GDR1! trade ideas

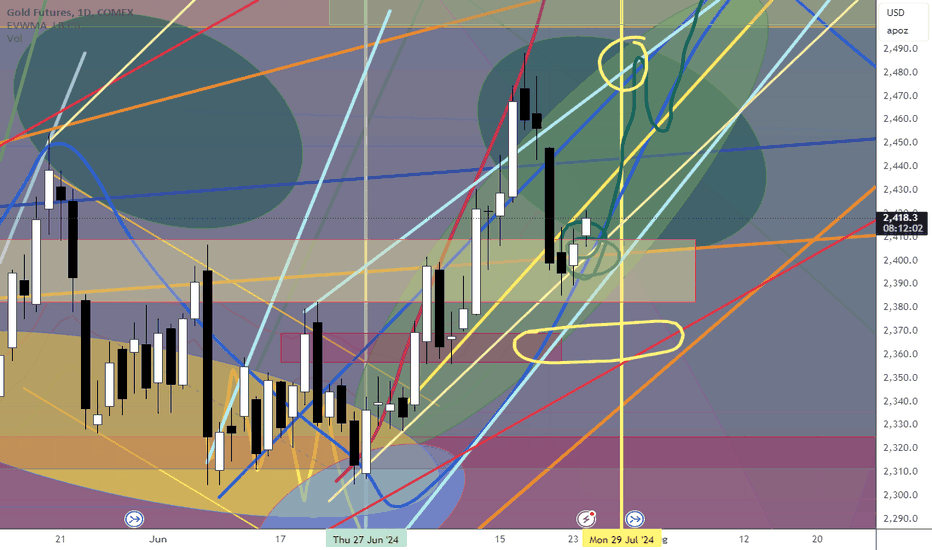

GOLD Cycle Patterns - Get Ready - Rally - Rally - RallyThis short video shows how my GOLD Cycle Patterns are set up for a broad upward price move in Gold/Silver over the next 5+ trading days.

If you've been following my Plan Your Trade videos (for the SPY/QQQ), you'll probably love these Gold Cycle Patterns and my metals research.

Some people continue to comment that my research is "Spot On". I tend to agree, but remember, these patterns are only about 80% accurate over 12 months.

Still, there is nothing else like these SPY/GOLD Cycle Patterns that provide clear/actionable trading signals/insights 2~3 weeks into the future.

Check it out... Get ready for Gold to target $2550+ over the next 5+ trading days.

Get Some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #es #nq #gold

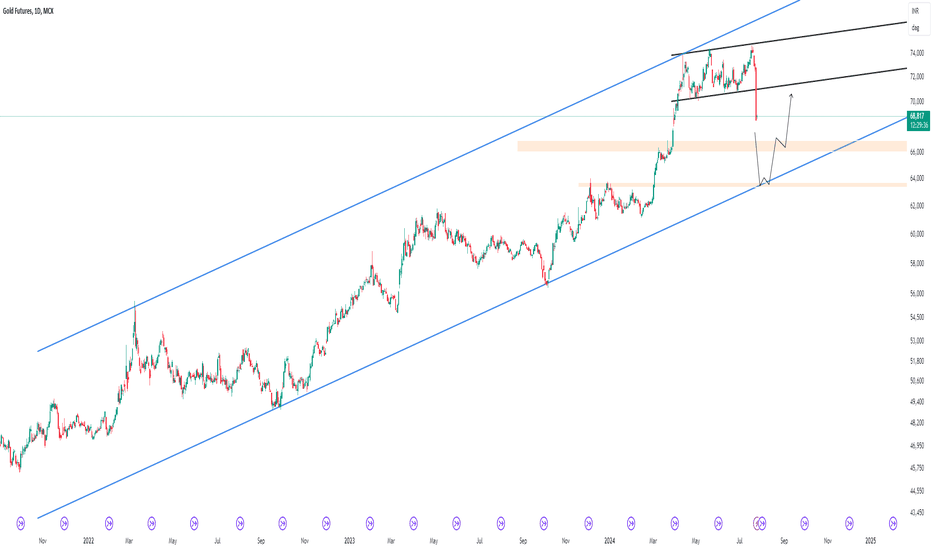

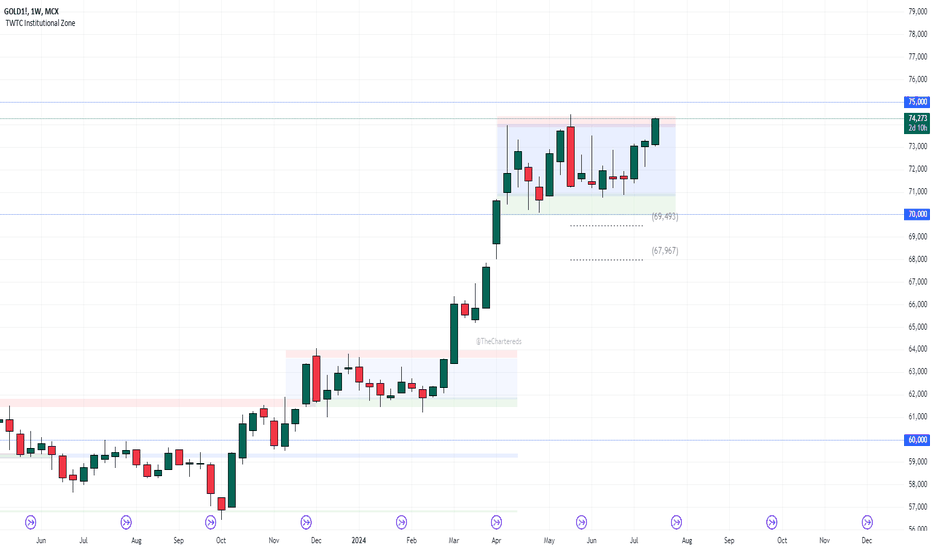

GOLD MCX Analysis#GOLDMCX has broken the black bull flag to the downside but is still within a blue uptrend channel.

The Indian government has proposed a reduction in customs duty on gold and silver from 10% to 6%. This initiative, part of the Union Budget 2024, aims to make gold more affordable domestically, potentially boosting the jewelry sector.

I am considering buying near the support level at 66600-500, followed by strong support at 63500.

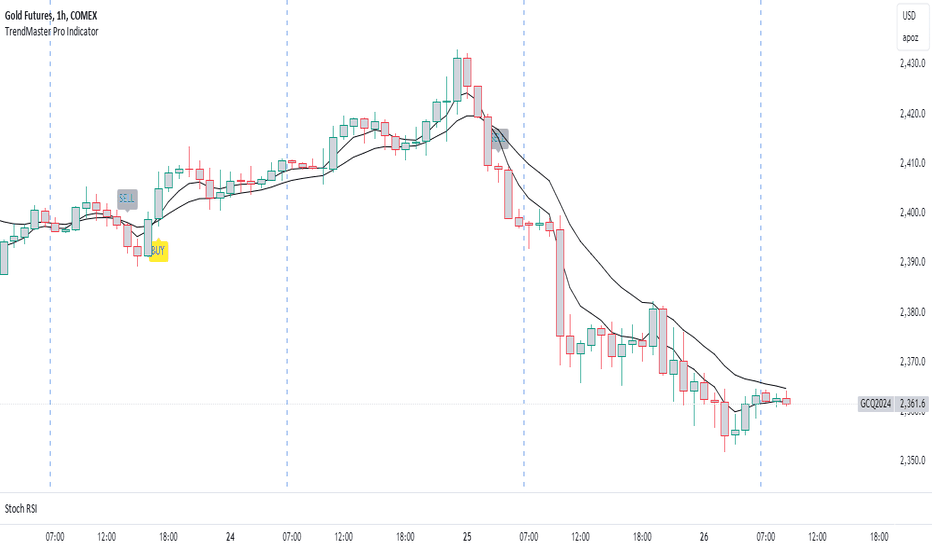

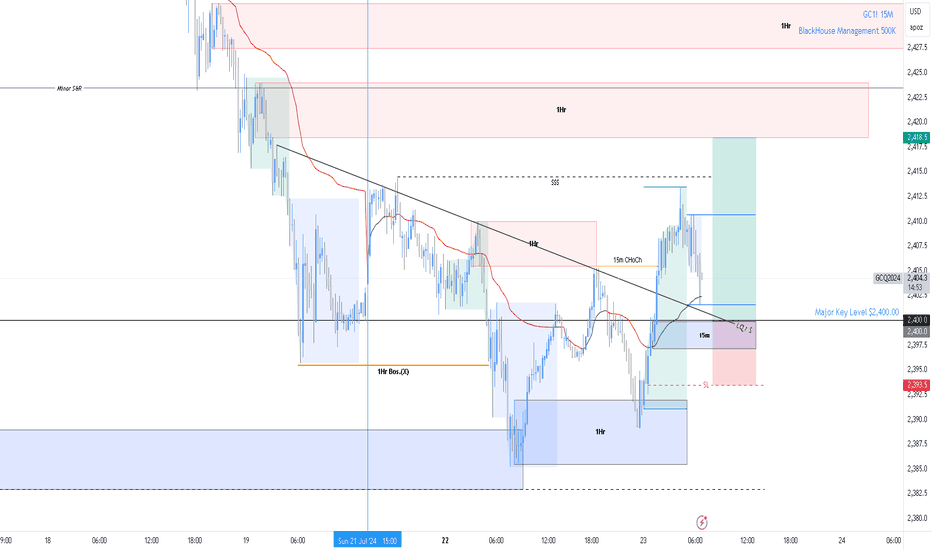

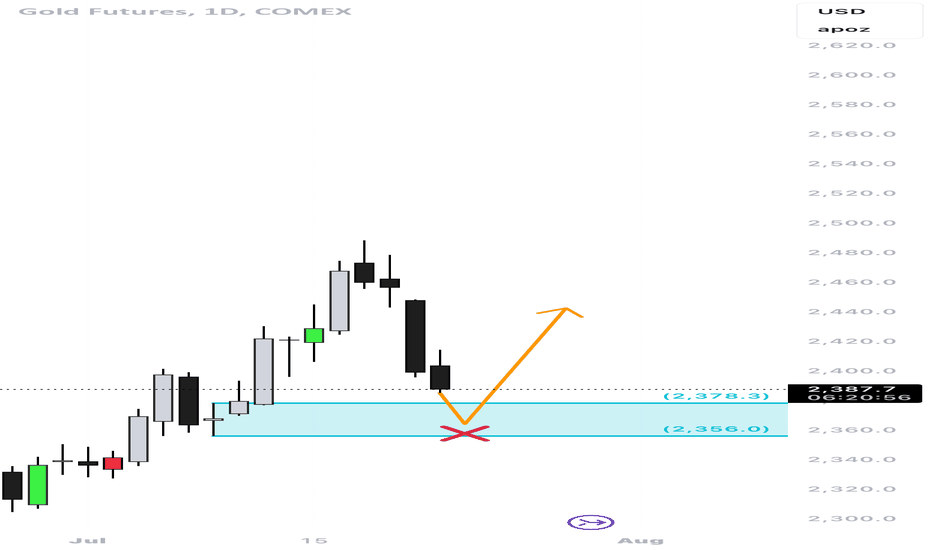

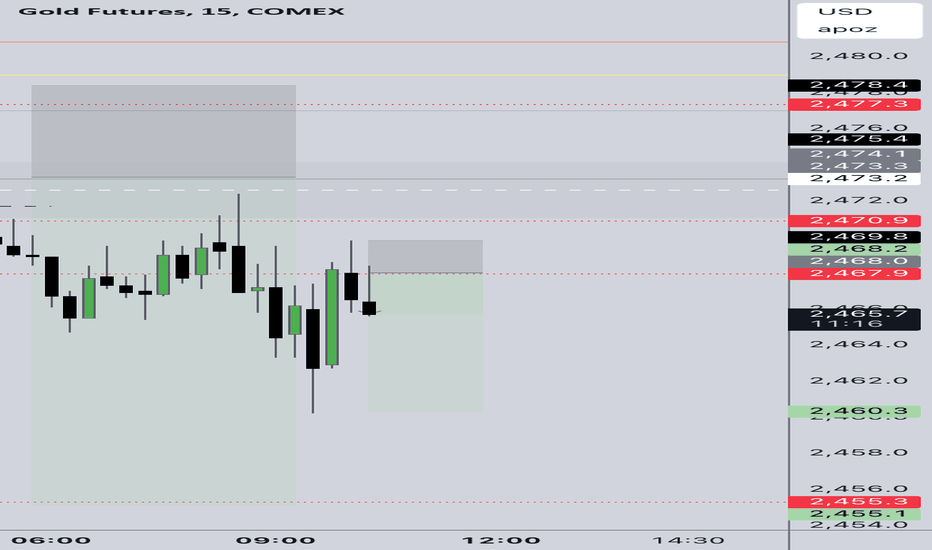

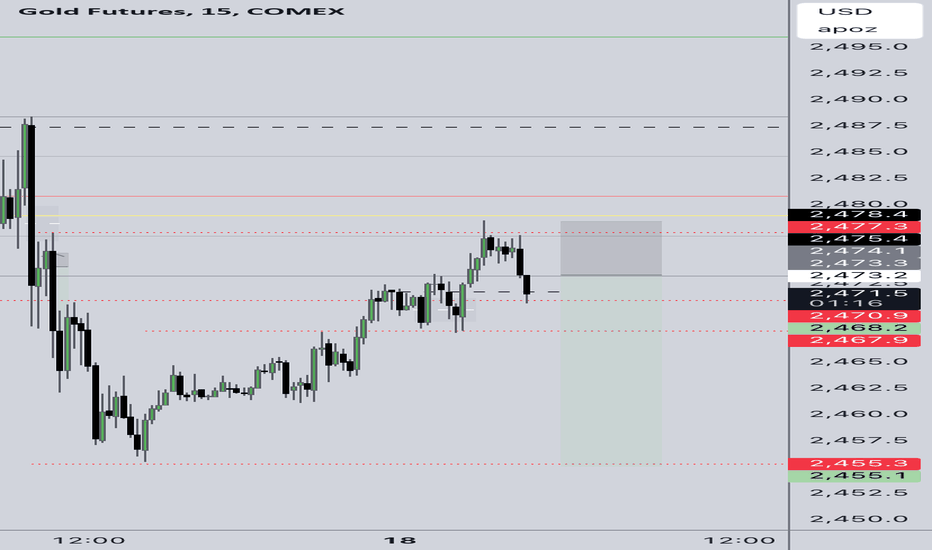

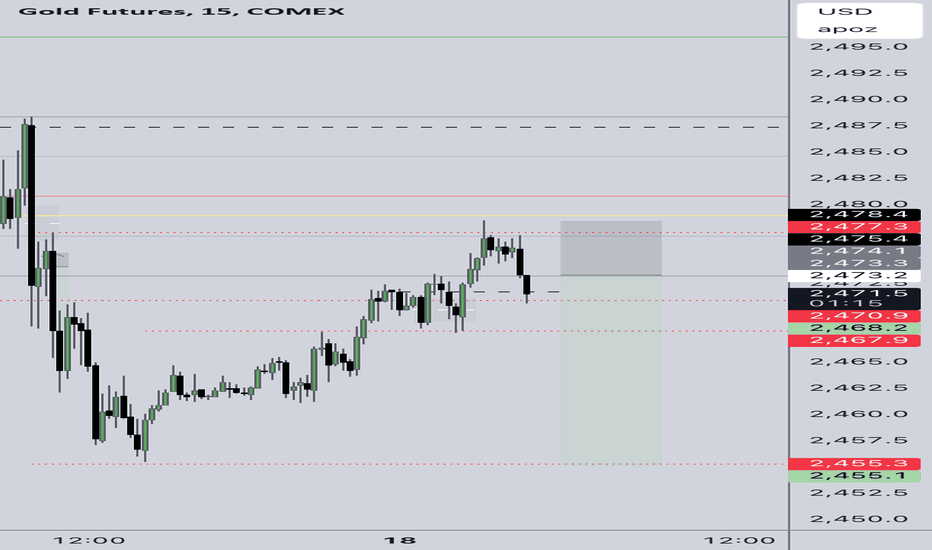

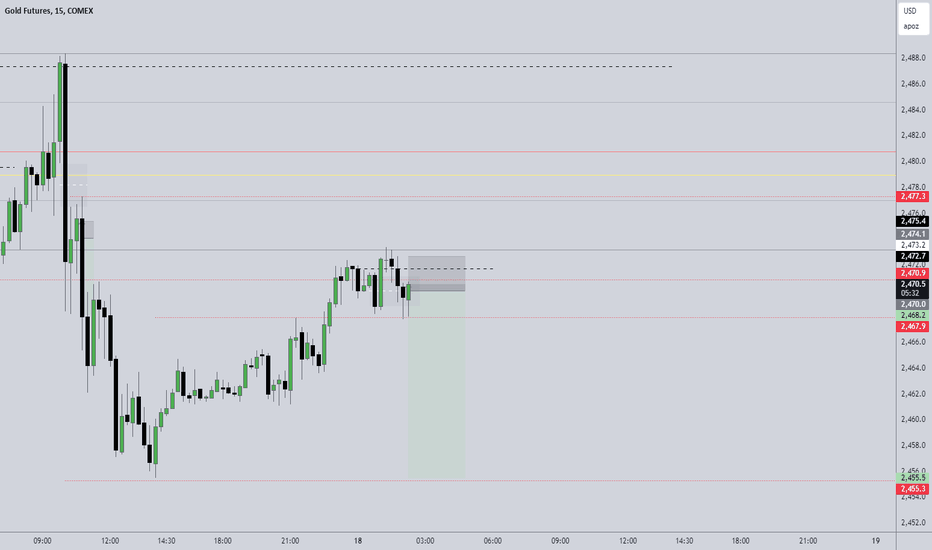

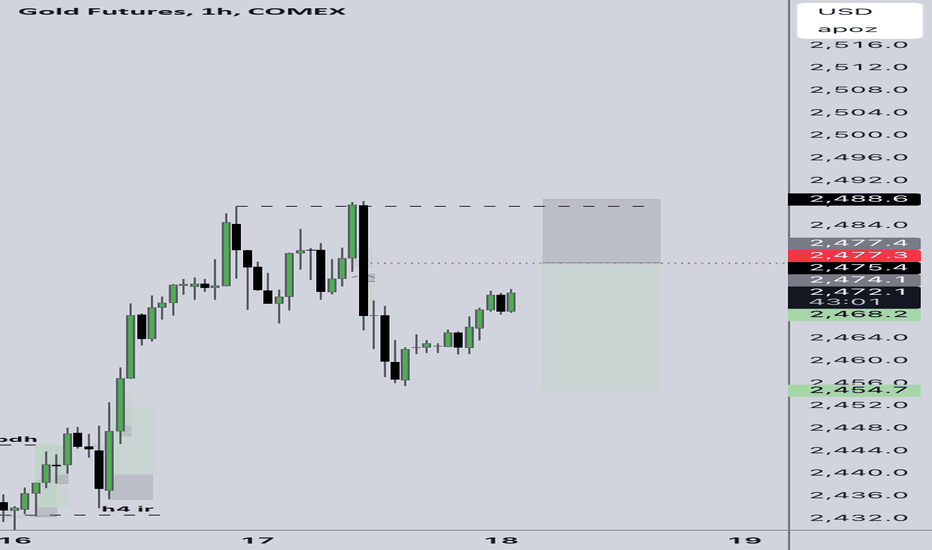

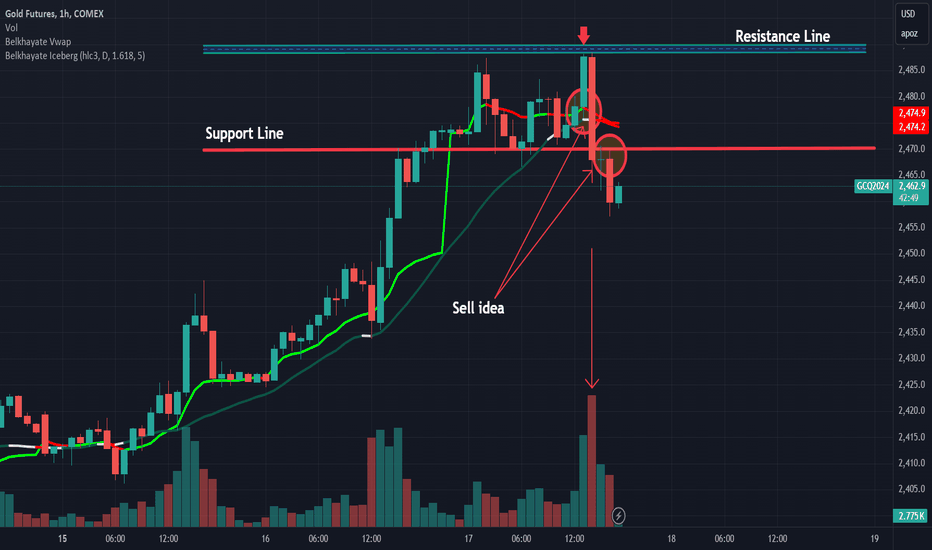

Can the HOUSE CAPITALIZE LONG during today's NY Session...?COMEX:GC1!

"The One Most Adaptable to Change is the One that Survives." -Charles Darwin

Last night as I was monitoring my assets I noticed here on GOLD that sellers have created this Descending iR/LQ Trendline on the LTF's 1Hr N below that needed to be swept.... Now that buyers have swept that liquidity during last night's London Session. I have now set my limit for NY session to go LONG. I want to see the retest of Major Key Level $2,400.00 as my Key entry and then target the unmitigated 1Hr Supply zone above.

1) I'll keep close update as PA develops and we have more data to work with.

Remember when it comes to FRM (Financial Risk Management) our job is to manage the downside costs of printing High side returns of $$$ consistently. Let's Keep Steppn!!

Stay Focused & Reach Excellence!!

#BHM500K #NewERA #Champions

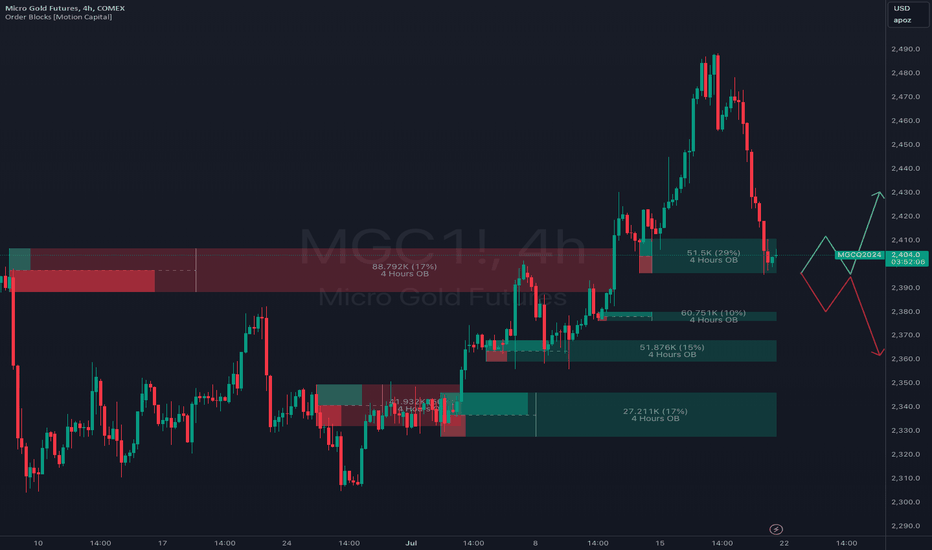

GOLD: Time to shine bright?- The chart is self-explanatory as always

- Gold is at the ATH with a strong Bullish candle

- A breakout will do the trick

- Bank of America has given a target of $3000 for 2025

- Yesterday, Gold flew high in the US.

- The rising uncertainty in the world is another impetus.

Thoughts???

⚠️Disclaimer: We are not registered advisors. The views expressed here are merely personal opinions. Irrespective of the language used, Nothing mentioned here should be considered as advice or recommendation. Please consult with your financial advisors before making any investment decisions. Like everybody else, we too can be wrong at times ✌🏻

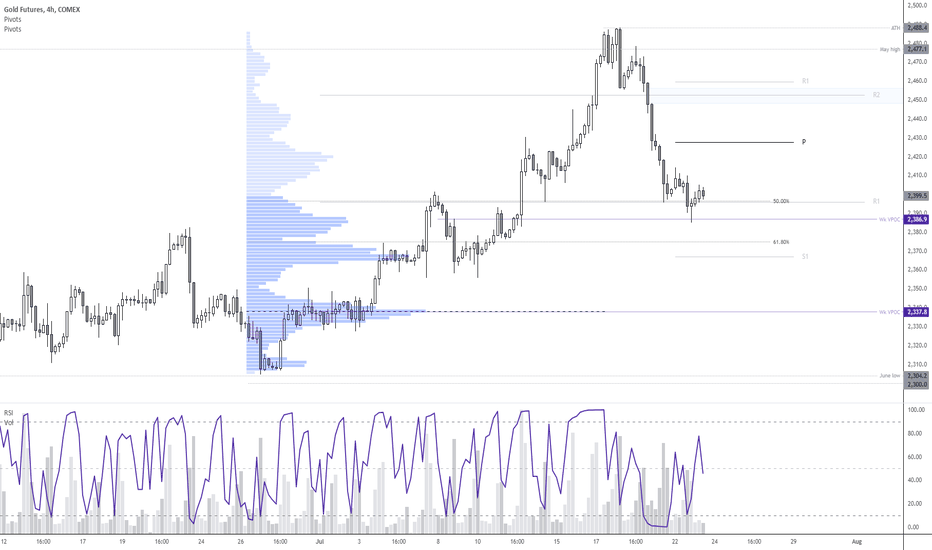

Gold swing trading ideas, with a new look at futures sentimentWe take a multi timeframe approach for today's gold analysis video. Taking into account COT data from the weekly chart, support levels on the daily and four-hour charts, we outline our rationale as to why gold could hit new lows after an expected bounce.

MS.

Gold Market Update: Key Support Levels to Watch This Week This week, the gold market is showing signs of potential recovery as prices dip into key demand areas. Currently trading at a discount, gold may find support around the $2,300 to $2,400 range. These levels are crucial to monitor as they historically represent strong buying interest and could act as a springboard for price stabilization or even a potential rally.

As always, keep an eye on broader market indicators, including economic data releases, geopolitical developments, and currency fluctuations, as they can significantly influence gold prices. Traders should remain vigilant and consider these support levels when making informed decisions.