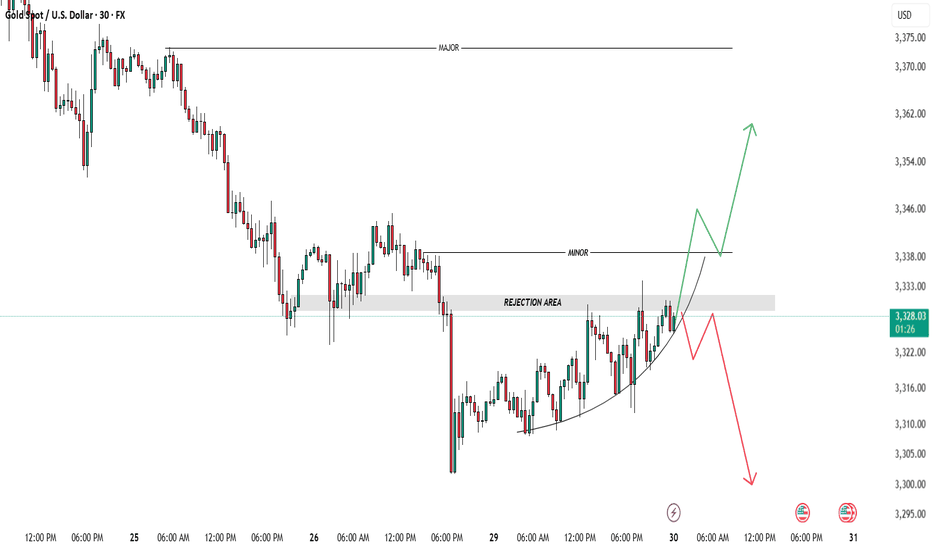

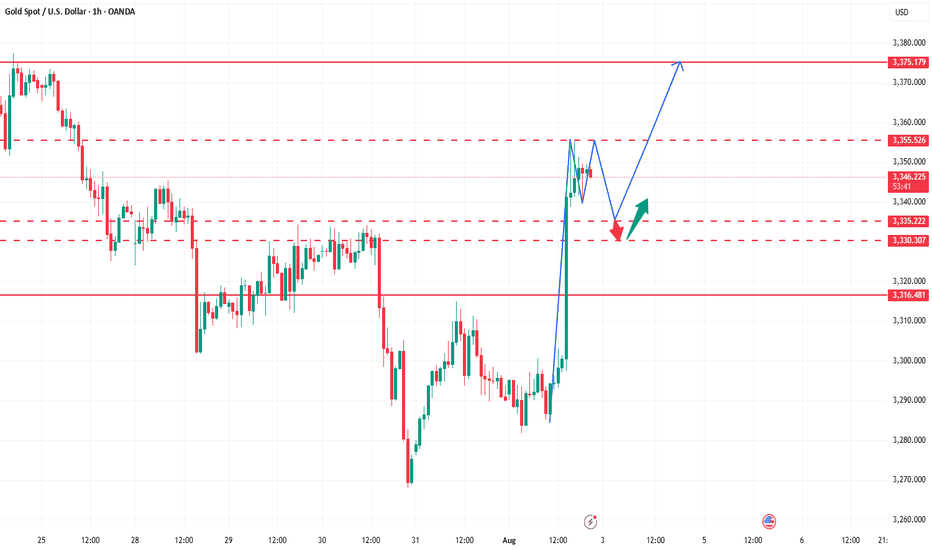

GOLD -Key Levels-Wait for Confirmation!Gold (XAUUSD) is now testing a critical Rejection Area 📍 (around 3,328–3,333), right beneath a minor CHOCH zone. This is a key decision level, and I'm just waiting for price to show its intrest – no early entries here. ⚠️

🔼 Bullish Scenario:

Price fails to hold above minor CHOCH ✅

Comes back to retest the Rejection Area as support 🧱

If we get a clean bounce + confirmation, I’ll look for buys toward 3,346 → 3,360 🎯

🔽 Bearish Scenario:

Price rejects from minor CHOCH ❌

Gives strong bearish confirmation 🔻

Then retests the Rejection Area as resistance 🚫

That’s my cue to short toward 3,310 → 3,295 📉

NOTE: possibility is that market take all liquidity from sell side. Avoid Taking any trade untill setup is clean.

Being patient here. Confirmation is everything! Let’s see🔍💡

Avoid Mid-Zone Entries!

GOLD trade ideas

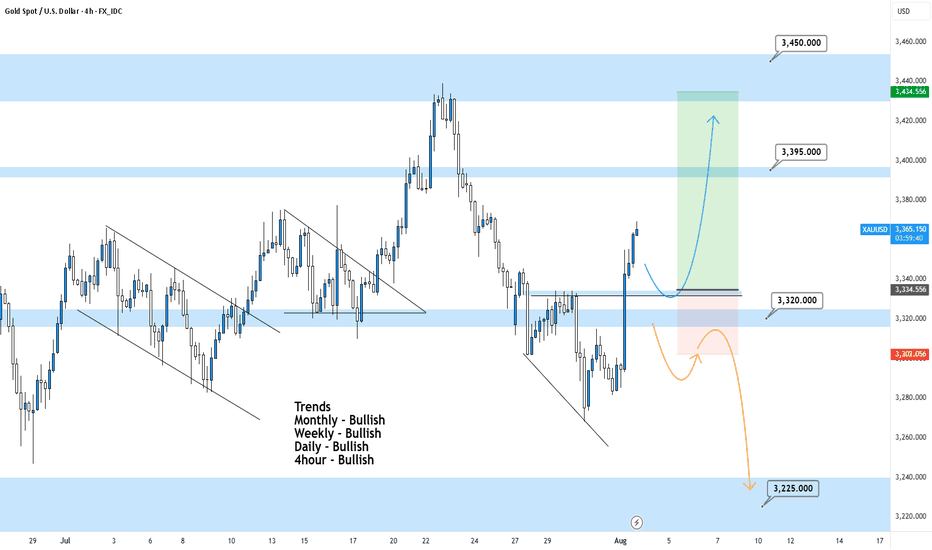

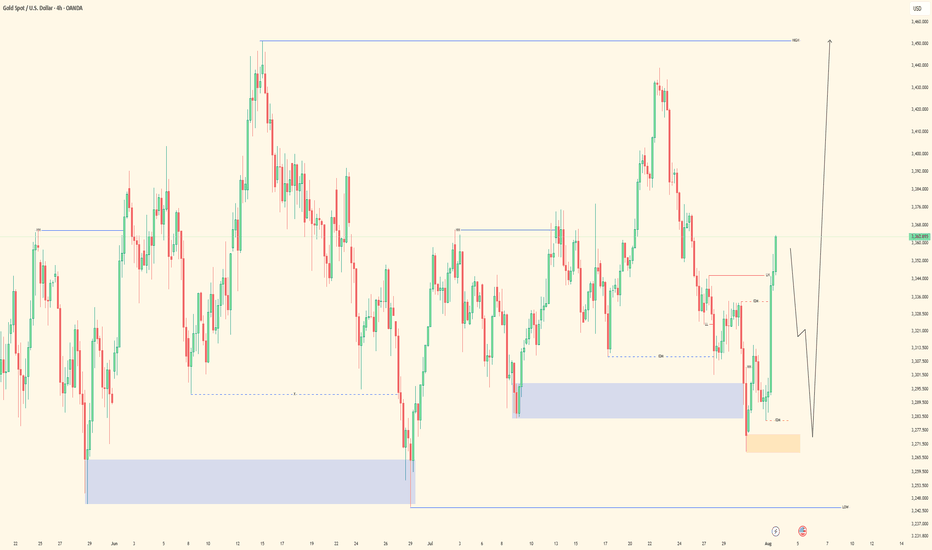

XAUUSD 4Hour TF - August 3rd,2025🟦 XAUUSD 4H Analysis Long Idea

📅 August 3rd, 2025

🔹 Top-Down Trend Bias:

• Monthly – Bullish

• Weekly – Bullish

• Daily – Bullish

• 4H – Bullish

Price has broken out of a consolidation, confirming short term bullish momentum in alignment with the higher timeframes. We’re now watching how price reacts on a potential retest of the key $3,320 structure.

🔍 Key Level: $3,320

This former resistance now acts as a critical support zone. How price reacts here will determine short-term direction.

✅ Scenario A: Bullish Continuation

Clean retest of $3,320–$3,335

1.Look for bullish confirmation: wick rejections, bullish engulfing, or lower timeframe structure shift

Target 1: $3,395

Target 2: $3,450

This setup aligns with the overall bullish bias. We have ideal R:R with a clear invalidation to exit on if $3,320 fails as support.

⚠️ Scenario B: Bearish Rejection

1.Failure to hold $3,320 = potential trap breakout

2.Look for structure below $3,320 + bearish conviction

Target: $3,225 support zone

Only valid if $3,320 flips to resistance and confirms structure shift.

🧠 Final Notes

• Let price confirm the setup

• Structure > emotion

• Both scenarios are valid, but only with confirmation

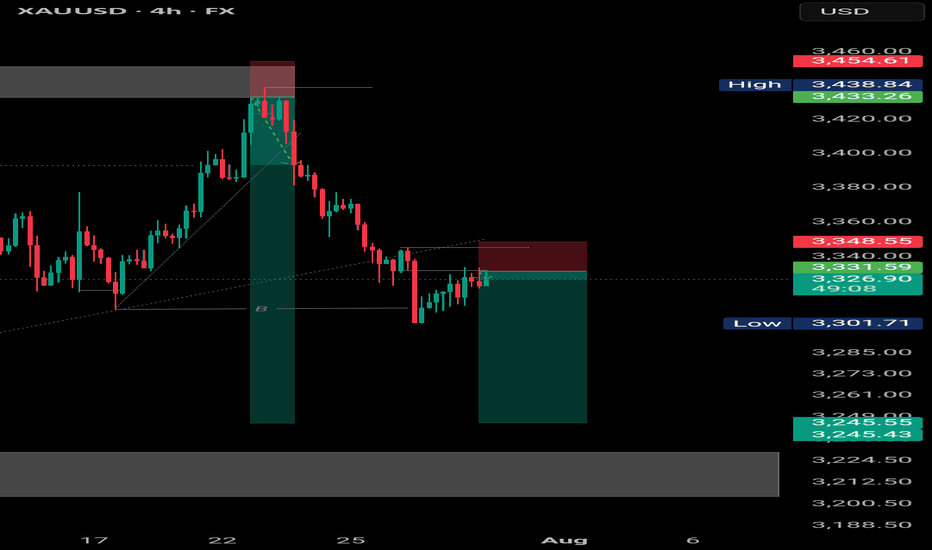

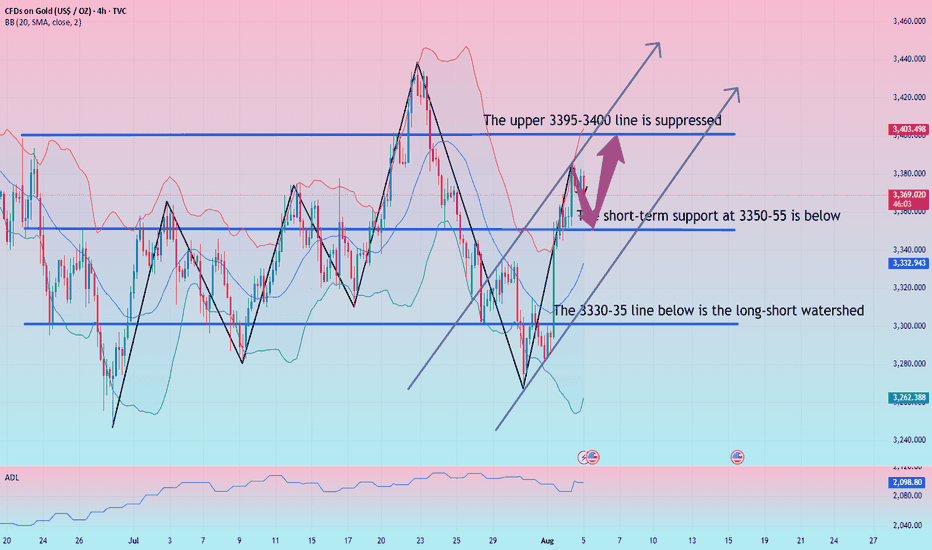

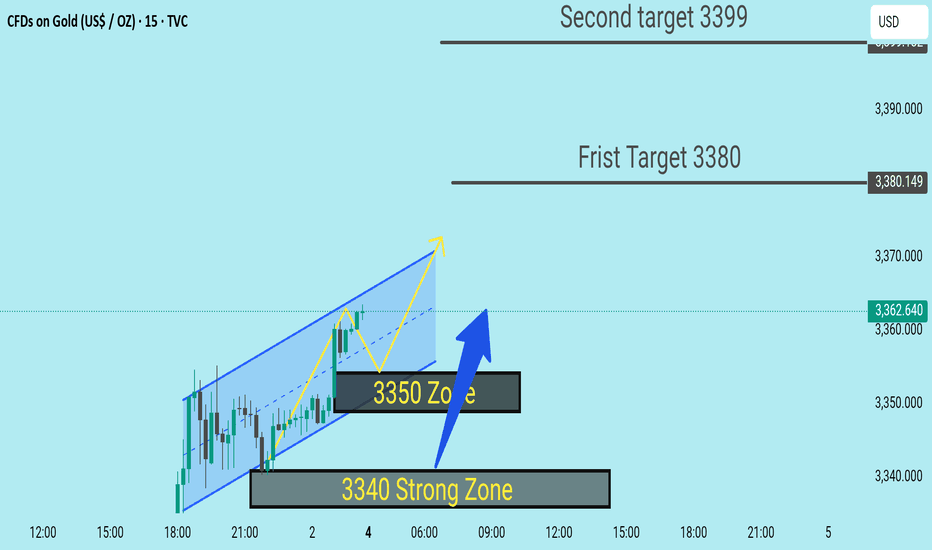

Gold bulls are under pressure to adjust and continue to increase

Gold prices continued their strong upward trend yesterday amidst volatile trading. Gold prices strengthened strongly around the 3345 level during the Asian and European sessions, rising through 3370 in the European session and continuing their upward trend. Gold then retreated and tested the 3361 level before stabilizing and accelerating higher through 3380 before closing strongly. The daily K-line closed with a volatile breakout above the highs, forming a pattern of consecutive rising highs. Gold prices continue to strengthen in the short term, reaching as high as 3385 but failing to hold, indicating significant upward pressure. A break above 3400 would likely target 3430; otherwise, a deeper correction could be in the offing. Technically, adjustments are needed, so excessive buying into the rally is advised. If your current trading is not ideal, I hope I can help you avoid investment setbacks. Welcome to discuss your options.

Based on the 4-hour chart, support is currently focused on the 3350-55 area. Rebounds to this level will maintain a bullish trend. The short-term bullish trend line is focused on the 3330-35 area. If the daily chart stabilizes above this level, continue to buy on dips and follow the trend. I will provide detailed trading strategies during the trading session, so please stay tuned.

Gold Trading Strategies:

1. Short gold on a rebound to the 3385-90 area, then cover your short position at the 3395-3400 area. Target: 3345-50, stop loss: 3405.

2. Go long on a pullback to the 3350-55 area, stop loss: 3323, target: 3390-3395. Hold if it breaks through.

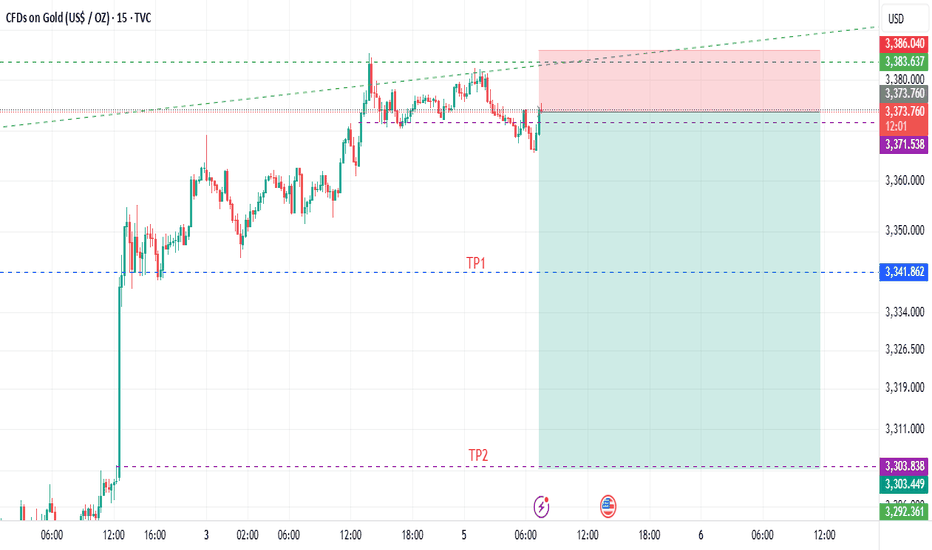

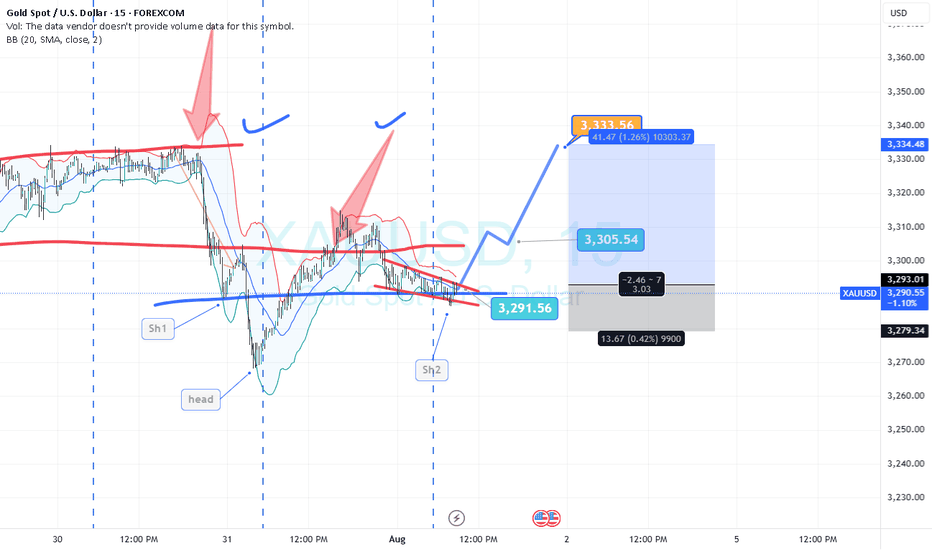

GOLD 15M BEAR ARE TAKING OVER (IM FULLY SELL THIS WEEK)Gold look like BEARS are back in control, i have take this 15m trade for 2 TARGET SHOWN ON THE CHART (WITH DXY LOOKING VERY BULLISH IN THIS COMING WEEKS, GOLD WILL CORRECT TO DOWNSIDE HARD)

All the best enjoy the sunny LONDON if anyone from there :)

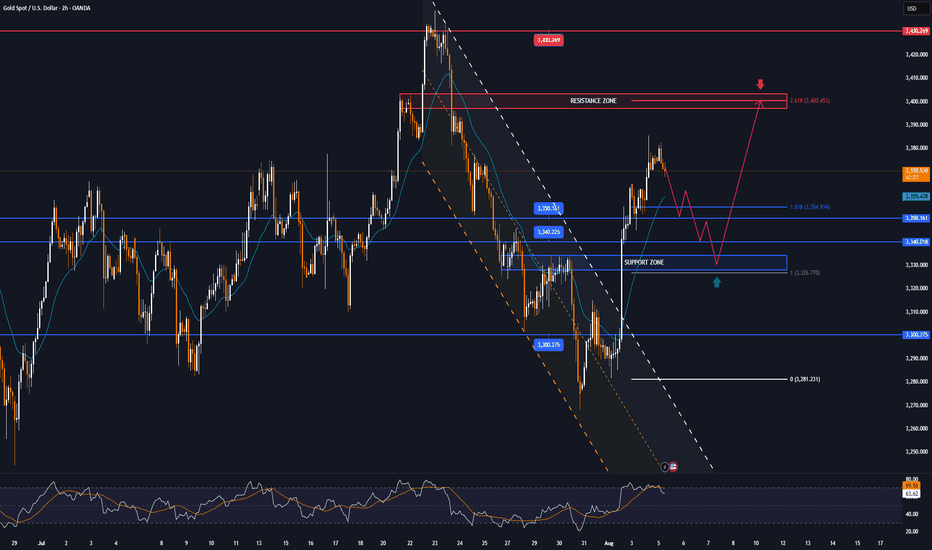

GOLD | Bullish Mitigation + Inducement Lining Up For Execution(Refined & Structured):

• Pair: XAUUSD (Gold)

• Bias: Bullish

• 4H Overview: Gold broke last week’s previous high, then pulled back and mitigated this week’s order block within the same range. A significant internal high (turnover HH) has now been broken, and price retraced to sweep liquidity and tap into the OB zone.

• 30M Structure: Now watching for a clean pullback into a refined OB after taking out sell-side liquidity/inducement. Structure is aligning perfectly for the next leg up.

• Entry Zone: Once price enters the OB zone, I’ll be watching the 5M for church-level confirmation. Execution follows once LTF speaks clearly.

• Targets: 5M to 30M structural highs depending on delivery.

• Mindset Note: I’m not rushing. Just following structure and reading price. Analysis mode right now—execution comes once price gives the sermon.

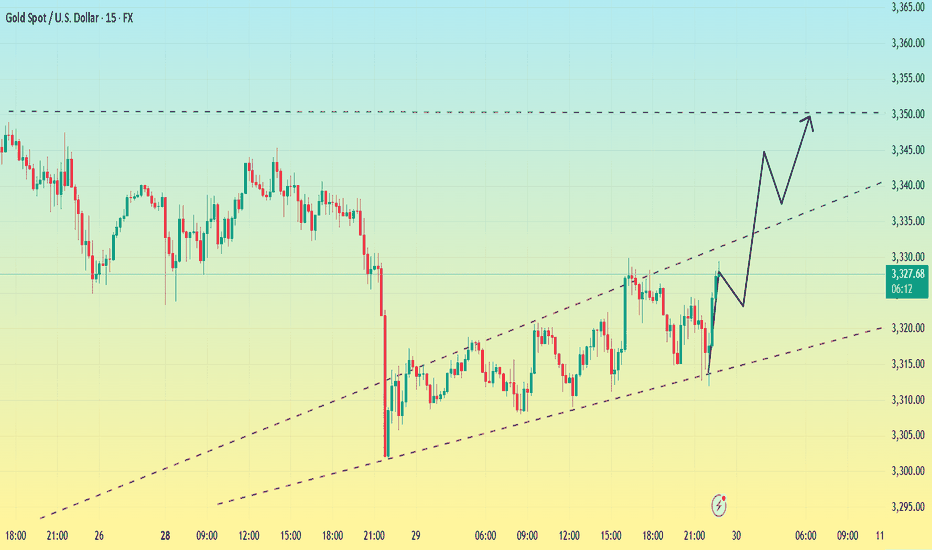

XAUUSD Expecting bullish Movement Price respected the Strong Demand Zones at 3350 & 3340, showing clear signs of buyer strength. After forming a falling wedge pattern, a bullish breakout was observed — confirming potential upside momentum.

Zone Analysis

3350 Zone: Minor support confirmed with consolidation

3340 Zone: Stronger support with buying pressure visible

Current Price: 3362

First Target: 3380

Second Target: 3399

A clean move above the wedge resistance is now playing out, and as long as price holds above 3350, bullish momentum remains valid.

Monitoring price action around 3380 for partials, and watching for clean sweep into 3399

How to seize the key turning points in the gold market?The market is ever-changing, and following the trend is the best strategy. When the trend emerges, jump in; don't buy against it, or you'll suffer. Remember not to act on impulse when trading. The market is a haven for all kinds of resistance, so don't hold onto positions. I'm sure many people have experienced this: the more you hold onto positions, the more panic you become, leading to ever-increasing losses, poor sleep, and missed opportunities. If you share these concerns, why not try following Tian Haoyang's lead and see if it can open your eyes? I'm always here for you if you need help, but how can I help you if you don't even offer a hand?

Gold did not fall below 3280 during the day on Friday and started to fluctuate in the range of 3280-3300. The non-farm payroll data was bullish, and it directly broke through the pressure of 3315, and then broke through the important pressure of 3335 again. As of now, it has reached a high near 3355. The non-farm payroll data market has almost been exhausted. Next, we will focus on the technical form adjustment. At present, you can consider light shorting in the area near 3355-3370. After all, chasing long is risky, and the technical side needs to be adjusted. If your current operation is not ideal, I hope I can help you avoid detours in your investment. Welcome to communicate with me.

Based on the 4-hour chart, short-term resistance is near 3355-3365, with a focus on the key resistance level of 3370-3375. Short-term buy orders should be taken if a rebound continues. I'll provide detailed trading strategies at the bottom of the page, so stay tuned.

Gold operation strategy: Short gold in batches when gold rebounds to 3355-3370, with the target being the area around 3340-3335. Continue to hold if it breaks through.

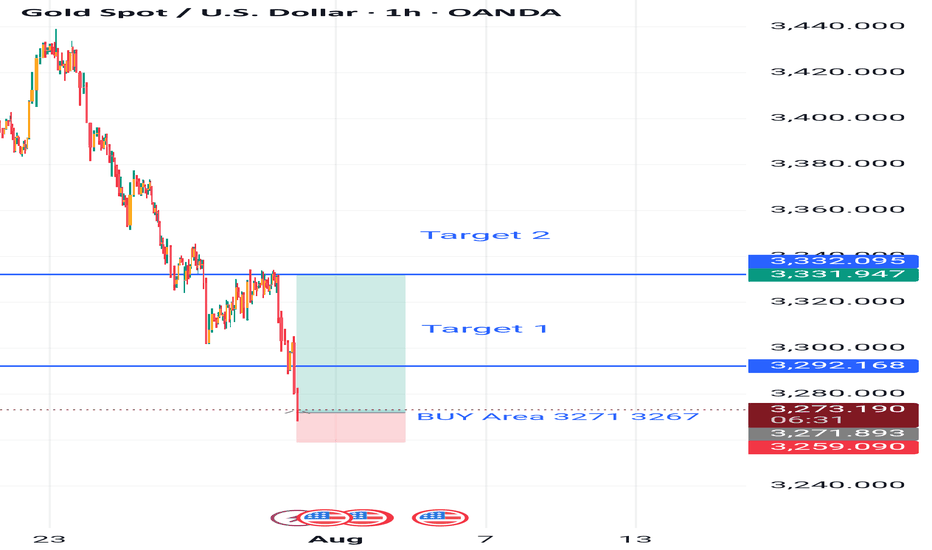

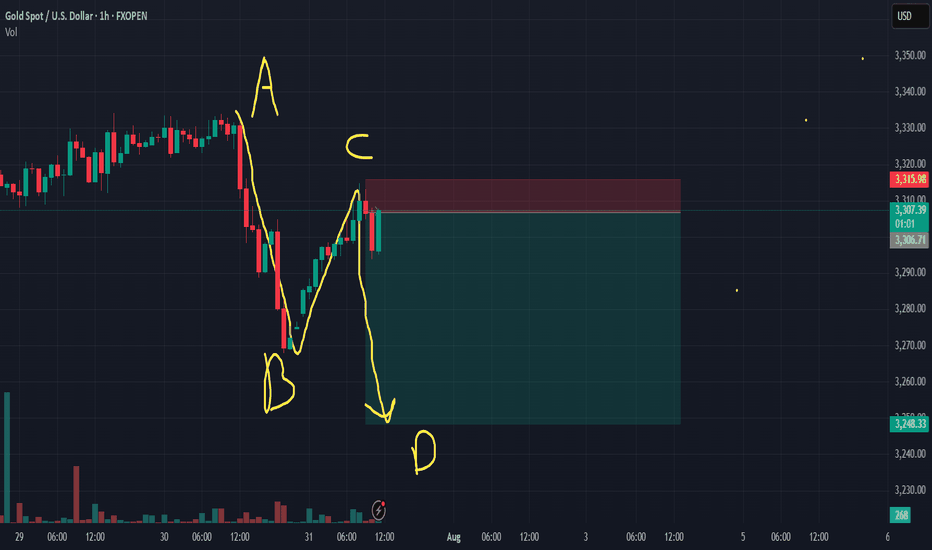

Bottoming out? Be wary of the market.After a sharp drop to around 3300 on Monday, gold rebounded, reaching a high of around 3330 so far.

From the 1-hour chart,Gold has now broken out and stabilized within the hourly chart's downward trend channel. The key upward level is currently around 3330. If it breaks above 3330 again, caution is advised; it may test 3345-3350. Conversely, if it fails to break above 3330, gold may consolidate between 3300-3330 before the non-farm payrolls release.

From a short-term 15-minute perspective, the current 15-minute range has been broken out and stabilized. The current situation is unfavorable for bears. Based on the trend, a breakout above the 15-minute range would indicate a rebound. However, until 3330 holds, the 3320-3330 range is the only option. However, the current trend favors a bullish pullback, so I'm not too keen on shorting. Therefore, focus on support at 3320.

If it fails to break below 3320, enter a long position near 3320. The upper target is the top of the 3345-3350 range.

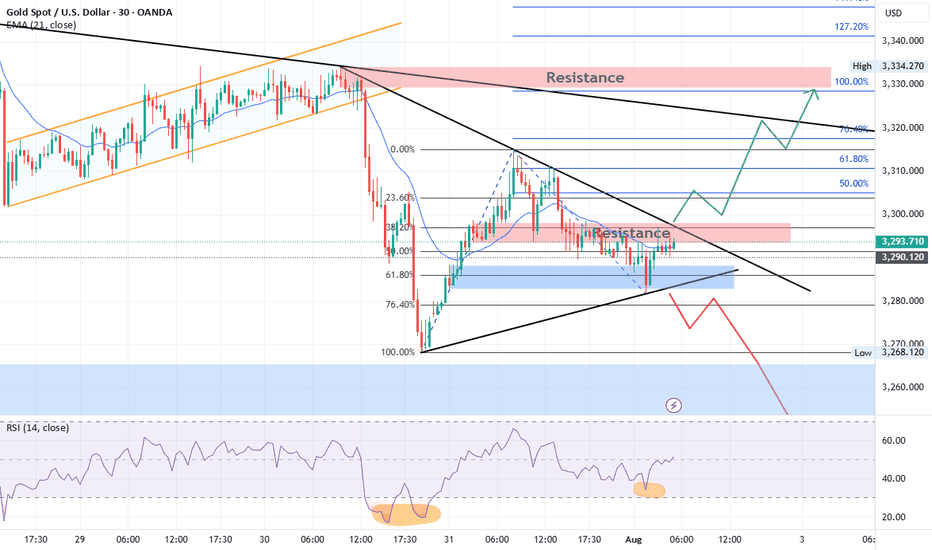

Gold Technical Outlook

Gold is currently consolidating inside a triangle pattern. After a recent bullish rally, price retraced between the 61.8% – 76.4% Fibonacci levels, finding support and bouncing upward. At present, gold is facing resistance at both the falling trendline and the 3298–3300 zone.

Bullish Scenario:

A breakout above the resistance trendline and the 3298–3300 zone could trigger a strong bullish move toward 3311, 3322, and 3333. A sustained break above 3333 would confirm a short-term bullish trend, opening the way for higher targets at 3360 and 3400.

Bearish Scenario:

If price faces rejection from the 3300 resistance and the falling trendline, gold is expected to move lower, retesting 3270. A decisive break below 3270 may extend the decline toward 3250. If 3250 is broken, gold could enter strong bearish momentum, potentially shifting the long-term trend to the downside with targets at 3000 and 2850.

OANDA:XAUUSD Gold Technical Outlook

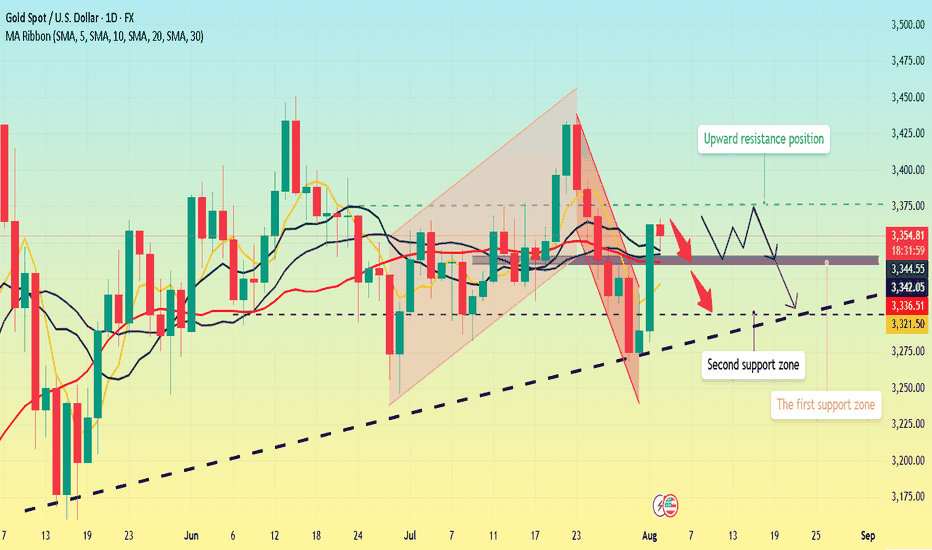

Gold prices are fluctuating. Is a correction coming?Gold surged last Friday, directly breaking through multiple moving average resistance levels. This trend is quite strong. Currently, the 5-day moving average has turned upward, indicating short-term upward momentum; however, the 10-day moving average remains slightly downward, indicating some divergence in the short- and medium-term trends. The 20- and 30-day moving averages have flattened. Overall, the short-term moving averages are less reliable, making it difficult to clearly predict the precise short-term trend based on them.

Since mid-May, gold has been fluctuating widely at high levels. Within this trend pattern, continued monitoring of fluctuations within this broad range is warranted. Until a major trend breakout occurs, the overall approach should be to maintain a volatile outlook and avoid prematurely declaring a unilateral trend.

The upper resistance level is around 3375, which has been repeatedly suppressed during previous price fluctuations. Focus on support in the 3340-3335 area below. This marks the low point after last Friday's sharp rise. The market has stabilized in this area and continued its upward trend. If the decline is significant, the 3300 round-number resistance level will need to be monitored.

Trading strategy:

For aggressive trading, short around 3375 with a stop-loss at 3385 and a profit range of 3345-3335.

GOLD Short From Resistance! Sell!

Hello, Traders!

GOLD surged up sharply

On Friday and is already

Retesting the horizontal

Resistance of 3377$

From where we will be

Expecting a local pullback

On Monday as Gold

Is locally overbought

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

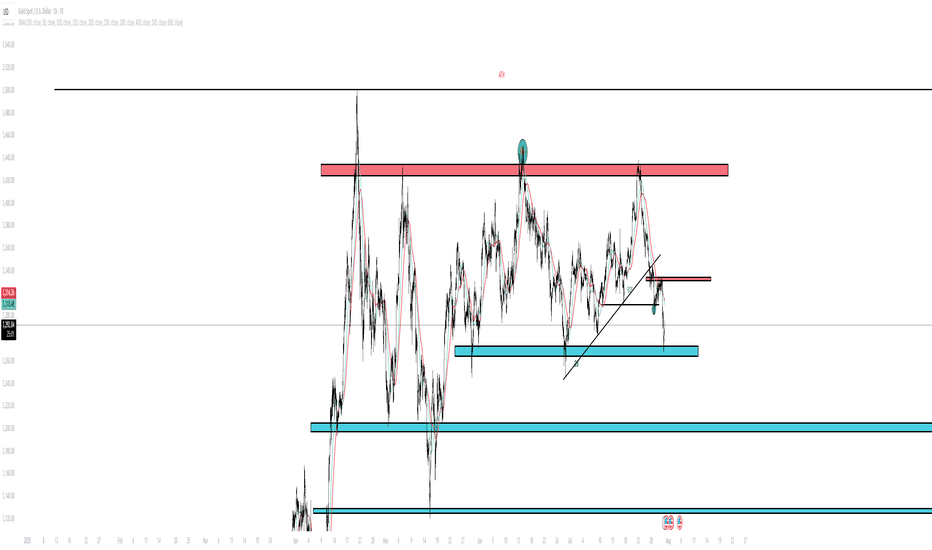

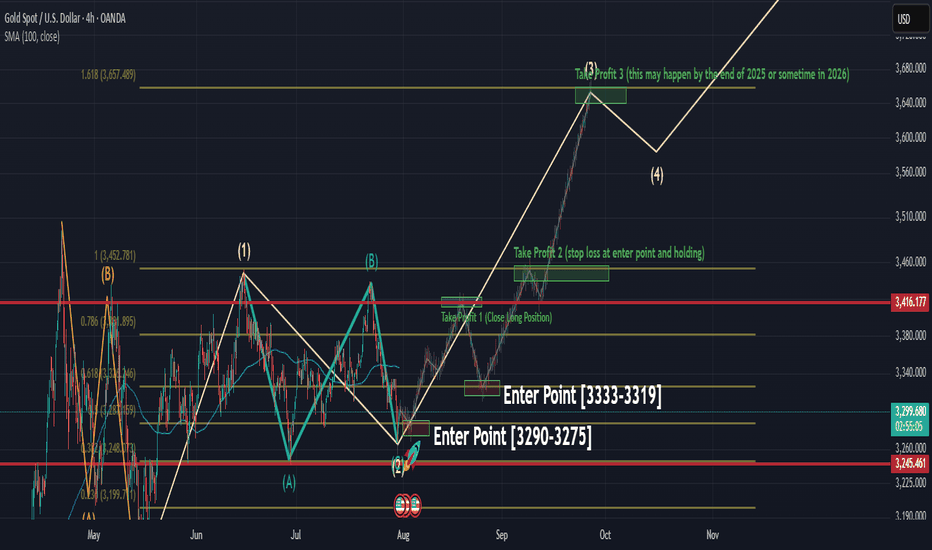

Roadmap to 3982: Key Long Entries and Profit ZonesThe initial long entry zone is between 3290 and 3275 .

From this range, an uptrend is expected to begin, targeting 3416 , which is our first exit point to close the initial long position.

After that, we wait for the next long entry , ideally around 3333 to 3319 . A new upward movement from this range is expected to reach 3455 . At this level, we continue to hold the position while placing the stop loss at the entry level to protect profits.

The next take profit target is 3650 , which may be reached by the end of 2025 or in 2026.

The final target is 3982 , which is likely to be hit in 2026, as the market may not have enough strength to reach it in 2025.

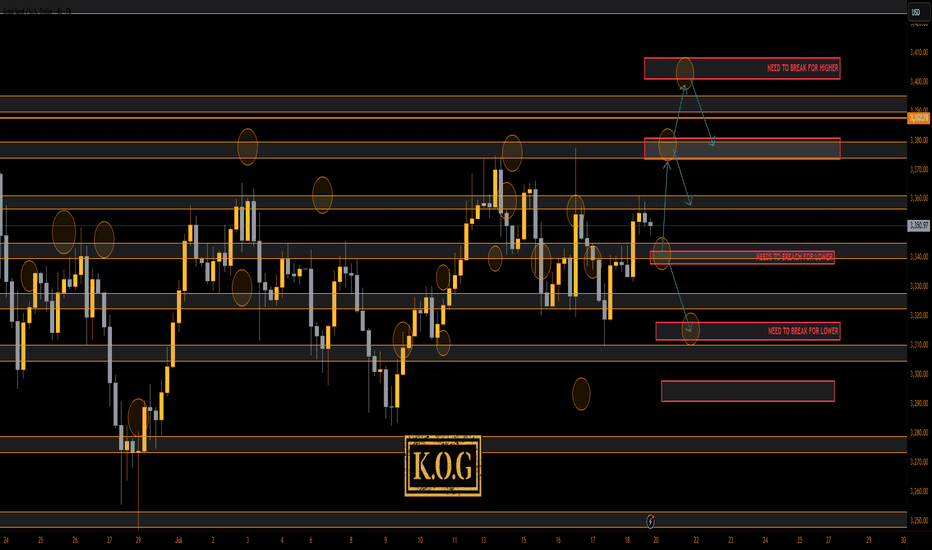

THE KOG REPORT THE KOG REPORT:

In last week’s KOG Report we said we would be looking for a price to attempt the higher level red box sitting around the 3370-75 region and if not breached, we felt an opportunity to short would be available from that region. We said if that failed and the move commenced, we would be looking at a complete correction of the move back down into the 3330-35 region, where we would then monitor price again in anticipation of a long from there or the extension level of 3310 which was also a red box short target (move complete). As you can see from the above, not only did we get that higher red box, we rejected, completed the move downside and then our traders managed to get that long trade all the way back up into the Excalibur target, red box targets and the hotspots shared in Camelot.

A decent week again, not only on Gold but also the numerous other pairs we trade, share targets on and analyse.

So, what can we expect in the week ahead?

For this week we can expect more ranging price action, but due to the previous range from last week being so tight, it looks like we’ll see a breakout coming in the latter part of the week unless there is news to bring us unexpected volume.

We have the key level below 3335-40 support and above that resistance and a red box sitting at 3375-80. This is the region that needs to watched for the break, and if broken we should hit the range high again at 3400-10. However, if rejected, we could again see this dip to attack that lower order region 3310-6 before attempting to recover.

Last week we wanted to see that curveball and although we did see some aggressive price action, I think we will see something extreme for this week. It’s that lower level 3310-6 that is a key region for bulls, if broken we can see a complete flush in gold taking us down into the 3250’s before we start the summer run. That for us would be the ideal scenario going into the month end, but, we’ll play it how we see and as usual, we go level to level and update any changes as we go along.

KOG’s Bias for the week:

Bullish above 3340 with targets above 3355, 3361, 3368, 3372 and above that 3385

Bearish below 3340 with targets below 3335, 3330, 3322, 3316, 3310 and below that 3304

RED BOX TARGETS:

Break above 3350 for 3355, 3361, 3367, 3375 and 3390 in extension of the move

Break below 3340 for 3335, 3330, 3320, 3310 and 3306 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

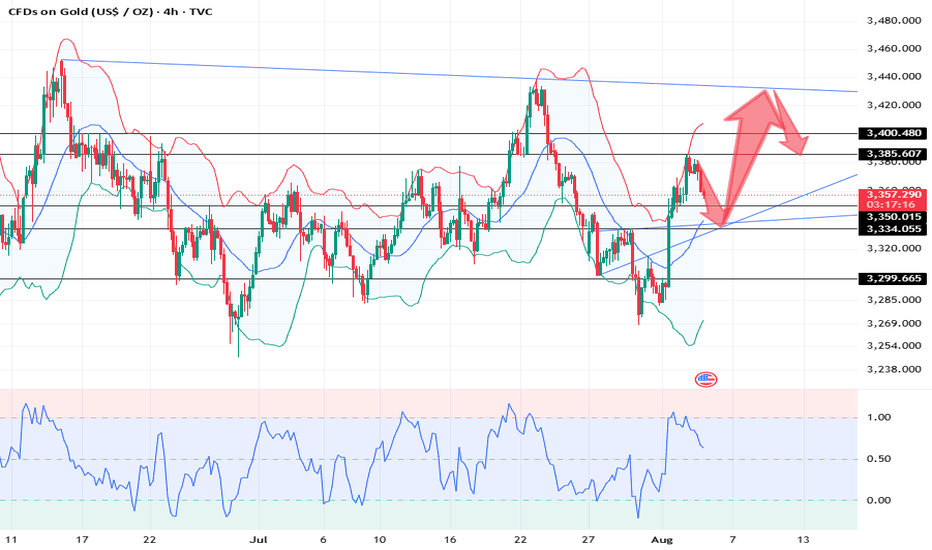

XAUUSD: Market Analysis and Strategy for August 5th.Gold Technical Analysis:

Daily chart resistance: 3430, support: 3300

4-hour chart resistance: 3400, support: 3334

1-hour chart resistance: 3385, support: 3350.

Gold prices have continued their upward trend since breaking through $3335 last Friday, with an overall bullish outlook. Currently trading around $3356, support lies at $3350, a key defensive barrier for bulls. If this level breaks, gold could fall further to $3328 or even the $3300 mark. Conversely, upward resistance lies at $3385 (previous high), $3400 (round number), and $3430 (trend line resistance). If gold successfully breaks through these resistance levels, it could retest the year's high of $3500. During NY trading, focus on the $3388-3405 range above and the $3350-3334 support range below. Keep an eye on the bull-bear dividing line at 3350!

BUY: 3350

SELL: 3345

SELL: 3385

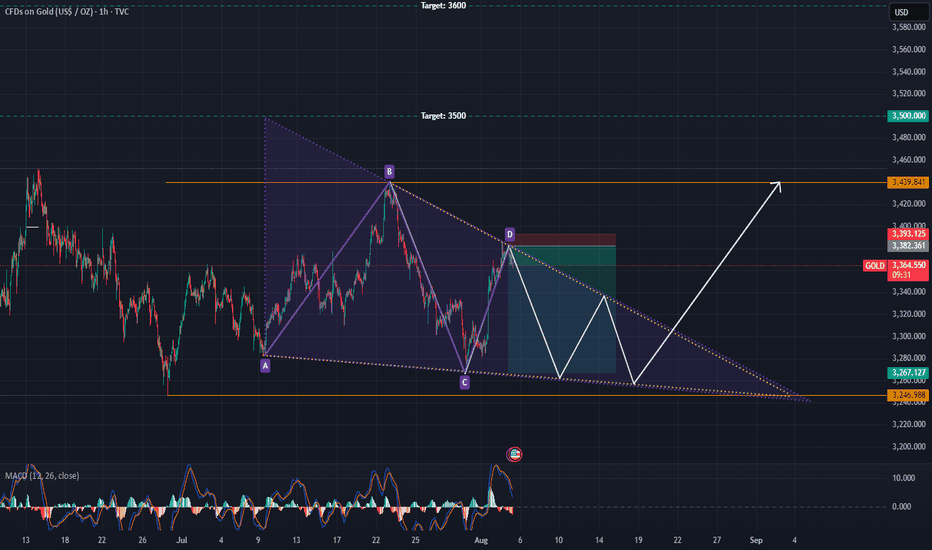

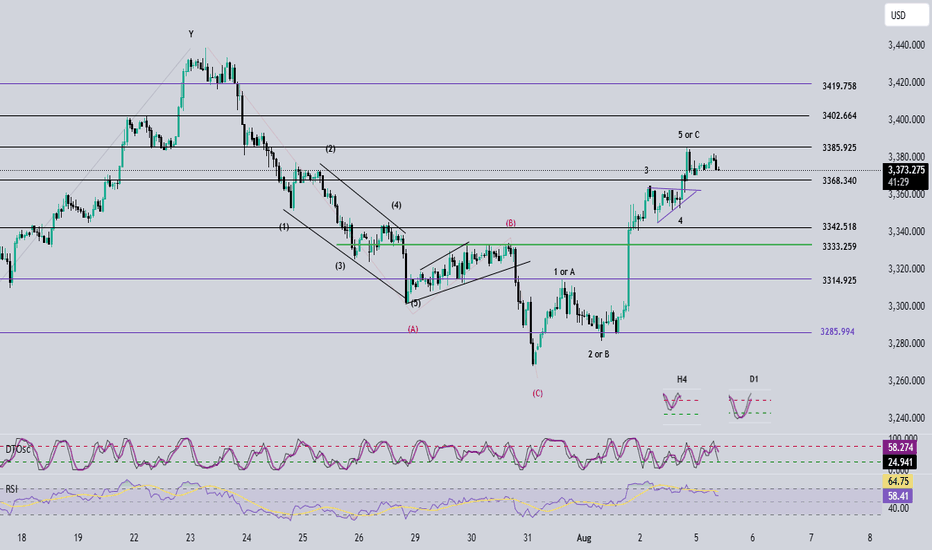

Elliott Wave Analysis – XAUUSD, August 5, 2025📊

________________________________________

🔍 Momentum Analysis:

• D1 Timeframe:

Momentum has entered the overbought zone. As anticipated in previous plans, we've seen four consecutive bullish days, and the current overbought condition signals that bullish momentum is weakening.

• H4 Timeframe:

Momentum is reversing downward → We expect a potential pullback today, at least until the US session.

• H1 Timeframe:

Momentum is also turning down → This supports the possibility of a short-term pullback on the H1 chart.

________________________________________

🌀 Wave Structure Analysis:

Currently, there are two key scenarios to consider:

✅ Scenario 1 – ABC Correction Structure (black labels):

• If this is a C wave completing an ABC correction, the current bullish move is likely over.

• In this case, price may break below the 3315 support zone, resuming the medium-term bearish trend.

✅ Scenario 2 – Impulse Wave 12345 (black labels):

• If this is wave 5 of a 5-wave impulse, the uptrend may not be complete yet.

• Currently, wave 5 has reached its first target at 3385, however, we must still watch for an extended target around 3402.

• Notably, wave 4 took the form of a triangle. According to Elliott Wave theory, when wave 4 is a triangle, wave 5 typically travels a distance equal to the triangle’s maximum height → This makes 3385 a highly probable peak area.

________________________________________

🧭 Trade Plan (Reference Only):

🔹 Sell Setup #1 – Near Potential Wave 5 Top:

• Sell Zone: 3375 – 3378

• Stop Loss: 3387

• TP1: 3365

• TP2: 3344

• TP3: 3333

🔹 Sell Setup #2 – In Case of Extended Wave 5:

• Sell Zone: 3400 – 3402

• Stop Loss: 3410

• TP1: 3385

• TP2: 3368

• TP3: 3333

GOLD down slightly, watch today's data, technical conditionsOANDA:XAUUSD edged lower in Asian trading on Tuesday (August 5), currently trading around $3,380/ounce. On Tuesday, the US ISM services PMI will be released, which is the most important economic data of the week and is expected to impact the gold market.

OANDA:XAUUSD prices surged after weak jobs data increased the possibility of the Federal Reserve cutting interest rates.

Data released last Friday showed that the number of new jobs in the US non-farm sector in July was much lower than expected, and the total number of non-farm jobs in the first two months was revised down by 258,000, indicating a sharp deterioration in the labor market.

Traders now see an 87% chance of a rate cut in September, up from 63% last week, according to CME Group's FedWatch tool. Expectations of a rate cut have boosted gold prices, as the dollar provides support for the precious metal.

The US ISM non-manufacturing purchasing managers index (PMI) for July will be released today (Tuesday) and is expected to be 51.5, up from 50.8 previously.

The July ISM services PMI could impact the US dollar and gold, depending on whether it is biased towards supporting a rate cut or pausing rate cuts for an extended period.

Gold itself does not generate interest, but generally performs well in low-interest-rate environments and is seen as an inflation hedge.

On the trade front

Today (August 5), US President Donald Trump threatened to raise tariffs on Indian goods in protest at India's purchase of Russian oil. New Delhi called Trump's attack "absurd" and pledged to protect its economic interests, deepening the trade rift between the two countries.

Trump posted on the social media platform Truth Social: "India not only buys massive amounts of Russian oil, but also sells much of it on the open market at a huge profit. They don't care how many people are being killed in Ukraine by the Russian war machine."

Trump added: "Accordingly, I will be substantially increasing the tariffs that India pays to the United States."

However, Trump did not specify the specific tariff amount.

Responding to Trump's remarks, an Indian foreign ministry spokesperson said on Monday that India would "take all necessary measures to protect its national interests and economic security." The spokesperson added: "These actions against India are unjustified and unjustifiable."

Over the weekend, Reuters reported that India would continue to buy oil from Russia despite Trump’s threats.

In July, Trump announced that he would impose a 25% tariff on imports from India, and US officials have also pointed to a range of geopolitical issues as holding up the signing of a US-India trade deal.

Trump has also described the BRICS group as generally hostile to the US. Those countries have rejected Trump’s accusations, saying the group protects the interests of its members and the developing world as a whole.

Technical Outlook Analysis OANDA:XAUUSD

On the daily chart, although gold has been very volatile in recent times, it is still moving sideways, with price action clinging to the EMA21. And after a strong recovery in the past three trading sessions, gold is temporarily limited by the 0.236% Fibonacci retracement level, which was the bullish target that readers paid attention to earlier. The return above the EMA21 provides gold with initial conditions for bullish expectations, but a new trend has not yet formed.

If gold takes its price action above the 0.236% Fibonacci retracement level and stabilizes above it, it will have room to continue rising with the next target being the raw price point of $3,400 rather than the $3,430-$3,450 target. But at its current position, it still has no clear trend either up or down.

Meanwhile, once gold sells below the 0.382% Fibonacci retracement level, it could continue to decline with a target of $3,246 in the short term, which also means that the $3,300 – $3,292 area is the current key support area.

Momentum-wise, the Relative Strength Index (RSI) is also hovering around 50 with little fluctuation, indicating a hesitant sentiment in the market without leaning to either side.

For the day, the technical outlook for gold is a sideways consolidation but the technical conditions are slightly more bullish, and the notable positions are listed as follows.

Support: $3,350 – $3,340 – $3,300

Resistance: $3,400 – $3,430

SELL XAUUSD PRICE 3402 - 3400⚡️

↠↠ Stop Loss 3406

→Take Profit 1 3394

↨

→Take Profit 2 3388

BUY XAUUSD PRICE 3329 - 3331⚡️

↠↠ Stop Loss 3325

→Take Profit 1 3337

↨

→Take Profit 2 3343

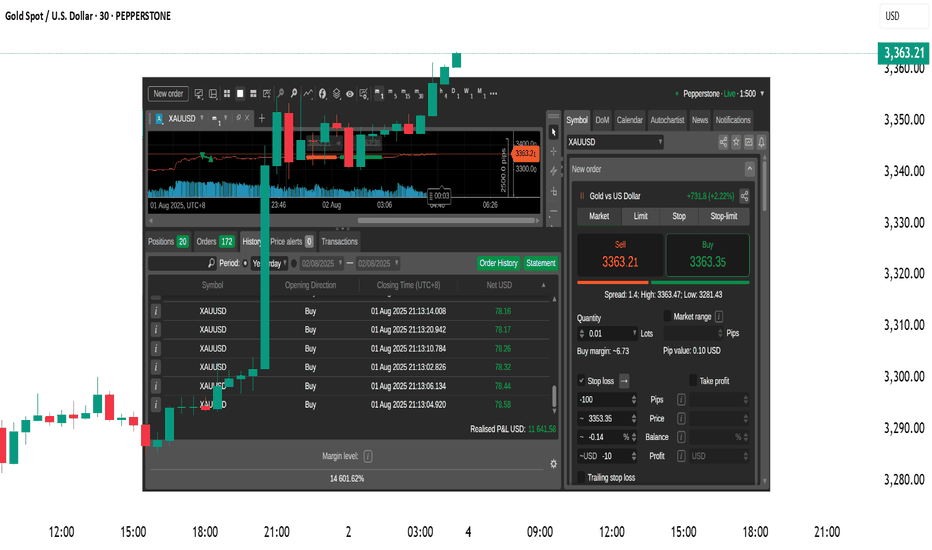

XAUUSD Live Trade with 11,641 USD ProfitsI managed to ride the momentum last night on XAUUSD and made over 11,641 usd profit on a live trading account. Gold usually create a range. It will create a top and a bottom then it will spend most of its time inside that range. That is pretty much how XAUUSD moves. If you can identify the top and the bottom then you can short it from the top and do a long trade on the bottom. The price will just travel from bottom to top and top to bottom. You can scalp your way to profits on this move if you can time it properly. Once in a while, a break from the top or the bottom happens. This is where you switch from trading the range to trading breakouts.

When you trade breakouts, you must trade it with the knowledge that less than 15 percent of breakouts are successful. Failed breakouts are very common. You need to have some form of stoploss below your breakout levels. You will know that the breakout fails once your stoploss is hit. If the breakout is successful then ride it. Do not put some TP (target price or take profit price) rather just trail your profits. Move your stops a few pips behind the price. Just enough distance to let the price breathe. If the price reverses then it will hit your stops. If the breakout is strong then you will ride it for a while until it reverses.

It will form another top and bottom again and move inside that range. Switch your approach again in trading long trades near the bottom and short trades near the top.

Just remember to always have some stoploss on every trade and never try to predict what the market will do or how the price will move. Let the market do its thing and just react to its movements.

Goodluck on your trades.