Oil Market Sentiment Shifts After Trump’s Urgent Warning, but...On June 23, 2025, at 9:35 AM, President Donald J. Trump issued a stark warning via social media:

"EVERYONE, KEEP OIL PRICES DOWN. I’M WATCHING! YOU’RE PLAYING RIGHT INTO THE HANDS OF THE ENEMY. DON’T DO IT!"

Since his post, oil prices experienced a notable bullish impulse. From both fundamental a

Related commodities

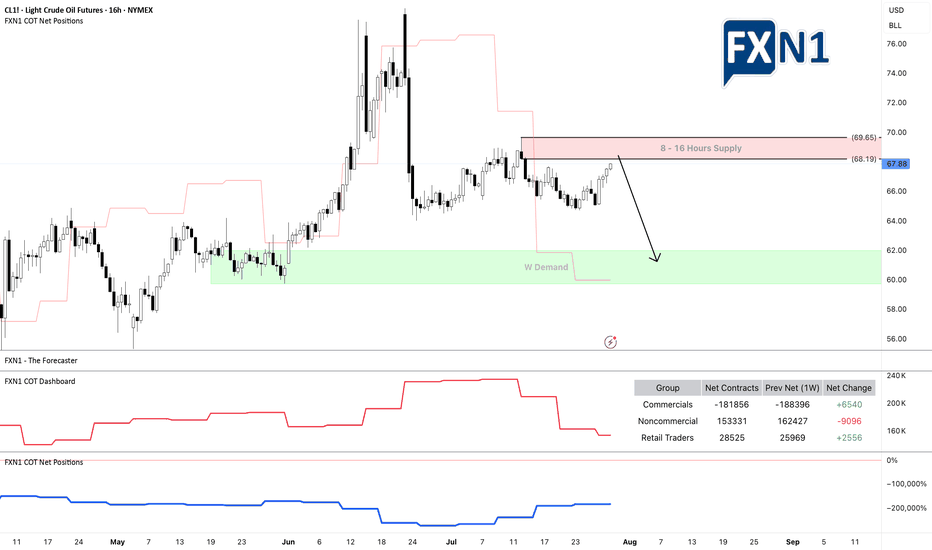

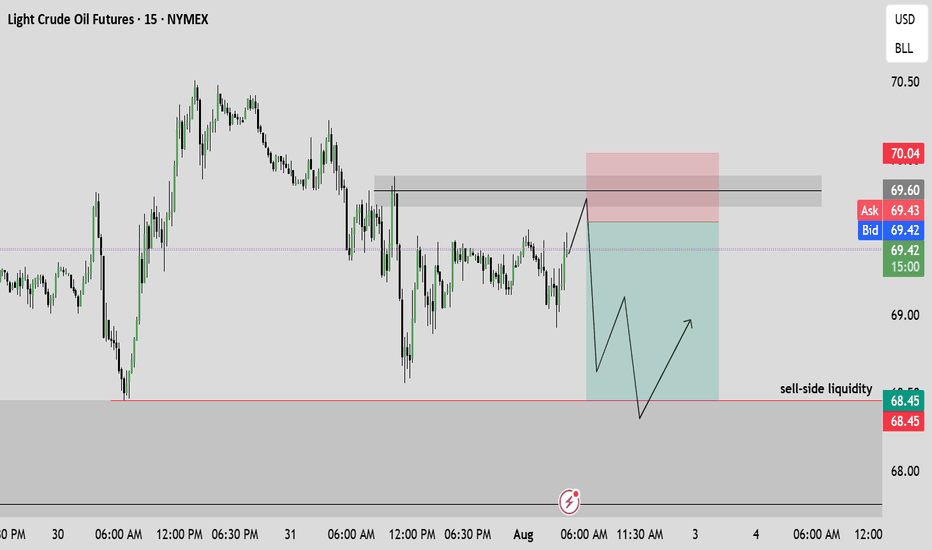

Crude oil: Sell around 70.20, target 65.00-64.00Crude Oil Market Analysis:

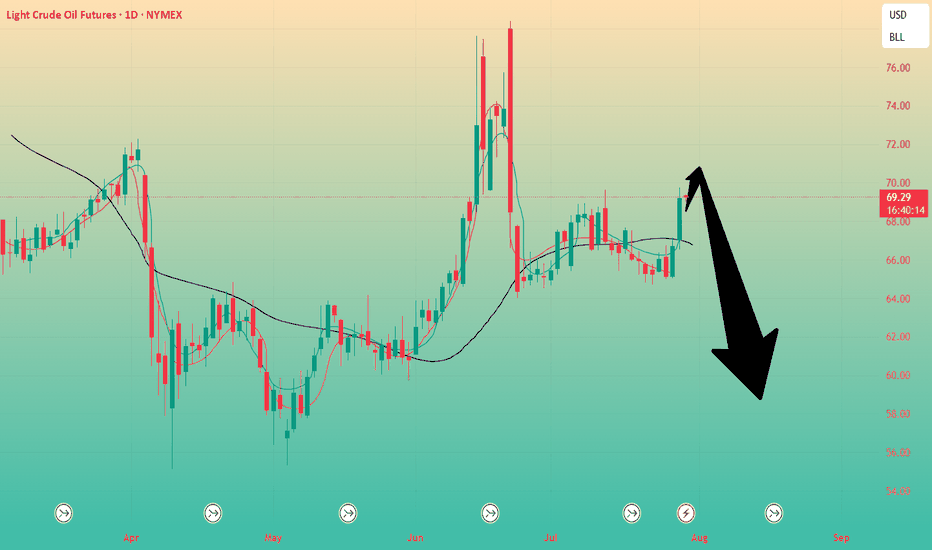

Yesterday's crude oil market was very strong, with buying driving the market higher. The daily chart ultimately closed with a clear bullish candlestick. Buying on the daily chart is testing the resistance level between 70.00 and 70.60. After two consecutive days of bullis

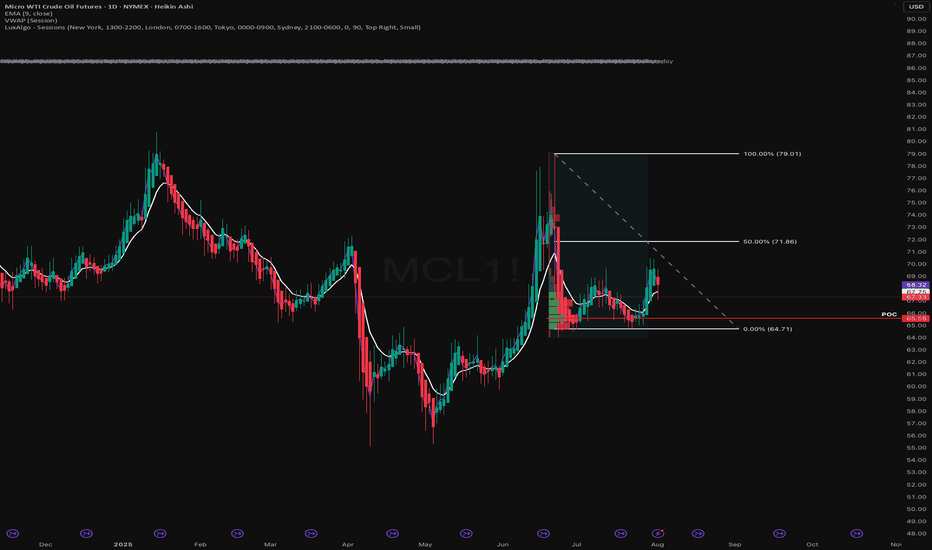

Crude Awakening. This Double Bottom’s Built DifferentCrude oil is sitting at a critical technical level. Zooming out to the daily chart, we’re seeing a textbook double bottom forming at $64.70 a level that’s already been defended twice this summer. Each time price tagged that zone, buyers stepped in with conviction, and last month we saw a strong rall

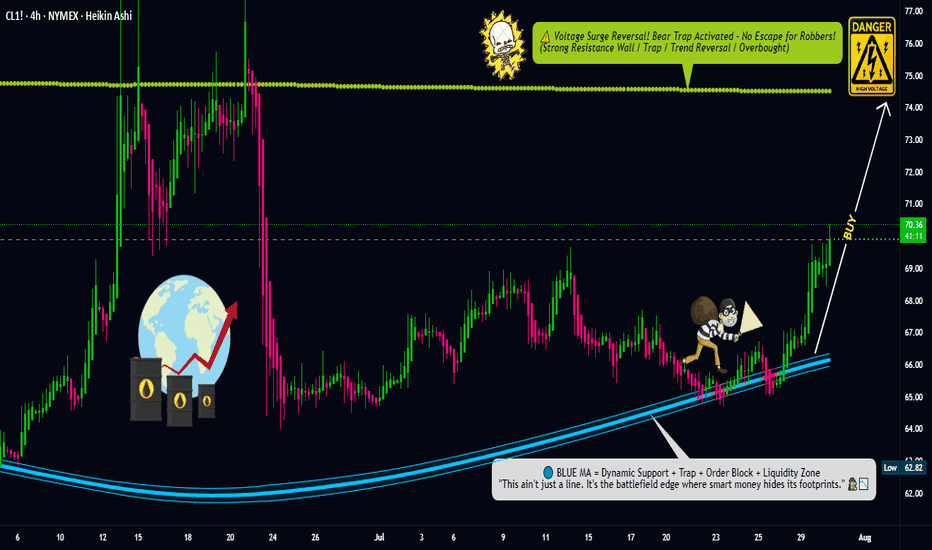

Oil Trap Activated – Limit Orders Set for the Big Score💥🛢️Crude Oil Vault Breach Plan – DCA Heist Begins!🧨💰

🚨Asset: CL1!

📈Bias: BULLISH RAID MODE ON

🎯Target: $74.50

🛡️Stop Loss: $67.50

🔑Entry: ANY LEVEL – Thief stacking limit orders like layers of gold bars 💼⚖️ (DCA Mode Activated)

🕵️♂️Thief Trader is not chasing, we're ambushing 🧠 — scaling in smart

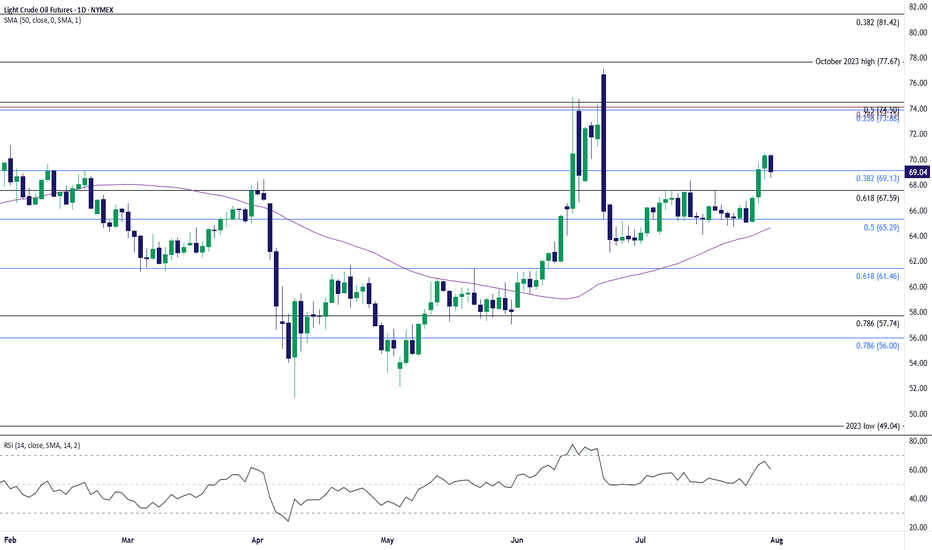

Oil Price Pulls Back to Keep RSI Out of Overbought ZoneThe recent rally in oil appears to have stalled as it struggles to extend the bullish price series from earlier this week, with the Relative Strength Index (RSI) pulling back ahead of overbought territory.

Lack of momentum to hold above the $67.60 (61.8% Fibonacci retracement) to $69.10 (38.2% Fibo

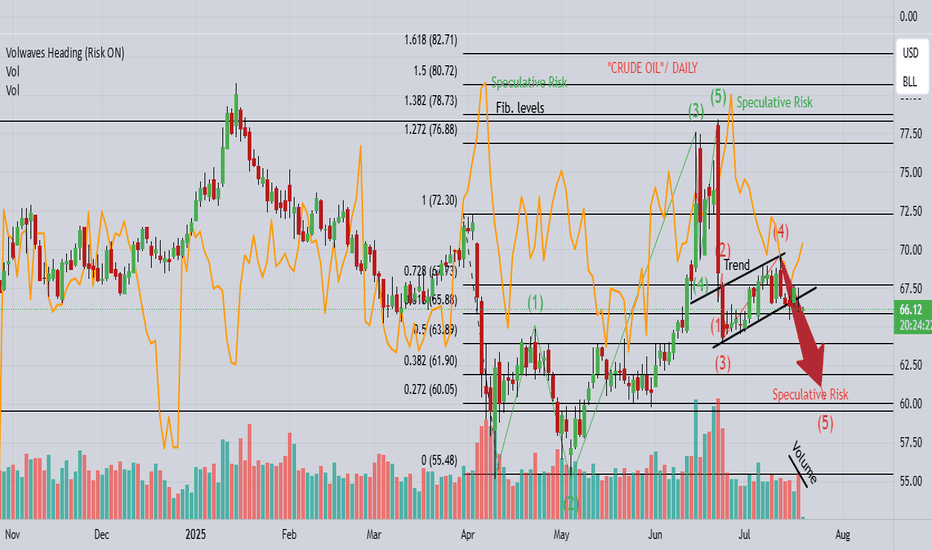

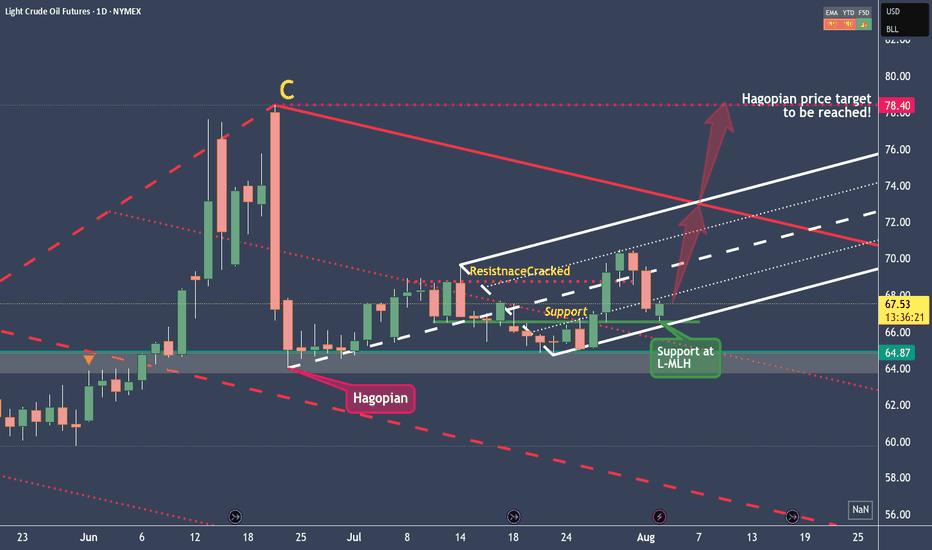

Crude Oil setting up for a Long Trade to $78.40In the long term, Crude Oil is in a short position.

We can see this from the red pendulum fork, which projects the price movement downward.

However, in the short- to medium-term, we're long, as clearly illustrated by the white fork. Supporting the case for higher prices is the Hagopian signal that

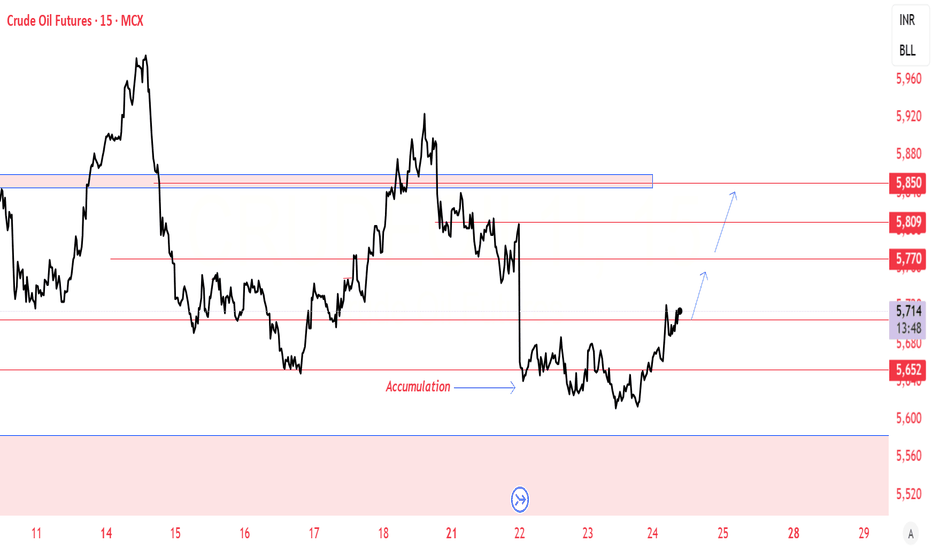

Price Stability Signals Long OpportunityCurrent Price: $65.45

Direction: LONG

Targets:

- T1 = $67.25

- T2 = $68.50

Stop Levels:

- S1 = $64.15

- S2 = $63.25

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of WTI Crude Futures is 62.35 USD — it has fallen −0.24% in the past 24 hours. Watch WTI Crude Futures price in more detail on the chart.

Track more important stats on the WTI Crude Futures chart.

The nearest expiration date for WTI Crude Futures is Dec 18, 2028.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell WTI Crude Futures before Dec 18, 2028.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For WTI Crude Futures this number is 1.50 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for WTI Crude Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for WTI Crude Futures. Today its technical rating is sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of WTI Crude Futures technicals for a more comprehensive analysis.