Is the End of an Era for Tupperware?The iconic Tupperware brand, once a household staple, has recently faced a significant setback with its declaration of bankruptcy. This unexpected turn of events has sparked a deep dive into the factors contributing to its financial decline and the potential avenues for its revival.

A closer examination reveals that the changing consumer landscape, rising costs, and the shift toward digital commerce have played pivotal roles in Tupperware's struggles. However, amidst these challenges, there also lie opportunities for innovation and reinvention.

To navigate this critical juncture, Tupperware must prioritize product innovation, brand revitalization, and digital transformation. By developing sustainable alternatives, reconnecting with its heritage, and embracing emerging technologies, the company can potentially overcome its current challenges and secure a prosperous future.

The bankruptcy of Tupperware serves as a poignant reminder of the ever-evolving business landscape and the importance of adaptability in the face of adversity. As the company grapples with its future, the question remains: Can Tupperware reinvent itself and reclaim its position as a leading brand in the food storage industry?

TUP trade ideas

Tupperware Brand Faces Bankruptcy Amid Mounting DebtOnce a symbol of suburban independence and a household name in food storage, Tupperware Brands Corporation is teetering on the edge of bankruptcy. According to reports from Bloomberg News, the iconic company is preparing to file for Chapter 11 as early as this week, after breaching the terms of its debt agreements. The development has sparked shockwaves across the business community, marking a critical turning point for a brand that shaped post-war American culture and defined the way millions stored their food.

A Legacy Stretched Thin

Founded in 1946 by chemist Earl Tupper, Tupperware revolutionized the way people thought about food storage with its airtight plastic containers. Its products quickly gained a cult following in the 1950s, bolstered by the rise of "Tupperware parties" – home gatherings where suburban women could sell products and earn financial independence. The brand became synonymous with empowerment, entrepreneurship, and the idea that women could manage both their homes and their finances.

Yet, over recent years, Tupperware's legacy has been tested by changing consumer habits and evolving market landscapes. The COVID-19 pandemic initially revived sales as families cooked more and relied on leftover storage while staying home. However, the post-pandemic era has exposed deeper challenges within the company, as recent quarters saw significant declines in sales.

Financial Struggles and Bankruptcy Preparations

Tupperware’s financial woes run deep. Struggling with more than $700 million in debt, the company has been in extended negotiations with its lenders. Despite receiving temporary relief, Tupperware’s downward spiral continued, prompting the current push for court protection. According to insiders, the company has enlisted legal and financial advisers to navigate this difficult phase, with bankruptcy preparations potentially offering the company a path to restructuring.

The warning signs have been clear for some time. In March 2024, Tupperware issued a stark message, raising doubts about its ability to remain a viable business. This year, it closed its only U.S. factory and laid off nearly 150 employees in an effort to stem its losses. Leadership shake-ups, including the replacement of CEO Miguel Fernandez with Laurie Ann Goldman, have done little to prevent the company's financial deterioration.

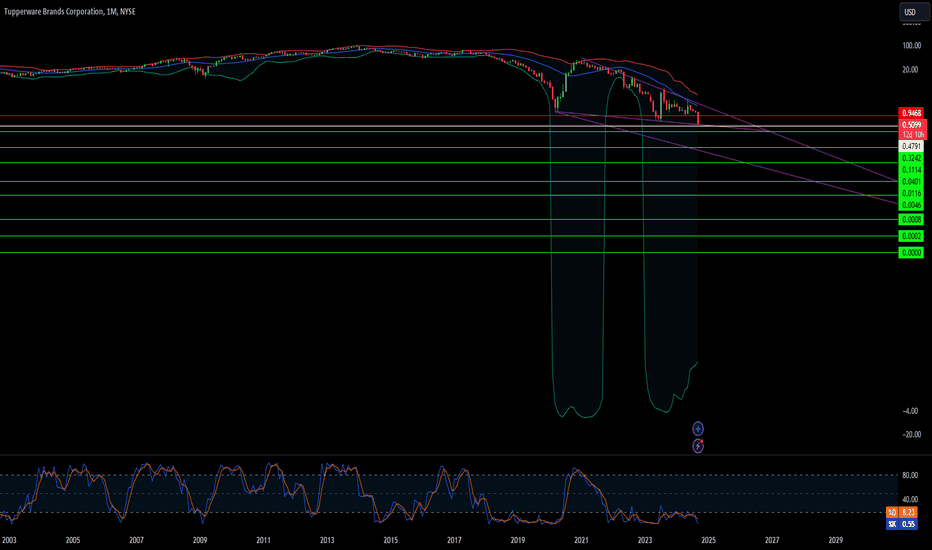

Stock Price Collapse

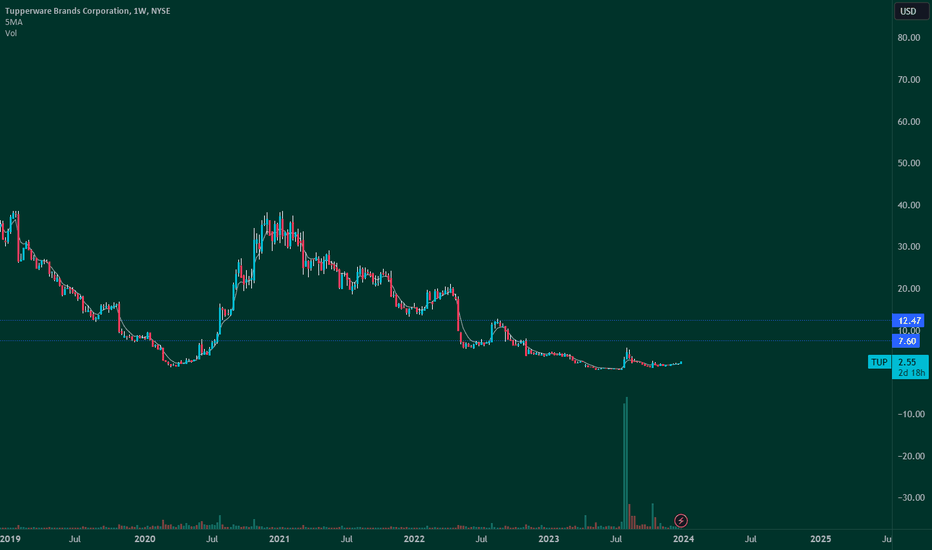

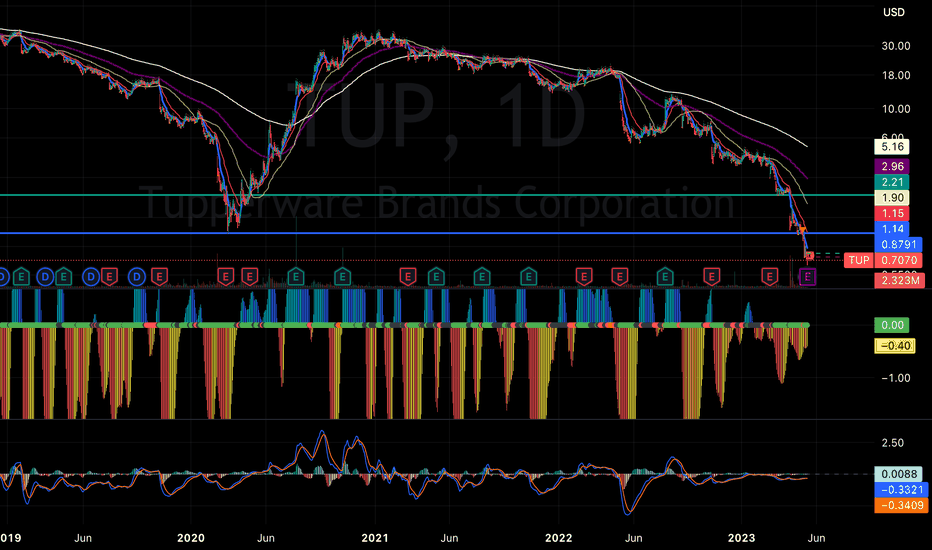

The market reacted swiftly to the news, sending Tupperware's stock into a freefall. The company's shares plunged 57% in regular trading on Monday and dropped another 15% after hours, trading at just 43 cents. With an RSI of 30, the stock is now considered deeply oversold, suggesting that investors are fleeing in the face of further declines.

Technical indicators show a sharp, downward trend in Tupperware's price action, which points to further downside. The company's stock has been in a steady decline for months, and with bankruptcy on the horizon, it's unclear how far it may fall.

The End of an Era?

For nearly 80 years, Tupperware (NYSE: NYSE:TUP ) has relied heavily on a direct sales model, using an independent army of more than 300,000 salespeople to distribute its products. But this business model, which once thrived, now seems outdated in the age of e-commerce and changing consumer behavior.

Tupperware’s future is uncertain. With bankruptcy looming and no clear turnaround in sight, the company faces the stark reality of its long, storied history potentially coming to a close. Despite efforts to modernize and revitalize the brand, its debt load and declining sales have proven too much to overcome.

For a generation of consumers who grew up on Tupperware (NYSE: NYSE:TUP ), this moment marks the potential end of an era. Whether the brand will emerge from bankruptcy and continue as a leaner, more focused company remains to be seen. What is clear, however, is that Tupperware’s storied legacy is at a critical juncture, one that may reshape the future of this once-dominant household name.

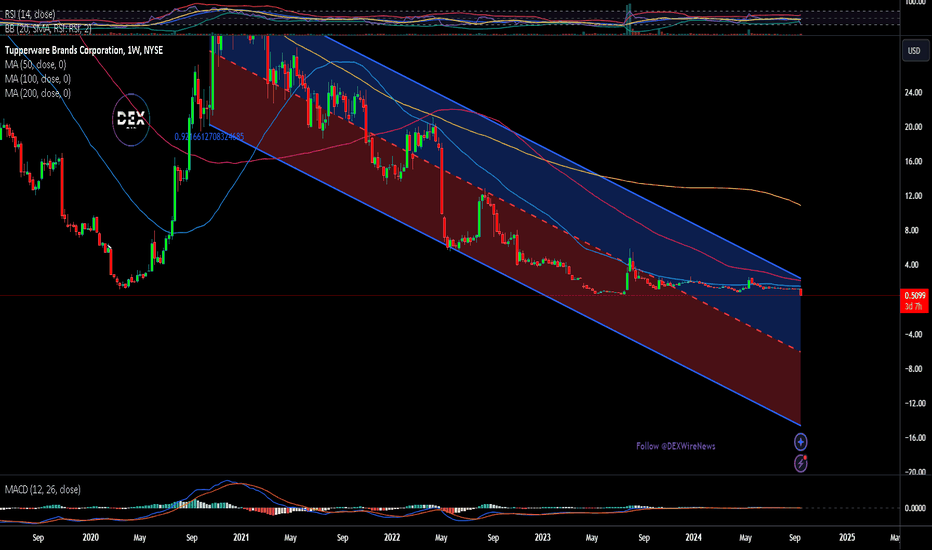

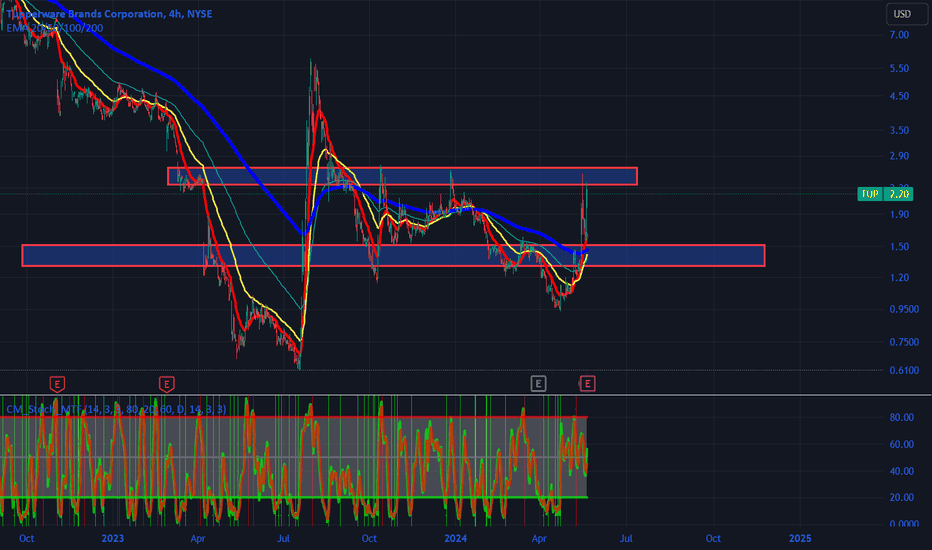

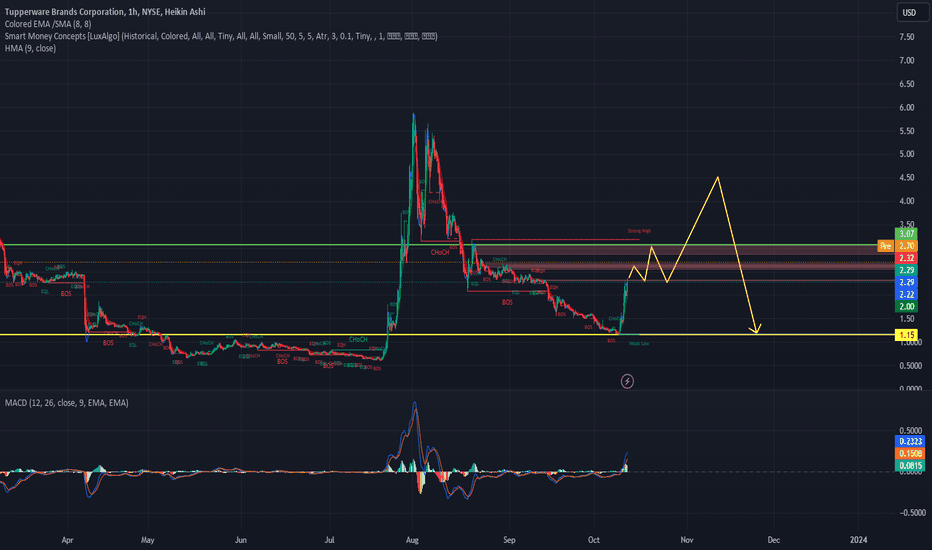

TUP | Tupperware idea | Key levelsTUP | Tupperware idea | Key levels

Tupperware NYSE:TUP

standing at a important breakout point , breakout an retesting of trendline expected ahead

good to buy if Day closing/opening stay above $2.84

$3.6-3.8/5.98 nearest tgt before TP 2.5/TP5

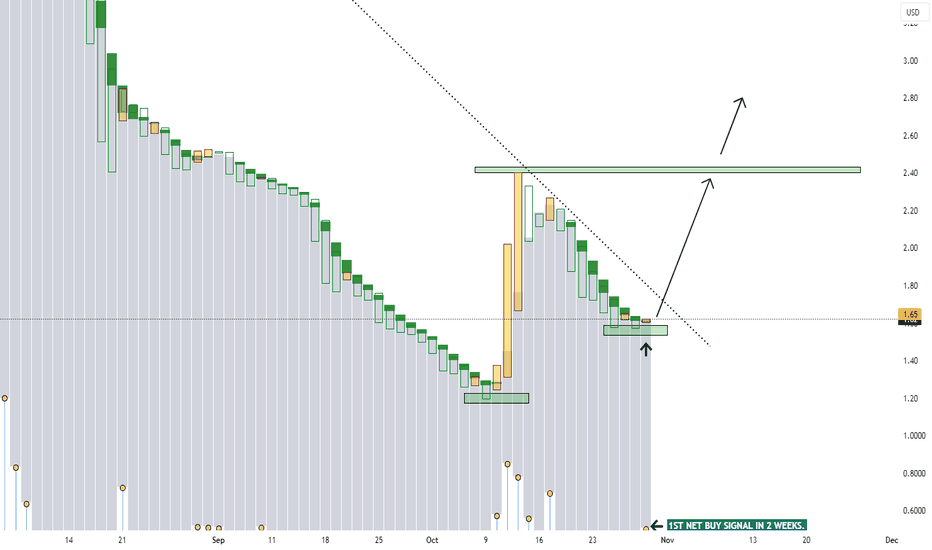

TUP, swing play ready at 1.60 range... see you 'up' there.A swing play in order....

The important daily shift.

Daily higher lows.

1st net buy volume signal in 2 weeks.

Spotted at 1.60

Watchout for 2.4, if this breaks wild movement ahead favoring bulls.

TAYOR.

Safeguard funds always.

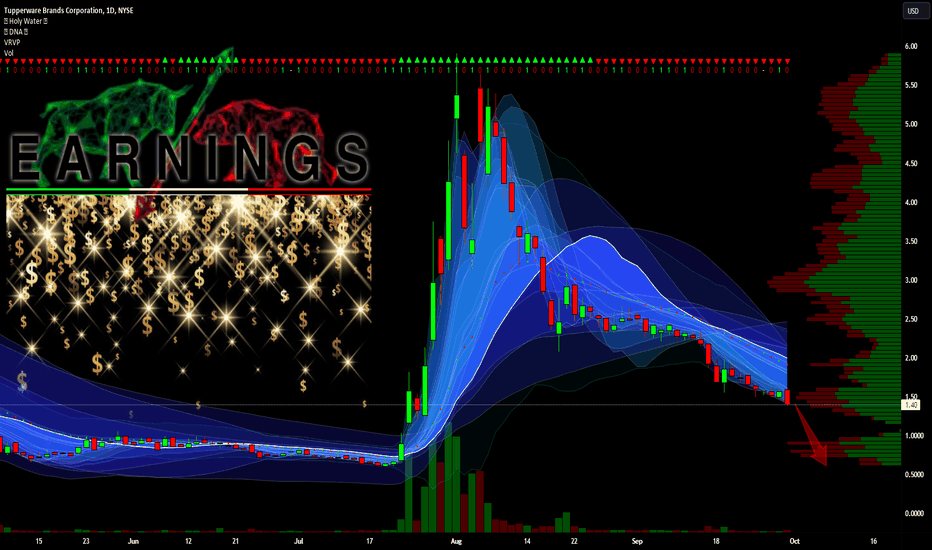

tupperware earnings beatso tupper is looking strong but maybe overbought at rthis point it is facing heavy resistance so i am undecided as to wheather or not im feeling a put or just wait in seee either way ive added this to my watch list

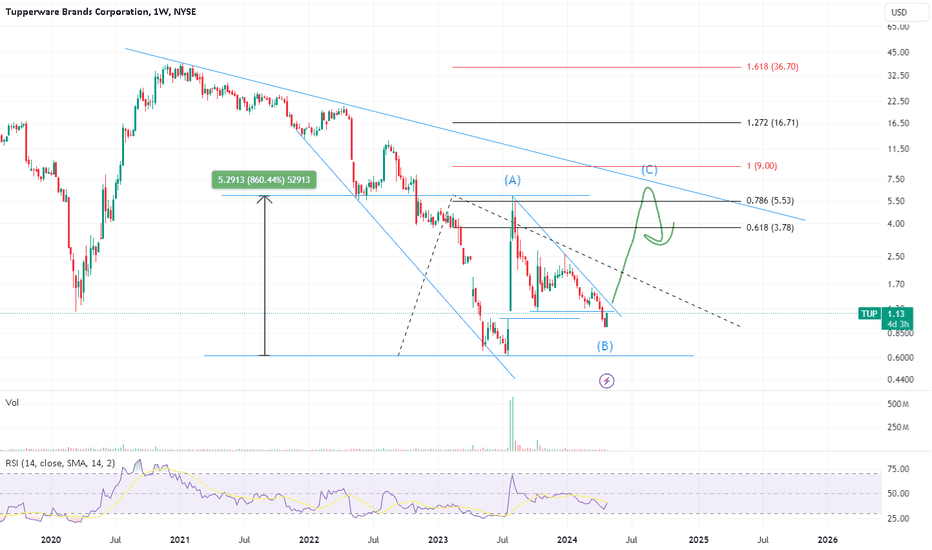

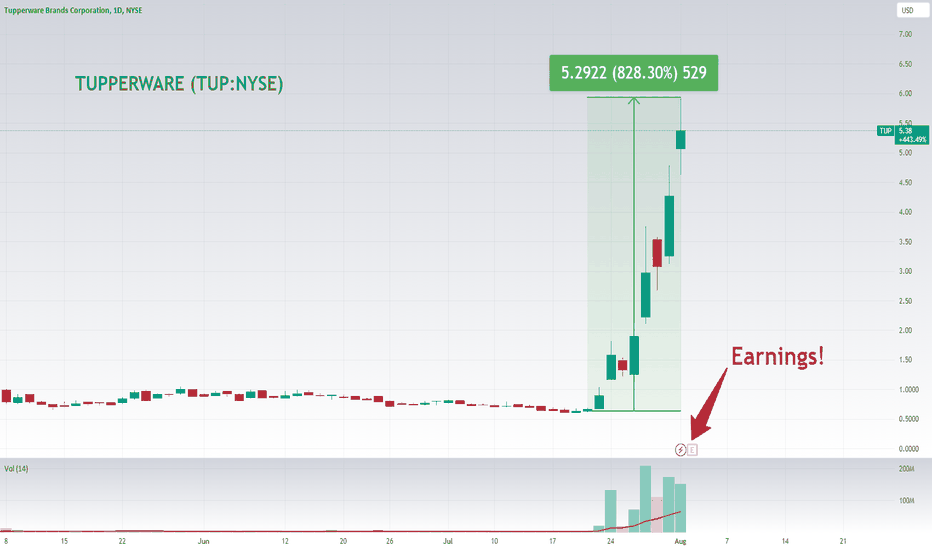

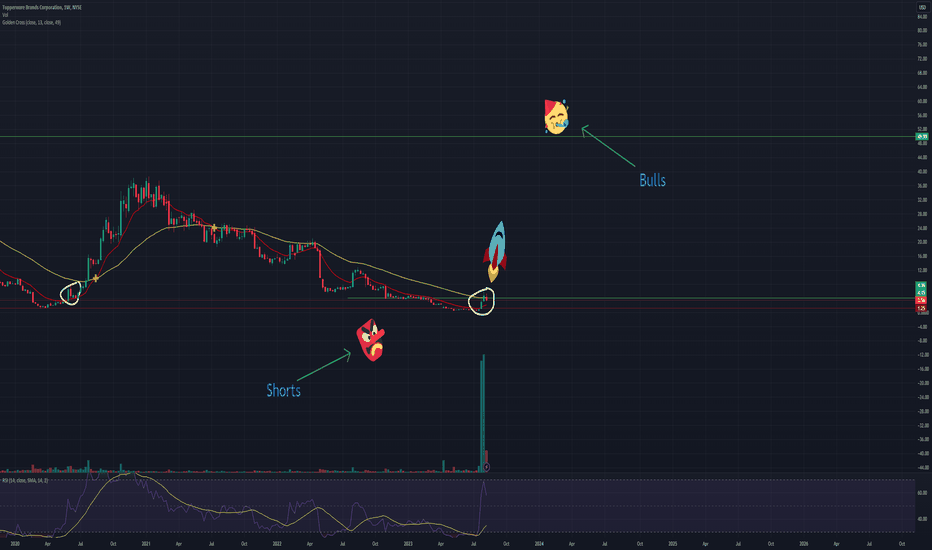

8x again for TUP?TUP bounced nicely today - may be the start of another leg up to soar the stock 8x?

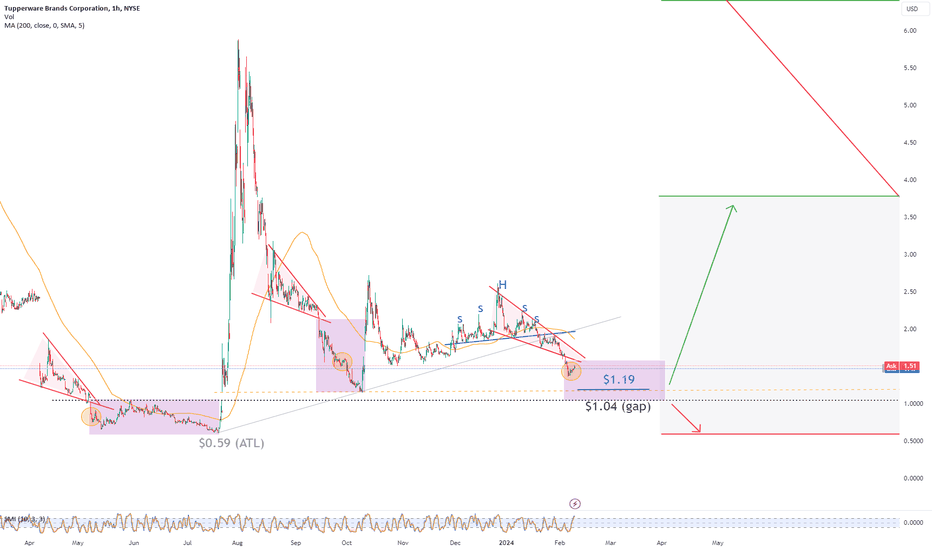

TUP long entries trying long in the $1.19 to $1.04 range in case patterns repeat, risks: they do not deliver on their deadlines, no earnigs, delisting, bankruptcy, etc.

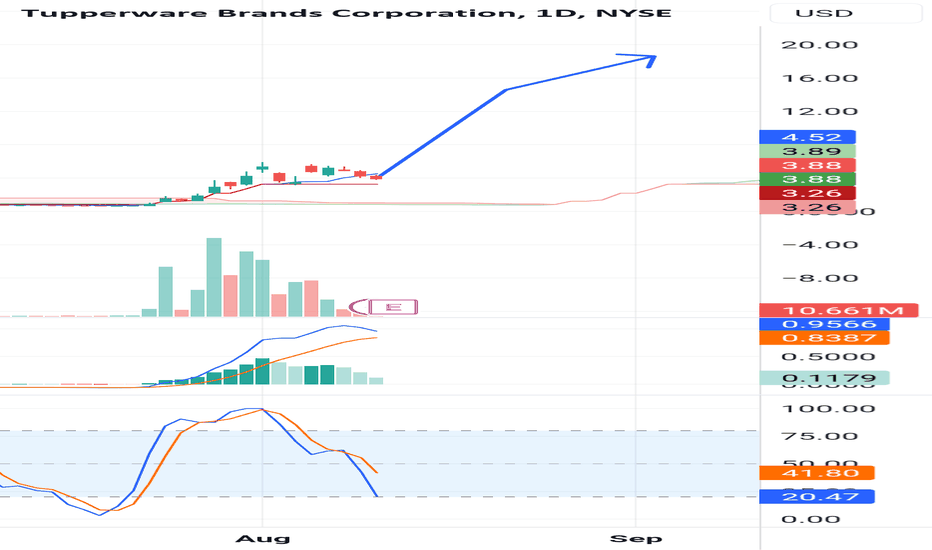

Alright... All set for 7.50?Looks like it wants to hit 7.50 where it can meet its first resistance. If it holds 7.50 and break above it, then next target is 12. Huge volume recently and chart looks bullish, oversold, formed a bottom and looks like a U-shaped recovery.

Memestock: Earnings Tomorrow!Tupperware has been threatening to go bust for months so of course the WallStreetBets crew have been piling in nuking all the short sellers and creating an 800% run over the last few days.

With earnings out tomorrow this could end in disaster. It's not one I would trade, but could be an interesting short if you were prepared for your money to go to zero rather than hero.

Will be interesting to see what happens over the next few days.

Gap to FillTupperware is consolidating and trying to build a bounce here. I see a gap to fill back to the upside. It's been trying to head back up but the market has been down lately. In time, it should fill all the orders between the blue line and the green line. Which should give a nice up move.

Tupperware Brands Corporation TARGET $3.00 [KaliGhazii]Meme stock Tupperware Brands (TUP) is struggling, but it isn’t dead yet.

The company has been granted an extension to regain compliance with the NYSE.

Shares are up today, but this doesn’t guarantee that its growth will continue.

Tupperware Brands Corp (NYSE:TUP) stock is having its best day in months. The company known for producing kitchen storage containers has been struggling lately. The meme stock momentum that pushed it to noteworthy highs in July 2023 has since run out. But TUP stock may have been granted the lifeline it needs to continue trading on the New York Stock Exchange.

In June 2023, Tupperware received a non-compliance notice from the NYSE, which cited its inability to trade above $1 per share for 30 consecutive days. The company filed for an extension to regain compliance, and this month, they received it. In an 8-K filing dated Oct. 3, Tupperware reported that it had been granted the requested extension.

Earnings JournalAT A GLANCE

Simplistic Analysis: sell wave to the floor.

Trade Type: Sell & Hold wait for a close.

Research Depth: technical glance only.

Earnings Anticipations: negative surprise for EPS, positive surprise for Revenues.

Surprise-confidence on a scale of 0-5: 2

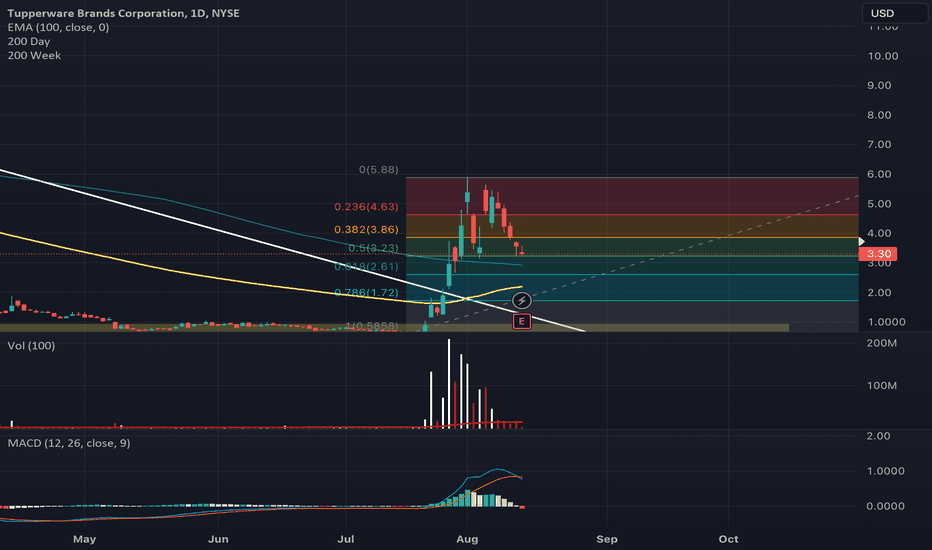

TUP UP?After a pullback of 50% from the top, the fibonacci indicator could be our best friend. Let's see if the market will agree.

Tup short squeeze The real squeeze has not yet begun. Grabbed some on dip friday back to 5 + this week?

$TUP Tupperware is aiming for $20Tupperware is on a beautiful journey towards $20 and will get there in a few weeks....

TUP Long over 3.7Volume has picked up and trend established. Going long over 3.7. Holding until around marked profit target.

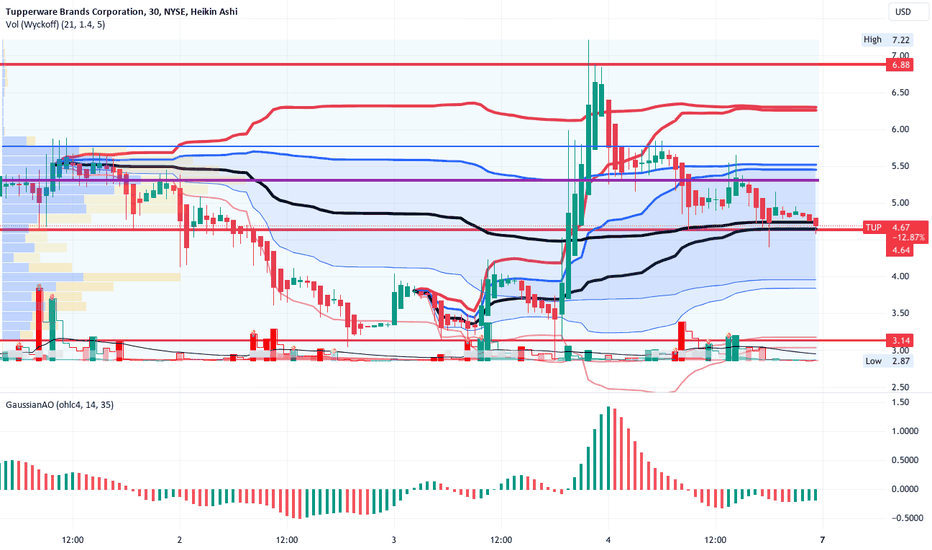

TUP the newest meme fundamentally dead LONGTUP on the 30-minute chart has some decent technicals. Based on anchored

VWAPs one set for 8/1 and another 8/3, TUP has pulled back into solid support

at the two mean VWAP lines. Volume has been steady. It is in the middle of the

fair value zone and under the POC line of the volume profile. Analysis of that

profile is that price should seek the POC as if a magnet. there is could be

pushed up or repelled down depending of the relativity of the dynamic of

buying and selling pressures interplay in that zone. I see TUP as having 20% upside

for sure on the retracement of the trend down. An additional leg up and over the

POC line is possible or even probable but not a certainty.

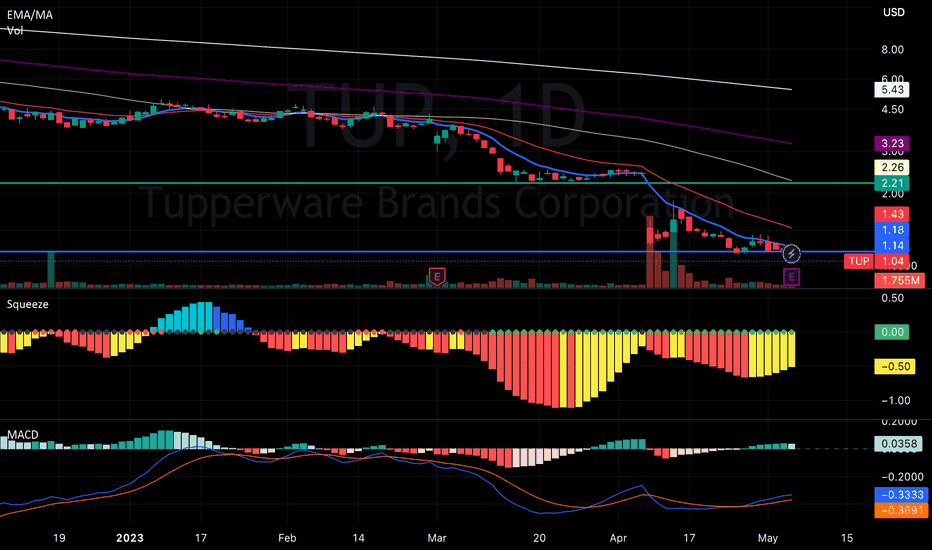

TUP Hitting Bottom?Looks like NYSE:TUP broke through a major support. Earnings are on May 15th. This company has a nice gap to fill but, I'm still waiting for a couple days of stabilization in price. This is a speculative stock but, once it turns around. There should be a nice return on this if, the company does do something crazy.

$TUP An American Icon In RuinsGoing short on Tupperware Brands Corporation (NYSE: TUP) may at first seem absurd given the stock’s recent 428% run, however, due to the company’s current circumstances a short play could be viable for multiple reasons. TUP’s sales have dwindled significantly since the pandemic due to its lack of adaptability. Additionally, the company is late in filing its earnings reports which could lead to delisting and the stock plummeting. Having said that, TUP has nearly $700 million in long-term debt and leasing obligations that it needs to pay to avoid bankruptcy. Given the company’s failing business model, it may be unlikely for the company to pay off its debt and instead seek relief by filing for bankruptcy. For these reasons, shorting TUP stock may prove to be profitable for investors.

TUP Fundamentals

At first glance, TUP may seem like a solid investment due to the iconic nature of its products and its rich 70-year history. Be that as it may, despite its past resiliency the company is exhibiting undisputable signs of decay, chief among them, is that it has not filed its 2022 annual report or its Q1 2023 report yet – making its Q3 2022 report its latest financial report. In that report, the company witnessed a drastic YoY plunge in sales from $376.9 million to $302.8 million due to outdated business practices and pricing issues.

Since then, TUP has negotiated an amended credit agreement that alleviates debt in order to navigate through its going concern status and has resorted to liquidating real estate properties to raise capital. That being said, TUB forecasts that it will have insufficient liquidity to pay off its interest payments in July which is an extremely bearish indication for the company since it hints at the possibility of bankruptcy.

Archaic Sales & Outrageous Prices

How did TUP end up in this position? Well, there are two overarching reasons. The first is the fact that TUP’s business model is outdated which resulted in insufficient marketing and subpar distribution. TUP’s archaic retail model does not rely on stores, instead, it relies on a direct sales force that resorts to tactics like throwing Tupperware parties. Recently, TUP started leaning on big wig retailers like Target, however, it was too late by then, which is why it only generates 1-2% of its revenue from these retailers.

It is worth mentioning that TUP has started to put more effort into selling its products online, however, it may be too late for the brand to recover. Decades of outdated business practices have taken a toll on the brand’s visibility and its online presence does not solve its second overarching problem, which is its pricing.

As things stand, most of TUP’s products are priced between $20-$40, with some products reaching prices as high as $80 and $100. Currently, plastic containers are a dime a dozen. Why pay $20 for a container when one can just go to a dollar store to get one for little more than a dollar? It is also worth noting that exporting Tupperware would amplify this pricing issue which means that entering foreign markets may be out of the question for TUP. All in all, in order for TUP to efficiently sell its products it will have to drastically lower its prices and overhaul its business model to compete in the market.

Counter Measures & Pending Calamity

In an effort to minimize its losses, TUP sold its central properties in central Florida and placed a sale-leaseback agreement on its headquarters to obtain liquidity back in 2021. That said, the company was not able to turn itself around since then which is indicated by TUP’s report in which it predicted material losses in revenue.

TUP stated that its Q1 revenue is expected to be around $280–$290 million. In an attempt to manage its declining health, the company signed on investment bank Moelis & Co LLC to explore strategic alternatives. Given this information, bankruptcy is a likely scenario for TUP, especially since it has $687.8 million in long-term debt and lease obligations, six times more than its $102.9 million cash balance.

A compounding factor in this assessment is TUP’s amended credit agreement. The agreement does have its benefits since it increased its leverage ratio which is a ratio that contrasts debt to a company’s assets. It is calculated by putting debt over assets -Debt/Assets. The agreement increased the company’s permitted leverage ratio to 5.25% in Q4 2022. This was critical since TUP’s Q4 leverage ratio was 4.9%, which is a clear violation of the previous agreement’s 4.25% maximum.

Despite that, the deal is extremely harmful to TUP since it shortened the debt’s maturity date from November 23, 2025, to July 31, 2025, and increased interest payments. The increase in interest payments relates to SOFR which is the cost to borrow cash overnight collateralized by the U.S Treasury securities. This means that as interest rates increase, so do TUP’s interest payments.

Under the old agreement, TUP was set to pay a SOFR rate of +2.75%. Meanwhile, the new agreement stipulates that the company will pay a SOFR rate of +6.25% in 2023 and the SOFR rate will further increase to +7.5% in 2024 and +8% in 2025.

In short, the deal is set to permit TUP to finance itself with more debt in exchange for a shortened maturity date and increased interest rate. Its current fiscal trajectory is unsustainable which is why if TUP continues down its current path, the company might implode.

The Filing Dilemma

Another issue that TUP stock faces is a possible delisting because of NYSE guideline violations due to issues filing its 2022 annual report and its Q1 2023 report. Generally, filing deadline regulations indicate that a 10-K must be submitted 90 days after the end of its fiscal year and a 10-Q must be submitted 60 days after the end of its quarter. As things stand, TUP has not filed its 10-K which was due on April 1, 2023.

Additionally, it has not filed its Q1 2023 report which was due on May 30th. Currently, the company intends to file its 2022 annual report in August 2023 and its Q1 2023 report in September. However, it is important to note that the company had violated its previous filing deadlines. If TUP violates its own deadline again, the stock could potentially be delisted and end up as an OTC stock which will likely cause the stock’s PPS to plummet.

Risks

As things stand, TUP stock has a low float of 44 million shares and is heavily shorted with short interest at 29% and 31.4% of its float on loan. With utilization rate extremely high at 100%, TUP stock is likely to witness short squeezes as shown by its recent run which makes shorting the stock a risky decision. For this reason, investors shorting the stock should set stop losses to mitigate the risk of short squeezes occurring.

TUP Financials

According to its Q3 2022 report, TUP experienced a significant decrease in its assets from $1.25 billion in Q4 2021 to $1.05 billion due to its cash balance decreasing from $267.2 million to $102.9 million during the same period. This decline in its cash balance is likely due to the company paying off a portion of its long-term debt, leasing obligations, and current liabilities which decreased from $555 million to $374 million over the same period. Having said that, total liabilities declined from $1.4 billion to $1.2 billion as a result of the decrease in current liabilities.

Due to the aforementioned issues regarding sales and pricing, TUP experienced a devastating YoY decrease in revenue from $376.9 million to $302.8 million. Meanwhile, its operating costs declined from $190.7 million to $175.6 million most likely due to rightsizing. In this way, the company's net loss of $86.1 million in Q3 2021 turned into a net income of $16.8 million in Q3 2022.

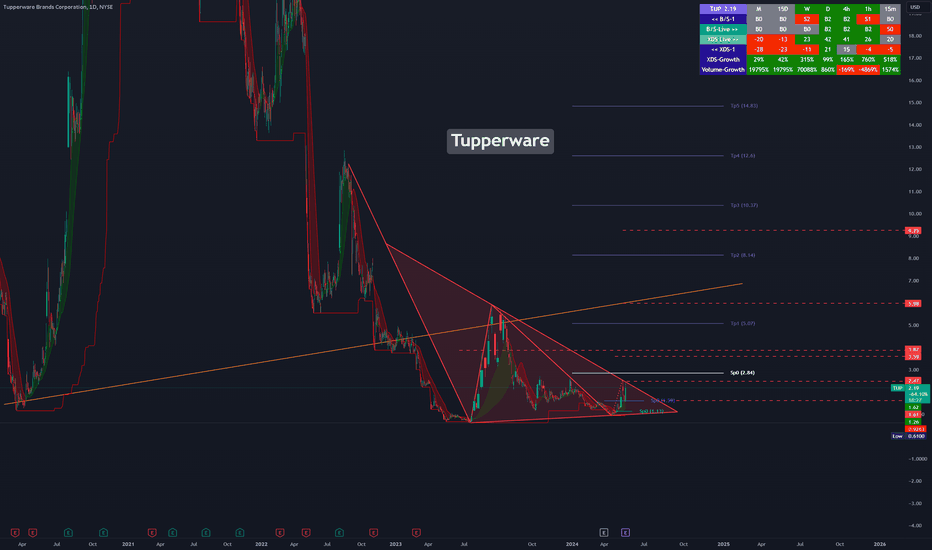

Technical Analysis

TUP stock is in a neutral trend and is trading in a sideways channel between its support at $2.53 and its resistance at $3.73. Looking at the indicators the stock is trading above the 200, 50, and 21 MAs which is a bullish indication. Meanwhile, the RSI is overbought at 71 and the MACD recently turned bearish.

As for the fundamentals, TUP stock may be poised for a sharp drop given that it is highly likely the stock gets delisted or the company declares bankruptcy since its current cash balance is not enough to pay off July's interest payments. For this reason, taking a short position in TUP stock may prove to be a profitable decision.

With this in mind, a good entry point could be at the current PPS and take profits on retests of the 50 and 200 MAs, while leaving a tail in case the company files for Chapter 11. Meanwhile, a stop loss could be set at $3.3 since breaking above that level would indicate that there is strong buying action which could see the stock continue its run.

TUP Forecast

As is, TUP is likely to implode due to its overwhelming debt, as in its current circumstances, the company is likely incapable of paying its debt obligations. The company's revenue has constantly dwindled due to outdated business practices as well as pricing issues and it does not have enough liquidity to cover its interest payment for July. Taking all these factors into consideration the company is likely to go bankrupt which makes shorting TUP stock a potentially profitable decision.

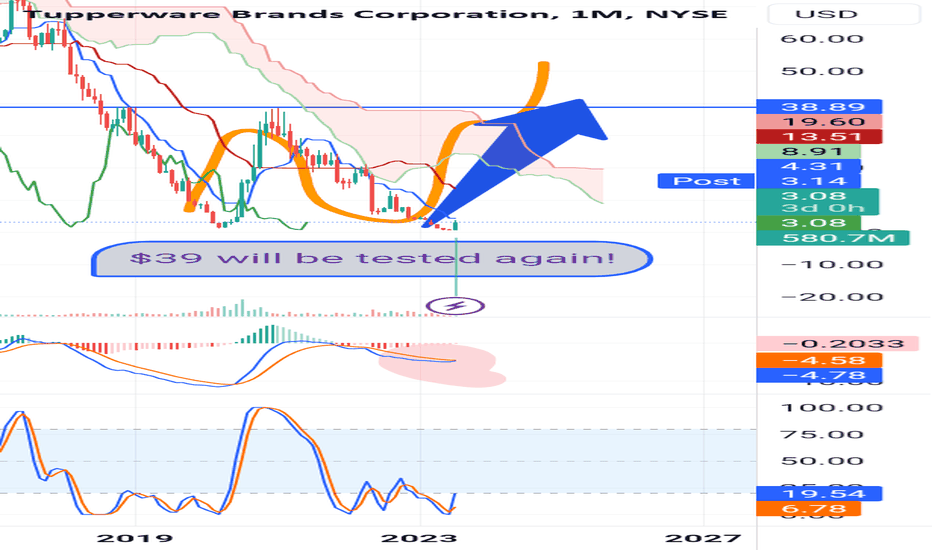

$TUP $39?NYSE:TUP Is now in the center of attention. $39 can be tested again during this rally. Blackrock news and company's restructuring are the price motives.

Good luck guys

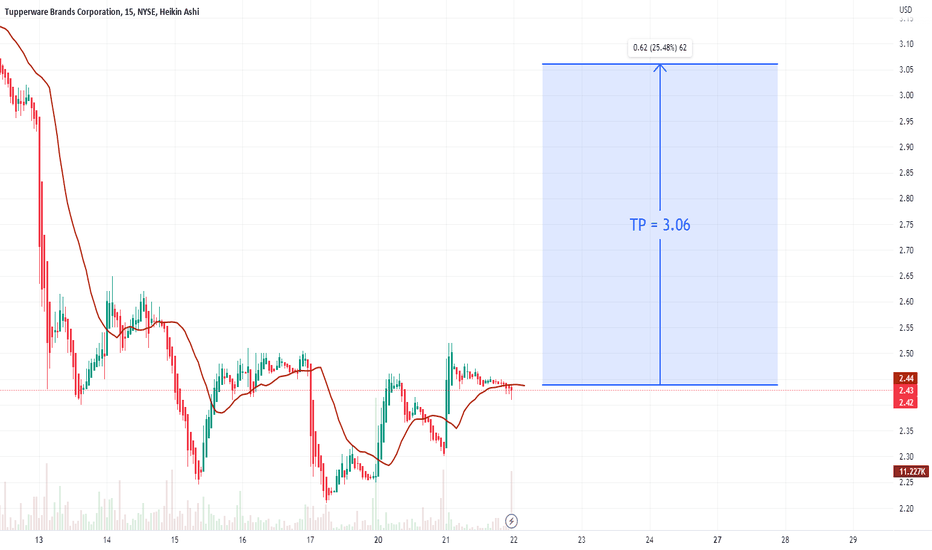

TUP (Tupperware Brands) , TF M15 LONG.On the 15-minute chart a new trend has begun.

The channel on the chart is clearly not complete.

My opinion now it is possible to enter in buying. Takeprofit level is 3.06. Do not forget about the SL = 2.19

Good luck!

Regards, WeBelieveInTrading

$TUP food storage 2.0 👁🗨*This is not financial advice, so trade at your own risks*

*My team digs deep and finds stocks that are expected to perform well based off multiple confluences*

*Experienced traders understand the uphill battle in timing the market, so instead my team focuses mainly on risk management*

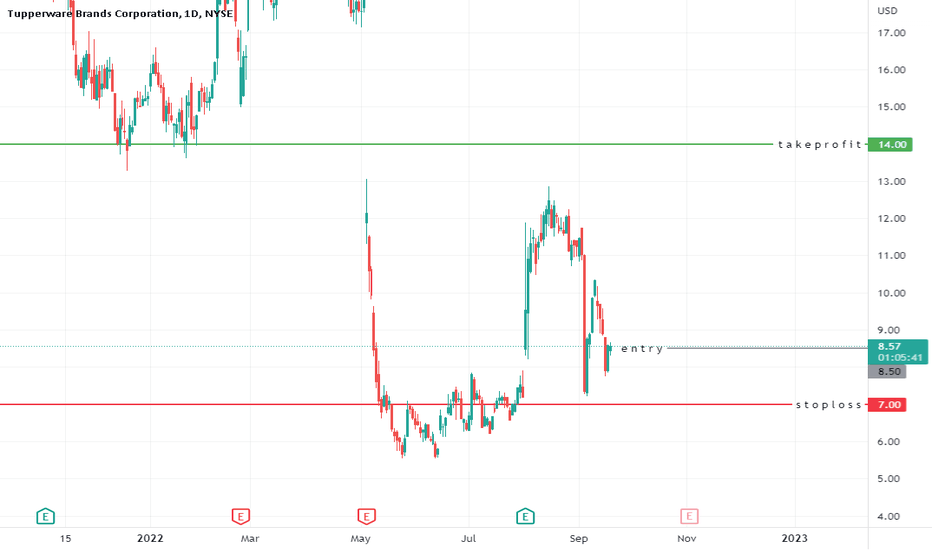

My team entered Tupperware Brands Corporation $TUP today at $8.5 per share. Our take profit is set at $14. We also have a stop loss at $7

OUR ENTRY: $8.5

TAKE PROFIT: $14

STOP LOSS: $7

If you want to see more, please like and follow us @SimplyShowMeTheMoney

$TUP food storage 👁🗨*This is not financial advice, so trade at your own risks*

*My team digs deep and finds stocks that are expected to perform well based off multiple confluences*

*Experienced traders understand the uphill battle in timing the market, so instead my team focuses mainly on risk management

My team entered Tupperware Brands Corporation $TUP today at $7 per share. Our first take profit is set at $8.50. We also have a stop loss at $6.70

OUR ENTRY: $7

FIRST TAKE PROFIT: $8.50

STOP LOSS: $6.70

If you want to see more, please like and follow us @SimplyShowMeTheMoney