GOLD | Bullish Bias Amid Fed & Trade Policy UncertaintyGOLD | Bullish Bias Amid Fed & Trade Policy Uncertainty

Gold prices edge higher as markets weigh conflicting signals from the Federal Reserve and renewed trade policy uncertainty. Diverging opinions among Fed officials regarding the inflationary impact of President Trump's proposed tariffs have fueled demand for safe-haven assets.

While some members like Waller and Bowman appear open to rate cuts, others remain cautious about lingering inflation risks, adding to market volatility.

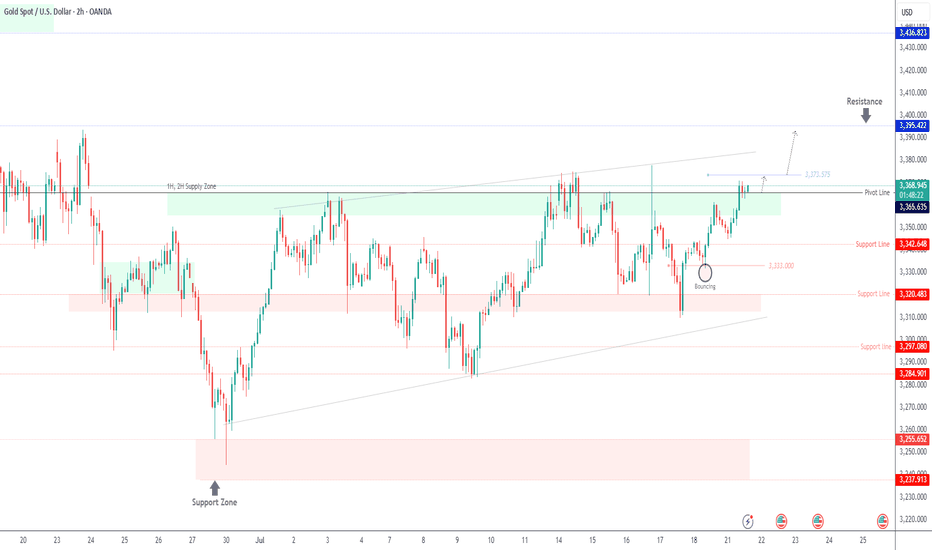

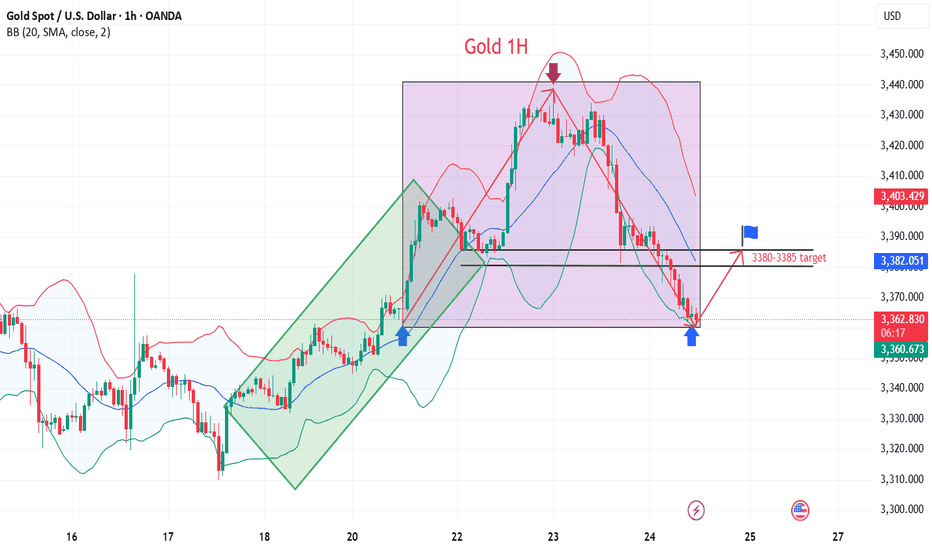

Technical Outlook:

Gold maintains bullish momentum above 3365. A break and hold above this pivot supports continuation toward 3375, and if momentum builds, toward 3385 and 3395.

However, any sustained move below 3365 may trigger a bearish correction toward the support zone between 3355 and 3342.

Pivot Line: 3365

Resistance Levels: 3375 · 3385 · 3395

Support Levels: 3355 · 3342

Bias: Bullish above 3365

GOLDCFD trade ideas

Gold dips on profit-taking, long-term outlook still bullishGold prices continued to decline this morning as investors locked in profits following the precious metal’s recent rally above $3,400.

In the short term, further downside is possible if profit-taking persists and capital flows shift toward equities, especially as U.S. stock markets hover near record highs. However, gold remains a favored safe-haven asset for the long run amid ongoing global economic and geopolitical uncertainties.

Markets are also turning their focus to the upcoming Federal Reserve policy meeting on July 29–30. While the Fed is expected to hold interest rates steady this time, many investors still anticipate a potential rate cut in September. A low interest rate environment typically supports non-yielding assets like gold.

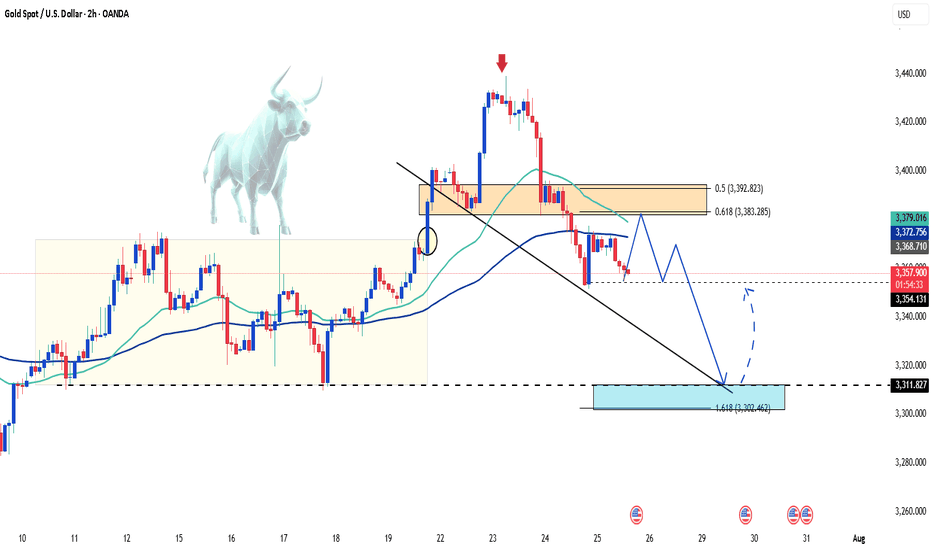

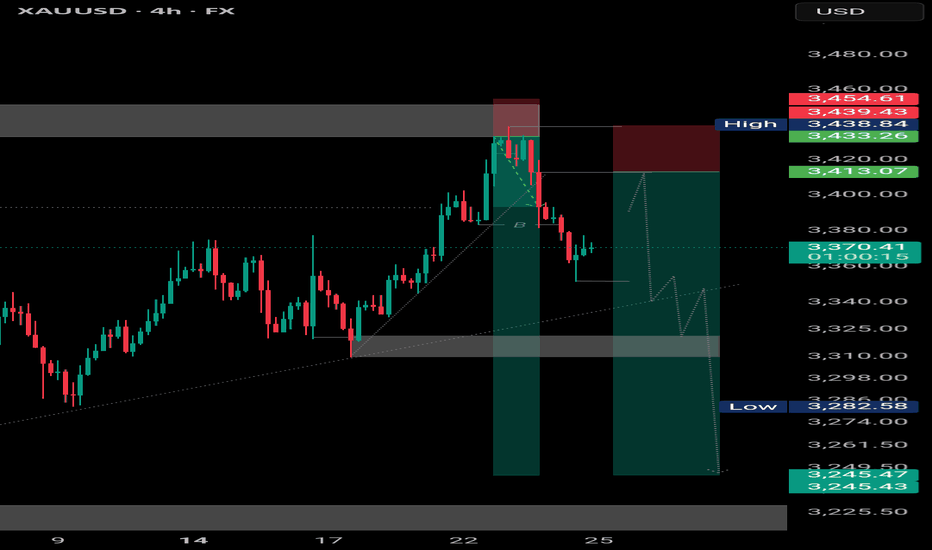

Gold is weak. Beware of lows.On Thursday, the dollar index ended a four-day losing streak thanks to the progress of the fund between the United States and its trading partners.

As signs of easing global trade tensions curbed demand for safe-haven assets, gold fell for the second consecutive trading day, and yesterday it hit the 3350 bottom support level.

From the 4-hour chart

although it rebounded to the 3370-3380 range after hitting 3350. But it can be found that the current rebound is actually weak, and it is still maintained at 3360-70 for rectification. At present, the bottom of the 4-hour bottom is absolutely supported at 3340-3335. The rebound high is around 3375. As of now, gold has not rebounded above 3375, and gold is actually in a weak position.

Secondly, from the hourly chart, the weakness is even more obvious. The high point on Thursday was around 3395. Today's current high point is around 3375. It can be seen that if the bottom falls below the 618 position 3350 again, it will directly touch around 3335. It coincides with the target position of 3340-3335 in the previous 4-hour chart.

Therefore, it is not possible to buy the bottom and go long today. Be alert to the possibility of further touching 3340-3335.

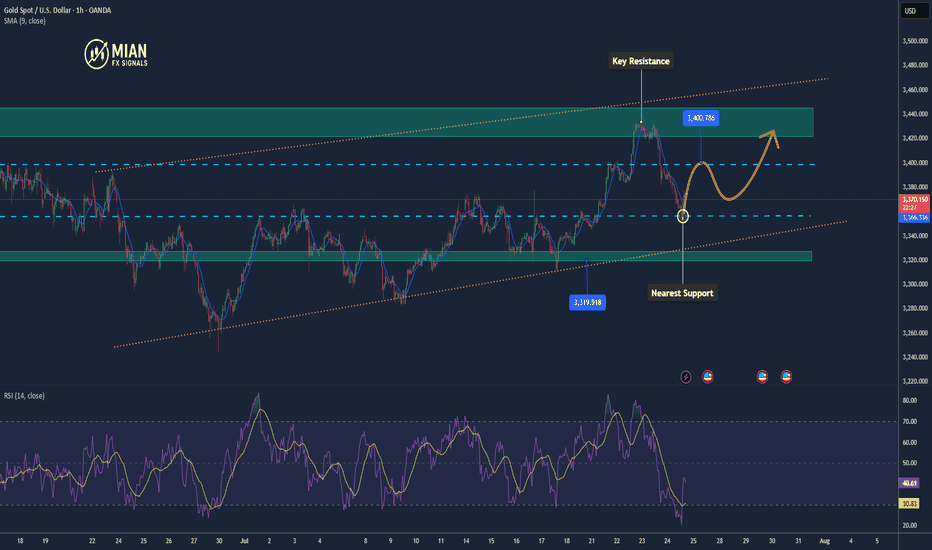

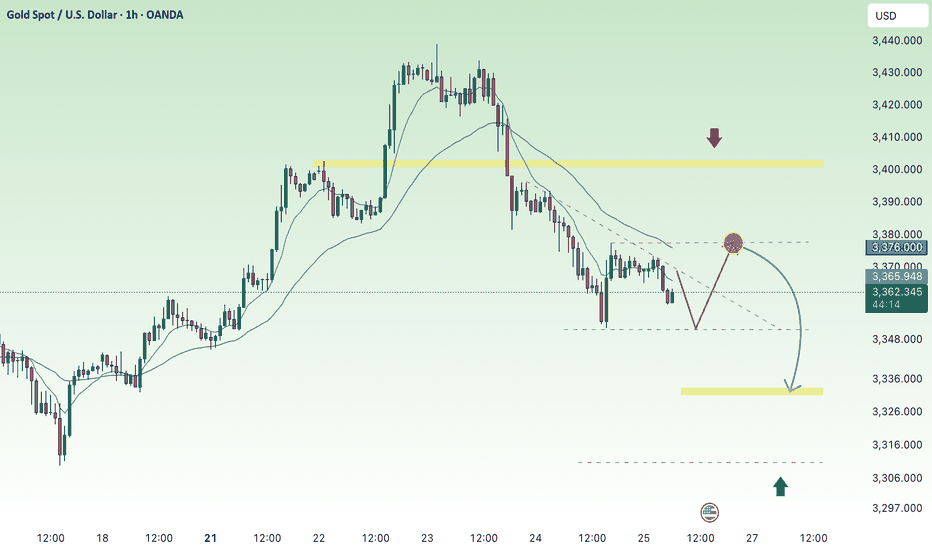

Gold Bounces Back After Testing Key Support📊 Market Drivers

• Gold dropped to around $3,352, touching a key support zone, then quickly rebounded to $3,373, gaining over +20 points.

• The rebound is supported by continued weakness in the US Dollar and slight easing in Treasury yields, keeping gold attractive as a safe haven.

• Although some optimism around US-Japan trade negotiations slightly reduced risk aversion, it wasn’t enough to push gold below support.

📉 Technical Analysis

• Key Resistance:

o $3,397 – $3,400: psychological resistance and near the next bullish breakout zone.

o If breached, next target lies around $3,420–3,445.

• Nearest Support:

o $3,356 – $3,364: recently confirmed support zone that triggered the current rebound.

o Deeper support at $3,326 – $3,320 if the rebound fails.

• EMA (EMA50):

o Price remains above the 50-period EMA, indicating bullish momentum in the short term.

• Patterns & Momentum:

o Market structure shows a "rising low" pattern — a bullish signal that buyers are stepping in at higher levels.

o RSI was briefly in oversold territory and now supports a recovery bounce.

o If $3,356 holds, the upside targets remain valid toward $3,397 → $3,439.

📌 Assessment

• Gold has confirmed strong support at $3,356–3,364, with the rebound from $3,352 as proof.

• Short-term uptrend remains intact, unless the USD strengthens sharply or unexpected macro news hits.

• If gold breaks below $3,356, it may retrace toward $3,326–3,320, but the upside potential is currently favored.

💡 Suggested Trade Setups

BUY XAU/USD: $3,356–3,364

🎯 Take Profit: 40/80/200 pips

❌ Stop Loss: $3,346

SELL XAU/USD: $3,397–3,400

🎯 Take Profit: 40/80/200 pips

❌ Stop Loss: $3,407

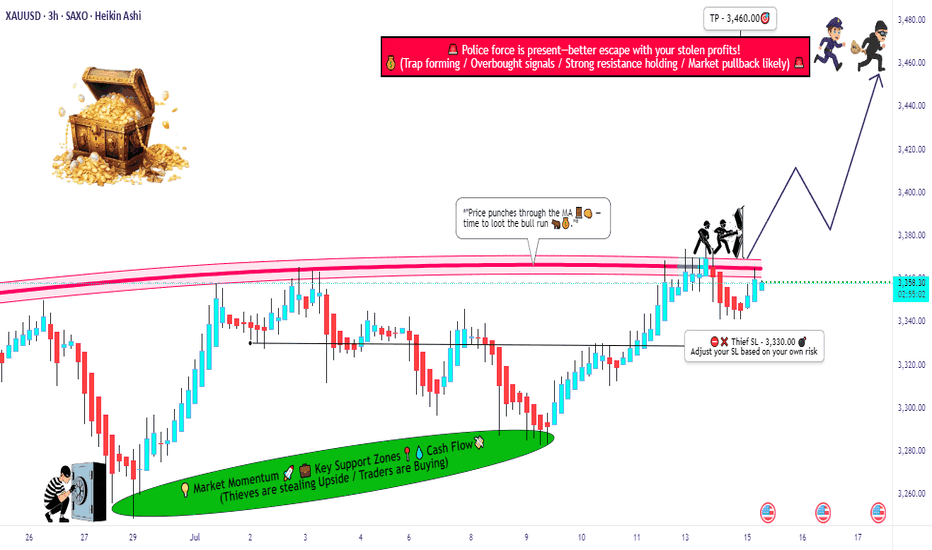

GOLD (XAU/USD) MA Breakout – High-Probability Long Setup!💰🚨 GOLD HEIST ALERT! XAU/USD MASTER PLAN (Thief Trading Style) 🎯

🔥 Steal Pips Like a Pro – High-Probability Gold Breakout Strategy! 🔥

🎯 Thief Trading’s GOLD Heist Strategy (Swing/Day Trade) �💸

👋 Hey there, Market Pirates & Profit Snatchers! 🌍✨

Based on our 🔥Thief Trading Style🔥 analysis, we’re plotting a major heist on XAU/USD (GOLD). The plan? Buy the breakout, escape before the cops (resistance) arrive! 🚔💨

📈 ENTRY ZONE: The Heist Begins!

🚀 "Wait for the MA Breakout (3400) – Then Strike!"

Bullish Confirmation: Enter on a 15M/30M pullback after MA breakout.

Thief’s Trick: Use Buy Stop above MA or Buy Limit near swing lows for best risk-reward.

DCA/Layering Strategy: Deploy multiple limit orders to maximize gains.

🔔 Set an ALERT! Don’t miss the breakout – thieves move fast! ⏳

🛑 STOP LOSS: Protect Your Loot!

📍 Thief’s SL Placement: 3330.00 (4H Swing Low) – Adjust based on your risk & lot size.

⚠️ WARNING: If using Buy Stop, DO NOT set SL until after breakout – unless you love unnecessary losses! 🔥

🎯 TARGET: Escape with the Gold!

🏴☠️ Take Profit Zone: 3460.00 (or Exit Early if Bears Show Up!)

Scalpers: Only trade LONG side – use trailing SL to lock in profits.

Swing Traders: Ride the wave but watch for resistance traps!

📰 MARKET CONTEXT: Why This Heist?

Neutral Trend (But Bullish Potential! 🐂)

Key Factors: Geopolitics, COT Data, Macro Trends, Sentiment Shift

🚨 News Alert: Avoid new trades during high-impact news – trailing SL saves profits!

💥 BOOST THIS HEIST! (Like & Share for More Pips!)

💖 Hit the 👍 Boost Button to strengthen our Thief Trading Crew!

🚀 More Heist Plans Coming Soon – Stay Tuned!

⚠️ DISCLAIMER (Stay Safe, Thieves!)

This is NOT financial advice. Do your own analysis & manage risk.

Markets change fast! Adapt or get caught.

🎯 Happy Trading, Pirates! Let’s Steal Some Gold! 🏴☠️💛

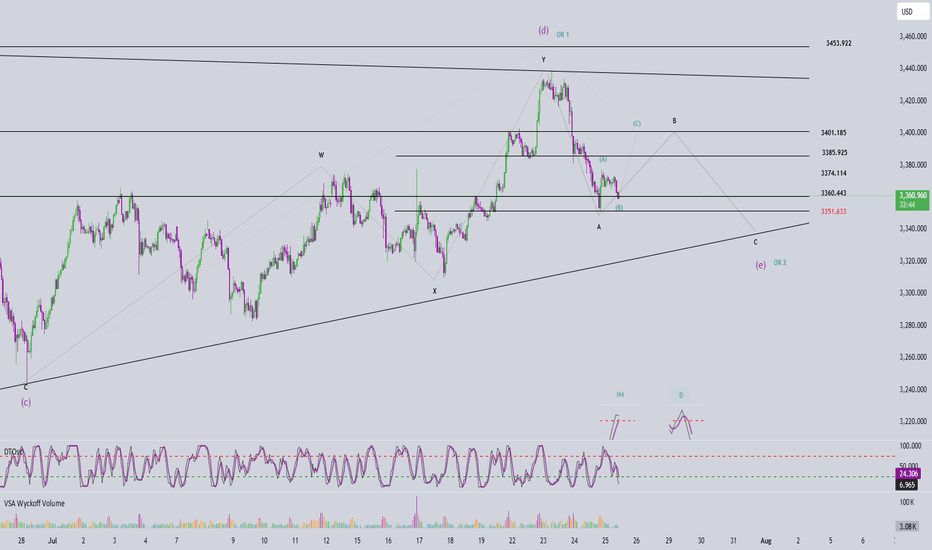

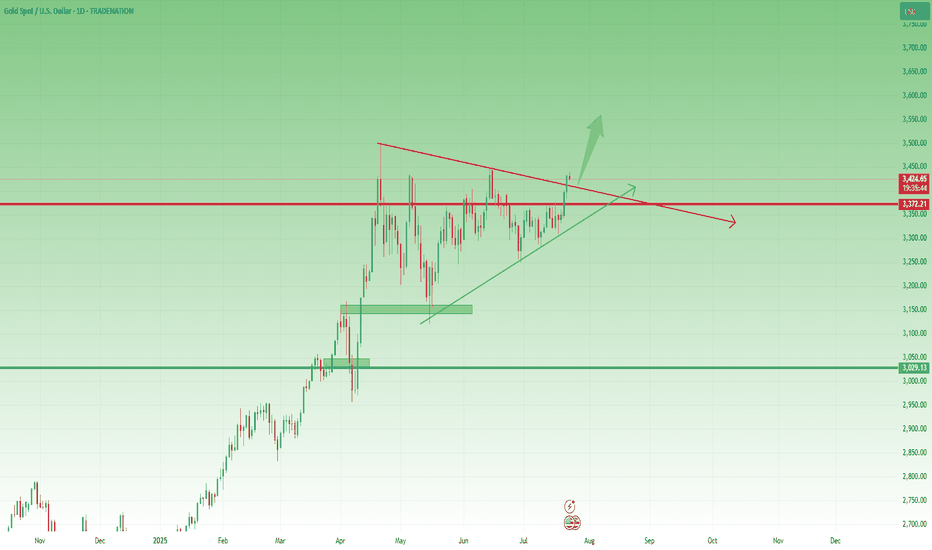

Elliott Wave Analysis – XAUUSD July 25, 2025📊

________________________________________

🔍 Momentum Analysis

• D1 Timeframe: Momentum is declining. Based on the current pace, it’s likely that only 1–2 more daily candles are needed before momentum enters the oversold zone → suggesting one more potential downward leg.

• H4 Timeframe: Momentum is about to turn bearish, indicating we might see a sideways movement or a slight drop in the short term.

• H1 Timeframe: Momentum is currently falling. By the end of the current H1 candle, momentum will likely enter the oversold zone → potential for a bullish reversal soon.

________________________________________

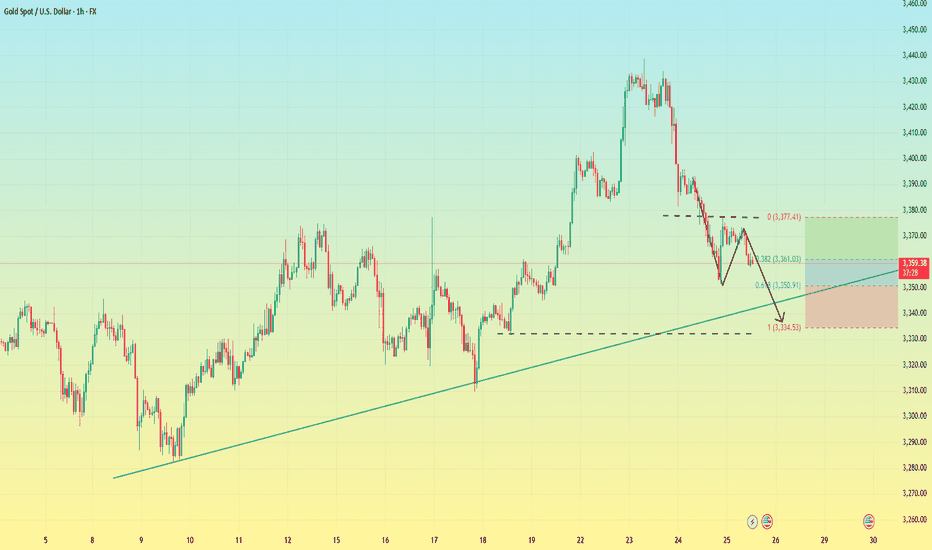

🌀 Elliott Wave Structure

• A clear 5-wave Wave A has already formed with no irregular patterns, so I’m expecting Wave B (black) to unfold as a 3-wave structure.

• Within this black Wave B, price is now developing Wave B (blue), meaning Wave A (blue) has already completed. Looking at the lower timeframe, I can identify a 5-wave structure → suggesting a zigzag correction in the form of 5-3-5 for black Wave B.

• Target for Wave B (blue): The 3360 area – this is a support level and also aligns with Fibonacci confluence, making it a strong candidate for the end of Wave B (blue) and a potential reversal zone.

• If price respects the 3360 level, then projected targets for Wave C (blue) would be around 3386 or 3402.

• However, if price breaks below 3351, the current wave count becomes invalid. In that case, we will shift to an alternate scenario and look for a buy opportunity near the lower edge of the triangle (c)-(e) and other confluence support zones.

________________________________________

🔄 Combining Momentum & Wave Structure

• D1 momentum shows weakening in this downward move, and the lower boundary of the triangle (c)-(e) is a prime area to look for the end of Wave e.

• Ideally, we want to see:

o A short-term bounce upward aligning with H1 momentum reversal to complete Wave C (blue).

o Then a confluence with H4 momentum turning bearish, indicating possible trend continuation or reversal.

________________________________________

📌 Trade Plan

• For experienced traders:

Watch closely around 3385 and 3401 for reversal signals to enter Sell positions.

• For beginners, I recommend the following limit setup:

o SELL ZONE: 3399 – 3402

o SL: 3501

o TP1: 3374

o TP2: 3351

Gold selling pressure decreased at the end of the week⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) remains under modest pressure during Friday’s Asian session, unable to build on the previous rebound from the mid-$3,300s. Renewed strength in the US Dollar, which extends its recovery from a multi-week low, acts as a headwind for the non-yielding metal. Additionally, fresh optimism surrounding the US-Japan trade agreement has dampened safe-haven demand, keeping gold on the defensive for the third consecutive day.

That said, lingering uncertainty over the Federal Reserve’s rate-cut trajectory, along with concerns about its independence amid growing political pressure, could limit the USD's upside. Meanwhile, rising geopolitical tensions—this time along the Thailand-Cambodia border—may lend some support to bullion. Investors now await US Durable Goods Orders data, which could influence the greenback’s direction and provide short-term cues for the XAU/USD pair going into the weekend.

⭐️Personal comments NOVA:

Gold prices are consolidating and starting to fall below 3400 to stabilize. The momentum for an early rate cut is waning.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3399- 3401 SL 3406

TP1: $3390

TP2: $3380

TP3: $3370

🔥BUY GOLD zone: $3310-$3312 SL $3305

TP1: $3325

TP2: $3333

TP3: $3345

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Simple Swing Trading Strategy with Smart Money Concept Explained

I will share with you the essential basics of swing trading forex gold with Smart Money Concepts.

You will learn how to do swing trading with the best SMC strategy.

I will teach you to c ombine order blocks, liquidity zones and imbalances to spot accurate entries and confirmation signals.

If you just started learning swing trading Forex with Smart Money Concepts, I strictly recommend trading with the trend only.

The cases and examples that we will discuss will be strictly trend-following ones.

Swing Trading with SMC in Uptrend

For swing buying any forex pair, we will look for the market that is trading in a bullish trend.

To confirm that the market is rising, you will need to execute structure mapping and find a forex pair that updates Higher Highs HH and Higher Lows HL.

Above is the example how I confirmed that GBPUSD is bullish with structure mapping. You can see that the pair consistently updates the highs.

Once you identified a bullish pair, your next step will be to find the zone from where the next swing move will follow.

According to the rules, the market remains in uptrend till the price is staying above or on the level of the last Higher Low HL.

Here is such a zone on GBPUSD.

It is based on the last Higher Low and current price levels.

We will assume that buying orders will concentrate within that area and from that a bullish rally will follow.

The problem is that this area is extremely wide, and we can not just buy randomly within.

Our next step will be to find liquidity zones within.

To buy, we need demand areas.

I found 4 price action based historic demand zones on GBPUSD.

We will need to wait for the test of one of these zones and then wait for an order block - a place where smart money are placing their buy orders.

The problem is that we don't know in which of these areas the order block is, so we will need to wait for tests of these zones and a consequent imbalance to confirm it.

To confirm a bullish imbalance for swing trading Forex, I recommend analyzing a 4H time frame after a test of a demand zone.

According to Smart Money Concepts, a bullish imbalance can be any sign of strength of the buyers : bullish breakout of a vertical/horizontal resistance, change of character, high momentum bullish candle, bullish price action pattern, etc.

An order block on GBPUSD was confirmed with a breakout of a resistance line of a falling channel on a 4H time frame.

That was the signal that Smart Money are buying, and that is your signal to open a swing long trade.

You place a buy position then with a stop loss below the order block and a target - at least a current high.

Swing Trading with SMC in Downtrend

For swing selling any forex pair, you will need to find a market that is trading in a bearish trend.

I suggest applying structure mapping to identify such a pair.

It simply should update Lower Lows LL and Lower Highs consistently.

USDCAD is trading in a bearish trend.

Structure mapping helps to easily confirm that.

Then, we will need to identify the zone from where the next bearish wave will start.

According to Smart Money Concepts structure mapping rules, the market remains bearish till the price is staying below or on the level of the last Lower High LH.

That's such a zone on USDCAD.

It is based on current prices and the last Lower High.

We will assume that selling orders will be distributed along the entire lenth of our zone.

Of course, we can not sell randomly within that zone because it is relatively extended.

Our next task will be to find liquidity supply zones within.

I found 2 price action based supply zones within our underlined area.

Before we sell, we will need to find an order block.

A place from where smart money are selling big.

To spot that, I suggest waiting for a test of one of our supply zones and wait for a bearish imbalance on a 4H time frame.

According to SMC, a bearish imbalance can be a bearish high momentum candle, a bearish CHoCH, a bearish price action pattern, a bearish breakout of a horizontal/vertical support , etc.

You can see that a lower supply zone was tested on USDCAD.

Our bearish order block confirmation is a bearish Change of Character, a formation of a high momentum bearish candle and a breakout of a rising trend line.

After that we can open a swing sell position and expect a bearish movement at least to a current low.

Stop loss should lie strictly above the order block.

TP should be at least a c urrent low.

That is how a trade should be executed on USDCAD pair.

Remember that there is no guarantee that the order block will be within a liquidity zone. You should learn to track the signs of smart money and their operations.

A proper combination of a trend analysis, liquidity zones and order block is the essential basis of a profitable swing trading Forex.

Mastering that, practice recognizing the imbalances and confirmations for spotting the best swing trading entries.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

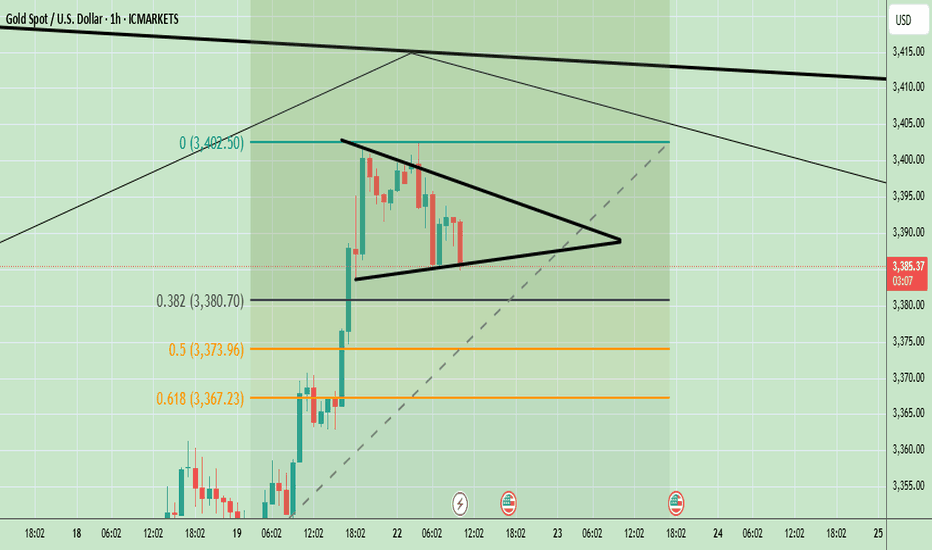

XAUUSD Technical Analysis – Triangle Breakout Ahead?Gold is currently consolidating in a symmetrical triangle pattern around $3,389. If it breaks above $3,402, we can expect a bullish continuation toward $3,420 and beyond. Key support lies at $3,367; a breakdown below this level would turn the trend bearish. The overall trend is still bullish, but a breakout is needed for confirmation.

📈 Potential Scenarios:

✅ Bullish Breakout Scenario:

- Break above $3,392–$3,402 zone.

- Targets: $3,420 > $3,450 > $3,480

- Supported by strong upward BOS (Break of Structure) and higher lows.

❌ Bearish Breakdown Scenario:

- Breakdown below $3,373–$3,367 zone.

- Targets: $3,355 > $3,345

- Would invalidate current bullish structure and form a lower low.

🔮 Trend Bias:

Bullish Bias remains intact as long as price stays above $3,367 and maintains higher lows. However, consolidation suggests waiting for breakout confirmation from the triangle before entering new trades.

🧭 Trend Outlook:

Gold is currently consolidating in a symmetrical triangle pattern, which typically precedes a breakout — either upward or downward. The price is holding above the key Fibonacci support levels and the overall market structure is bullish, suggesting an upward continuation is more likely if buyers maintain momentum.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

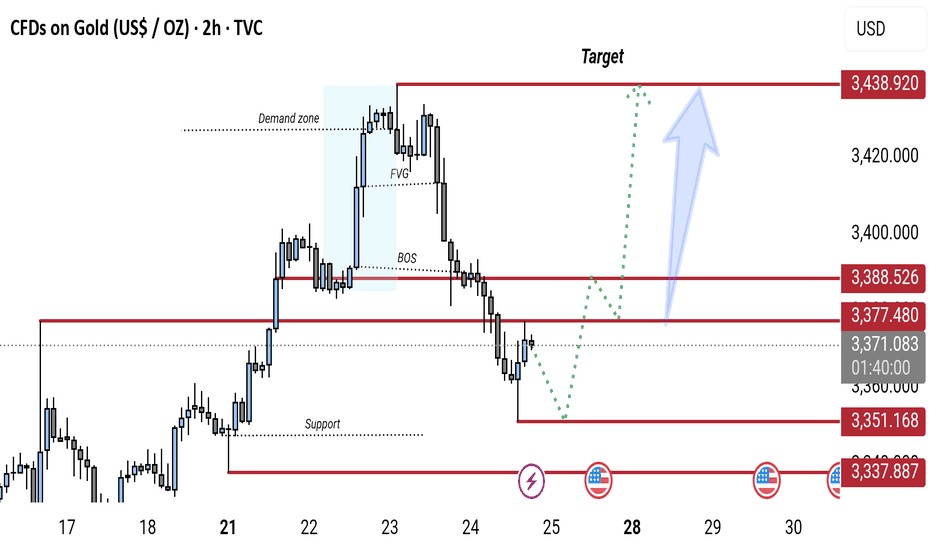

Gold 2H Chart: Bullish Reversal Expected from Key Support ZoneGold (XAU/USD) 2H chart shows a bearish break of structure (BOS) followed by a pullback toward a key support zone (around 3,337–3,351). A potential bullish reversal is expected from this zone, targeting the 3,438 resistance level. The chart highlights a demand zone, FVG (Fair Value Gap), and possible retracement before continuation to the upside.

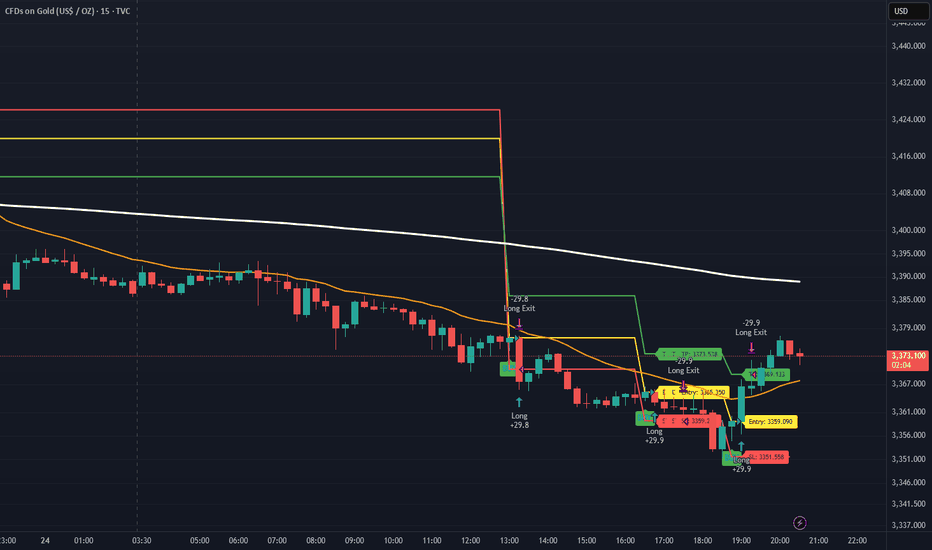

XAUUSD Traders - Turn Chaos into Pips with This StrategyHello Traders,

Struggling to trade XAUUSD due to its high volatility? Taking small profits but suffering big losses?

We’ve got your back.

Introducing Gold Sniper — a high-probability strategy specially crafted for XAUUSD traders. With a 65%+ win rate and a consistent 1:1.33 risk-reward ratio, it’s designed to help you catch sharp moves with confidence.

🚨 Live Performance Highlights:

Today’s Trades:

Signal 1

🟢 Buy @ 3365.350

🔴 SL @ 3359.209

🟢 TP @ 3373.538

❌ Result: SL Hit → 61 Pips Loss

Signal 2

🟢 Buy @ 3359.090

🔴 SL @ 3351.558

🟢 TP @ 3369.133

✅ Result: TP Hit → 75 Pips Profit

📊 Net Profit Today: +13 Pips

📅 Yesterday’s Profit: +150 Pips

✅ Gold Sniper helps you:

• Avoid fake breakouts

• Catch real momentum

• Stick to disciplined entries and exits

🎯 Want to boost your trading accuracy?

📩 DM us now to get access and start using Gold Sniper directly on your TradingView chart.

If you find this valuable, like the idea and show your support. Let’s grow together!

Happy Trading,

InvestPro India

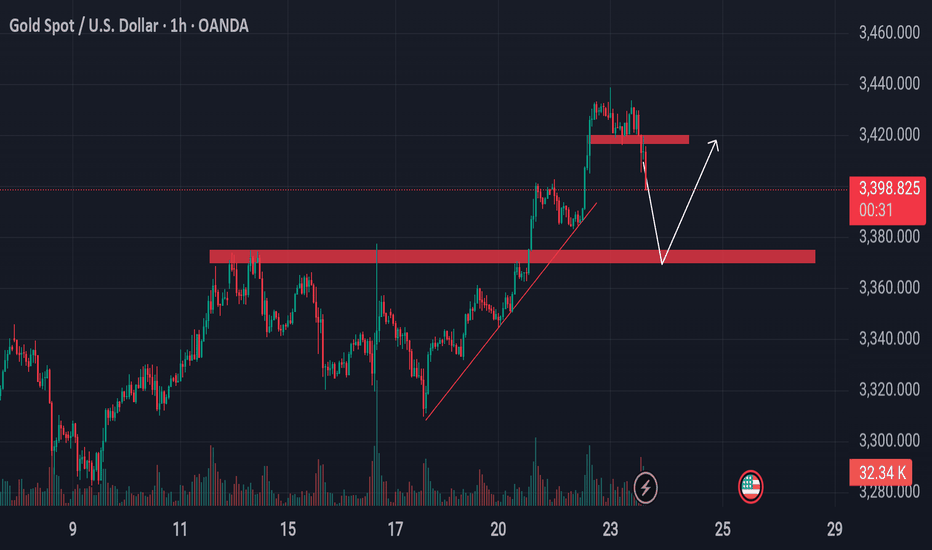

Gold Takes Flight, But Will Support Hold? Watch This Zone!Gold has broken its key resistance level in the New York session and, at the same time, has taken support from the trend line, which is pushing it upward. Currently, however, gold has also broken through another minor support level, and we can now observe that it is pulling back and moving downward.

It is advisable to remain patient at this stage. Wait for the market to come down to the zone where the previous resistance has now turned into support. If the price reacts positively at that level and shows signs of holding, we could potentially see a good buying opportunity from there.

As always, please conduct your own research (DYOR) before making any trading decisions. This is not financial advice.

Gold failed to break through three times, short-term bearish?

💡Message Strategy

Gold's decline today means the second consecutive day of decline as investors turn their attention to more positive trade developments since yesterday.

However, gold still received buying support earlier this week and briefly broke through $3,400. This round of gains tested key resistance levels on the gold daily chart, but ultimately the bears held their ground.

This is the third time in nearly three months that gold has tried to break through the $3,430 to $3,435 resistance area, but all failed.

📊Technical aspects

Gold’s latest decline this week has brought the price back into a range-bound trading state between key hourly moving averages. This means that the short-term trend has become more neutral.

This shows that the upward momentum has clearly weakened and buyers need to regain short-term dominance before they can hope to challenge the key resistance area mentioned earlier again.

Currently, the 200 hourly moving average near $3,365 provides support to the downside. If the price can hold this level, it will indicate that buyers are still holding on and waiting for the next upside opportunity.

Combined with the current 1H chart trend analysis, there is still a great chance of a bullish pullback in gold in the short term.

💰Strategy Package

Long Position:3360-3365,SL:3340,Target: 3380-3400

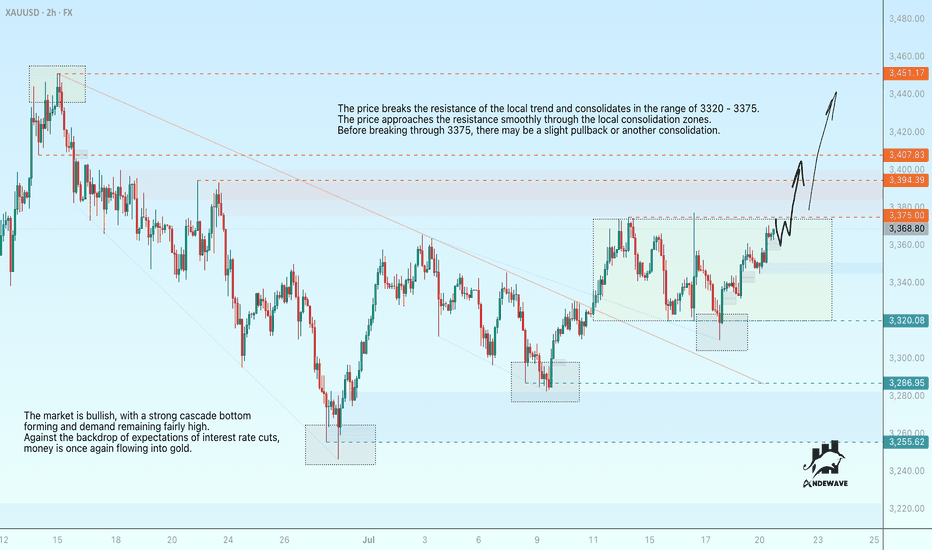

Gold tests resistance for a rally to 3450The price breaks through the resistance of the local trend and consolidates in the range of 3320-3375. The price approaches the resistance smoothly through local consolidation zones. Before breaking through 3375, there may be a slight pullback or another consolidation.

The market is bullish, with a strong cascade bottom forming and demand remaining fairly high. Against the backdrop of expectations of interest rate cuts, money is once again flowing into gold.

Gold Update – Strong Breaks, Strong BullsYesterday, after the break of the key 3370 resistance, Gold corrected slightly toward 3383, then consolidated briefly in that area. From there, it launched into a strong new leg up, closing the day once more near the highs, around 3430.

📌 What’s important here is that the price did not even come back to retest the broken resistance — now turned support. Combined with the strong daily close near the high of the range, this gives us a clear message:

➡️ Bulls are in full control.

________________________________________

🔍 This Week – Three Key Breaks

So far this week, Gold has delivered three major breakouts:

• ✅ A clean breakout from the box consolidation that kept price stuck and indecisive last week

• ✅ A decisive break above the 3400 psychological figure

• ✅ A breakout above the symmetrical triangle resistance, which had been forming since late April

Each of these is significant on its own. Together, they suggest a shift toward a more aggressive bullish scenario.

________________________________________

🔮 What’s Next?

All these breakouts point to the potential for more gains ahead.

In fact, the next logical step could be an attempt to mark a new All-Time High.

My view remains the same:

Buying dips remains the strategy of choice, with a focus on the 3400 zone as a key support area, and a swing target around 3500.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Gold’s Wild Ride: A Trader’s Take on What’s NextHey Fellow Traders! 👋

Gold’s been an absolute beast this week, smashing through both buyers and sellers like it’s playing a high-stakes game of market whack-a-mole! 😅 After Wednesday’s wild moves and today’s follow-up, Gold’s keeping us all guessing.

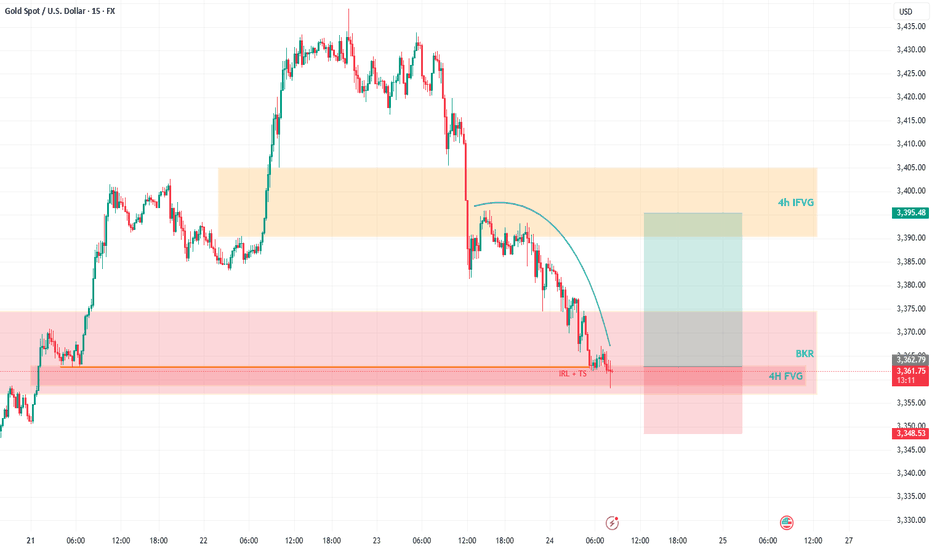

Right now, I’m not locking in a long-term bias—Gold’s too unpredictable for that. But here’s the exciting part: I’m eyeing a short-term long opportunity. Why? The price just dipped into a 4H Fair Value Gap (FVG) and tagged a Breaker, setting up a potential bounce. 📈

My plan? I’m expecting Gold to sweep up the highlighted liquidity and charge toward the 4H Inversion Fair Value Gap (IFVG). Once it hits that zone, I’ll be glued to the charts, watching for its reaction to decide the next move. 🧐

As always, trade smart! Set your stops, size your positions wisely, and don’t let Gold’s volatility catch you off guard. Protect your capital first—always! 💡

What’s your take on Gold right now? Are you jumping on this setup or waiting for more confirmation? Drop your thoughts in the comments below, give this post a like, and follow for more updates! 👇 Let’s keep the trading convo going! 🔥

XAUUSD I Potential Pullback and More GrowthWelcome back! Let me know your thoughts in the comments!

** XAUUSD Analysis - Listen to video!

We recommend that you keep this on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

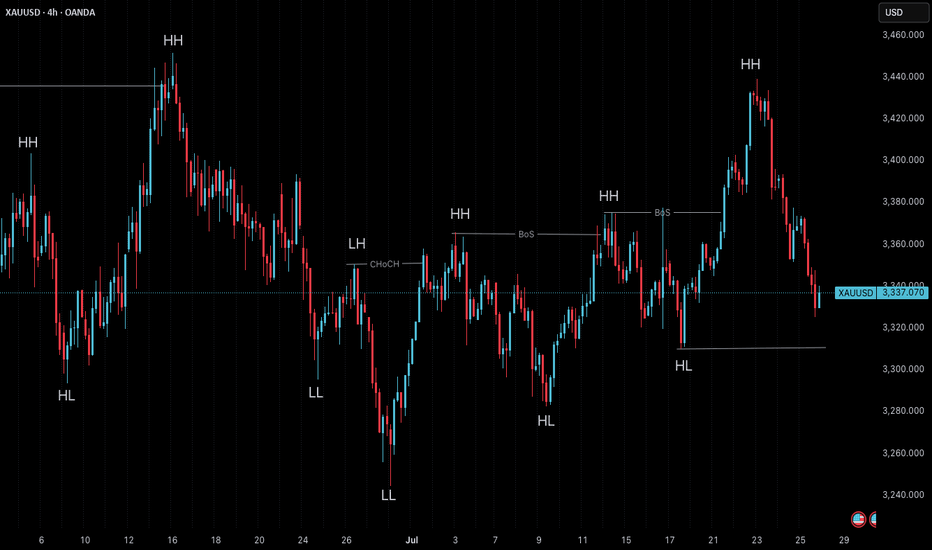

Market Structure is Not Strategy — It’s Your Starting Point“The chart doesn’t hide anything. But your mind does.”

Before any indicator, setup, or signal… comes structure.

🔍 What is Market Structure?

At its core, market structure is the sequence of higher highs (HH) and higher lows (HL) in an uptrend, or lower lows (LL) and lower highs (LH) in a downtrend.

It is the skeleton of price .

Everything else — entries, zones, signals — is just clothing.

If you can’t see the skeleton, you’re reacting to noise.

🎯 Why It Matters:

It’s not a signal. It’s context .

It tells you whether you’re trading with the market or against it .

It defines where your patience begins — not where your entry is.

Market structure helps you let go of the urge to chase. It brings order to the chaos.

🧩 Key Components to Track:

Break of Structure (BoS): Confirms trend continuation

Change of Character (ChoCH): Signals a potential reversal

Swing Points: Define the intent behind price moves

Liquidity Sweeps: Often mask real structure beneath short-term traps

🛑 Common Mistake:

Most traders jump straight to the setup without asking the most important question:

“Where am I in the structure?”

They try to buy a pullback — in a downtrend.

They try to fade a move — right before continuation.

They chase candles — instead of waiting for alignment.

That’s not strategy. That’s stress.

🛠 Tip to Practice:

Use this simple framework to build clarity:

Start from the H4 chart — this gives you the broader directional bias

Drop to M15 — here’s where structure begins to form tradeable setups

Finally zoom into M1 — this is where confirmation happens before entry

Ask yourself:

Where did the last BoS or ChoCH happen on each timeframe?

Is M15 aligning with H4 intent — or contradicting it?

Did you enter after M1 confirmation , or based on impulse?

You don’t need to predict price. You need to align with it.

🪞 Final Thought:

Structure isn’t strategy.

It’s the mirror that shows what’s real before your bias speaks.

When you master structure, you stop forcing trades — and start flowing with them.

💬 Want more like this?

If this post resonated with you — drop a comment below.

Let me know what you'd like to dive deeper into — price action, gold setups, market structure, or the psychology behind your trades.

I’ll build future tutorials based on what matters to you.

📘 Shared by @ChartIsMirror

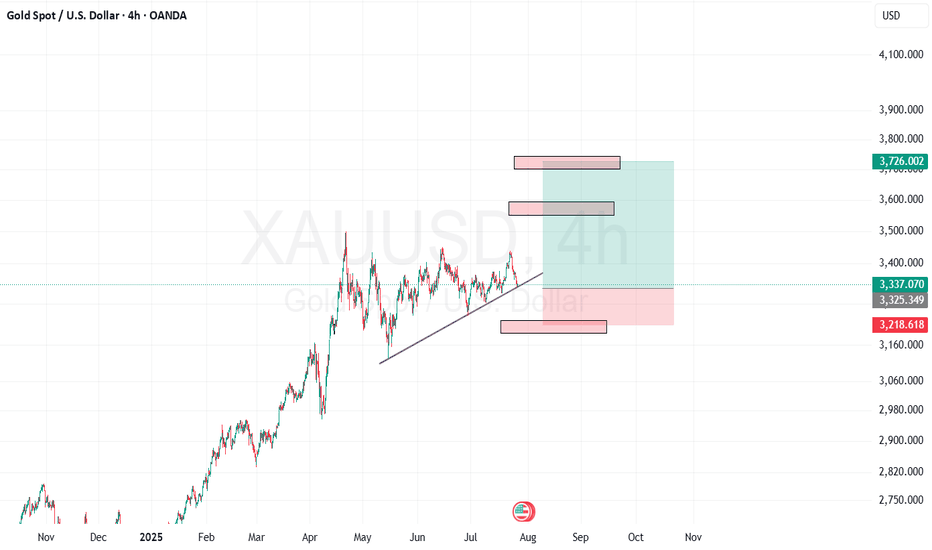

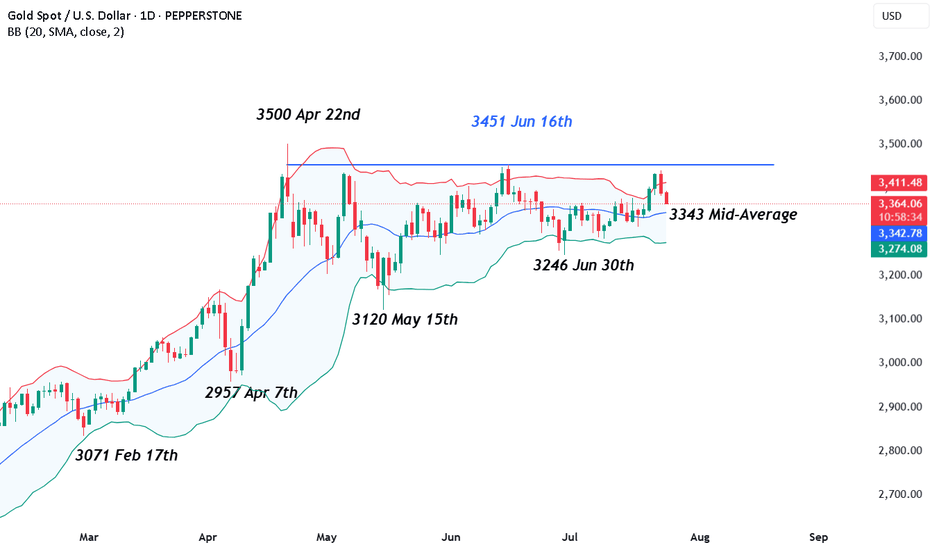

Can Gold Regain Its Recent Highs or Does a Shakeout Loom?Gold has seen its price volatility increase across the first three trading days of this week. The initial move was a 3% spike higher from opening levels at 3339 on Monday, to a one month high of 3439 early on Wednesday morning, as traders sought out Gold as a safe haven hedge against renewed political attacks on the independence of the Federal Reserve and more specifically its Chairman, Jerome Powell.

Then on Wednesday, the outlook for Gold changed again, almost instantaneously, and prices reversed their course, dropping 1.7% to touch a low of 3381 after President Trump announced a trade deal with Japan, which agreed tariffs of 15% on Japanese imports into the US, a number better than many traders and investors had anticipated. Taken alongside a Bloomberg report released on Wednesday afternoon suggesting a similar agreement could be reached with the EU using the Japan deal as a blueprint, and suddenly the need for Gold as a safe haven hedge didn’t seem quite so necessary.

However, while Gold has traded as low as 3374 this morning, prices remain around 1% higher on the week (around 3380 at time of writing 0700 BST), supported on dips by an on-going theme of dollar weakness, which has continued as risk sentiment has shifted to a more positive stance. The challenge for traders is to determine whether this will remain the case into the weekend.

Looking forward, President Trump still needs to agree any trade deal negotiated with the EU, which could be a stumbling block keeping Gold volatility elevated, as could updates on the strength of the US economy when the Preliminary PMI Surveys for July are released later today at 1445 BST. Any print below 50 = economic contraction, while any print above 50 = economic expansion, and the direction of service activity in the US economy may be what draws the most headlines, especially if it moves back to the downside.

The failure of Gold ahead of the June high at 3451 may also be potentially important from a technical perspective and this is discussed further below.

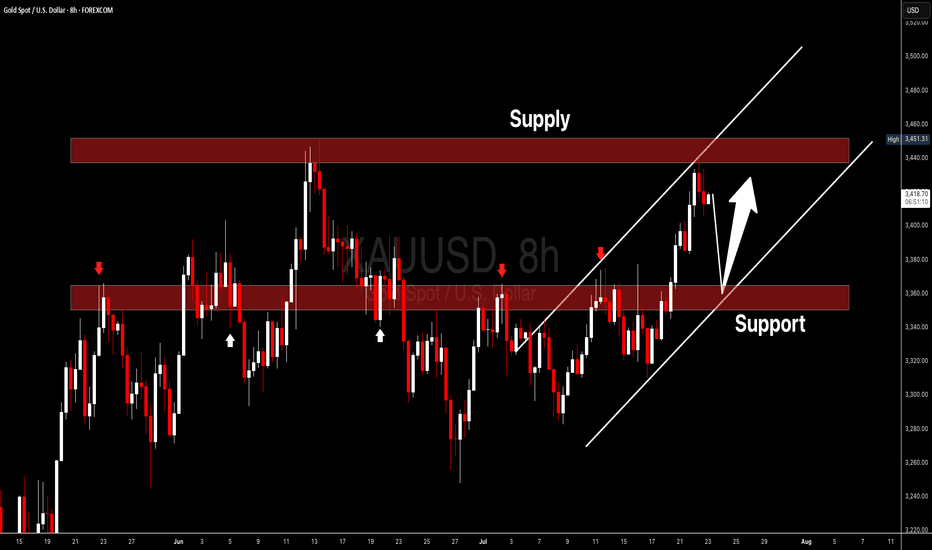

Technical Update: 3451 June Highs In Focus

Having previously encountered selling pressure leading to price weakness after being capped at the June 16th high of 3451, this level remains a potential resistance focus for traders. These themes may also have been strengthened after Wednesday’s failure below this level (the session high was 3439), which has prompted the latest downside price activity, as the chart below shows.

This activity may see traders question the sustainability of the recent price strength, even looking for fresh price declines. With this in mind, let’s consider what support or resistance levels could be monitored to help establish the direction of the next possible price move.

Possible Support Levels:

The first support level if price declines are seen over the balance of the week may be marked by 3343, which is equal to the Bollinger mid-average.

Closing breaks under the 3343 support, while not a guarantee of a more extended phase of price weakness, might then open potential for a move towards 3246, the June 30th session low.

Possible Resistance Levels:

As we have suggested, it’s possible the 3451 June 16th session high represents the first resistance focus for traders, if attempts at price strength are again seen.

However, closing breaks above 3451 may be required to suggest the potential of a more extended phase of price strength to challenge the 3500 April 22nd all-time high and possibly further if this is broken on a closing basis.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

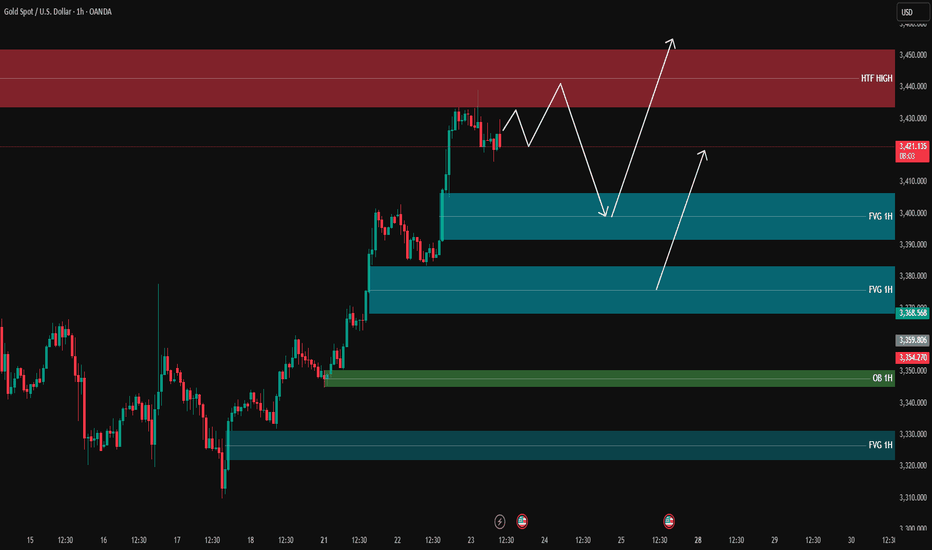

XAUUSD analysis - 1H FVG and OB setupsOn the 1H timeframe, price is reacting as it approaches the HTF high zone (3430-3450) and is currently pulling back.

The 1H FVG zones at:

🔹 3400

🔹 3368

and the 1H OB around 3350 are key areas we are watching for potential long entries.

📌 Plan:

We will wait for price to pull back into one of these 1H FVG/OB zones and look for entry confirmations on the 5M or 3M timeframe to go long.

🎯 Targets: 3430 – 3440 – 3450

❌ No sell setup for now unless a clear structure break happens.

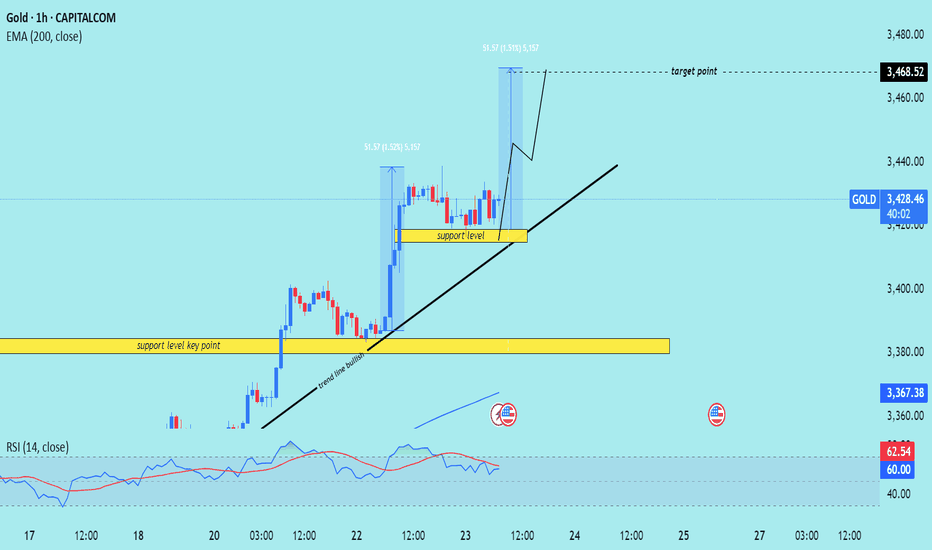

XAU/USD) Bullish trend analysis Read The captionSMC Trading point update

Technical analysis of Gold (XAU/USD) on the 1-hour timeframe. Here's a breakdown of the key trading

---

Technical Overview

Price: $3,428.71 (currently near the upper consolidation)

EMA 200: Around $3,367.38 (well below price, indicating strong uptrend)

Target Point: $3,468.52

Indicators:

RSI (14): 60.19–62.55 → shows moderate bullish momentum, not yet overbought.

---

Key Technical Elements

1. Bullish Breakout Structure:

Price has broken out of a previous range, and is forming a bullish flag or rectangle, which typically leads to continuation higher.

Measured move projection from previous leg (approx. $51.57 gain) targets the $3,468.52 level.

2. Strong Support Zones:

Two yellow zones highlighted:

Upper support level (around $3,415): acting as immediate structure support.

Lower key support (around $3,380): crucial structure level from where the trend initiated.

3. Trend Line Support:

A clearly marked ascending trend line supporting higher lows—indicating bulls are in control.

Expect price to stay above this trend line to maintain bullish bias.

4. Volume & RSI Confirmation:

RSI remains in a bullish zone but isn’t overbought → leaves room for upside.

Volume remains steady, confirming healthy consolidation.

Mr SMC Trading point

---

Conclusion & Trade Idea

Bias: Bullish

Entry Zone: On breakout or retest of minor support ($3,415–$3,420)

Stop Loss: Below trendline or below $3,415

Target: $3,468.52

Confirmation: Hold above trendline + RSI staying above 50

This is a classic bullish continuation setup supported by structure, RSI, and trend momentum. Traders could look for buying opportunities on minor dips or trendline retests.

---

Please support boost 🚀 this analysis)