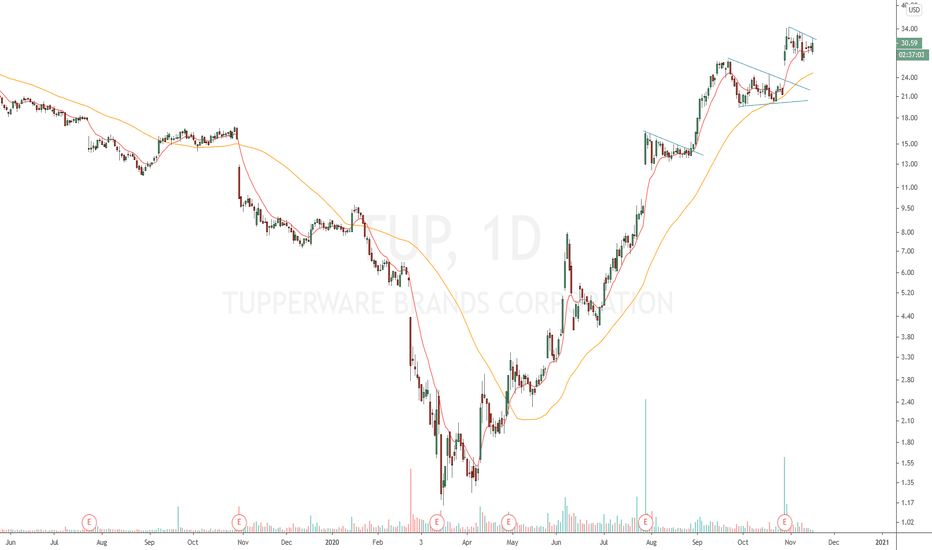

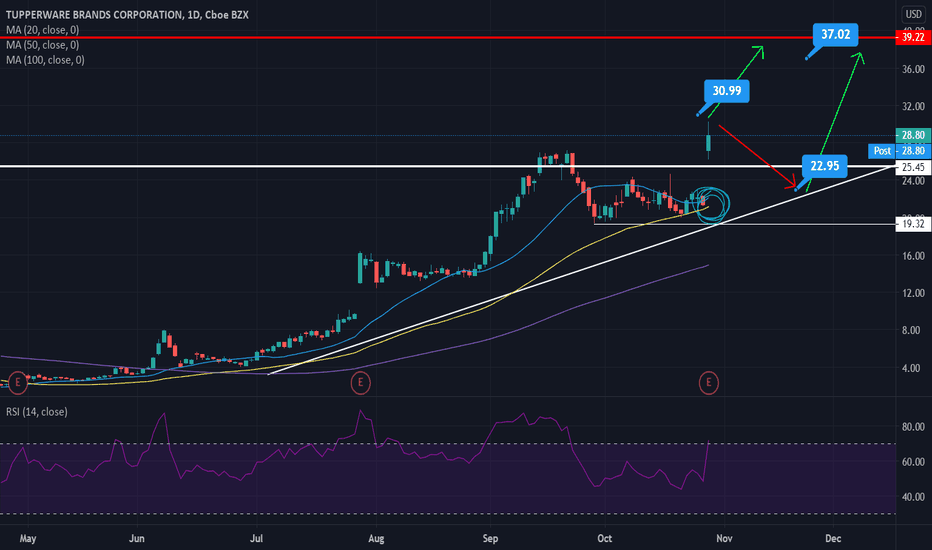

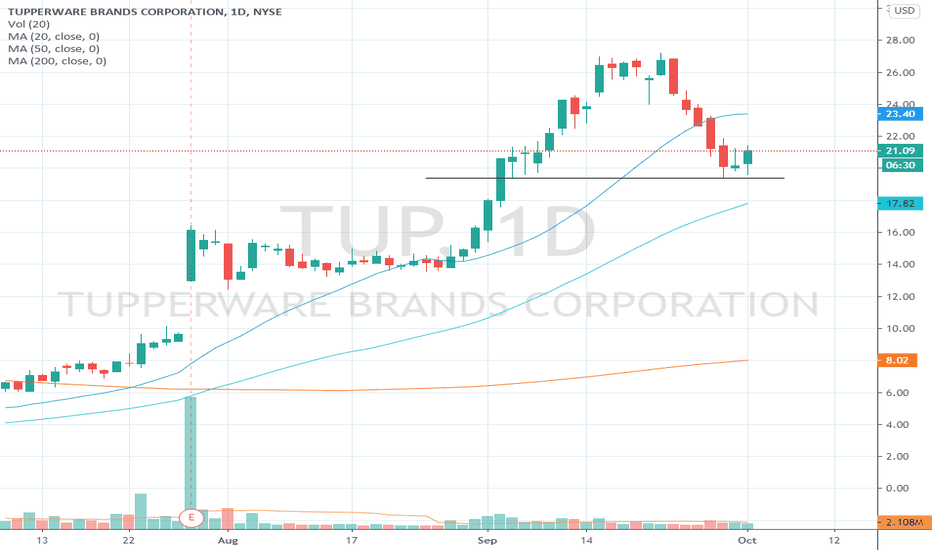

TUP FlaggingTUP putting in a bullish engulfing candle today within a post-earnings flag. This stock has been a great stock to trade. Watch for a break out from this flag to go long.

TUP trade ideas

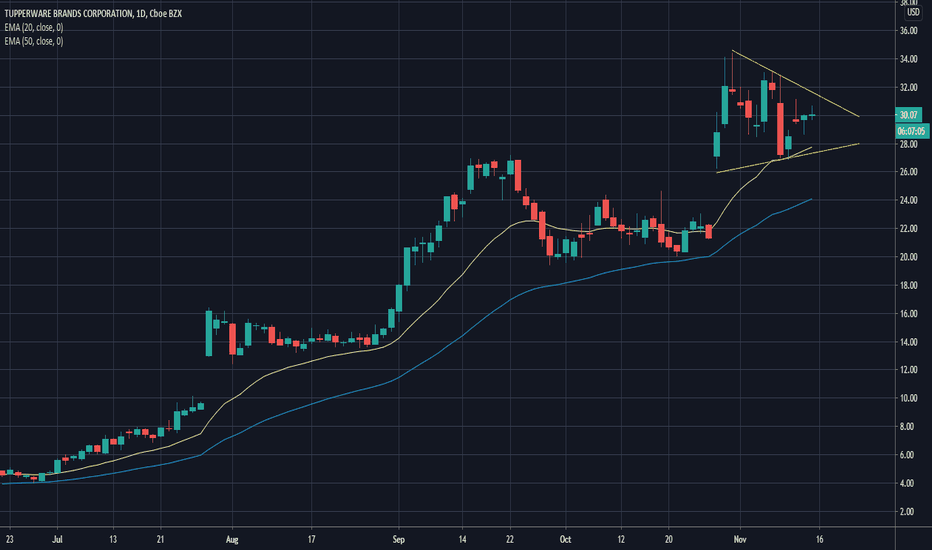

$TUP forming a bull pennant hereTup is forming a classic bull pennant. Gapped up on volume and now consolidating. Look for a breakout in the coming days.

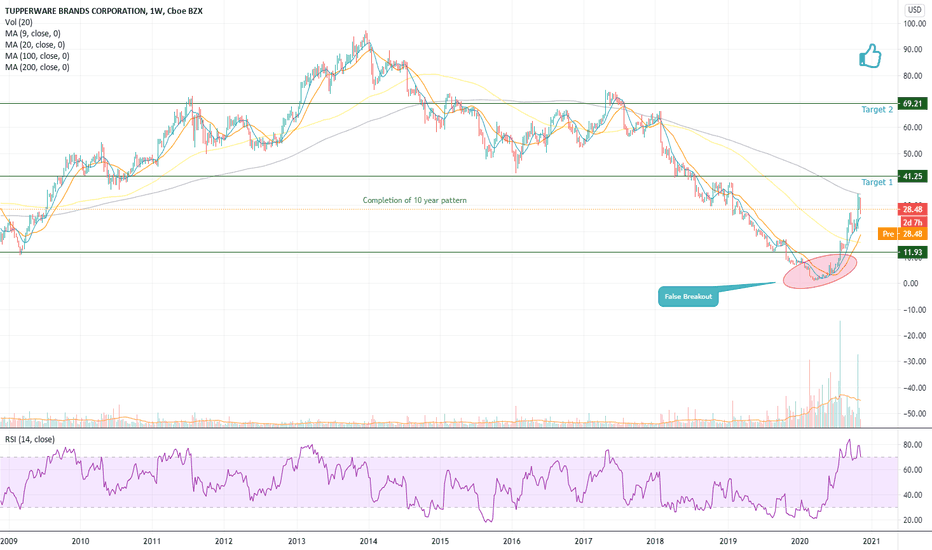

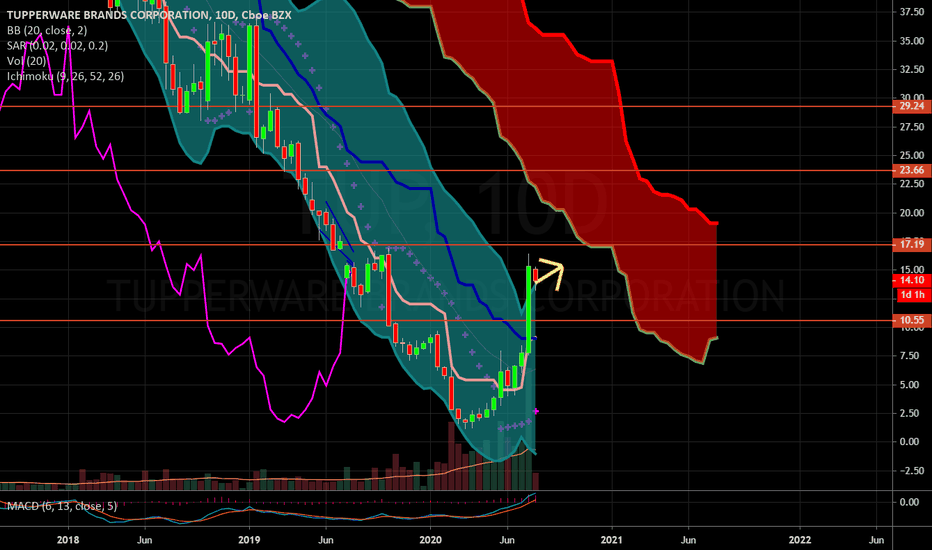

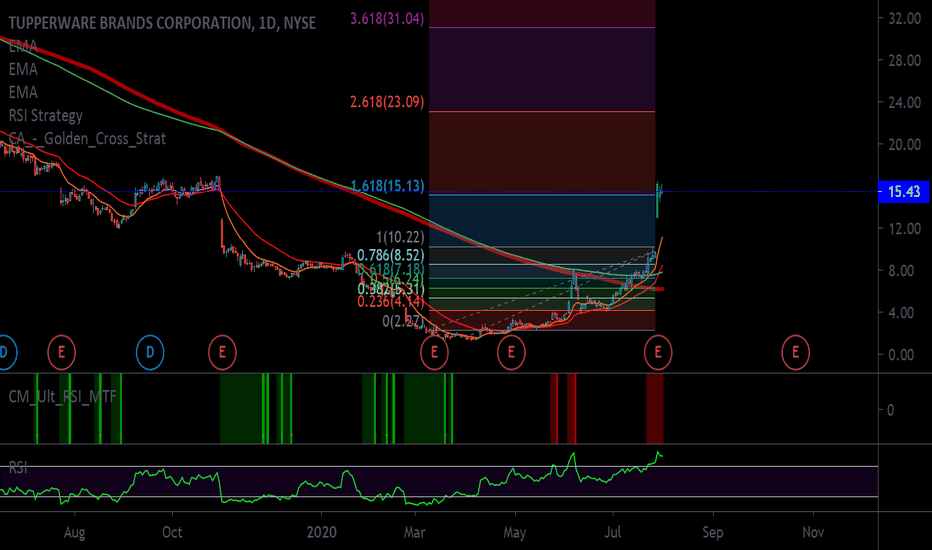

Long Term investmentThis is a weekly chart of TUP. Allow time for the targets accordingly.

Rsi Super Bullish

9,20 MA are rising nicely after false break with volume also rising

Fresh buying from insider

Got resisted at 200 MA (Grey line) looks like a pullback with low volume

Please like or comment

Thank you for reading

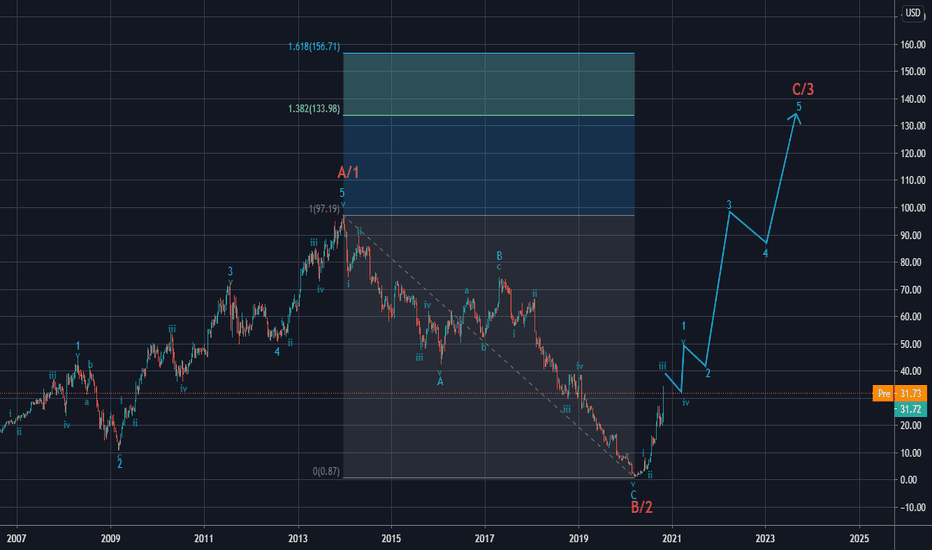

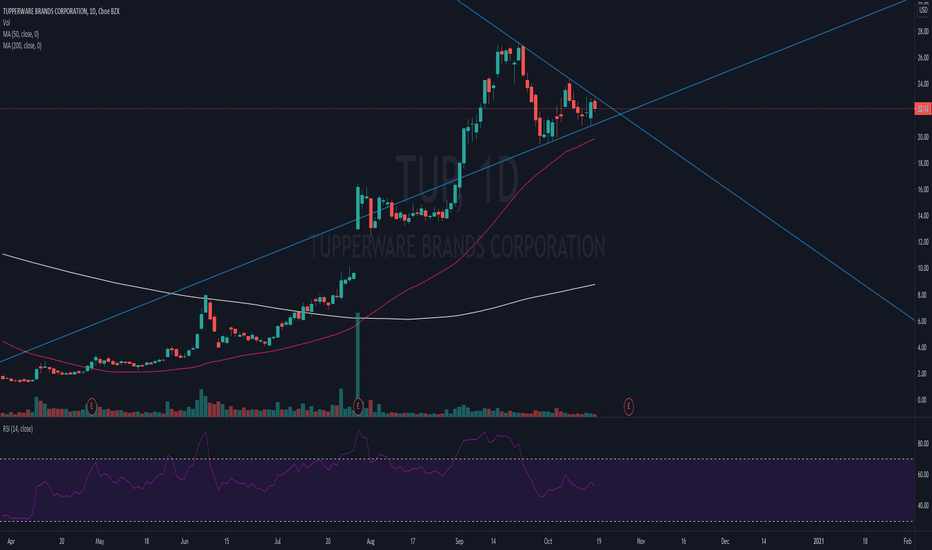

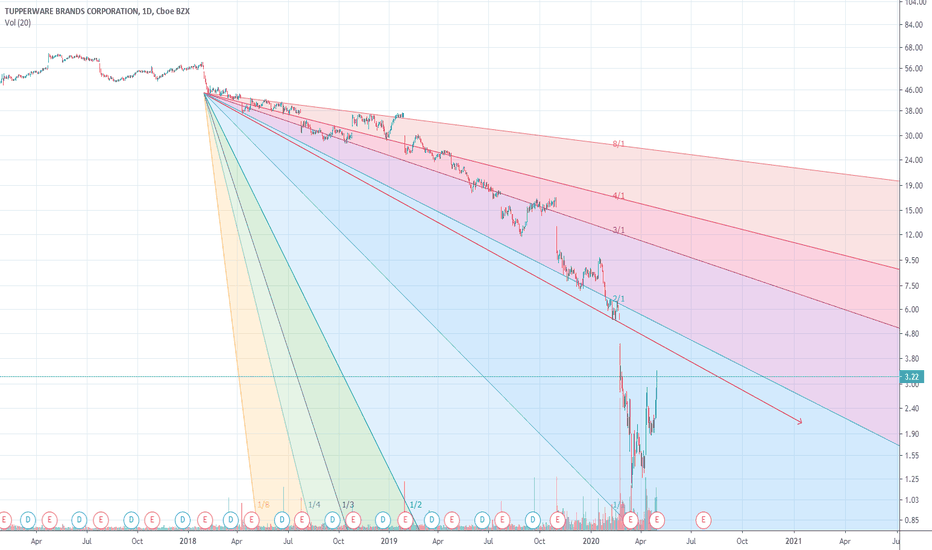

Tupperware Weekly Elliott Wave CountThis is my longterm view at Tupperware Brands Corp . NYSE:TUP

From 2007 coming we can count an impulsive 5 wave with a final high in Dec 2013 at a level of 97 USD marked in the chart as blue 5 of red A/1. The following correction has found an end with a low at 1.15 USD this year in Mid March, marked as blue c of red B/2.

We have now the chance of a longterm rebound in the stock in the upcoming wave red C/3. Targets can be market as A=C at 97USD / an C extension to 138% at 134 USD or as an 3 with targets of 156 USD (161.8 Extension).

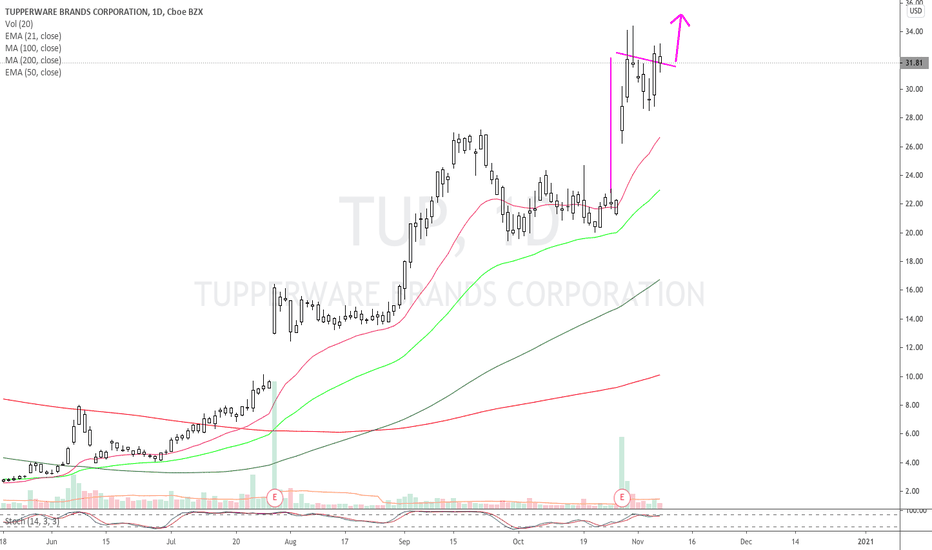

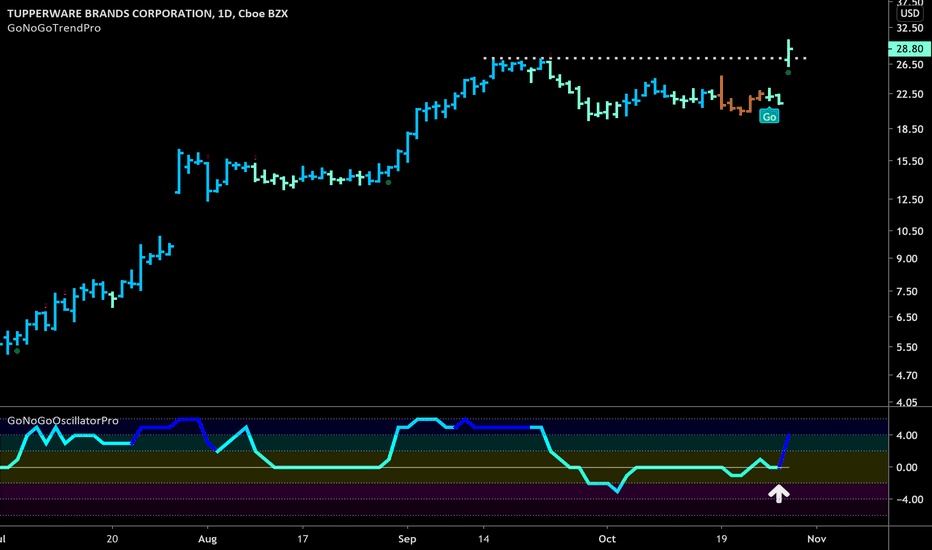

TUP showing exceptional strengthTupperware Brands Corporation is showing strength amongst the weakness of the general stock markets.

After consolidating sideways for a little over a month we saw a break out to the upside yesterday after a new “Go” trend was spotted 3 days ago.

This move sent price to a new high and closed above significant resistance of those prior highs.

At the same time, the GoNoGo Oscillator has broken back above zero, on heavy volume, confirming the bullish price action.

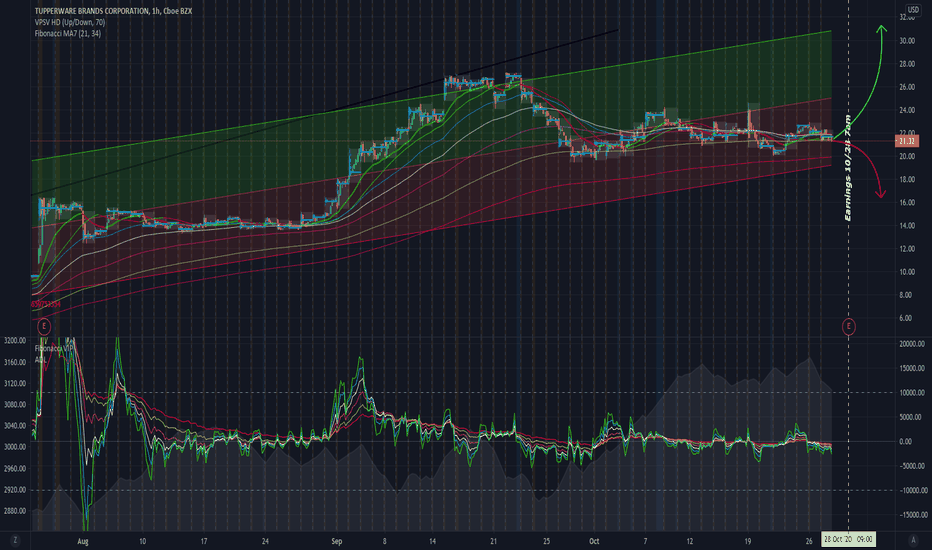

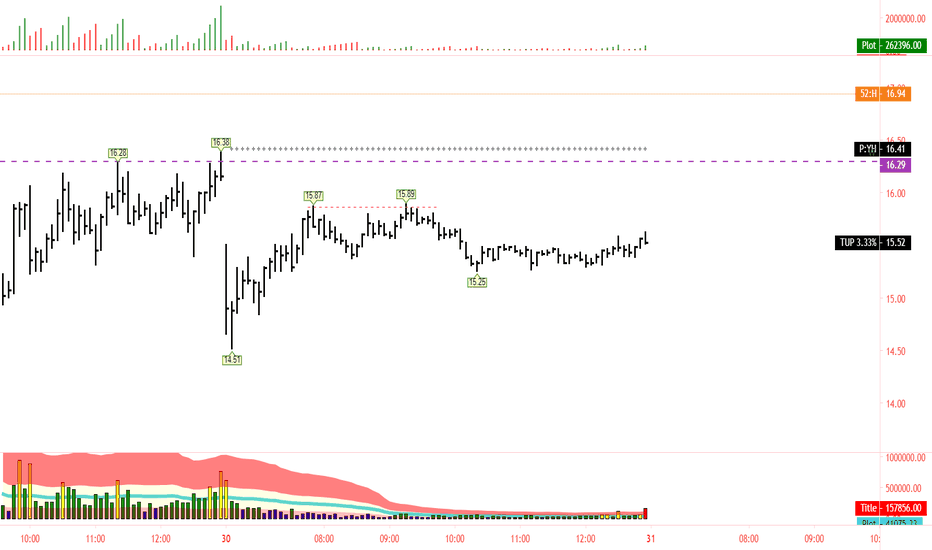

TUP earnings tomorrow 10/28 at 7amTUP earnings is tomorrow 10/28 at 7am. I'm not exactly sure which way this is going to go. But the one thing I do know is that TUP moved a lot after Q2 earnings. And TUP has been consolidating, so we'll find out tomorrow after it's earnings call. Good luck and happy trading friends...

TUP Ascending Triangle/ConsolidationUpcoming earnings on 10/28.

On the weekly chart there was tons of volume when it bottomed out, signaling possible accumulation. Stock gapped up previous earnings and is on an upward trend.

I could see this breaking out of consolidation on a run-up towards earnings.

TUP ready to go again?Failed to breakout the 24 level but just the matter of time imo. That huge volume from gap up and low volume consolidation here tells you big players have not left this name.

TUP: no brainer reversalFormer multyday runner

Reversal together with industry peers

What I like here: very close stop loss, great risk reward ratio.

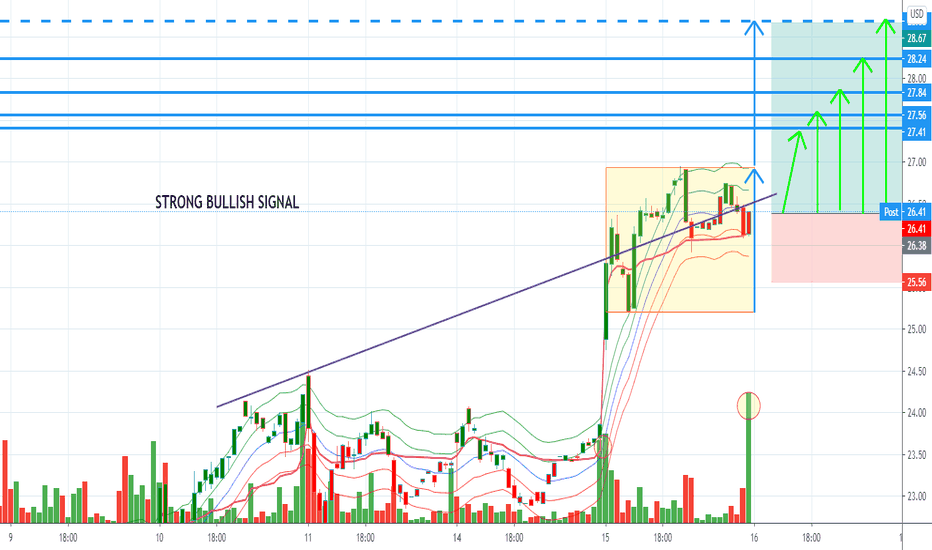

TUPPERWARE BRANDS CORPORATION Idea Hello traders, TUPPERWARE BRANDS CORPORATION is in a bullish continuity with a large volume of purchases made especially at the end of the session. The shadow of the candle on the VWAP makes an effect of implusion, in the TIMEFRAME 5 1 Min it is observed to leave the VWAP. Great propability to breakout the equilibrium zone to arrive in another zone and reach highs. On this one not enough force to breakout again.

Please LIKE & FOLLOW, thank you!

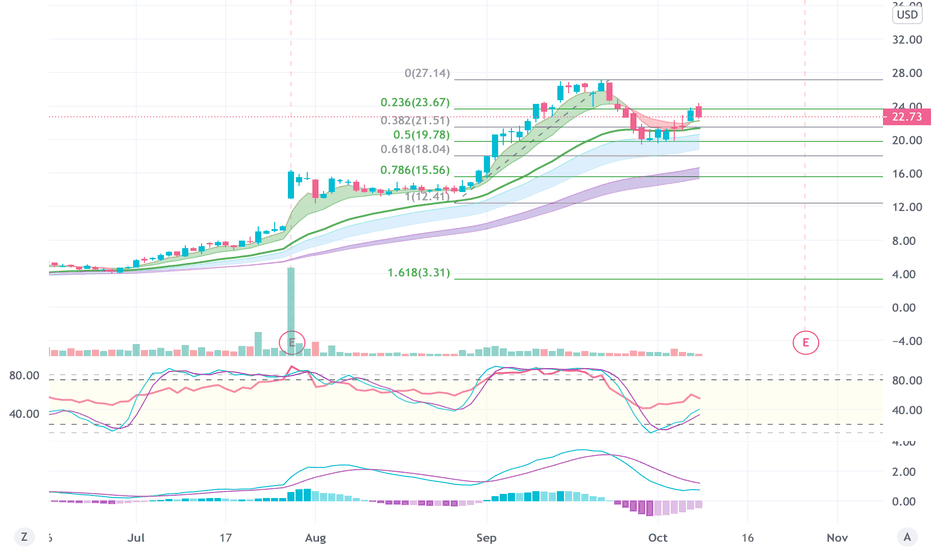

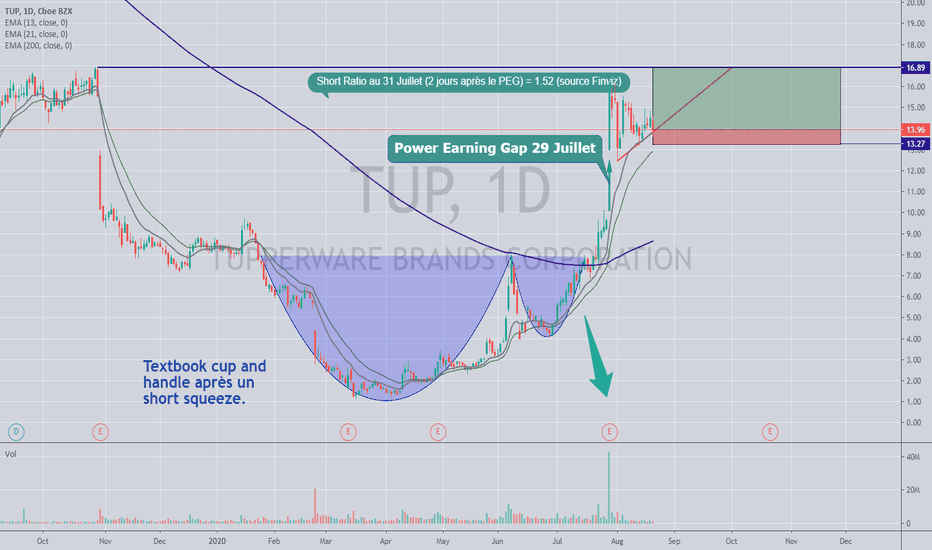

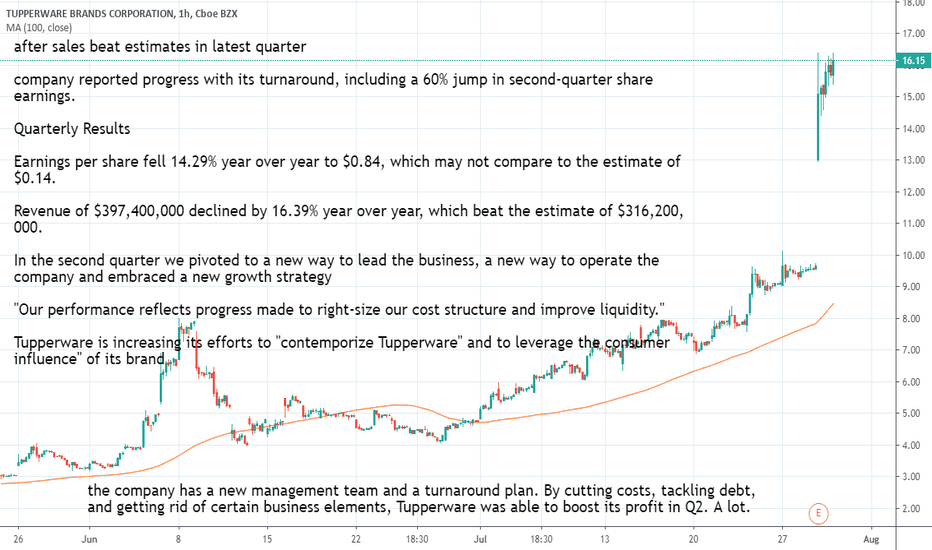

Short squeeze to continue on TUP following the PEG.Following a strong Q2 results on the beaten TUP, a short squeeze occured bring the stock to a year to date high on July 29th. The short squeeze is likely to continue for Q3 as the company managed to reduce their debt for a cheap price helped by strong sales growth. Tupperware announced expecting strong sales for the remainder of the year. The recent pullback on the stock offers a great opportunity to buy on support arround the 13D or 21D EMA for a target price just slightly under the 17$ mark. This opportunity for a swing trade has around a 5/1 risk-reward ratio with an entry price just below 14$.

LONG TUP, this thing is gonna POP like a tupperware bowlClear bull pennant, Target 20+ easily, get in on TUP now

9/18 ATM calls are cheap and should profit nicely

TUP LongChart speaks for itself, wait for confirmation on the breakout candlestick with higher volume. Volume has reduced significantly after positive earnings report while price real bodies stay within the igniting candlesticks range. Waiting for the breakout candlestick and then we going to the moon boys.

sales beat estimates+new management team+turnaround planafter sales beat estimates in latest quarter

company reported progress with its turnaround, including a 60% jump in second-quarter share earnings.

Quarterly Results

Earnings per share fell 14.29% year over year to $0.84, which may not compare to the estimate of $0.14.

Revenue of $397,400,000 declined by 16.39% year over year, which beat the estimate of $316,200,000.

In the second quarter we pivoted to a new way to lead the business, a new way to operate the company and embraced a new growth strategy

"Our performance reflects progress made to right-size our cost structure and improve liquidity."

Tupperware is increasing its efforts to "contemporize Tupperware" and to leverage the consumer influence" of its brand

the company has a new management team and a turnaround plan. By cutting costs, tackling debt, and getting rid of certain business elements, Tupperware was able to boost its profit in Q2. A lot.

The net profit for Tupperware is important. The company's current liabilities (including current portion of long-term debt) are $1.2 billion. The heavy load is partly why the company was left for dead earlier this year, as investors questioned its long-term viability. However, it was able to retire $100 million of debt during Q2, improving its prospects.

Over the last 12 months, it has generated negative EPS, even after the quarterly beat. Stable profits and revenue are some of the characteristics that make a great value buy, and Tupperware hasn't demonstrated those lately. One quarter

finance.yahoo.com

www.thestreet.com

www.fool.com

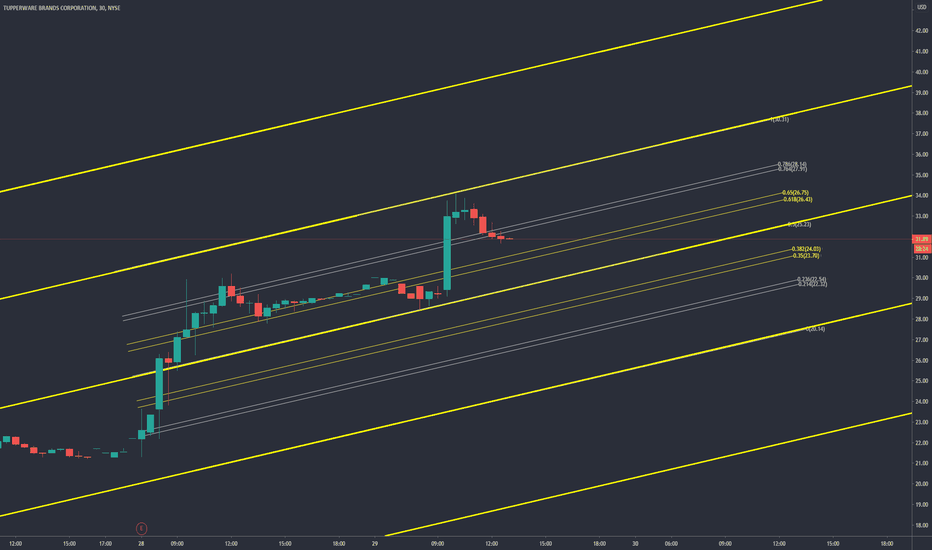

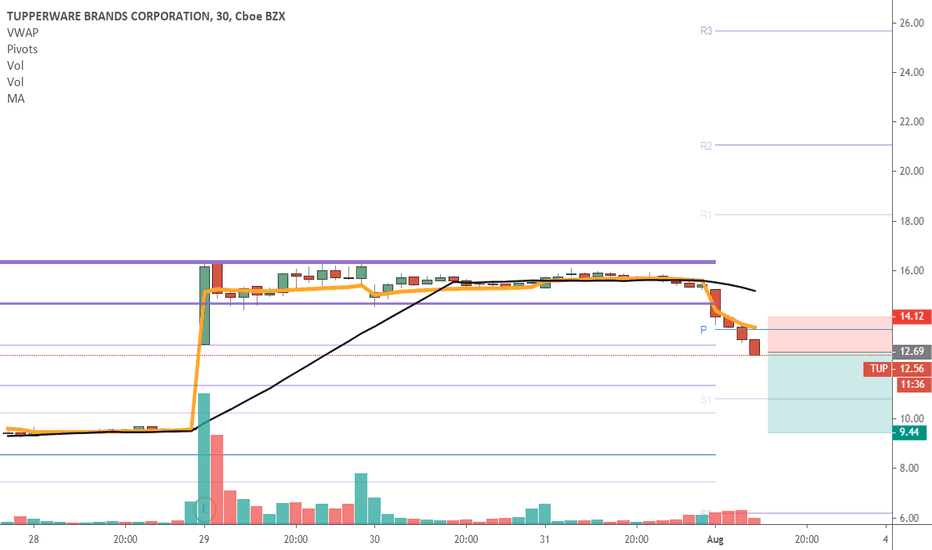

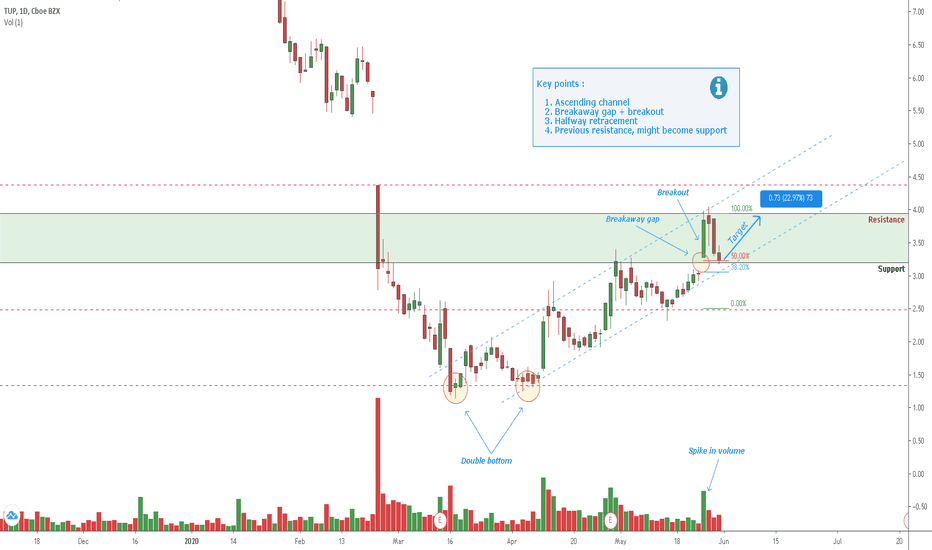

Price action & Psychology - Ascending channel,breakout,pullbackHello,

Key points :

Ascending channel : clear uptrend ignited by the double bottom

Breakaway gap + breakout : psychological shift causing the breakaway gap, buyers still strong

Halfway retracement : after a breakout stocks tend to pullback halfway

Previous resistance = support

The double bottom ignites a new trend and creates the ascending channel. The stocks makes higher highs, higher lows.

Everytime it pulled back from there on, it always retraced halfway (didn't draw it in because the chart would look messy).

It makes up for a decent swing up to the swing high where I'll start scaling out.

Make sure you keep an eye on the gap on the left side if the stock breaks the resistance.

Thanks for reading and if you have suggestions or want to discuss the idea, just leave a comment, I'll be happy to answer.

***Disclaimer : This is not an advice to buy the stock. Please, be aware that trading is a matter of probabilities and that it only takes ONE trader to deny your trade.***

TUP - Too late!Gann Fan...Cool! - The best tool I could find to show what I see...too much risk! Okay company...I prefer Pyrex (Corning Inc. - GLW) on sale now!