HYPEUSDStill by far the best project in this space after btc and eth

Top revenue generating project

Lowest btc fees

Self custody dex direct to trezor

Best perp trading experience

Best tokenomics

Still woefully undervalued

Nothing short of a massive exploit or the crypto market going to 0 would make me bearish on this product..

We also completed the wave down according to ta theory so unless we really do start world War 3 then this should grind back up..

HYPEHUSD trade ideas

Hyperliquid $HYPE to $100 once Bitcoin re-establishes an uptrendHyperliquid has found product market fit as the most used on-chain perpetual swap decentralized exchange in crypto. It is consistently among the top 5 in daily revenue among all crypto blockchains, applications, on-chain products etc, most recently often coming up in 3rd behind stablecoin comanies circle (usdc) and tether (usdt). What separates Hyperliquid from the market isn't an irreplicable ux/ui, a completley novel or broad defi offering, no - what separates Hyperliquid is its design, community, and team.

Hyperliquid is often talked about as one of the only projects truly building in the original vision of crypto. The team took no VC funding, issued a massive airdrop to the community, and paid themselves only in $ HYPE. The incentives here between the team and the community are well aligned for long term success. Jeff, the founder of Hyperliquid often talks about wanting to build the blockchain to houses all of finance and is owned by the people. Recently Hyperliquid achieved two major milestones, one is the launch of spot Bitcoin available to trade, deposit, and withdraw from the Hyperliquid exchange, and the other was the launch of the HyperEVM, allowing developers to deploy applications on the Hyperliquid blockchain. Both of these verticals will be developed further (more spot, and perpetual offerings, as well as more revenue from applications on the EVM), and this could easily lead to Hyperliquid surpassing Circle in daily revenue before the end of 2025. Now you might be asking, why does the revenue matter for $ HYPE, because most tokens are not designed for any sort of direct value accrual from the native blockchain. Most tokens have insignificant revenue and even if it were to increase it likely would not directly benefit the users (the token price could go up, but the revenue is likely directly benefiting the VCs who funded the project). However, with Hyperliquid, not only is the revenue significant because they built a flagship app with product market fit, it directly benefits the holders of $ HYPE token as a significant portion (%s reported vary between 50+% -95%) goes to buying back $HYPE. Since the token generation event at the end of October, the Hyperliquid Assistance Fund (where revenue goes to buy back $ HYPE) has purchased 4.776% of the circulating supply, almost 16 million $ HYPE tokens worth just over 307 million dollars ($ HYPE 19.2 at time of writing). The assitance fund is consistently buying over a million dollars in $ HYPE per day and this number has clear path for growth from multiple angles.

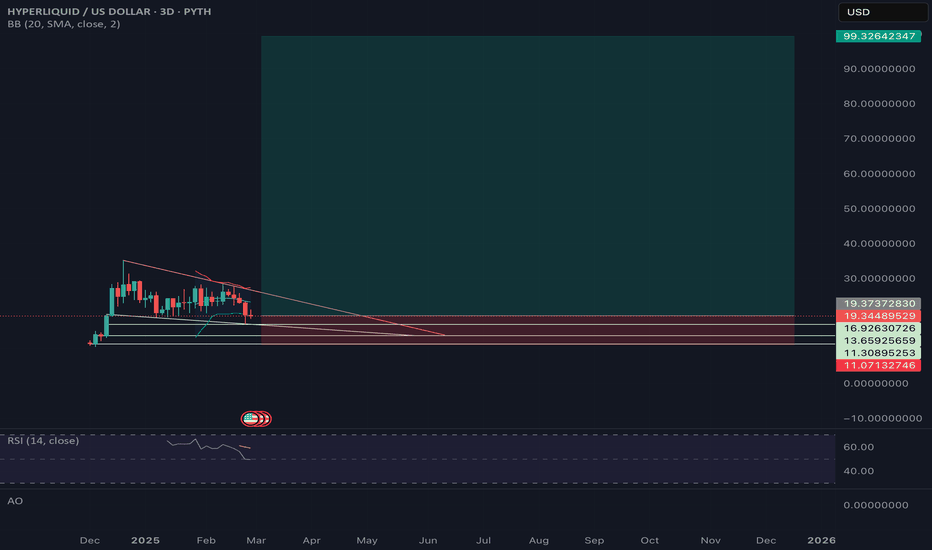

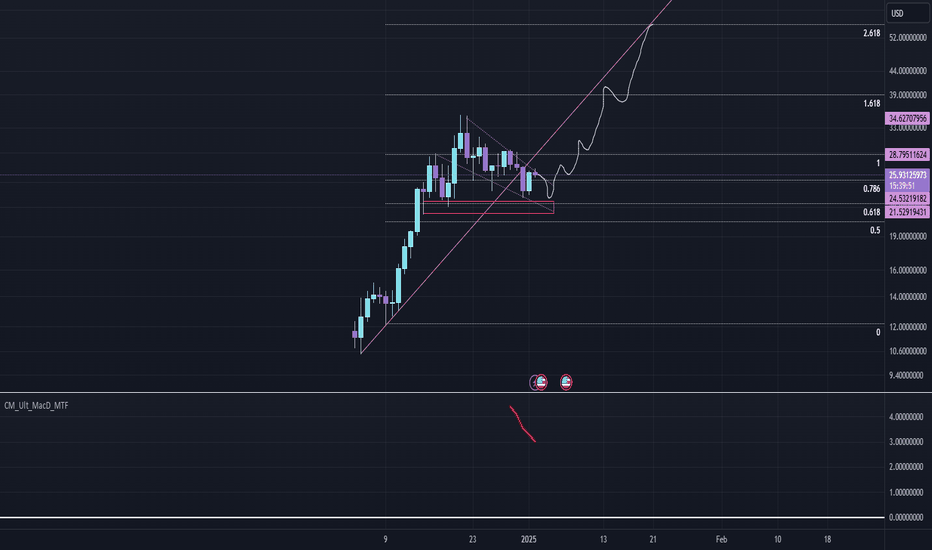

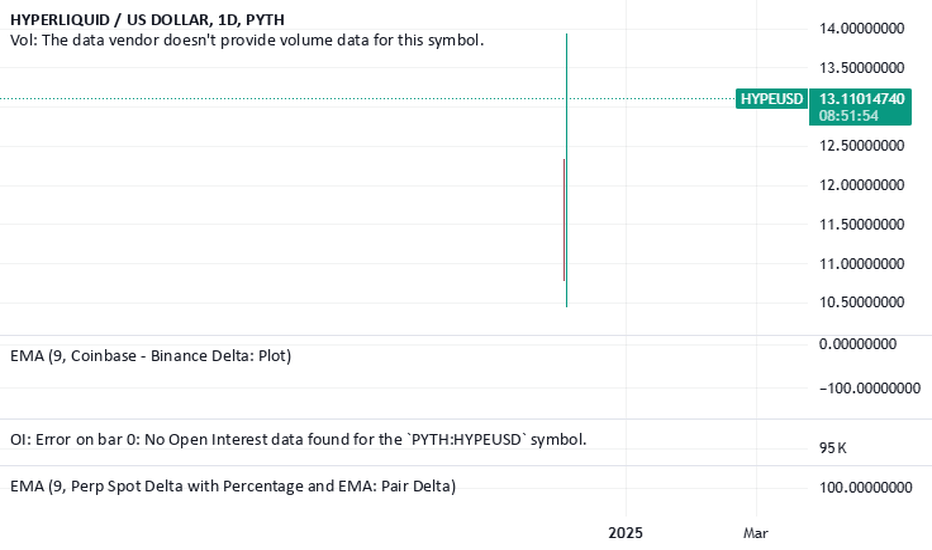

TLDR: Hyperliquid is relatively mispriced versus Solana and Ethereum, and while crypto is in the gutter at the moment, $ HYPE has held up moderately but relatively well. I would not be surprised to see $ HYPE trade as low as $10-$13.5, but this token has the best fundamentals in the game. Additionally, arguably the most competent and incentive aligned team. The market will reprice this over time. Staking hyperliquid or using the hyper EVM has a nonzero chance of being rewarded with another $ HYPE airdrop in the future, as there are still more locked tokens designated for community rewards. $ HYPE to $100+ once Bitcoin re-establishes an uptrend.

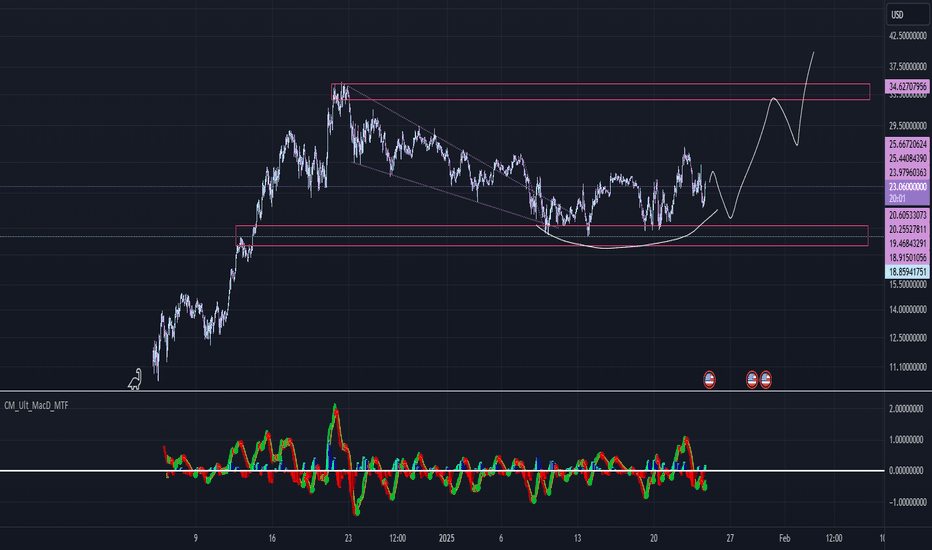

moon thatSome technical analysis:

We are retesting support. Fresh wallets depositing 7 figures to buy Hyperliquid, bullish orderbook imbalance at 24.

Some fundamental analysis:

Close to 50% of circulating supply staked, assistance fund buying back 23% of circulating supply per year, with no infinite sell pressure from the team and investors.

Old and jaded market participants are capitulating here. They are selling before the ftx inflows, before the final mania stage of the bull market starts.

I believe the new participants we have seen are ahead of the curve, the herd lags behind them.

don't sell your hype

Long the Hyper ecosystem. Lots of wonderful things coming.My biggest conviction long since XRP at .24 in 2018, but this time we have a real narrative, HyperEVM is coming with their very own L1 network. We ended the 2024 year with a wonderful Air Drop to users who had used the platform (genius) and now we have them adding the ability to buy spot crypto on a decentralized exchange and then off ramp it through their own network, and use GETTEX:HYPE to stake for APR and voting rights in governance. O and did I mention the fee's the platform accrues goes to buying spot HYPE. They also have a fund set to the side to buy hype for the Hype foundation, and they have continued to avg up constantly. They believe in their product, and future products. I'm apart of the community and want to be a long for the ride.

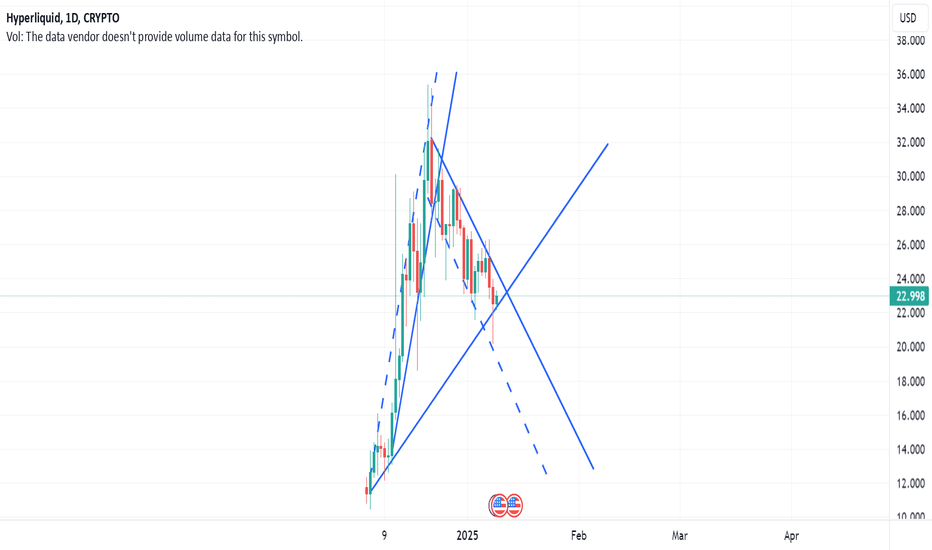

HYPEUSDstill undervalued

the market structure forming nicely with a pretty clear range being set..

52$ still main target with top 10 then top 5 even 3rd market cap overall as the final target after btc and eth..

most performant exchange and its a dex,

an l1 faster than solana,

evm compatibility coming very soon

revenue share for stakers in the future also

no vcs or presales just airdropped direct to the community

best project in this space since eth

HYPEstill quite undervalued

perps volume hitting all time highs

40% of hype already staked this is a higher % than eth which is insane

should break top10 mcap

genuine target would be flipping solana.. :)

no other dex has managed to pull of a performant perp dex exchange

and EVM bridge/ capabilities will be here soon

buy the dip spot and chill :)

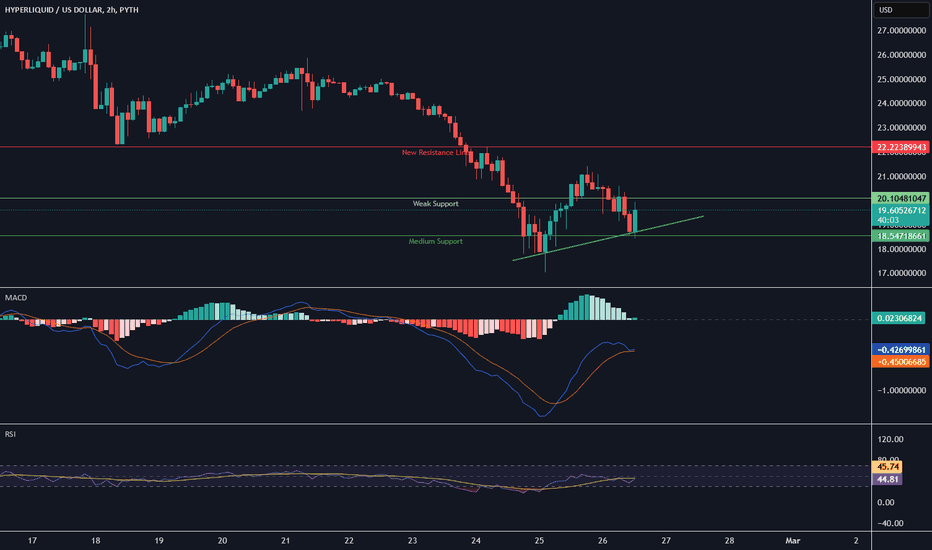

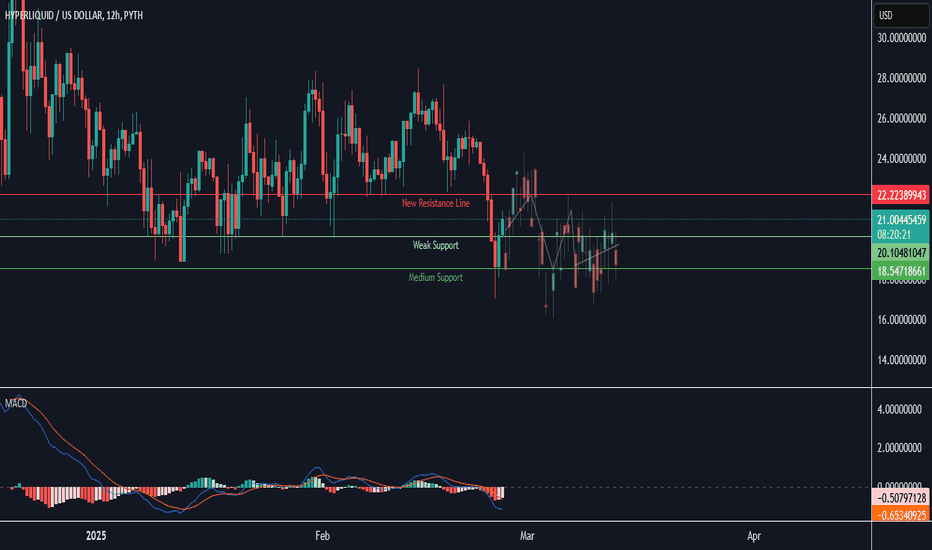

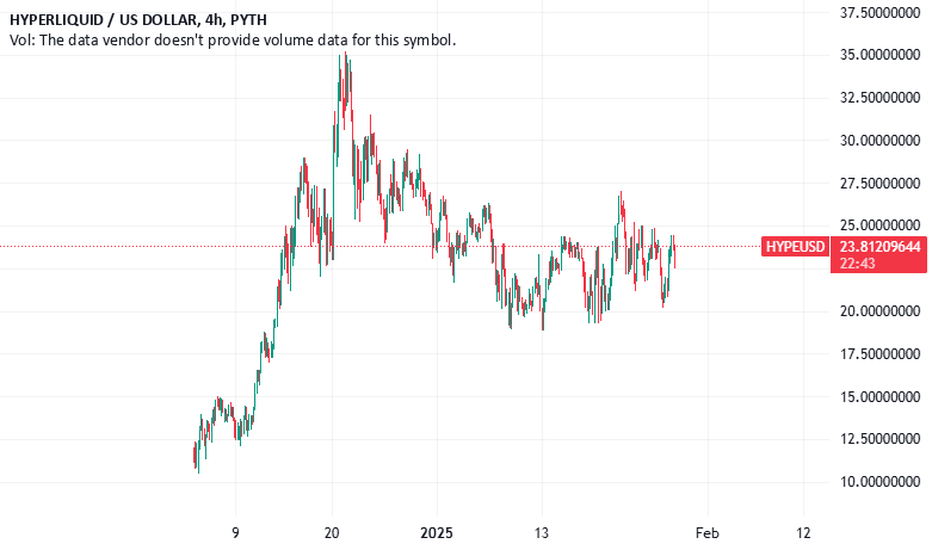

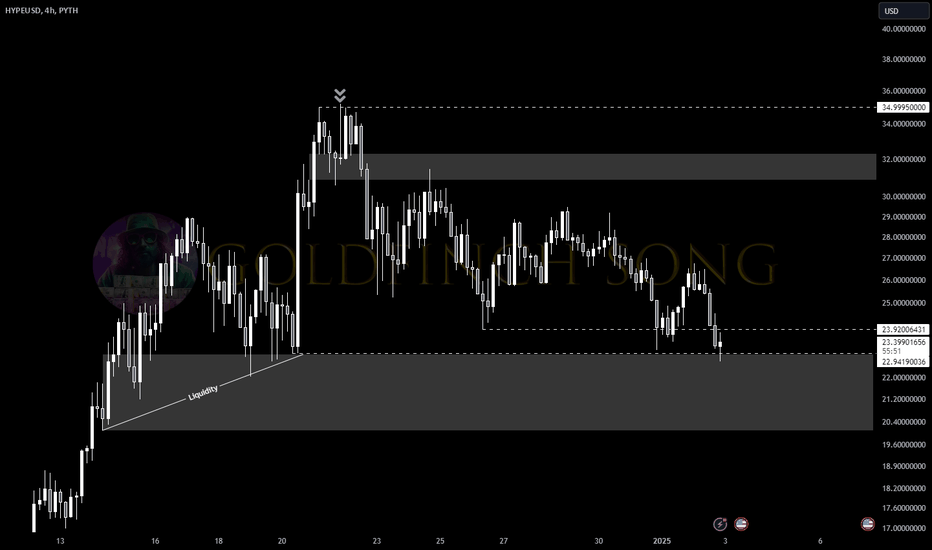

HYPE Analysis: Consolidation Continues Amid Key Liquidity ZonesCurrent Dynamics

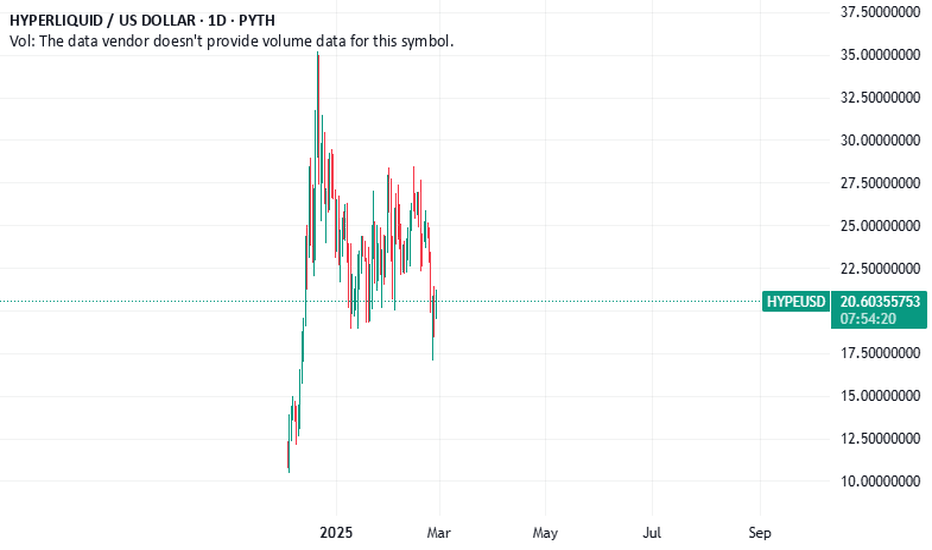

GETTEX:HYPE is experiencing a correction following resistance above the $30 level. Price action is moving downward, testing zones of imbalance and liquidity.

The ongoing correction is forming a structure conducive to future growth.

Liquidity zones between $22-23 are particularly important, offering potential opportunities for long entries. This range creates an attractive entry point for spot or futures positions. Establishing a strong base here would signal potential for upward momentum.

Resistance at $30-32 remains a critical barrier. A breakout above this level could lead to a push toward $40.

A confirmed breakout could accelerate GETTEX:HYPE toward $40.

Trading Strategy

Current price action offers clear opportunities for managing positions:

$22-23: Ideal for placing bids; watch for a stable base formation.

Use stop orders below key liquidity levels to manage downside risk.

Monitor for price holding above these levels, signaling readiness for a new upward impulse.

HYPEStill undervalued

hyperEVM coming this month

and staking launched a few days ago...

likely becomes next strong L1 competitor with BNB and SOL

massive volume perp dex trading volume is astronomical

no unlocks

no sharing with centralized exchanges

next level performant exchange

the hype is real

potential for 150+ this year

first targets are shown ~52$

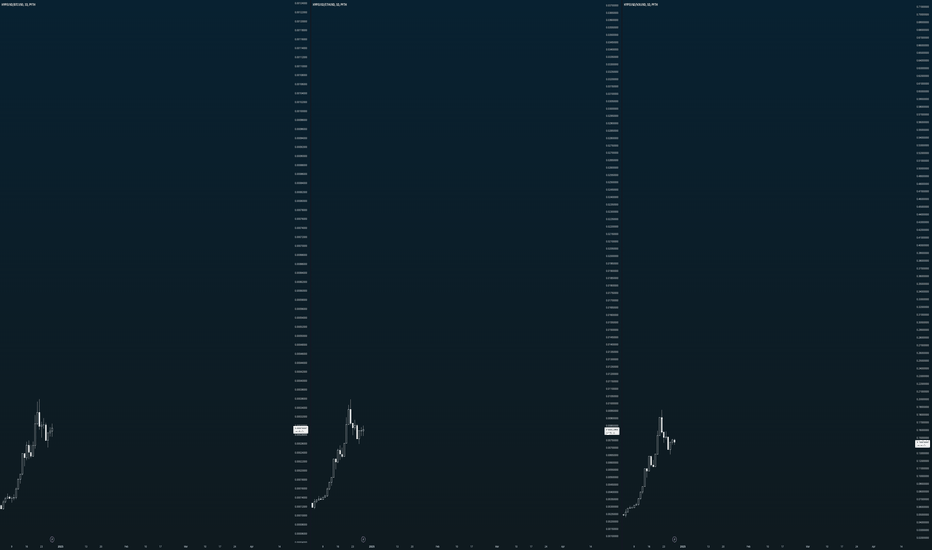

HYPE/BTC - HYPE/ETH - HYPE/SOL // Q1 2025 OutperformanceWe look at Q1 2025 and want to outperform the 3 majors.

I am buying HYPE and chart against:

- BTC

- ETH

- SOL

I don't want to midcurve it and hold the 3 majors or engage in any rotation or infighting which takes place between holders of these major assets.

This chart should help to follow along the progress and if we can achieve what is set out to do.

Challenge runs from now until 1 APR 2025 when Q1 ends.

H y p e r l i q u i d.

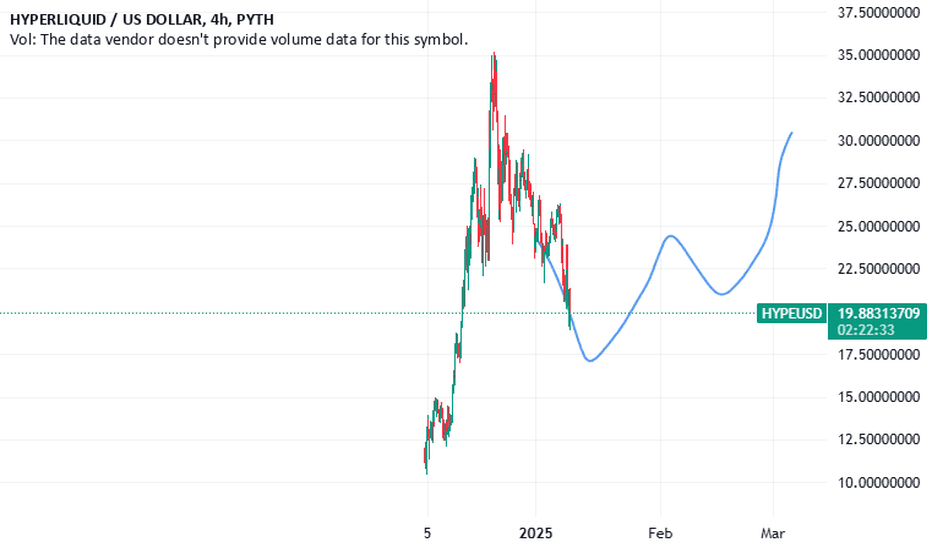

HyperliquidHyperliquid will consolidate for a while, but I believe eventually we will reach 100s of dollars per token.

Total circulating supply is around 28%. I don't believe the team will need to sell for the next year, (and their team tokens are locked for that time).

This means the marketcap and FDV can be treated equivalently for the purpose of this trade, as the timeframe is short.

The EVM and native spot assets will make Hyperliquid the definitive best decentralized exchange. Orderbooks are inherently superior to AMMs. I believe short term, Hyperliquid can realistically trade 4-10b daily during its peak months. The valuation would easily reach 30-40b, by accounting for the layer 1 premium. However, this is a function of buying, therefore it is best if spot listings happen sooner than later.