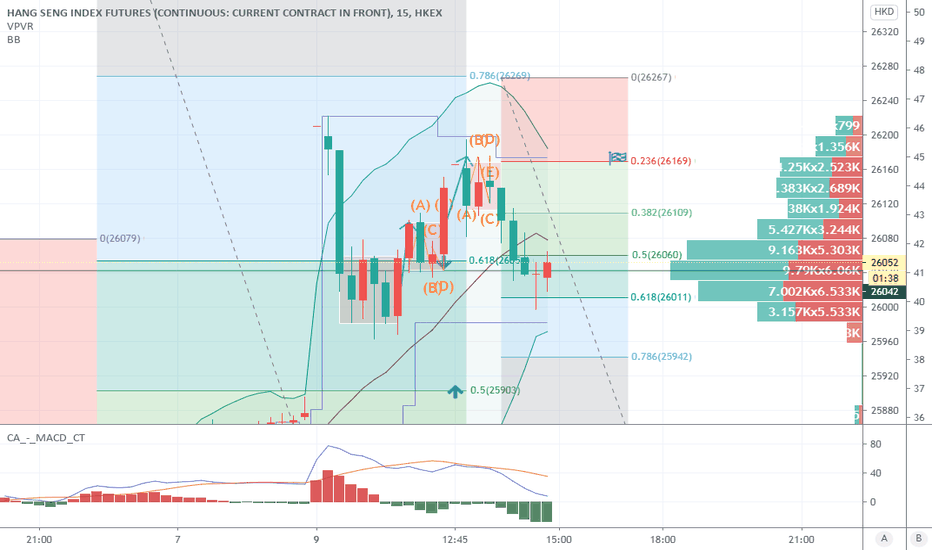

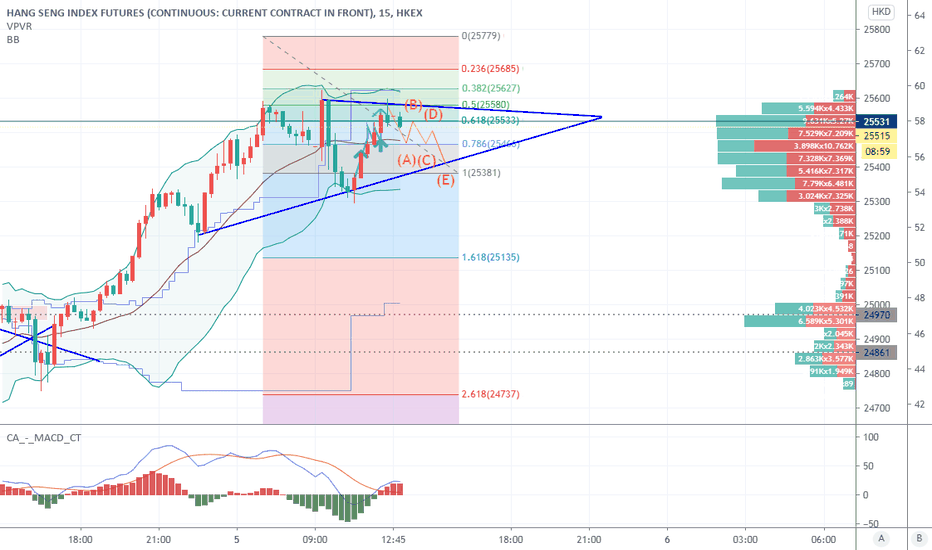

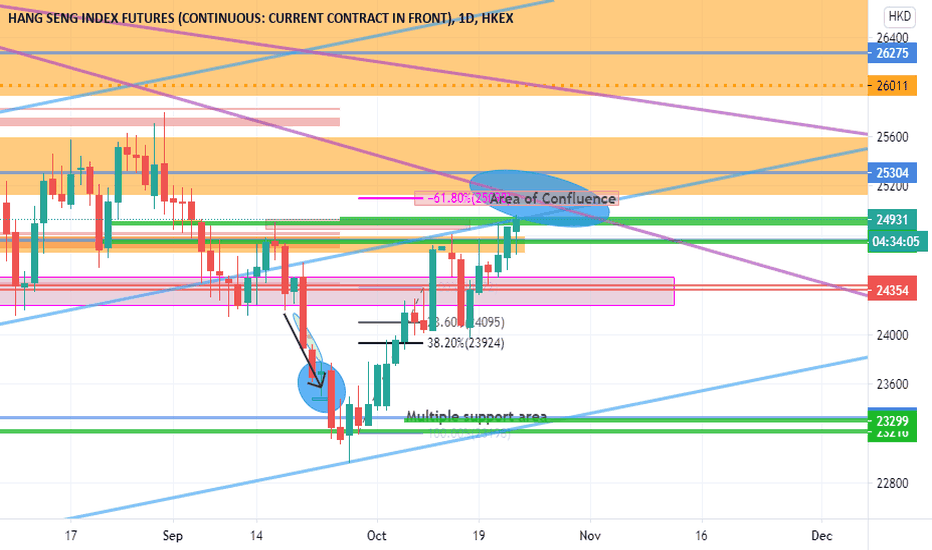

Accumulation and Timing the Trades.For second week in a row, we sold on Thursday anticipating a selloff on Friday but both times it happened on Monday. We sold in good areas but timing was off by a day. I am not comfortable holding a trade over the weekend unless well in profit. It can be argued that trades should be given enough room and time. Valid point but Gaps are a common theme in HSI futures and i have seen gaps of up to 1000 points. I always insist on timing the trades because i personally like to time the quickest moves in the market and then spend majority of the time on the sidelines. Staying on the sidelines help me stay unbiased.

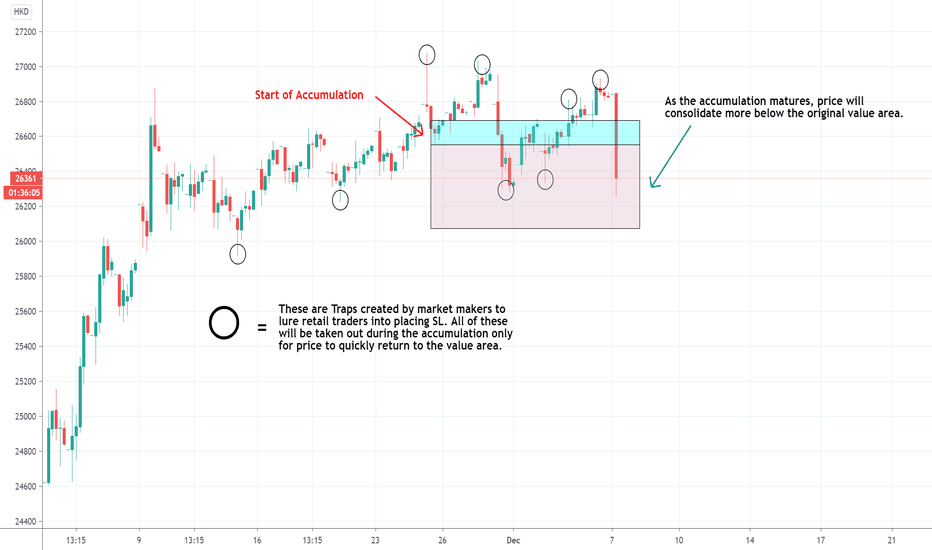

For market makers to accumulate, we retail traders have to sell. In order for us to sell, market has to look weak, indicators have to give sell signals, wave counts have to suggest 3rd of 3rd of 3rd. Up moves have to look laboured while the sharp moves are swift and so on.

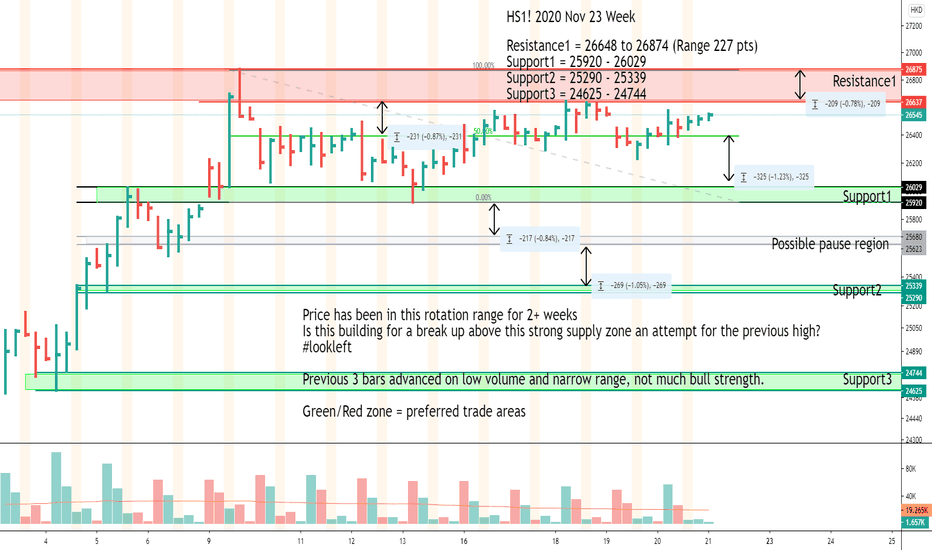

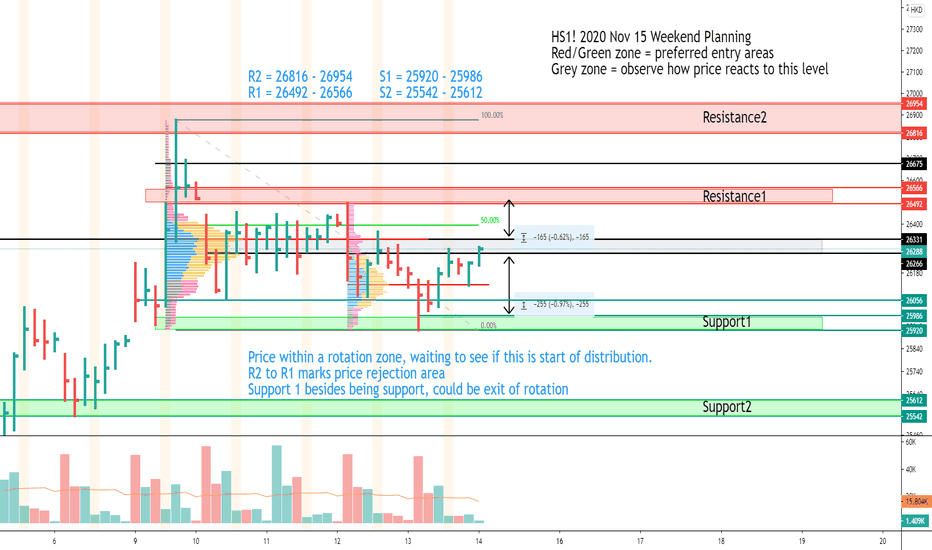

HSI1! trade ideas

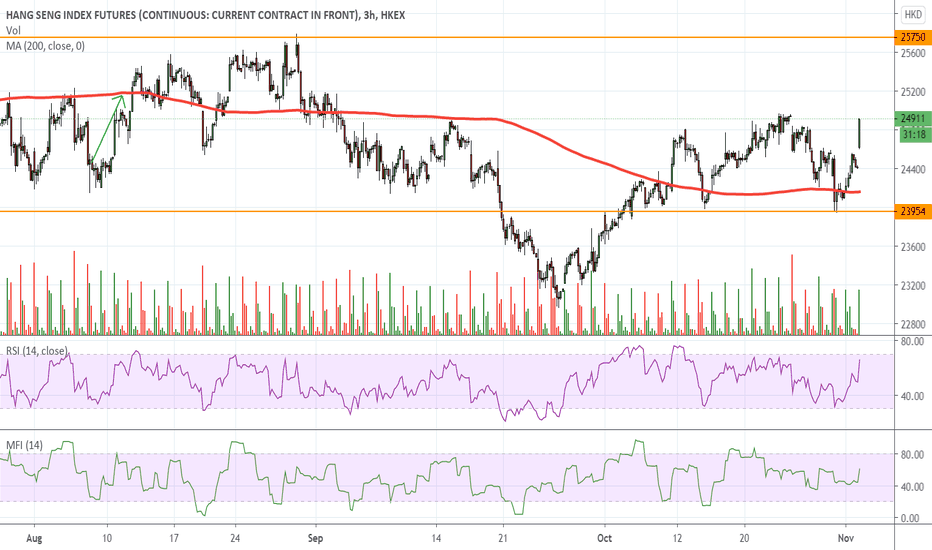

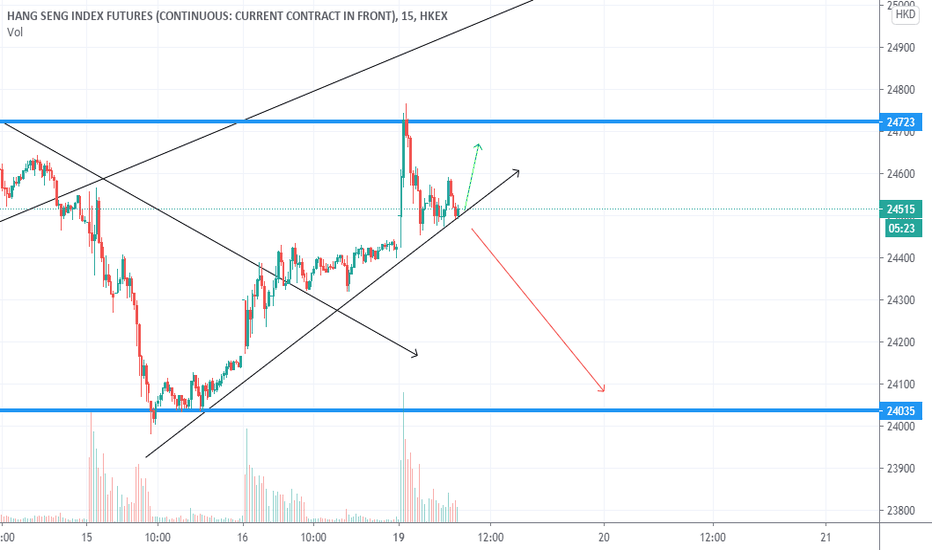

Hang SengLooks to me like the Chinese were responsible for the EOD pump, HSI and KOSPI are both up .6%.

HSI has a long way to go until it hits 2018 peak, so don't be surprised if you see more random pumps like we had Tuesday. Also note that they love NQ, which is green right now while ES, RTY, and YM are all red. Asians love to pump tech.

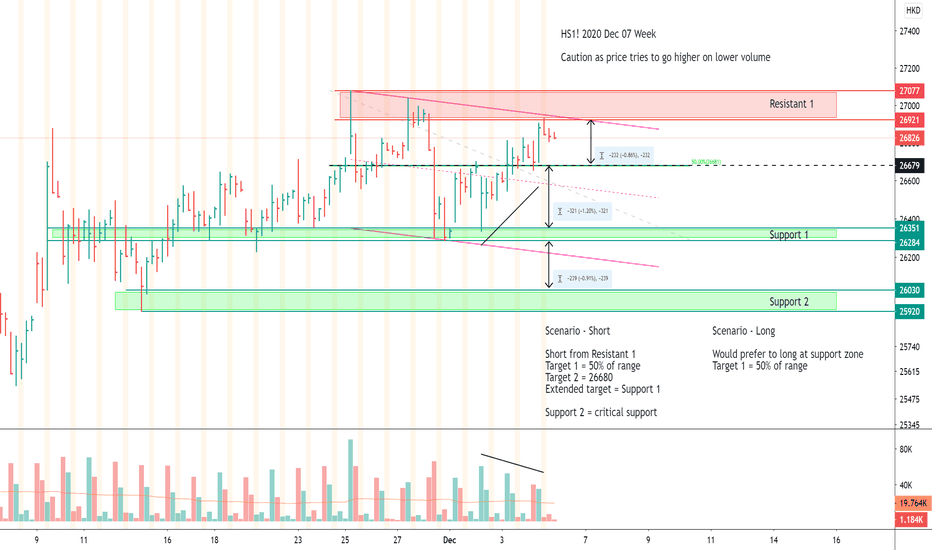

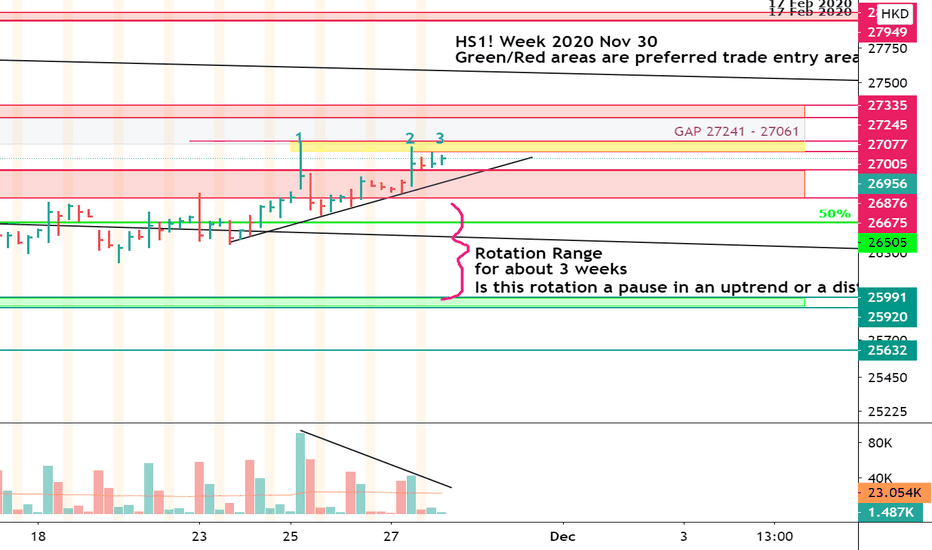

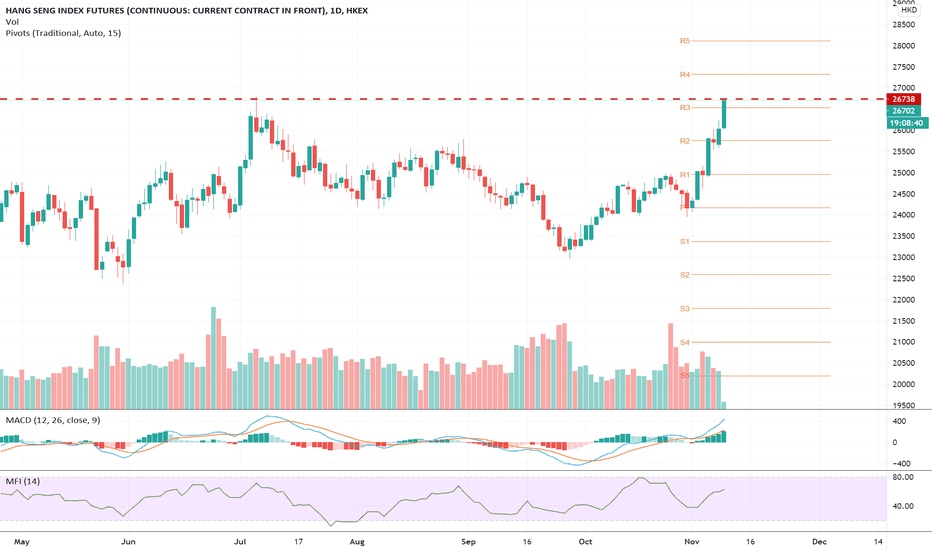

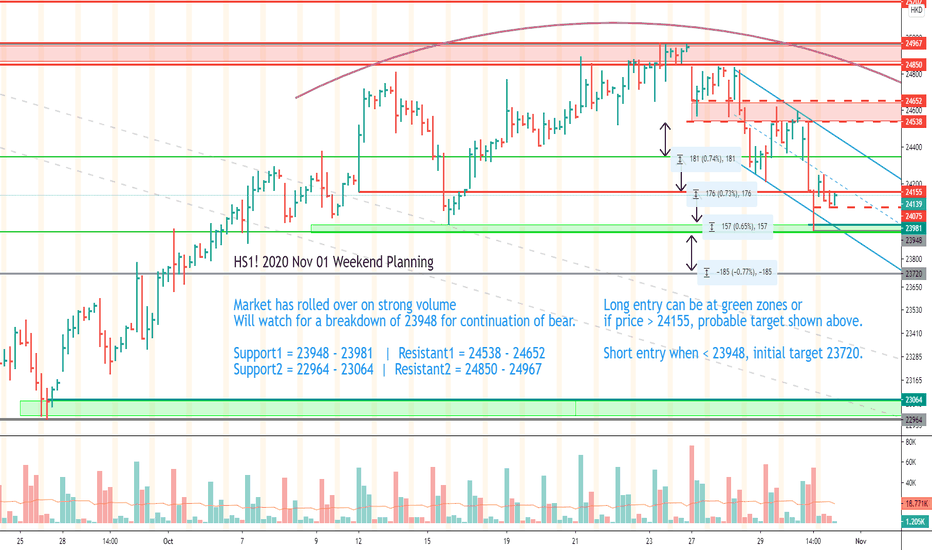

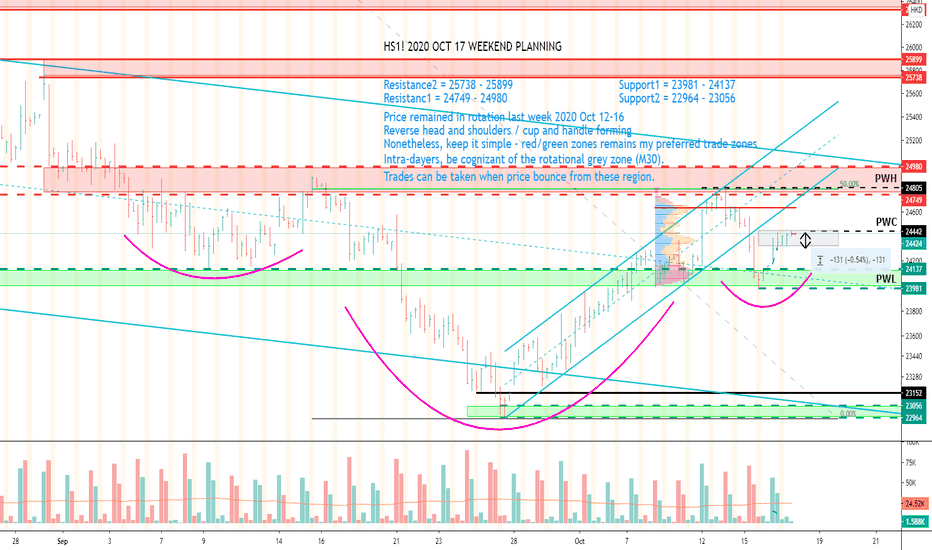

HS1! 2020 Nov 30 Week PlanningHS1!

Bar 1

Price tried to break out of the resistance zone before meeting rejection to higher prices, closing in the lower region of the bar.

The breakout is not convincing

Bar 2

Another breakout attempt, but made a lower high than bar 1.

There is some demand as price close slightly above middle of the bar.

Reason for caution is that although the top of the resistance at 26876 is beginning to act like support, we are still in the supply area of Bar 1.

And the diminishing volume on the breakout attempts tell us that bullish strength is not really present.

Scenario planning:

1) 26876 resistance turned support and strong buy volume comes in. Will it attempt to close the gap from February 2020?

2) Mark up on low volume continues before price reversal

3) Price reversals back into resistance zone, and subsequently goes lower back into the rotation range

Trade with care for 30 Nov week.

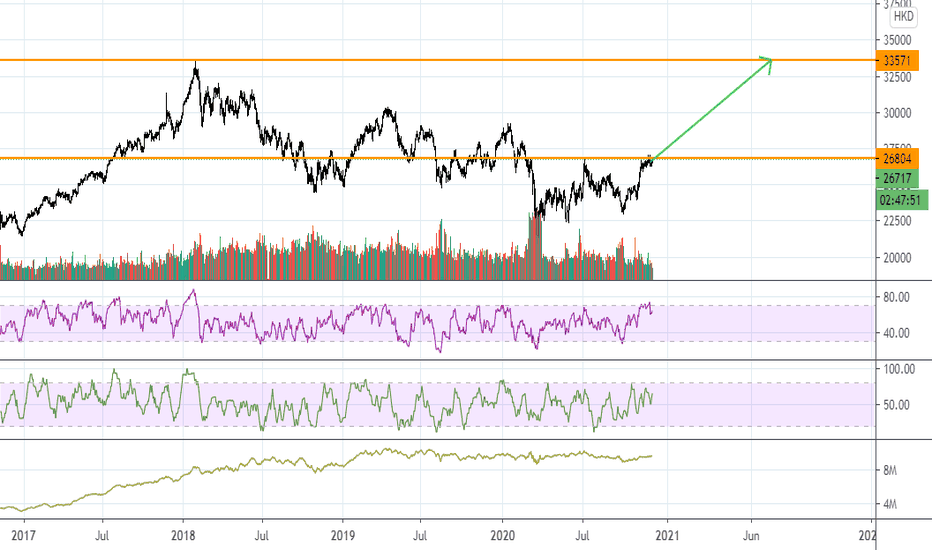

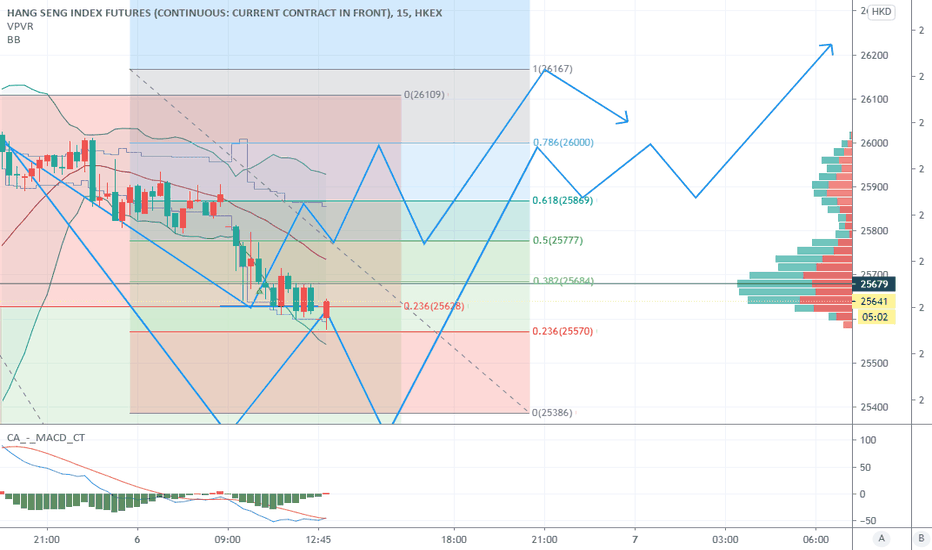

Vaccine News - HSI Futures up 600 pointsVaccine news from Pfizer (PFE) and BioNTech (BNTX) seems to have cause another sector rotation from "Covid" proof stay at home (Look at PTON) stocks to the more cyclical stocks (Think airlines, banks, etc...). The HSI futures are also up 600 points which indicates that we will be seeing another green day tomorrow for the HK markets. Pay special attention to real estate, bank, and stocks that are especially affected by Covid. If you are feeling frisky, feel free to short the big tech stocks!

Views are my own, ideas are meant for discussion and educational purposes only. Please make your own investment/trading decisions!

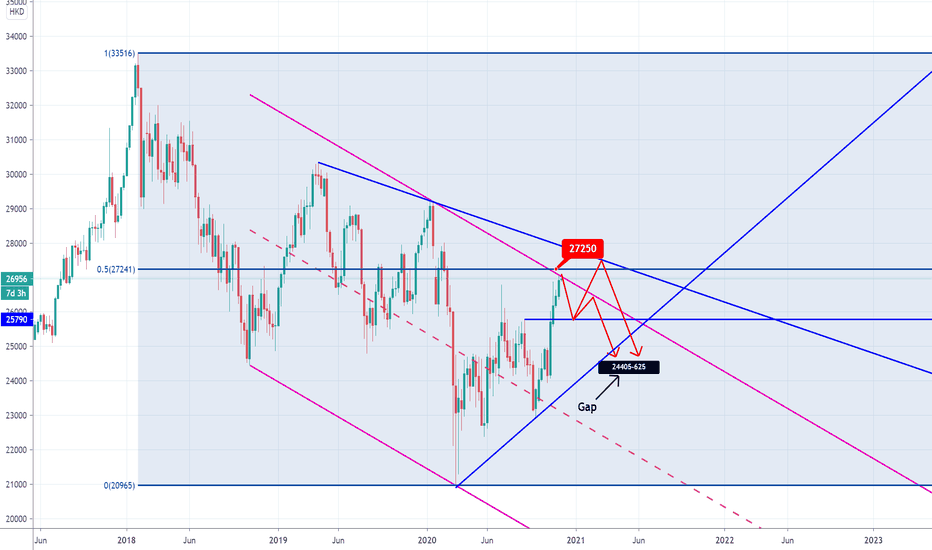

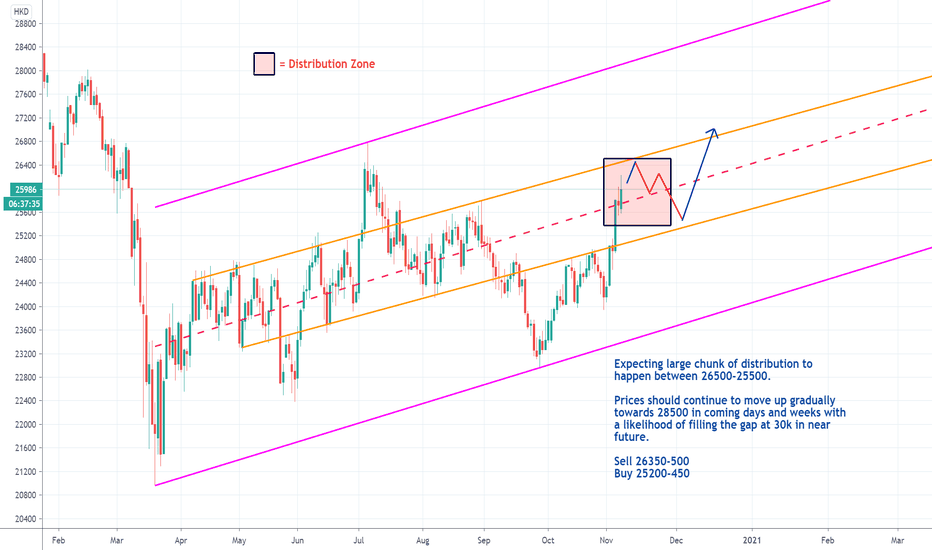

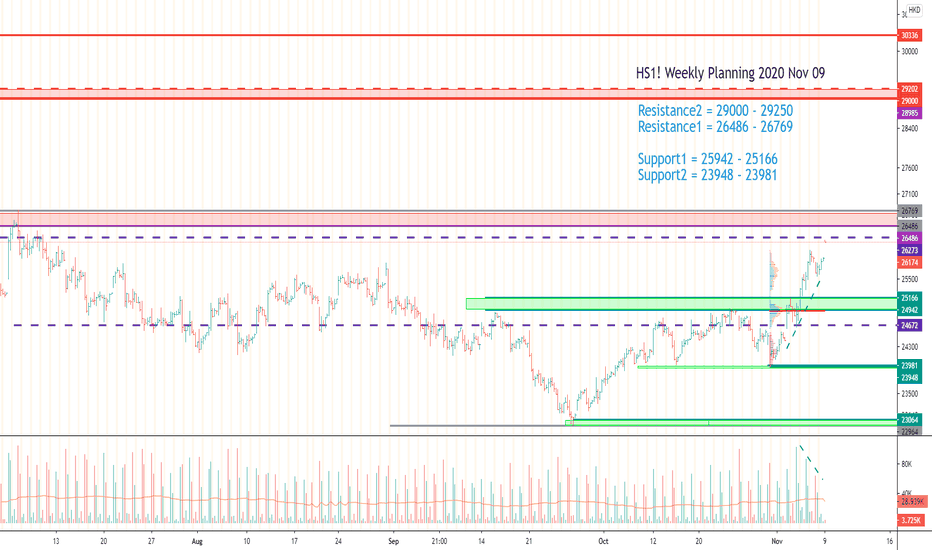

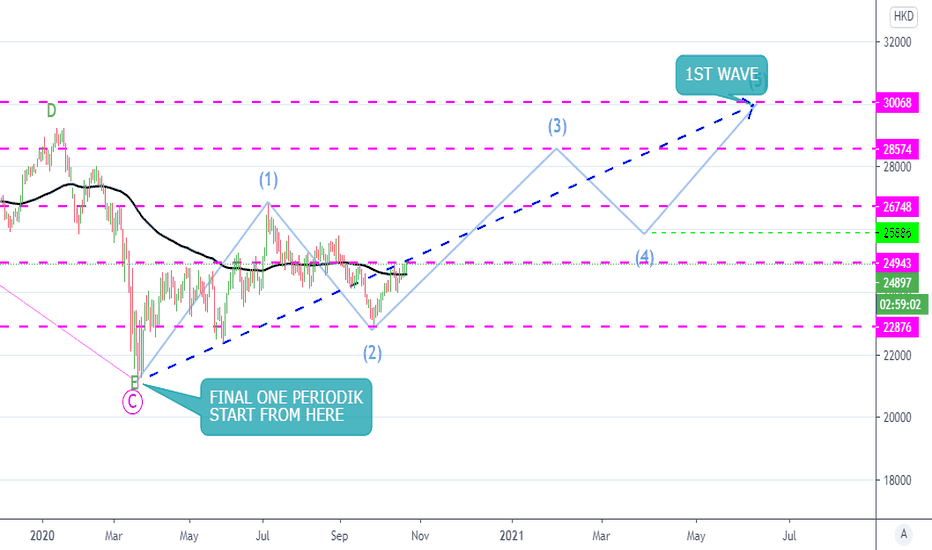

Biden vs TrumpLittle does it matter. Long term policies of USA won't change whoever wins meanwhile markets will continue to do their own thing.

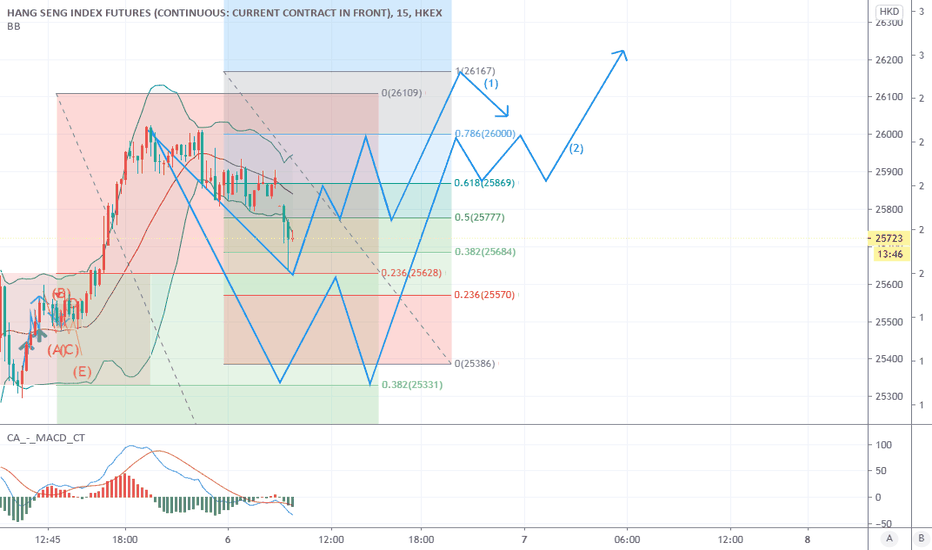

There has been accumulation happening for last 2 months which should see HSI rally towards 26k post elections with Ant's ipo carrying it higher still from there.

Euphoria won't last for very Long as the market movers will use these 2 events to distribute whatever is left from 2 years of distribution. 2021 may see the bubble burst and all hell breaks loose but we will worry about that when the time comes.

Friday's afternoon selloff was a shakeout below which SL can be placed.

P.S. Trump will win.