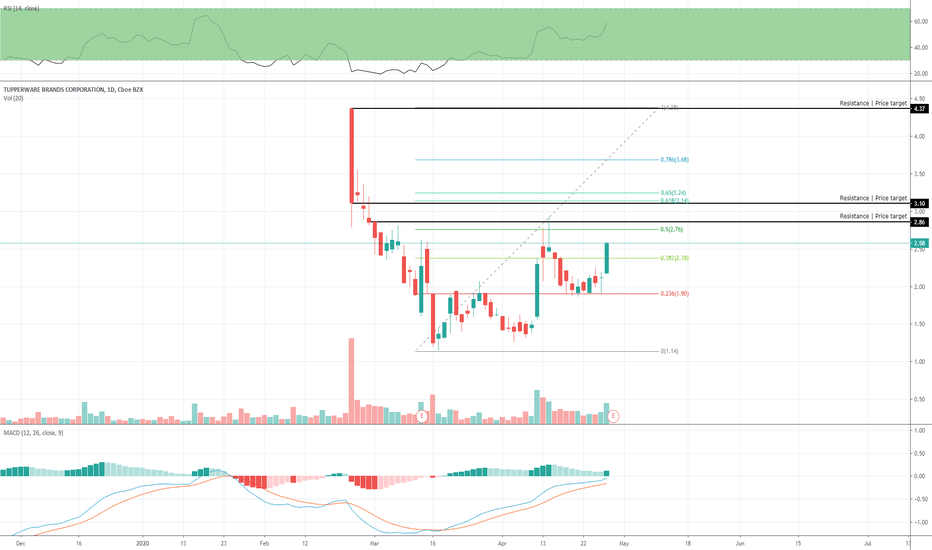

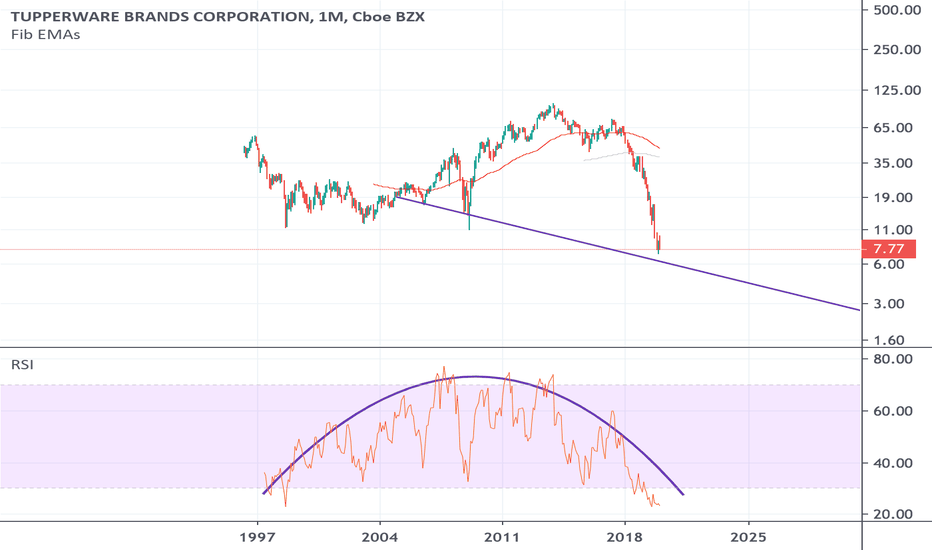

$TUP Bullish into earnings RSI in strong uptrend.

stock making higher highs and higher lows

macd and histogram bullish

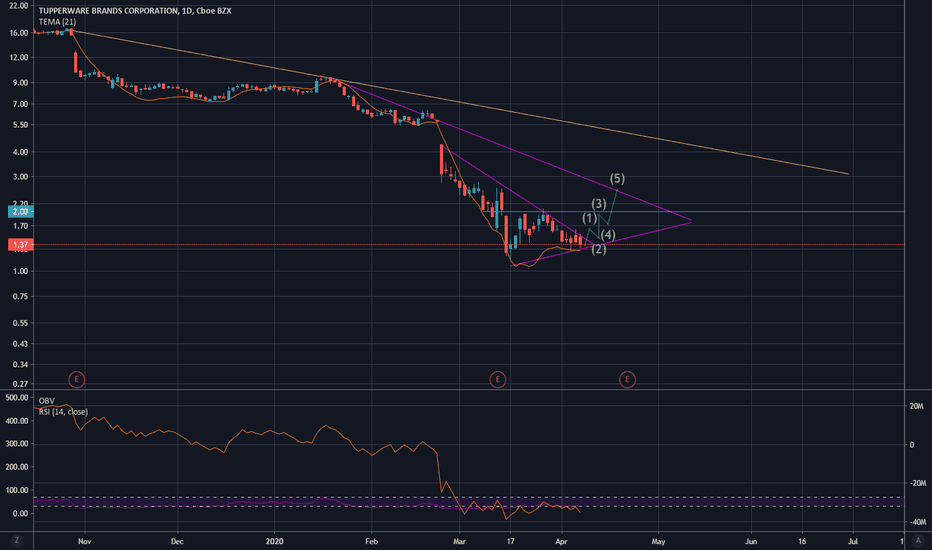

TUP trade ideas

TUP long for fundamentals and crisisHello. Here is what I know. We are all eating out less due to the #coronavirus. There are more leftovers in the fridge in every household today than there were 3-4 weeks ago. Let's hope I am right.

the ultimate investmentYou've heard about GameStop ($gme), now take a look at $tup.

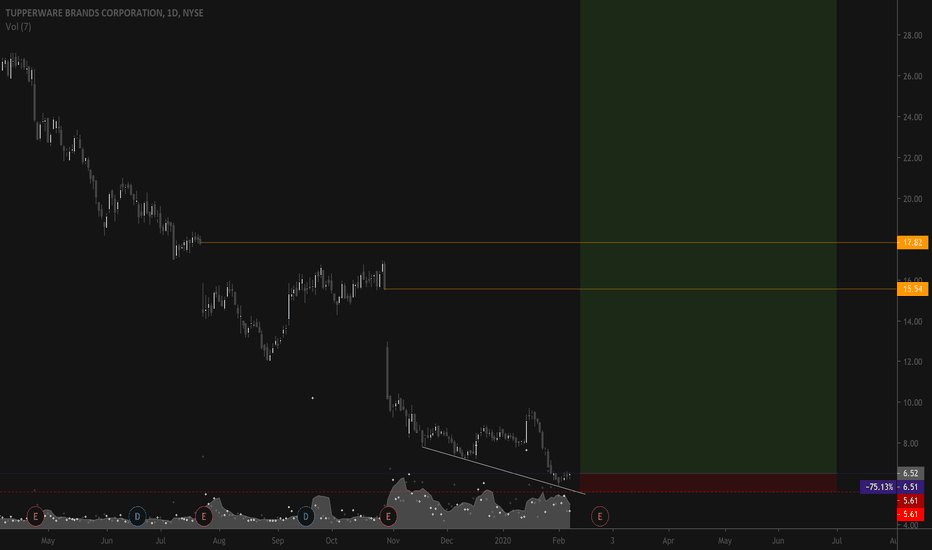

Tupperware Brands Corporation, trading at 6.51$ a share on the Friday close, with an history of down-gaps after earnings plays.

Down over 93.11% from the highs, $tup has definitely taken a beating from its peak Christmas '13, but I'm betting on a big reversal here.

Daily chart shows two gaps on chart, 15.54 and 17.82, first targets for this position.

Three solid points on a down diagonal trend for support and over-all oversoldness, I will become a titan of Tupperware industry.

Top target at 83.85$.

Stop at 5.61.

TUP - 2/25/20 earnings2/25 is a long time away for earnings update.

Board member retired. They will not fill his spot.

Now, to try and find the new bottom.

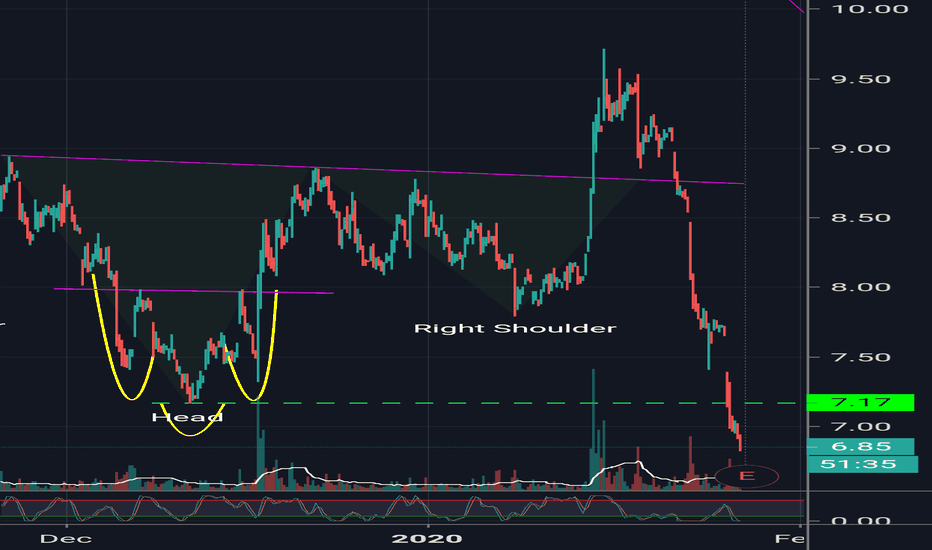

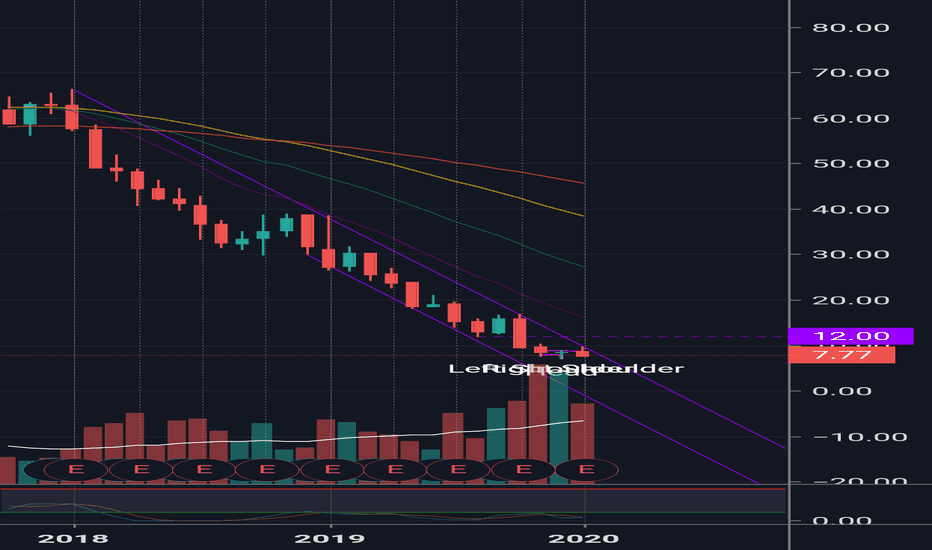

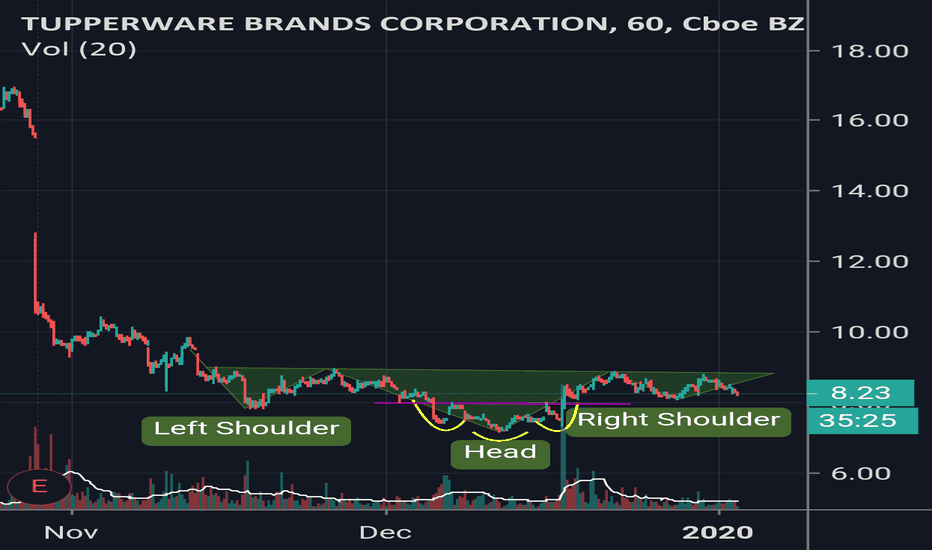

TUPWith earnings a week away, best case (longs) scenario: TUP challenges the neck line ($8.75) at earnings, and continues its reversal trend upwards.

Likely scenario, neckline breaks and we test bottom again!

TUP - Squeezed?Inverse Head and shoulders broke above the neckline, however, I don't believe this is a reversal pattern, rather a short squeeze.

News?

Tupperware Forming a bottom Possible inverse head and shoulders formed.

Bullish bottoming process may be complete.

$10-$12 target for a sustained rally.

Caution though getting quite high on RSI.

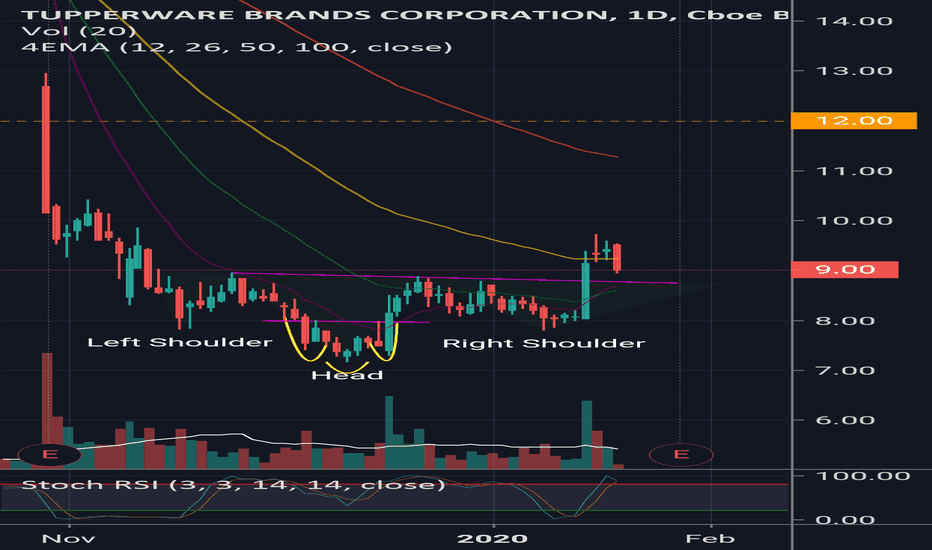

TUP: failed larger breakoutTUP completed a smaller inverse H&S reversal and completed almost perfectly to realize a nice 10% gain (~$8 - $8.80).

However, it looks like it is failing the larger IHS pattern.

I expect a continuing decline through $8 and retest of $7.50 area.

Inverse Head and Shoulders breakoutBreakout in progress!! After a significant SP drop MACD is trending up and breaking out of downtrend, as you can see the 50 DMA and that gap make for nice targets; enjoy.

Also, TUP currently way undervalued w/ a PE of 2.63 and good ROA in industry.

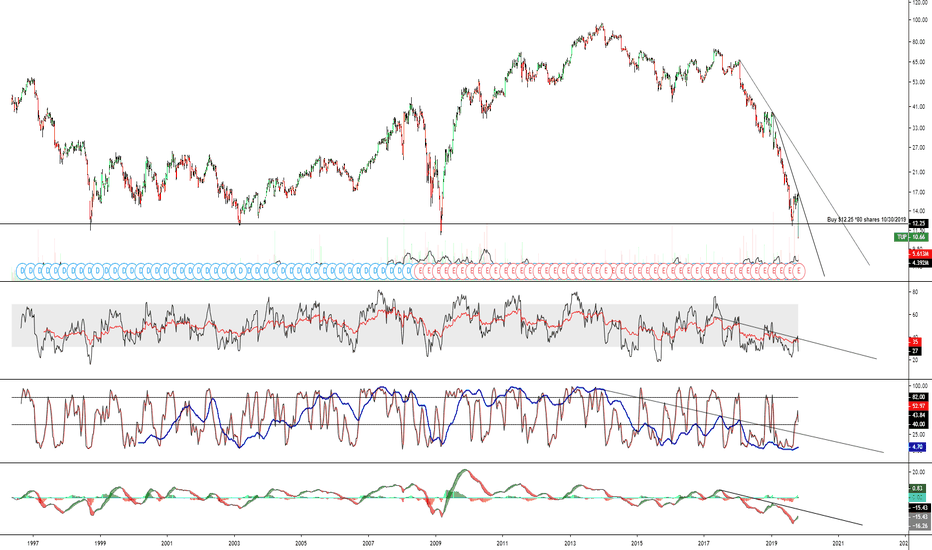

TUP Vanguard Purchase - Tupperware Brands @$12.25 on 10/30/2019Got a Vanguard notification of a purchase this morning. I'd like to attempt to document, on the same day, all individual stock purchases for future reference and timing studies.

Vanguard purchases are my Long-to-Ultra Long term holdings.

Companies purchased reflect positive outlooks on - Valuation, Growth potential, Technicals, and Future trends.

I want to make these public so that I keep myself honest by allowing everyone to view my winning trades and losing trades.

Sometimes months go by where I won't purchase anything, I have my limit orders preset. I wait for price to come to me.

Best,

RH

tupperwareKnown support / resistance since 2008. An Executive of company bought shares here after fall to this level

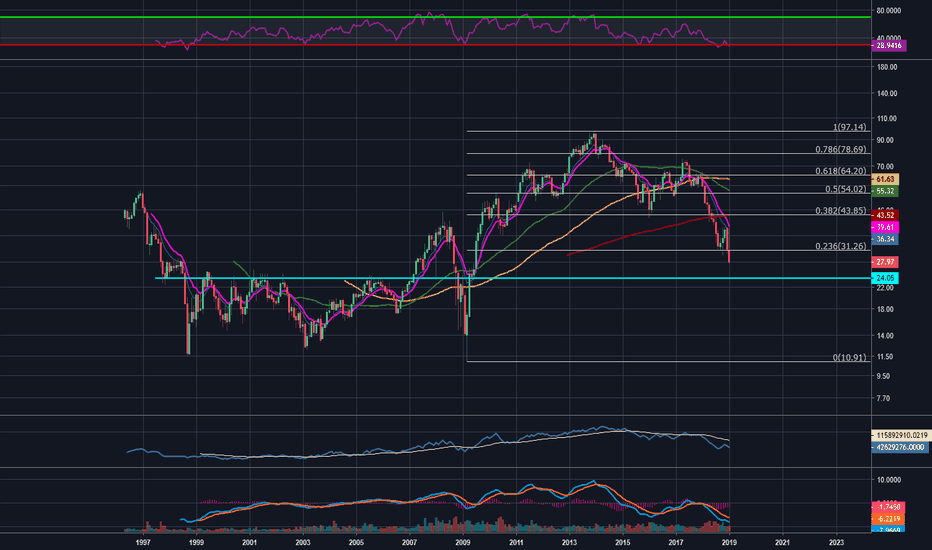

TUP Becoming Buyout Candidate...?After an abysmal earnings report and subsequent drop of over 25% today, shares of TUP are becoming a potential takeover target.

Who might buy? It could make sense for several companies: P&G (PG) could expand its portfolio of product offerings, as could Colgate-Palmolive (CL), but it could also make sense for Amazon (AMZN), as their endeavor in to fresh foods could benefit.

Five years ago, shares of TUP were nearly $100, but today at just about $28, they're down over 70%, which for shareholders, is catastrophic.

Clearly TUP management isn't cutting it, so there's going to have to be a shakeup there, or more preferably, an outright sell of the company to more capable enterprises like those I've listed. It wouldn't be hard to get funding by any of those aforementioned giants.

I'm not suggesting jumping in today, but give it time to settle and look to pick up some shares for a long-term view or if you're like me, some long-dated calls to minimize capital outlays.

TUP long term supportShares of TUP are approaching a critical long-term support level at $39-42, depicted on this weekly chart with the blue line.

The daily chart is also looking favorable, with shares now trading above the 50-day moving average, and my 5/13ema's are in a buy mode.

I'm a buyer with a stop on a weekly close below $39.

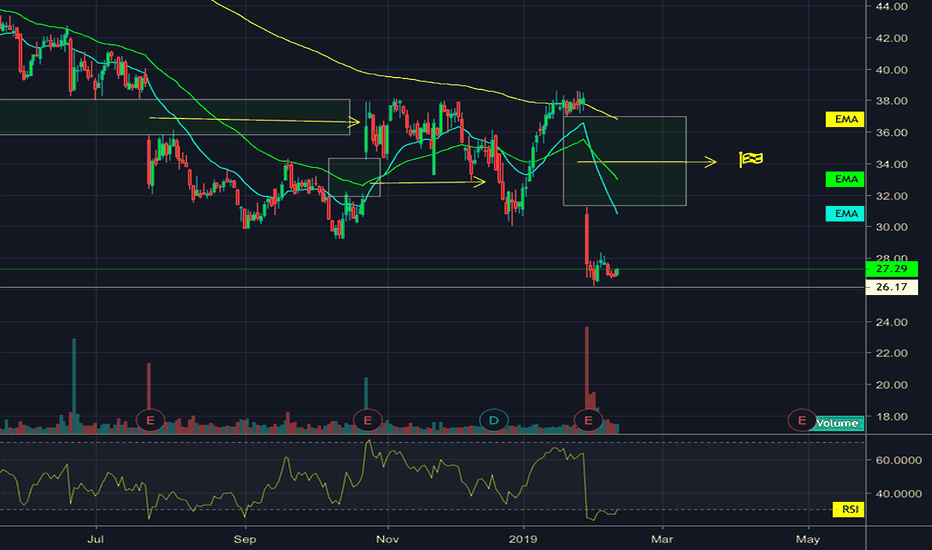

On breakout WatchWatch the RSI trendlines closely. Look a trendline break on both the price action and the RSI

TUP - hedge your longs with Feb 55 putsOn January 13th and 17th, Smart money built up almost 5,000 contracts of new open interest in Tupperware Brands Feb 55 puts. Using Friday Jan 13th's cost of $2.40, break even stands at $52.60 -- basically at the recent support confirmed during the last two weeks of December. These Feb 55 puts include earnings and will profit should earnings disappoint or if recent bullish technicals fail to confirm and the stock price resumes it's downtrend from its Oct 2016 highs.

With the stock price recently breaking out of a downtrend and recapturing the 50 day moving average, I am bullish as long as price stays above the 50dma, but watching for a Failed Breakout Reversal to join the Feb 55 puts.

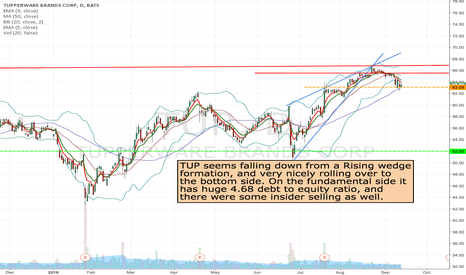

TUP- Short from current level to 52 TUP seems falling down from a Rising wedge formation, and very nicely rolling over to the bottom side.

On the fundamental side it has huge 4.68 debt to equity ratio, and there were some insider selling as well.

For trade we are looking for Jan2017 $60 puts, which are trading for $2.73

You can check our detailed analysis on TUP in the trading room/ Executive summary link here-

www.youtube.com

Time Span: 18:30"

Trade Status: Pending

TUPTUP Daily

Potential complex 1.5 years HS pattern, breakdown from neckline, and 2009 uptrend_line. Gapped Down, on big volume. ( potential : measured target 54 )

Target_1 : 70.46

Target_2 : 67.00