go short in this stock by placing a stop loss Above 1080+.

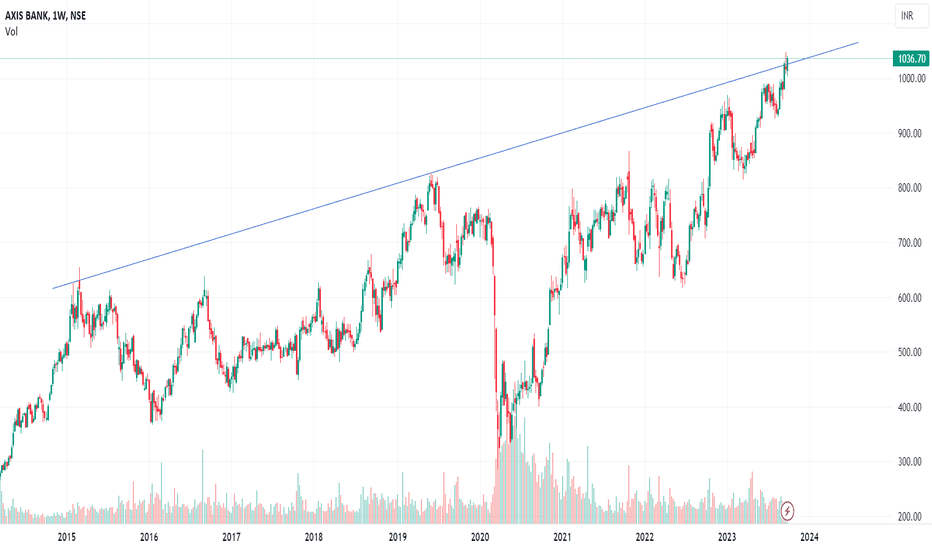

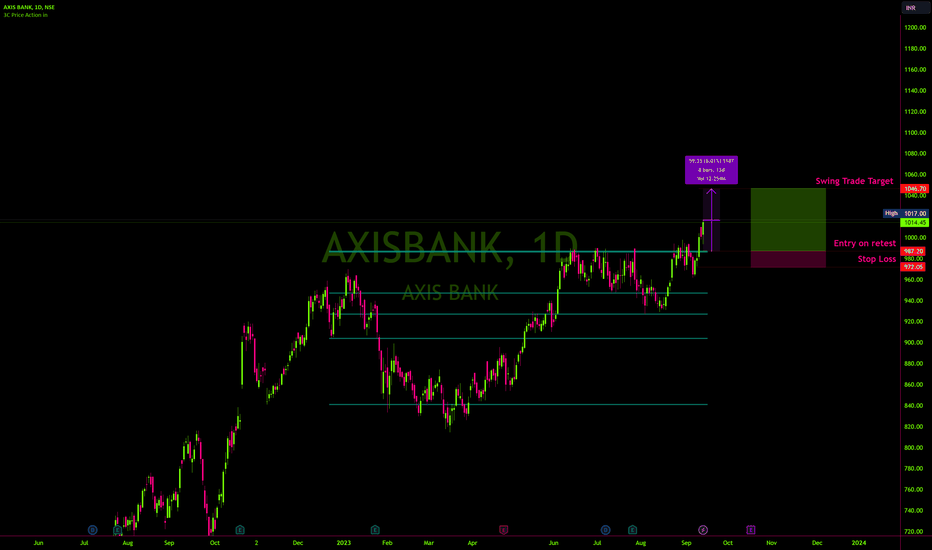

Axis Bank Swing Trade SetupAxis Bank is trading at its 52-week high and all-time high. There is no resistance on the upper side. Volume is increasing.

The relative strength index is above 60 daily, weekly and monthly.

The cup and handle pattern is visible.

If the prices retest the neck level, 987 - 985, it would be a good entry-level with a target level 1045. We can achieve a 4 risk-to-reward ratio if the trade goes positive.

Even after stretching the stop order below the previous swing low, the risk-reward ratio would be more than 2.

Stop loss can also be trailed as the price moves upward.