GDR1! trade ideas

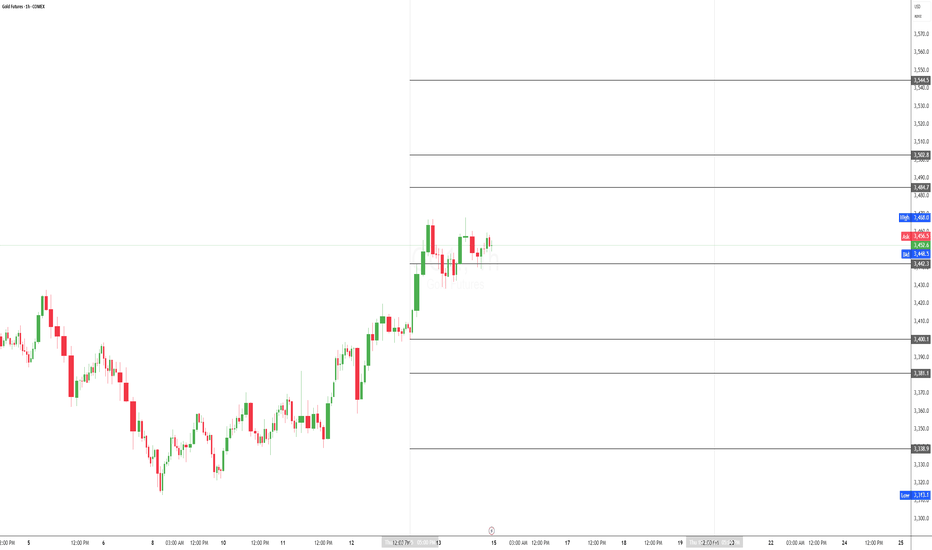

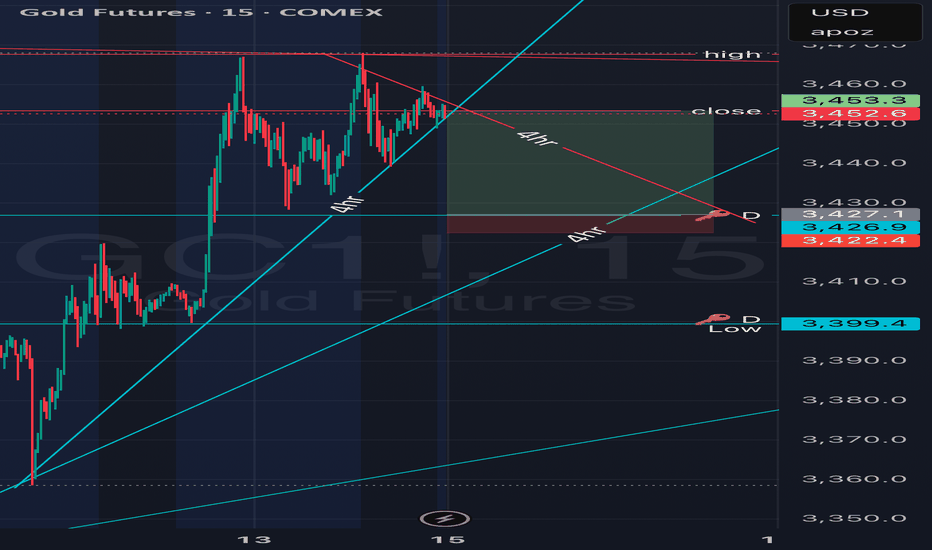

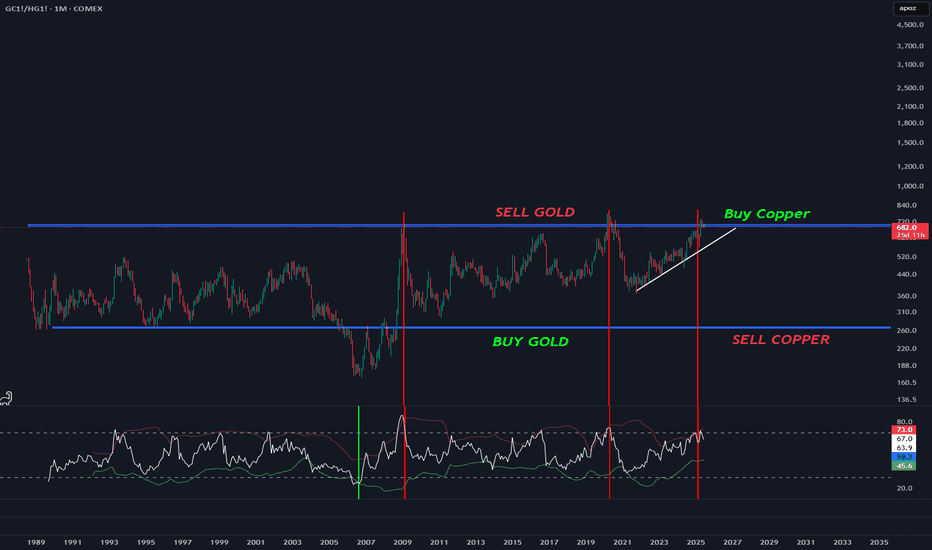

GOLD ANALYSIS FOR THE WEEKI've been studying GOLD (GC) & others and want to share my analysis. Trading involves probabilities, so it's essential to be confident and prepared. Study the market thoroughly before trading with real money.

Let's test strategies this week. You may use a live account if you have capital, and manage your stop losses carefully. Next week, I'll provide more details on entry points and stop losses. Wait for trades at specified levels and avoid positions in the middle to minimize losses. Be patient and trade from one edge to the other.

Good luck and make money.

For one-on-one sessions: $20k per person. You'll learn weekly, monthly, and yearly calculations. Weekly subscriptions are also available for $500 per person. COMEX:GCD1!

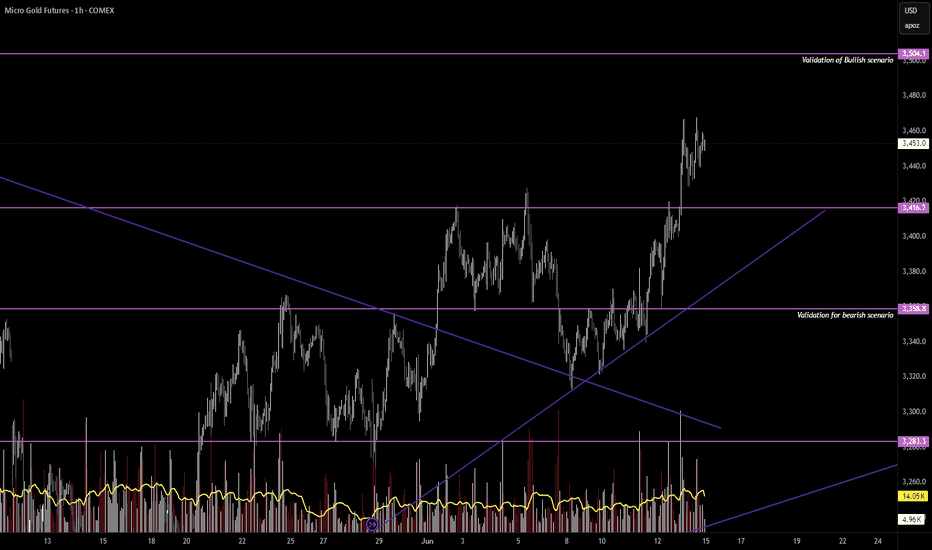

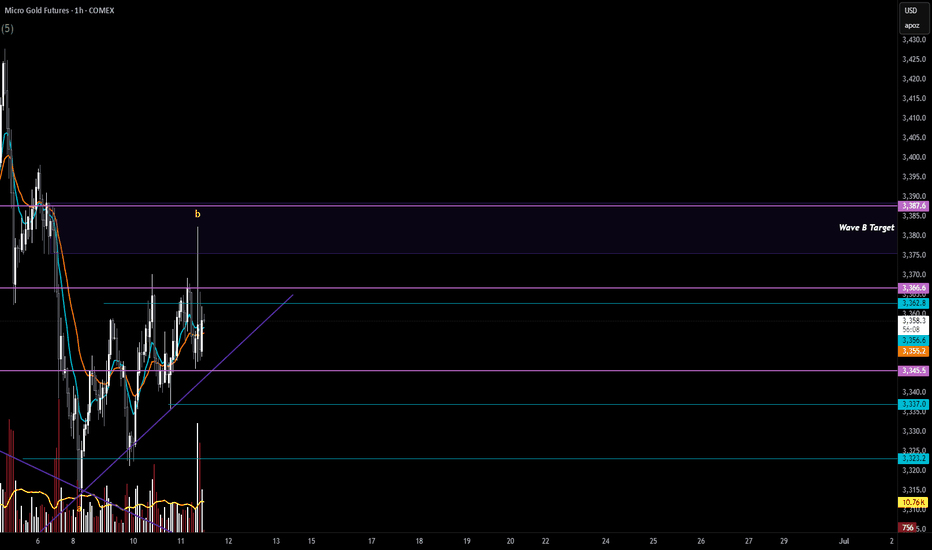

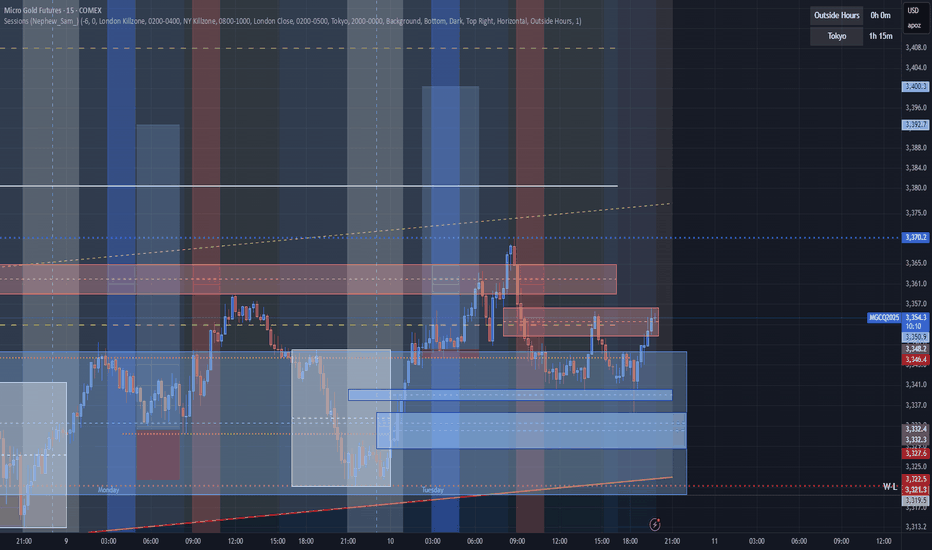

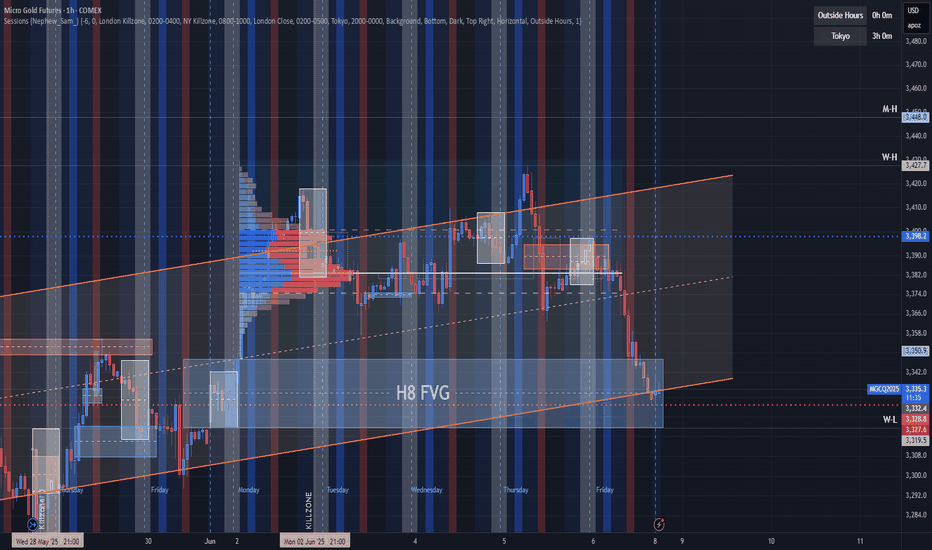

$MGC1(Gold) Weekend Update - June 14Hello Fellow Gamblers,

I hope you're not sinking in your twin size bed thinking about your losses from this week.

I am bringing to you a weekend update on gold, so we can get ready for this week. This video is a little bit longer and my ability to speak becomes worse as time extends, so take your time and get your notes right to prepare for the week.

- 3416.2 needs to hold for more upside. A break below that level can take us towards 3358.8.

- A break below 3358.8 validates our bearish scenario.

- A break above 3504.1 validates our bullish scenario.

- Levels to watch: 3416.2, 3358.8, 3504.1

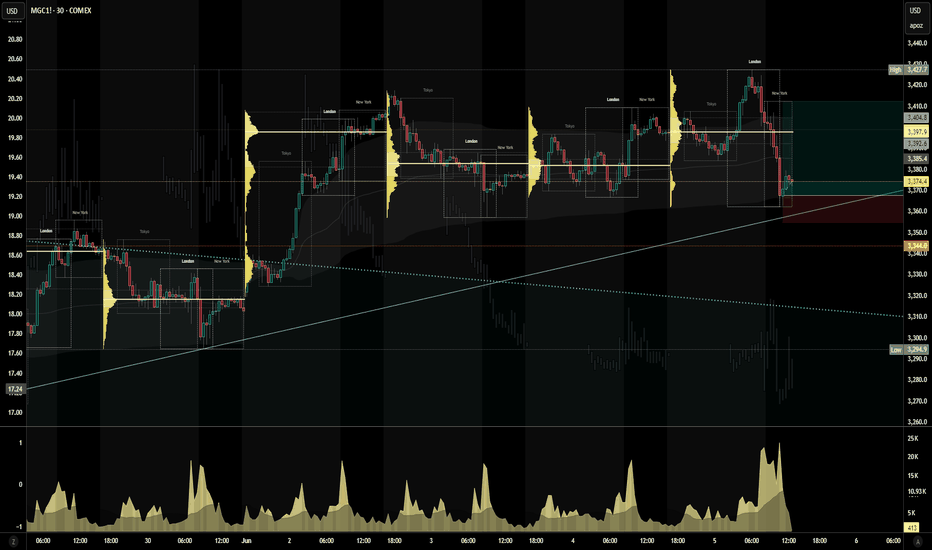

MGC Post Market Update - The Battle of the Two CountsHello Fellow Gamblers,

As you know we are tracking 2 EW counts at this time and they are both still in play.

W5's are tricky to deal with but with a little patience we should be able to make our portfolio grow.

- I am currently looking for bearish divergences to support our bearish Scenario but the current price move strength favors our bullish scenario.

- Be aware of a possible Cup and Handle formation

- Levels to watch: 3508.4, 3441.9, 3365.2, 3314.7.

See you next time!

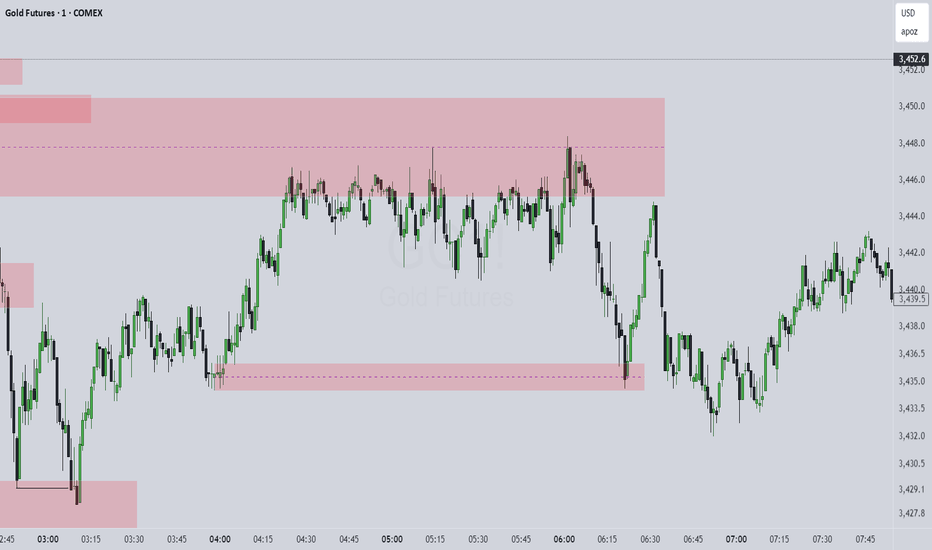

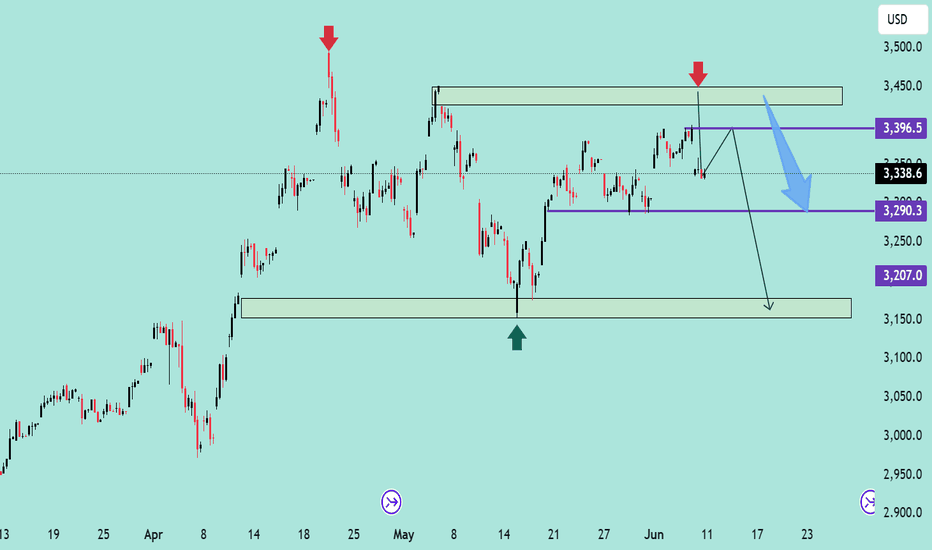

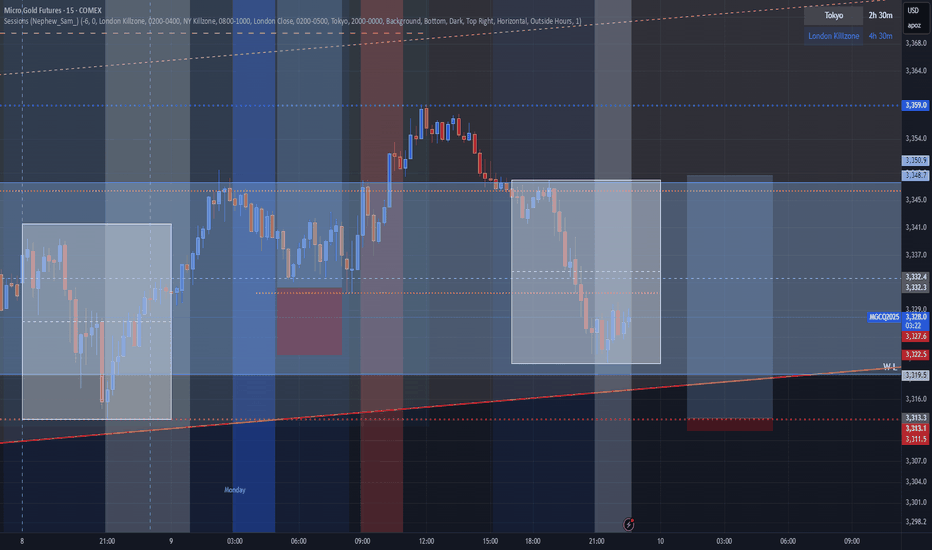

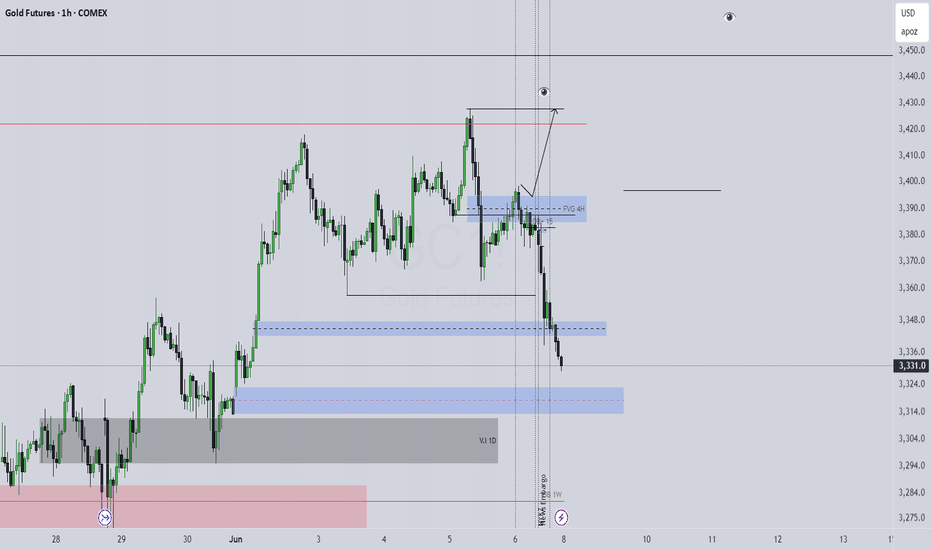

XAUUSD Bearish Rejection Setup Unfolding – June 11, 2025XAUUSD Bearish Rejection Setup Unfolding – June 11, 2025 🧠🔍

📊 Technical Breakdown:

🔴 Resistance Rejection Zone (Supply Area)

Price recently tested the $3,440 - $3,460 resistance zone, marked with red arrows. This zone previously acted as a strong supply area, leading to aggressive sell-offs.

📉 Bearish Rejection Candle

A rejection occurred near the same supply zone again, hinting at a potential double top or failure to break structure. Sellers seem to defend this area aggressively.

📍 Current Price: $3,338.6

Price is hovering below mid-range resistance at $3,396.5, indicating weakness after a failed breakout.

📉 Bearish Plan in Motion:

🔁 Scenario Highlighted:

Price might retest the $3,396.5 level (purple line) before resuming the downward move (illustrated by the blue and black arrows).

A breakdown below the $3,290.3 support zone will likely trigger further downside.

🎯 Target Levels:

1st Target: $3,290.3 – Key structural support. A close below this level will confirm the bearish momentum.

2nd Target: $3,207.0 – Final support area aligned with previous accumulation zone.

🛑 Invalidation Point:

A sustained breakout above $3,460 would invalidate the bearish bias and suggest continuation to the upside.

✅ Summary:

Bias: Bearish 📉

Strategy: Sell on pullback to $3,396.5 with stops above $3,460.

Targets: 🎯 $3,290.3 ➡️ $3,207.0

Watch for a strong bearish confirmation candle below $3,290.3 to load in shorts.

🔔 Stay alert for volume spikes and lower time-frame breakdowns to fine-tune entries! 💼📊

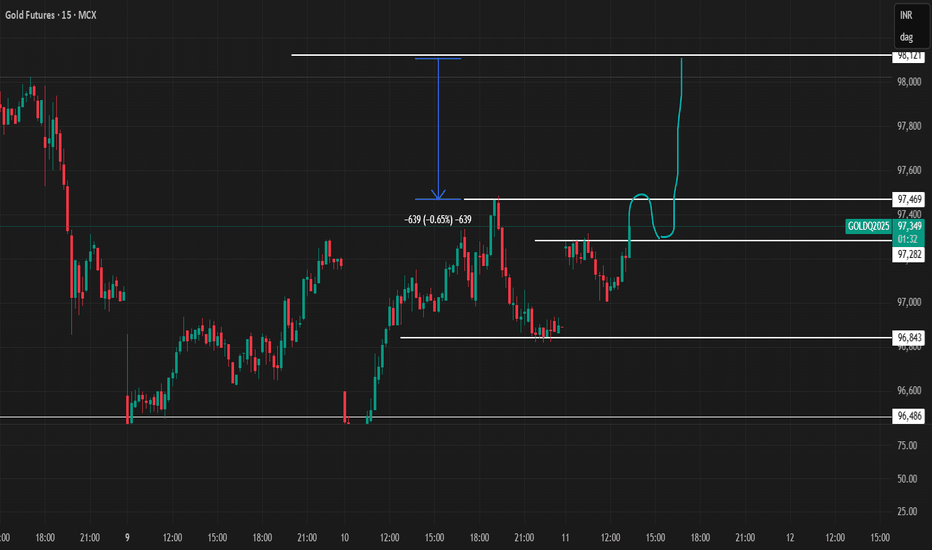

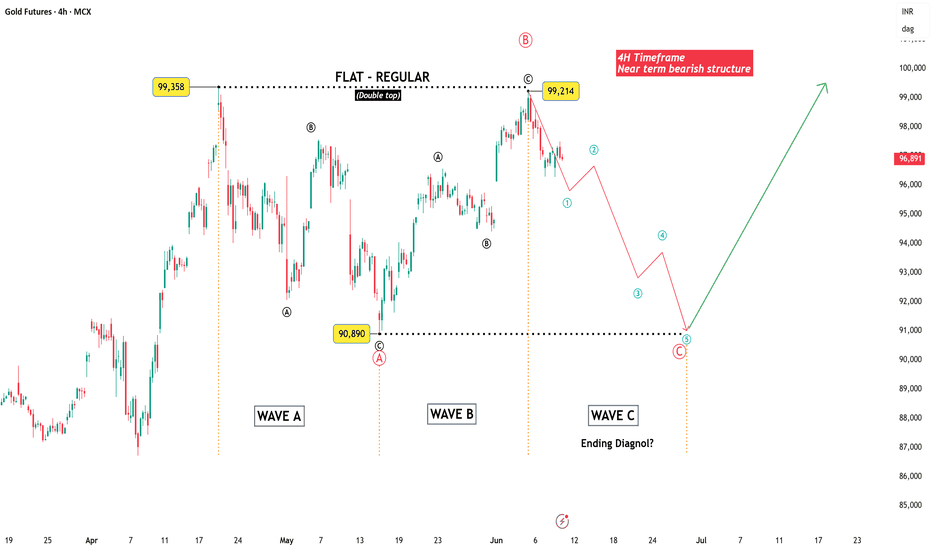

Gold Futures – Double Top Leads to Bearish SetupGold Futures on the MCX chart is showing a classic Elliott Wave pattern in play. After forming a regular flat correction with a double top near the 99,300–99,200 zone, prices have started to drift lower. The double top structure—combined with the completion of Wave B—suggests that a Wave C decline is underway.

Wave A took the price down to around 90,890, followed by a corrective Wave B that failed to break the previous high convincingly.

The near-term outlook on the 4-hour timeframe remains bearish. I am anticipating five waves down within Wave C, which may take price back toward the previous Wave A low or slightly lower, possibly ending in a diagonal pattern, before a bullish reversal can be expected.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) before making any trading decisions.

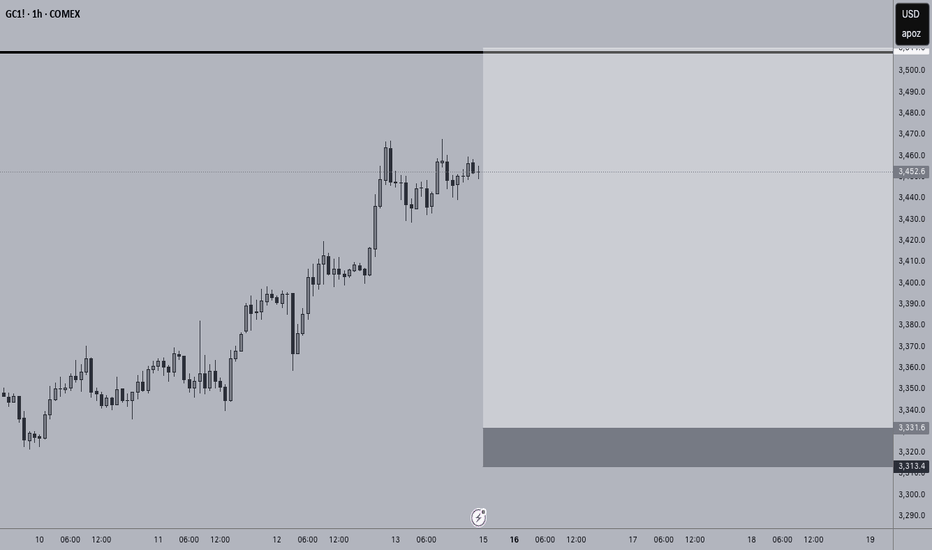

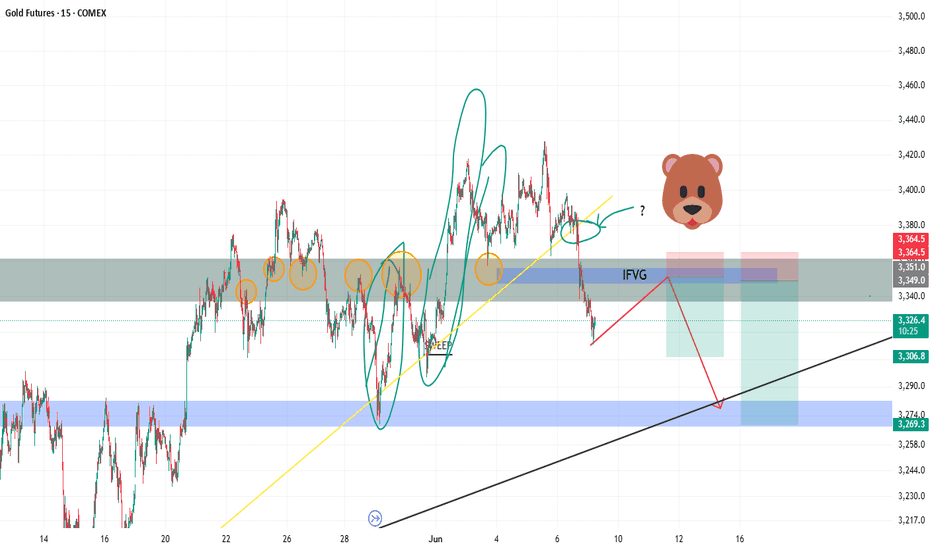

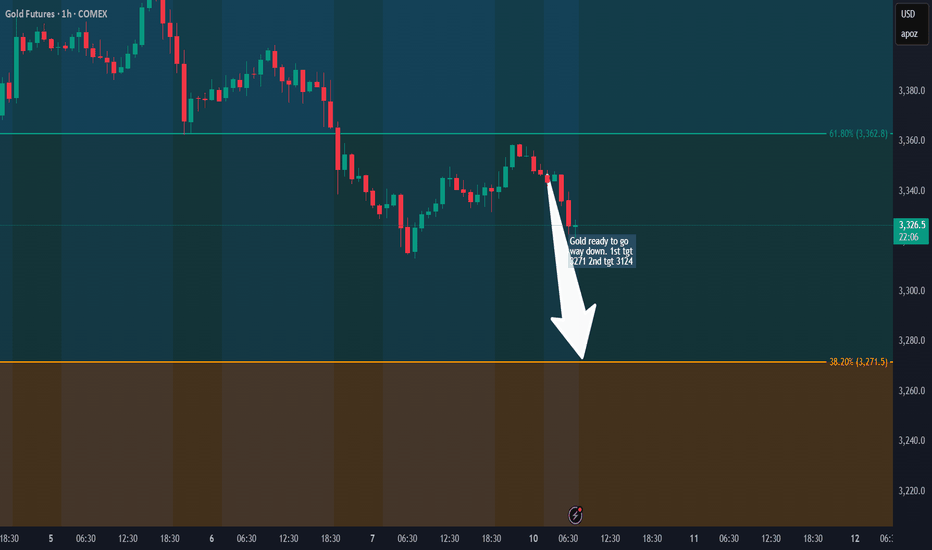

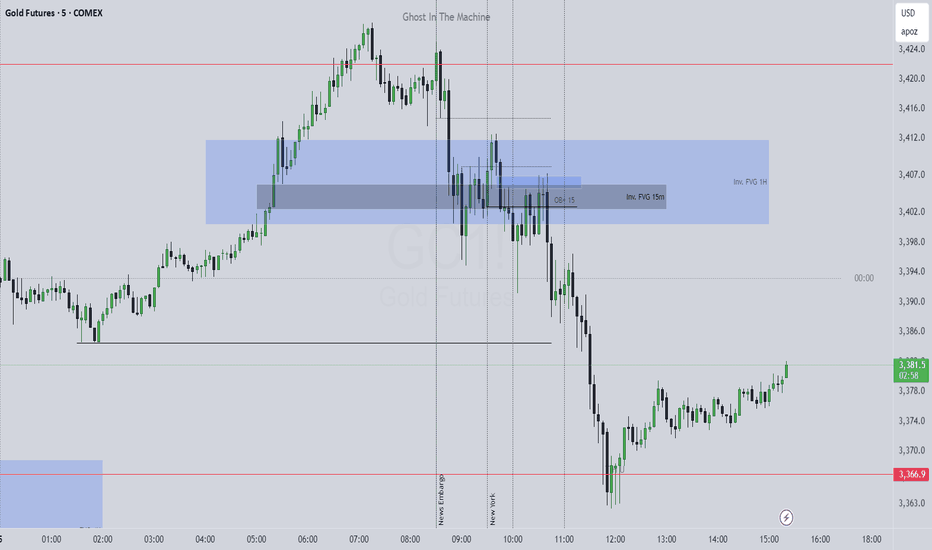

Shorting GoldWell, iam taking this trade for sure.

Iam shorting Gold again because of the following reasons.

The reason behind this trade is the IFVG that is nested withing the now resistance level (marked in black)

Secondly, there is a broken trendline that i dont think it will be reclaimed anytime soon (marked in yellow).

There are many others small details that should point toward a bearish scenario.

but on a scale from 1 to 10, how confident in my analysis iam, is 7.5.

Boost the idea if you like it : D

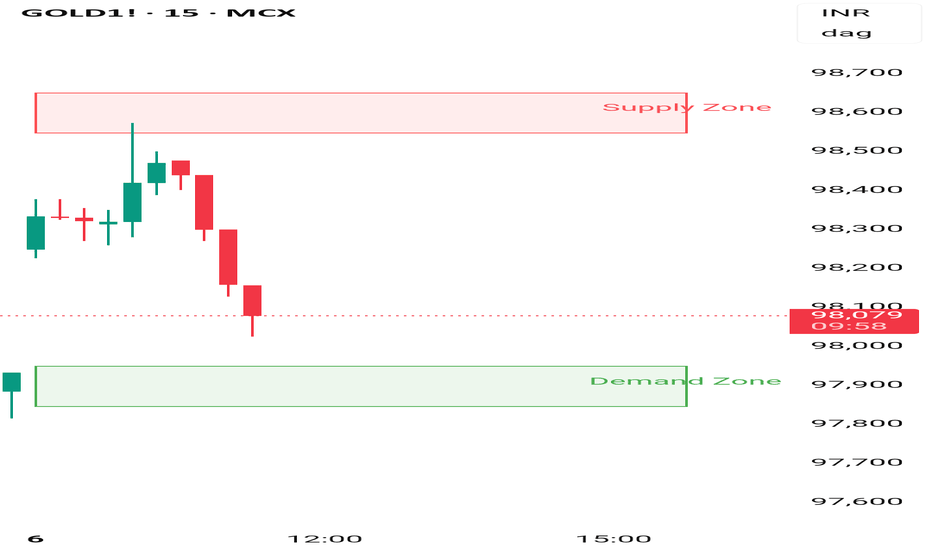

Gold exact rejection from supply zone Gold took exact rejection from supply zone . We took sell trade below supply zone sl was above the zone and target is demand zone .

Our strategy is to sell from supply or buy from demand . Today sell got active first and price moved in our direction. Waiting for target demand zone