NIO | Solid Price Action At The Current BottomHi,

Nio is a leading electric vehicle maker targeting the premium segment. Founded in November 2014, Nio designs, develops, jointly manufactures, and sells premium smart electric vehicles.

The company differentiates itself through continuous technological breakthroughs and innovations such as battery swapping and autonomous driving technologies.

Nio launched the first model, its ES8 seven-seater electric SUV in December 2017, and began deliveries in June 2018. Its current model portfolio includes midsize to large sedans and SUVs. It sold over 122,000 EVs in 2022, accounting for about 2% of the China passenger new energy vehicle market.

Technically NIO looks attractive; I like the way it found a support level from my previous call(s) at TradingView. I like the previous monthly close and if somebody is interested in it then I can give a technical confirmation. Technically it is solid but you have to consider fundamental risks to invest in China and etc.

Technically haven't seen such a price action that can be attractive for me on the NIO chart. I cannot say that it is the best but first time, since the all-time high, it looks solid and I would like to share it - odds should be in our favor ;)

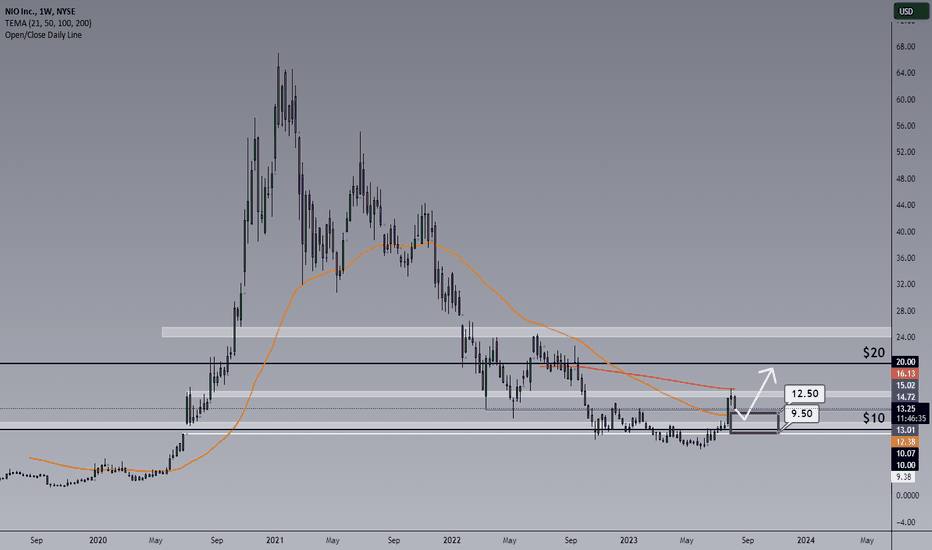

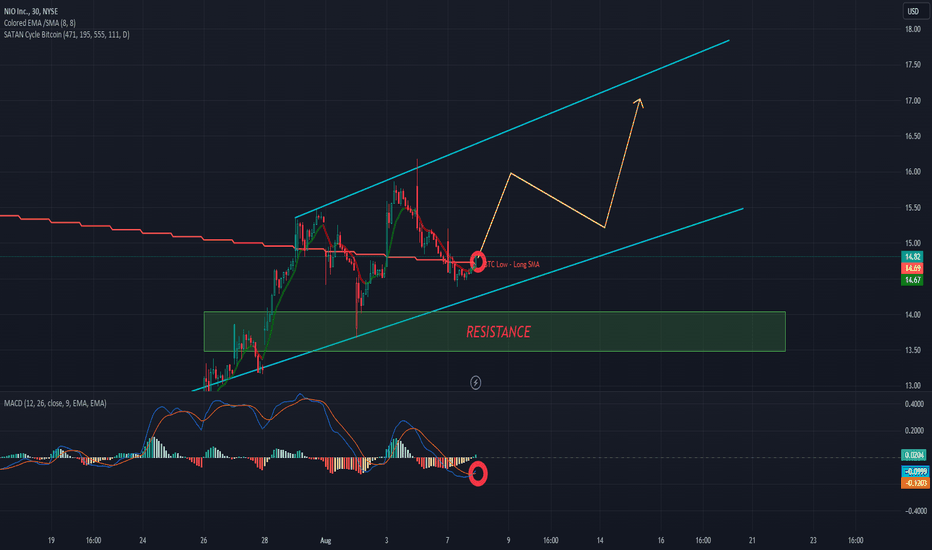

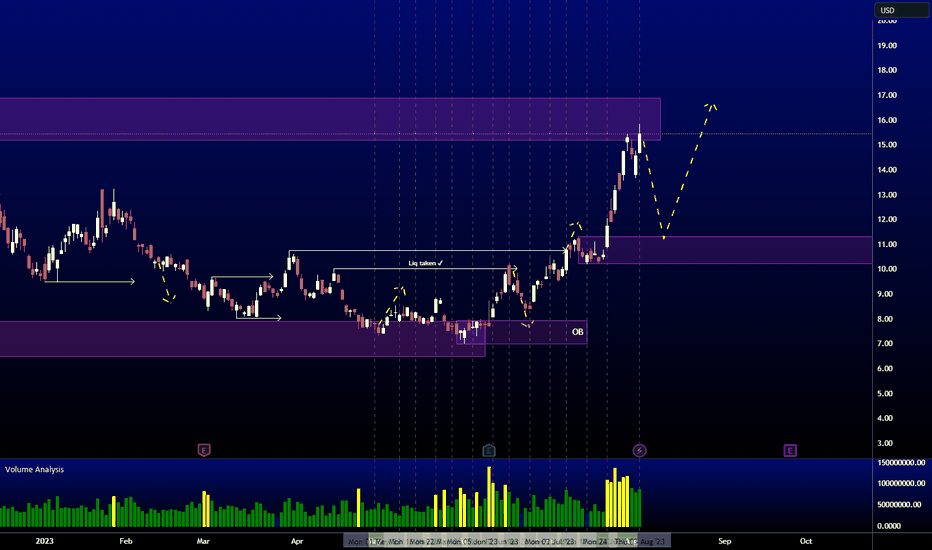

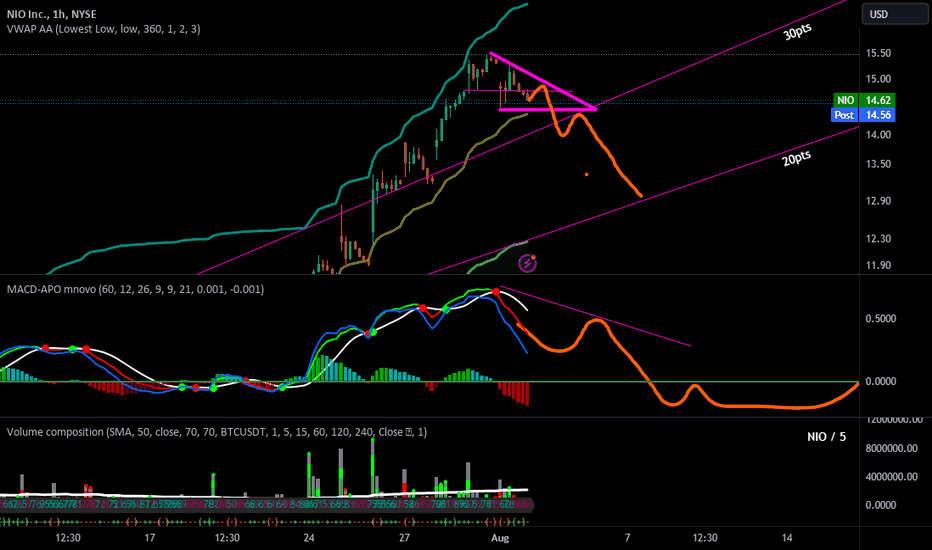

NIO price got a rejection upwards from the minor horizontal area, there was also the psychological number of $10 and a gap fill from 2020. These criteria held it, got a rejection, and now in the last week it found a great volume and it brought the price to another obstacle which is around $15. So a little pullback was expected.

A strong area around $15 can act, and actually has already acted, as a solid resistance level. Still, I'm waiting for that retest because we have some short-term new higher highs, a strong bullish weekly candle close above the Weekly Moving Average of 50 (orange line).

* Considering the recent price action then we should see the retest and an optimal buying zone should stay between $9.5 to $12.5

* First targets updated on the chart room

Good luck!

9866 trade ideas

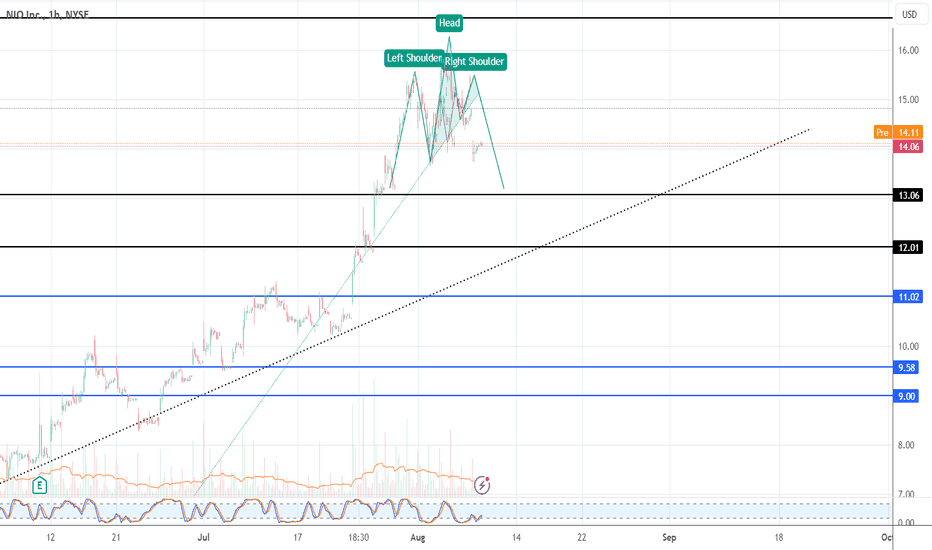

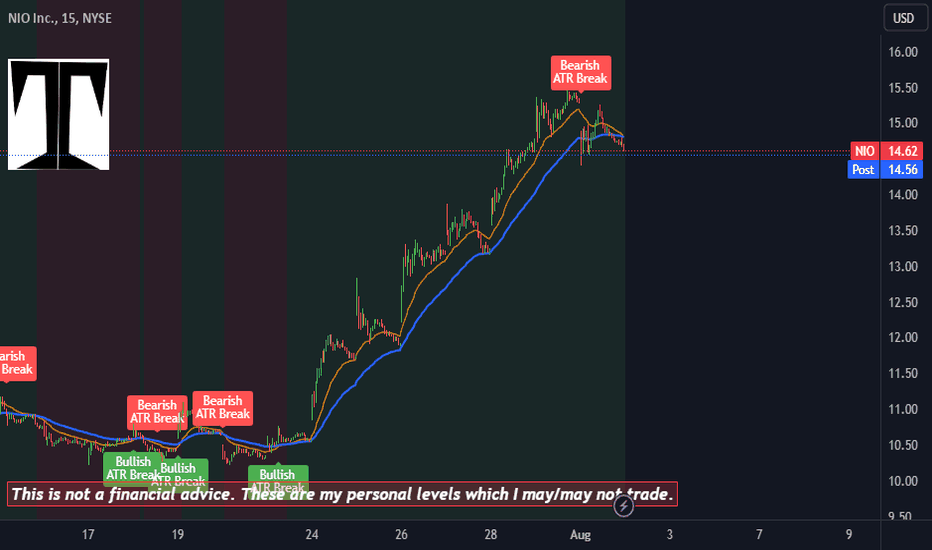

Is there a reversal pattern on NIO?NIO seems to be forming an head and shoulders pattern that can mean a trend reversal and consequent price adjustment.

The right shoulder is yet not quite formed but it seems to be heading that way.

Should this be confirmed we can see us testing support at $12 or even $11

NIO AnalysisPrice consolidated since my last analysis. Price gave a good reaction to the downside while respecting the current bearish OB, but not yet given a confirmation to break to the downside. No changes to my expectations, will be waiting for a break of market structure to the downside before a bearish move is confirmed.

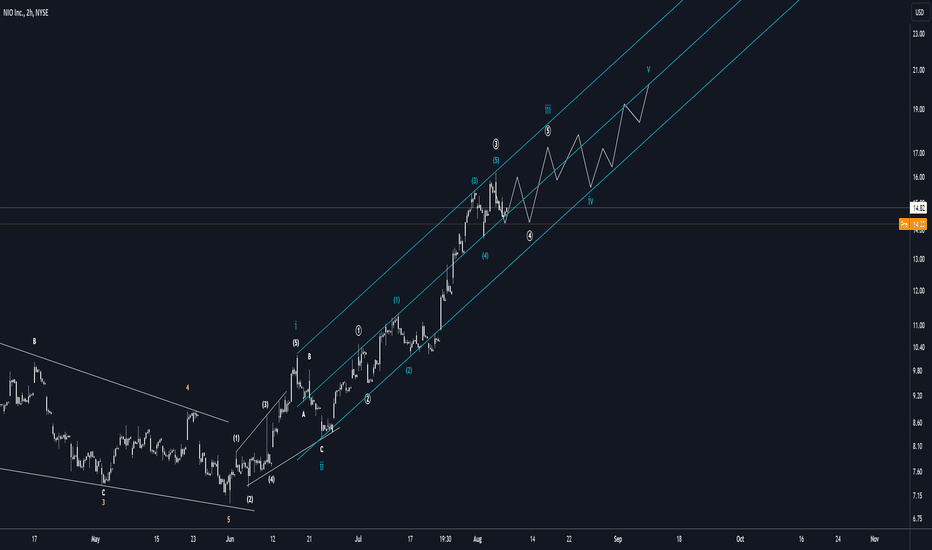

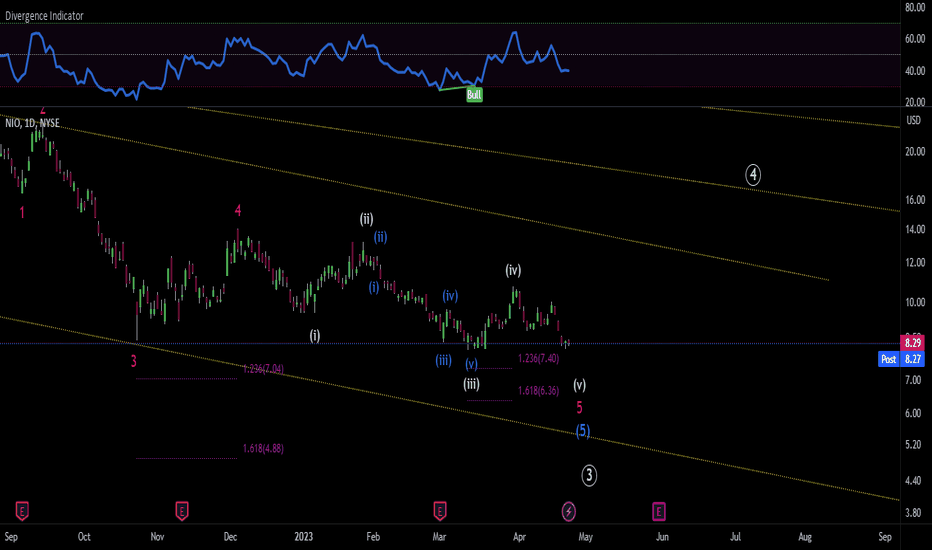

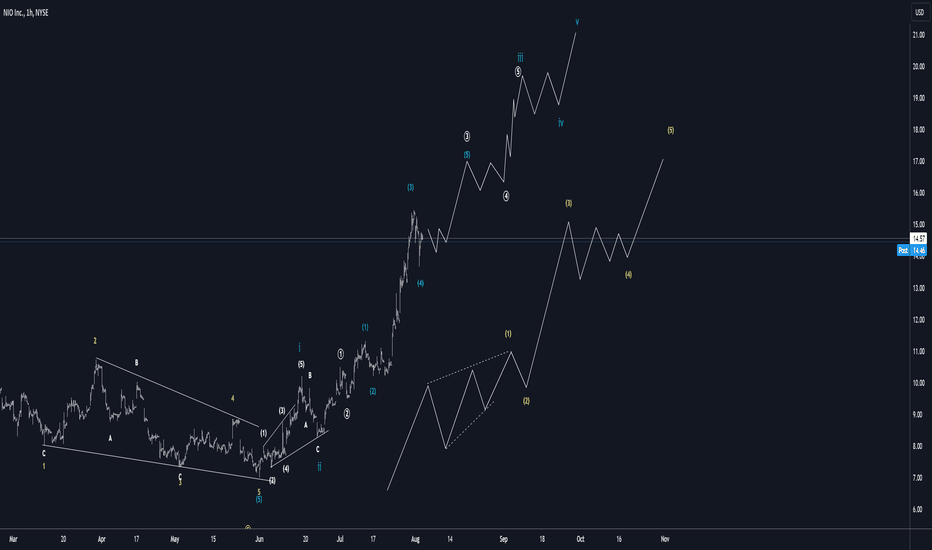

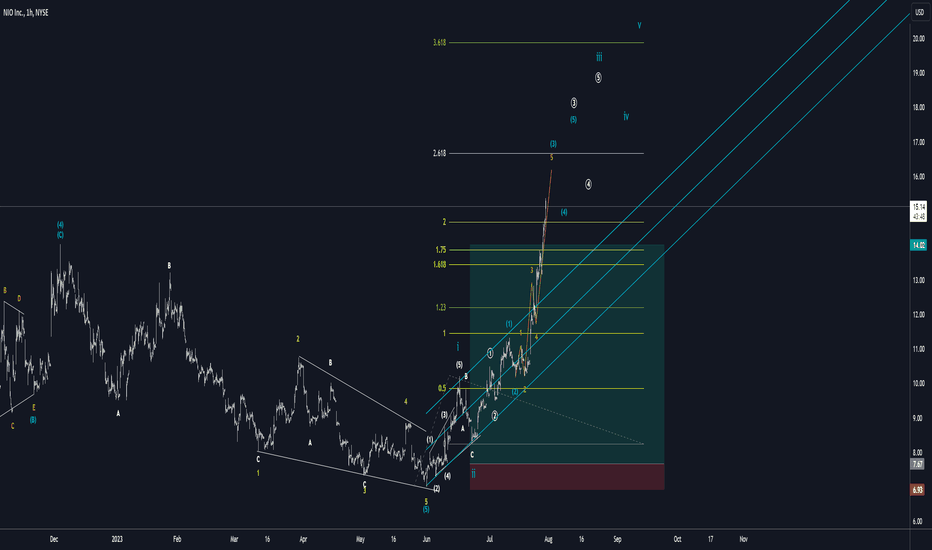

NIO - POSSIBLE ELLIOT WAVE 3 ENDINGNIO has followed a bearish trendline very beautifully.

Can see theres still room for further downside. My count shows that NIO is close to completing wave 5 of (5) of ((3)), so thee are multiple sequences that NIO will be completing at this area with the target range within the pink lines ($7.40-$4.88). Can it go lower? Of course, its markets that decide, will it go lower? probability wise not here and not now, but after wave 4 rally, we can favor stronger bearish move lower.

I would suggest being patient with NIO as market wide sentiment is 'take caution', and as always never throw all your eggs in 1 basket. Manage Risk and use a DCA strategy to accumulate a position. Below$6.00 is great area to buy some NIO but always be prepared that it can drop all the way to the lows

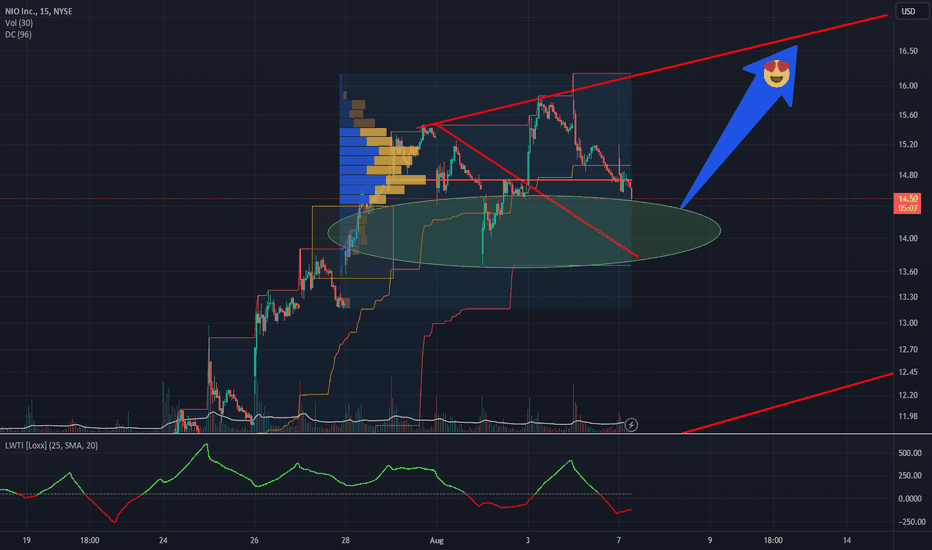

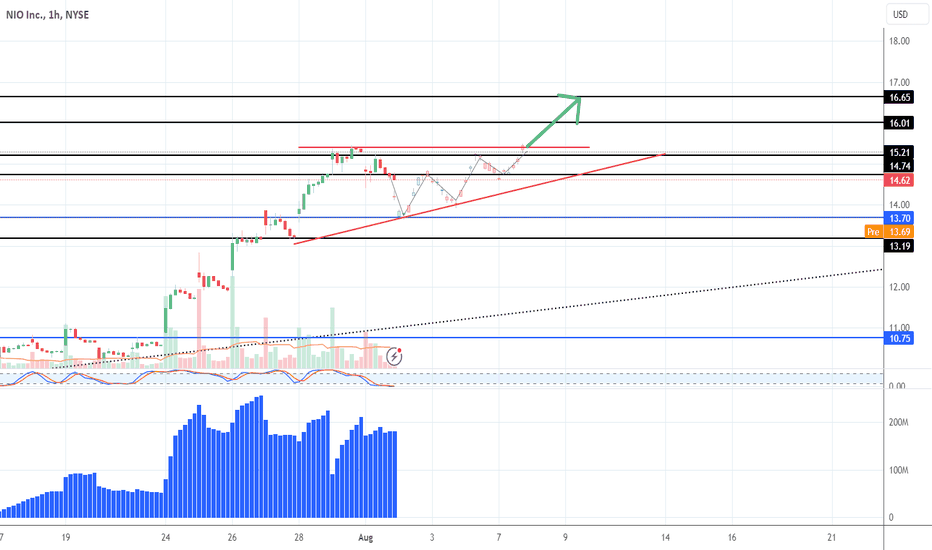

NIO is forming a bull flag before further moves upwardsThe recent NIO rally came to an halt and is now correcting.

I think we can expect the price to drop to around $13.70 which a support level. Should we go much lower than that price point and we might see a trend reversal to the downside. Next support should be around $13.15.

If price holds above $13.70 this pattern is confirmed and we should be a new try at piercing through the current resistance level ($15.45).

NIO, mby close your shorts guys, this one is goin places Everything is going in favor of NYSE:NIO , i wouldnt short this.

When you buy now ist not even FOMO, long-term 100+ for sure.

Make your own analysis, i m all in on this one, selling on 120, until that HODL !! :D

Have a succesfull day ! NYSE:NIO

$NIO Major Room For GrowthIt has become abundantly clear that NIO Inc. (NYSE: NIO) is setting its sights towards expanding in the Dutch market following its recent announcement of opening its first NIO Hub in the European country. NIO’s Dutch hub is far from being an outlier. Currently, the Netherlands hosts 5 NIO swapping stations which is the highest number of NIO’s swapping stations among European countries. When news of the new facility became public, the stock ran 12% because investors saw the move as NIO doubling down on its European expansion. Having said that, the significance of this facility lies in the fact that it furthers NIO’s efforts to dominate the Dutch market. For this reason, the NIO stock forecast appears to be bright for 2023 and beyond.

NIO Fundamentals

As things stand, NIO is set to open its Netherlands hub on Tuesday, August 8th. The hub is located in the Netherlands’ fourth largest city in terms of population, Utrecht. Having said that, the geographic significance of Utrecht lies in the fact that the city is in close proximity to Rotterdam, The Hague, and Amsterdam, which are the Netherlands’ three largest cities.

This location along with the fact that the Netherlands has one of the highest swap station densities since it is the only country with 5 swapping stations within a 40 thousand square km area as well as the stations being clustered around the most densely populated areas. This indicates that NIO is strengthening its grip on the Dutch market.

At first glance, the Dutch market may not seem significant, especially since the population of the Netherlands is only around 17 million which is minuscule compared to European countries like France – 67 million – and Germany – 83.2 million. The reason for NIO’s Dutch fixation is simply due to the fact that the Netherlands has the third highest share of battery-electric vehicles in Europe which accounts for 2.8% of all cars in the Netherlands.

Additionally, the Netherlands has a zero-emission policy, which states that all new passenger vehicles must comply with zero-emission regulations by 2030. Once this policy is taken into consideration, NIO’s Dutch tactic becomes abundantly clear. The company’s investment in developing infrastructure in the Netherlands is likely made in anticipation of a sudden surge in demand due to the aforementioned zero-emission policy.

Once the policy takes effect, EV purchases will drastically rise due to a lack of alternatives. By placing 5 battery-swapping stations, NIO houses, and a NIO hub in the Netherlands, the EV maker is increasing its visibility while at the same time providing the necessary infrastructure for battery swapping and car maintenance ahead of time.

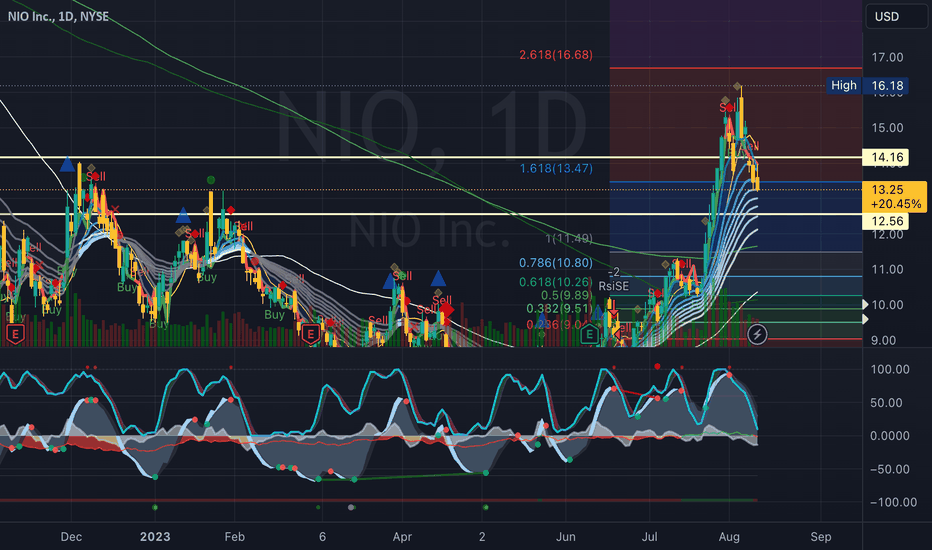

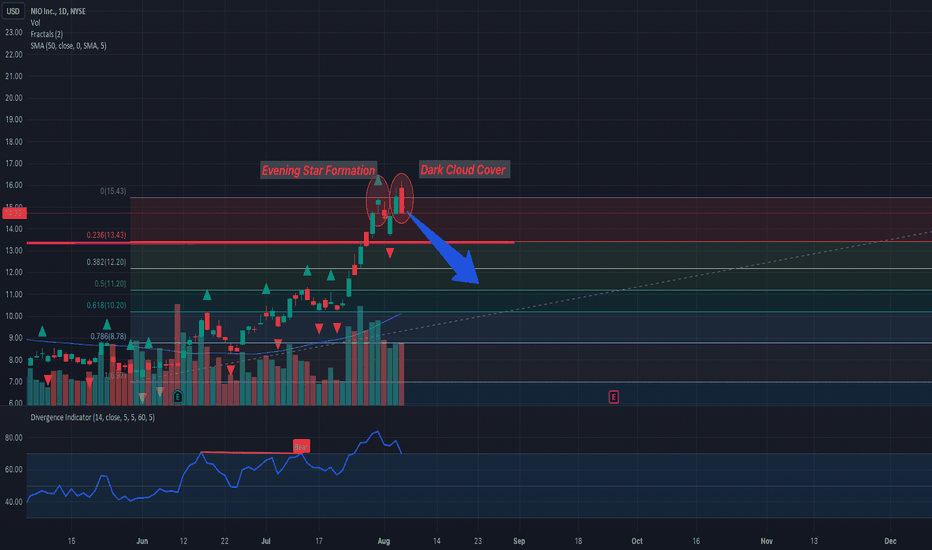

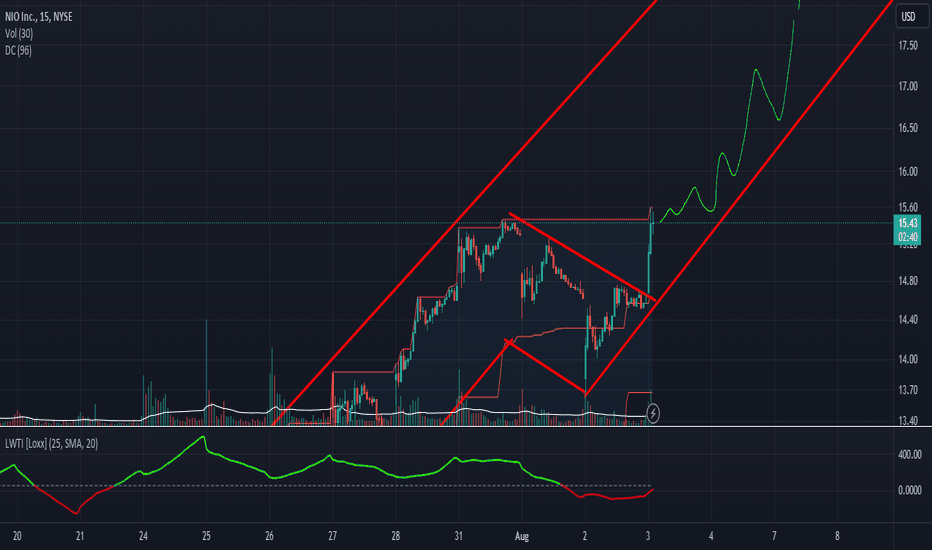

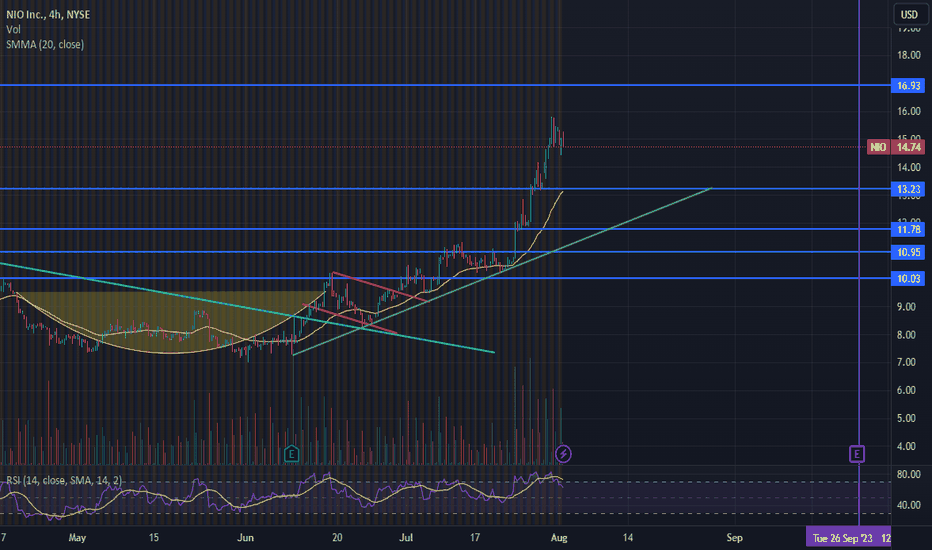

Technical Analysis

NIO stock is in a bullish trend and is trading in an upwards channel. Looking at the indicators, the stock is above the 200, 50, and 21 MAs which is a bullish indication. Meanwhile, the RSI is overbought at 81 and the MACD curling bearishly.

As for the fundamentals, the stock might be poised for a run this month because its July deliveries are set to be released in the coming days. Considering the growing speculation that the company may announce the delivery of 20 thousand vehicles in July, the stock could further soar if these speculations prove to be true. With the stock trading near resistance, investors could wait for a breakout of the current resistance with a pullback to go long on the stock ahead of the release of its July deliveries.

NIO Forecast

NIO’s new Netherlands-based NIO hub is likely part of a larger Dutch tactic that anticipates a surge in demand due to the country’s zero-emission policy. As is, NIO has already established a network of facilities in the Netherlands that will help it capitalize on a possible sudden surge in demand. With growing speculations that the company may announce the delivery of 20 thousand vehicles in its July report, the NIO stock forecast could be bullish for the rest of 2023.

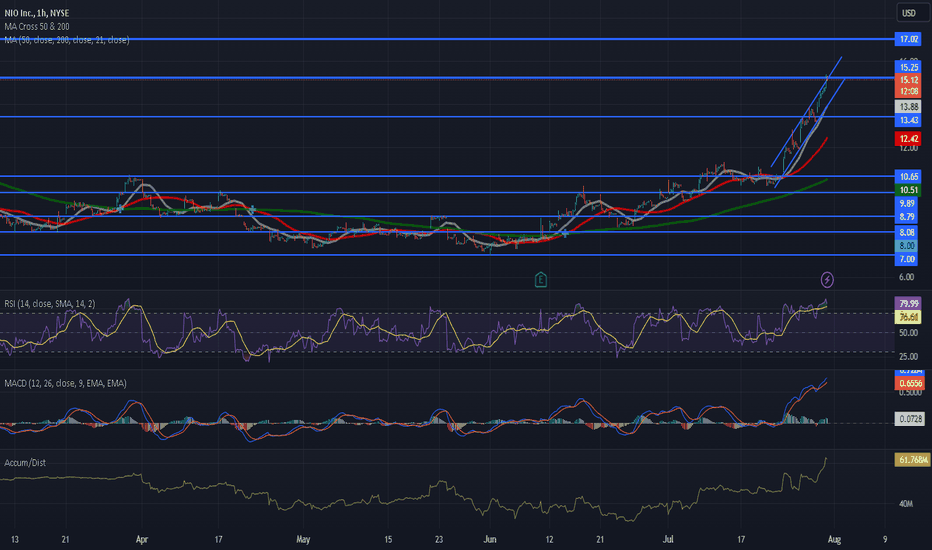

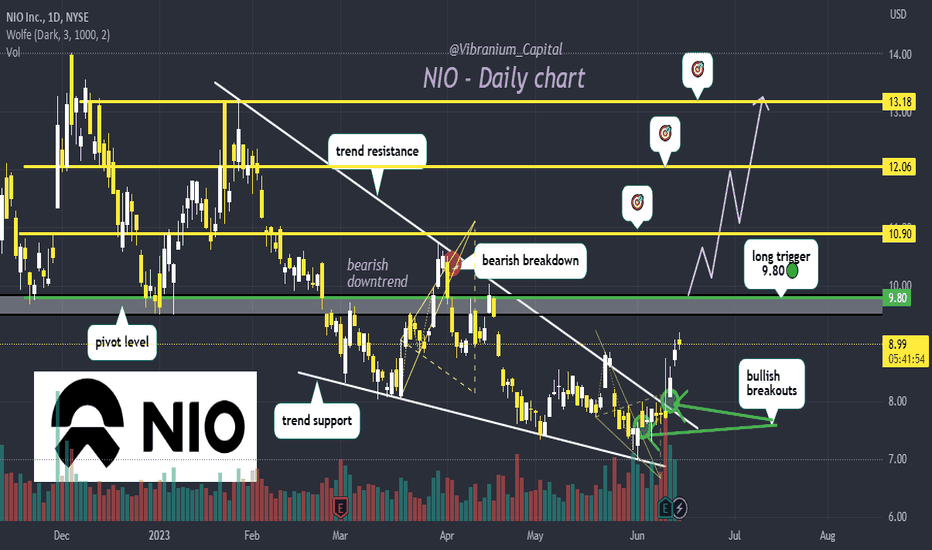

could go on a explosive rally soon 👋🚀NIO breaking downtrend that's held it back all year after a few bullish breakouts past trend resistance..

break past 9.80 and we hit 10.9-12.06-13.18 targets within a week or two 🎯

needs to break back above that pivot level though because it recently turned into resistance 🔭

boost and follow for more! thanks 💛

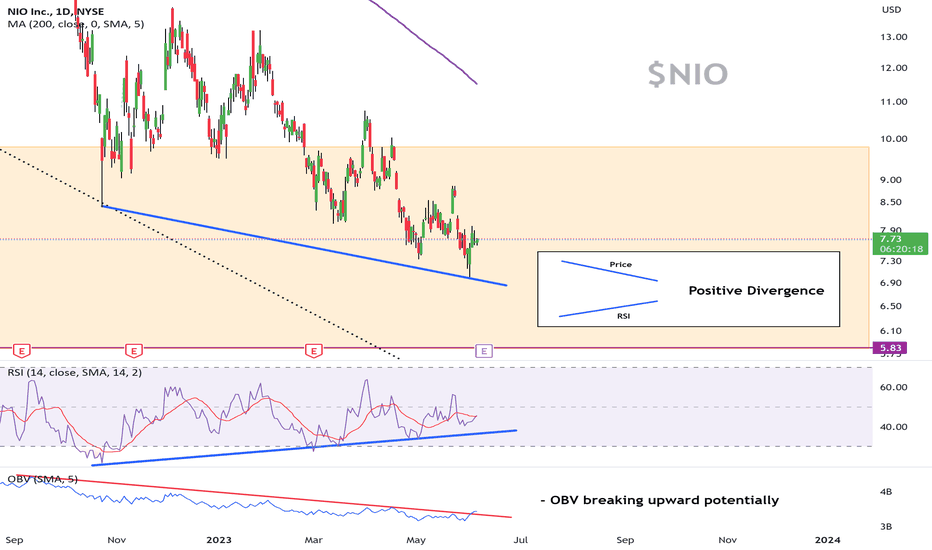

Is this the turning point for NIO? NIO earnings are this Friday 9th June

- Positive Divergence

- OBV breaking upward potential

- As per prior post, we are in half way into the long

term buy zone. Long term accumulation can

commence for long term investors.

- Price could drop as low as $6 however there is no

guarantee, and with the positive divergence there

is a trade to be considered to the upside with

earnings on the agenda this Friday.

- Stop Loss at June 1st low somewhere between

$7.00 - $7.42 depending on risk tolerance.