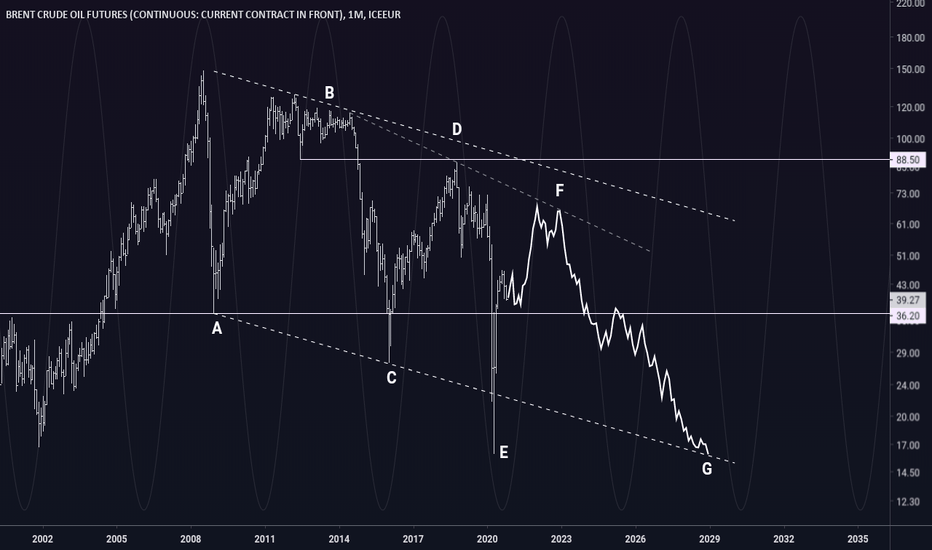

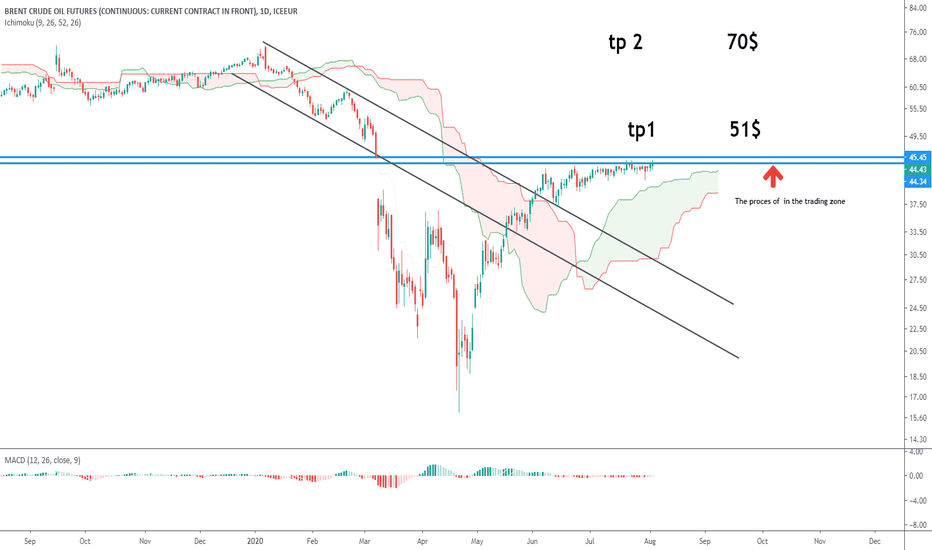

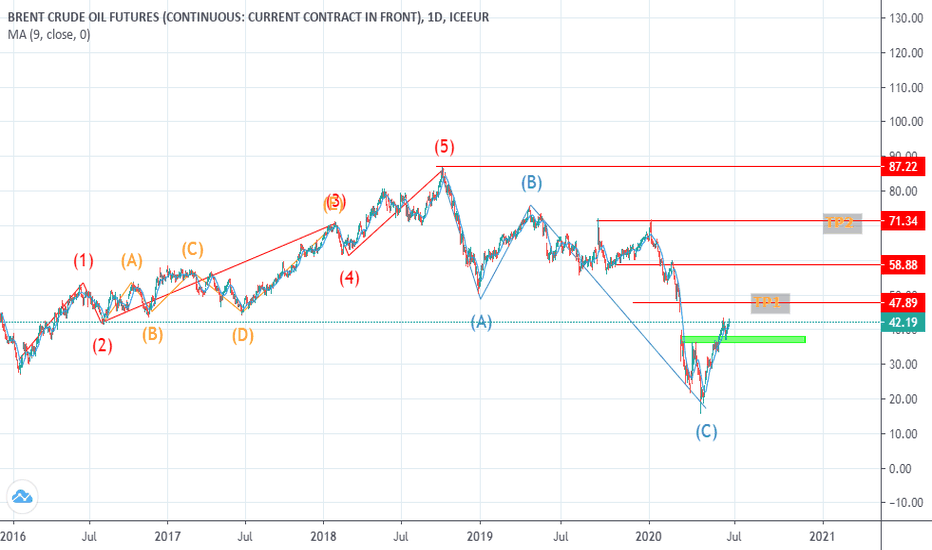

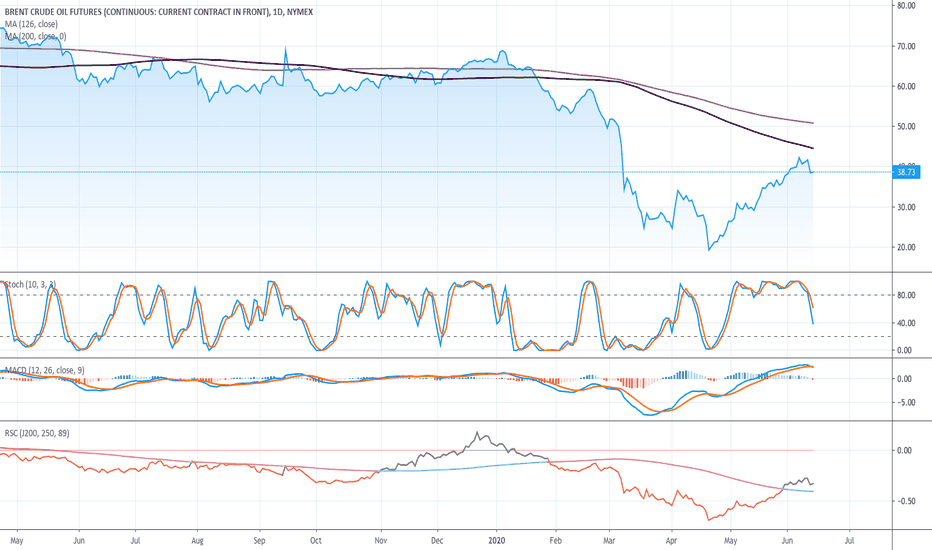

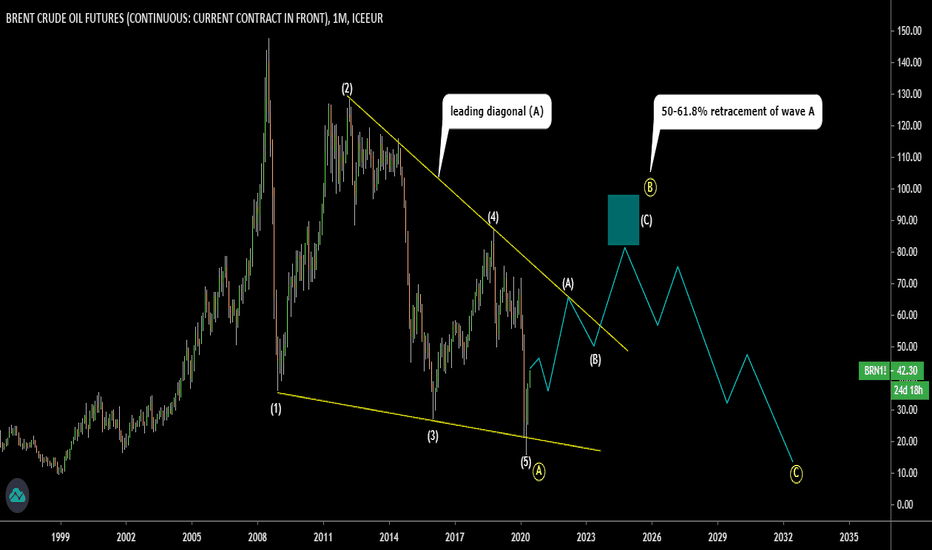

OIL, Long-term Diametric formation...Previous drop was devastating, but based on a remarkable Diametric pattern, the correction phase for OIL may not be over yet.

If this pattern holds true something similar to drawn projection should happen.

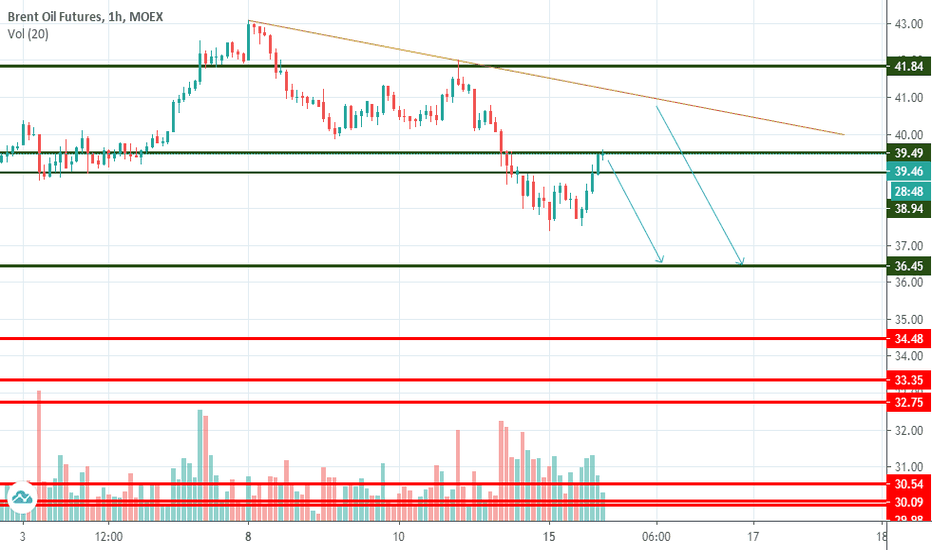

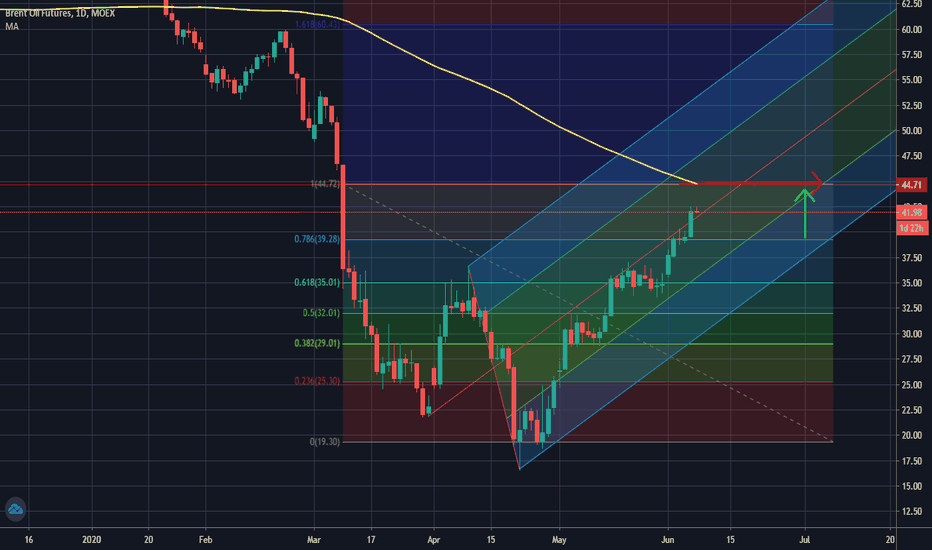

On the other hand we have 36 level as an obvious PA support (next one is 26). It is still untested after the break and we can expect OIL to be supported at nearby levels.

If 36 holds as expected we should see approximately $70 dollars per barrel for OIL in coming years.

Afterward if price follows Diametric pattern, the price should be rejected somewhere around the top of bearish channel to test the lows.

An early breakout of bearish channel (if happens) AND 88 level is NOT expected with current fundamentals; if even happens, it can't be considered an end for Diametric (there will be still a different g-wave), but of course it will indicate the strength of the market.

BRN1! trade ideas

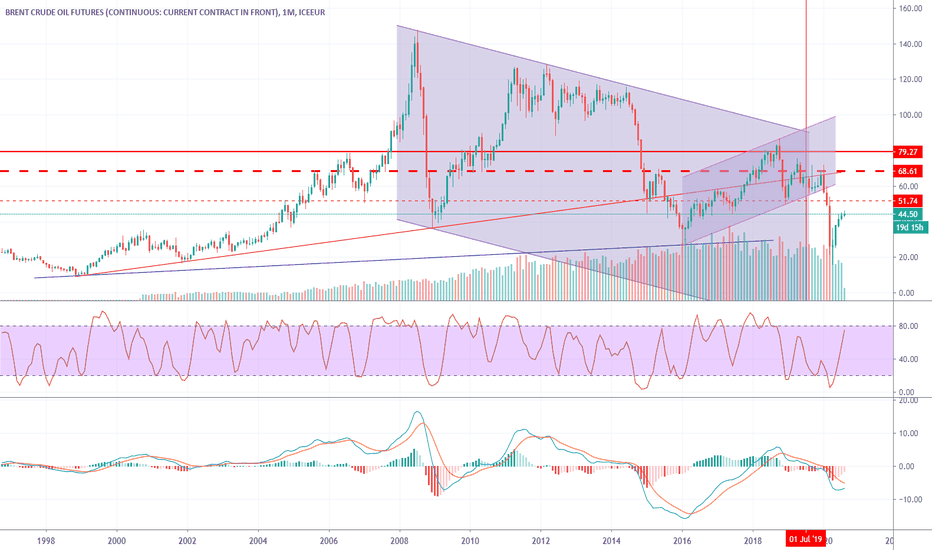

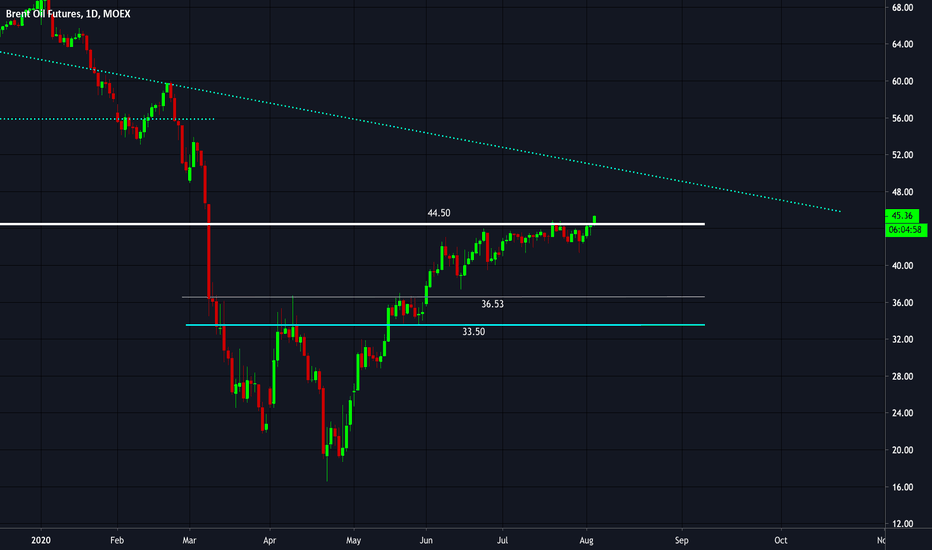

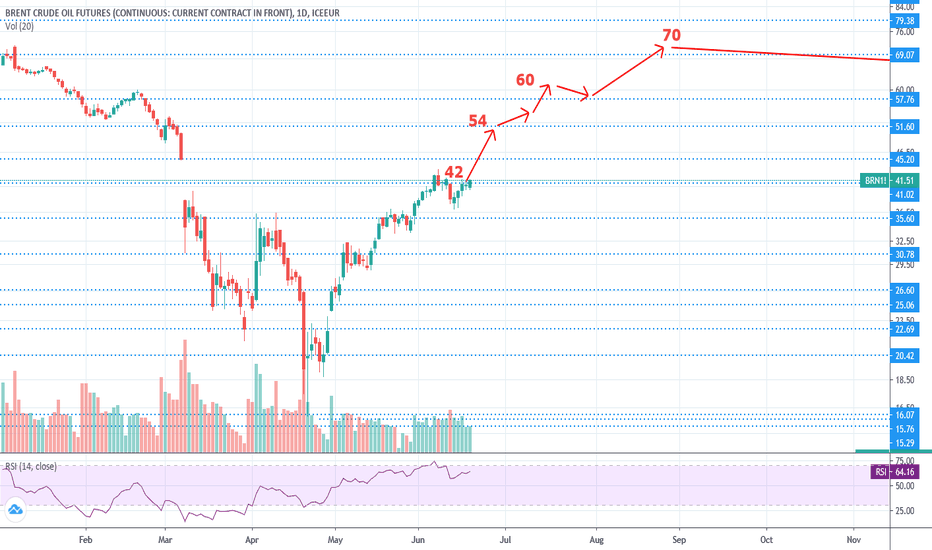

Oil complex - something is rottenOn daily charts, I can see any number of head and shoulder formations incudling on the ETFs

The monthly WTIC chart is looking like.... the last gasps of a dying industry? Is that possible?

I can see how commodities in general will rally in the medium term. The oil chart however says this is a secular decline....

I am short the oil sector till I will no longer be...

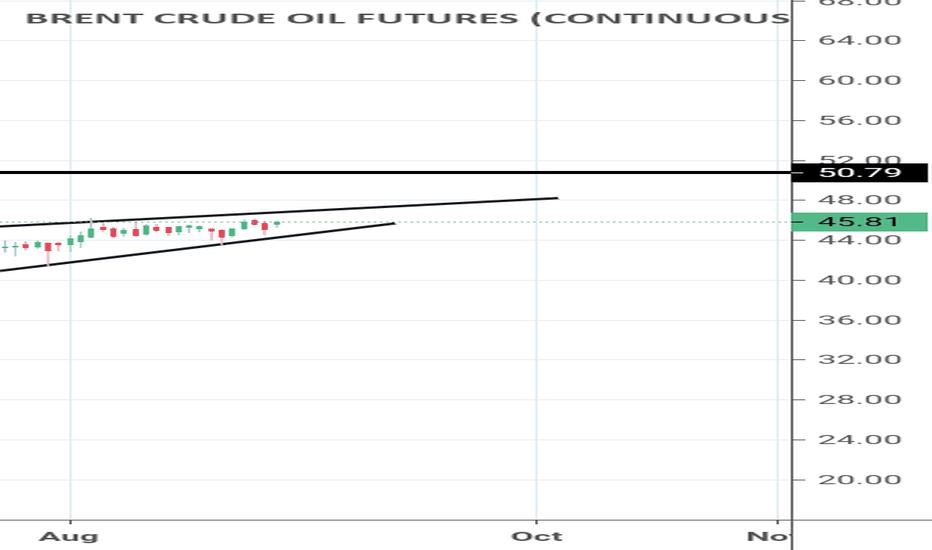

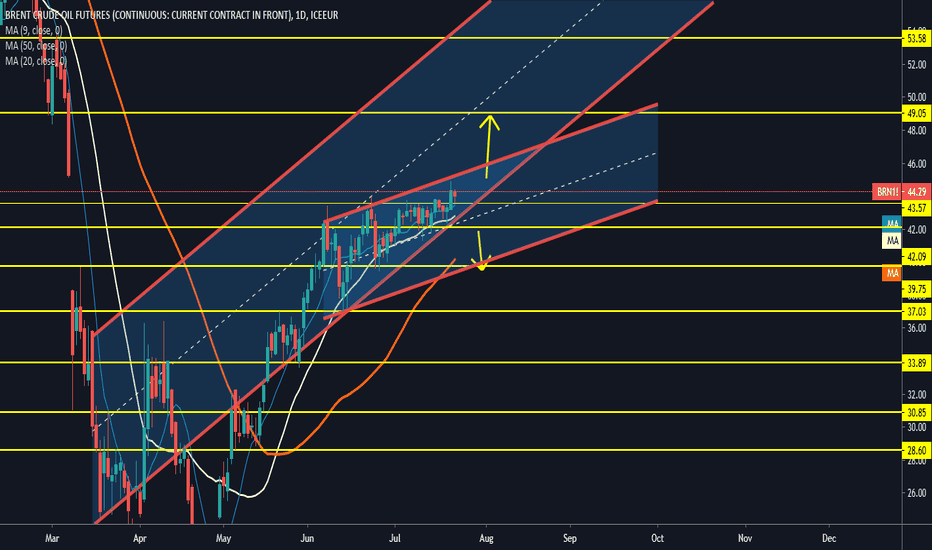

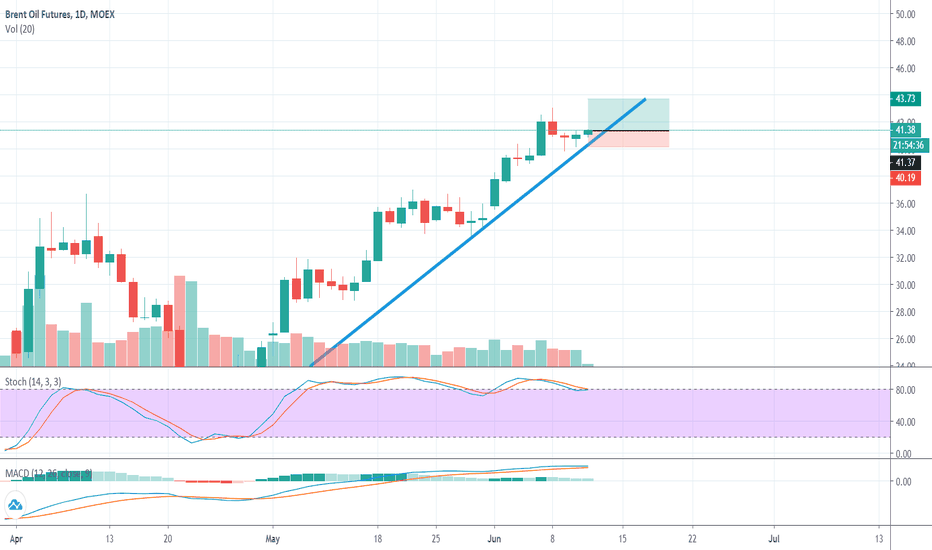

Is Energy Sector ready to move ? XLE (US Energy Sectors) increase 3.19% second best to Finance Sector (XLF +3.44%)

XLE chart appear to be at support. Last friday rally is the best since 9 June sell-off.

BRENT retesting Resistance numerous time.

Is O&G related stock ready to move ?

Stock to watch SerbaDK, Dialog, Hibiscus ?

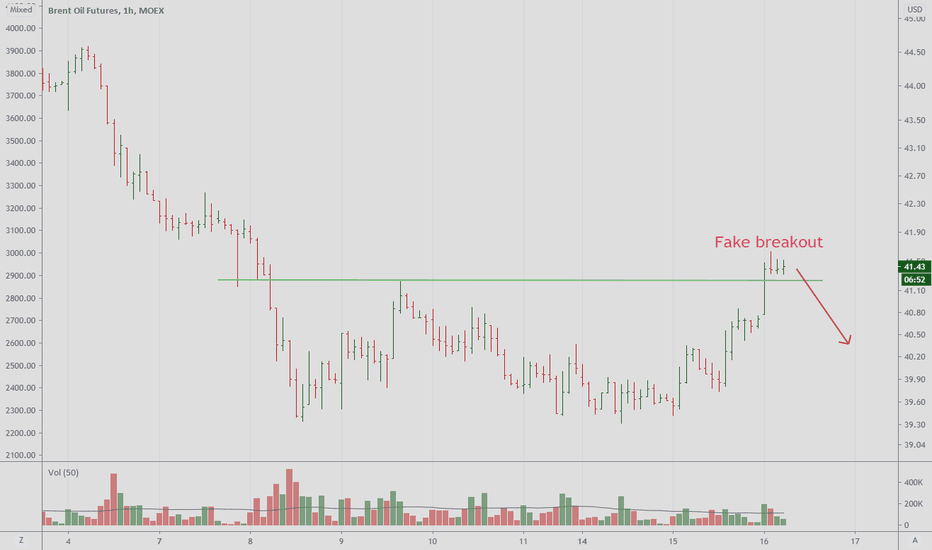

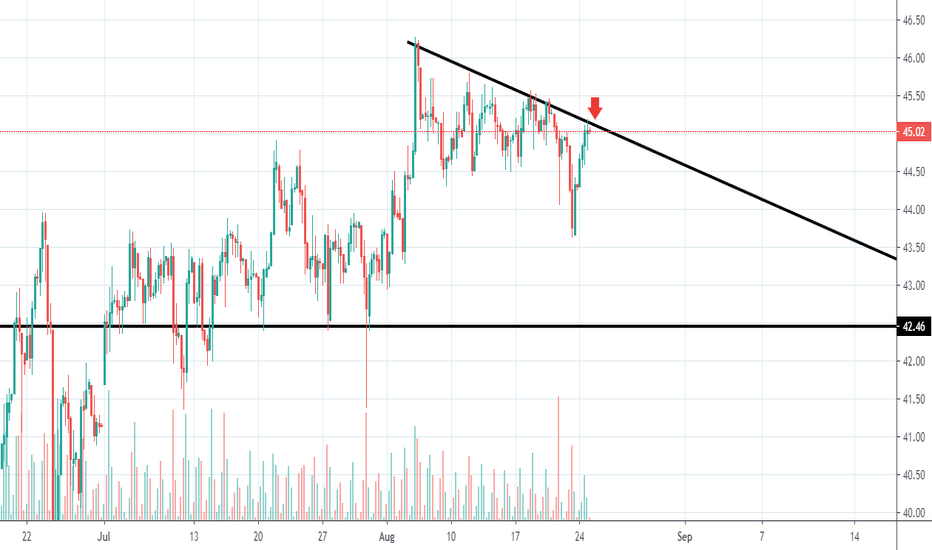

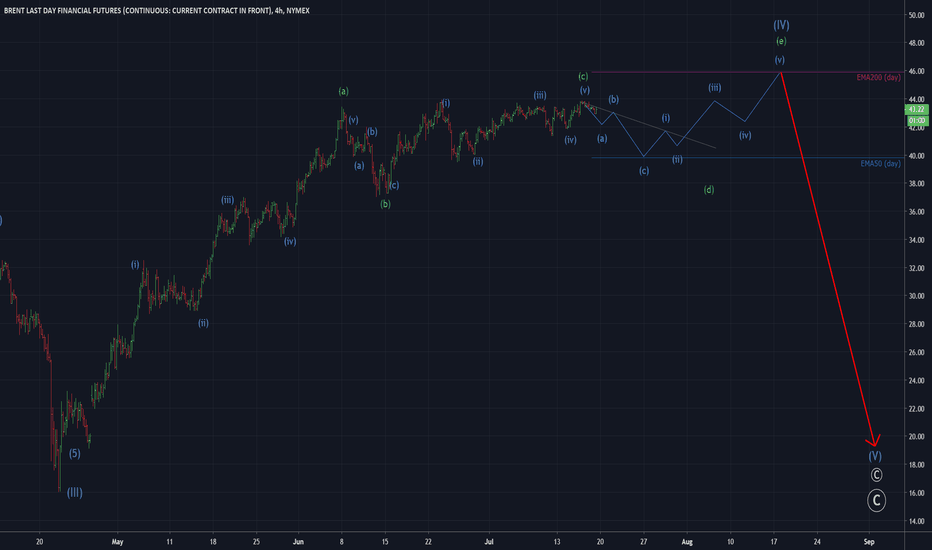

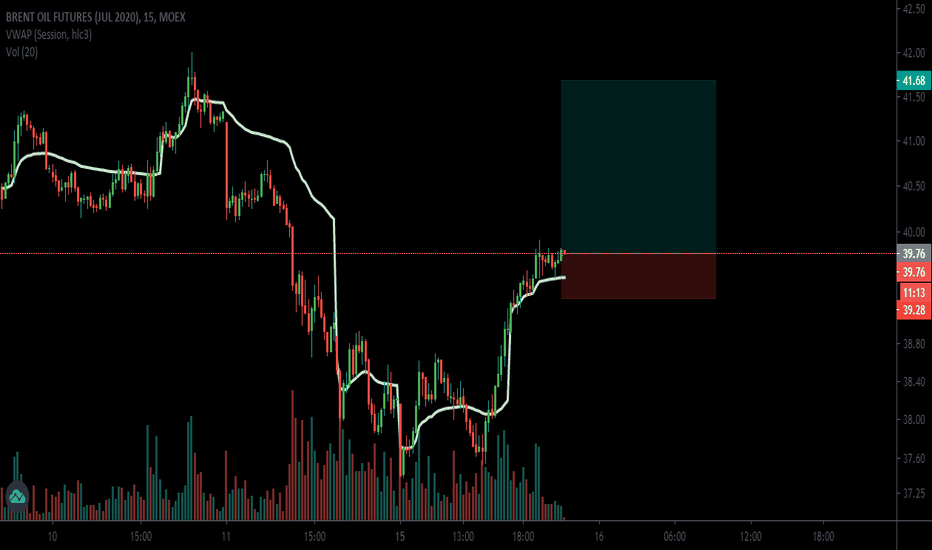

BZ1! (CL1!)SHORT: Target is 40$ (BZ1!)

However:

The current wave (IV) is the next-to-last wave in general downtrend/correction since July 2008 (on monthly timeframe). Upon completion of last (I)-(V) out of last {C} the trend will change and the targets will be (80$ and then 140$)

Here it means that either (IV) or the last wave (V) will be complicated.

In other words:

If (IV) is complicated (e.g. double zig-zag) than (V) is simple

If (IV) is simple (zig-zag) than (V) is complicated (e.g. ending diagonal)

As to the current technical situation I do not see any sentiment to drop the price below EMA50 (day) and complicate wave (IV). To the contrary the price tends to 50$ (EMA200 day) and only after the price will look down to 20-s$.