TradeCityPro | HBAR Rebounds Sharply After Trendline Breakout👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review the HBAR coin for you—one of the RWA and Layer1 crypto projects, currently ranked 16 on CoinMarketCap with a market cap of 9.95 billion dollars.

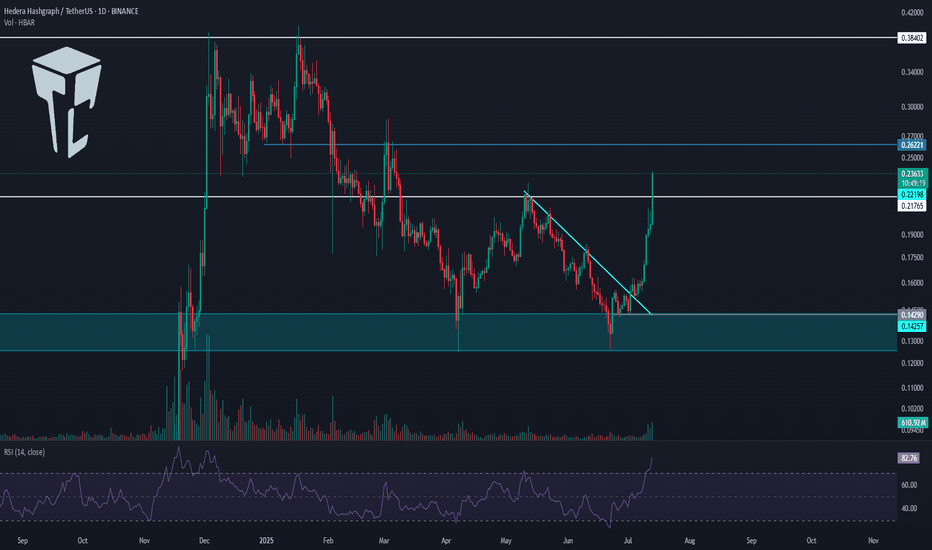

📅 Daily Timeframe

On the daily chart, as you can see, after a bullish rally toward the e

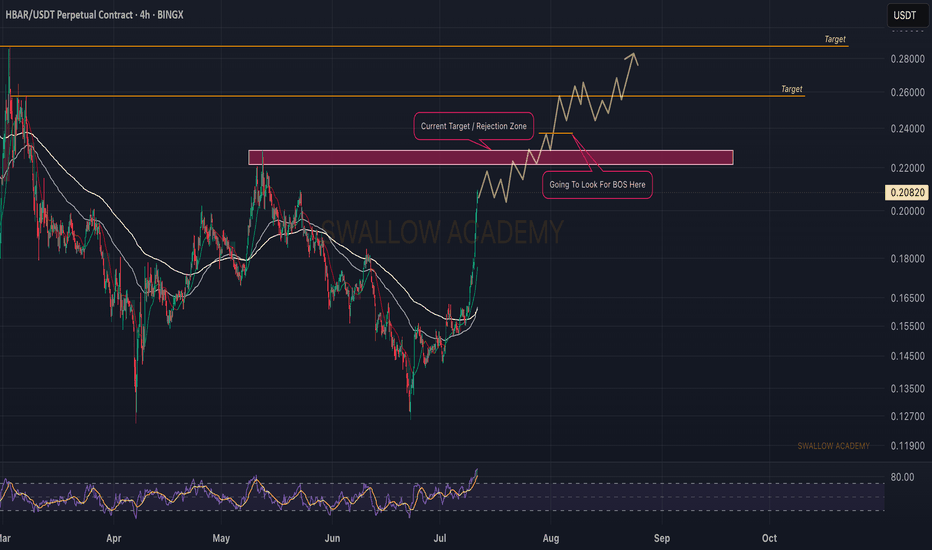

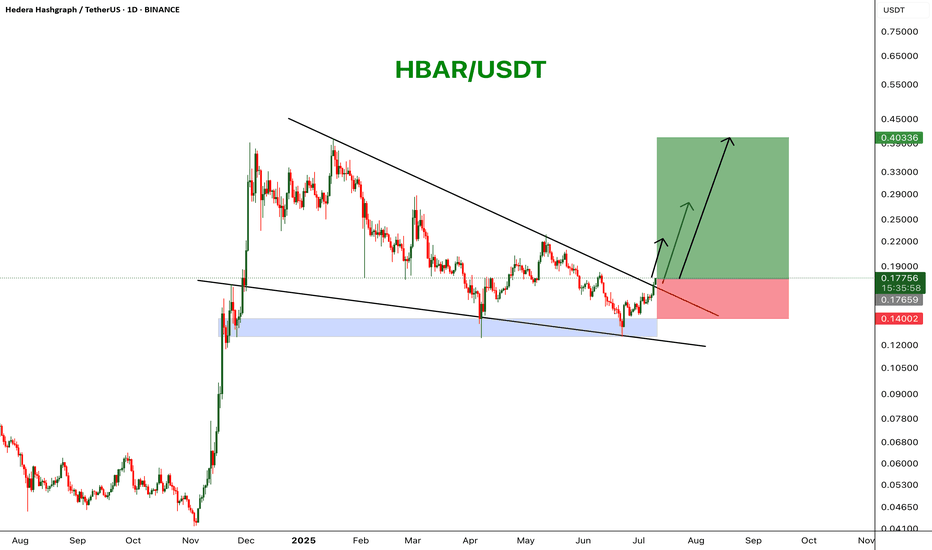

Hedera (HBAR): Looking For Break of Structure (BOS)Hedera is strong where we are seeing a strong upside trend, which might be breaking the local high area (the resistance). As soon as we see it, we are going to look for proper BOS near that area where we will set out a long position.

Now bear in mind, RSI is heavily overbought so we might see some

Hedera: How To Catch The Altcoin That Will Move NextWhich one is going to move next? That's the question and here is the answer: Look for those with a confirmed bullish setup.

There are hundreds and hundreds of trading pairs. We go by the saying, "everything will grow." But not everything grows the same day nor at the same time. So which ones are th

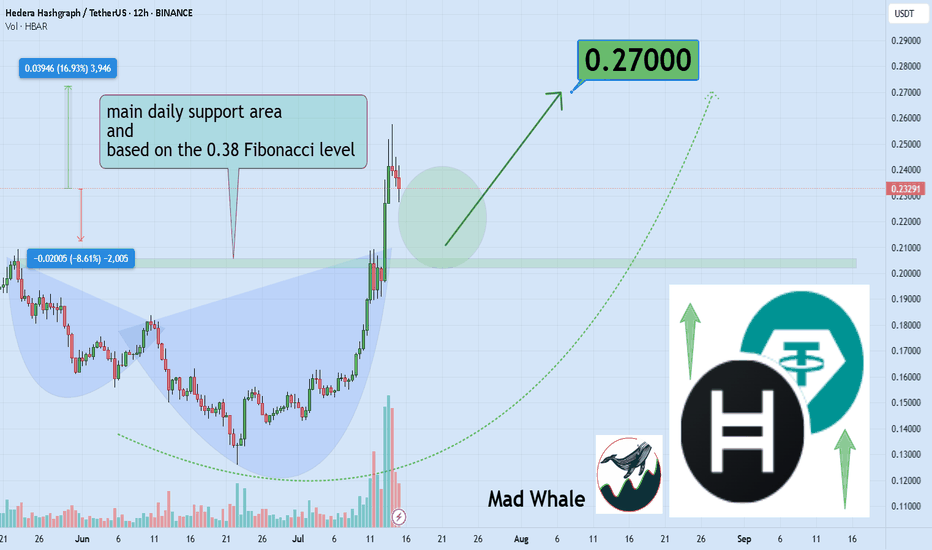

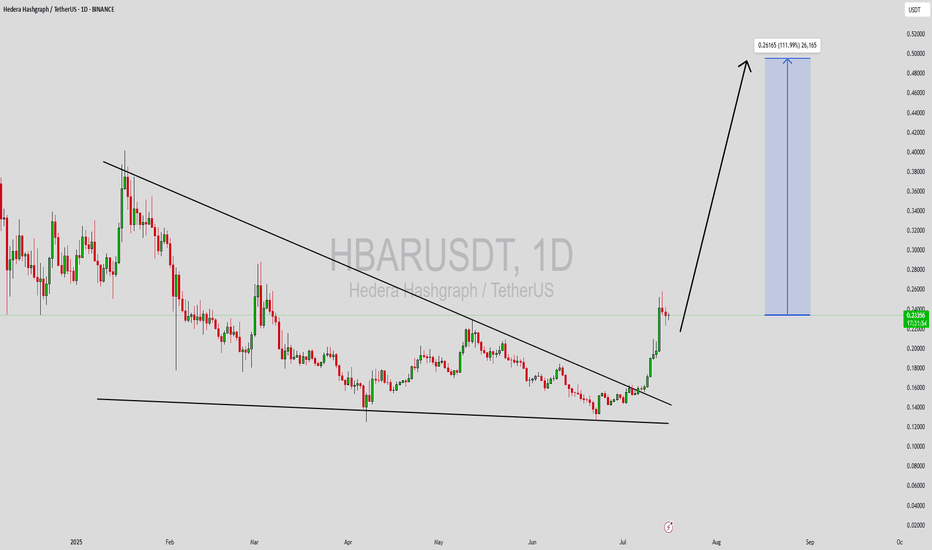

Can Hedera Hashgrap sustain the breakout for 17% gains to $0.27?Hello✌

Let’s analyze Hedera Hashgraph’s upcoming price potential 📈.

BINANCE:HBARUSDT has broken above multiple daily resistance levels and is now holding near a strong Fibonacci support and daily demand zone 📊. This setup suggests a potential upside of around 17%, with a primary target at 0.27

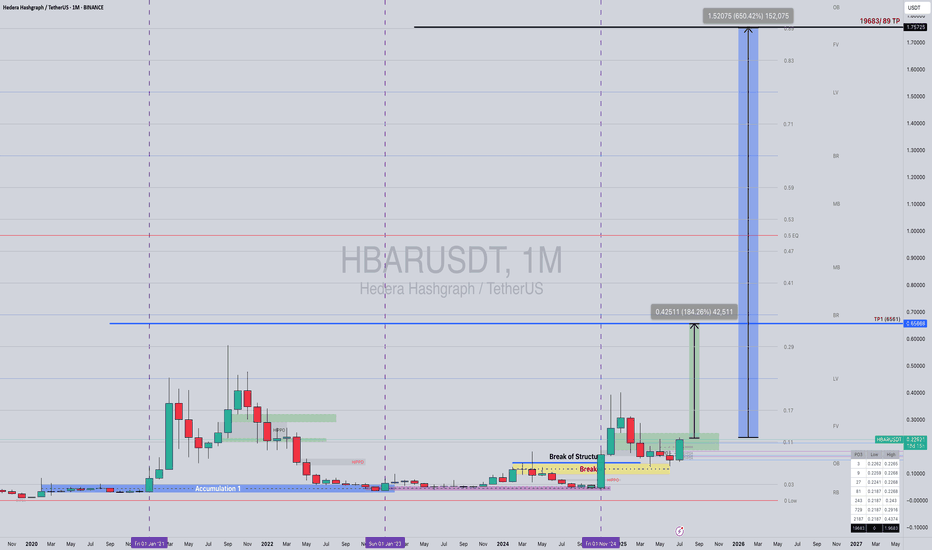

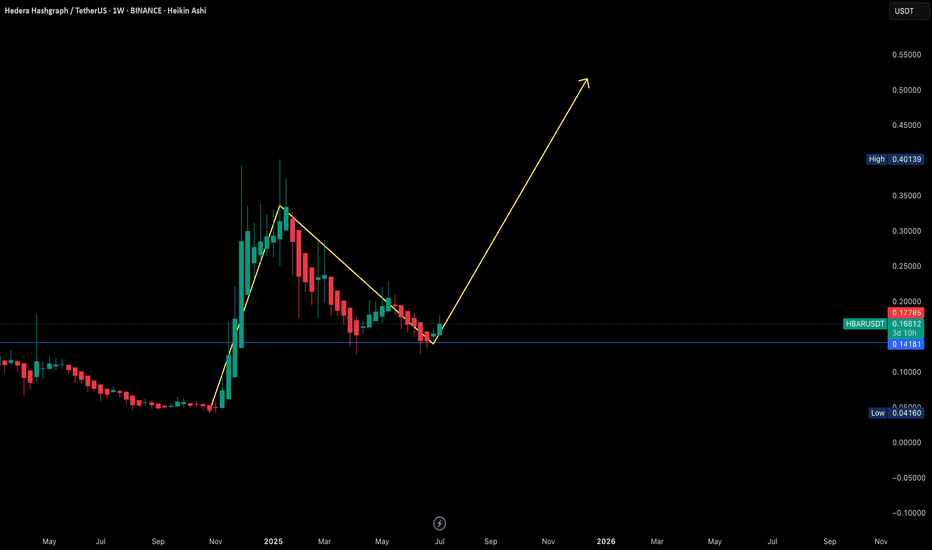

HBAR/USDT Weekly Setup – Lord MEDZ Trading Journal"Where Smart Money Moves, Profits Follow"

This is not financial advice. This post is for personal trading journaling and educational purposes only.

Overview

In this week's market breakdown, I’m sharing my current view on Hedera Hashgraph (HBAR/USDT) using a combination of Smart Money Theory (SMT),

Additional Spot Buy Recommendation (HBARUSDT)Additional Spot Buy Recommendation

Pair: HBARUSDT

Trading Style: Swing (Spot)

Entry (Supplementary): Current price around $0.17 (for those who previously entered at $0.14)

Profit-taking strategy: Follow peaks on Weekly (W) or Monthly (M) timeframes.

Suggested Target: Aim to hold towards $0.

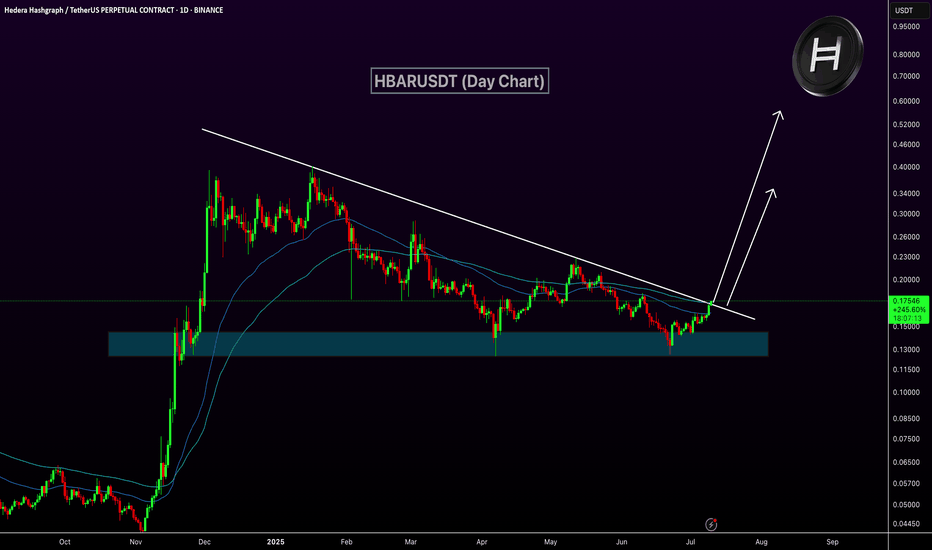

HBARUSDT Forming Bullish BreakoutHBARUSDT is showing strong signs of a potential bullish trend as it pushes higher with increased momentum. The recent breakout on the daily chart confirms that buyers are stepping in with confidence, supported by a good surge in volume. This uptick in activity is drawing fresh attention from traders

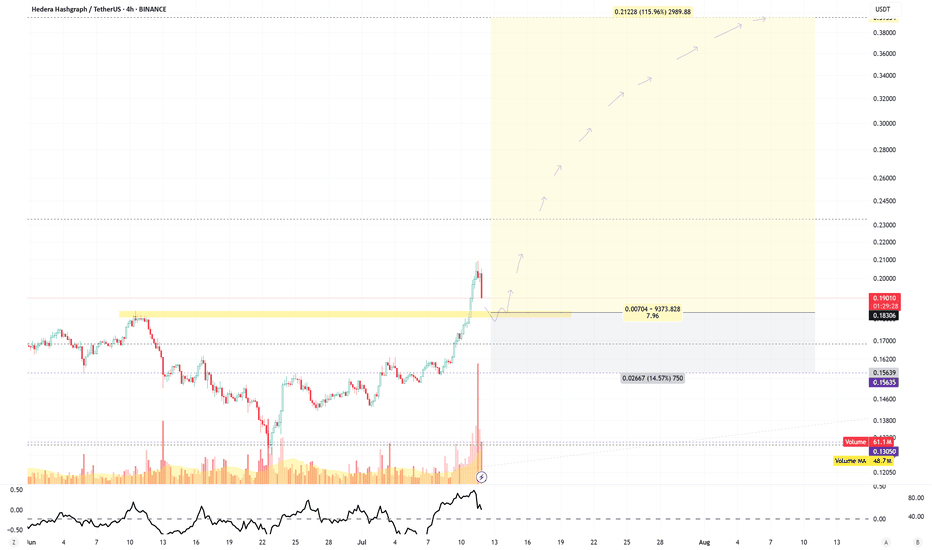

HBARUSDT Trendline Breakout - Target 150%!HBARUSDT is currently attempting a breakout from a long-standing descending trendline on the daily chart. The price has reclaimed a key demand zone and is now trading above both the 50 and 100 EMA, a bullish technical signal suggesting bullish momentum.

If the breakout sustains, HBAR could target t

HBARUSDT Wedge BreakoutHBAR has broken out of a falling wedge pattern on the daily chart, signaling a potential bullish reversal. Price is trading above a key support zone and is pushing through descending resistance with strong momentum. A move toward higher targets seems likely if the breakout holds.

Resistance 1: $0.2

HBAR wait for entryHBAR is a highly volatile crypto that often leads the market during Bitcoin rallies.

Let’s patiently wait for a price dip followed by a bounce from a key support zone.

Disclaimer:

This analysis is based on my personnal views and is not a financial advice. Risk is under your control.

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.