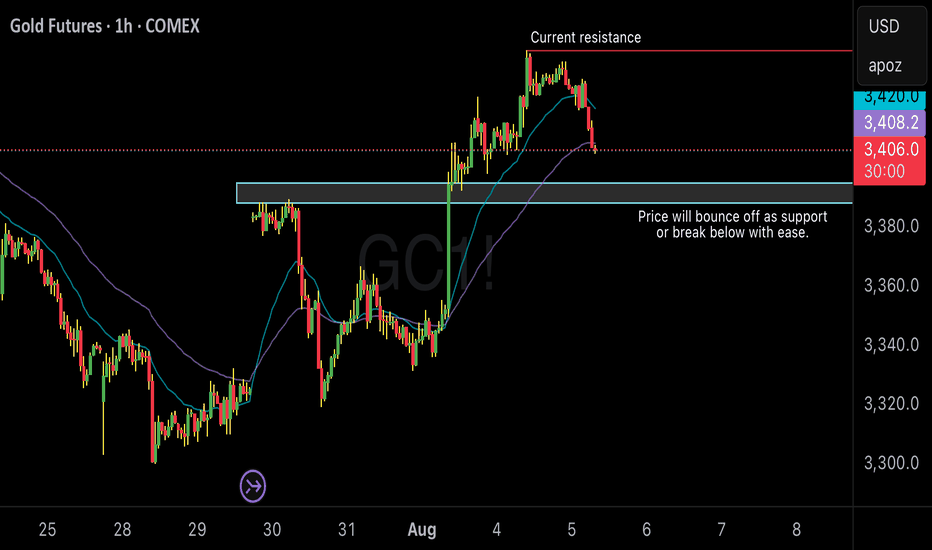

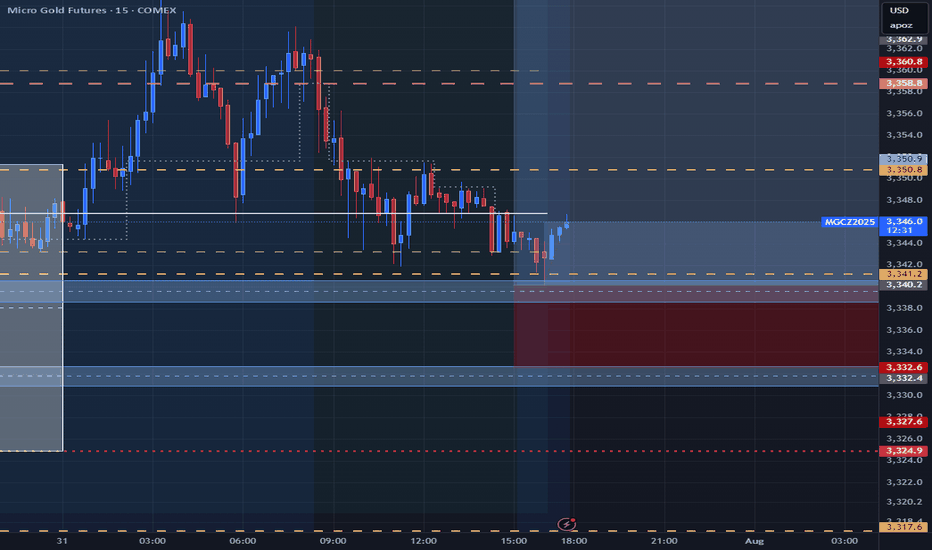

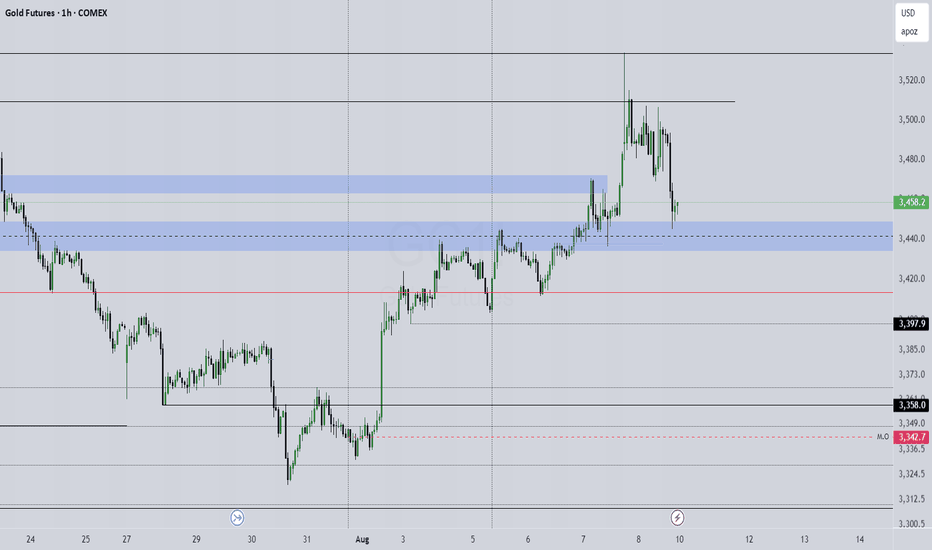

Gold is testing minor support and resistance I see gold trying to maintain above the $3400 level. I think today we will test $3390 - $3400 as a support level. If price breaks below $3388 I would entertain sells down to $3360 or $3350

If price bounces off the $3390 level, then I’m immediately looking for buys and looking to hold until $3480 or the end of the week. Which ever comes first.

GDU1! trade ideas

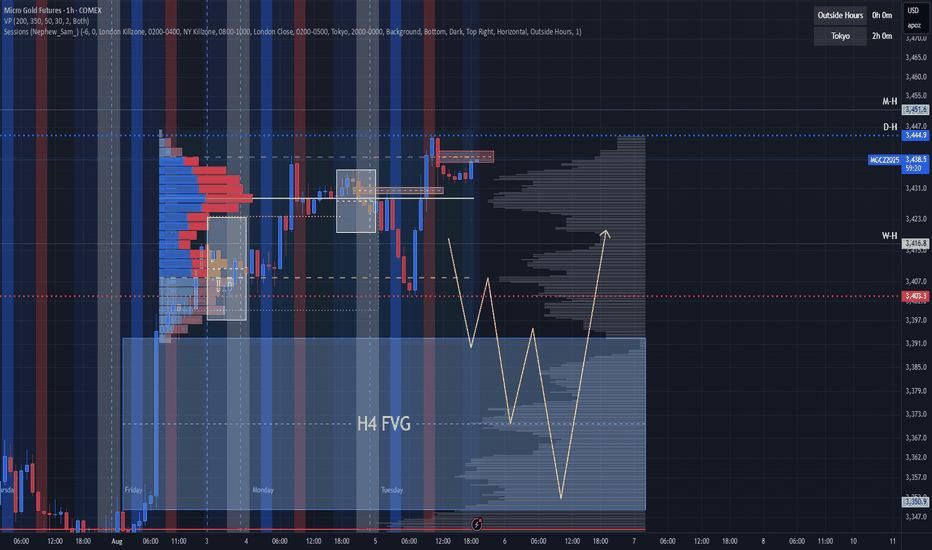

Gold Setting the Trap: Fake Rally Before the Fall?Gold (GC) Futures are showing signs of a potential reversal after a surprise bullish NY session, likely sparked by headline sentiment (Trump-related news). While the impulse looked strong, we remain below the previous daily high, and structure may still favor a deeper move south.

🔍 Key Notes:

Price is stalling near a high-volume node (~3436–3445).

Possible liquidity sweep above NY highs before reversal.

Watching for confirmation during Asian or London killzone.

Bearish continuation becomes more likely if we break below NY session lows and hold.

Bias: Bearish, targeting rebalancing of the H4 FVG if structure confirms.

Sharing this to track how the algo reacts inside upcoming killzones. Open to thoughts, breakdowns, and alternate reads 👇

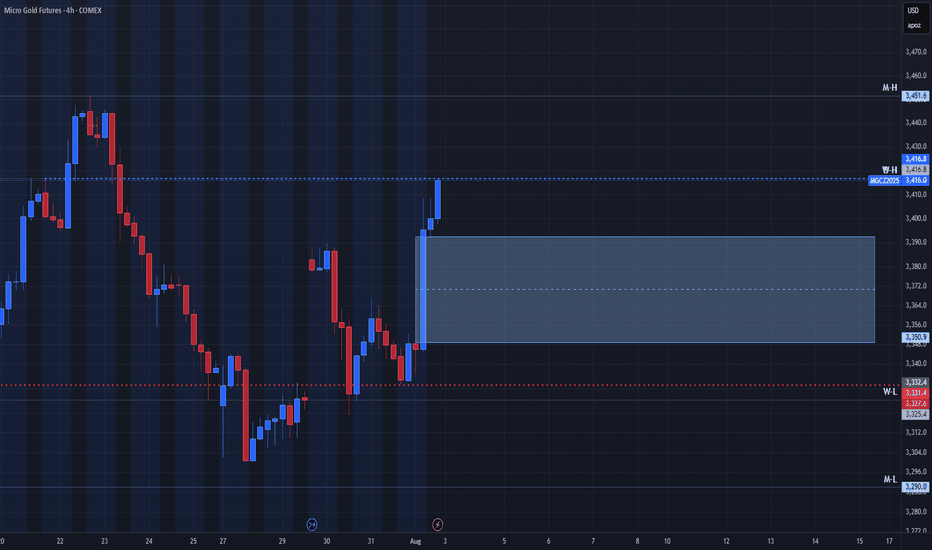

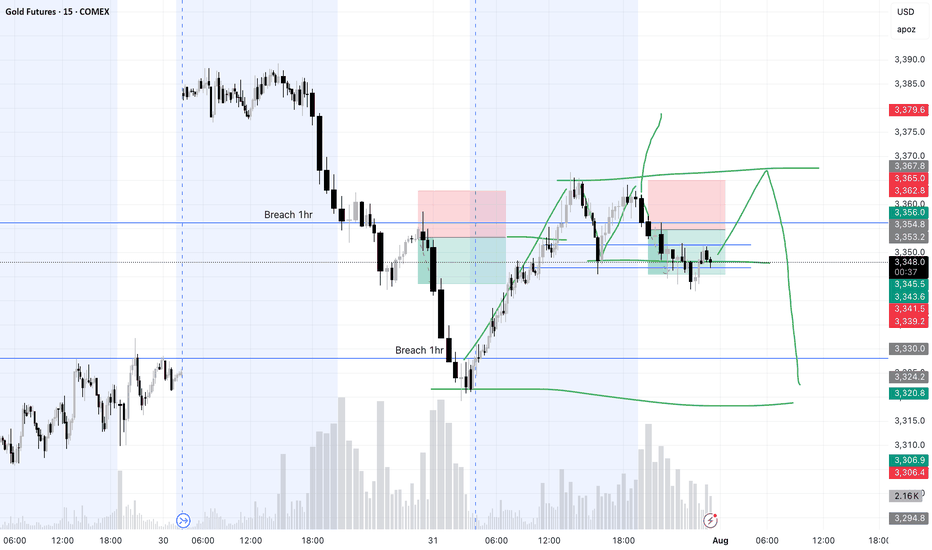

Gold – Eyeing the H4 FVG Before the Next Bull RunPrice has been consolidating within the current Asian range after running last week’s high and today’s daily high. The move into D-H lacked strong momentum, and with a large unfilled H4 Fair Value Gap (3,350–3,372) below, I’m anticipating a retracement to rebalance liquidity before resuming the bullish trend.

Key Notes:

D-H (~3,436) acting as short-term resistance.

Watching for a sweep of D-H to create excess on the DOM, then a potential breakdown toward the H4 FVG.

Bearish path targets: 3,397 → 3,372 → 3,350.

Bullish continuation requires a clean breakout and hold above D-H with volume.

This scenario could set up a stronger bullish leg later in the week, especially if the retracement aligns with London or NY session volatility.

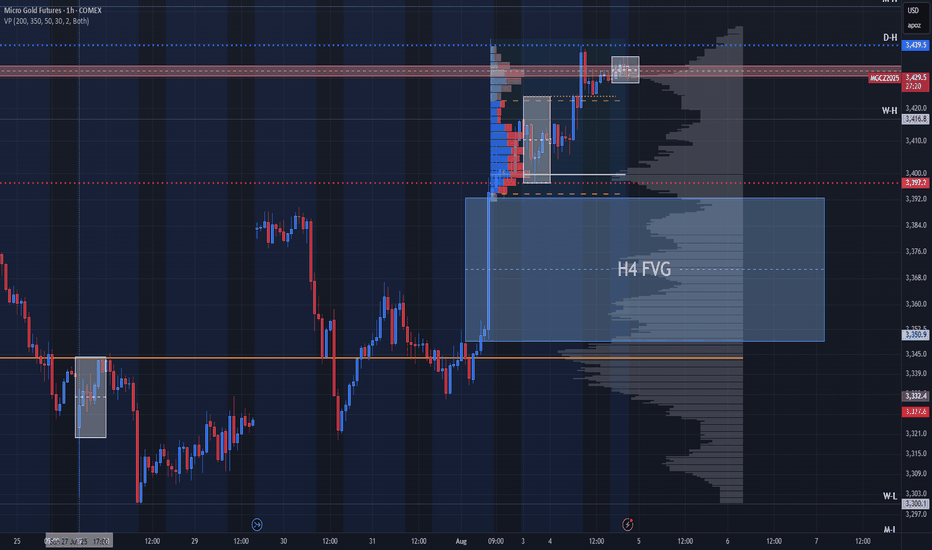

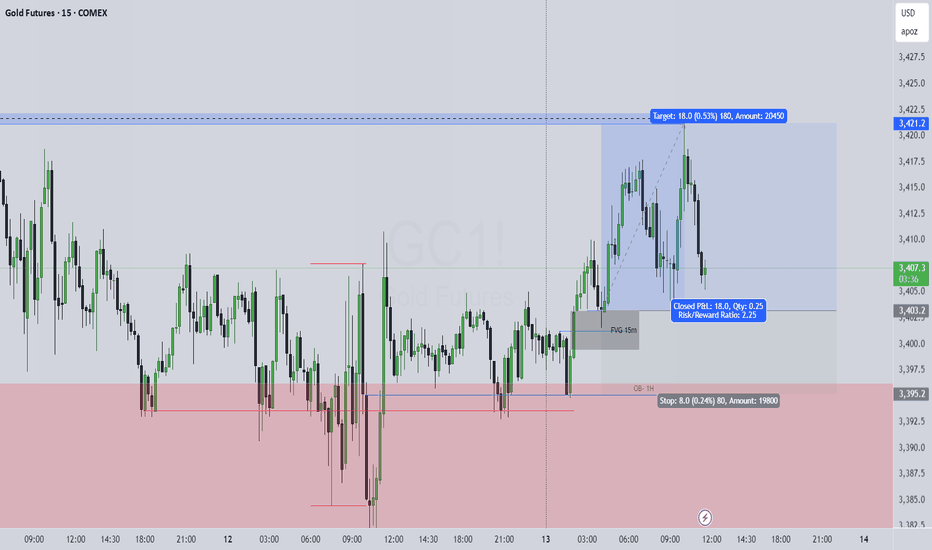

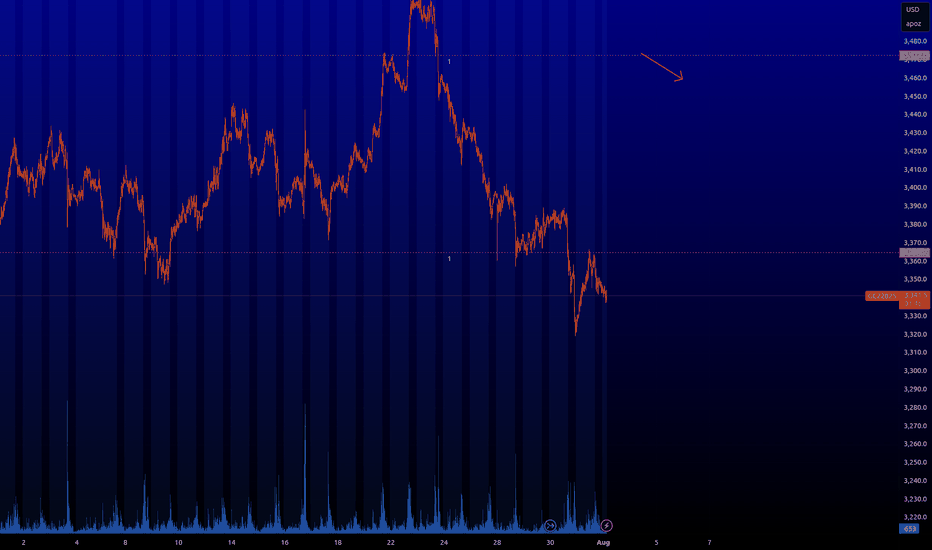

Gold’s on a Roller Coaster — and We’re Riding It Down🎢 Gold’s on a Roller Coaster — and We’re Riding It Down 🎢

Gold just snapped up like it saw Trump tweet “TARIFFS ARE BACK” — but the move smells like a knee-jerk algo pump, not real conviction. We just rejected right into a thin-volume imbalance zone and tagged the underside of a long-standing trendline.

📉 Short Setup Locked In:

💥 Entry: 3405

🛑 Stop: 3415

🎯 Target: 3353

💰 R:R ≈ 5:1

🔍 Why I'm In This Trade:

That rip? Total headline panic, not structural strength.

Low volume shelf above, with a massive POC magnet below at 3353.

We tapped the Developing VAH (3414) and got rejected — classic trap setup.

SQZMOM showing the energy is already fizzling. Green flash, no follow-through.

🧠 The Narrative:

Gold’s trying to price in volatility from every angle — Trump talk, tariffs, macro chaos — but under the hood, this pop looks unsustainable. If this is just a liquidity grab, we could see a flush back into the meat of value fast.

Grab your helmets — this roller coaster might just be heading downhill 🎢📉

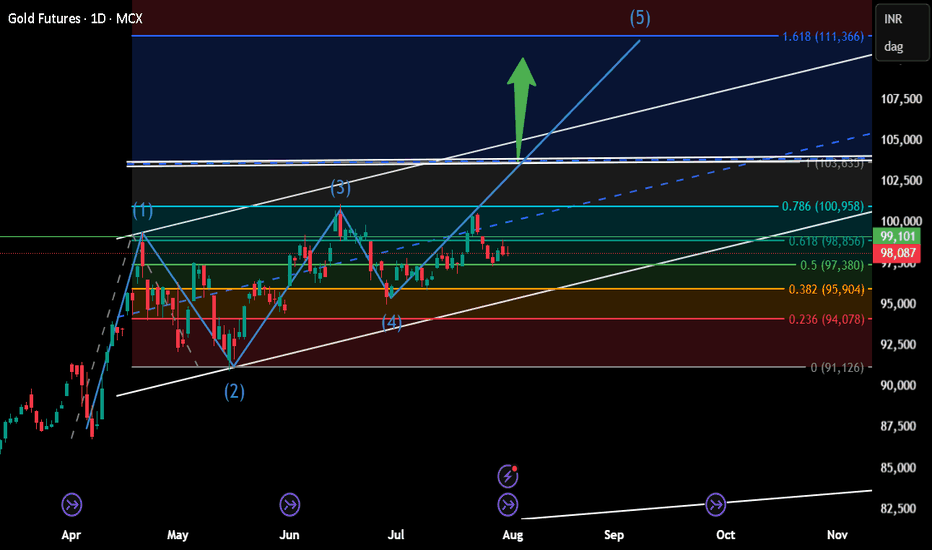

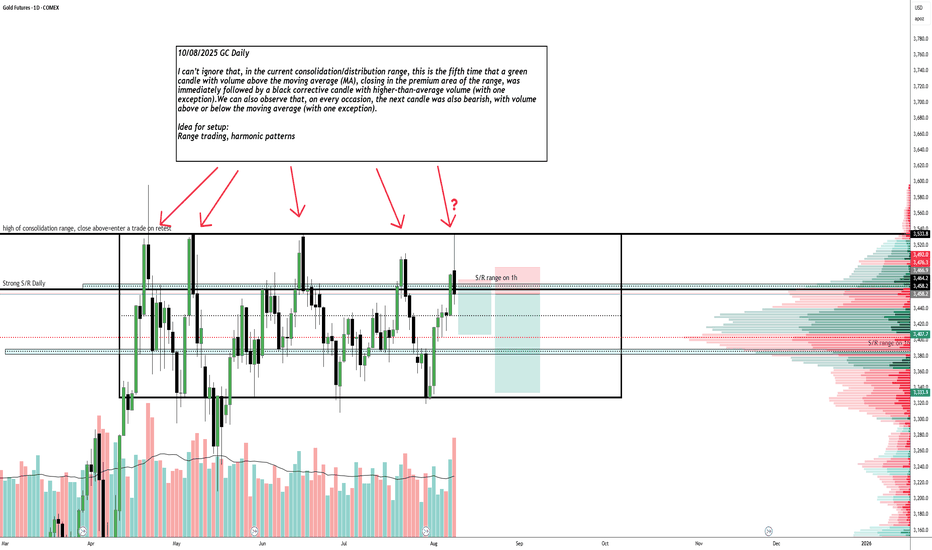

Gold Daily Bias – Bulls Have the Ball, But Watch the TrapGold Daily Chart – August Outlook

Bias is still bullish for August.

Price is holding well above the big 3M FVG ($2,900–$3,100).

Strong bounce from Weekly Low ($3,331) heading toward Weekly High ($3,416).

Above $3,416 we’ve got $3,451 (M-H) and ATH ($3,508) as liquidity targets .

Seasonal tailwinds could help push us higher into Q4.

Blind spots to watch:

Still range-bound between $3,330–$3,450 for months — no clean break yet.

Unfilled FVG near $3,210 could be a draw if we reject from resistance.

August liquidity is thin — spikes can reverse fast.

Triple-top risk if we reject near $3,450 again.

Game plan:

Bullish if we get a daily close above $3,416 (confirmation) and ideally above $3,451 to aim for ATH.

If breakout fails, I’ll target range play back toward $3,290–$3,210.

Bias = bullish, but I’m staying nimble.

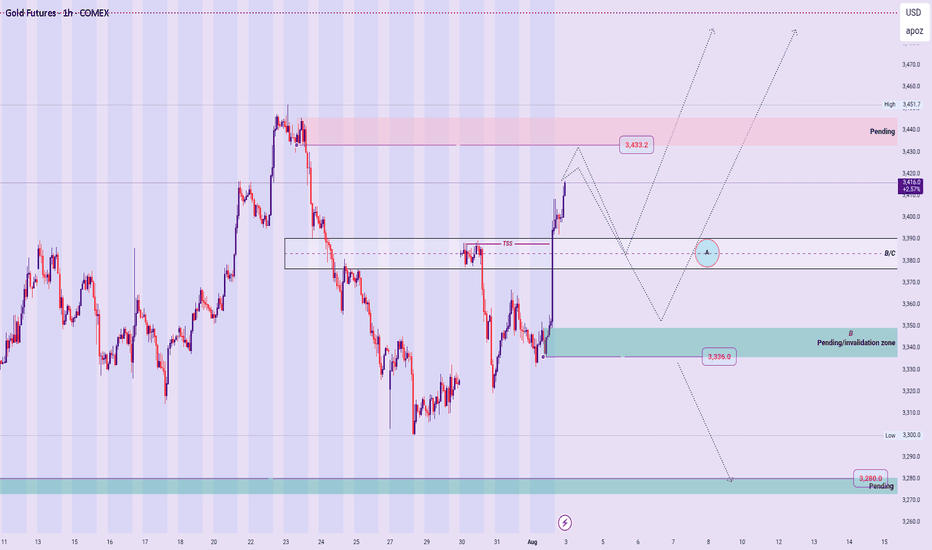

GOLD: NEW WEEK TECHNICAL BIAS (MARKET OPEN)CONTEXT

▪︎ HTFs Bias: Bullish stance remains intact until a valid structural breach occurs.

▪︎ Monthly Context: Despite consistent upper wick rejections, price continues to close above prior monthly opens — suggesting bullish resilience.

▪︎ Weekly View: Current price action reflects a Value Compression Phase (VCP) within the premium zone of the active range, implying potential buildup for a bullish Impulse Drive.

▪︎ Daily Alignment: Daily price behavior mirrors the Weekly context, supporting a continuation thesis.

Preferred Scenario: Leaning towards a Retrace Precision Entry (RPE) before the Ascend Sequence resumes. Watching:

• Point A (shallow pullback) near B/C level, or

• Point B (deep pullback) into the pending Rejection Zone (ARB).

Invalidation Trigger: A structural breach below 3336, backed by bearish momentum and microstructure shift, targets first 3280, then levels below.

Uncertainty Variable: Will price first sweep 3433.2 before retracing? Or will it retrace from market open? This remains unclear and demands a patient, reactive stance.

📌 Disclaimer: This is a strategic directional bias, not financial advice. Execute only with confirmation and proper risk management.

Close out the Week STRONGLooks like price has found its bottom and is ready to push from here. We are looking for a strong forceful break out from this zone so we can go for the higher levels. Everything looks right from here and value keeps shifting up. I know we should get a solid entry but waiting for it to line up with time.

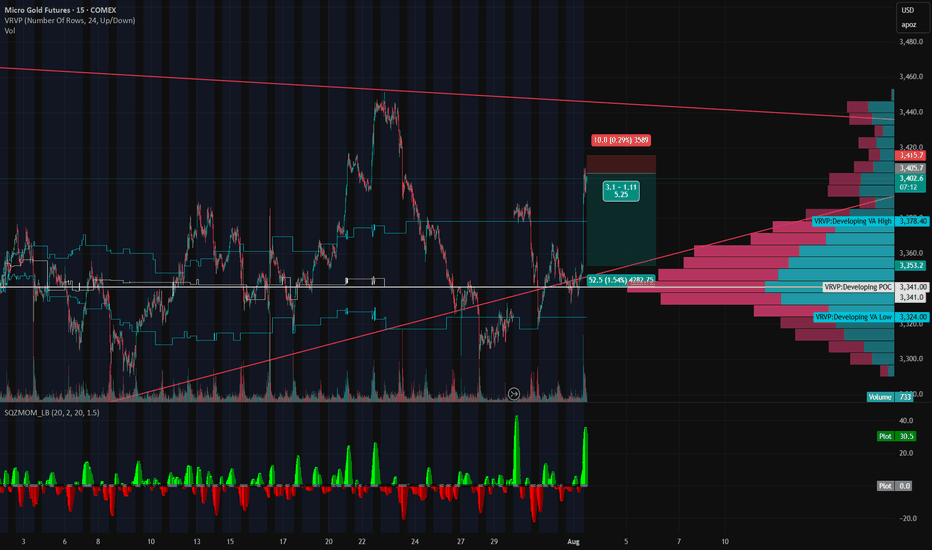

Gold Futures – Testing Trendline ResistanceGold has rallied back into a converging resistance zone — the intersection of the upper short-term trendline and longer-term descending trendline. Price is showing signs of hesitation here.

Price is pressing against the red diagonal resistance.

This level has rejected multiple times.

Setup targets a pullback toward mid-channel support near 3,407, then 3,388.

Stop positioned above resistance to protect against a breakout continuation.

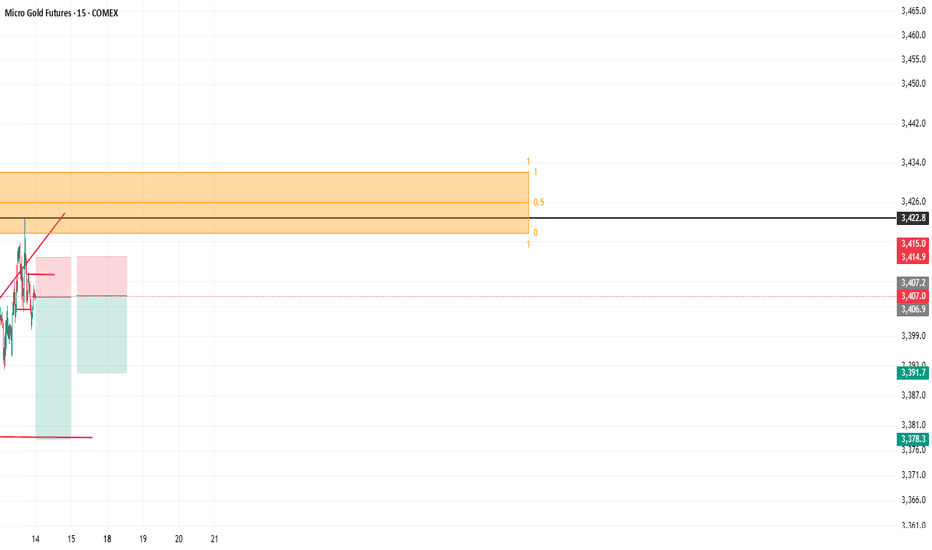

Tokyo Gold Play: 68% Short Bias, But Watch the FlipAlright, here’s where we’re at going into Tokyo. Gold’s stuck right between a rock and a hard place. On the 1-hour, we’ve just bounced off the upper side of a big descending channel and couldn’t even sniff past that 50% fib from the 3,510.9 → 3,386.3 drop.

On the 5-minute, it’s even cleaner: double top at 3,420.8, neckline chilling at 3,400.9, and we’re camped right at VWAP under a short-term downtrend line. Everything’s coiling, and whichever side breaks first is probably gonna run the table for the session. My bias? Still leaning bearish 68% downside odds based on the structure, the fibs, and how order flow’s been stacking.

The Bigger Picture (1H)

- Rejected straight off the channel midline, couldn’t crack 3,448.6 (50% fib).

- Lower highs still printing since Aug 8.

- Major support sits at 3,386.3 that’s the line in the sand for the next leg down.

Intraday Setup (5M)

- Clean descending trend line from the highs.

- Double top locked at 3,420.8, neckline at 3,400.9.

- Price hugging VWAP, which is acting like a lid.

Bearish Plan (Main Play – 68%)

- Trigger: Lose 3,404.0 (VWAP + fib cluster).

Targets:

- 3,400.9 (neckline)

- 3,392.4 (fib projection)

- 3,386.3 (1H support)

Why I like it:

Multi-TF downtrend, rejection from key levels, and lower-high flow on the 5M.

Bullish Backup Plan (32%)

- Trigger: Get back over 3,410.9 and crack 3,420.8.

- Targets: 3,424.9, 3,448.6 (HTF fib)

- Why it’s risky: Would need a trend line break + VWAP reclaim with decent volume.

Tokyo Flow

If nothing big hits the wires, Tokyo usually just extends NY’s late session move. Right now, sellers still have the ball unless buyers rip us back over 3,410.9 with conviction.

Quick Stats

- ATR(14) 1H: $17.2 → plenty of range for TP2 in one session if we trend.

- VWAP deviation ±0.25% lines up with our fib levels.

- Downside edge: 68%, Upside edge: 32% from my multi TF model.

Tokyo’s not usually the session that throws the knockout punch, but tonight’s setup has all the right ingredients for a clean move if we get that break. I’m leaning short until proven wrong, and always scalping. Watching 3,404 as the tripwire. If we hold under it, sellers probably drag this into the low 3,390s before the dust settles. But if buyers punch through 3,410 and especially 3,420, I’ll flip the script and ride the squeeze. No bias is worth blowing up a trade levels first, ego second.

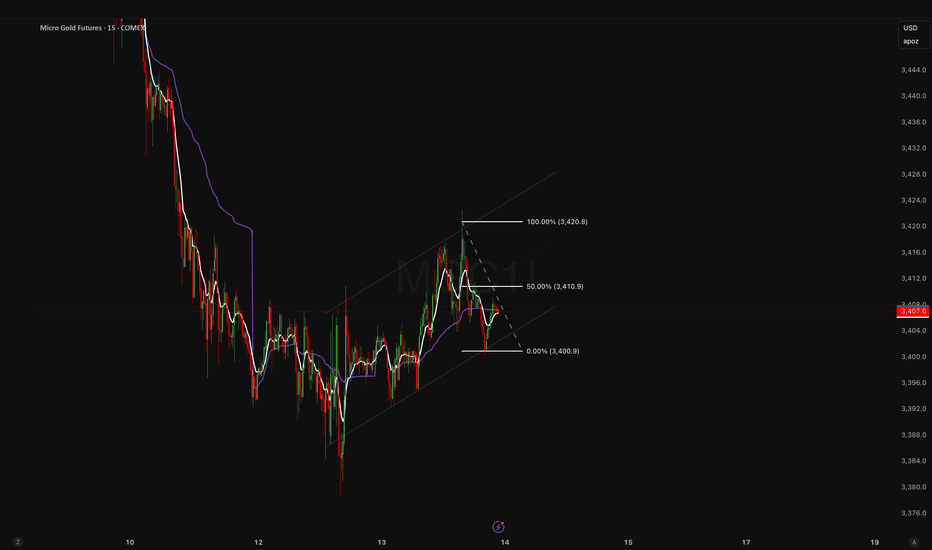

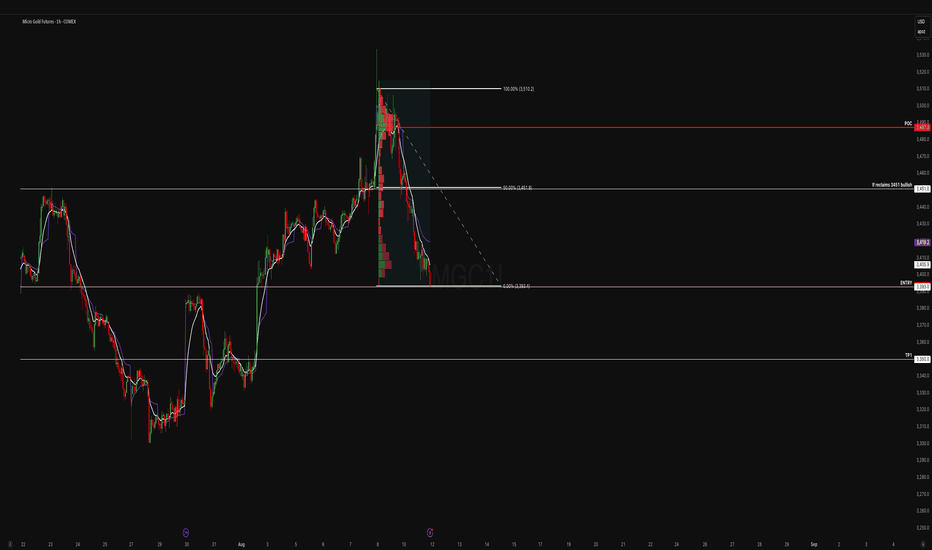

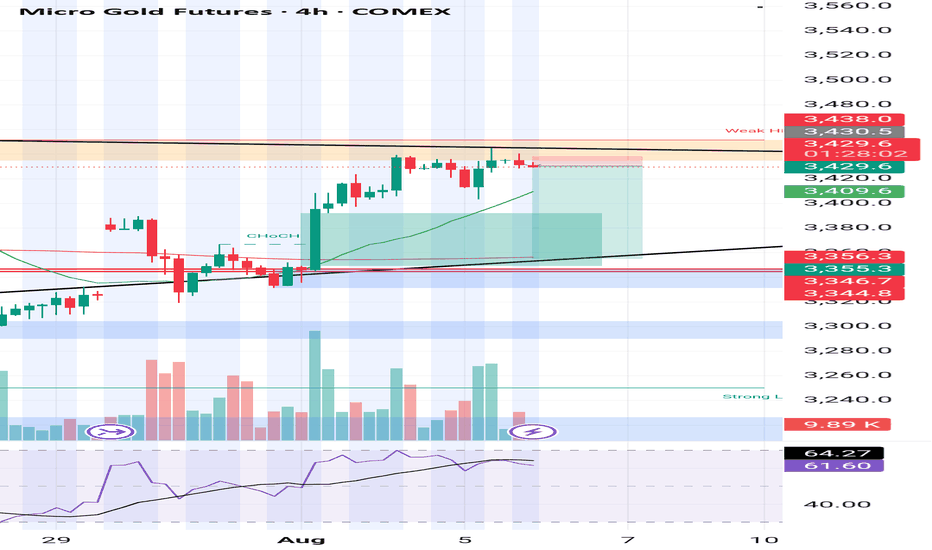

Support’s on Life Support. Paging Dr. TokyoMGC is currently trading at 3,393.8, positioned at the 0% retracement of the recent leg from 3,510.2 down to current lows. The prior swing high at 3,510.2 marks the 100% Fib, with the 50% retracement at 3,451.18 acting as the mid-range pivot. Price action has been in a sustained downtrend since rejecting the 50% retracement level, with EMAs aligned bearish on the H1.

The Point of Control (POC) for this distribution is located at 3,492.0, which coincides with the upper value area, untested since the selloff.

Bias Assessment:

- Bearish Bias: 60% Probability

- Bullish Bias: 40% Probability

- Volatility Expectation: Moderate in Asian session, potential acceleration on key level breaks due to lower liquidity.

Bearish Scenario – Primary Path:

- Breakdown confirmation requires an H1 close 3,393.4 (0% Fib).

- Immediate target: 3,365.0 (local structural demand)

- Extended target: 3,350.0 (measured move completion / previous support cluster)

- Risk trigger: Failure to break 3,393 followed by reclaim of 3,410 negates short bias.

Bullish Scenario – Alternate Path:

- Defense of 3,393.4 with absorption will reclaim 3,410.0 (minor LVN).

- Upside target 1: 3,451.18 (50% Fib, key mid-range)

- Upside target 2: 3,492.0 (POC, high-volume resistance)

- Continuation trigger: Break and hold - 3,492 opens 3,510.2 retest.

Key Tokyo Session Levels:

- Support: 3,393.4 → 3,365.0 → 3,350.0

- Resistance: 3,410.0 → 3,451.18 → 3,492.0 → 3,510.2

Tokyo session tends to front-load stop hunts in the first 15–30 minutes. Prefer confirmation based entries at key level breaks with tight stops in low-liquidity conditions. Position sizing should be reduced relative to NY/London volatility profile.

Happy Trading

Shorting GoldWell, it does looks like short needs to be shorted.

I mean on bigger timeframes, the price has been rejected and corrected hard from the 3,533 area. This also means that there is tons of liquidity that is waiting to be taken above that level.

So just to cut short the confusion, technically, once the price tapped into that level, it rejected and broke a bullish leg. So technically i would say that we are at least going to correct.

Also i have identified the area of interest with entry and targets.

Hopefully it goes through.

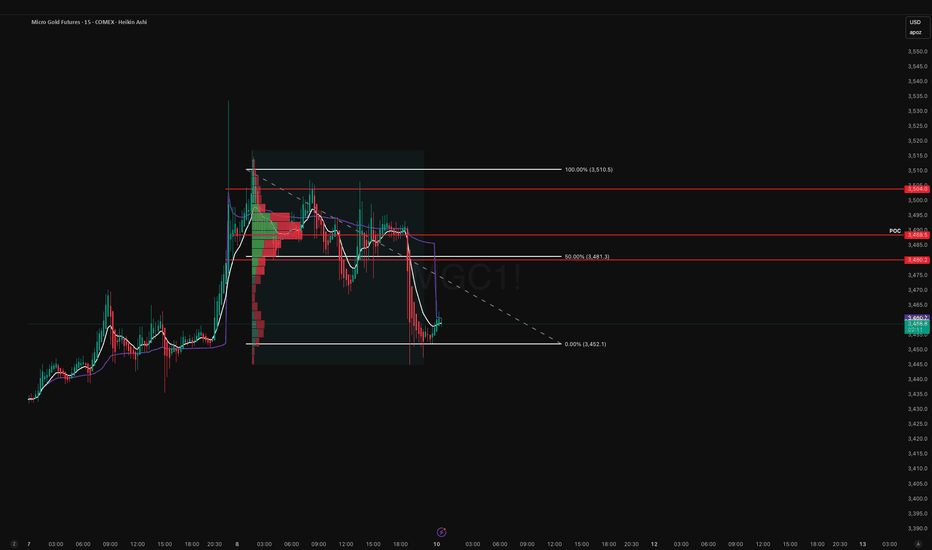

Tokyo Gold Fight Club. First Rule: Respect the POCGold is setting up for a clean Tokyo session play, and the chart structure couldn’t be clearer. We’re currently sitting just above the 0% Fib at 3,452.1, after a controlled rotation down from the Point of Control at 3,488.5. That POC is key it’s where the highest traded volume of the session sits, meaning it’s a true decision point for buyers and sellers.

The 50% Fib at 3,481.3 lines up with a low volume node, which often acts as a springboard or rejection zone depending on who’s in control. Above that, we have a tight resistance cluster the POC, the psychological level at 3,500, and the 100% Fib at 3,510.5 all stack together, creating a major liquidity magnet if price can rally into it.

My primary bias into Tokyo is bearish (around 65% probability) unless we see a decisive breakout above 3,500. The preferred short setup is a push into 3,480–3,490 that fails to hold, with stops above 3,500 to stay safe from any thin session spikes. In that case, I’m targeting the session low at 3,452.1 first, then 3,435 for the second scale-out, and finally 3,420 if sellers press the advantage.

The alternative scenario, with a 35% probability, is a clean break and hold above 3,500, which flips bias long. In that case, the upside play would be to enter on a breakout retest, with stops back under the POC at 3,488, targeting the Fib high at 3,510.5 first and then 3,525 as a stretch target.

Tokyo tends to give one of two plays in gold: either a low volume POC retest that rejects and runs in the prevailing direction, or a sharp reclaim of a key level that forces an aggressive squeeze. Until proven otherwise, I’m watching 3,480–3,490 as the battleground and planning to short rejection wicks there, keeping risk tight and targets clearly defined.

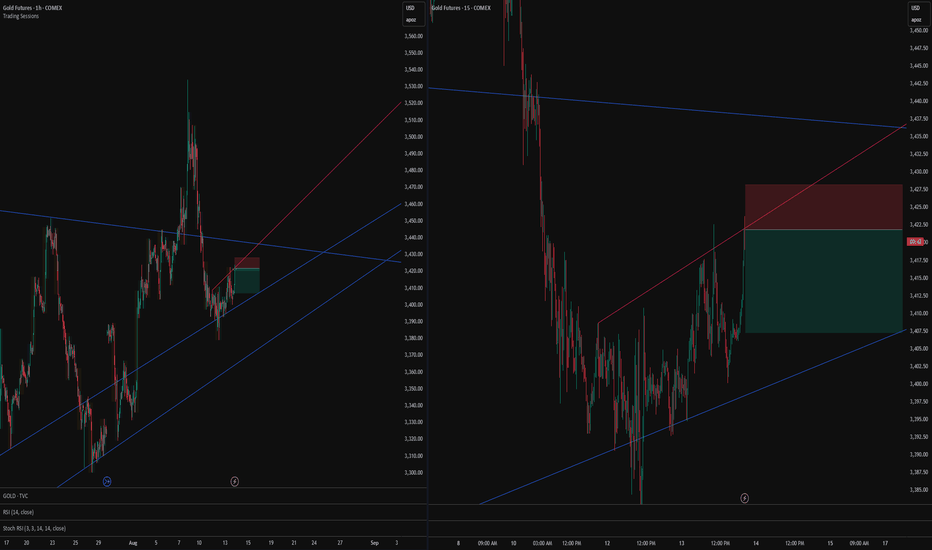

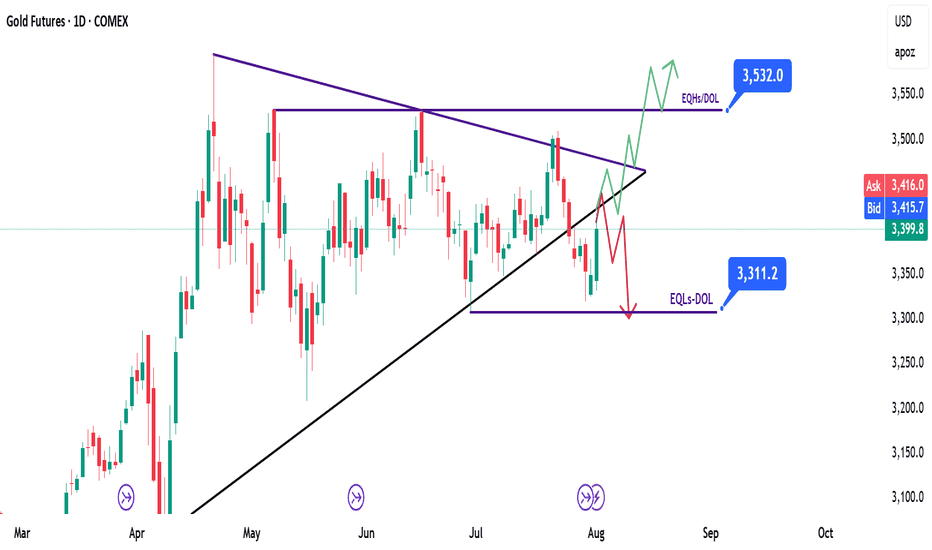

GOLD | XAU/GC - Weekly Recap & Gameplan - 03/08/25📈 Market Context:

Gold is currently trading within an accumulation zone as the market begins to price in a potential 0.25% rate cut by the Fed.

This macro expectation is supporting the broader bullish bias in the commodities market.

🧾 Weekly Recap:

• Price broke below the HTF bullish trendline — a key sign of weakness and potential structural shift.

• However, a sharp drop in the DXY (US Dollar Index) provided a bullish tailwind for gold, resulting in a mid-week bounce.

• This mixed action sets the stage for two potential outcomes next week.

📌 Technical Outlook & Game Plan:

I’m preparing for two possible scenarios:

1️⃣ Bearish Scenario (Red Path):

→ Price retests the broken trendline and rejects it

→ Continuation to the downside

→ Play: Short setup

2️⃣ Bullish Scenario (Green Path):

→ Price reclaims the broken trendline and closes above it

→ Continuation higher toward next resistance

→ Play: Long setup

🎯 Setup Trigger:

I will wait for a clear break of structure (BOS) on the 1H–4H timeframe to confirm directional bias.

📋 Trade Management:

• Stoploss: Below the demand zone (for longs) or above supply (for shorts) on the 1H–4H chart

• Target:

→ Bullish: $3,536

→ Bearish: $3,305

💬 Like, follow, and comment if this breakdown supports your trading! More updates, setups, and educational posts coming soon — stay tuned!

Gold’s weekly chart looks strong Gold futures has been teasing $3500 for a few weeks now and every time it gets to $3350 the shorts roll in and the buyers continue to show their strength.

If prices breaks above and maintains the $3475 support before the week ends; then we will see a strong run above $3500 next week.

Lastly, the EMA 20 & 50 as well as the RSI are all bullish on the 1hr, 4hr, and 1w timeframes.

Always remember the trend is your friend!

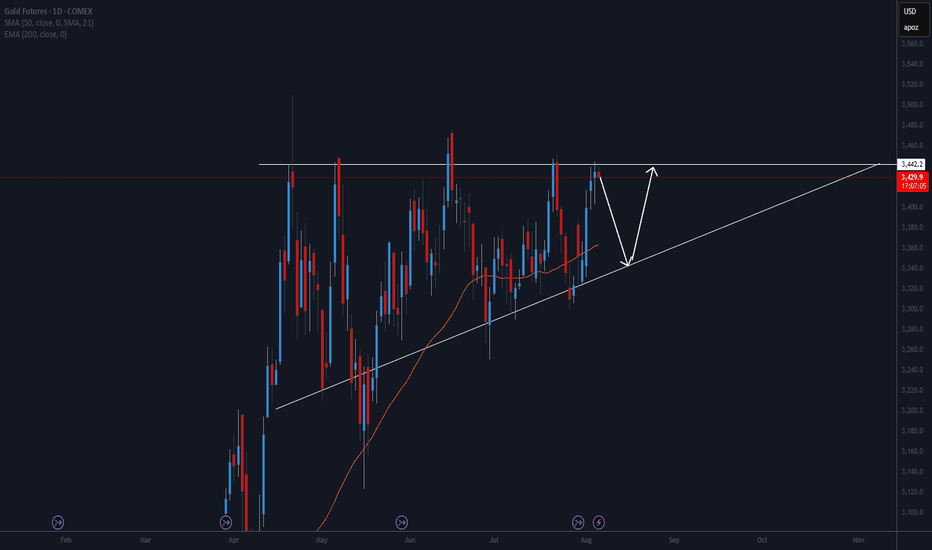

Potential breakout As we observe GC in the Daily timeframe, it's been consolidating in this sort of range for a while now. With the higher lows and 3442 level acting some sort of resistance, we may see some sort of breakout soon. If not, we can see it going back down and MAYBE creating another higher low