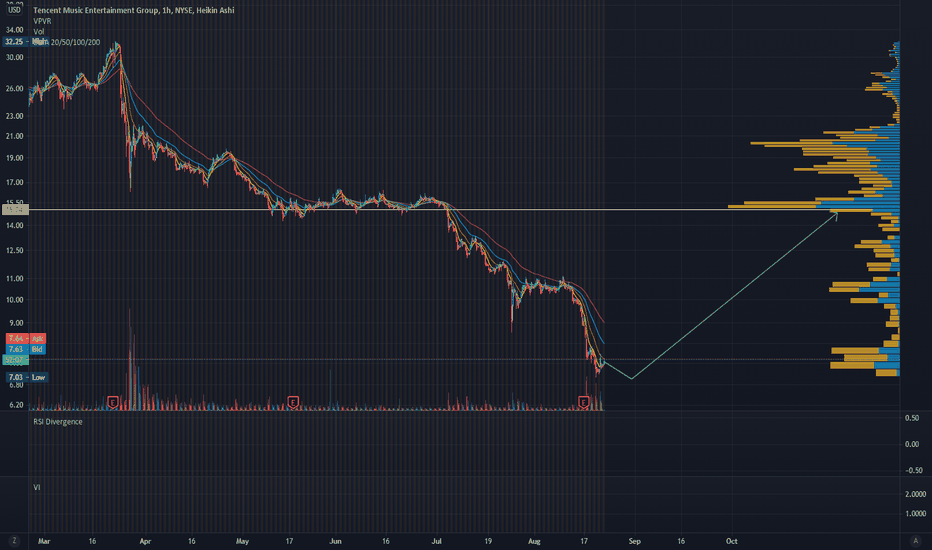

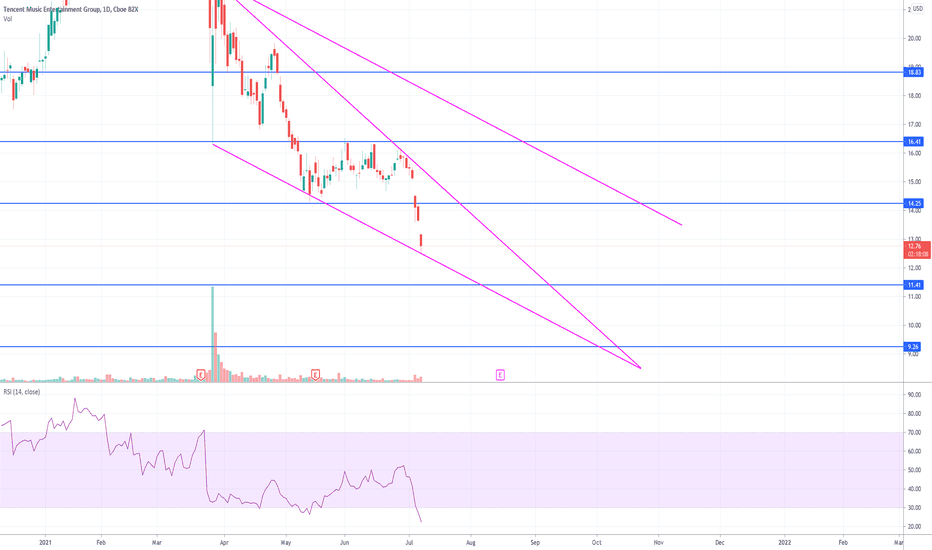

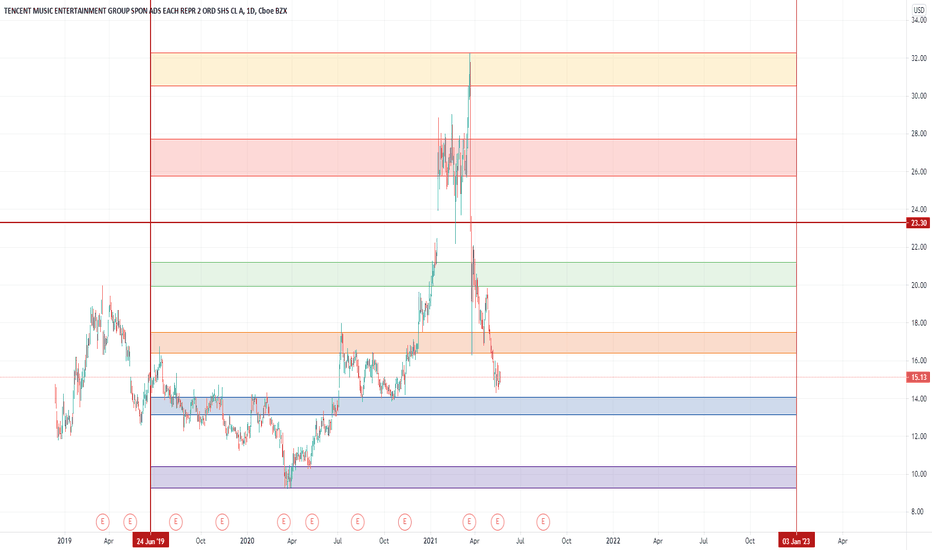

In times when no one pay attention to fundamentalsMany experienced investors look where most of people are not looking. Looking at TME chart it looks like trash if anything one may want to short it with such downward momentum. While in short term there is gain in shorting TME (At this time there are no good entry and exit point as the price is going through an uncharted territory). If you look at some education content online it is not hard to stumble upon market participants bragging how they don't "fish the bottom" or not "adding to a losing position". But big money plays it differently. They do add to a losing position because for one they can afford to do so, they do not need to barrow money to do it and secondly they hunt for bargains! I believe if you look under the hood at this prices TME is a bargain!

The company is having net profit quarters after quarter. With positive annual EBTIDA and EBTI. Is it under pressure from Chinese government? Absolutely, but right now it is a hot topic around every Chinese stock. It is just matter of time for dust to settle! Unlike education sector in China TME will thrive unless Chinese government bans streaming music all together!

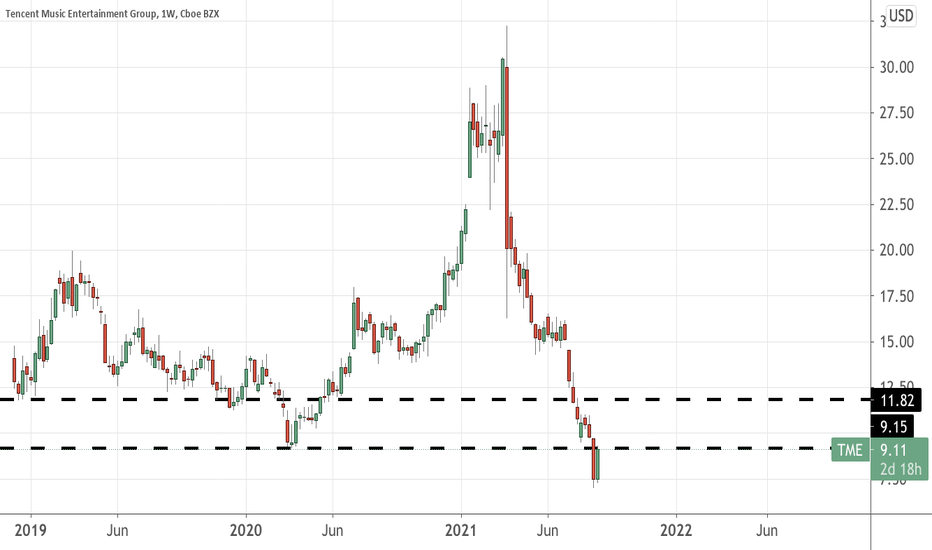

The book value on TME is 4.77 meaning if TME to be delisted or get liquated today this is roughly how much each investor will receive per share. At less than 50% of it current value! Just to put things in perspective TSLA trading at $660 has book value of $23! So aren't we looking at a bargain?

So how am I going to play this?

I have been having a tiny position averaging at about 11.00. I have added to my position today small and going to add to my position at around 5.50 in larger number of shares but in the same dollar amount as before, if we ever get there. I am not expecting to profit from this in a short period of time hence I am investing the money I can pretend I never had to begin with (I can afford to park my cash). As of now there is no exist strategy on TME I am just going to wait for sell off to end and going to plan for one once the stock changes trend (it may take years!)

1698 trade ideas

Pick up some shares of TME last night , would you ?read latest news here and here

Again, not all businesses that falls 77% from its peak are good business. You need to know the market ,its growth forecast down the road before picking up. If you are not comfortable, there are always other stocks to go bargain hunting.

Please do your own due diligence !

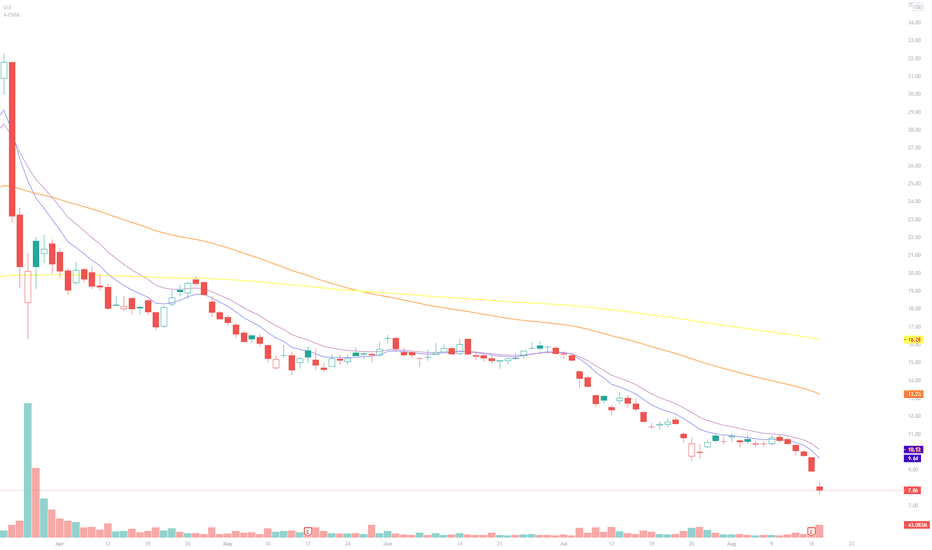

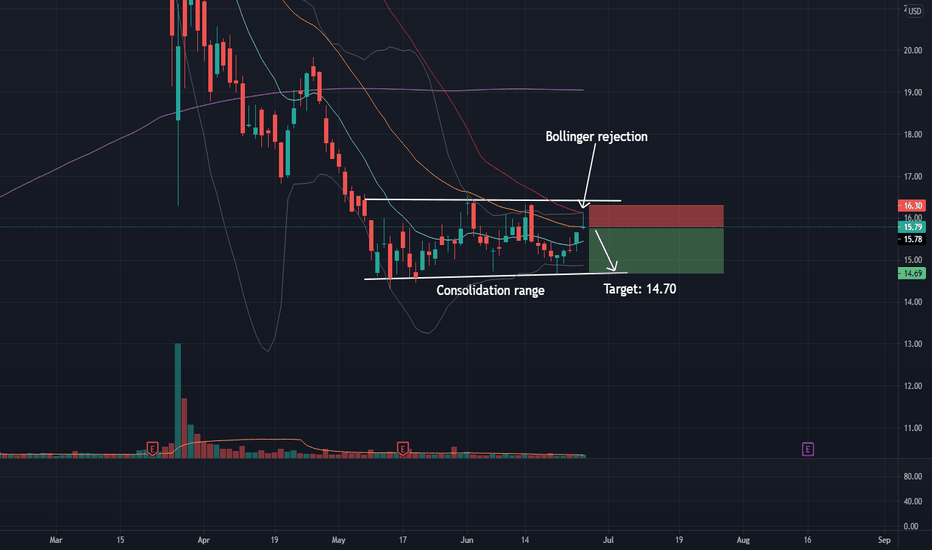

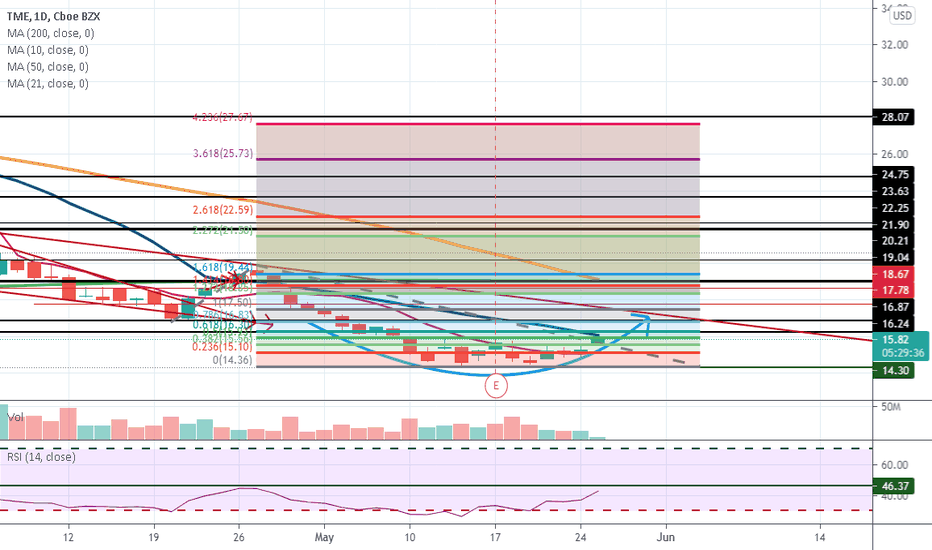

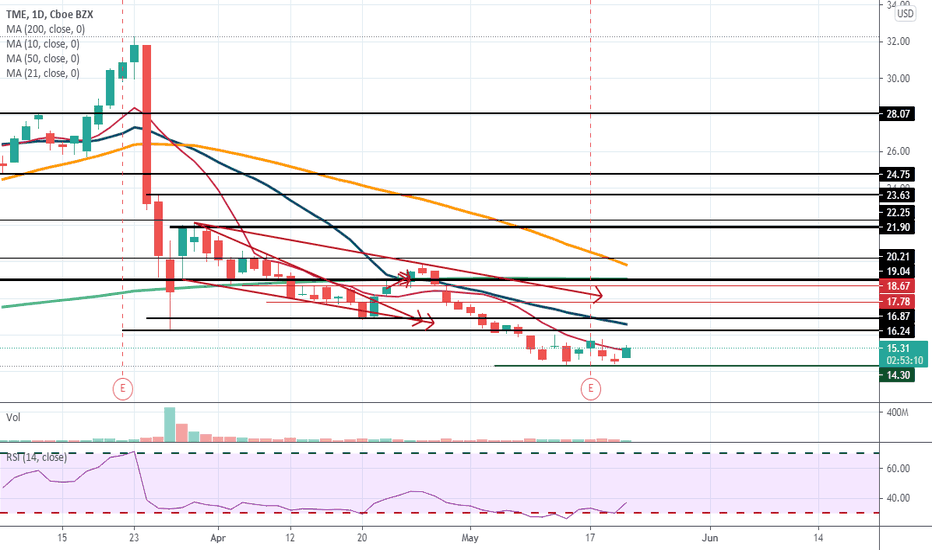

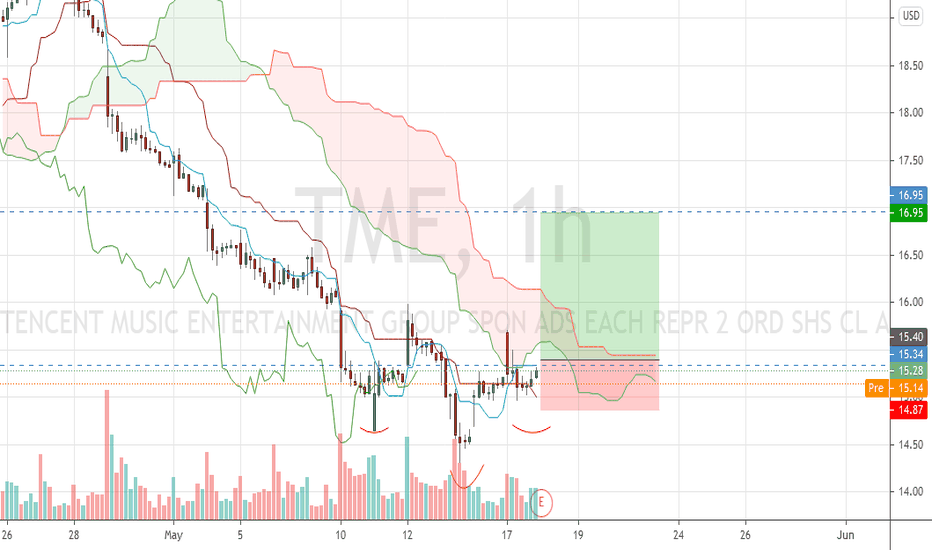

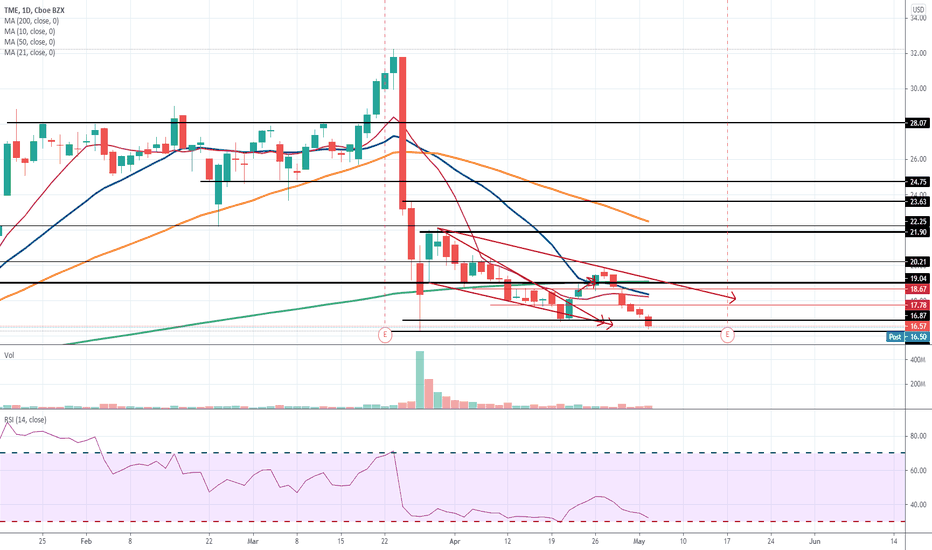

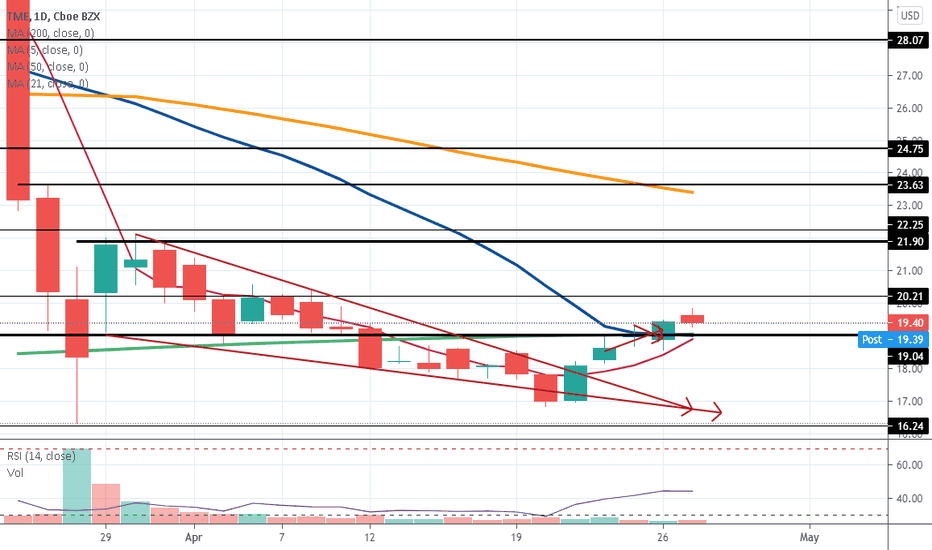

TME Bollinger RejectionTME has been consolidating in a range and has now reached the top of that range and got rejected by the upper bollinger band. The bollinger bands are contracting showing more range bound trading from top to bottom of the consolidation range. There soon will be a breakout from this range but i don't think thats coming quite yet. Looking for this to go to the bottom of the range.

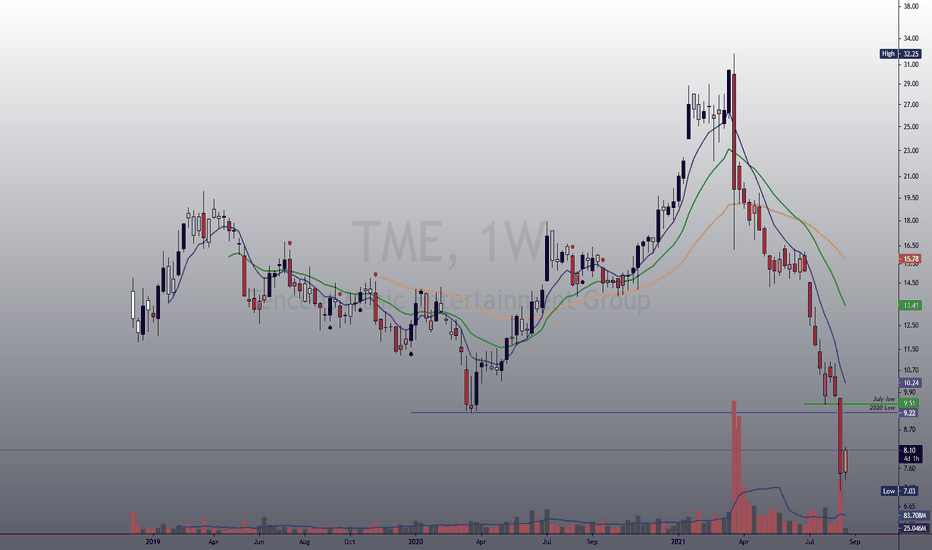

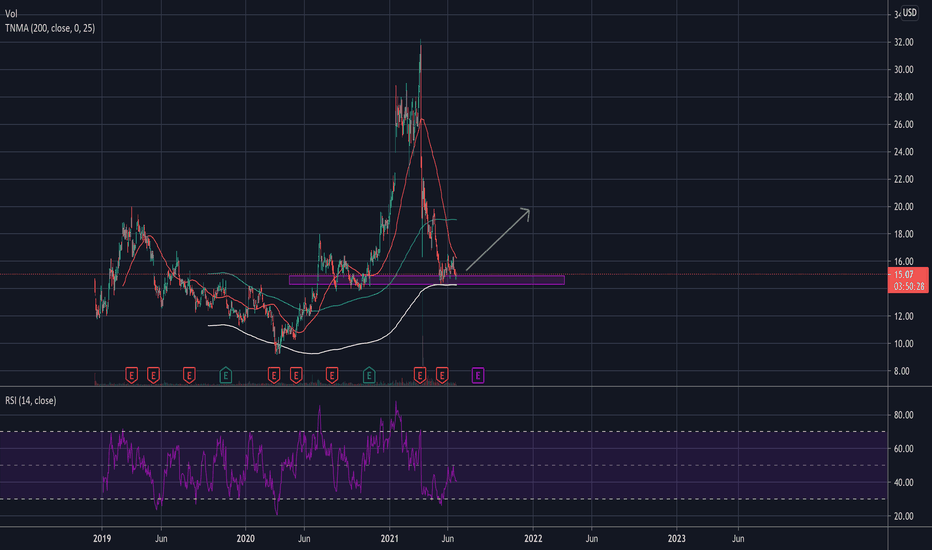

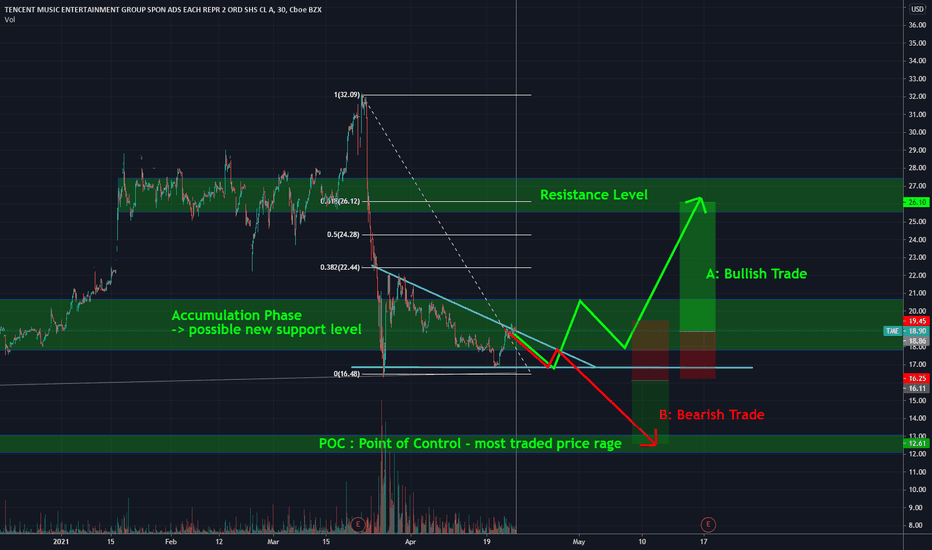

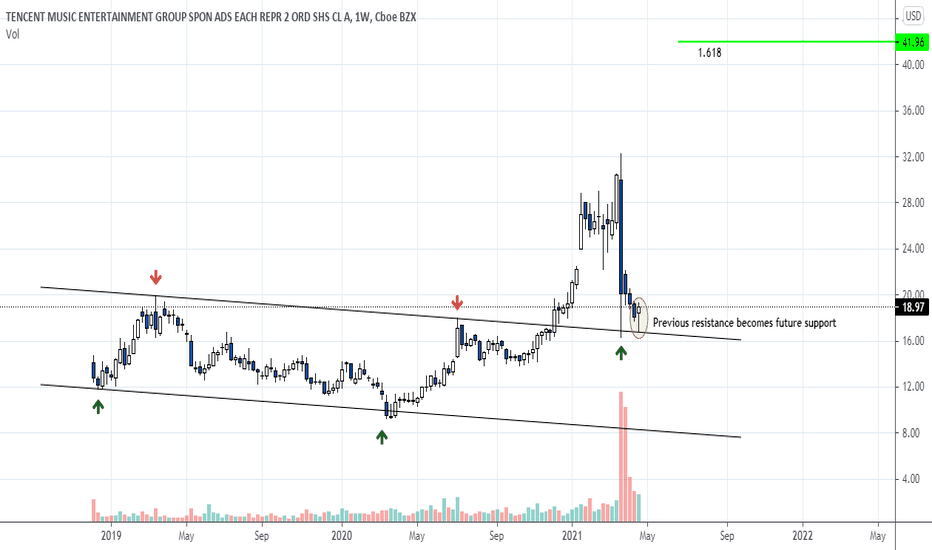

TME: Approaching 3 Layer SupportTencent Music's fluky selloff was the result of Archegos Capital's reckless overleveraging. However, this selloff has created an interesting opportunity to buy off of weekly trendline, horizontal, and 50 day SMMA support. The fundamentals of TenCent remain unchanged and many Wall St. analysts maintain an average $25 price target despite the selloff. Revenue + Net Profit continue to increase QoQ. This may be a great opportunity to grab some shares of China's #1 music streaming company.

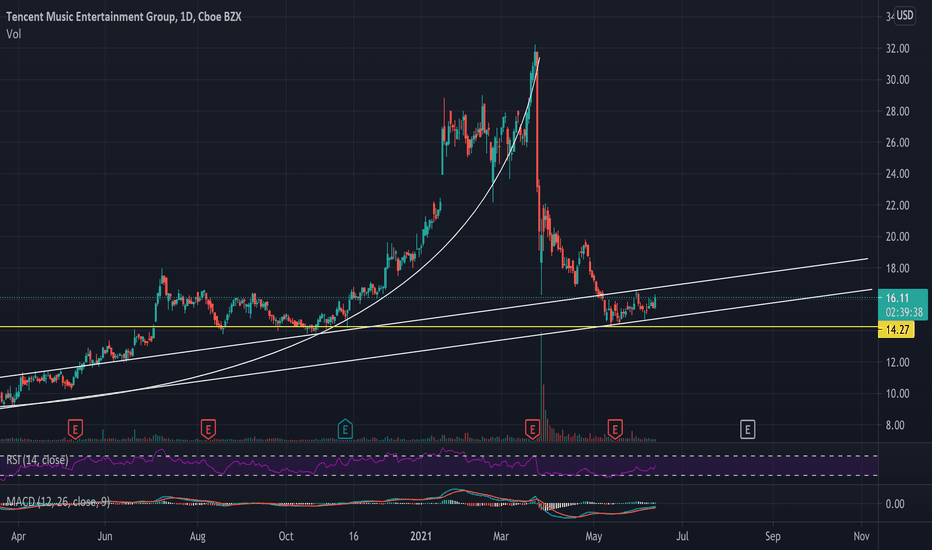

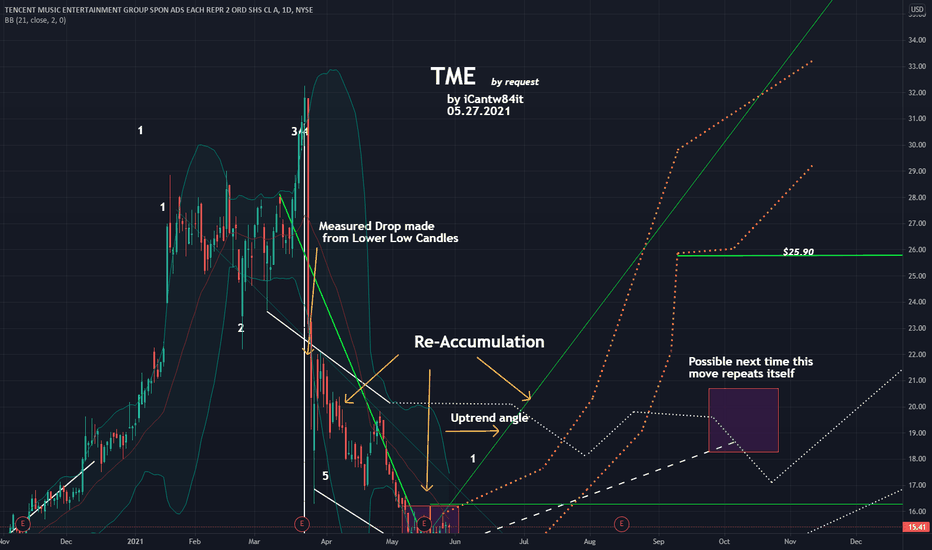

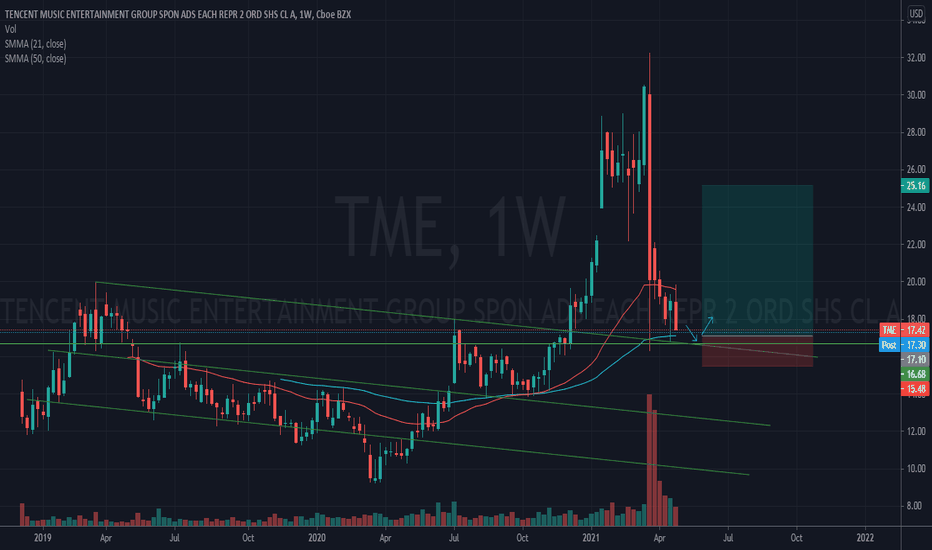

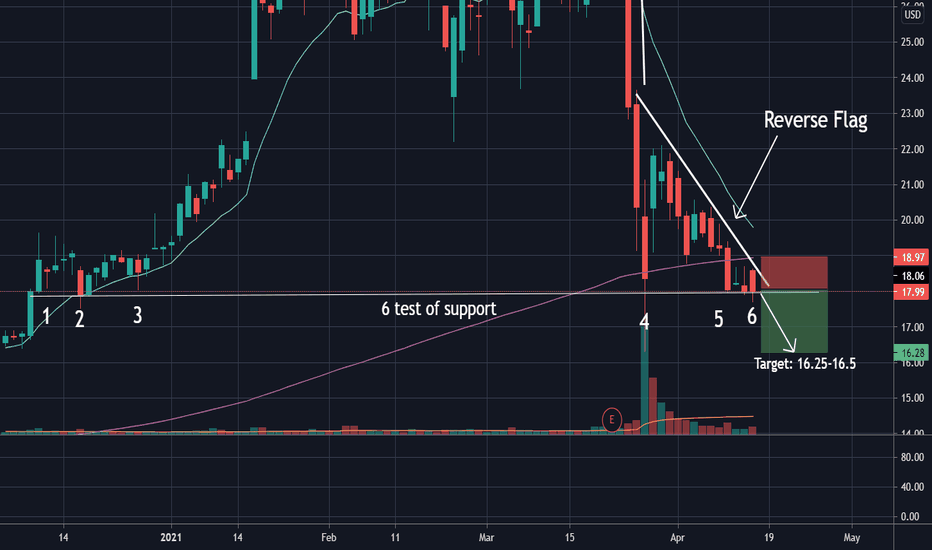

$TME analysis This is by far the most interesting chart in the market right now ...the market initially broke out of a descending channel , shot out and lost momentum . it the decided to go back and test the backside of the broken resistance thus making it support. now a hammer formed on the weekly chart which suggests to me further bullish momentum may be expected ...by using Fibonacci i have a target of $42