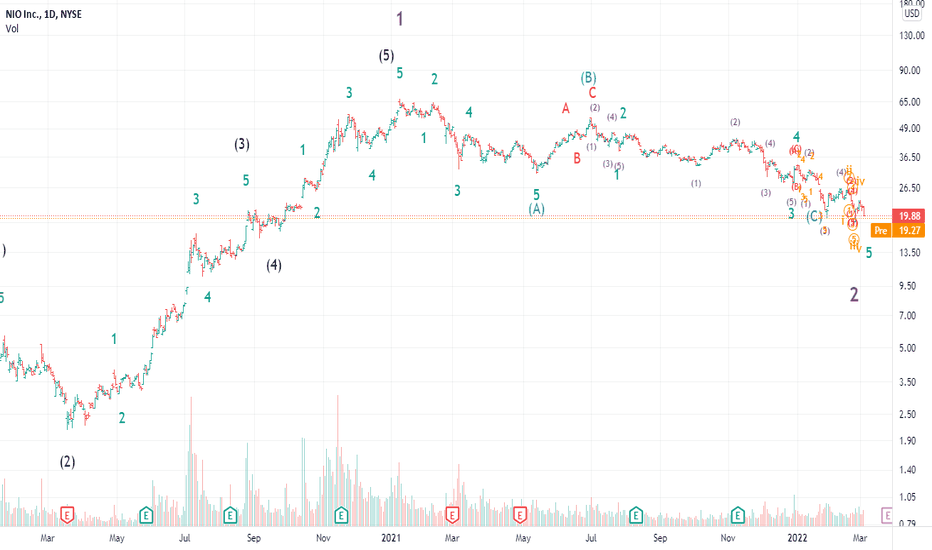

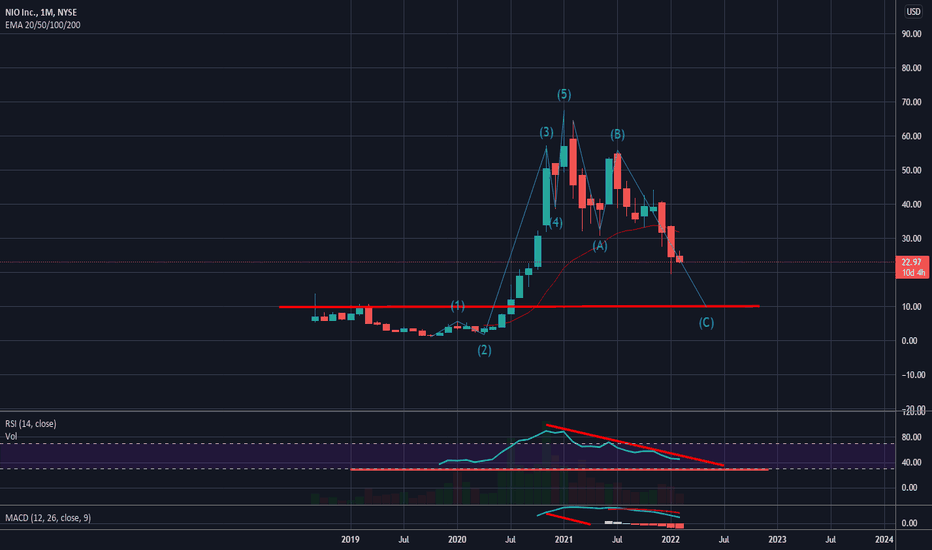

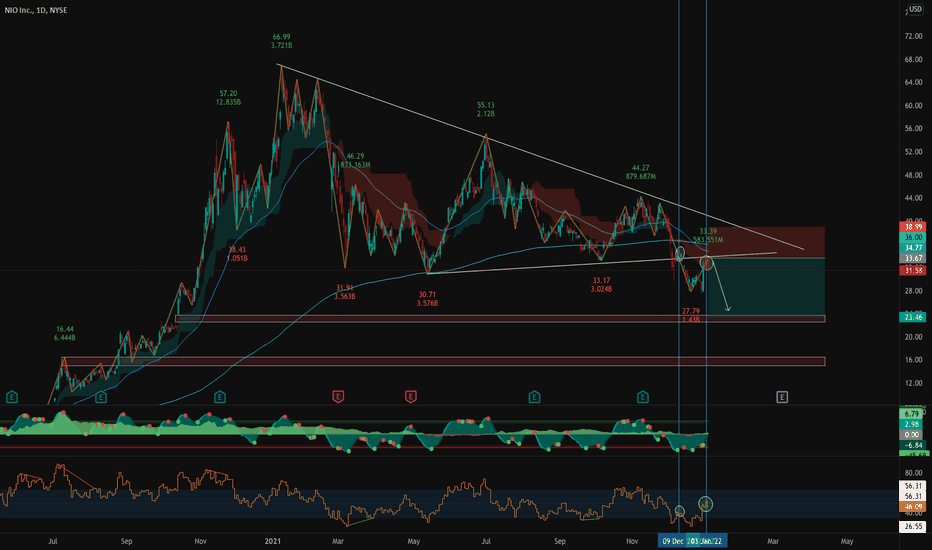

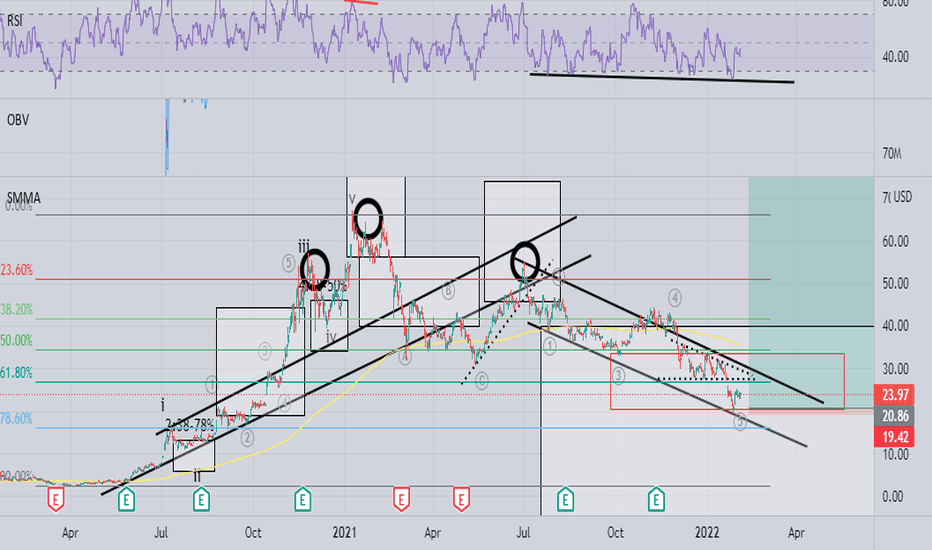

NIO is nearing the end of its correctionI've been tracking NIO for quite a while now, and the correction has been long, and complex.

I have had this down as a 5-3-5 correction since Feb/March 2021, and it has played out accordingly.

The last couple of days have been confusing, but it's clear that we're on either Wave 1/2/3 of:

5 of 5 of C of 2.

On the Primary count, this is a Wave 2. I was going to buy at $27 at the 0.618 fib, but feel this may go as low as the 0.786 fib at $15.43ish.

I plan to start buying in tranches when this falls below the previous low of $18.08.

Ideally, I want to buy from $17.50 and lower, but we will see what happens!

NYSE:NIO

9866 trade ideas

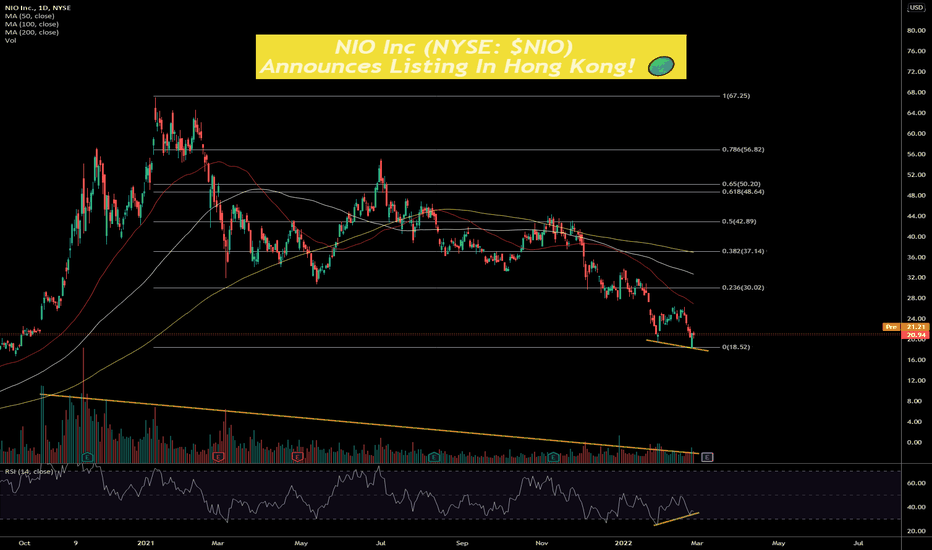

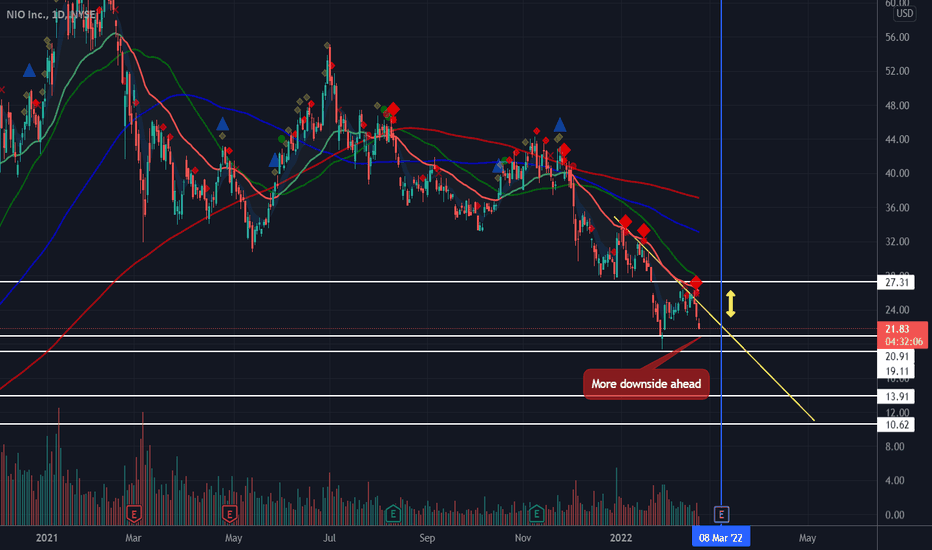

Bullish Fundamentals BUT Bearish Technical analysis Hello fellow NIO investors, in this post I will compare the bullish fundamentals and the bearish technical analysis of NIO. When a stock has such strong fundamentals like NIO, one may be confused on why the technical analysis is bearish.

Fundamentals: BULLISH (new-ish news)

- NIO getting approved to be in the Hong Kong and Singapore markets (by march 10th), that is another 1.4 billion people who are able to now purchase the shares, with that market being unable to form Short positions, it increases the buying power for NIO's stock.

- NIO continuing to rapidly expand open swap stations and NIO houses, expanding in other countries around the world, and waiting for the semiconductor shortage to end (and the completion of their new factories which are huge) so that they can open their factories at full capacity.

- NIO reportedly is experiencing a large amount of Preorders and is selling very quickly in Norway.

- I could go on and on, for more in depth Fundamentals you can see my previous posts.

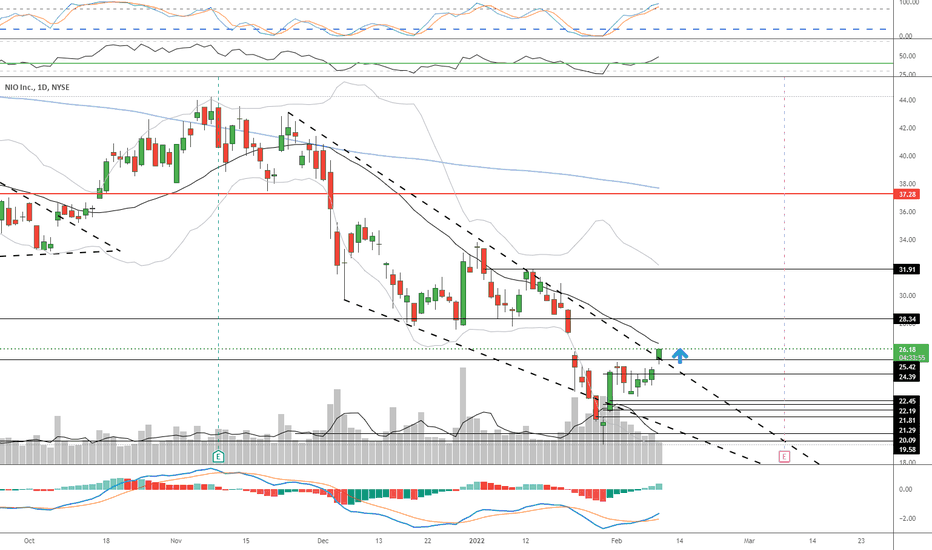

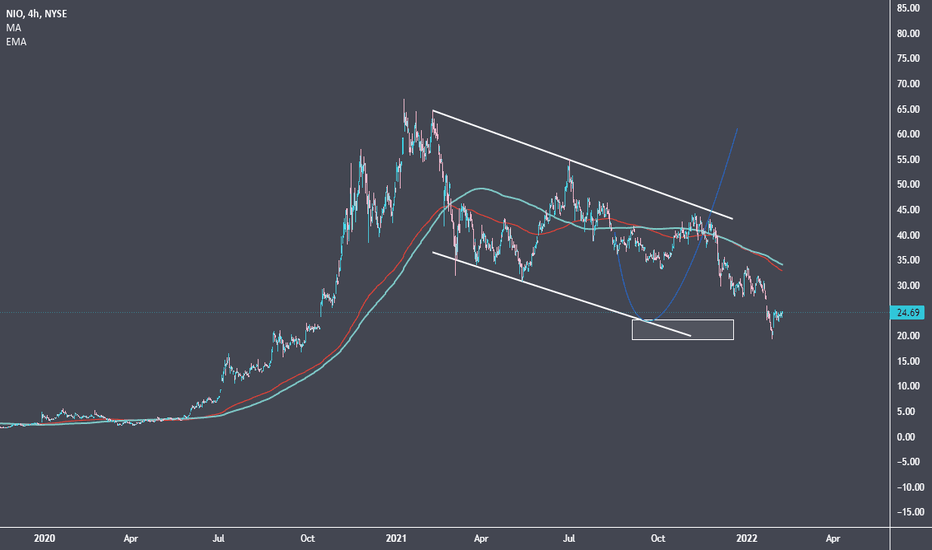

Technical analysis: BEARISH

- I tried to re-chart NIO many times as it continued to plummet, resulting in two possible chart patterns on the 1D chart. Seen in purple (1) a wedge, and red (2) a descending wedge, sadly, NIO broke the bottom trend line in both patterns.

It is important to not be emotionally attached to a stock, one must look at charts from an unbiased view to get the best results.

I will hold and continue to add to my shares for I highly think NIO will be a $200+ stock.

Remember what Warren Buffett said "It's far better to buy a wonderful company at a fair price, than a fair company at a wonderful price." and that is exactly what Im seeing.

This is not financial advice, this is just what I see happening. Let me know what you think.

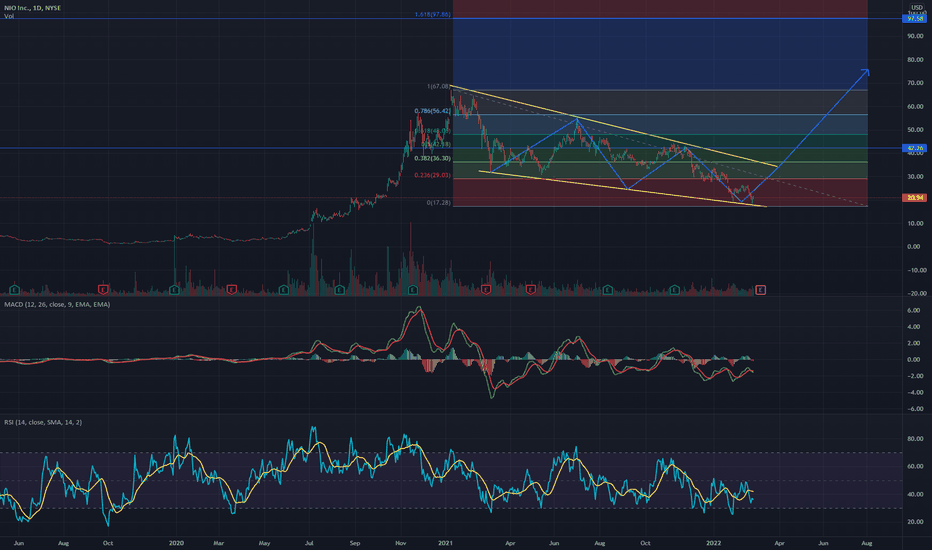

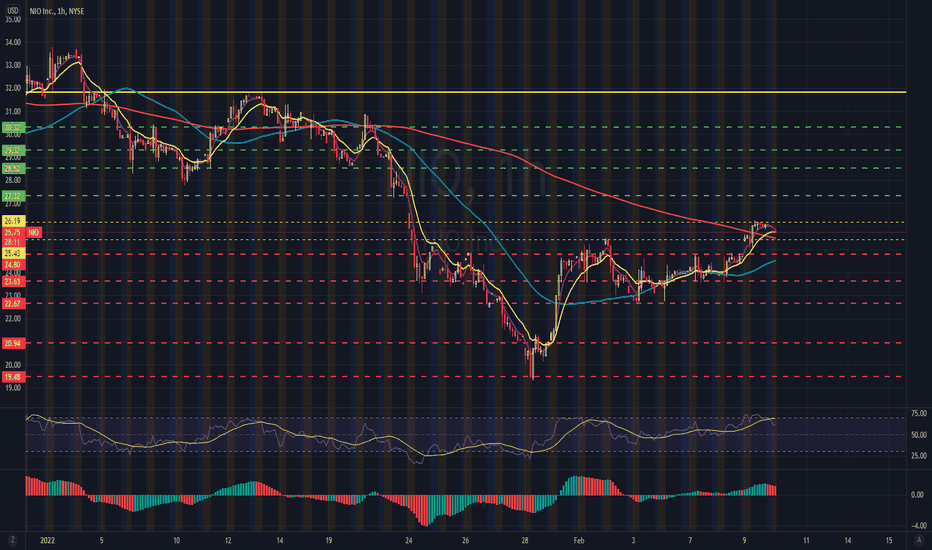

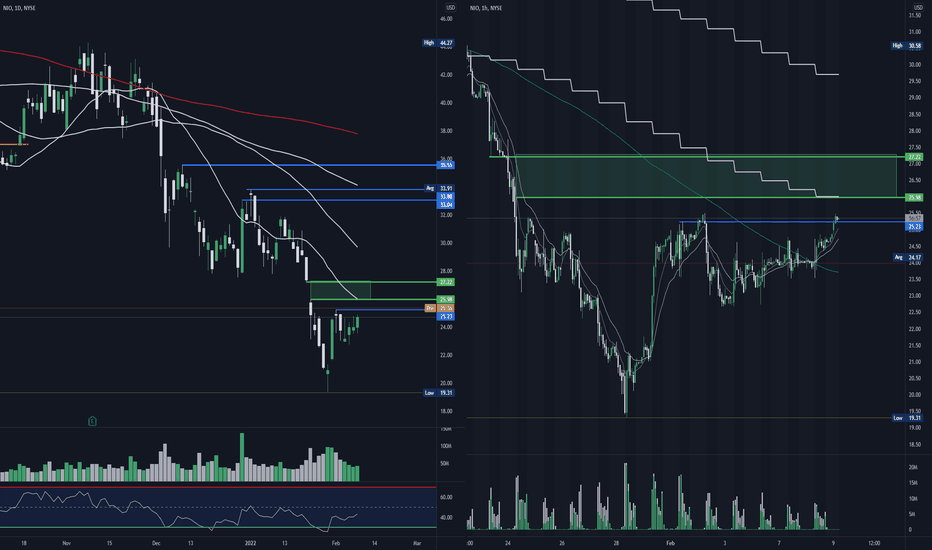

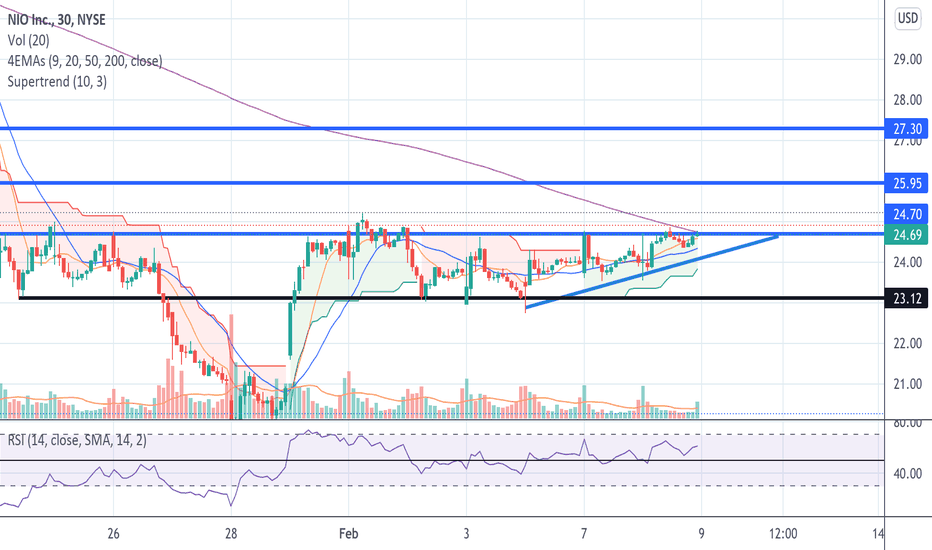

NIO LongAnalysis done on 30 minute and daily candles. Electric vehicle shares rallied today with NIO being one of the leading performers after their announcement to have a second listing on the Hong Kong Exchange. This is good news for investors because means the company will be able to bring in more capital from a new pool of investors. 2021 was a very tough year for NIO and Chinese stocks in general, the stock was trading at a high of nearly 70.00 at one point, but the rising fears of Chinese delistings and overall market correction has brought down its market value. Looking at the short term, today's rally brought NIO's daily candle up to the 10 day MA line on the daily, but wasn't able to breakout above it. Going into the rest of this week, your best case scenario is NIO gaps above that MA line and continues its rally. That would involve NIO breaking above the 23.15 resistance, which it would then have a price target of 24.50-25.00. If NIO fails to move above its moving averages then it can decline to test the 21.00 support. If it breaks below then it can see 20.00.

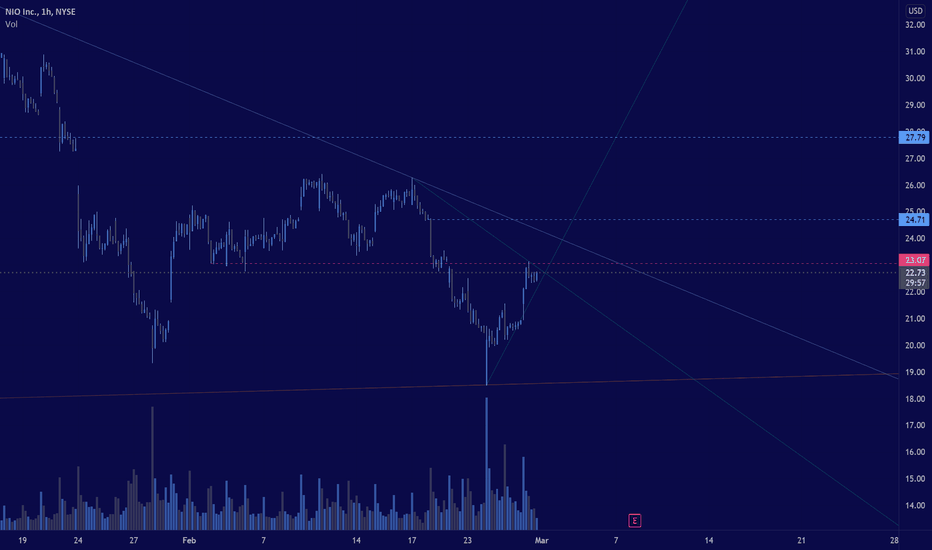

Swing on NIONIO appears to be setting up for a nice swing trade, if we can make a higher low and hold on the 1 hour, it would increase chances how having a bullish close above the trend line fueling the move upwards tin which 23.07 level would be crucial to hold to confirm the uptrend. I am personally in some leaps and I am confident my 24.71 and 27.79 levels will be hit. Keep in mind earnings are coming up and markets are highly volatile so as always assess your own risk. Happy trading.

NIO Inc (NYSE: $NIO) Announces Listing In Hong Kong! 🌏NIO Inc. designs, develops, manufactures, and sells smart electric vehicles in China. The company offers five, six, and seven-seater electric SUVs, as well as smart electric sedans. It is also involved in the provision of energy and service packages to its users; marketing, design, and technology development activities; manufacture of e-powertrains, battery packs, and components; and sales and after sales management activities. In addition, the company offers power solutions, including Power Home, a home charging solution; Power Swap, a battery swapping service; Public Charger, a public fast charging solution; Power Mobile, a mobile charging service through charging vans; Power Map, an application that provides access to a network of public chargers and their real-time information; and One Click for Power valet service, where it offers vehicle pick up, charging, and return services. Further, it provides repair, maintenance, and bodywork services through its NIO service centers and authorized third-party service centers; statutory and third-party liability insurance, and vehicle damage insurance through third-party insurers; courtesy car services; and roadside assistance, as well as data packages; and auto financing services. Additionally, the company offers NIO Certified, a used vehicle inspection, evaluation, acquisition, and sales service. NIO Inc. has a strategic collaboration with Mobileye N.V. for the development of automated and autonomous vehicles for consumer markets. The company was formerly known as NextEV Inc. and changed its name to NIO Inc. in July 2017. NIO Inc. was founded in 2014 and is headquartered in Shanghai, China.

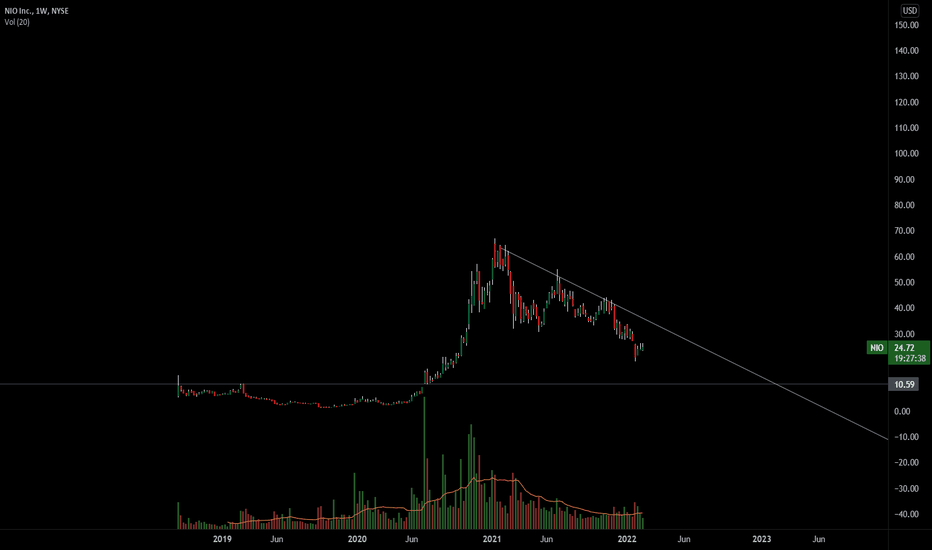

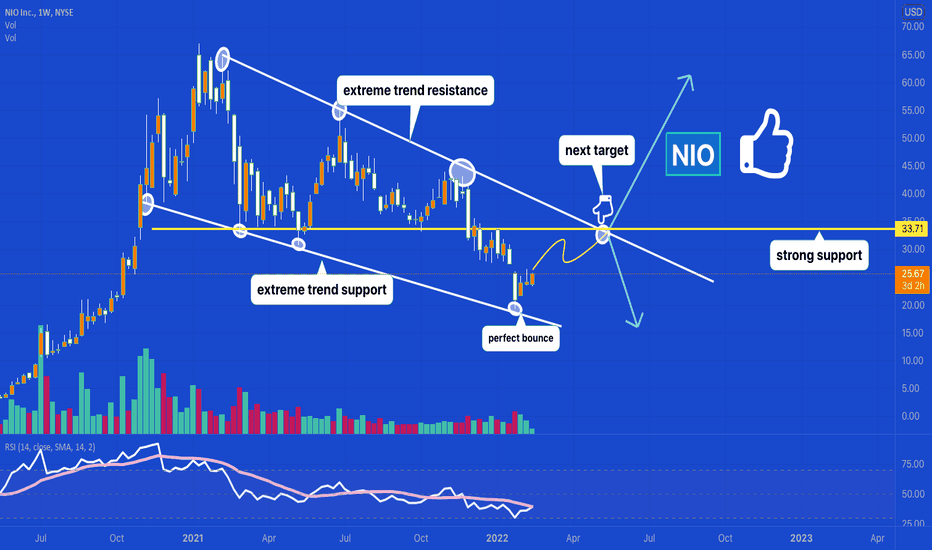

held the important trend support, good signs 💸NIO recently bounced off a extreme trend support line, but still in a bearish trend channel overall. we should rally to 30-33 area now, if we can break all time highs is possible. If we reject at trend resistance then expect more downside. like and follow for more! 💘

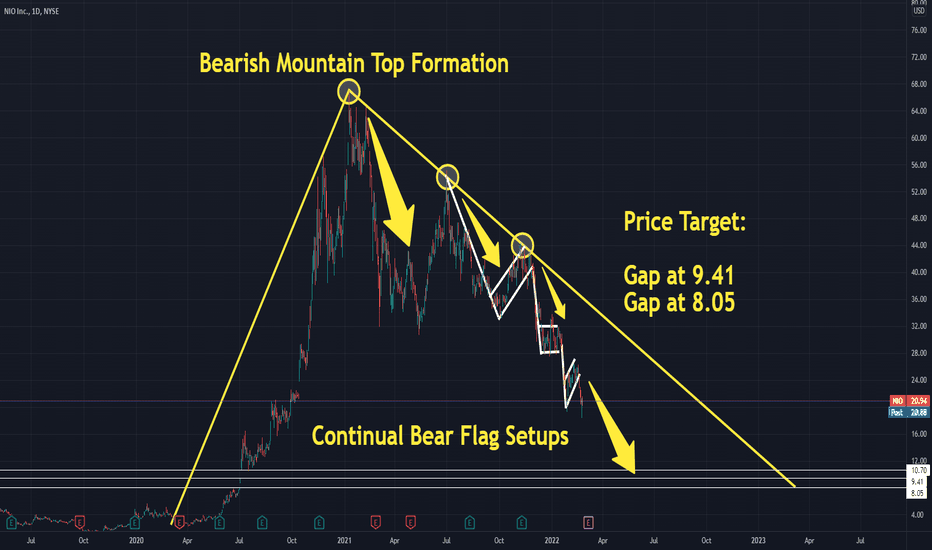

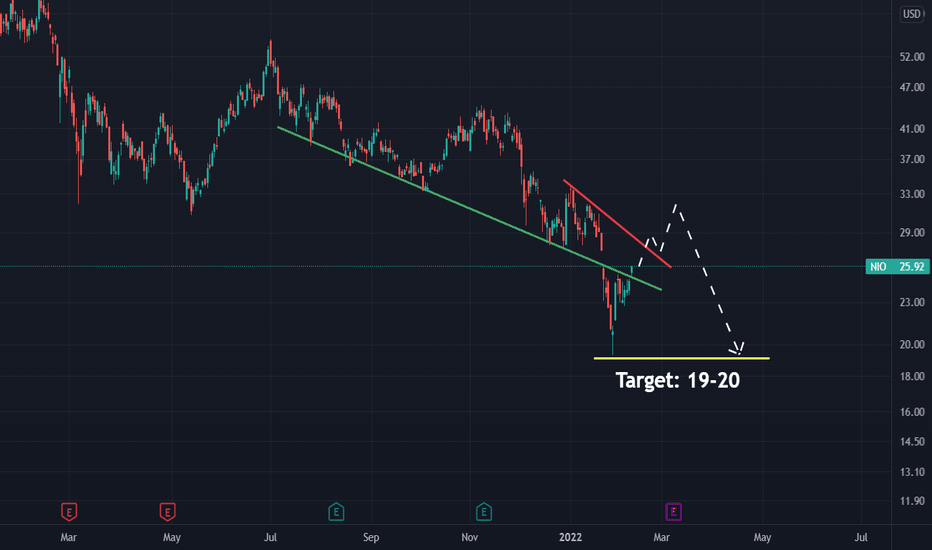

NIO is going to hurt youThis is one of the most bearish signs you can see and it's so easy to spot that lots of people choose to ignore it.

Nio is very likely going to come down in the range of 10 to 15 dollars. Since this has the same sentiment as a meme stock i won't try to trade it short.

It's more a warning for bullish people that they could get rekt big time. Especially when trading with leverage.

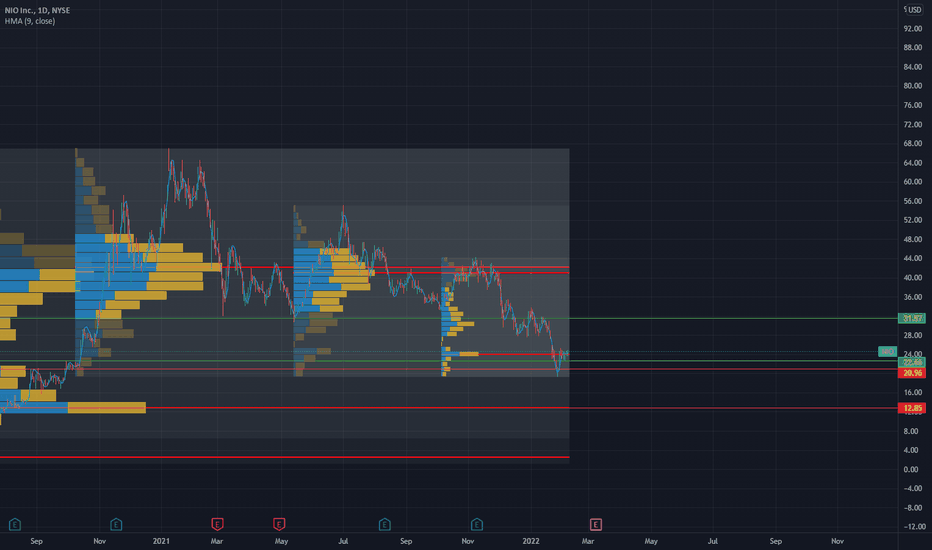

NIO - Not too optimistic on this one!-NIO declined for a few valid reasons. Namely, the fundamentals behind the stock aren’t as pretty as you might think and its valuation is too extreme.

-Now the logical question to ask is whether its current, lower price makes NIO stock a buy.

-Technical analysis may show that the stock is now oversold. This does not mean that in mid $20s the stock is a bargain. Do not confuse value with price.

-In the third quarter of 2021, NIO reported an increase in vehicle sales of 102.4% from Q3 2020 and 9.2% from Q2 2021. Total revenues of $1.52 billion showed an increase of 116.6% from the third quarter of 2020 and an increase of 16.1% from the second quarter of 2021. The gross margin was 20.3%, compared with 12.9% in Q3 2020 and 18.6% in Q2 2021. All of this is positive news.

-So what are the red flags from the Q3 2021 earnings report that most investors are overlooking?

First, the vehicle margin was 18%. In Q3 2020 it was 14.5% and in Q2 2021 this figure was 20.3%. According to NIO, “ ehicle margin is the margin of new vehicle sales, which is calculated based on revenues and cost of sales derived from new vehicle sales only.”

-Margin declined on a quarterly basis and should be monitored closely over the next quarters as NIO has plans to increase its manufacturing capacity, start delivering the luxury ET7 model next month and its midsize ET5 sedan in September.

-Profitability continues to be a riddle hard to solve for NIO. In fact, the firm reported a net loss of $443.7 million in Q3 2021. That’s a 140.7% jump from Q3 2020 and a 333.6% leap from the results reported in Q2 2021.

-Its operations losses added up to $153.9 million in Q3 2021 — a 4.9% increase from Q3 2020 and 29.9% increase from Q2 2021.

-Meanwhile, the cost of sales in the third quarter of 2021 increased 98.3% from Q3 2020 and 13.6% from Q2 2021. These details gain further meaning if you consider this comment by NIO itself: “The increase in cost of sales over the third quarter of 2020 and the second quarter of 2021 was in line with revenue growth, which was mainly driven by the increase of vehicle delivery volume in the third quarter of 2021.”

OUR TARGET PRICE:

$19-$20

NIO long gapNIO putting in a nice pattern on the daily.

Look like a gap up over previous resistance.

PM high currently 25.49 long over that but would prefer a dip and rip.

If it gets going it should be able to fill the gap to 27.22

Issues against it.

XPEV has some news and i dont know if its good or bad.

NIO probably needs XPEV with it, maybe not, but they generally run together

NIO - How can you not be bullishNIO is currently in an ascending triangle formation sitting at resistance. Its creating higher lows and struggling to break resistance at $24.67...The break out will occur tomorrow, if not it will break down. The upside is great.

Target #1 - $25.95

Target #2 - $27.30 (Gap fill resistance)

Risk level depending on how much breathing room you like $23.09(black lines) Anything below that and you know its gone beyond any point of return. Tighter if you see fit. Good Luck tomorrow.