Key stats

About WISDOMTREE FOREIGN EXCHANGE LIMITED

Home page

Inception date

Feb 17, 2010

Structure

Secured Note

Replication method

Synthetic

Primary advisor

WisdomTree Management Jersey Ltd.

ISIN

JE00B3MQG751

WisdomTree Long SEK Short EUR is designed to enable investors to gain exposure to Swedish Krona (SEK) relative to Euro (EUR) by tracking the MSFX Long Swedish Krona/Euro Index (TR) (the Index), which aims to reflect the performance of a position in forward contracts which are rolled on a daily basis

Related funds

Classification

Symbol

Geography

Sweden

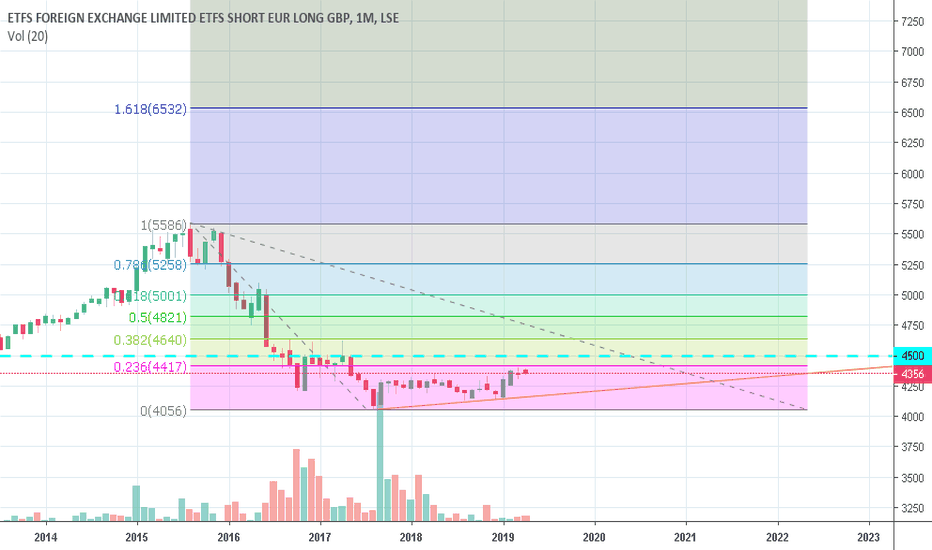

Leveraged Decay: how to calculate itBrexit and currency hedging has thrown up the need for products such as SUP3 however there is danger in holding such leveraged products as SUP3 (3X Long GBP Short EUR). As path dependency of the currency picks up in volatility the arithmetic mean drifts below the geometrical mean.

This is most easi

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

XBJD assets under management is 4.37 M EUR. AUM is an important metric as it reflects the fund's size and can serve as a gauge of how successful the fund is in attracting investors, which, in its turn, can influence decision-making.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

XBJD expense ratio is 0.39%. It's an important metric for helping traders understand the fund's operating costs relative to assets and how expensive it would be to hold the fund.

No, XBJD isn't leveraged, meaning it doesn't use borrowings or financial derivatives to magnify the performance of the underlying assets or index it follows.

No, XBJD doesn't pay dividends to its holders.

XBJD shares are issued by WisdomTree, Inc.

XBJD follows the MSFX Long Swedish Krona/Euro Index - EUR. ETFs usually track some benchmark seeking to replicate its performance and guide asset selection and objectives.

The fund started trading on Feb 17, 2010.

The fund's management style is passive, meaning it's aiming to replicate the performance of the underlying index by holding assets in the same proportions as the index. The goal is to match the index's returns.