TUP-BUY++This is also a share that will have the likely hood for a reasonable correction.

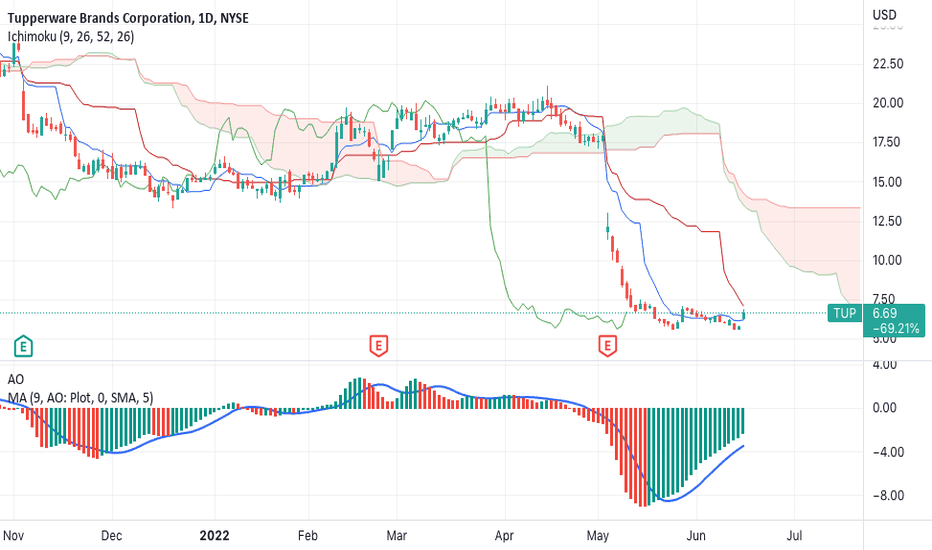

The AO is buyers mode, and as one can observe we above the MA-9 of the indicator. Further low into BB suggesting we should see minimum return $ 13-14 medium-term.

TUP trade ideas

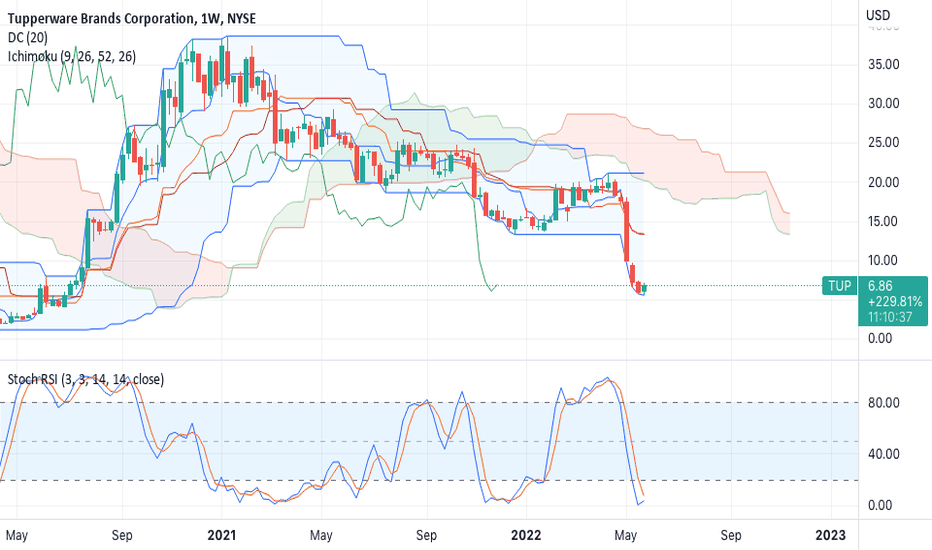

TUP-STRONG BUYThis stock is way undervalued, and a great opportunity to buy at current price of 6.50-7.00. The share price has potential to back to 15.00 and higher. we are positive stochastic (weekly) and usually a great signal and indication for what is to come.

TUP-BUY+++Such a great company and long time in existence.

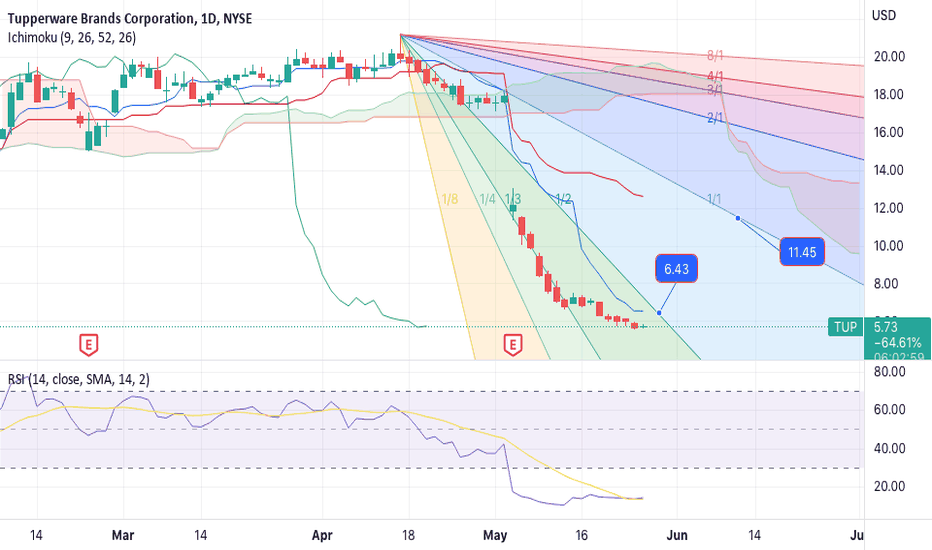

The GANN fan shows the angle of decline is too sharp. We got a resistance $ 6.50 (rounded) before we can move towards $ 11.50. Market is heavily oversold, and honestly the share is screaming for recovery.

For now we buy current @ 5.70-6.00 and take profit $ 10.80 for now.

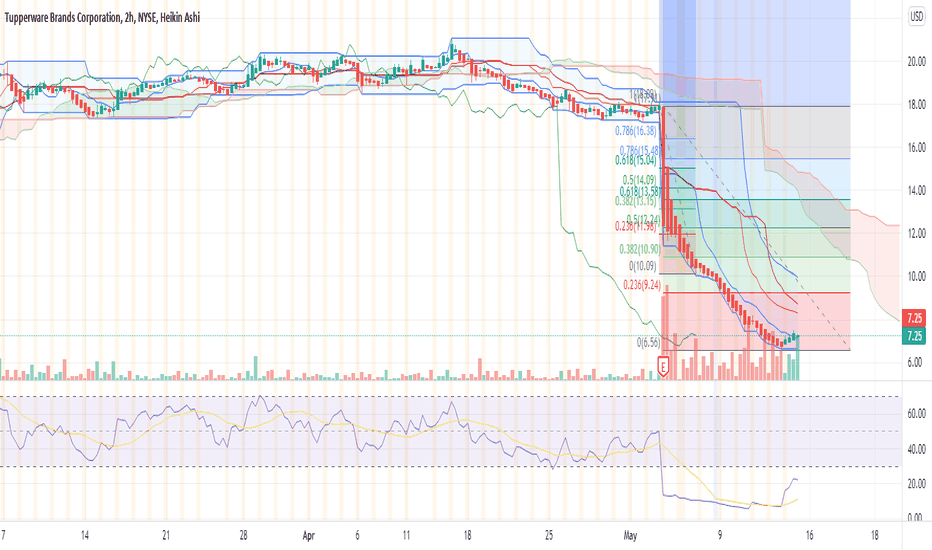

TUP wow this is way oversoldFib .618 is $13.58 should retrace to or close to this level. Definitely added more calls than I thought which is why I don't like placing order with my phone. June 17th $12.00 calls QTY too many lol

TUPPERWEAR ER miss and withdrawn guidanceMany companies are missing earnings and withdrawing guidance. I think the 35% drop is overdone, oversold on several indicators. Bought 300 June 17th $12.00 calls looking for a bounce back to $15-16 range but as always will adjust and be nimble on my targets.

TUP - Tupperware is an unconvintional position Tupperware is an unconventional trade because it has had declining revenues and is expecting declining revenue in 2022.

This trade is based on restructuring plans by the company and share buy backs as well.

Traditionally, TUP sold its products through retailer groups and an active sales force team.

In 2020, they began the restructuring plans

2020:

- Hired new management team with direct selling focus (direct to consumer and e-commerce). This includes the hiring of Miguel Fernandez, former global president of Avon products where he executed similar plans.

- Delivered $192 million in cost savings.

The company is investing in influncer, digital marketing and e-commerce. As they do this, they are able to reduce their physical presence.

Board approved a 250 million dollar share buyback program in 2021.

The stock has a short interest position of 9.11%

The stock buy back program, followed by the short squeeze is likely to produce gains over the next 2 years.

This is a turnaround play with a focus on growth and increasing cash flow year over year.

Final notes:

- Bill Miller is a well known value investor who has a track record of bearing the stock market (google him) and he has been purchasing this in July of this year.

- Bill Miller focuses on buying undervalued stocks.

- at this price level you are getting a stock considered undervalued by Miller, and you are getting it cheaper

- I do admit it is hard for me to get 'excited' about owning darned tupperwear. But maybe this is the kind of holding I need to start getting excited about.

- Turnaround present amazing opportunities.

- The short squeeze and share buy back will complement each other to create returns.

The cheaper the stock gets, whereas the fundementals are not changed or are improving, the greater the opportunity becomes.

This makes about 2.3 % of my portfolio, although I would certainly buy more should we see it come down to levels of 7-8 dollars.

Anticipated ROI

I can see 100% to 200% return over a period of lesser than 3 years. I am willing to hold this for 3 years, to see at least 100% return.

The faster I get my return, the more likely I would exit the position, and only re-enter should it come back down. For an example, if in this calendar year I see $38. I would sell it at that point.

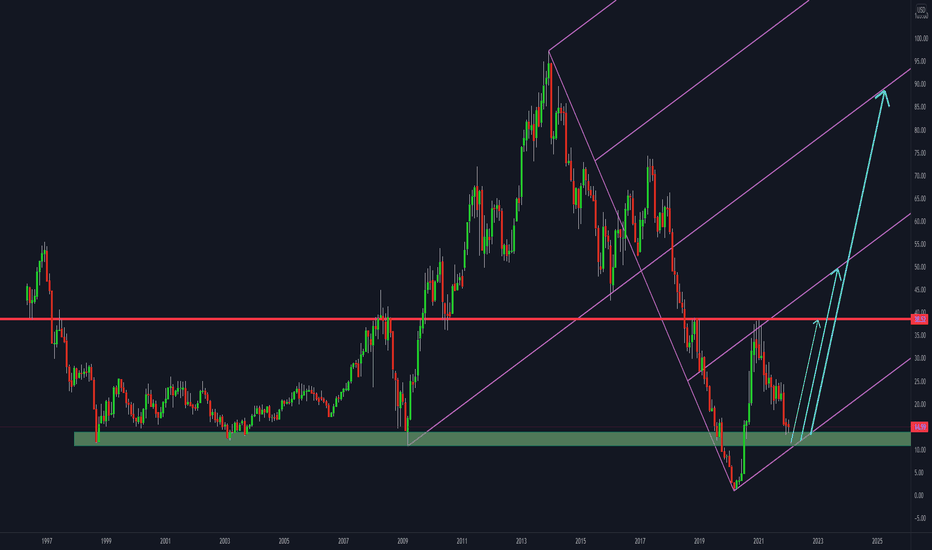

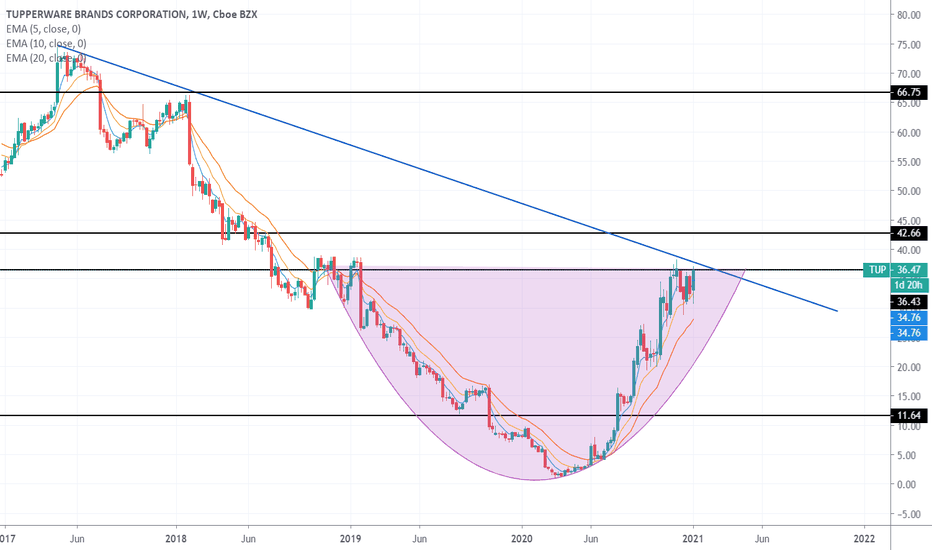

TUPPERWARE tehnical analysis monthly chartHi ! Above is my view for TUP, for long term strategy. I hope you use it. Good luck !

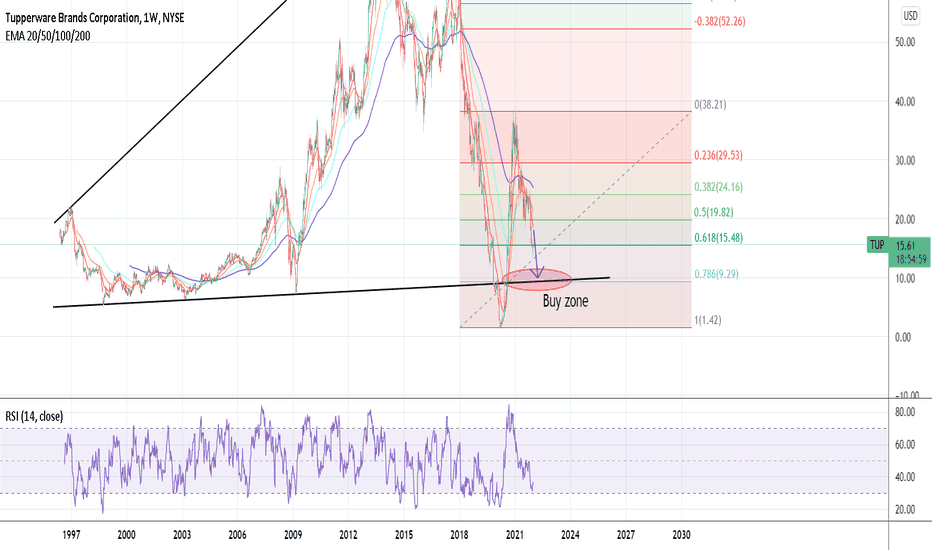

TUP shortRisky stock. 1st buy zone set at $9.29 / or 0.786 correction from March 2021 highs.

Look for more downside if that level does not hold

RSI could have one more dip to go in oversold territory under 30

Do your own DD, not financial advice

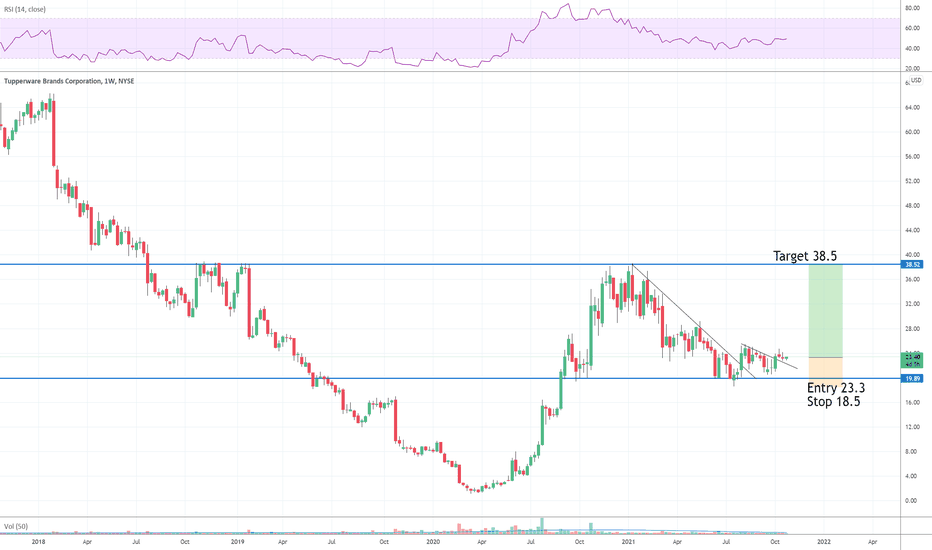

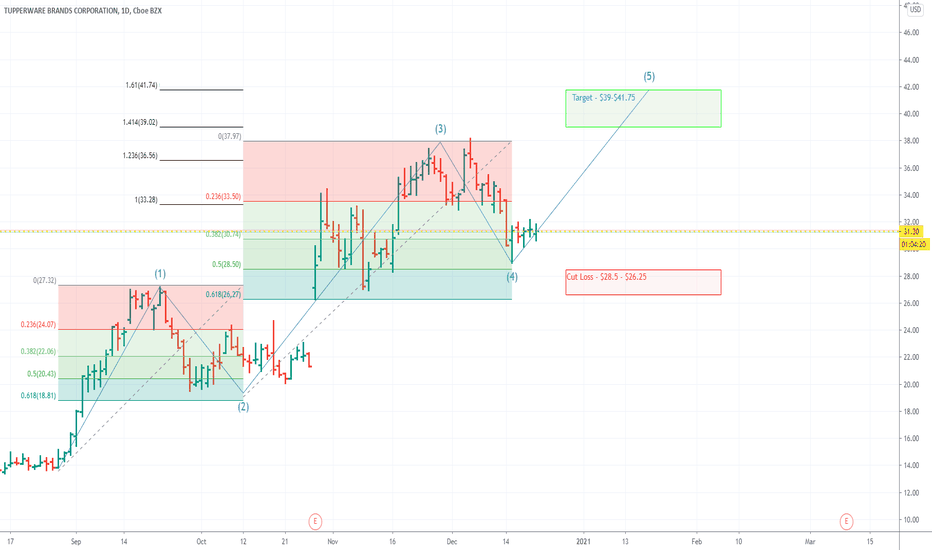

TUP LongTrendline Break + Trendline Break

At Support Zone

11/3 earning

Entry 23.3

Stop 18.5

Target 38.5

Risk management is much more important than a good entry point.

The max Risk of each plan should be less than 1% of an account.

I am not a PRO trader. I trade option to test my trading plan with small cost.

Tupperware Analysis 18.08.2021Hello Traders, here is a full analysis for this asset. The entry will be taken only, if all rules of your trading plan are satisfied.

Therefore I suggest you keep this pair on your watchlist and see if all of your rules are satisfied.

Leave your thoughts in the comment section, I will reply to every single one of them.

P.S. Tell me which asset you want me to break down next and I will cover it in my next analysis

_____________________________________________________________________________________________________________________________________________________________________

TUP ShortTook a short entry this morning on TUP with 7/16 $24p. Clear rejection at prior support (now resistance).

Tupperware Brands Corporation Announces Pre-Payment of Term LoanTUP: Tupperware Brands Corporation

2021-06-21 16:00:00

Tupperware Brands Corporation Announces Pre-Payment of Term Loan Debt And $250 Million Share Repurchase Authorization

Be like Jake *educational material*

*This is not financial advice, so trade at your own risks*

*My team digs deep and finds stocks that are expected to perform well based off multiple confluences*

*Experienced traders understand the uphill battle in timing the market, so instead my team focuses mainly on risk management*

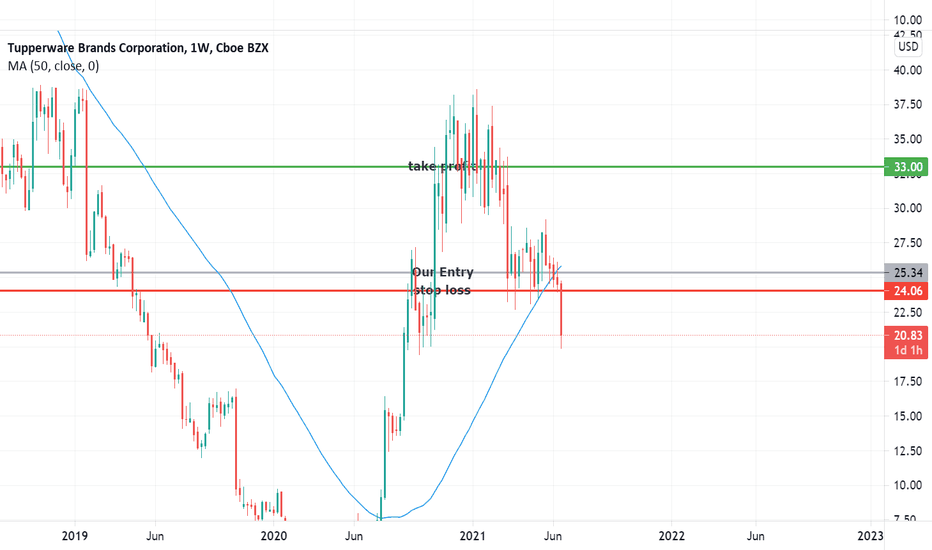

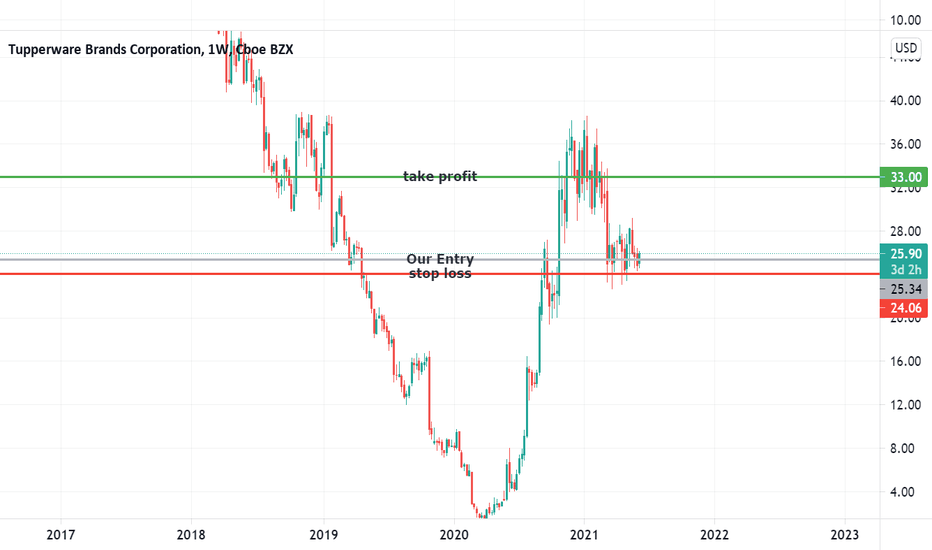

My team has decided to use a recent failed trade as an example of the importance of stop losses. Here @SimplyShowMeTheMoney you may have noticed that we place stop losses and stop profit losses on the majority of our trades. If we ever post a trade without a stop loss please understand that we're waiting for further information and that we have long-term confidence in the trade and are not worried about the short-term price action in-between.

To demonstrate the importance of stop losses we must first introduce you to a successful retail trader by the name of Jake. Our friend Jake has been trading for the past 5 years. Jakes trading strategy is simple: he finds a company that he likes, and he invests his money into it. Jake hits roughly 6 out of 10 of the trades that he places. Jakes 60 percent winning average may sound 'okay' at first but lets say Jake is consistent about managing his take profits and stop-losses. Jake may be losing 40 percent of his trades, but he is able to mitigate most of the risks due to his insane stop-loss precision.

But if you've been in the market long enough and have ever used stop-losses then you can probably recall a time where your trade broke through your stop-loss and then the worst thing possible happens...it shoots off to the moon without you while you watch in disbelief with your jaw dropped down to the floor.

Jake knows this feeling very well. So to lower this risk, Jake locates key price areas on the chart where the stock may be at its weakest and places his stop losses. Doing this helps prevents scenarios like the one above from occuring.

Jake cares about the roof over his head and keeping food in his belly. He cares about the amount of sleep he gets every night. Jake wants to be able to enjoy quality time with his girlfriend without feeling anxious about a trade that was supposed to buy her a ring, but is now worth as little as a ring-pop. That's why Jake uses stop-losses.

Be like Jake.

If you would like to see more, please please like and follow us @SimplyShowMeTheMoney

$TUP Inflation Play *This is not financial advice, so trade at your own risks*

*My team digs deep and finds stocks that are expected to perform well based off multiple confluences*

*Experienced traders understand the uphill battle in timing the market, so instead my team focuses mainly on risk management*

My team entered into $TUP on 6/7/21 at $25.34 per share. $TUP now sits at $25.93 after correcting from its previous 52-week high of $38.79. We plan to take profit at $33.00.

My team considers $TUP to be trading at a bargain price. With further inflation data being released on 6/10/21 $TUP becomes a fairly safe bet for a short-term rally.

If you want to see more, please like and follow us @SimplyShowMeTheMoney

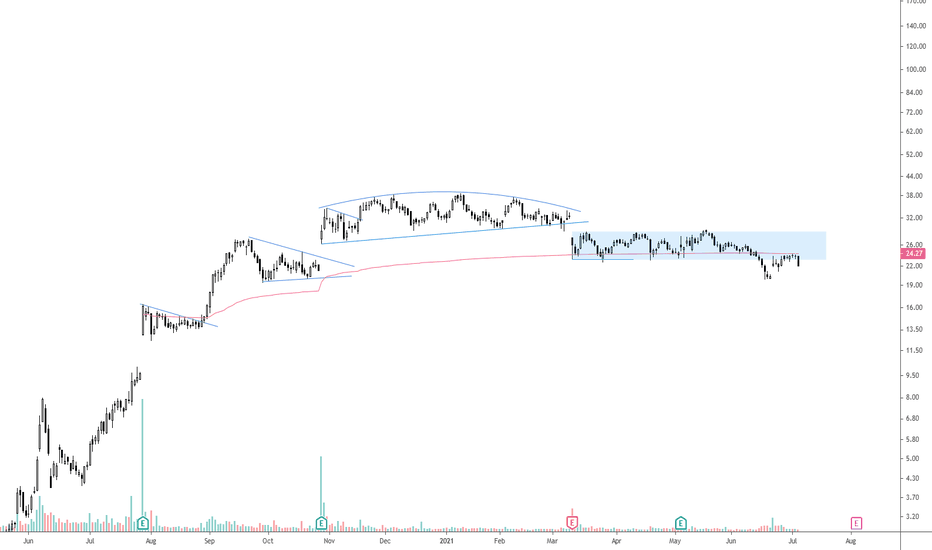

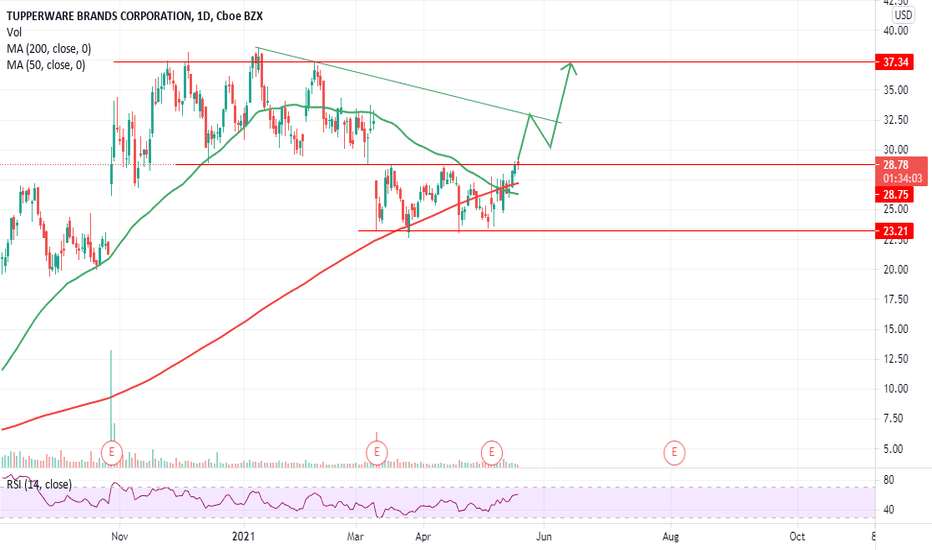

TUP breaking out of the sideways price actionNYSE:TUP is expected to go march higher. Anticipated price action and targets are shown on the chart, stop daily close below 50 MA.

Hit the like button please if you find this useful :)

This is only my own view and not a financial advice, do your own analysis before buying or selling

Happy Trading!

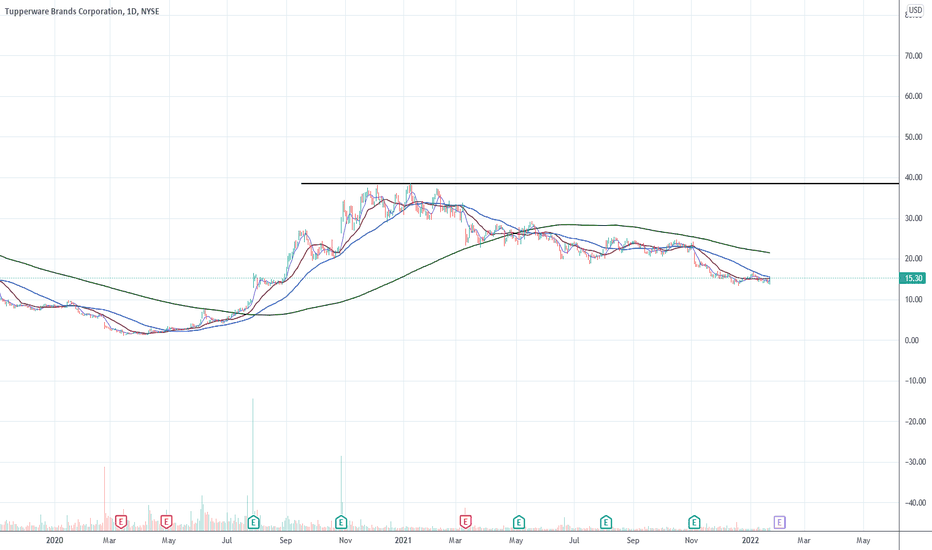

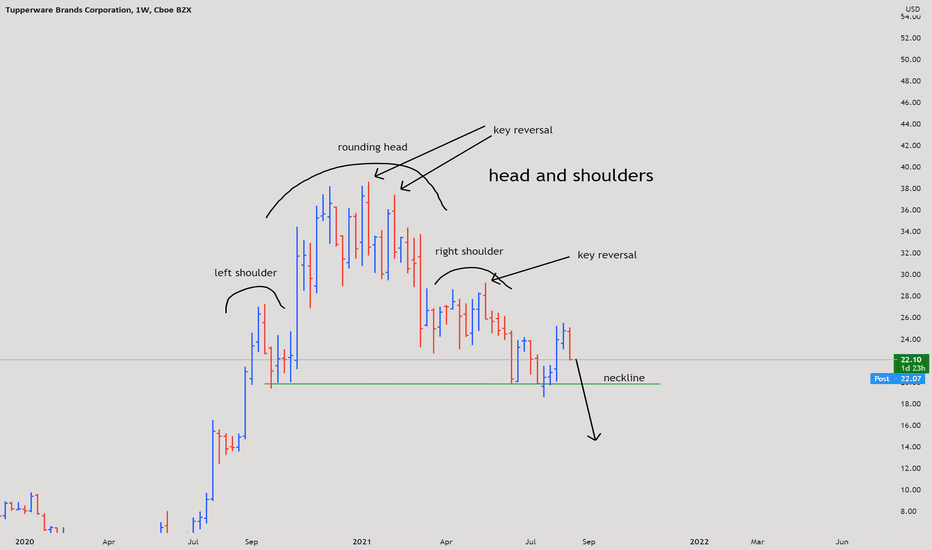

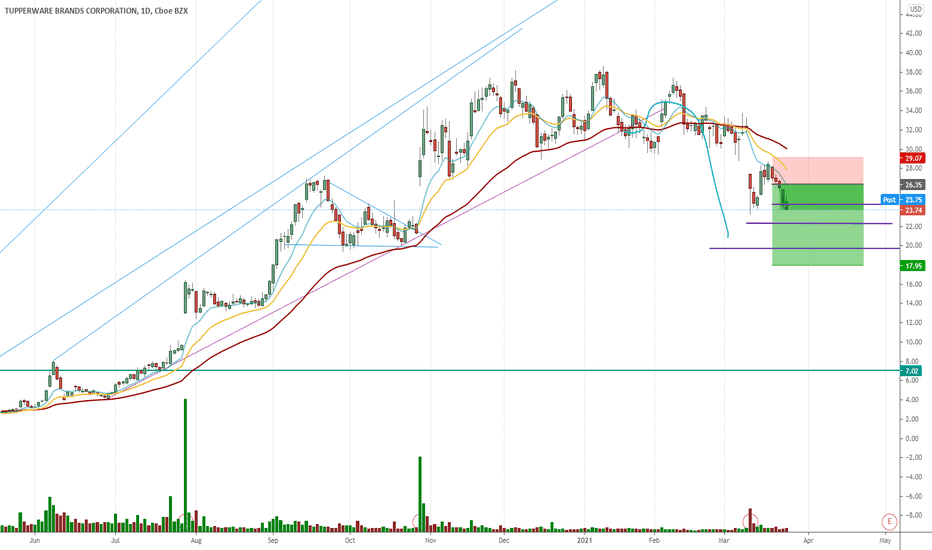

TUP ShortTUP topped with a beautiful rounding pattern. It is currently showing a consolidation pattern under downward sloping moving averages. It is in a downtrend and should resolve downward. This looks like it wants the teens.

TUP - Bearish if resistance can holdTUP - We got a nice round top here with a nice gap down. Price is now retesting the black resistance line.

If it holds, price should continue lower to the measured Fib retracement levels, starting with the 23.6%

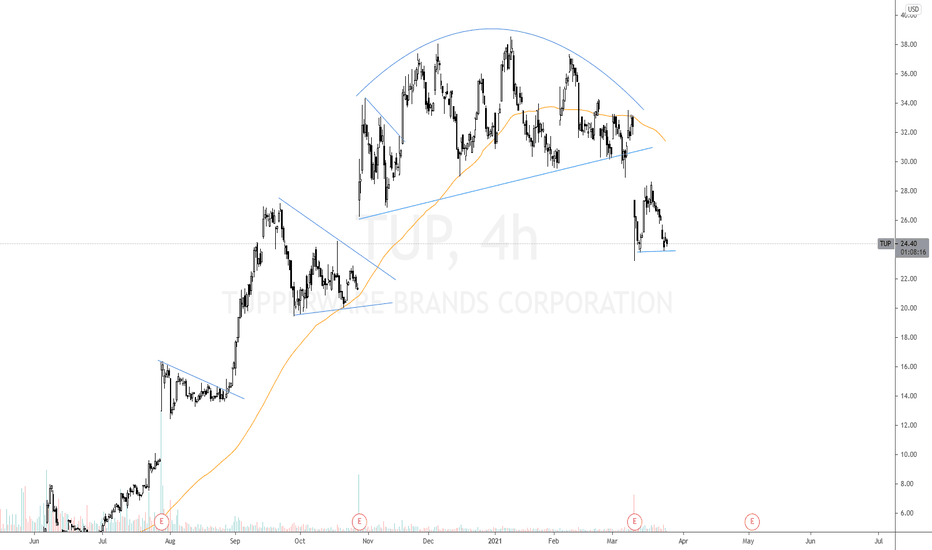

TUPNothing imminent here. I just like the way the chart was moving and how everything lines up so well.

Just an idea.

Tup Possible Swing TradeLooking for a bounce off the bottom Channel and 89 day moving average blue line Entry above the prior days close

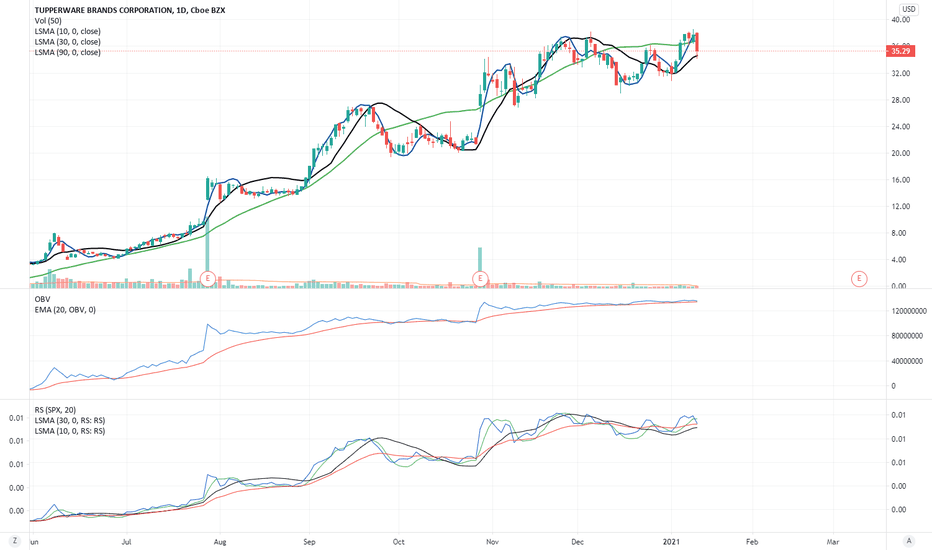

TUP enter long with the expectation of further reboundinghas been an leader compare to SPY and obv is also strong

TUP ATR: 5.46

WAM_RS: 87

A promising start.

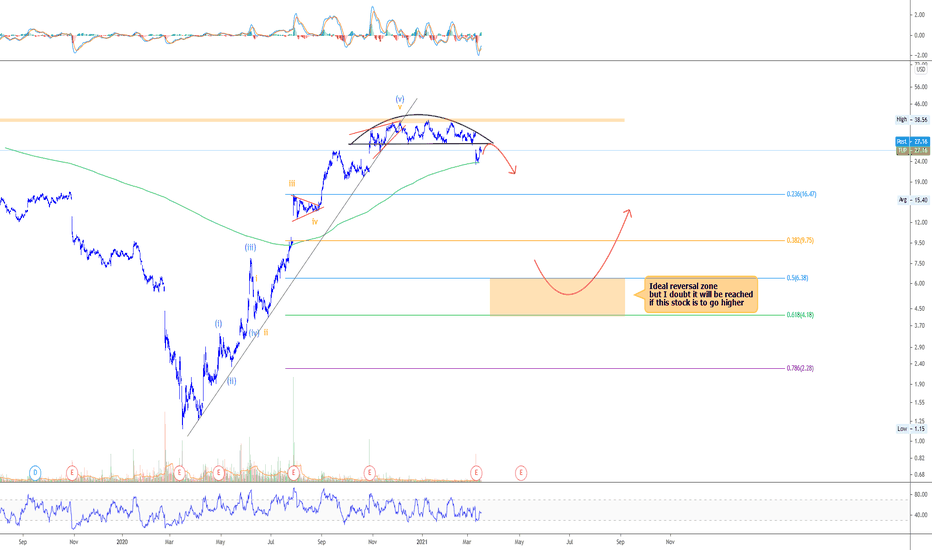

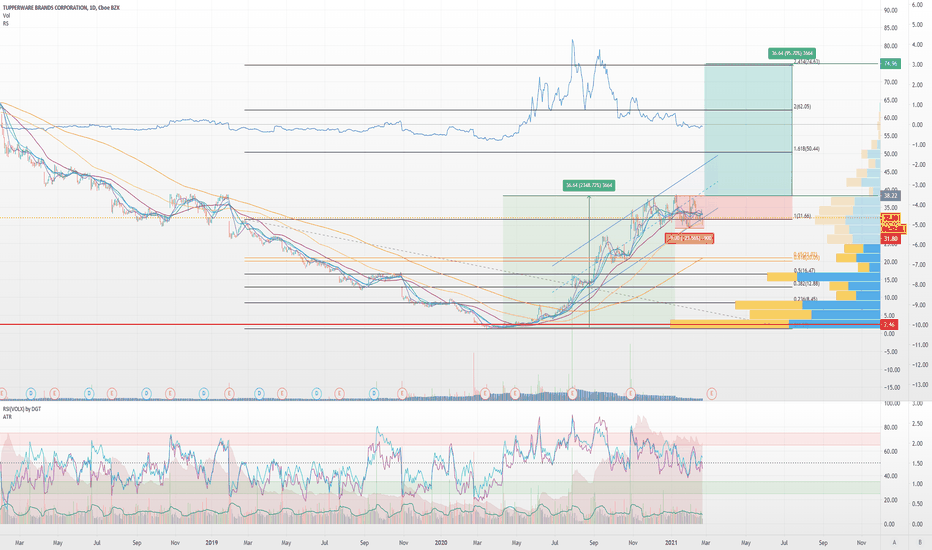

$TUP - Target of $39 - $41.75Learning Elliot Wave Theory. Looks like a great setup within parameters and rules.