JD Health set to make a move?Digital Health is on the rise ...with funds allocated toward E-Med endeavors growing rapidly.

It is tipped that artificial intelligence will play a key role in the development of industry wide efficiencies, with many advancements occurring over the last 12 months within the Medical Technologies spa

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.45 CNY

4.24 B CNY

59.25 B CNY

1.03 B

About JD Health International, Inc.

Sector

Industry

CEO

En Lin Jin

Headquarters

Beijing

Founded

2018

ISIN

KYG5074A1004

FIGI

BBG01GXJWFF0

JD Health International, Inc. operates as an online healthcare platform and retail pharmacy company. Its technology-driven platform is cantered on the supply chain of pharmaceutical and healthcare products and healthcare services, encompassing a user’s full life span for all healthcare needs. The firm's retail pharmacy business operates through three models: direct sales, online marketplace and Omni channel initiative. It offers comprehensive online healthcare services, such as online consultation and prescription renewal, chronic disease management, family doctor and consumer healthcare. Its platform allows doctors to practice multisite, acquire and manage targeted patients, conduct healthcare research, exchange academic and clinical knowledge and improve diagnostic and treatment skills. The company was founded on November 30, 2018 and is headquartered in Beijing, China.

Related stocks

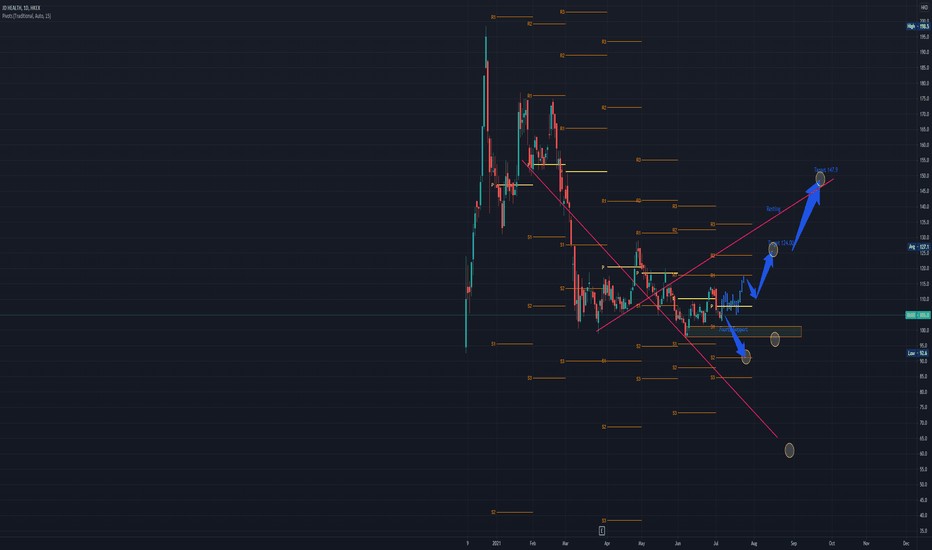

JD.com's Healthcare Unit Prepare for Next Battle Affected heavily by recent technological advancements, the sector may soon attract Chinese regulators' attention.

Background

2021 turned out to become a positive year for China's healthcare industry, where the gigantic demand stems from the aging population, growing individual wealth, and – more

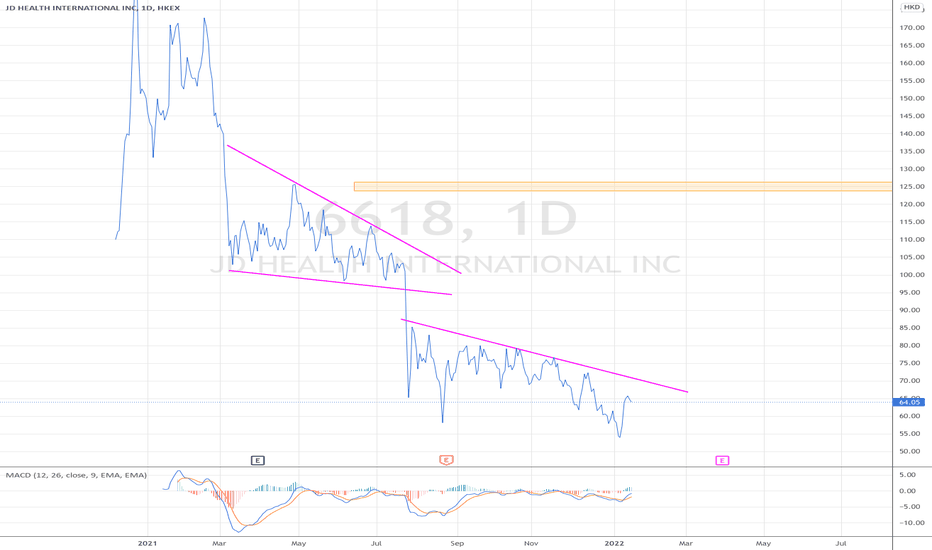

Trendlines drawing video tutorialHaha, this is my first maiden video tutorial on Tradingview. I hope it would be helpful in some ways to clear the doubts of those who are exploring or using trend lines in their charts.

Now, of course, there are many ways to draw trend lines and 2 persons looking at the same chart can draw it diffe

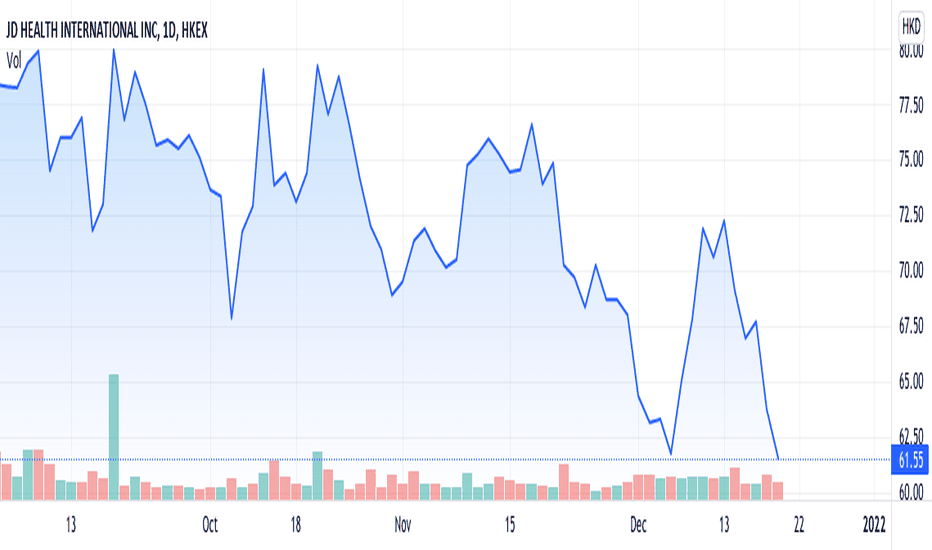

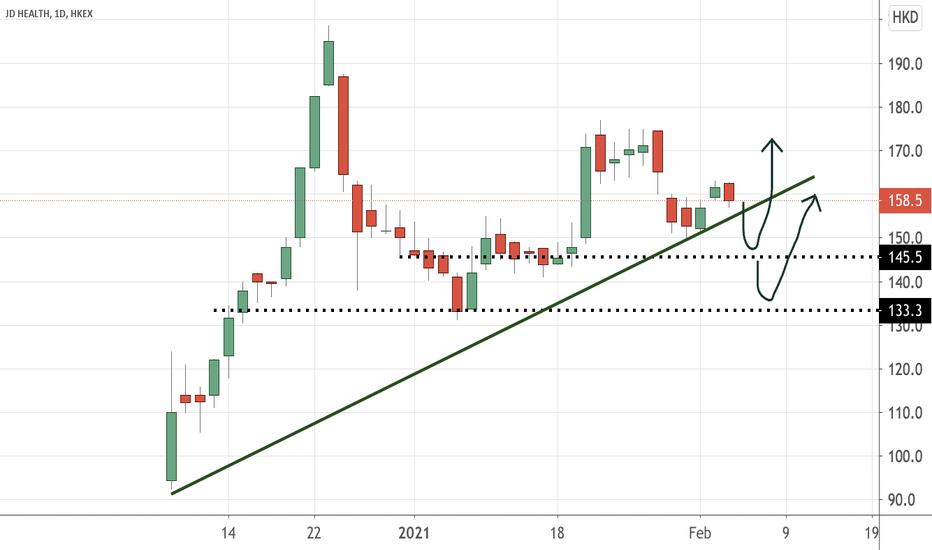

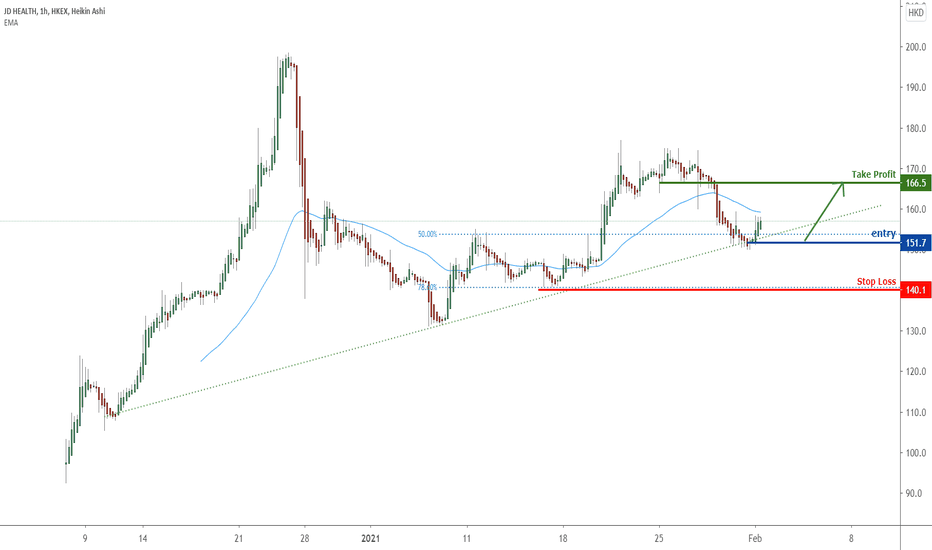

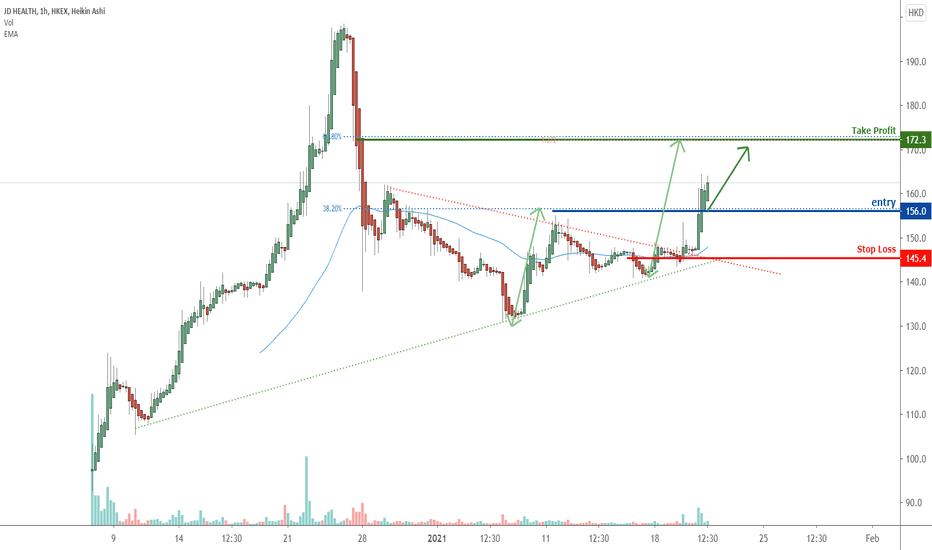

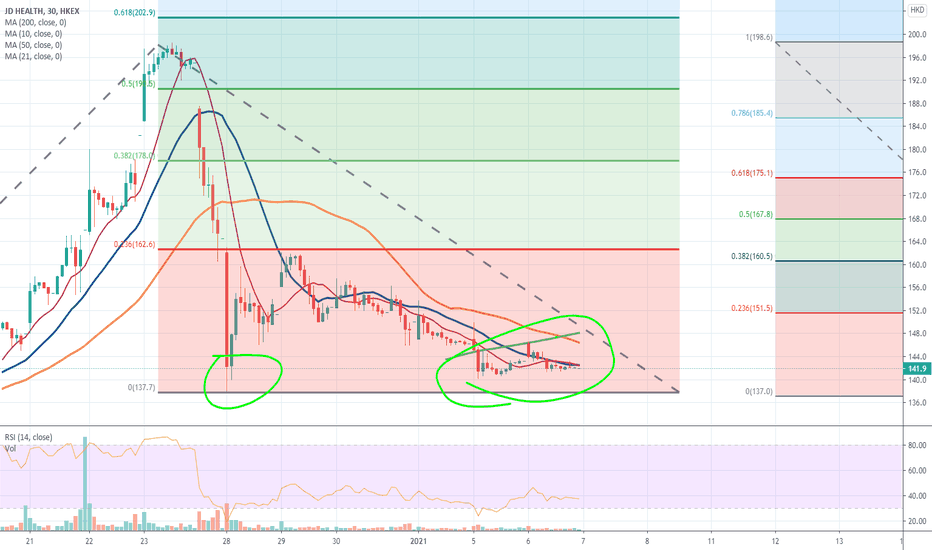

JD.com HEALTH ~ Looking for movement to appear soon... JD HEALTH as retail pharmacy has started to be online, and notice increase of sale retail is now online multiple supported showing JD Health have been ranging near the IPO price, premature Head and Shoulder is forming up.

Currently it's at lower zone, expecting as break out happening soon with the l

Have a pie of Chinese Healthcare market Read latest news here and here

What will be the new US President , Joe Biden stand on US-China relationship ? Will he continue to impose trade tariffs like Donald Trump ? How about the delisting of Chinese stocks on Wall Street ? If the latter continues to happen, we can expect more Chinese c

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

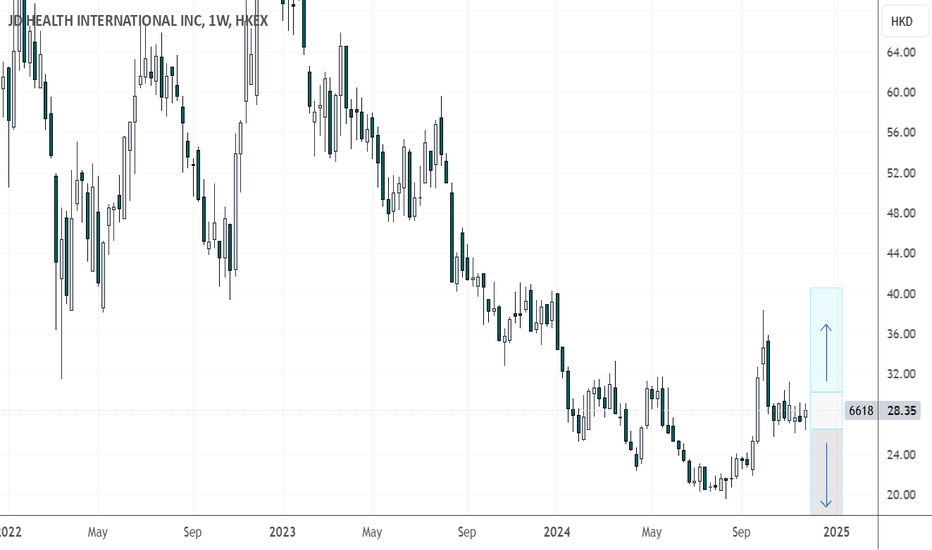

The current price of 86618 is 58.90 CNY — it has decreased by −0.60% in the past 24 hours. Watch JD Health International, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on HKEX exchange JD Health International, Inc. stocks are traded under the ticker 86618.

86618 stock has risen by 2.29% compared to the previous week, the month change is a 26.97% rise, over the last year JD Health International, Inc. has showed a 179.81% increase.

We've gathered analysts' opinions on JD Health International, Inc. future price: according to them, 86618 price has a max estimate of 80.81 CNY and a min estimate of 48.21 CNY. Watch 86618 chart and read a more detailed JD Health International, Inc. stock forecast: see what analysts think of JD Health International, Inc. and suggest that you do with its stocks.

86618 reached its all-time high on Aug 19, 2025 with the price of 63.60 CNY, and its all-time low was 18.30 CNY and was reached on Aug 15, 2024. View more price dynamics on 86618 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

86618 stock is 1.89% volatile and has beta coefficient of 1.27. Track JD Health International, Inc. stock price on the chart and check out the list of the most volatile stocks — is JD Health International, Inc. there?

Today JD Health International, Inc. has the market capitalization of 187.08 B, it has decreased by −3.21% over the last week.

Yes, you can track JD Health International, Inc. financials in yearly and quarterly reports right on TradingView.

JD Health International, Inc. is going to release the next earnings report on Mar 30, 2026. Keep track of upcoming events with our Earnings Calendar.

86618 earnings for the last half-year are 0.81 CNY per share, whereas the estimation was 0.99 CNY, resulting in a −18.59% surprise. The estimated earnings for the next half-year are 0.60 CNY per share. See more details about JD Health International, Inc. earnings.

JD Health International, Inc. revenue for the last half-year amounts to 35.29 B CNY, despite the estimated figure of 33.90 B CNY. In the next half-year revenue is expected to reach 34.92 B CNY.

86618 net income for the last half-year is 2.55 B CNY, while the previous report showed 2.17 B CNY of net income which accounts for 17.53% change. Track more JD Health International, Inc. financial stats to get the full picture.

No, 86618 doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Sep 4, 2025, the company has 3.56 K employees. See our rating of the largest employees — is JD Health International, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. JD Health International, Inc. EBITDA is 2.44 B CNY, and current EBITDA margin is 2.37%. See more stats in JD Health International, Inc. financial statements.

Like other stocks, 86618 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade JD Health International, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So JD Health International, Inc. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating JD Health International, Inc. stock shows the buy signal. See more of JD Health International, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.