89888 trade ideas

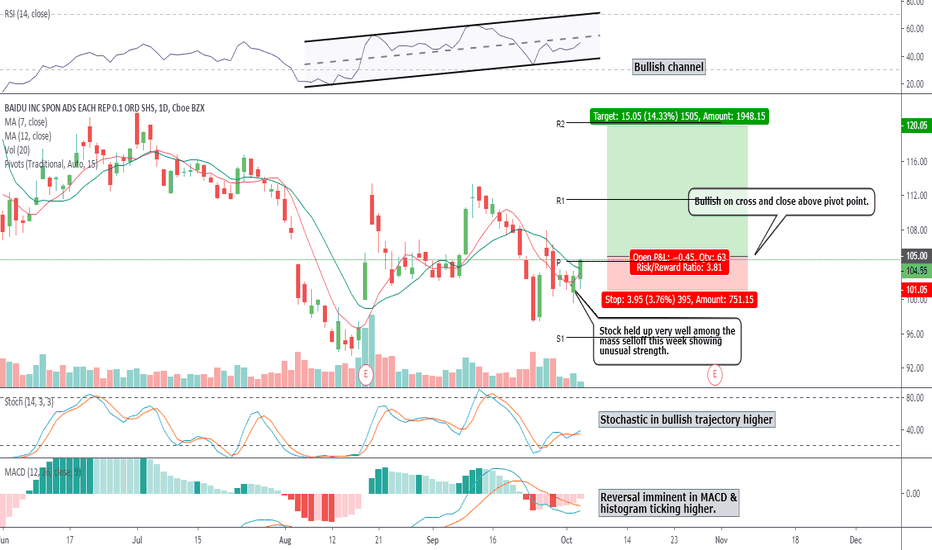

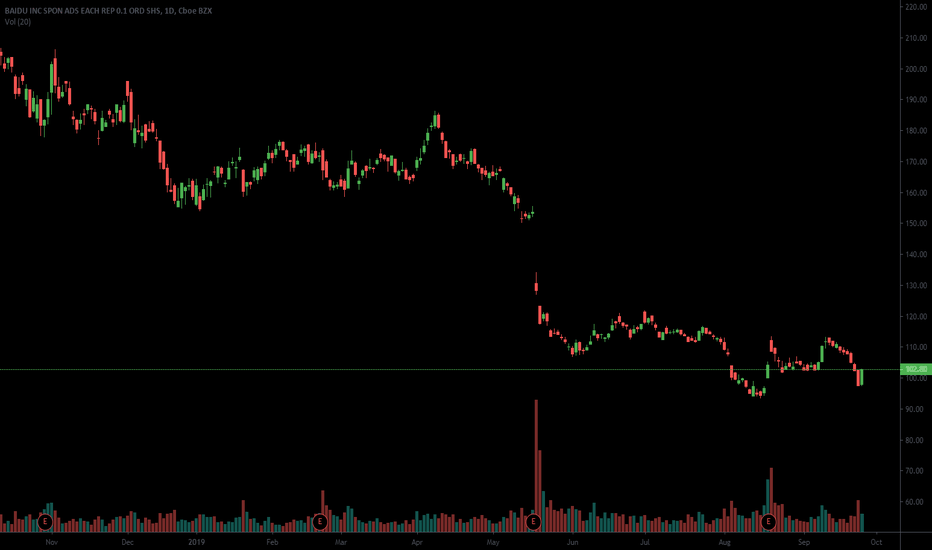

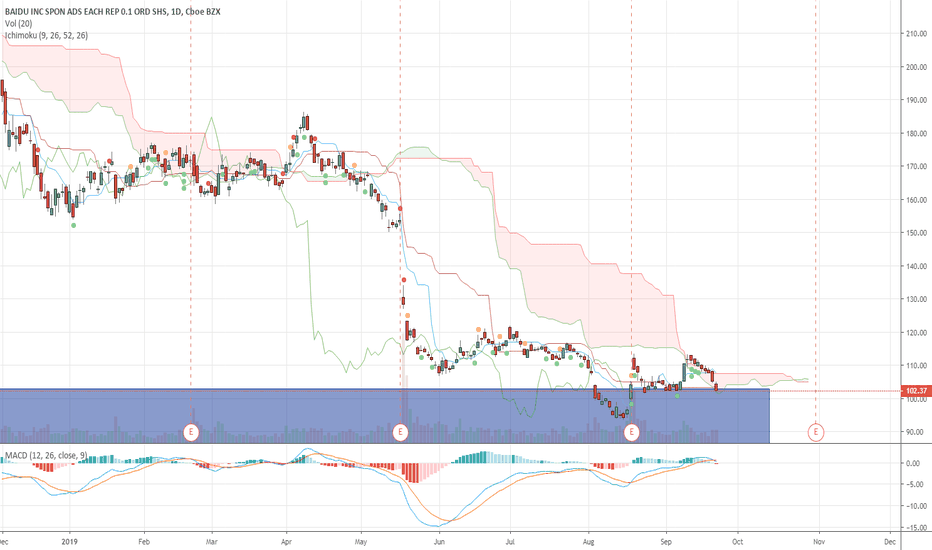

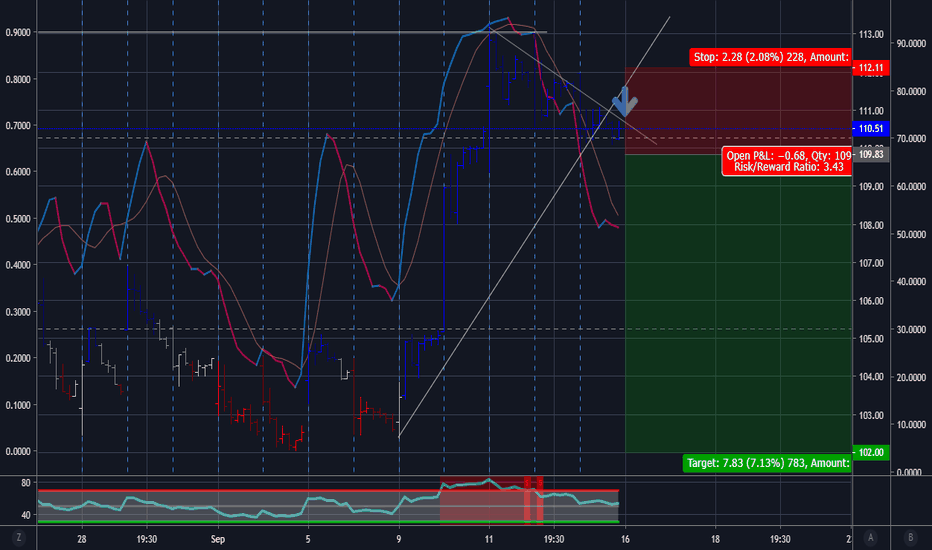

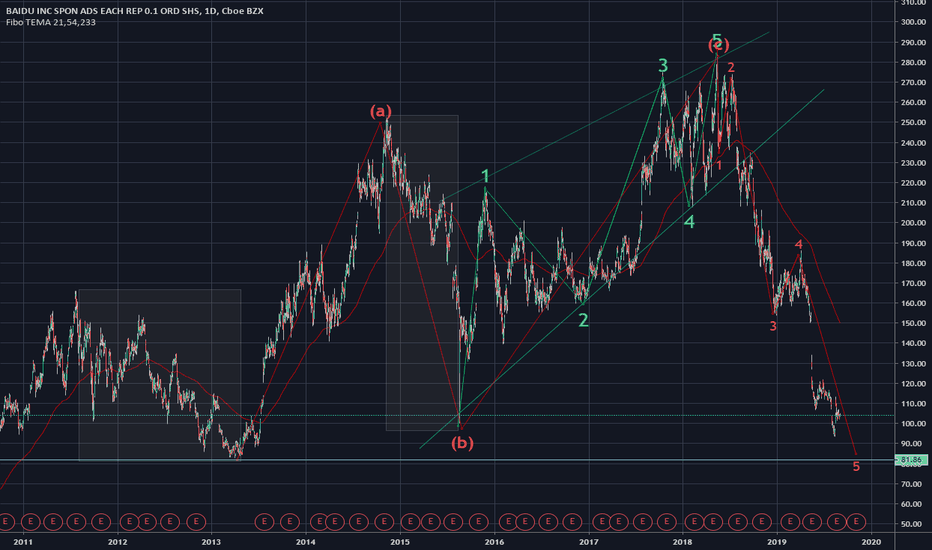

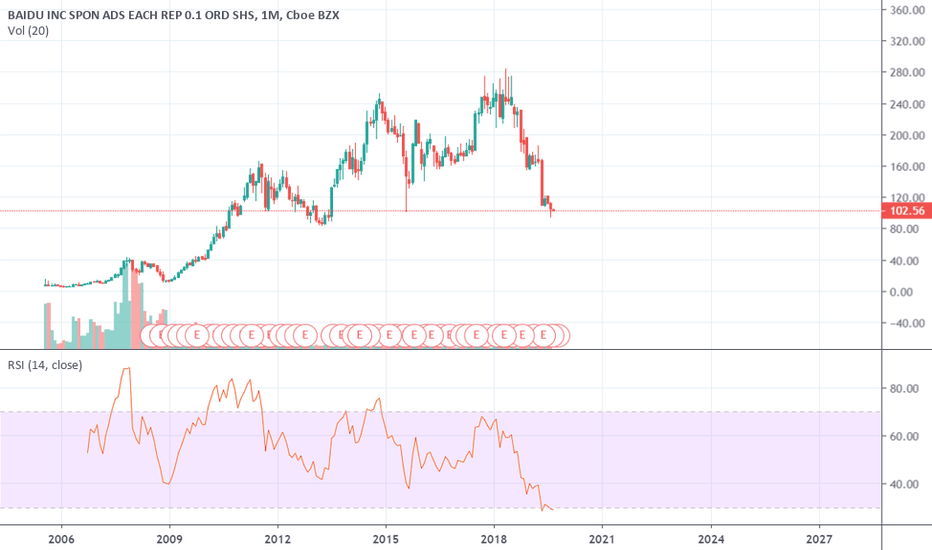

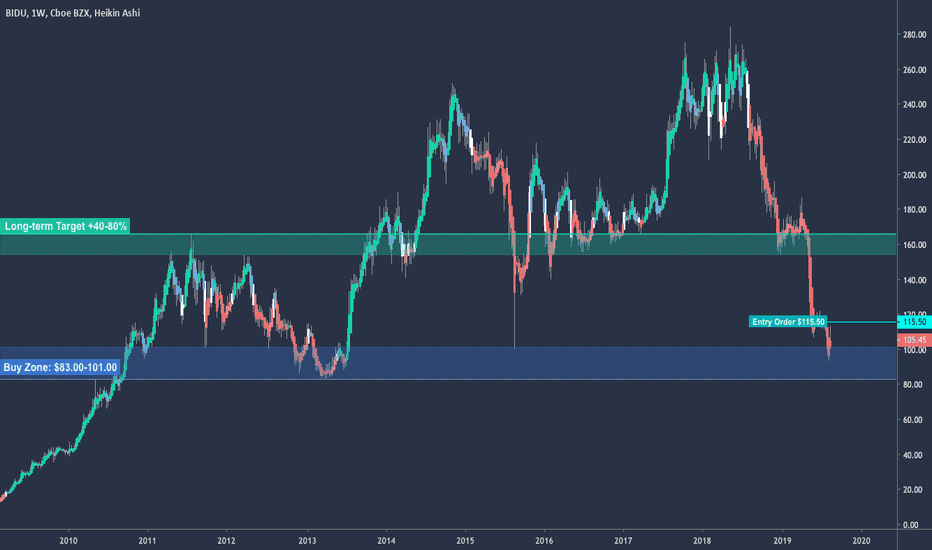

Don't be afraid of BAIDU, its a buy.Despite the stock halving in value in 12 months ,we see a great opportunity to get into this name, just like the other Chinese stocks it has shown enormous strength this week as the major USA stocks got slaughtered. Option traders are also seeing upside potential and betting big on a bullish outcome from the upcoming trade talks.

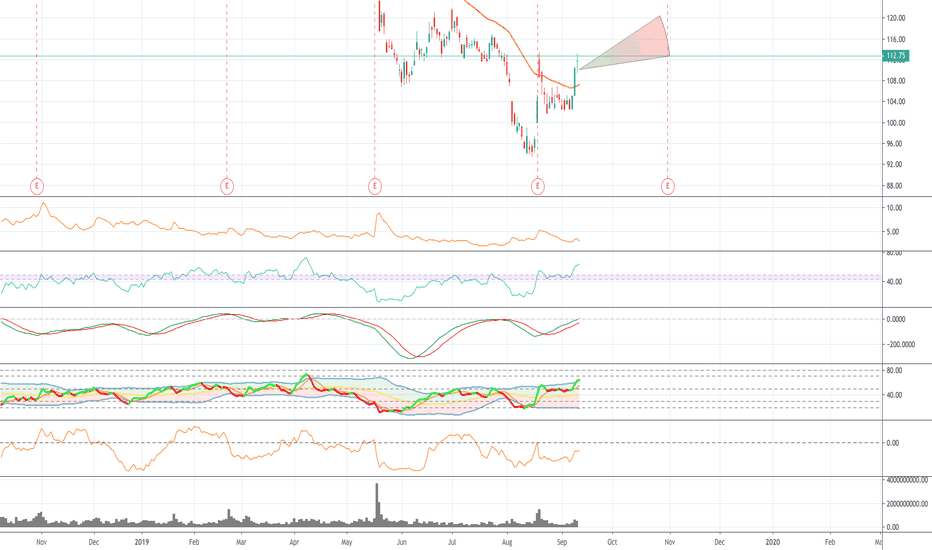

Entry level above pivot point $105

Target price short term $120

Stop loss below pivot $101

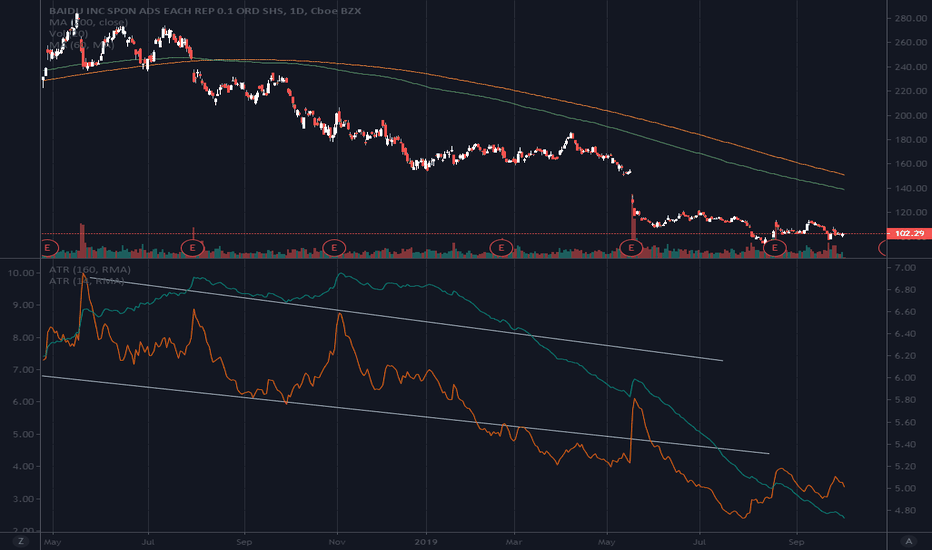

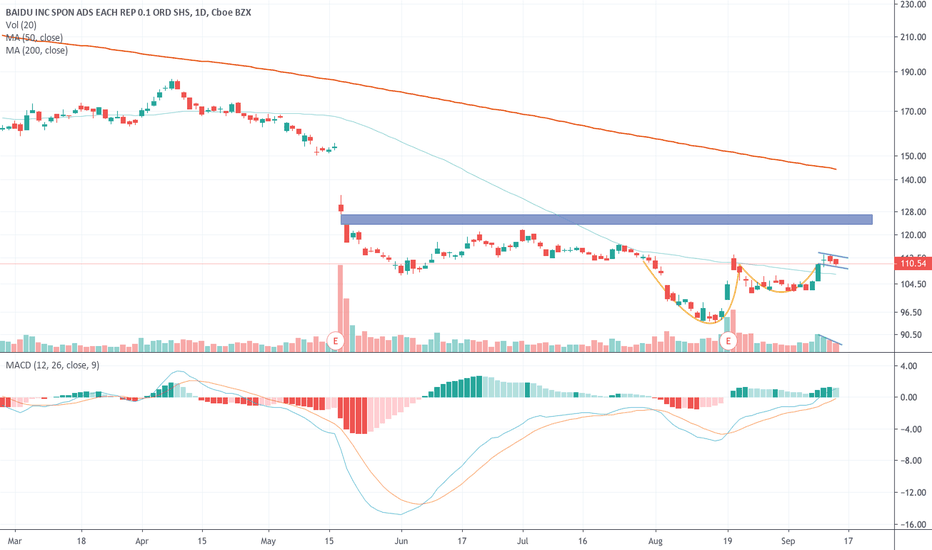

Baidu Inc.A good Fundamental, it will be a good buy below 106

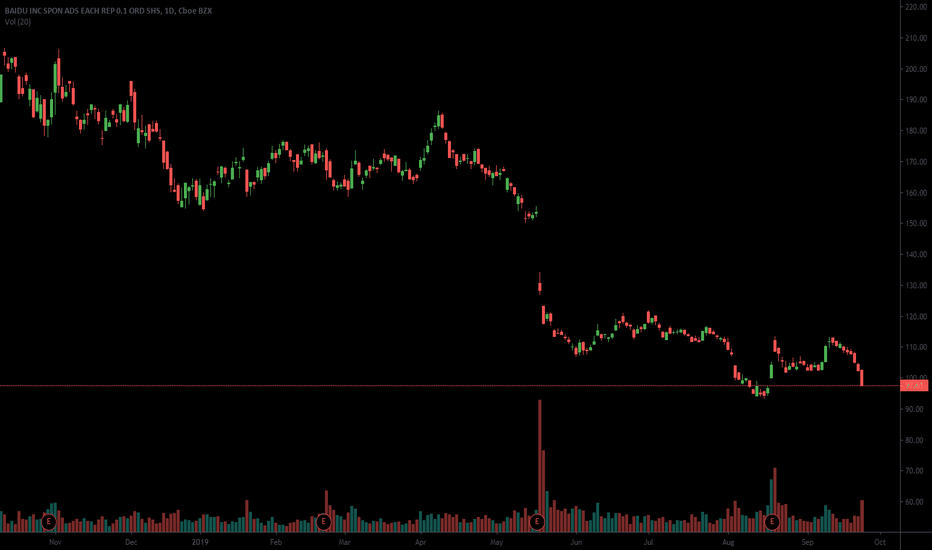

Baidu Inc.

Cyclically adjusted earnings yield:

12%

Dividend yield:

0%

Cash flow yield from operations:

9.2%

Cash flow yield TTM:

6.7%

Growth yield:

12%

Return on net tangible assets:

35%

Return on invested capital:

22%

Growth of revenue:

35%

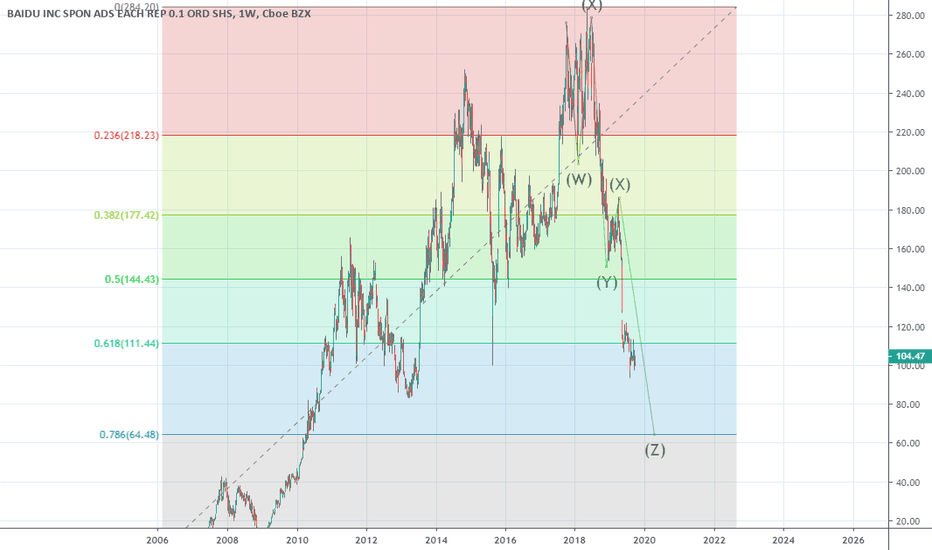

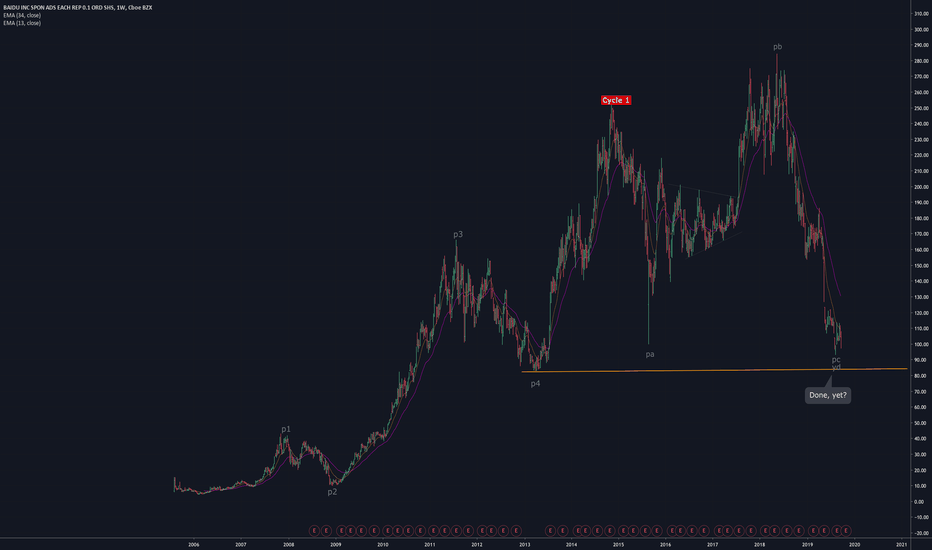

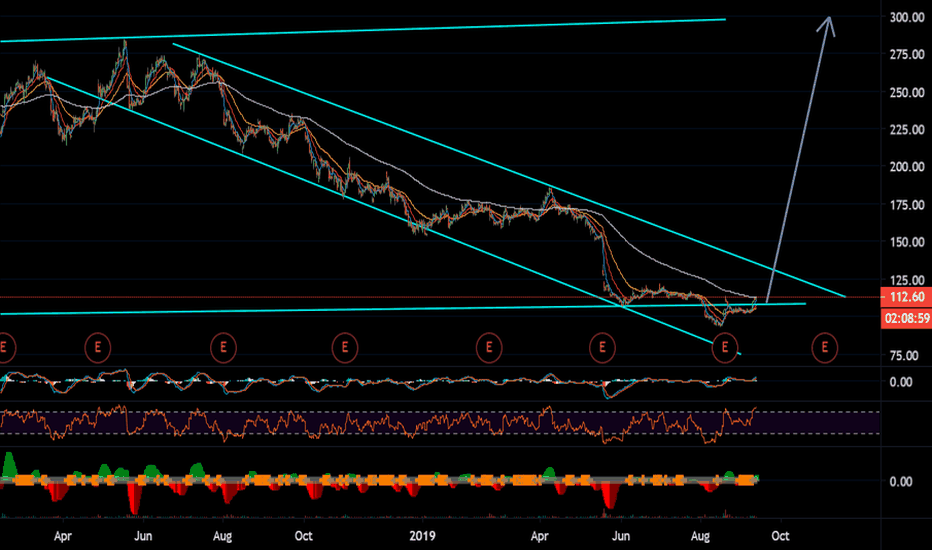

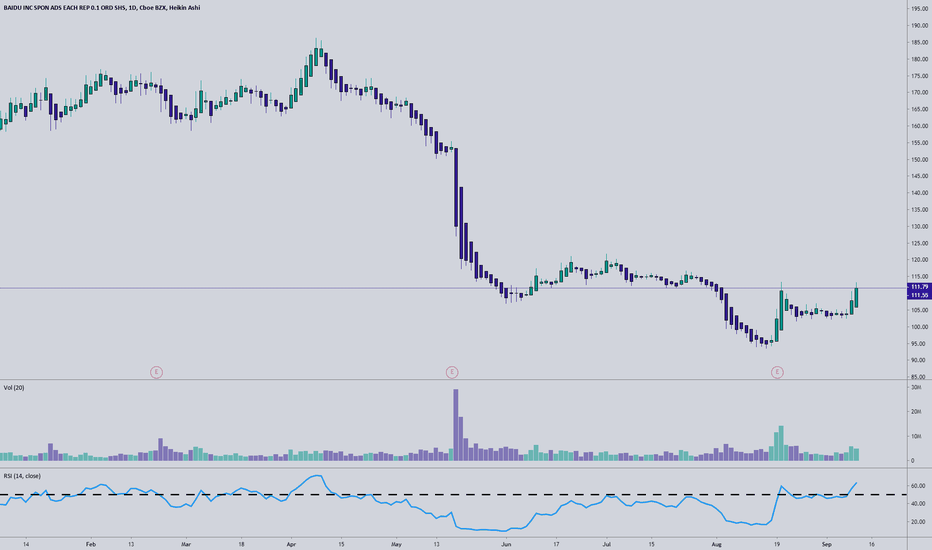

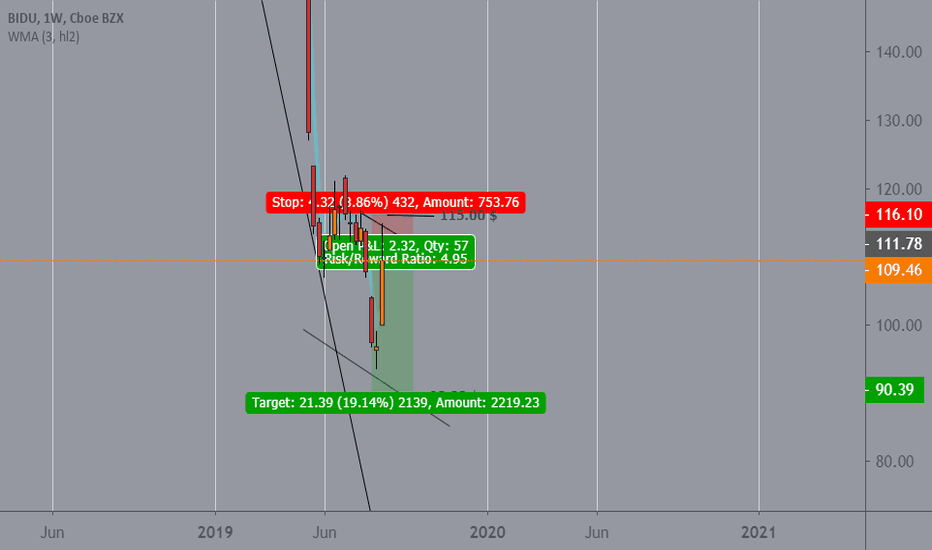

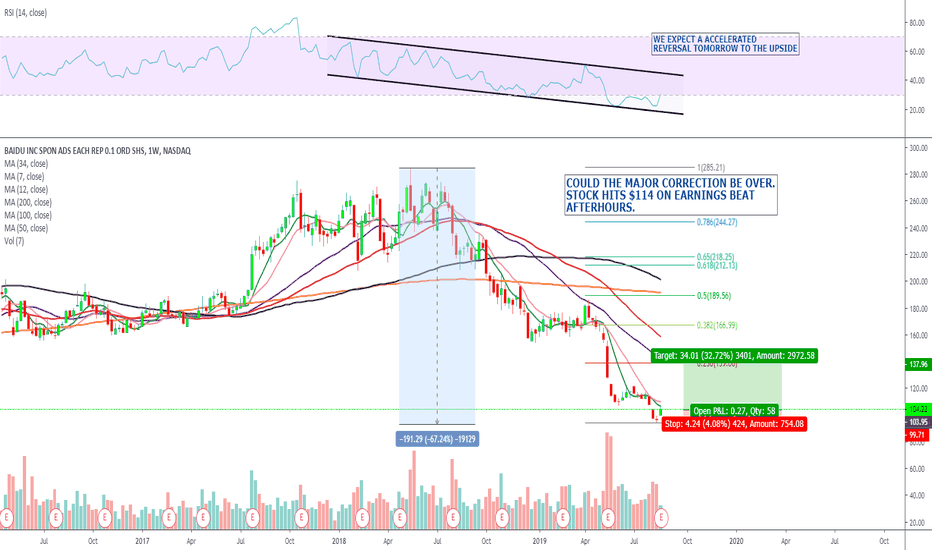

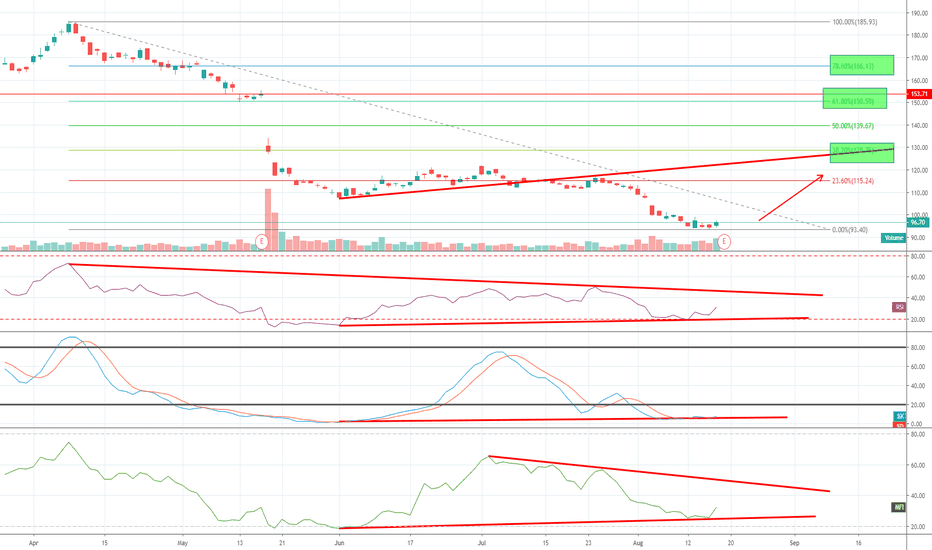

$BIDU Long targeting 150 on long term , Good indicatorsRSI positive and in buy limits also MFI and stochastic . BIDU shares dropped hardly from 160 begin of 2019 to 93 lowest this year . even the downtrend seems hide some major news or headlines related to this shares but as technical indicators showing good uptrend targeting 115 - 130 then 150-160 on large scale but early to confirm .. Stoploss for this trend at 93.3 and 115 is most important resistance

Baidu ready to recover after Q2 resultsThe stock has been in negative Weekly RSI since a few weeks now...

Last time this happened in 2015, the stock had jumped up by 70% after it recovered. In terms of Risk/Return it looks very attractive as the bottom has been hit while the recovery can be significantly interesting.

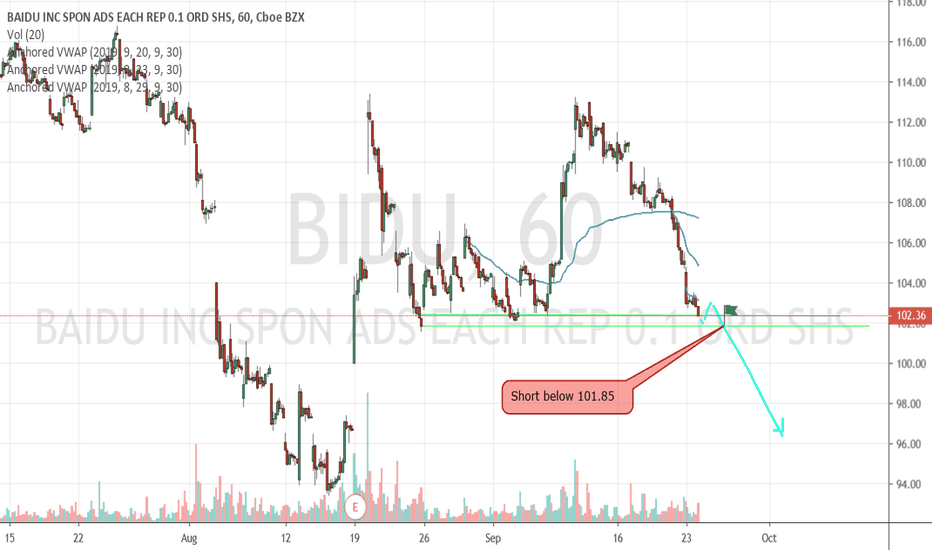

Fundamentally the stock has been hurt due to global environment (china trade war / economic slow-down) and the business has for the first time seen a real slow down in revenue and earnings (especially due to investment in new tech)

However, currently the valuation fundamentally doesn't make sense.

If you include CTRIP, IQIYI and the 12.5bn cash position. It means that Baidu Core Search engine is currently valued at 10BN

This mean 1x Revenue Multiple / 2x EBITDA Multiple. Not seen many companies trading at 2x EBITDA multiple. Huge undervaluation due to sentiment..