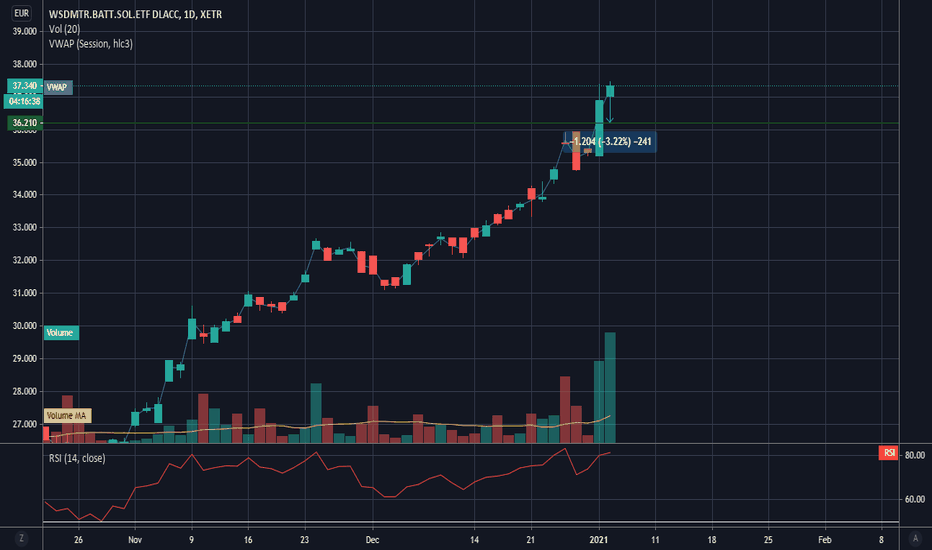

Correction expected WisdomTree Battery Solutions UCITS ETFAs WisdomTree Battery Solutions UCITS ETF entered to 2021 by almost 5% pump on daily and reached its ATH above 37.45, It gained some decent attention and unusually high volume.

I believe in potential of fundament of this ETF and my strategy here is a long term investment. Therefore, I am looking for

Key stats

About WISDOMTREE ISSUER ICAV - WISDOMTREE BATTERY SOLUTIONS UCITS ETF

Home page

Inception date

Feb 26, 2020

Structure

Irish VCIC

Replication method

Physical

Dividend treatment

Capitalizes

Primary advisor

WisdomTree Management Ltd.

ISIN

IE00BKLF1R75

The WisdomTree Battery Solutions UCITS ETF (the Fund) seeks to track the price and net dividend performance, before fees and expenses, of the WisdomTree Battery Solutions Index (the Index).

Related funds

Classification

What's in the fund

Exposure type

Producer Manufacturing

Electronic Technology

Non-Energy Minerals

Process Industries

Stock breakdown by region

Top 10 holdings

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

W1TA assets under management is 120.66 M EUR. AUM is an important metric as it reflects the fund's size and can serve as a gauge of how successful the fund is in attracting investors, which, in its turn, can influence decision-making.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

W1TA invests in stocks. See more details in our Analysis section.

W1TA expense ratio is 0.40%. It's an important metric for helping traders understand the fund's operating costs relative to assets and how expensive it would be to hold the fund.

No, W1TA isn't leveraged, meaning it doesn't use borrowings or financial derivatives to magnify the performance of the underlying assets or index it follows.

No, W1TA doesn't pay dividends to its holders.

W1TA shares are issued by WisdomTree, Inc.

W1TA follows the WisdomTree Battery Solutions Index. ETFs usually track some benchmark seeking to replicate its performance and guide asset selection and objectives.

The fund started trading on Feb 26, 2020.

The fund's management style is passive, meaning it's aiming to replicate the performance of the underlying index by holding assets in the same proportions as the index. The goal is to match the index's returns.