SDX1! trade ideas

Bites Of Trading Knowledge For New TOP Traders #4 (short read)Bites Of Trading Knowledge For New TOP Traders #4

---------------------------------------------------------------

What is the role of a financial custodian? –

A custodian or custodian bank is a financial institution that holds customers’ securities for safekeeping to prevent them from being stolen or lost. Custodians are responsible for the safety of assets and securities and provide services that include trade settlement, investing cash balances as directed, collecting income, processing corporate actions, providing valuation of securities positions, and providing recordkeeping and reporting services.

What is the role of a financial exchange? –

An exchange is a marketplace where securities, commodities, derivatives and other financial instruments are traded. The core function of an exchange is to ensure fair and orderly trading and the efficient dissemination of price information for any financial instrument trading on that exchange.

What is the role of financial regulators? –

A regulator authorizes, supervises and regulates, financial institutions operating in a country to ensure the soundness of the overall banking and financial system. This supervision enables financial institutions to operate and provide efficient banking and financial services.

RISKS AND OPPORTUNITIES FOR CORPORATES AND INDIVIDUAL INVESTORS – Portfolio Diversification –

Portfolio diversification is the process of investing your money in different asset classes and securities in order to minimize the overall risk of the portfolio.

For both corporate and individual investors, having access to markets that enable the building of a diversified portfolio is an important consideration when managing futures focused accounts.

Similar to managing risk, the market to trade would be a key variable to clearly state and support with reasons for trading or investing. Reasons for selecting one market over another could include price volatility, liquidity, daily volume traded, size of the minimum price increment, and value of the minimum price increment. Comparing these variables between markets will help decide the suitability and/or risk of each.

For example, the parameters for a price driven strategy may be designed to be applied to any market whether it be index equity futures or forex futures. However, the signals for entry may not always trigger if a trader were just to focus on a single index equity futures such as the Micro MSCI USA Index futures.

Having access to other futures markets to apply the strategy to allow for the creation of a diversified portfolio with varying entry and exit points or the ability for more trading oriented investors increased opportunities to execute price driven strategies more often across a range of futures markets.

TRADDICTIV · Research Team

--------

Disclaimer:

We do not provide investment advice, nor provide any personalized investment recommendations and/or advice in making a decision to trade. Before you start trading, please make sure you have considered your entire financial situation, including financial commitments and you understand that trading is highly speculative and that you could sustain significant losses.

Bites Of Trading Knowledge For New TOP Traders #1 (short read)Bites Of Trading Knowledge For New TOP Traders #1

---------------------------------------------------------------

What is Hedging? –

Hedging is the action taken through the use of a financial instrument to minimize the loss or risk of the loss of value of an asset due to adverse asset price movements.

Who are Hedgers? –

Hedgers are market participants such as commodity producers who want to lock in selling prices of commodities they produce, or food manufacturers who want to lock in buying prices of raw materials purchased.

Market participants also include financial institutions handling financial assets and use derivative products such as futures to manage the risk of a portfolio of financial assets.

What is the difference between Physically Delivered vs Cash Settled Futures Contracts? –

Physical delivery is a term in a futures contract which requires the actual underlying asset to be “physically delivered” upon the specified delivery date, rather than being cash-settled.

Cash settled futures on the other hand allows for the net cash amount to be paid or received on the settlement date of the futures contract.

Futures exchanges may offer both types of contracts to market participants who have different purposes for trading futures contracts.

Risks and opportunities for corporates and individual investors: HEDGING –

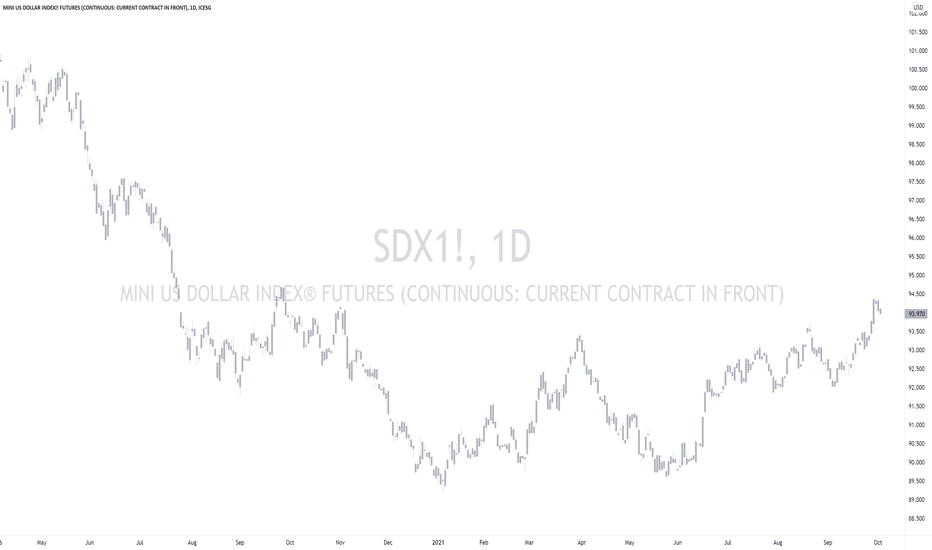

Hedging currency exposure with the Mini U.S. Dollar Index ® futures contract is a way to manage business currency risk by taking a directional position depending on business requirements for conversions to or from the U.S. Dollar.

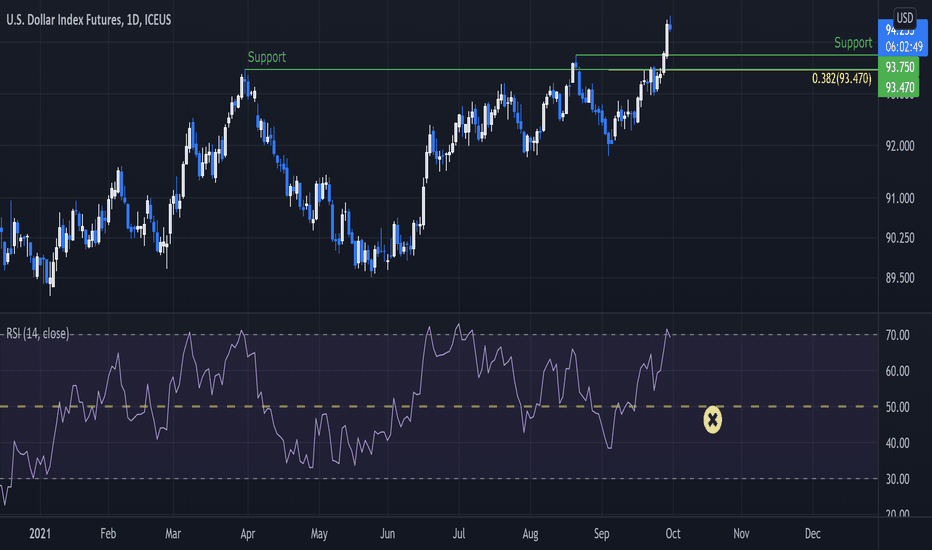

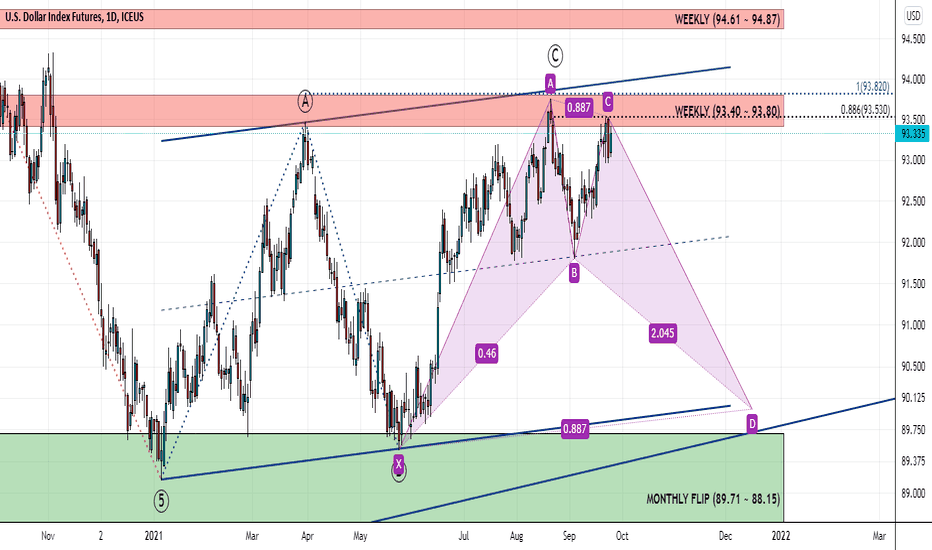

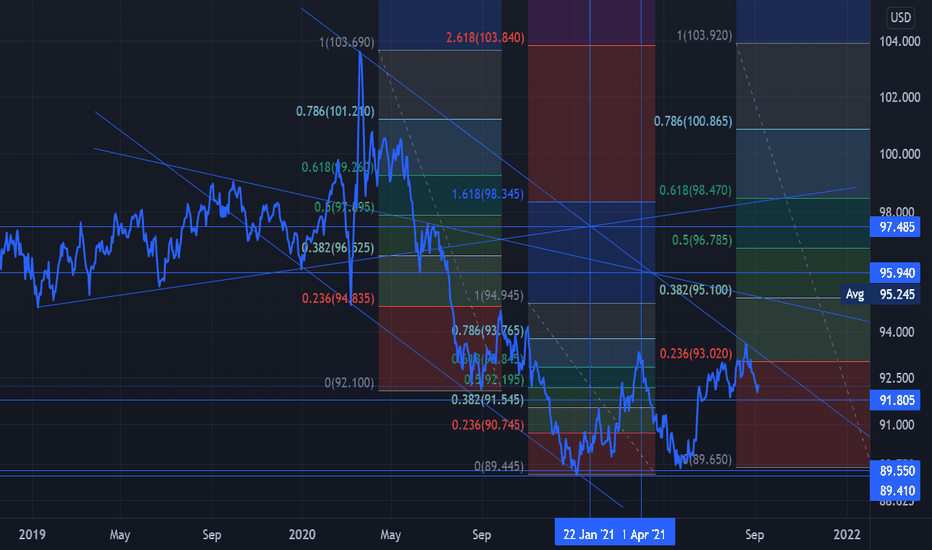

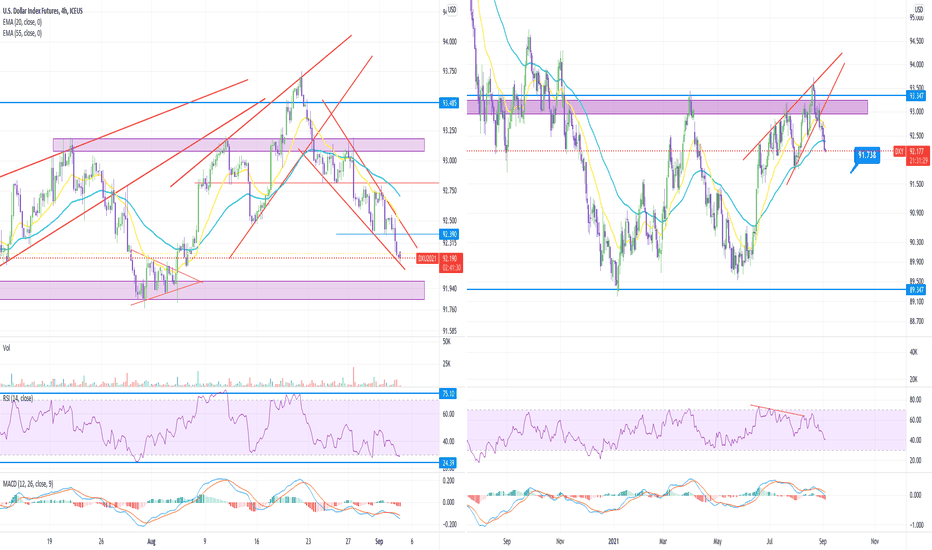

For example, a hedger may have expected the U.S. Dollar to weaken from 93.50 on 31st March (based on an analysis involving the overall downward trend in the market having retraced to the Fibonacci retracement level 76.8%) and may have had plans to convert U.S. Dollars to Singapore Dollars over the coming months to make payments to suppliers in Singapore Dollars. The hedger could have opened a short position using the Mini U.S. Dollar Index ® futures contract at or around 93.50 to lock in the value of the U.S. Dollars that they planned to use in the future at the time of payment to the supplier.

TRADDICTIV · Research Team

--------

Disclaimer:

We do not provide investment advice, nor provide any personalized investment recommendations and/or advice in making a decision to trade. Before you start trading, please make sure you have considered your entire financial situation, including financial commitments and you understand that trading is highly speculative and that you could sustain significant losses.

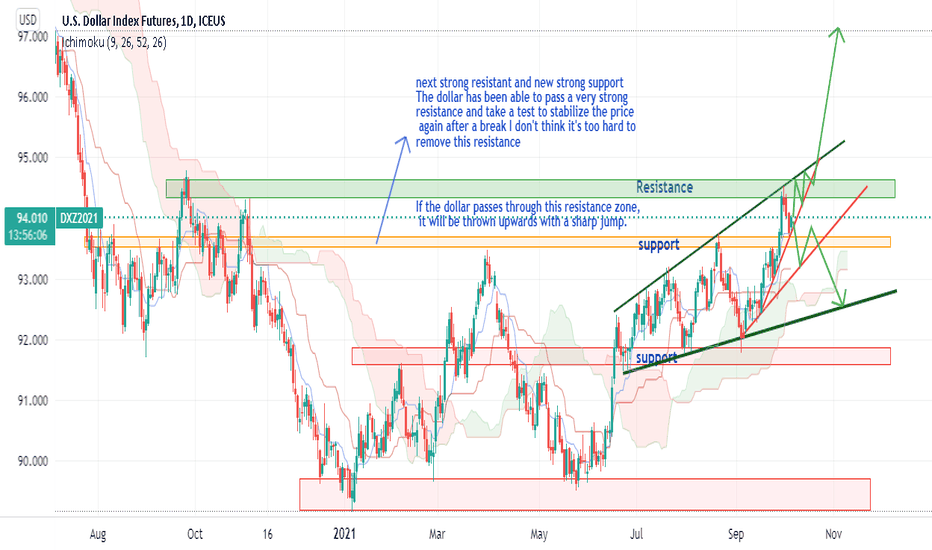

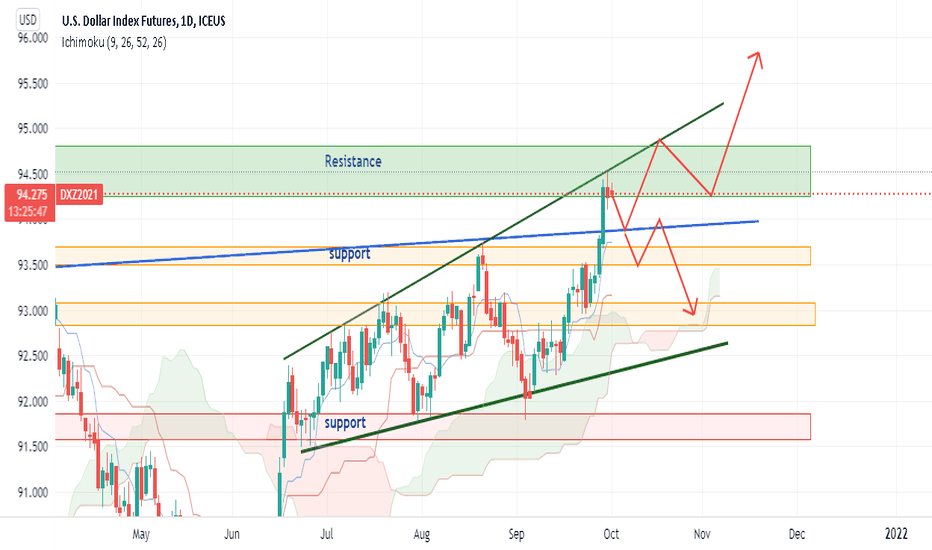

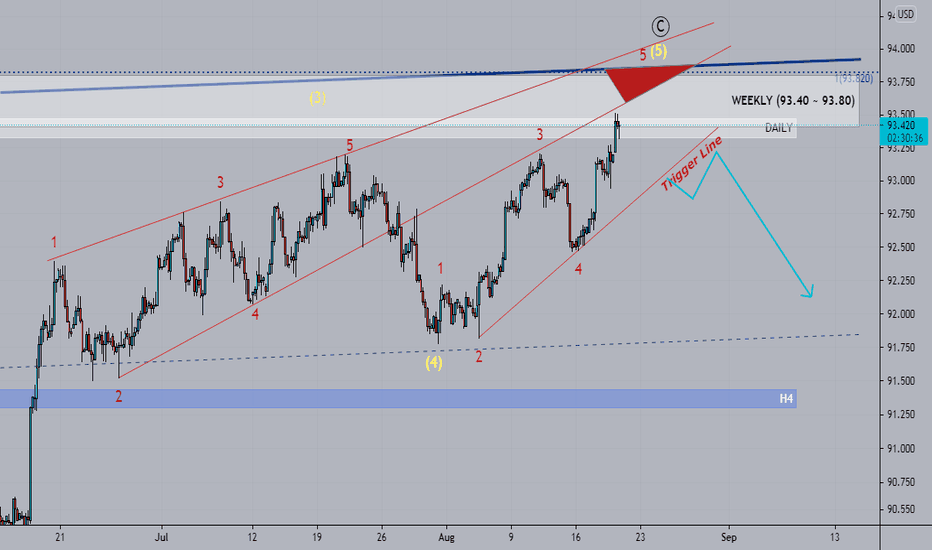

Dollar is on its final stage to complete wave five to the upsideU.S.Dollar Index Futures is on its final stage to complete wave five in a sequence of wave patterns to the upside; this means a pullback could be due.

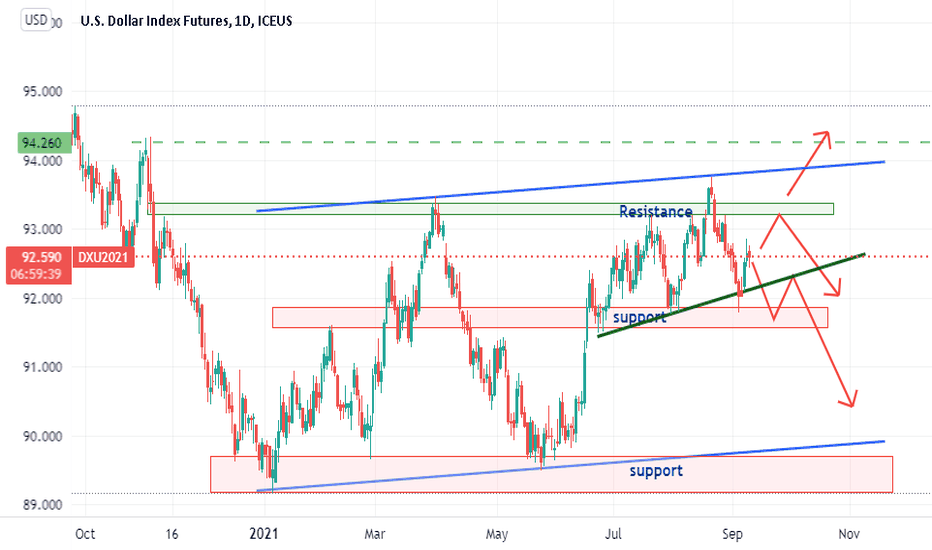

The nearest major resistance estimates are 94.30 and 94.80; the dollar could gradually pull back if it fails to hold above the two critical levels.

Major support/resistance estimates are automated and marked on the chart as solid lines for future references

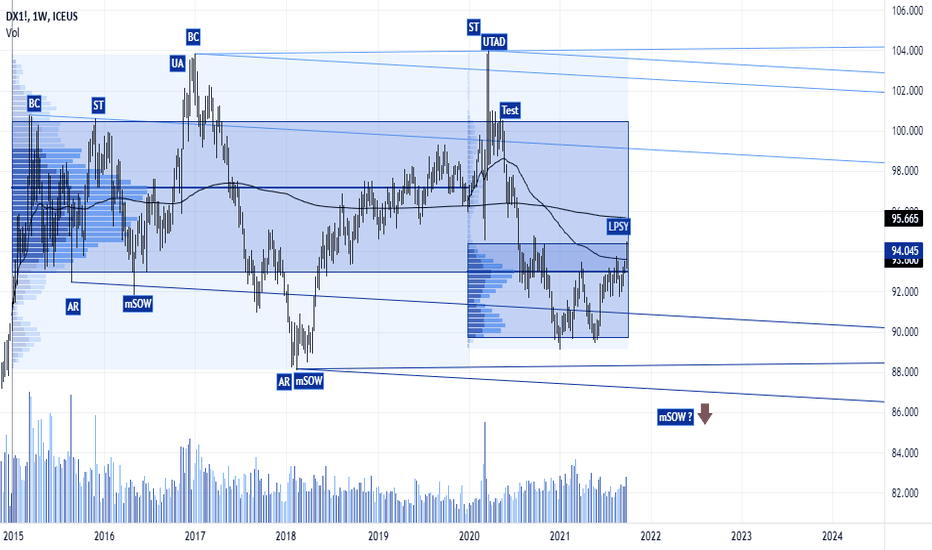

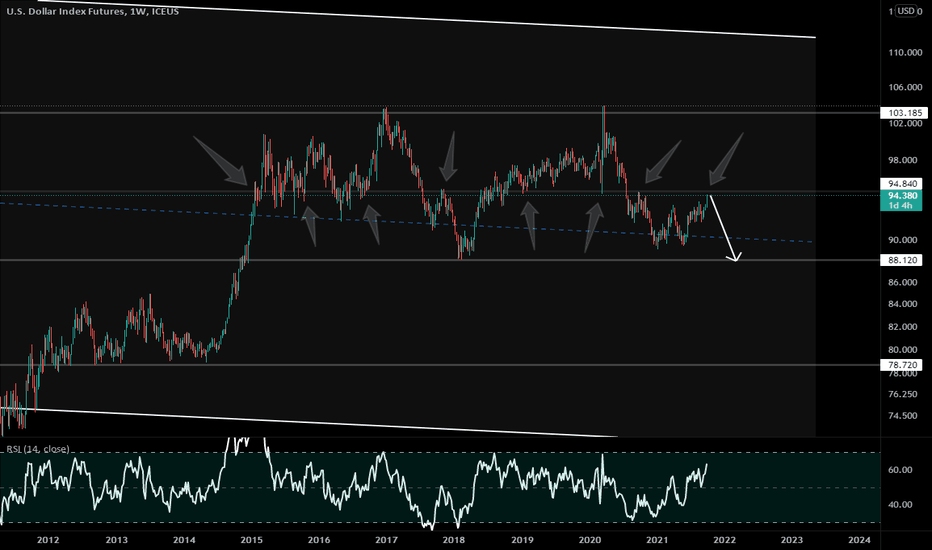

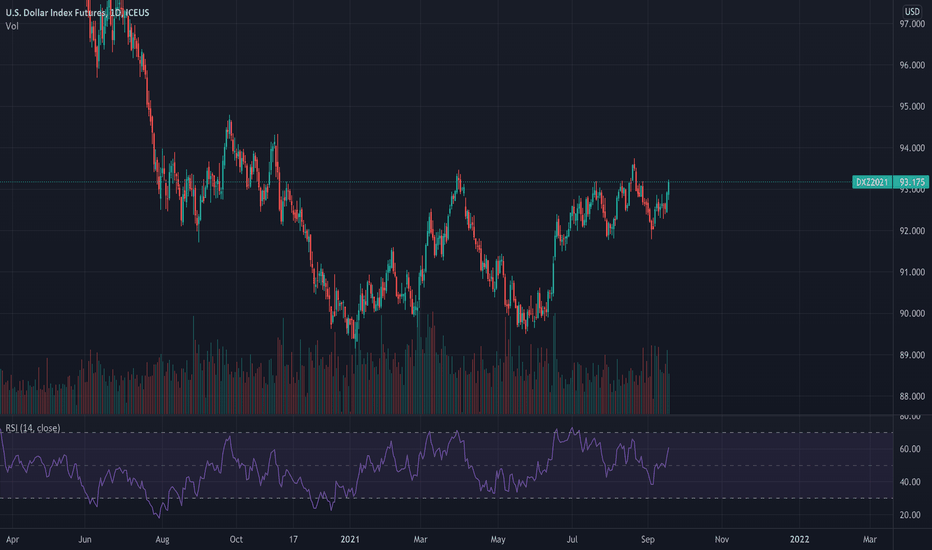

USD - Rejection The dollar is approaching a multi year line of resistance and also some overbought levels as can be seen on the RSI. The last time the dollar approached this target was 2020 and had a huge rejection. I suspect the same line will again act as level of resistance.

“It’s going to be the biggest crash in world history. We have never had this much debt pumped up. Debt is the biggest problem of all…the debt to GDP ratio is out of sync. So when it comes down, and it’s going to bring everything down with it, that’s when I’m going to be buying more gold, silver, and Bitcoin,” Kiyosaki said.

He noted that the possible crash will result from decisions made by the Federal Reserve and the Treasury. Kiyosaki opines that decisions made by the institutions do not mirror the current state of the economy (Author of Rich dad Poor Dad).

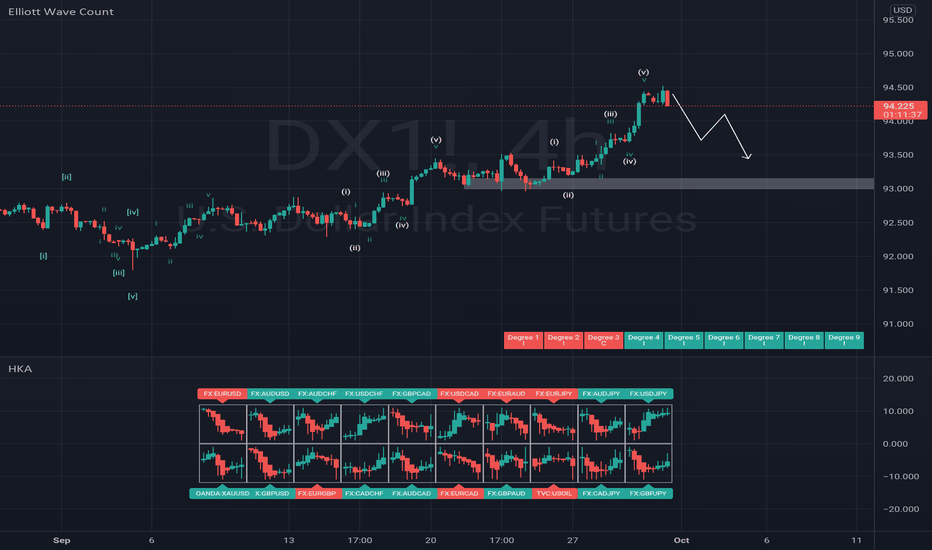

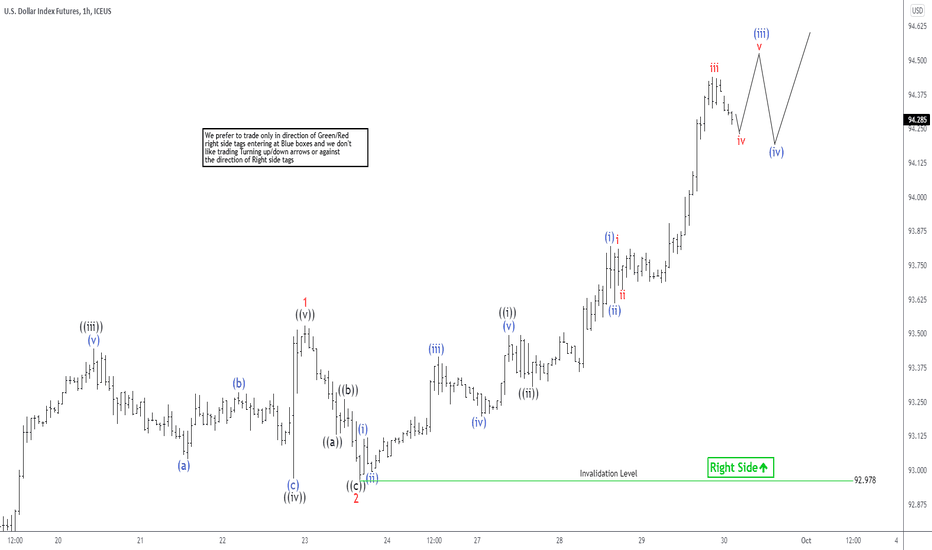

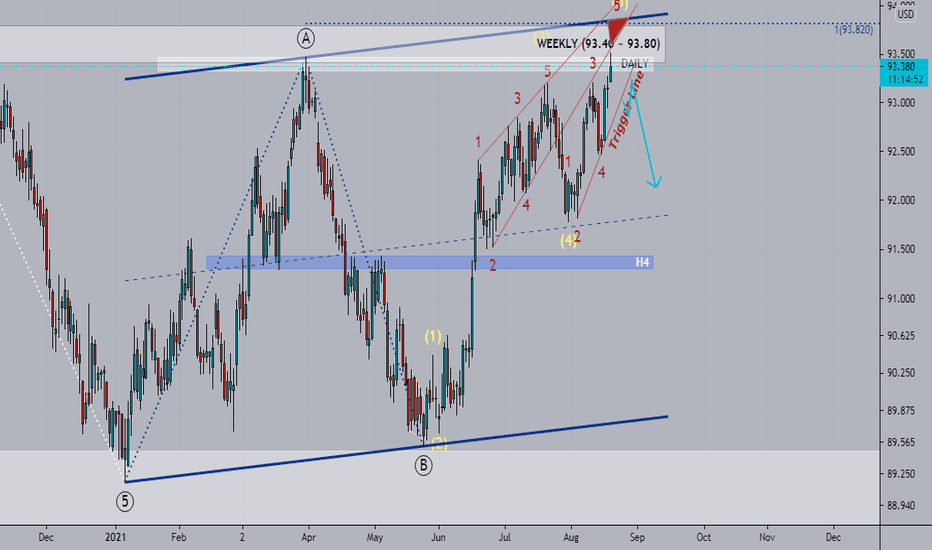

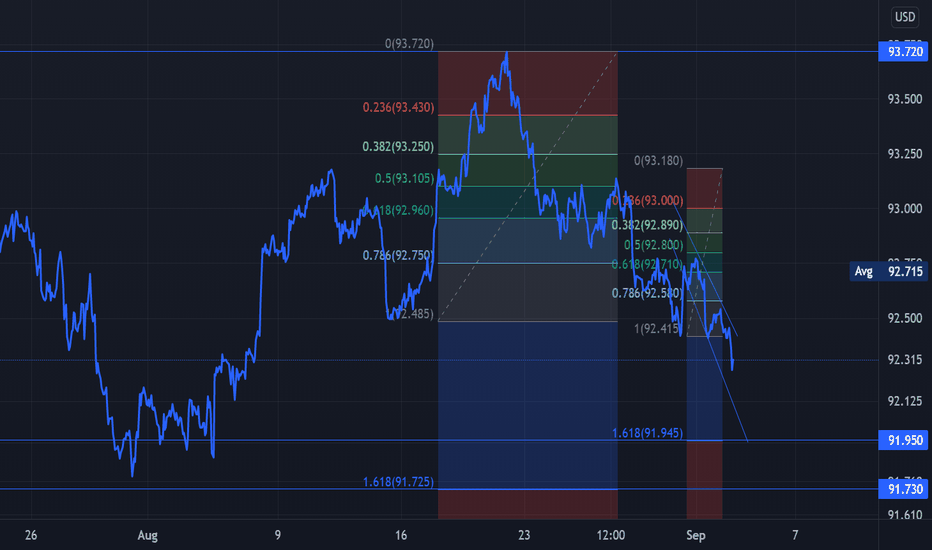

Elliott Wave View: Further Strength in US Dollar Index (DXY)Short Term view in US Dollar Index (DXY) suggests the rally from Sept 3, 2021 low is unfolding as a 5 waves impulse Elliott Wave structure. Up from Sept 3, wave ((i)) ended at 92.8, dips in wave ((ii)) ended at 92.32. Index resumes higher in wave ((iii)) to 93.45, pullback in wave ((iv)) ended at 93. The Dollar Index then completed wave ((v)) at 93.52 which should also end wave 1 in higher degree. Pullback in wave 2 ended at 92.98 with internal subdivision as a zigzag. Down from wave 1, wave ((a)) ended at 93.14, wave ((b)) ended at 93.25, and wave ((c)) ended at 92.98.

Index has resumed higher in wave 3. Up from wave 2, wave (1) ended at 93.12 and pullback in wave (2) ended at 93. Index resumes higher in wave (iii) towards 93.42, and pullback in wave (iv) ended at 93.2. Final leg higher wave (v) of ((i)) ended at 93.49. Pullback in wave ((ii)) has also ended at 93.3 and Index has resumed higher again. Up from wave ((ii)), wave (i) ended at 93.8 and pullback in wave (ii) ended at 93.6. Near term, as far as September 23 pivot low at 93 remains intact, expect pullback to find support in 3, 7, or 11 swing for further upside. Potential target higher is 100% – 161.8% fibonacci extension from September 3 low towards 94.56 – 95.55.

DXY index. Are we waiting for the breakout of the zone 94.28-95?Why is this zone important? In 2018, after breaking through this zone, a crisis began in the financial markets. SNP500 went into 20% correction within 3 months. Will history repeat itself this week? No, it took 18 weeks for the DXY index to break through this zone and gain a foothold above it in 2018. It turns out there is a possibility of getting a correction at the beginning of next 2021.

DX - @ Bottom of RangeA predicted 3% fall in the US Dollar during 2021, was incorrect and met with a Global

default denomination of +3.5%.

The 7.5% swing and miss in Sum.

In the world of currency values and major financial institution predictions - Missing

the Mark by the largest Margin in predictive assumptions is no small feat.

This never happens and yet it did happen.

Fears of the recovery in China, Japan, Australia, and the UK in terms of manufacturing

and durable goods corporate performance - failed to meet expectations.

China began to restructure Trade.

Japan turned inward continuing the largest build in Defense before World War 2.

Australia went full mental with Covid restrictions, closing off its Economy.

The UK further removed ties to the European Union with Bre-Exit advancing from

February to June.

Coffin Nails were abundant, their hammering continues.

DXY Dollar Index Losing Momentum $90.45This is your tarot chart reading per event.

DXY is the most important highlight to watch for all marketeers and traders. DXY is normally to calculate the relative between other currencies and some commodities.

1st rebound is on 7th January 2021

2nd rebound is on 1st June 2021

DXY is good performer when it comes out with stimulus projection or stimulus release.

This year 2021 pattern took some major constructive pattern.

January to March = strengthen

March to June = weaken

June to Sep = strengthen

Thus, we can expected Q4 the US dollar index will be weaken. As clearly shown that the pattern development on the current constructive pattern is losing.

The steam of strengthening losing it's momentum as the stimulus of injection dollar to the market gained less traction control.

Based on my calculation, there will be no more upscale towards the dollar projection.

Q4 is coming and the all indices will be going into depression.

Thus, I am predicting the dollar will hit the value of $90.45 starting next week course developing trend.

Zezu Zaza

2048

DX - Dollars Expanding Range 8950 - 9750Inflation Trades, Transitory Trades, Cleanest Dirty Blouse Trades

FX is setting up for a Primal Accident.

It remains the largest Intra-Day Market as Liquidity begins to abate

within the DX Complex.

The 6 pairs remain in FLUX, heavily so waiting on the DX to make it's

larger move.

With so many Macro and Geopolitical influences hip sway within

Foreign Exchange... it remains one enormous mess.

The 6e is likely the most damaged, although it's held up well, the

ECB continues to Provide Blunder after Policy Blunder. Negative Rates

were the final call, we are simply waiting for the disaster there to

unfold in the coming months. The ECB has provided more utterances

as to the direction and goals of their Basket Case.

Coppertone Goddess LeGarde's persistence in installing a Digital

"Currency" (Not a Currency in any manner, form, way) within the

Block has repeatedly been stymied... The intent is clear, the implementation

has been difficult as The Great Experiment was doomed to fail day

one. Monetary Unions which fail to aggregate Debts, Fail. Period,

the end.

We are simply waiting on the tempest to blow the teapots lid clean

off.

The GBP, London's Financial Center trembles at the thought of

how this transition will impact the imbalances. The Soft Exit

isn't quite working as planned.

The UK left the European Union's sordid mess and left 27 countries -

bringing to an end 47 years of British membership of the EU and

prior institutions. It was a slow and arduous divorce, one that

created immense volatility on the path of separation.

The actual effects did not begin to manifest themselves until

January 1, 2021 when the actual split began to take shape.

Northern Ireland, per usual, received the short end of the stick.

Nascent ties to the EU remained and with it, further anger,

dismay and despair.

Another version of the Potato Famine, brought to you by

the Technocrats with a number of regulations on Food.

Further restrictions on Travel, Residency and Third Party

Trade... did not fare well. Riots resulted.

These arsonists are always a day late, it adds to anger.

The UK, in sum, fundamentally withdrew from the collection

of Dunces to reposition it's Financial arrangements with

China, albeit slowly, but they are large supporters of

China's Bond Market.

It's complicated, but obvious as to why the UK began to

absolve themselves of these tenuous arrangements.

Northern Ireland was "Backstopped", or double bond

as we prefer with a 4 year screwing aligned with the

idiocy of Plutocracy that is the EU.

The AUZ, NZD and CANDO are simply along for the ride.

Degenerate outposts of the UK's progressive Policies

towards future arrangements.

A colossal experiment gone wrong shining ever so brightly

in the light of day. No shame, simply far more draconian

with each passing day.

JBG's are wholly owned in the Land of the setting Sun.

The vast majority of NIK225 Equities are wholly owned

by the same degenerate failures of JCB Policies for 3+

decades.

Idiocy which has never functionally changed anything

but served to worsen a sink hole.

This leaves the Dollar, the abused stepchild of Bretton

Woods. a Currency which has suffered one default when

French Warships entered New York Harbor to retrieve

the People's Gold. De Gaulle had enough and on collecting

France's Tier one assets... Monetary decentralization led

to France's attempt at decentralization and further

attempts at Nationalism.

Unfortunately, the winds of change were blowing in the

opposite direction and... you know the rest.

Uncle Buck's extraordinary privileges' were eroded over time.

Money from nothing became the Rule of Monetary Law. It began

with small footsteps, on the Journey of one thousand miles

to today.

How this all shakes out will be telling as the new monetary

order is arriving... Currency Wars lead to Trade Wars which

lead to Shooting Wars.

This is the History of it, it is always the same.

Digital Script requires a rearranging of the Deck Chairs, this

will unfold in the most violent of fashion.

Best to prepare for it, The liability side of the Balance Sheet

cannot be serviced.

It's best to eliminate them...

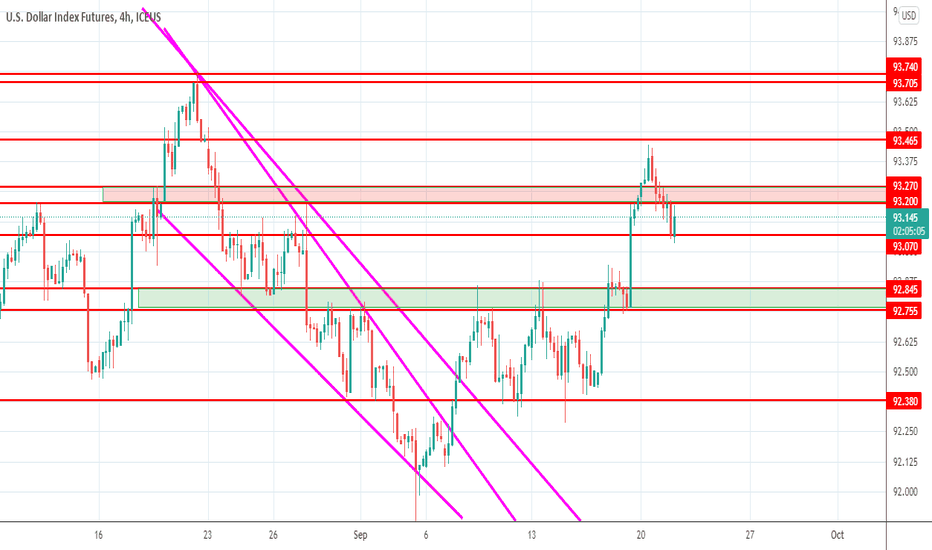

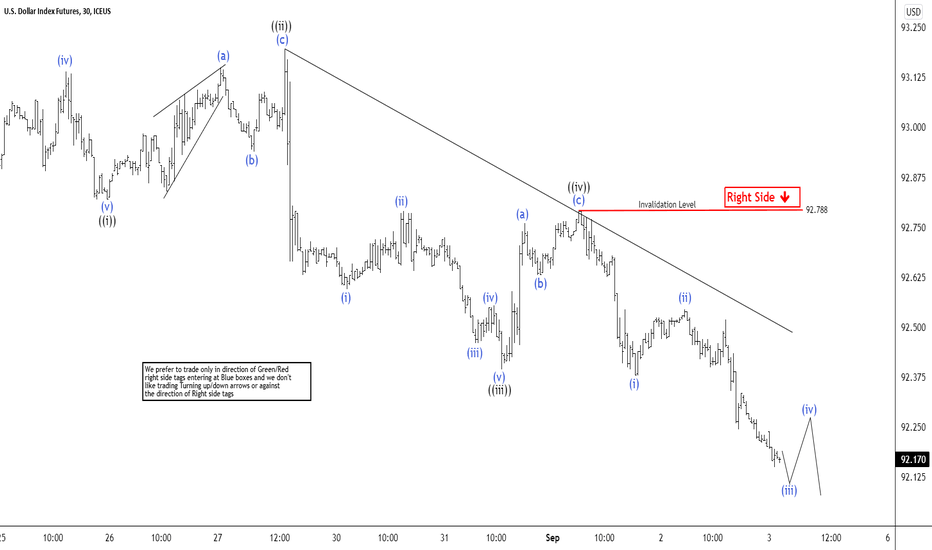

Elliott Wave View: Dollar Index Ending 5 WavesShort-term Elliott wave view in Dollar Index (DXY) suggests the decline from August 20 high is in progress as a 5 waves impulse Elliott Wave structure. Down from August 20 high, wave ((i)) ended at 92.80 and rally in wave ((ii)) ended at 93.18. Internal subdivision of wave ((ii)) unfolded as a zigzag. Wave (a) ended at 93.13, wave (b) ended at 92.93, and wave (c) ended at 93.18. The Index resumes lower in wave ((iii)) towards 92.4 in 5 waves of lesser degree. Down from wave ((ii)), wave (i) ended at 92.6 and rally in wave (ii) ended at 92.78. Index then resumes lower in wave (iii) towards 92.46, rally in wave (iv) ended at 92.55, and final leg lower wave (v) ended at 92.4.

Rally in wave ((iv)) ended at 92.78 and the Index has resumed lower. Down from wave ((iv)), wave (i) ended at 92.37 and rally in wave (ii) ended at 92.53. Expect wave (iii) to end soon, and the Index should rally in wave (iv) before turning lower again. Near term, as far as pivot at 92.78 high remains intact, expect rally to fail in 3, 7, or 11 swing for further downside.

DX - Whom DO You TRUSTGlobally, our nation has appeared as a Fruit Basket for some time to G7/G20

Members.

Afghanistan is simply a reminder.

A war which has waged on since forever...

Initially, we covertly funded Rebels against the Soviet incursions.

I've been the Soviet War Museum in Volgograd. It's as depressing as it gets

for Russians who fought their version of Nam.

Stingers to Hinds... death littered the landscape.

After Trillions of Dollars spent in this region, and hundreds of Billions in

Weapons left behind... our Tax Dollars spent are clearly coming into

question and it is a welcome discussion.

Wasted.

It's as though, Benghazi has re-appeared once again to re-arm the enemy

or so it would appear.

The Pullout, by most metrics was handled, poorly.

Our former partners around the Globe are reluctant to respond any longer.

They have watched for years... the United States devolve into a parasitic

Kleptocracy and "they" want no part of it.

The Deck Chairs began the collective re-arrangement some time ago.

And now, here we are... on the cliff's edge.

We are no longer "Trusted" to do the proper, correct and moral effort(s).

This continues to unfold as the DX accident approaches.

The Chart illustrates where the DX is heading shorter term, it's what follows

that should be of concern,