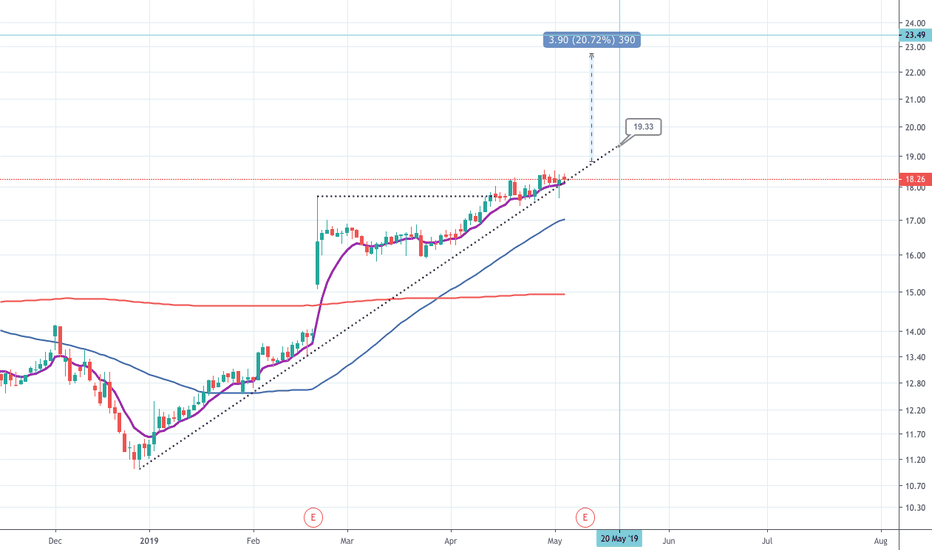

CECO – Long Trade Setup!📈 🟢

Ticker: CECO Environmental Corp. (NASDAQ: CECO)

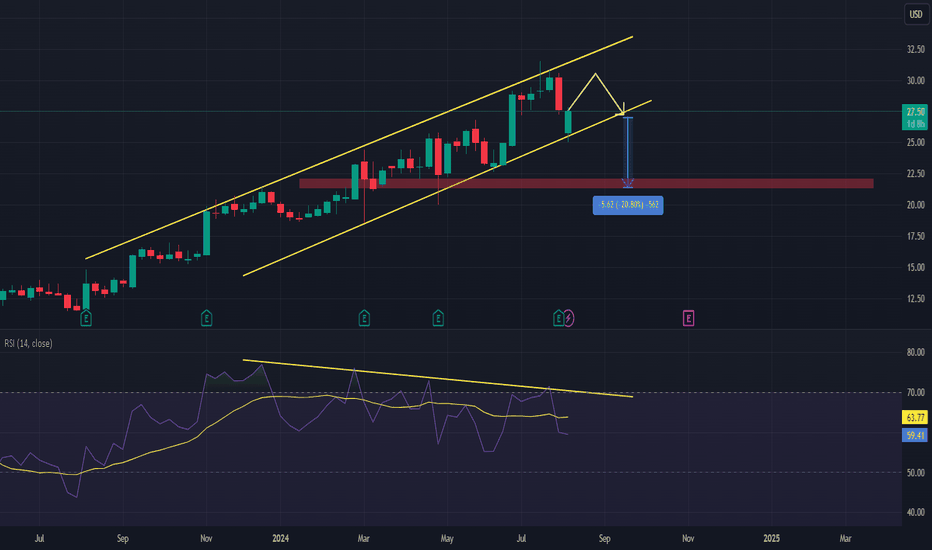

Chart: 30-Min Timeframe

Pattern: Trendline support + breakout continuation

🔹 Entry: $25.92 (retest near trendline & breakout zone)

🔹 Stop-Loss: $25.26 (below ascending trendline & consolidation)

🔹 Take Profits:

TP1: $26.94 – Previous resistance

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.25 EUR

12.52 M EUR

538.95 M EUR

29.74 M

About CECO Environmental Corp.

Sector

Industry

CEO

Todd R. Gleason

Website

Headquarters

Addison

Founded

1966

FIGI

BBG000BP3XY8

CECO Environmental Corp. engages in the provision of engineering technology and solutions. It offers services in the field of environment, energy, fluid handling, and filtration. The firm operates through the following segments: Energy Solutions, Industrial Solutions and Fluid Handling Solutions. The Energy Solutions segment improves air quality and solves fluid handling needs with market engineered, and customized solutions for the power generation, oil and gas, and petrochemical industries. The Industrial Solutions segment serves the industrial pollution control market. The Fluid Handling Solutions segment provides pump and filtration solutions that maintain safe and clean operations in some of the most harsh and toxic environments. The company was founded by Phillip DeZwirek in 1966 and is headquartered in Addison, TX.

Related stocks

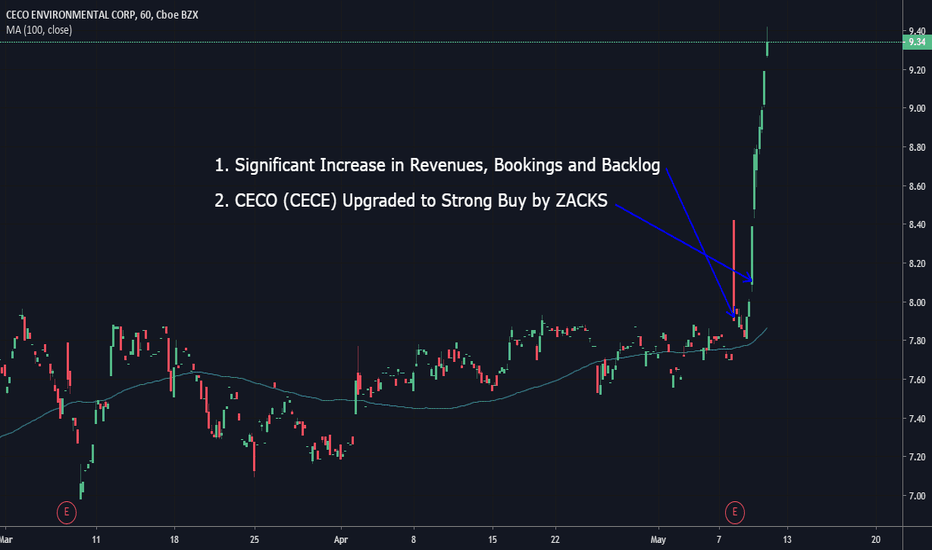

CECO Short PositionHi traders,

We are looking at a potential shorting opportunity for CECO. The stock is currently in an uptrend, but we are anticipating a correction based on bearish regular divergence observed on the weekly timeframe. Since this divergence alone doesn´t provide a strong sell signal, our strategy i

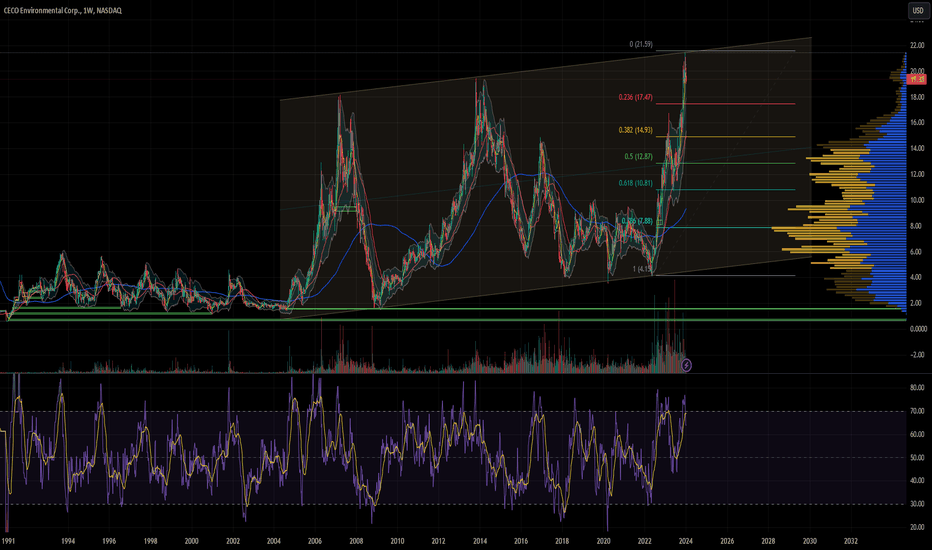

$CECE daily triangle, weekly triangle I view the daily chart as the ideal buy opportunity for the potential weekly triangle breakout. The way I'm thinking about it, am I willing to risk 5% (stop below 7.70) below the backtest of a now 4x tested trendline for a potentially massive weekly triangle breakout? To me that seems like an attrac

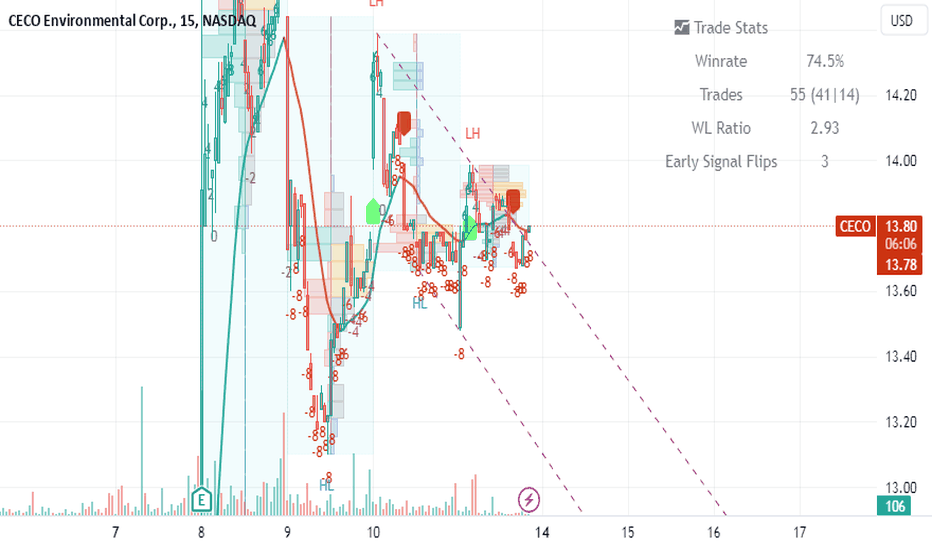

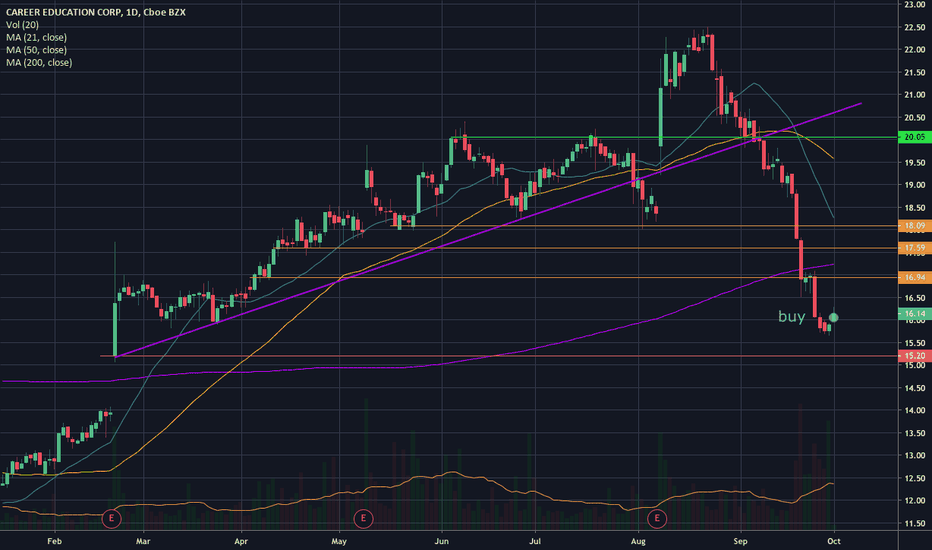

Let's get a Higher Education w/ $CECOThis stock entered my Over sold watchlist late last week and I was waiting for a little bounce back to ensure that a bottom had been represented. Opened up steaming today and again watched the 5m chart to ensure proper entrance after first dip and then bounce back.

Goals and price points are liste

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of WCE is 24.96 EUR — it has increased by 0.32% in the past 24 hours. Watch CECO ENVIRONMENTAL CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on GETTEX exchange CECO ENVIRONMENTAL CORP stocks are traded under the ticker WCE.

WCE stock has risen by 4.04% compared to the previous week, the month change is a 3.52% rise, over the last year CECO ENVIRONMENTAL CORP has showed a 8.52% increase.

We've gathered analysts' opinions on CECO ENVIRONMENTAL CORP future price: according to them, WCE price has a max estimate of 30.65 EUR and a min estimate of 28.90 EUR. Watch WCE chart and read a more detailed CECO ENVIRONMENTAL CORP stock forecast: see what analysts think of CECO ENVIRONMENTAL CORP and suggest that you do with its stocks.

WCE stock is 2.38% volatile and has beta coefficient of 1.50. Track CECO ENVIRONMENTAL CORP stock price on the chart and check out the list of the most volatile stocks — is CECO ENVIRONMENTAL CORP there?

Today CECO ENVIRONMENTAL CORP has the market capitalization of 872.28 M, it has increased by 6.26% over the last week.

Yes, you can track CECO ENVIRONMENTAL CORP financials in yearly and quarterly reports right on TradingView.

CECO ENVIRONMENTAL CORP is going to release the next earnings report on Aug 12, 2025. Keep track of upcoming events with our Earnings Calendar.

WCE earnings for the last quarter are 0.09 EUR per share, whereas the estimation was 0.08 EUR resulting in a 18.41% surprise. The estimated earnings for the next quarter are 0.15 EUR per share. See more details about CECO ENVIRONMENTAL CORP earnings.

CECO ENVIRONMENTAL CORP revenue for the last quarter amounts to 163.33 M EUR, despite the estimated figure of 140.07 M EUR. In the next quarter, revenue is expected to reach 155.10 M EUR.

WCE net income for the last quarter is 33.26 M EUR, while the quarter before that showed 4.71 M EUR of net income which accounts for 605.88% change. Track more CECO ENVIRONMENTAL CORP financial stats to get the full picture.

No, WCE doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jun 23, 2025, the company has 1.6 K employees. See our rating of the largest employees — is CECO ENVIRONMENTAL CORP on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. CECO ENVIRONMENTAL CORP EBITDA is 50.21 M EUR, and current EBITDA margin is 9.84%. See more stats in CECO ENVIRONMENTAL CORP financial statements.

Like other stocks, WCE shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade CECO ENVIRONMENTAL CORP stock right from TradingView charts — choose your broker and connect to your account.

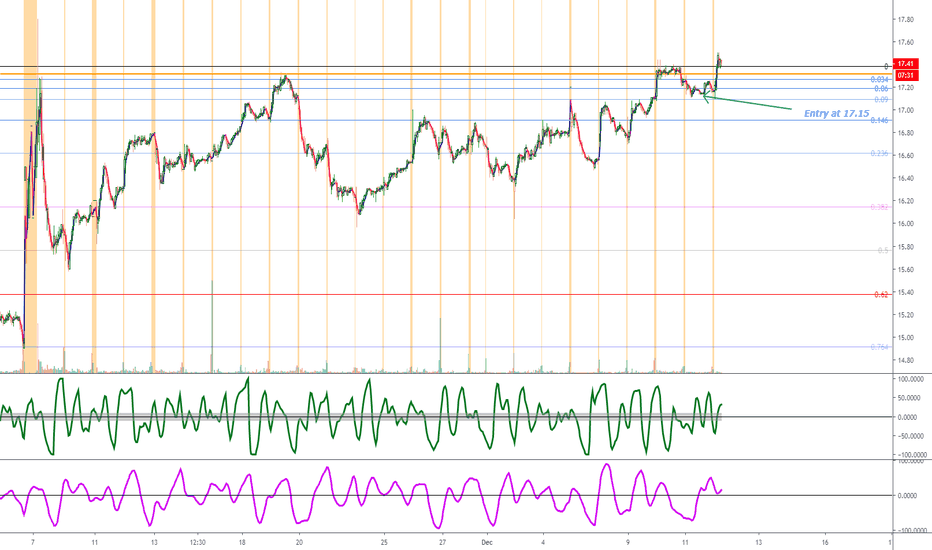

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So CECO ENVIRONMENTAL CORP technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating CECO ENVIRONMENTAL CORP stock shows the buy signal. See more of CECO ENVIRONMENTAL CORP technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.