NIO - are the fundamentals good enough?Analysts have adjusted earnings estimates and thus, an earnings beat does not always translate to good prospects for some of the businesses:

Earnings Estimate Management

From the earnings forecast by Investing above, we can note the following:

The coming EPS forecast (for the period ending 06/2023) is worse than the previous period ending 03/2023.

In fact, the EPS forecast is expected to be the worst at record -2.96 since 06/2022.

For the revenue forecast, it is expected to be lower than the previous quarter. It stands at 9.16B compared to the forecast of 11.93B from the previous quarter ending 03/2023.

This is in fact the lowest revenue forecast since 06/2022.

In the event that NIO beats both EPS & revenue forecast in the coming earnings, is the company doing better? In my opinion, it is a “NO”.

Beating such an estimate is not something to brag about as the company remains unprofitable with “falling” sales. It can be too early to call this a falling trend but the quarterly signs are there.

Conclusion

Before we embrace any content from news agencies or investing portals, let us do our due diligence.

One quarter does not define a trend and thus, looking at the business as a whole from afar can help to put some objectivity and remove the impact of seasonality. This will help to put things in a better context as we even out peaks from new launches and service offerings.

9866 trade ideas

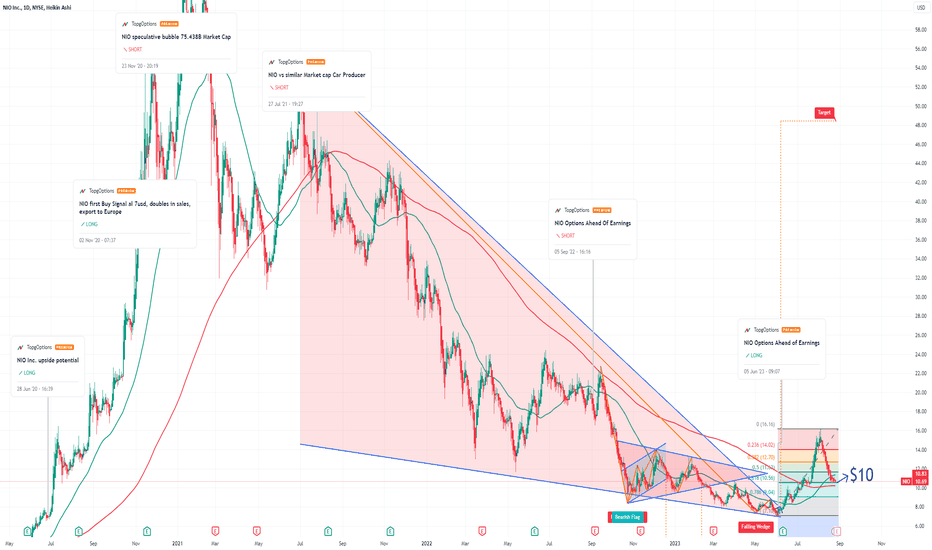

NIO Options Ahead of EarningsIf you haven`t sold NIO when it had a market cap of $75.43 Billion:

or after this comparison to BMW:

and reentered before the previous earnings:

Then analyzing the options chain and the chart patterns of NIO prior to the earnings report this week,

I would consider purchasing the 10usd strike price Calls with

an expiration date of 2024-2-16,

for a premium of approximately $2.48.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

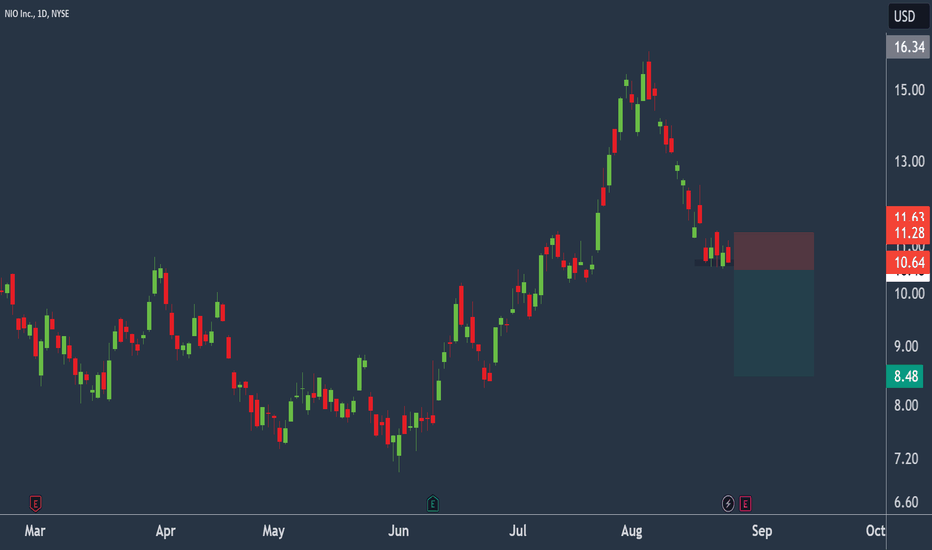

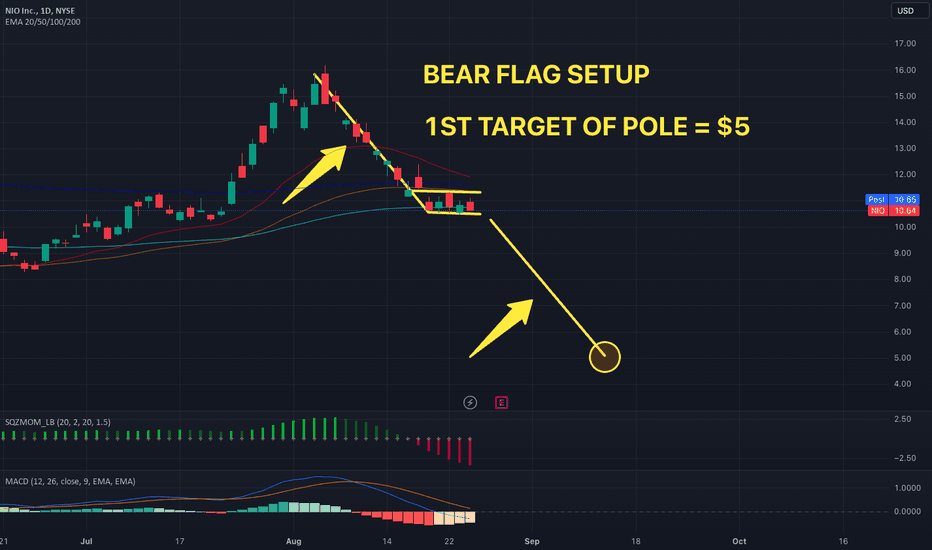

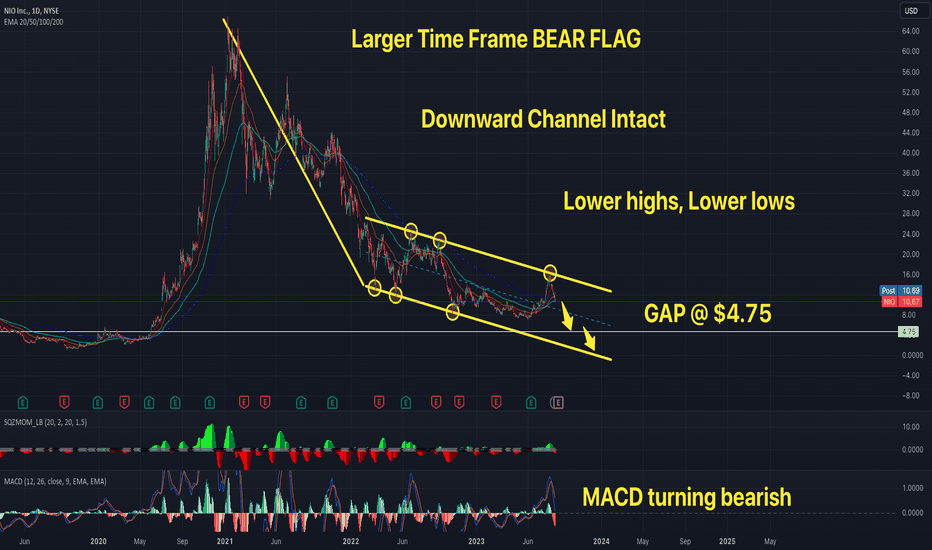

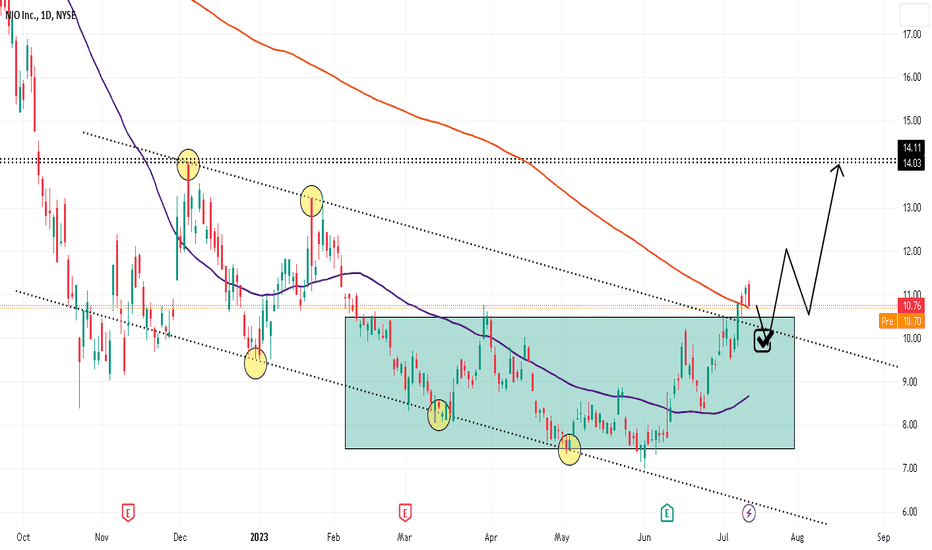

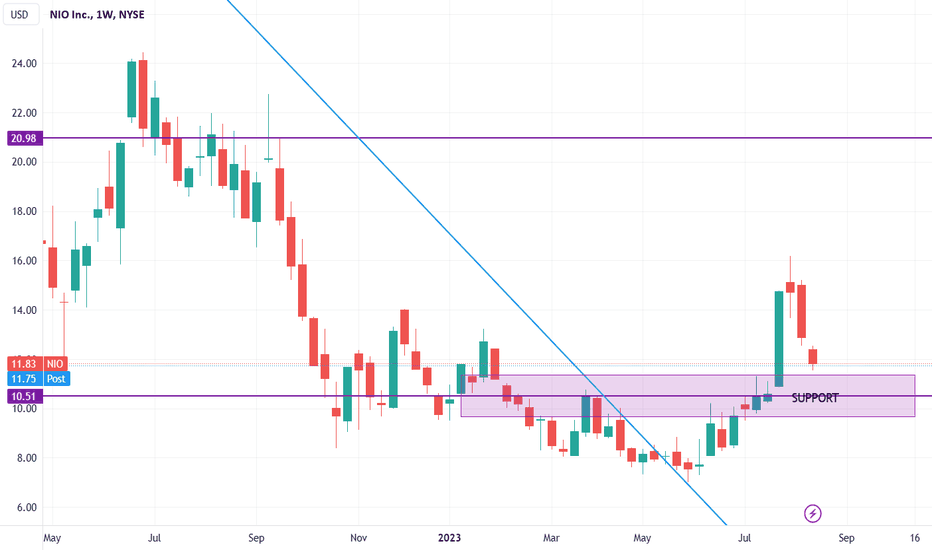

NIO to continue in the downward move?NIO - 30d expiry - We look to Sell a break of 10.48 (stop at 11.28)

Prices have reacted from 16.18.

Short term momentum is bearish.

There is no clear indication that the downward move is coming to an end.

A break of the recent low at 10.50 should result in a further move lower.

In our opinion this stock is overvalued.

We look for losses to be extended today.

This stock has seen poor sales growth.

Our profit targets will be 8.48 and 8.08

Resistance: 11.33 / 12.00 / 12.50

Support: 10.50 / 10.00 / 9.50

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group

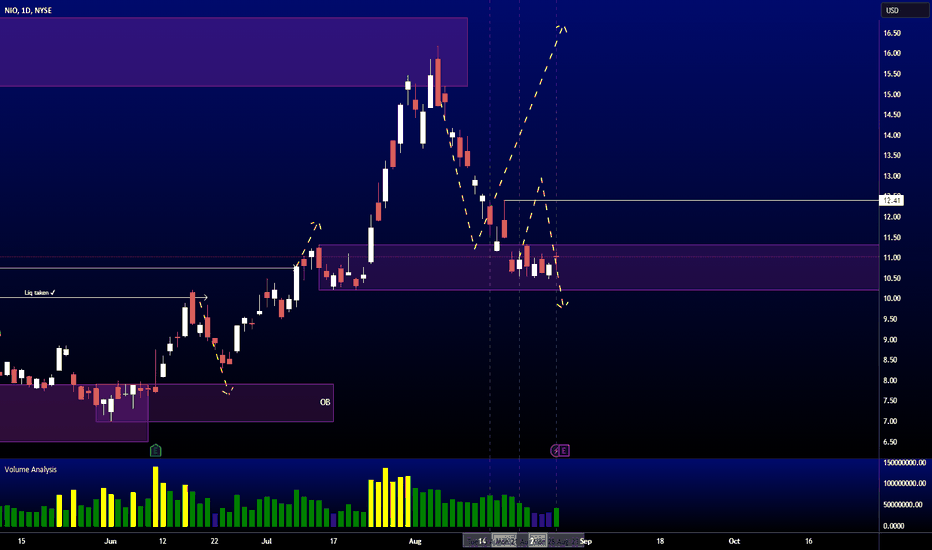

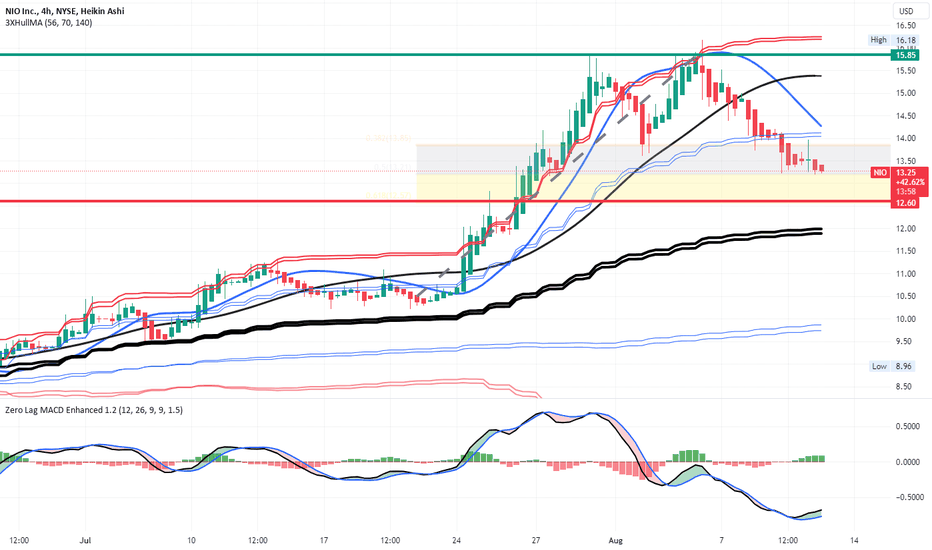

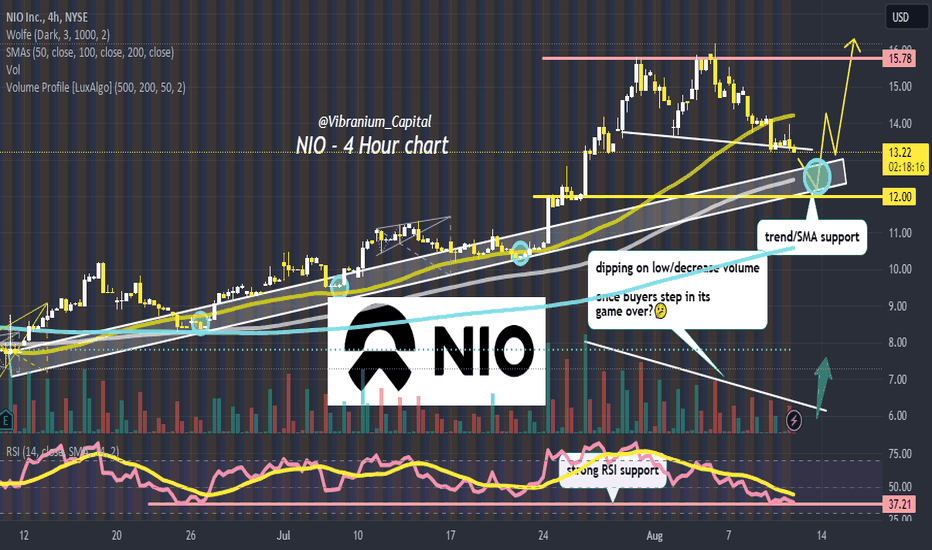

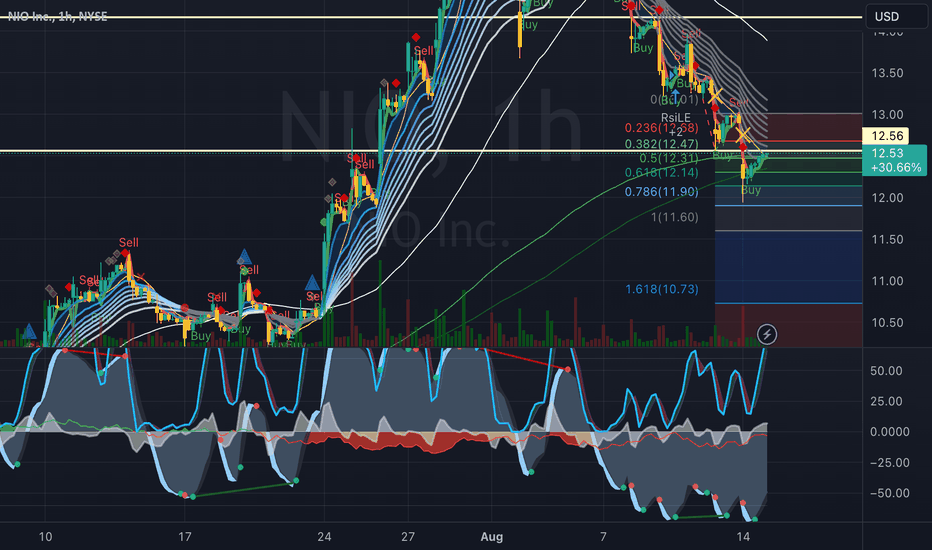

NIO finishing a Fib Retracement Ready to Continue LONGNIO on the 4H chart was on an uptrend into a double top in late July and Early Augus. This

was confluent with the second upper deviation line above the mean anchored VWAP line

which is thick black. Now on the retracement price has hit the mid-Fibonacci levels of

0.38-0.5-0.62. The MACD is sowing an early buy signal with a line cross under the histogram.

I see this as a long trade on continuation with some early bullish divergence with a

the potential upside of 20% back to the VWAP lines whose resistance forced the double top.

I will put this on my China watchlist watching for the pivot low from which to enter.

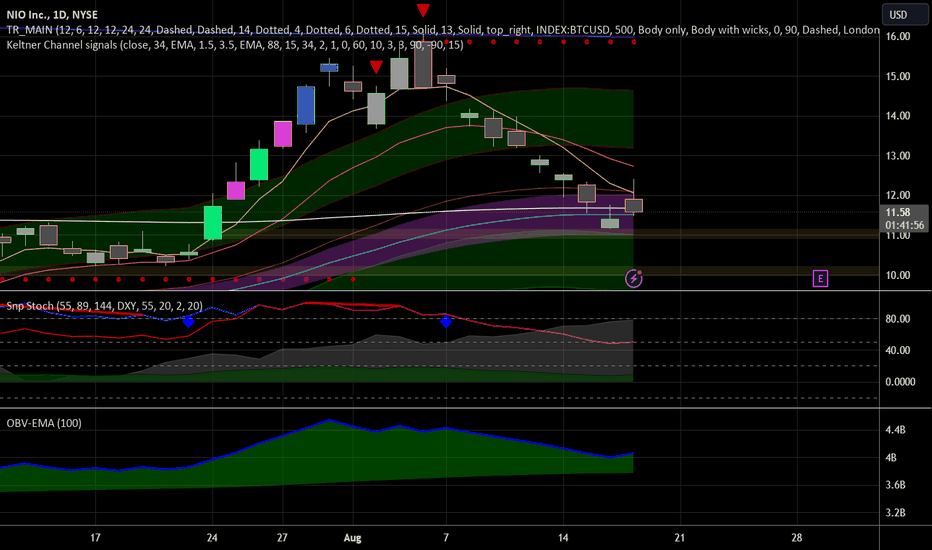

NIO: Covered Call Bought NIO for $11.60

Sold Sept 1,2023 Call for $0.63

Net Debit = 10.97

Return if flat:

0.63 / 10.97

+ 5.7%

Not exactly a 20 cross on sniper stochastics but it does bounce off the 50%. The three lines of the Sniper Stochastics are together as one. This is extra strength.

The OBV is green.

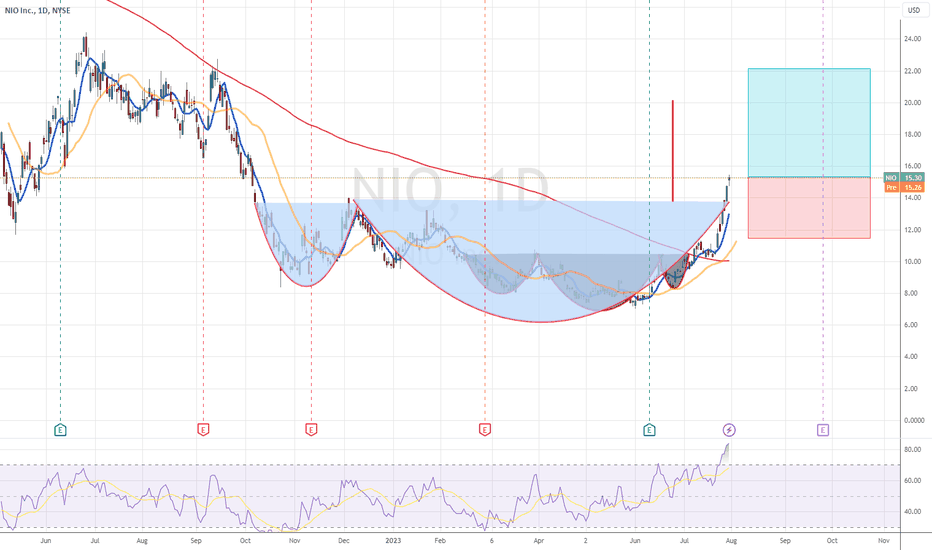

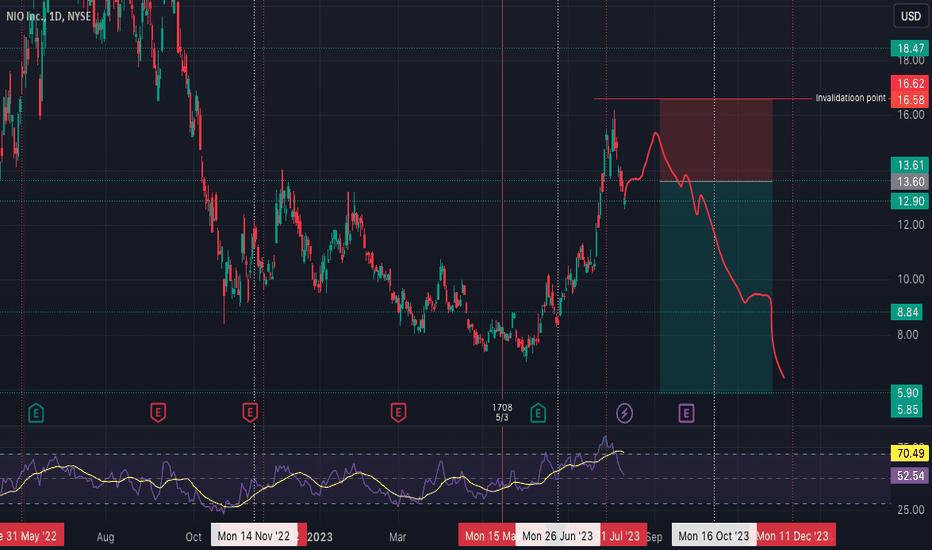

"Charging Up: Bullish Momentum Ahead for NIO with a $22 Price TaNIO

"Charging Up: Bullish Momentum Ahead for NIO with a $22 Price Target"

1. Price Formation: The price has broken out from an inverted C&H price formation on a daily chart.

2. Moving Averages: The 7-day moving average (MA) is above the 21-day MA, which is a positive sign indicating short-term bullish momentum.

3. 200-day Moving Average is below the Price.

4. Thus, Mas 7>21>200

5. Relative Strength Index (RSI): The RSI is greater than 50, indicating bullish momentum and potential further upward movement.

6. Price Target: $22.00

NIO

NIO Inc. is a Chinese automobile manufacturer that specializes in designing and developing electric vehicles. The company was founded in 2014 by William Li, and is headquartered in Shanghai, China.

As of my last update in September 2021, NIO offers several models of electric vehicles, including the ES8, a full-size SUV; the ES6, a performance SUV; the EC6, a coupe-style SUV; and the ET7, a luxury sedan. They are known for their impressive range, high performance, and innovative battery swapping technology, which allows the car's battery to be replaced in a few minutes instead of waiting for it to charge.

NIO has established itself as a significant player in the electric vehicle market, often compared to Tesla for its high-tech vehicles and its status as a start-up that's challenging traditional automakers. However, the company has faced some financial challenges, as the electric vehicle market is highly competitive and requires substantial capital to innovate and produce vehicles.

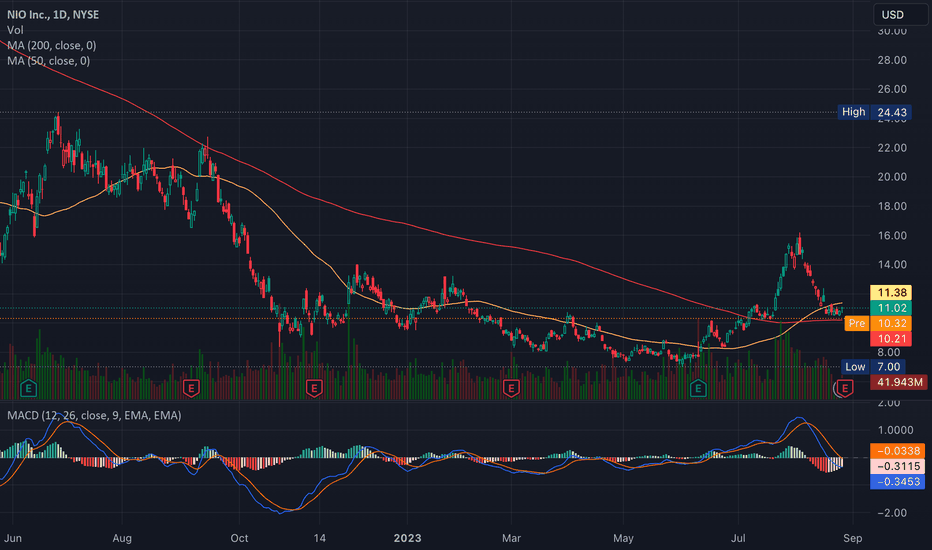

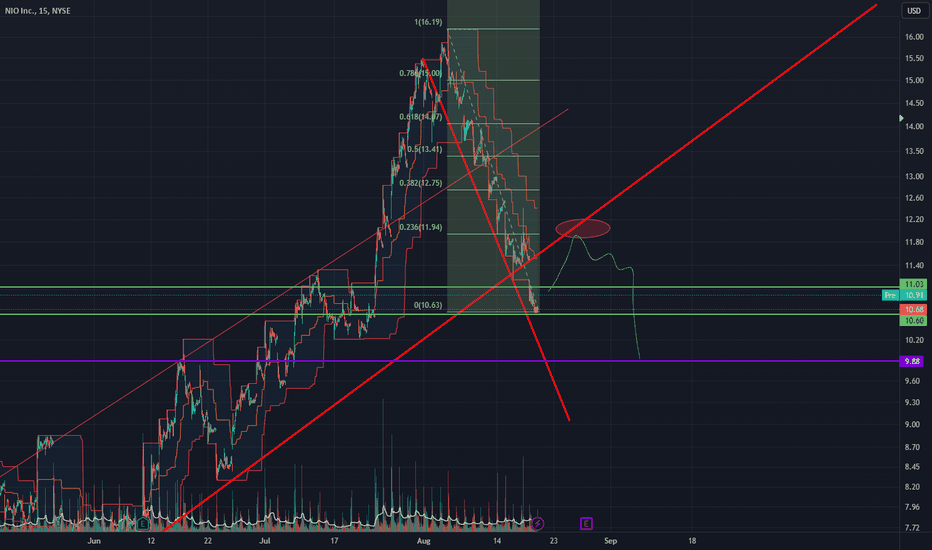

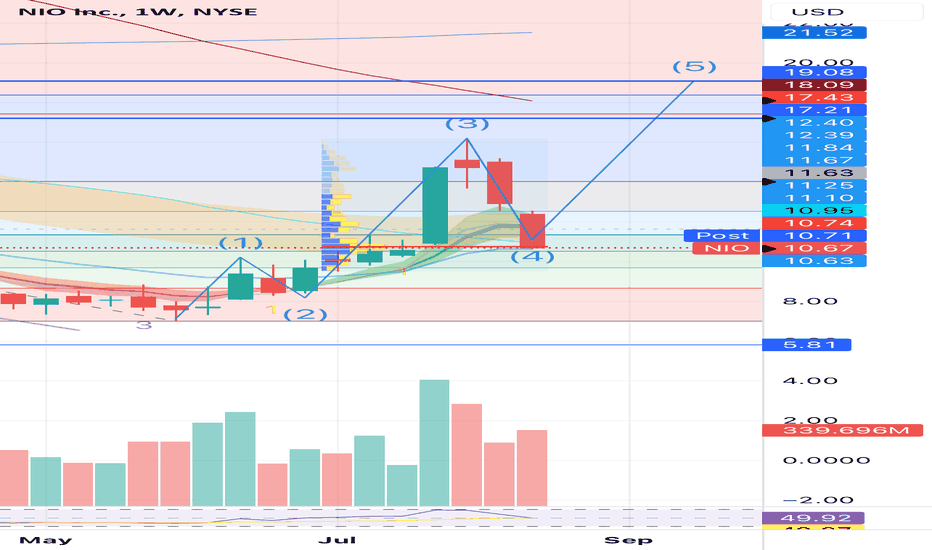

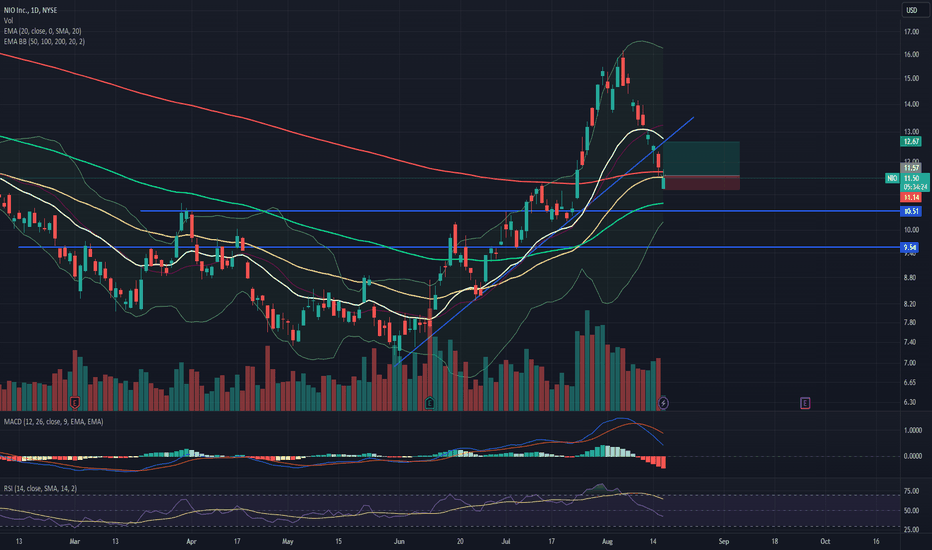

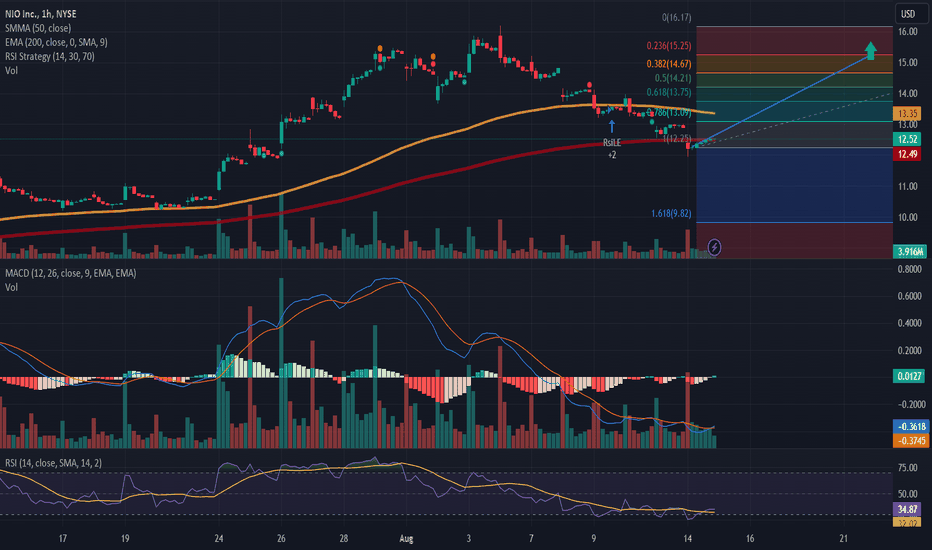

My Swing Approach For NIO Touching 50 and 200 EMAI was waiting to see NYSE:NIO this week as it could continue to move around the 200 EMA or possibly go even lower to the 50 EMA.

The lowest and clearest support area that I see is only at $10.51. I would love to get feedback if you are seeing something else. So this is why I chose to use the EMA's as an entry point.

I took a long position today at $11.57 after starting the day at around $11.20. So I got in after pushing around 3% on the day to cross back to the 50 EMA and touch the 200 EMA with a little pushback, so I entered after that.

There is a huge gap down to my lower support, at around $10.51, so I put my stop loss at around $11.14, which would be a ~3.72% loss.

I want to exit and sell my position at around $12.65, a potential 9.51% upside. In that area, it would be back at the 20 EMA.

$NIONYSE:NIO

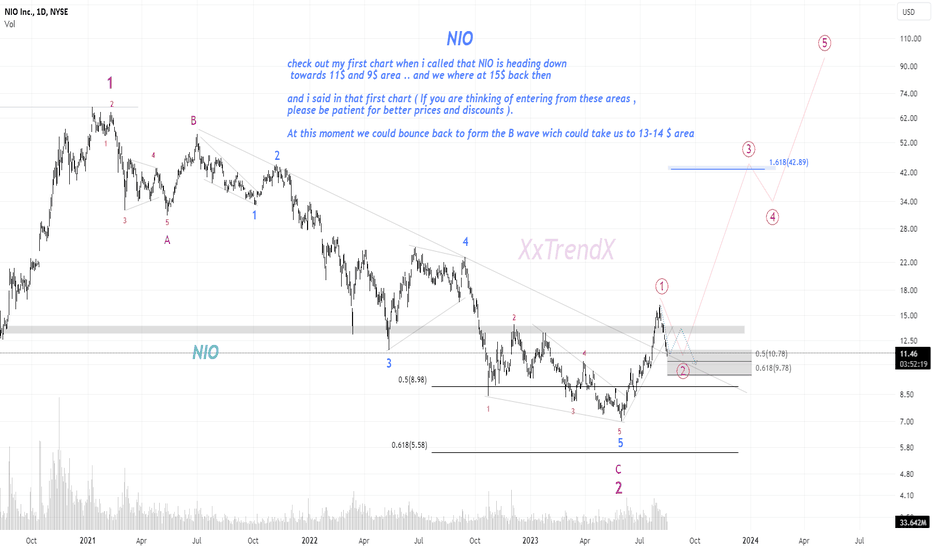

check out my first chart when i called that NIO is heading down

towards 11$ and 9$ area .. and we where at 15$ back then

and i said in that first chart ( If you are thinking of entering from these areas ,

please be patient for better prices and discounts ).

At this moment we could bounce back to form the B wave which could take us to 13-14 $ area

looking at the chart at 1hr or 2hr strong signs of reversal!.is it finally over!? looking to consolidate in the 12 or 13s for the week, looking to go long anywhere @ $12.25 if it were to drop again at support which would be unlikely as sellers have lost momentum.

looking to enter long @ 12.50 and expecting profit of atleast 10% even if I were to enter at $13.50, personally see more upside for NIO fundamentally overall as a ev company to dominate the eastern market. Not ignoring the signs but see signs of reversal up from here on out if it were to retest the 14s and 15s again before earnings!!!

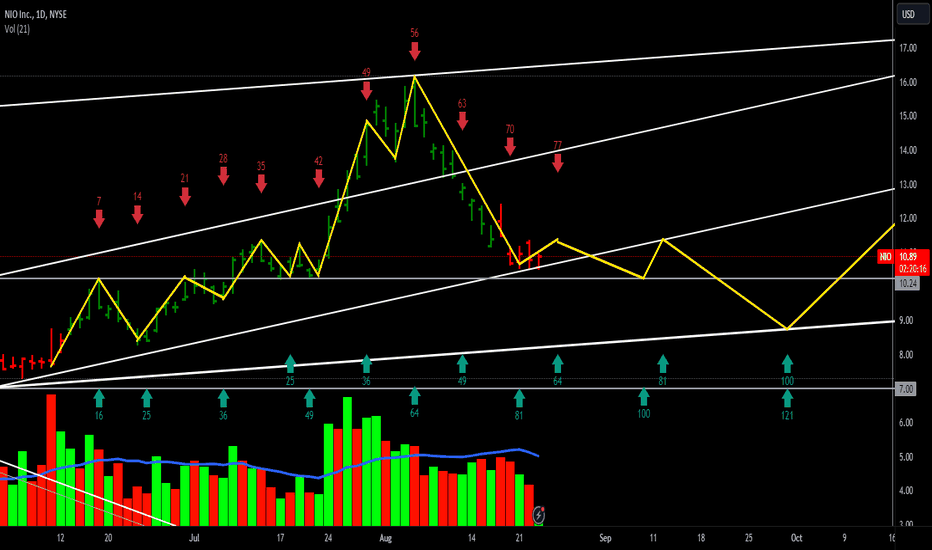

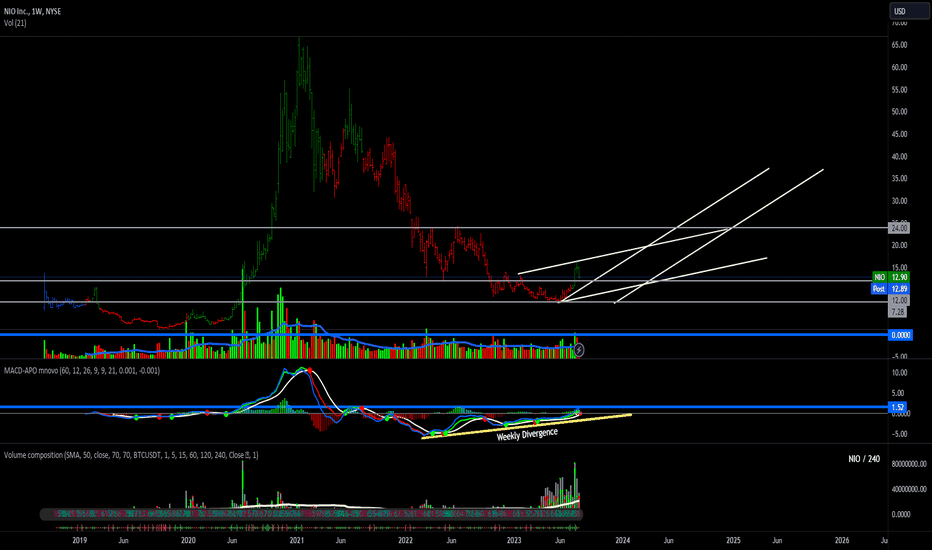

NIO Looong termIf you know Gann, you know what these lines mean. A tunnel through the air is plotted for the next Lassonde curve. Track your moves and pivots on the wheel of twelve. This should get very interesting soon. MACD Divergence and zero cross. Support on sevens. Resistance on twelves.

Boost if you agree. :)