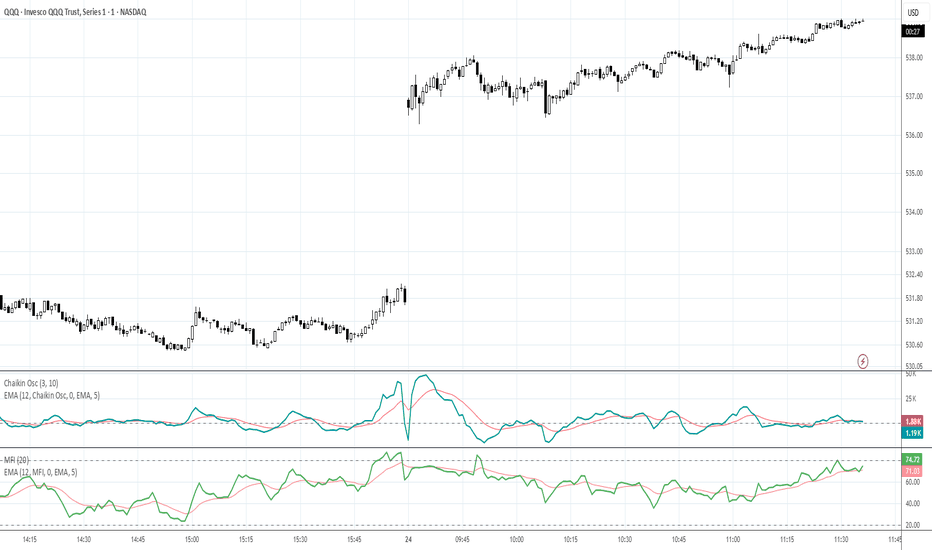

Learn how to trade EOD / FOD Professional StrategyEOD /FOD is an acronym for End of Day buy or sell short entry that holds overnight and the First of Day sell the ETF or stock at Market Open. This is a strategy for experienced to Elite aka Semi-Professional Traders. Beginners need to hone skills and practice in a simulator.

Professional Traders

Related funds

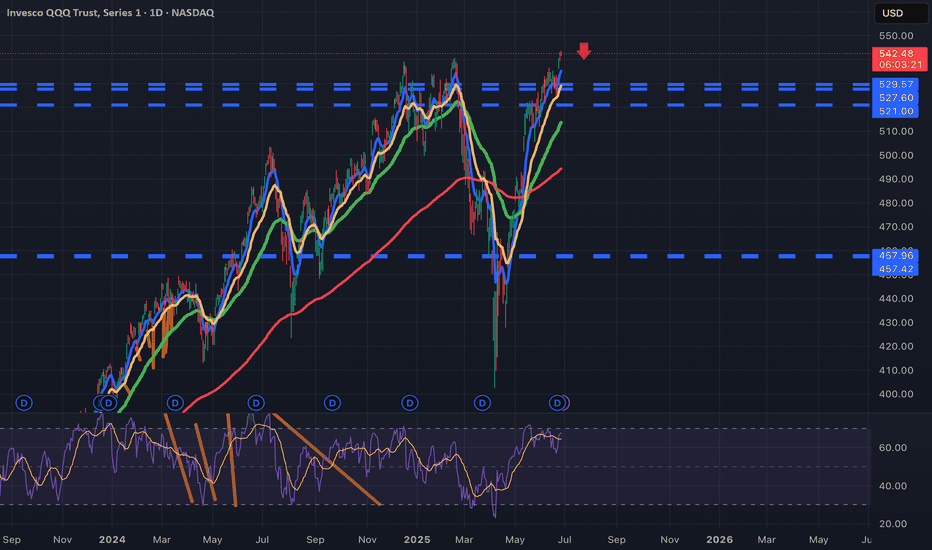

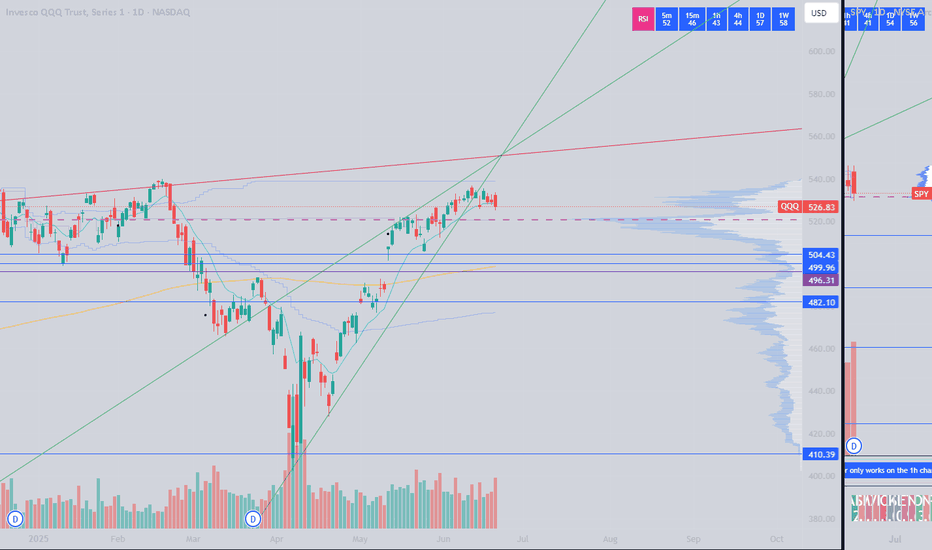

Triple Top on QQQAs I said some the same things for the S&P 500 . here we have QQQ . Repeating this pattern staying In this box for some time now. investment accounts , 401ks, real estate , etc etc. I see all accross the board people buying almost everything at very high prices. With no in dept look . lets try and m

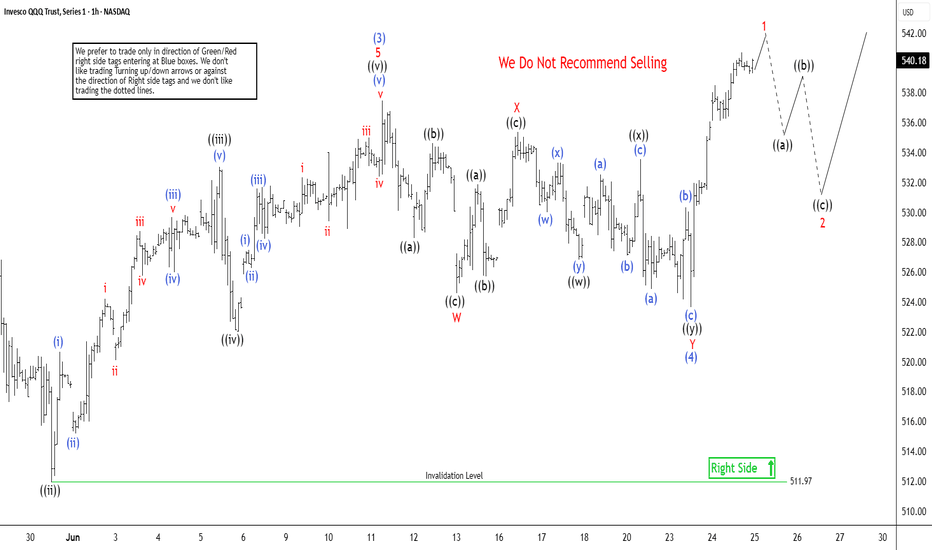

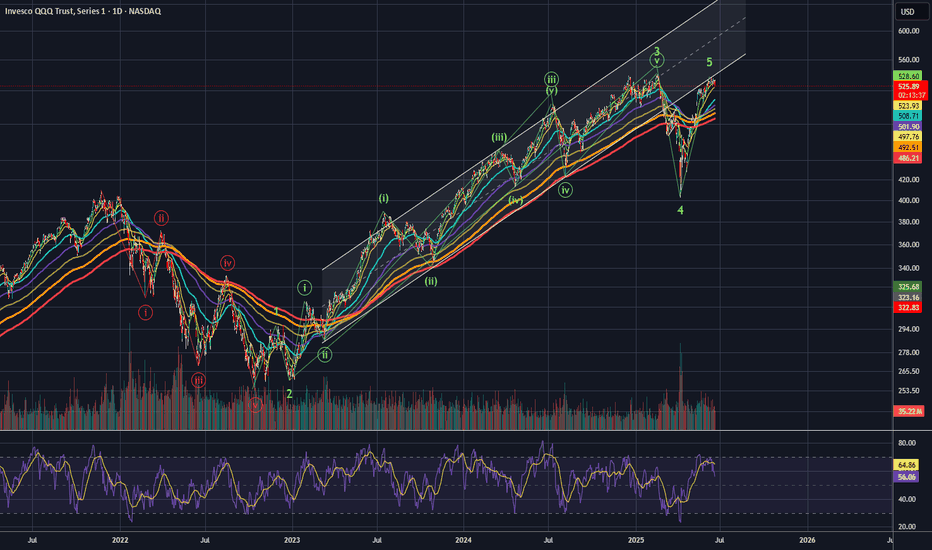

Nasdaq 100 (QQQ) Affirms Bullish Outlook with Five Wave RallyThe Nasdaq 100 ETF (QQQ) has continued its upward trajectory, confirming a five-wave Elliott Wave structure originating from the April 7, 2025 low. This development solidifies a bullish market outlook and eliminates the possibility of a double correction scenario. Starting from the April 7 low, wave

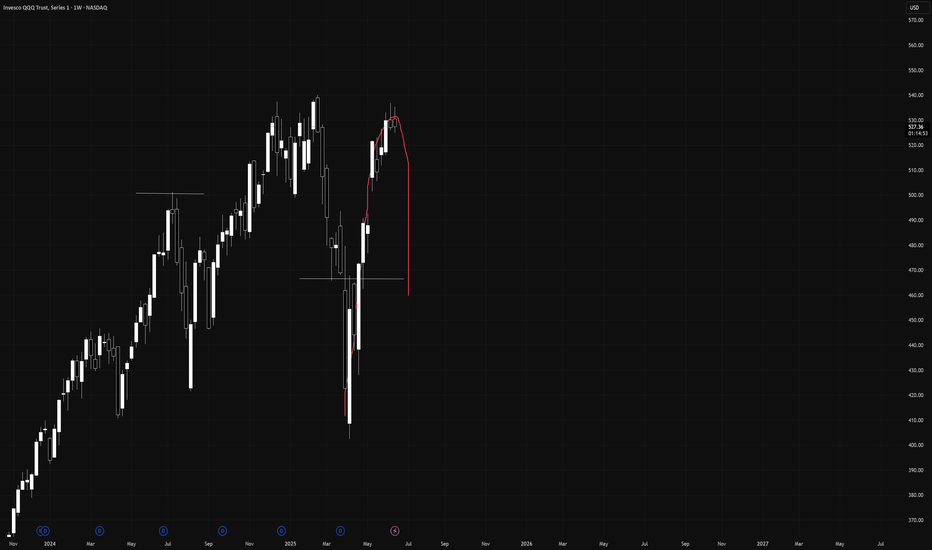

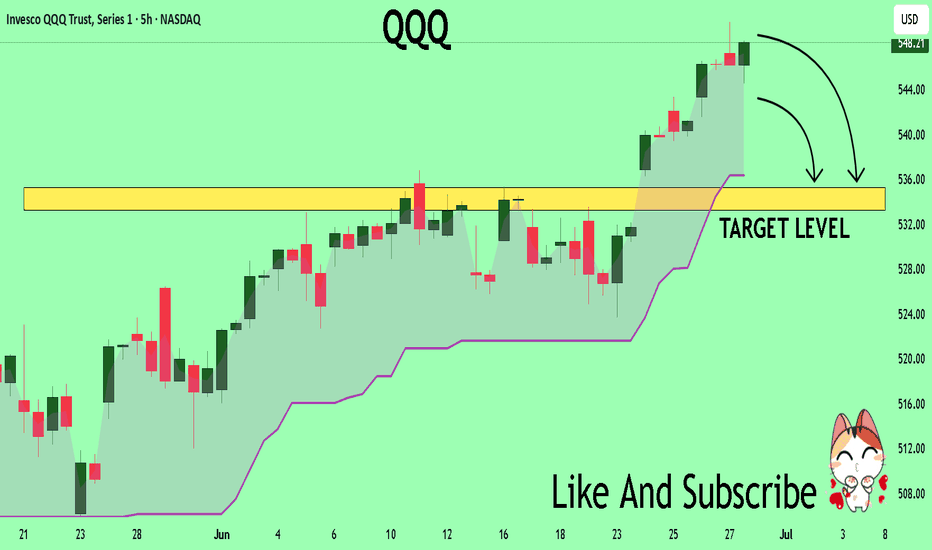

QQQ A Fall Expected! SELL!

My dear subscribers,

This is my opinion on the QQQ next move:

The instrument tests an important psychological level 548.21

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target

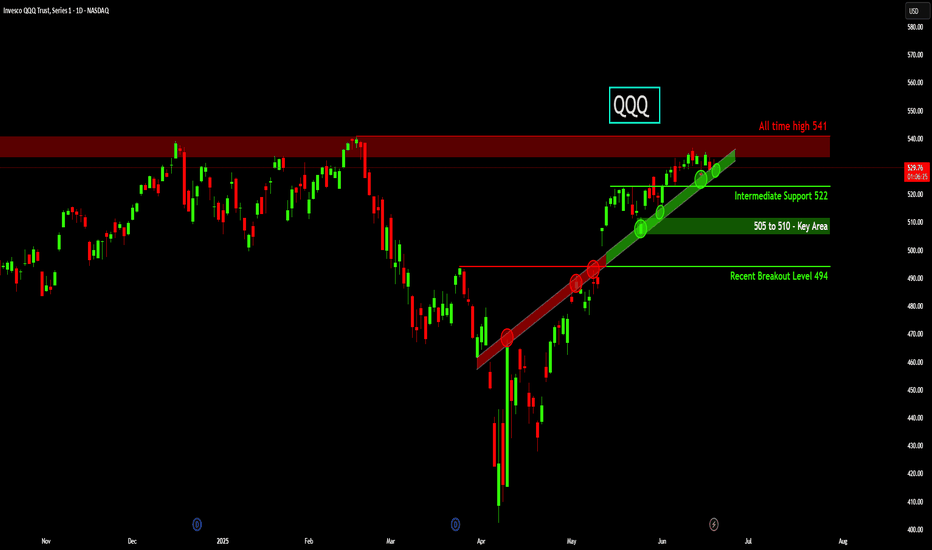

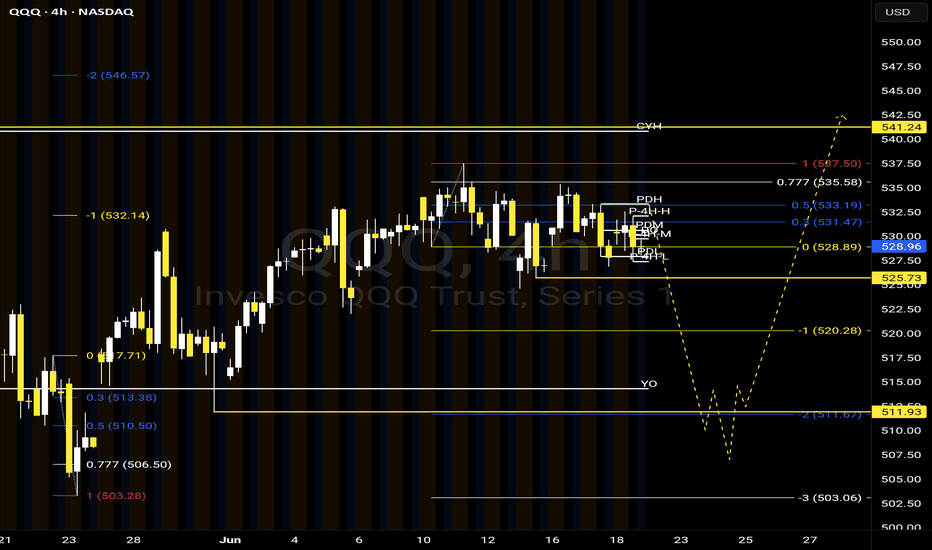

QQQ: All-Time High Resistance vs. Strong Trendline Support• Approaching All-Time High Resistance: QQQ is currently trading directly beneath its all-time high of $541 and is encountering a robust overhead resistance zone, indicating a critical test for bullish momentum.

• Strong Ascending Trendline Support: The price action is consistently supported by a we

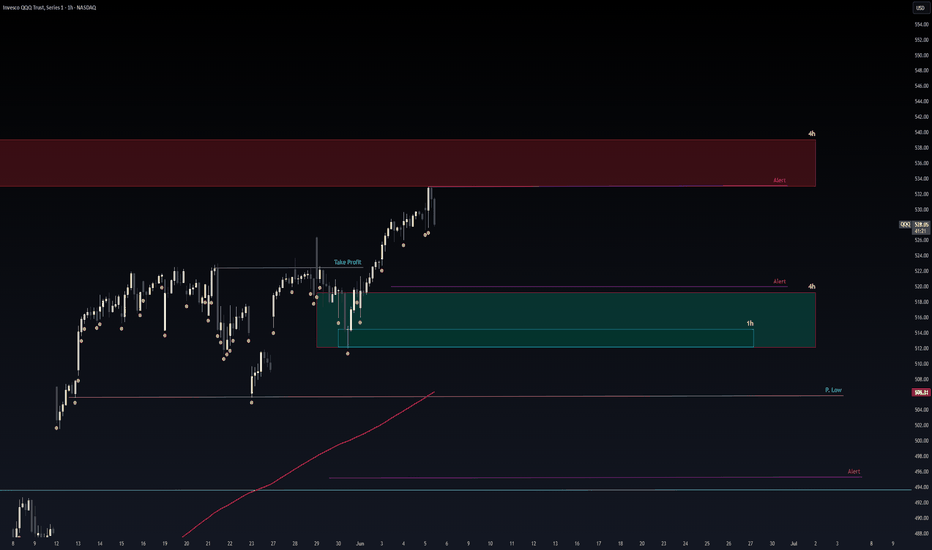

Safe Entry Zoneafter Rejection from the Resistance 4h Red Zone.

we have 4h and 1h Green Zone as Strong Support levels.

Note: Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The

QQQ Potential *Short Term Bearish SetupAfter studying the HTF here is what I am seeing as a potential setup forming.

We formed a HTF MSS on the 4H close to ATH leaving an epic equal high to come back to later. I am looking for a candle body closures *BELOW lows to confirm as we leave the MSS yellow zone and head to TP1 (-1). Once we ap

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

83455 trades at 3,877 CNY today, its price has risen 0.47% in the past 24 hours. Track more dynamics on 83455 price chart.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

No, 83455 doesn't pay dividends to its holders.