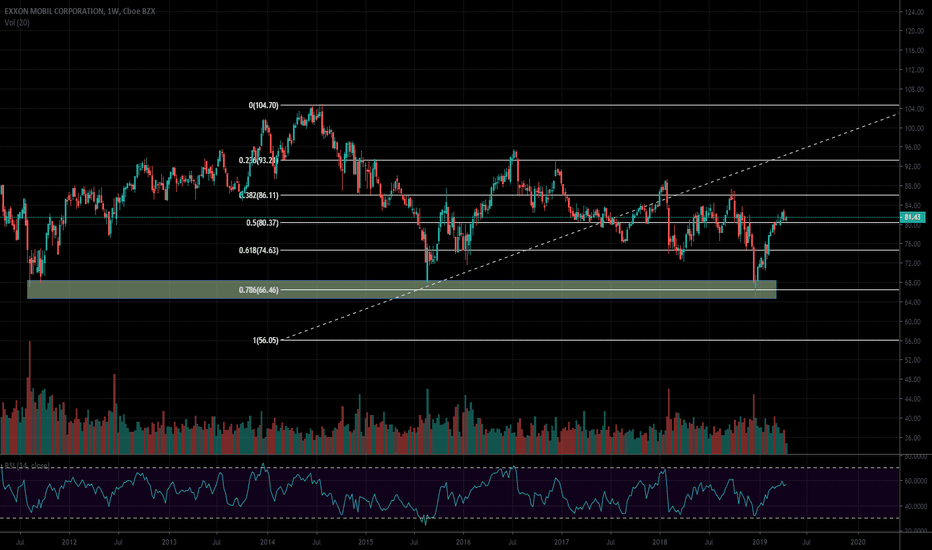

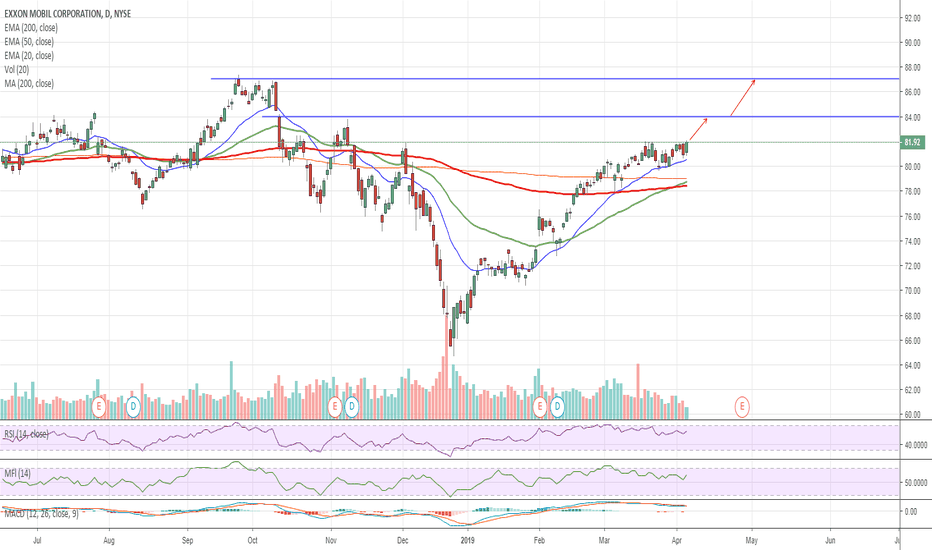

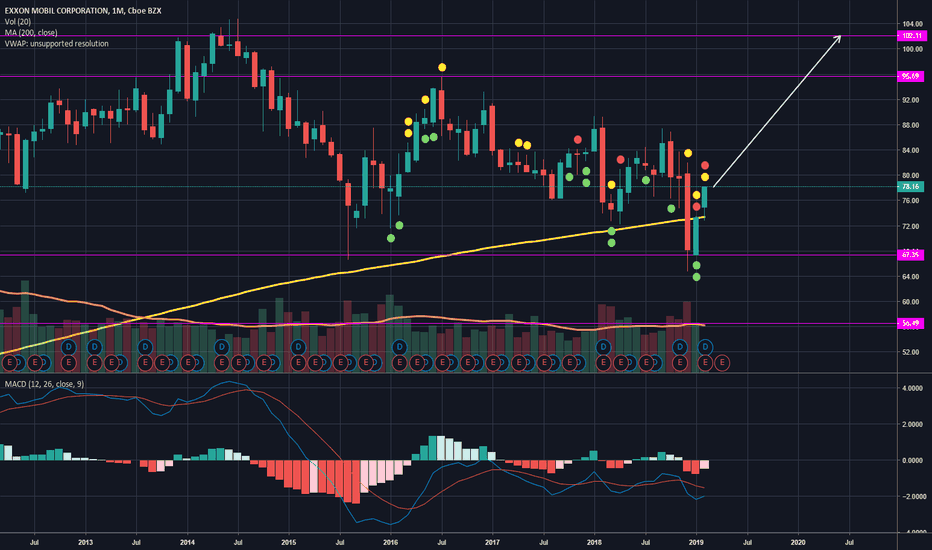

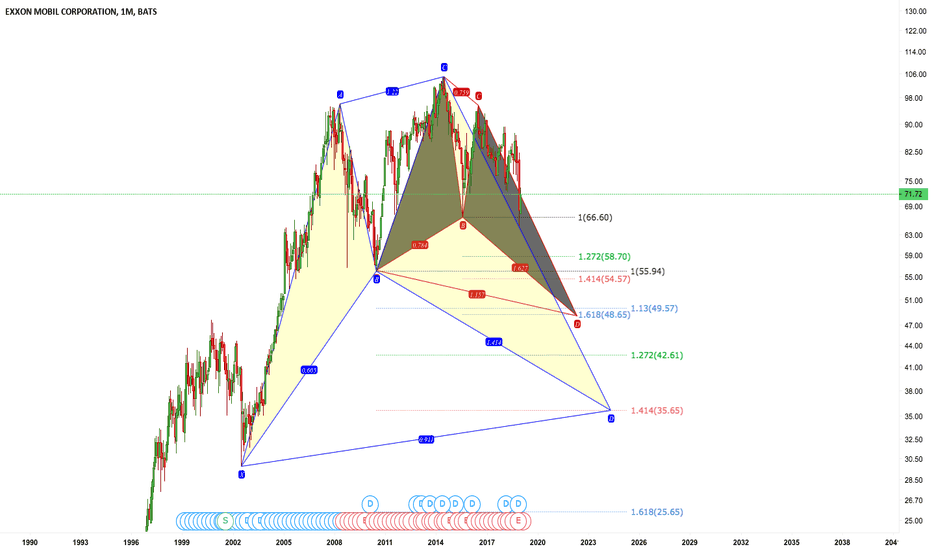

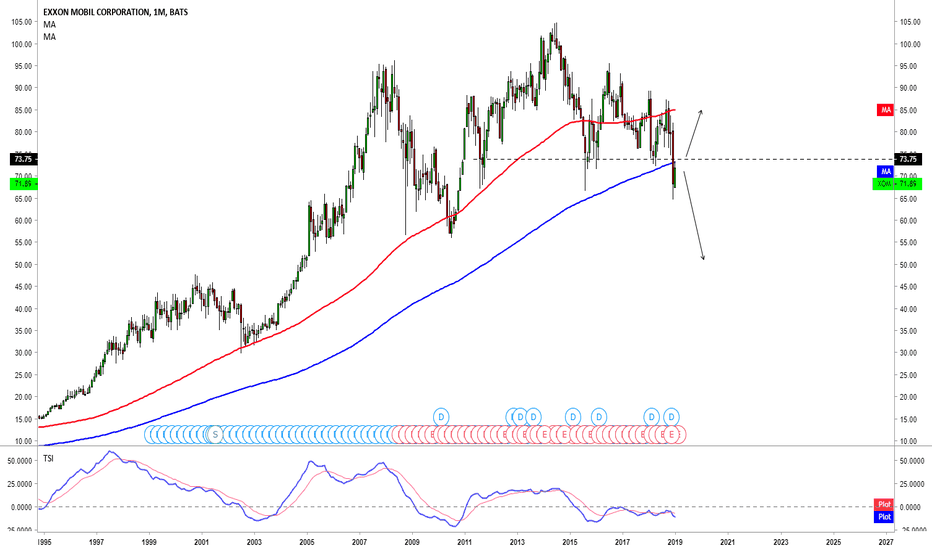

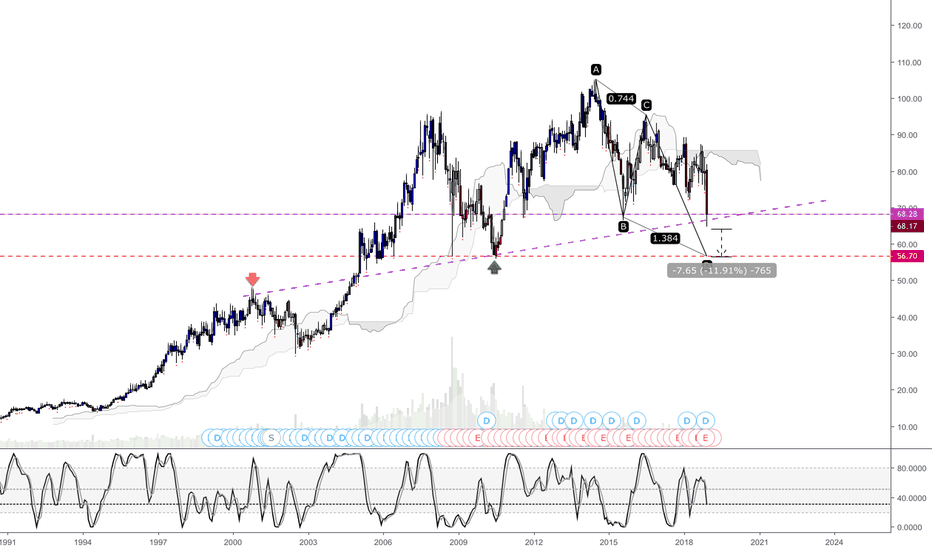

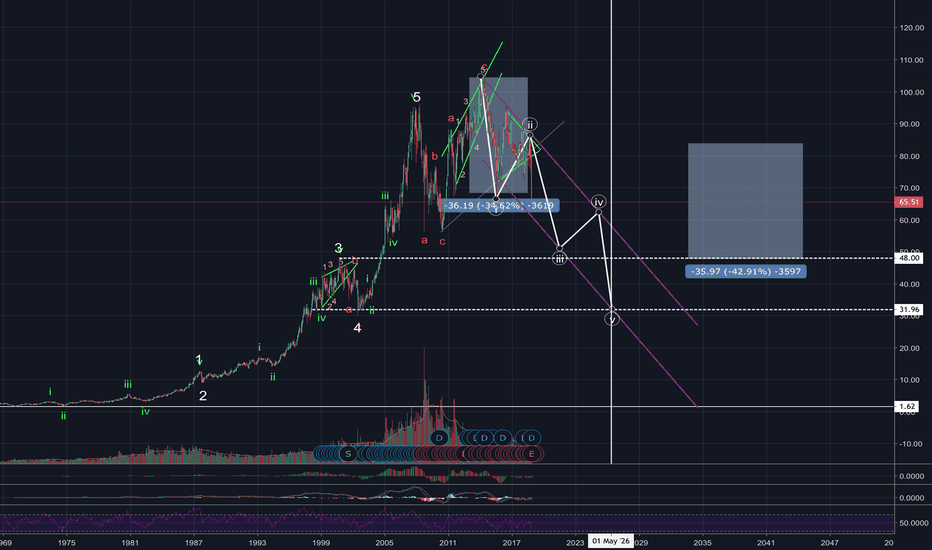

EXXON to continue a strong 20191. Exxon Mobil recently bounced back from a 30 year low - indicating we have seen the bottom so the stock is relatively cheap compared to its all time high.

2. Exxon Mobil plan to push hard in the U.S. onshore market. With a goal of 55 rigs from 48 by the end of 2019 - this is a very large number especially as smaller drillers are actually reducing their number of rigs.

3. For over 30 years Exxon Mobil has delivered annual boosts to it quarterly payout (last year's was a 6.5% rise) and with production recovering, there is a good chance the payout could keep increasing.

Like our ideas? Check out our site at: insidebitcoins.com

XONA trade ideas

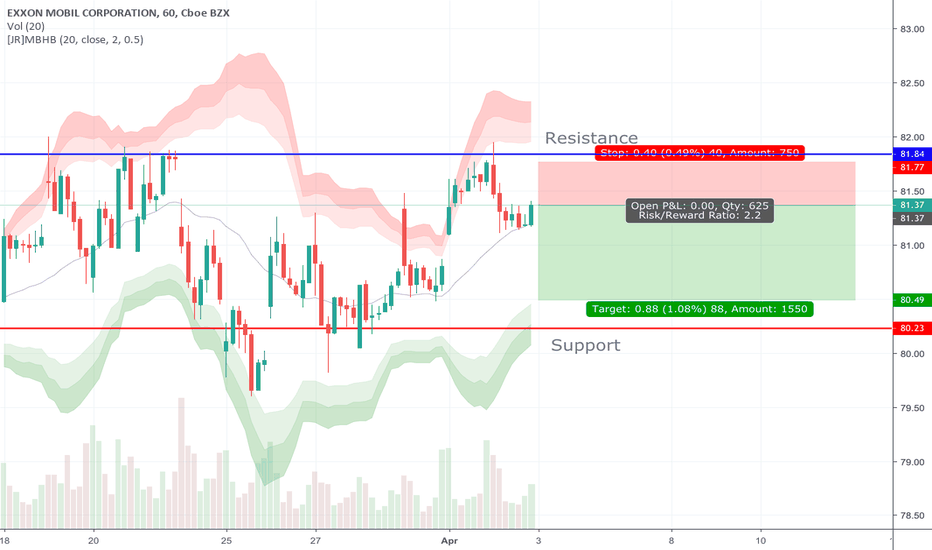

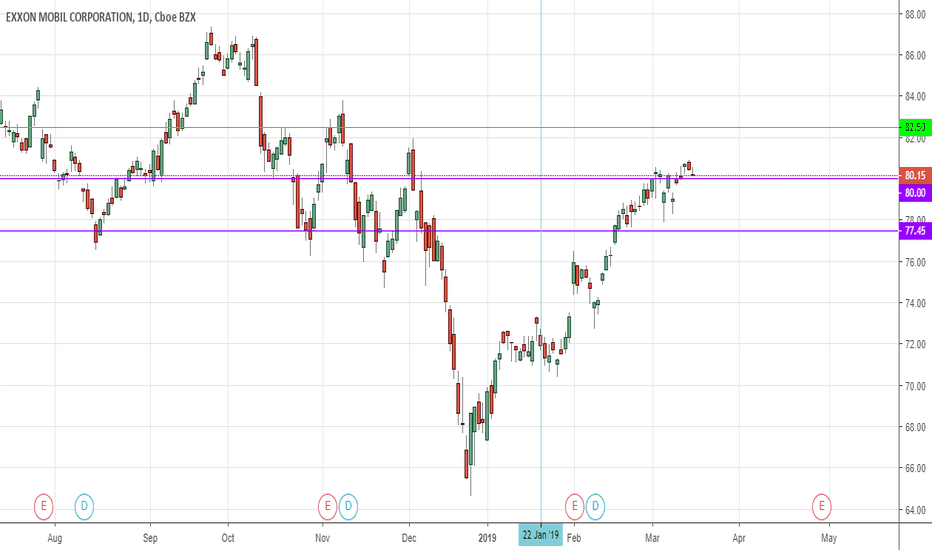

Dividend Capture Strategy for easy cash flowDividend Capture strategy for easy cash flow on XOM

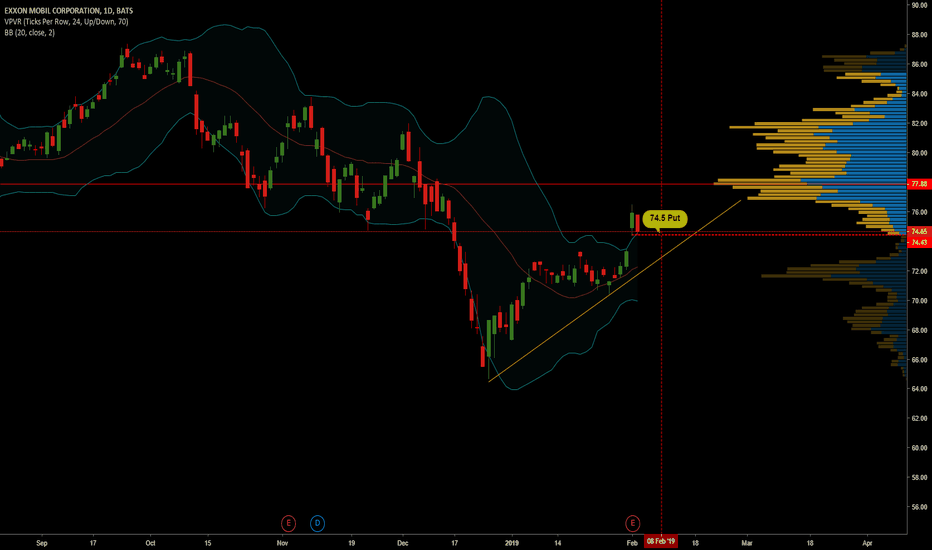

Exxon Mobil pays .82 per share quarterly and the ex-dividend date is this Friday (2/8/2019) the dividend pay date is on 3/11/19. So yearly Will get $3.28 (.82x4)for a dividend yield of 4.4% not bad.

But by selling the ATM Put for $1.02 I will increase the premium plus dividend paid for the year to $4.30 and increase the yield to 5.77%. That alone is an improvement of 31%.

If I don't get assigned I get to keep the premium and make over $500 in a couple of days and if I do get assigned then I will sell some calls to keep reducing my basis and improve my yield even more.

The Trade: XOM

Sold 5 ATM Puts @ 74.5 for $1.02

4 days to expiration

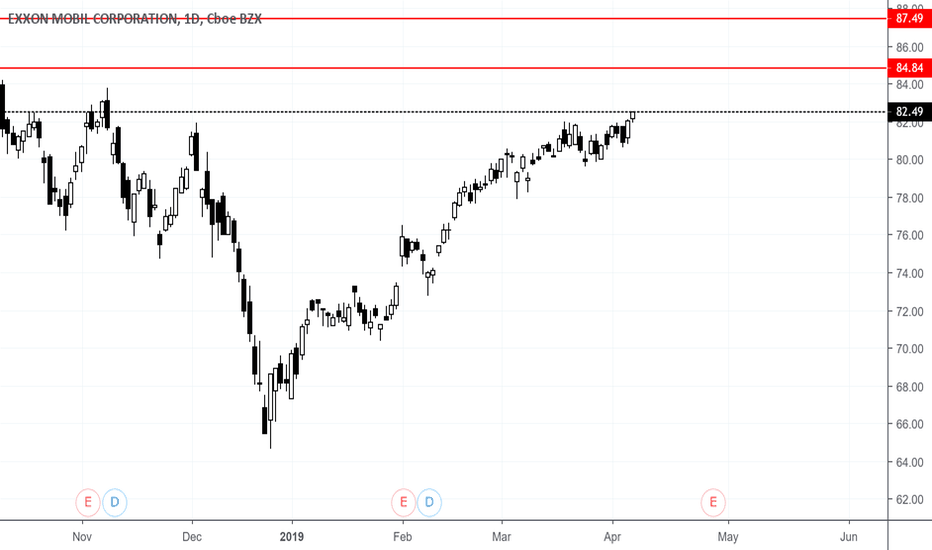

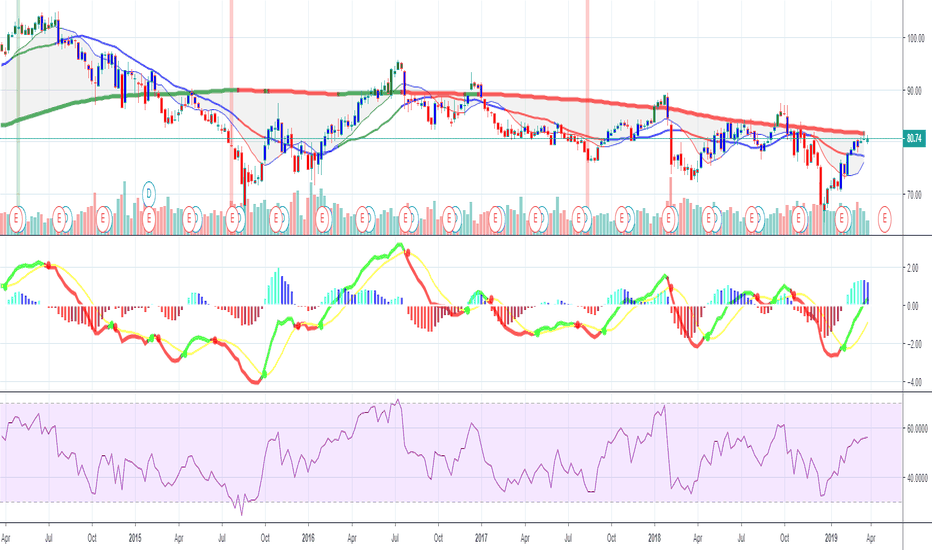

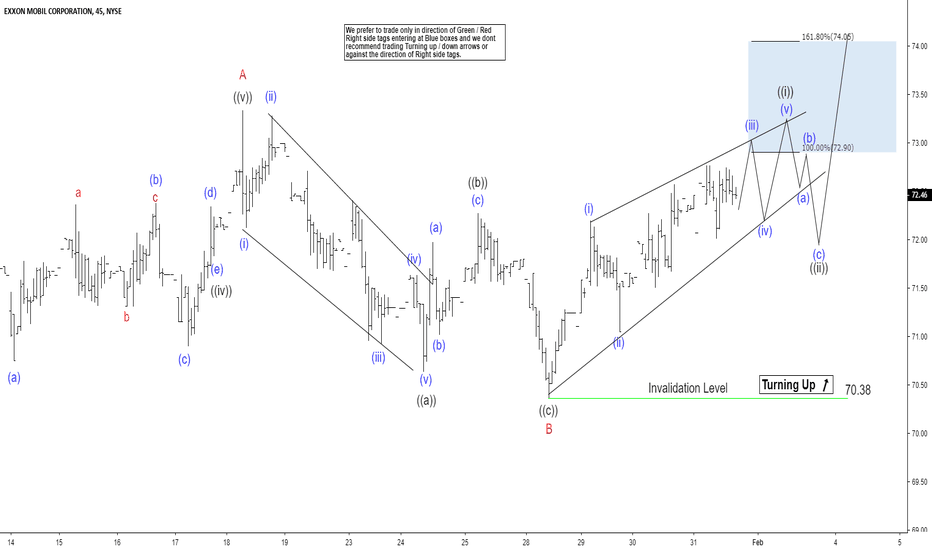

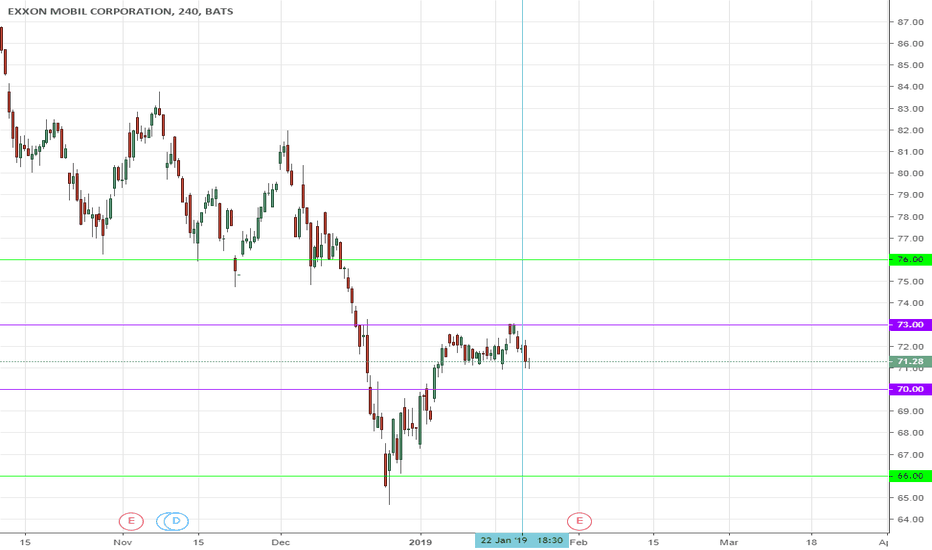

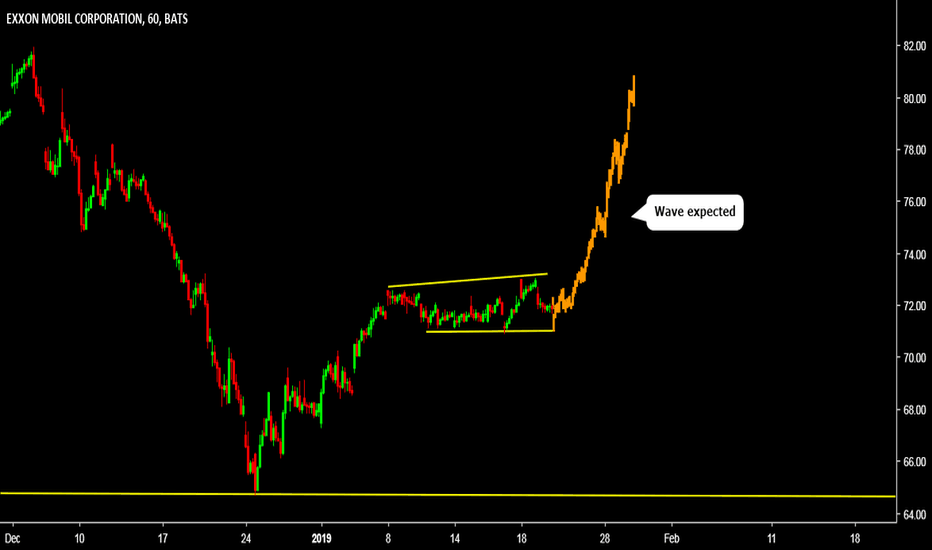

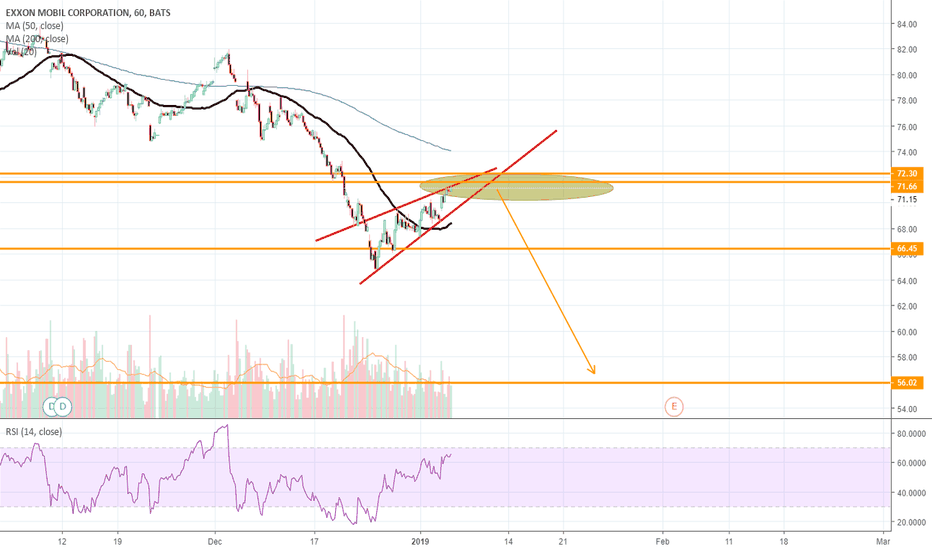

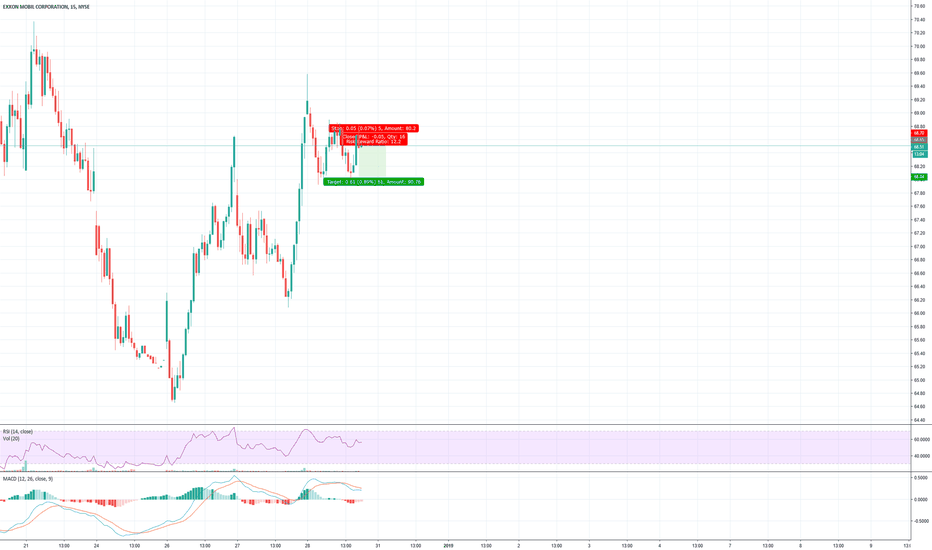

Elliott Wave View Expects Exxon Mobil To RallyElliott Wave view in Exxon Mobil (ticker: XOM) suggests that the rally from December 26, 2018 low ($64.65) is unfolding as Elliott Wave zigzag. The first leg of the zigzag ended at $73.33 on January 18, 2019 high as wave A. A zigzag is a 5-3-5 structure and wave A should unfold in 5 waves in impulse or diagonal. We can see in the chart below that wave ((iii)) of A ended at $73, wave ((iv)) of A ended at $71.95, and wave ((v)) of A ended at $73.33.

The stock then pullback in wave B with the internal as a zigzag Elliott Wave structure as well. Down from $73.33, wave ((a)) ended at $70.64, wave ((b)) ended at $72.27, and wave ((c)) ended at $70.37. Wave C rally has started and the stock is expected to break above wave A at $73 and could see as high as $79 when wave A = C. To gain confirmation for this view, the stock still needs to break above $73. Otherwise, technically we still can’t rule out a double correction in wave B. Near term, while pullback stays above $73.33, expect Exxon Mobil to extend higher.

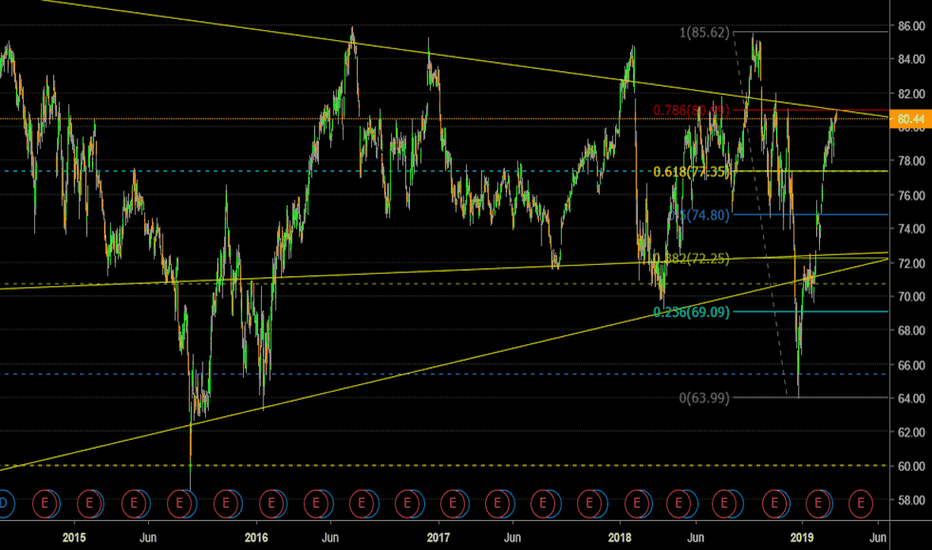

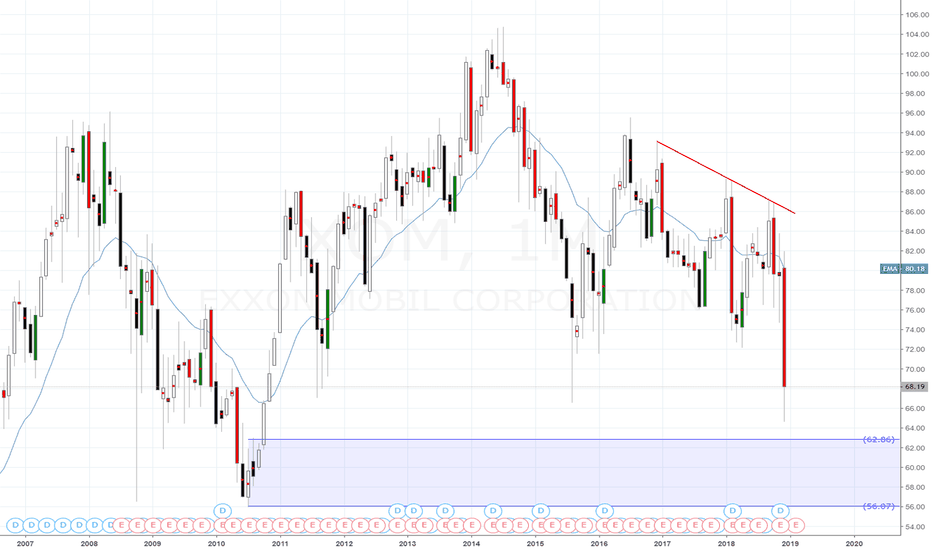

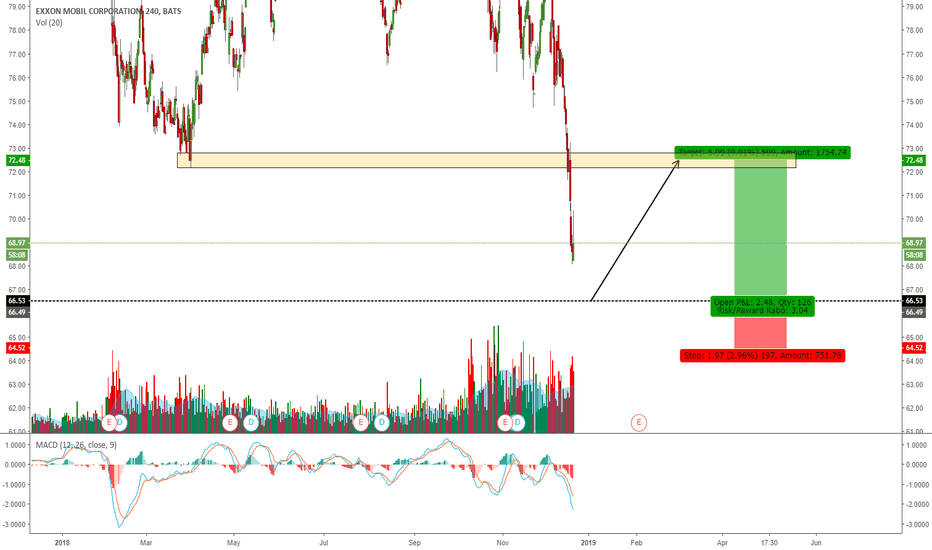

EXXON MOBIL Buy IdeaEXXON MOBIL Buy Idea @ Monthly Demand Zone (62.86 - 55.77)

Buy Limit: 63.10

Stop Loss: 55.77

Take Profit: 79.47

Risk Management = 0.01/$100

Recommended Leverage not to exceed 1:50

Recommended Risk Ratio 1:2 – 1:3

Close partially the contract once it reaches 50% of profit, Move stop loss over the entry level

Close partially the contract once it reaches 80% of the profit