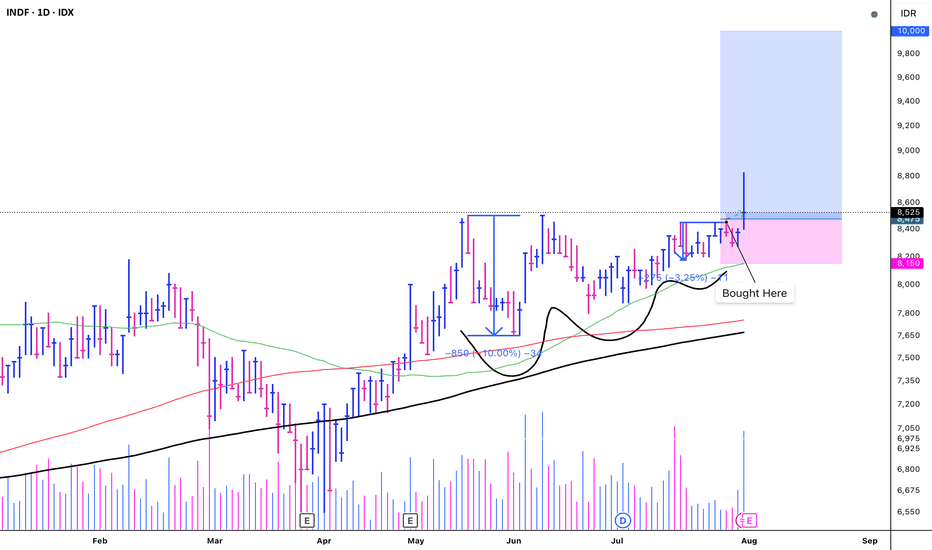

INDF - VCP (13W 10/3 3T)IDX:INDF - VCP

+)

1. Low risk entry point on a pivot level.

2. Volume dries up.

3. Price has been above the MA 50 > 150 > 200

4. Price is within 25% of its 52-week high.

5. Price is over 25% of its 52-week low.

6. The 200-day MA has been trending upwards for over a month.

7. The RS Rating is above 70 (71).

EPS Growth:

a. Quarterly QoQ: -

b. Quarterly YoY: +11.20%.

c. TTM YoY: +32.14%.

d. Annual YoY: +6.07%.

(-)

1. There is no significant breakout with substantial volume.

INDF trade ideas

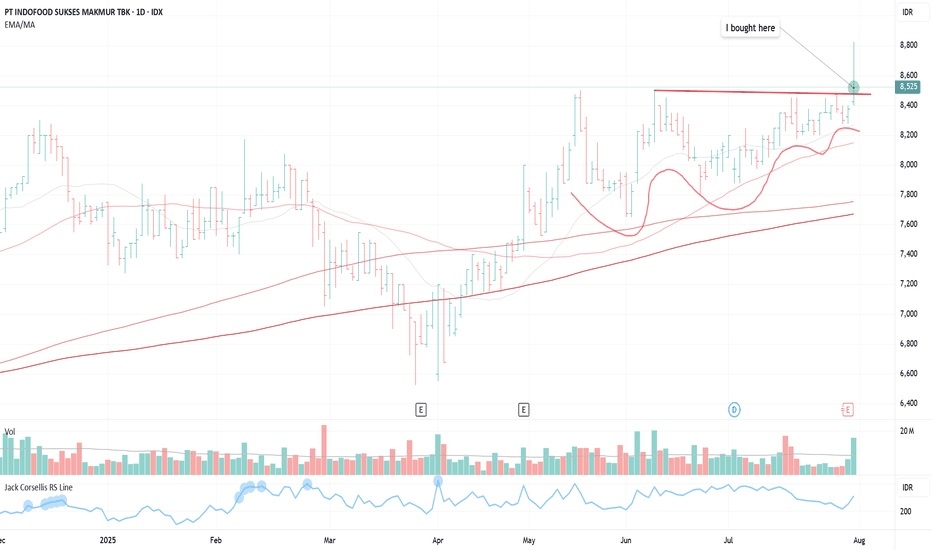

$INDF (VCP - 10W 10/3 4T)Position update: July 31, 2025.

Key factors:

1. Confirmed stage 2 uptrend.

2. A textbook Volatility Contraction Pattern (VCP) with a clearly defined, low-risk entry point.

3. Price action moves in the opposite direction of the declining general market.

4. The stock moves on its own drummer, rallying 30% to a new 52-week high, while the broader market declined 14%.

5. Volume has dried up, indicating less supply coming to the market.

6. Significant volume expansion on the breakout.

Considerations:

1. The percentage of stocks trading above their 200-day moving average stands at 51%—a positive sign and a strong indication of a potential bull market campaign.

2.Despite the technical strength, the stock squatted into the close, signaling potential weakness in the breakout. Risk should be managed carefully with appropriate stop-loss placement.

This represents a quintessential VCP breakout, offering a clean pivot entry with minimal risk. I’m seeing improved traction in my personal trades and have accordingly increased my position sizing at this stage.

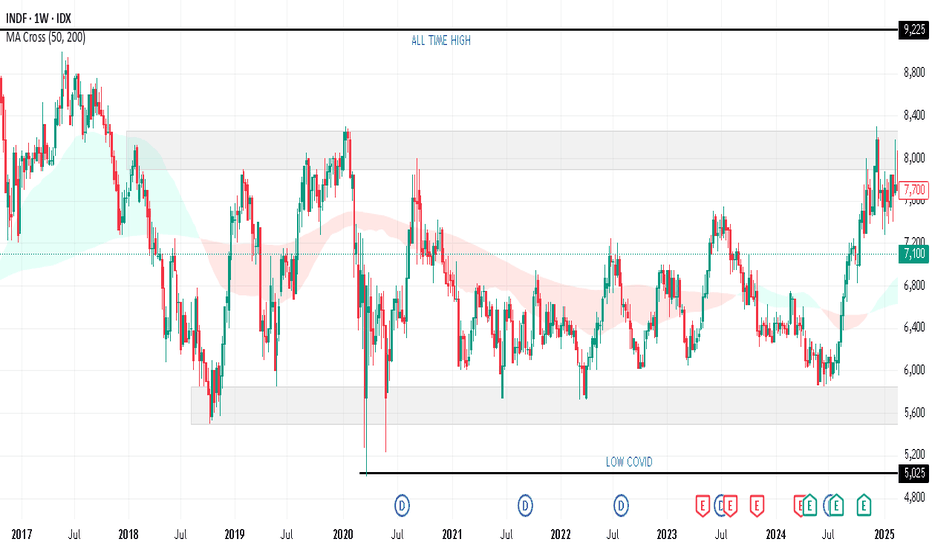

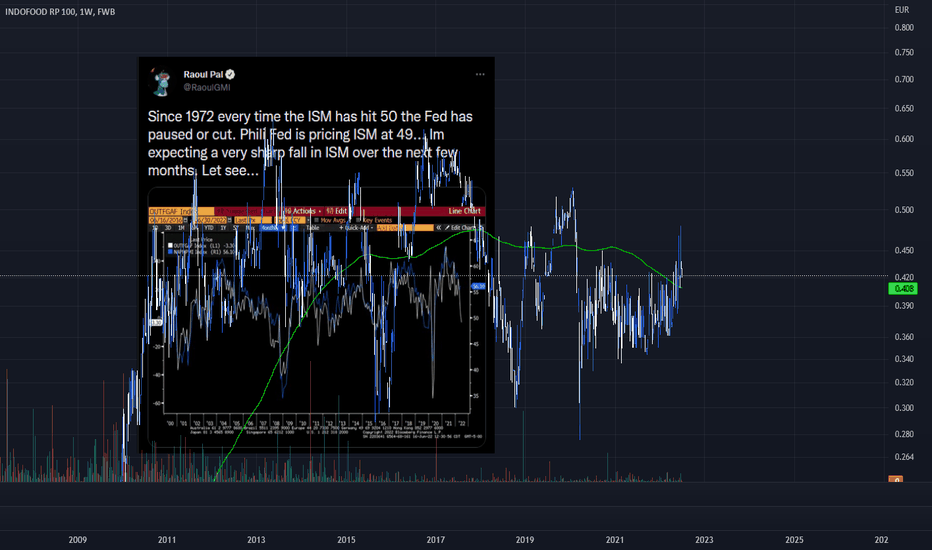

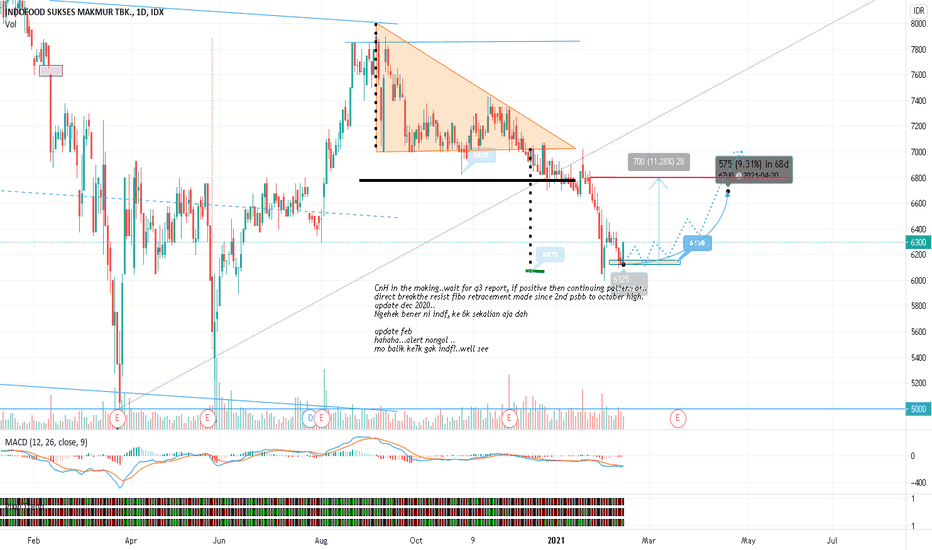

Raoul Pal say money printer will go BRR when the ISM hits 50I have set alerts for this

The ISM manufacturing index or purchasing managers' index is considered a key indicator of the state of the U.S. economy. It indicates the level of demand for products by measuring the amount of ordering activity at the nation's factories.

people are going to stop buying cars, stop spending money and demand will stop.

Suppliers have been increasing supply and a bullwhip will occur during high inflation

Recession is likely

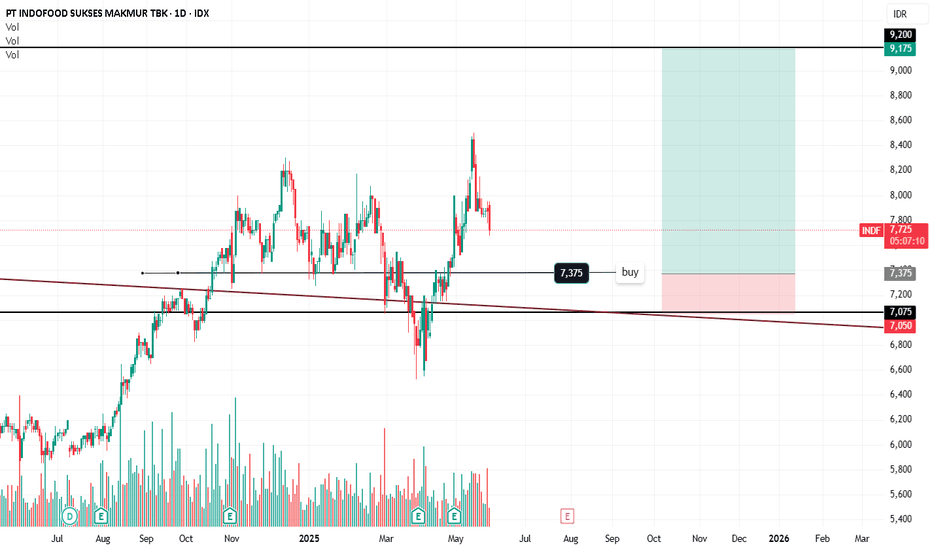

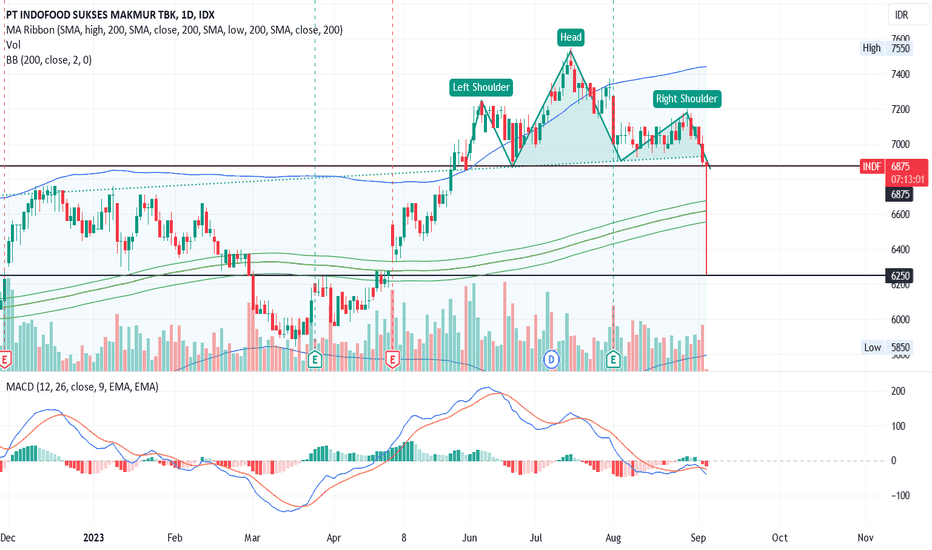

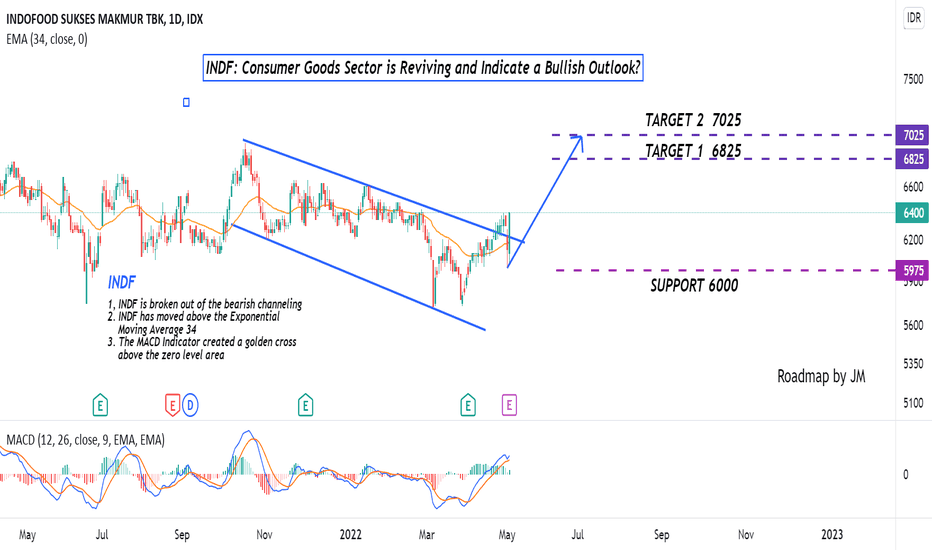

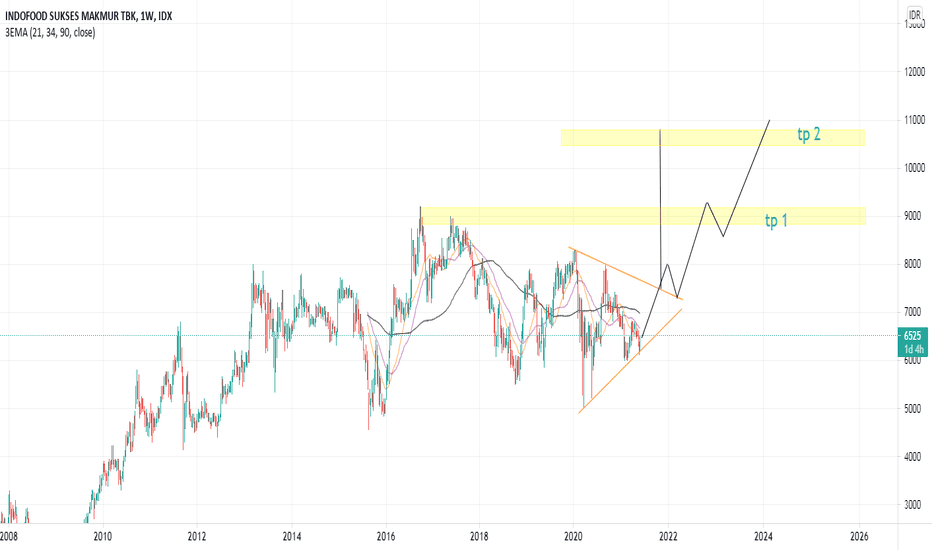

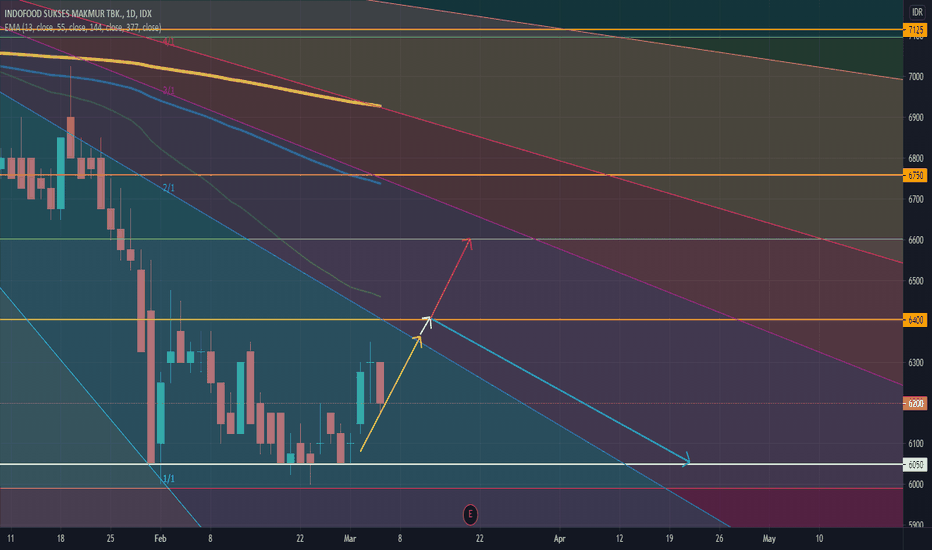

INDF: Consumer Good Sector is Reviving, a Bullish Outlook ahead?Hello Stock Market Enthusiast! Here's the Long-term outlook for INDF, Support the Channel by smashing the FOLLOW and LIKES Button, then Share your opinion in the Comment Section below :)

INDF is broken out of the descending broadening wedge pattern. The golden cross signifies a potential bullish movement ahead on INDF, potentially to the target area.

The explanation is already presented in the chart.

The roadmap will be invalid after reaching the support/target level.

Disclaimer: The outlook is only used for Educational Purposes, The Creator doesn't responsible for any of your trade position or other financial decisions*

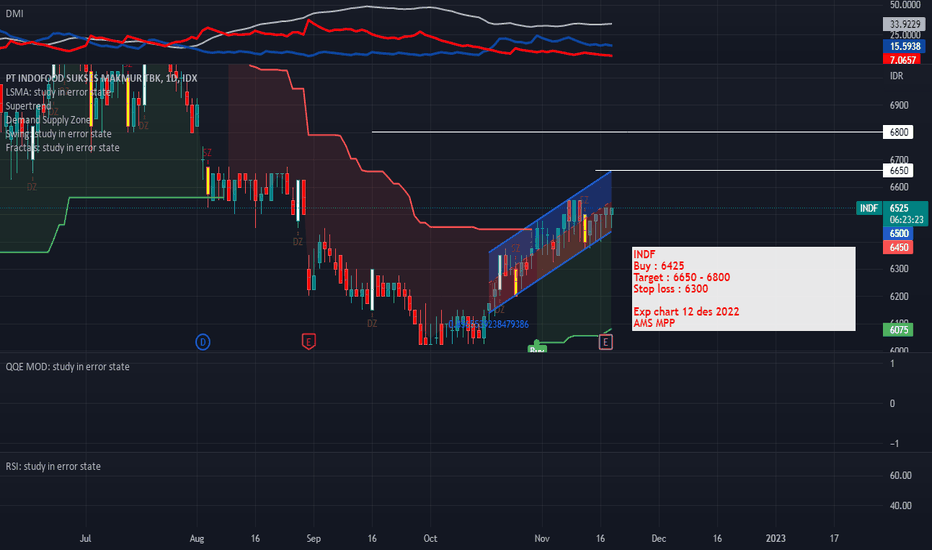

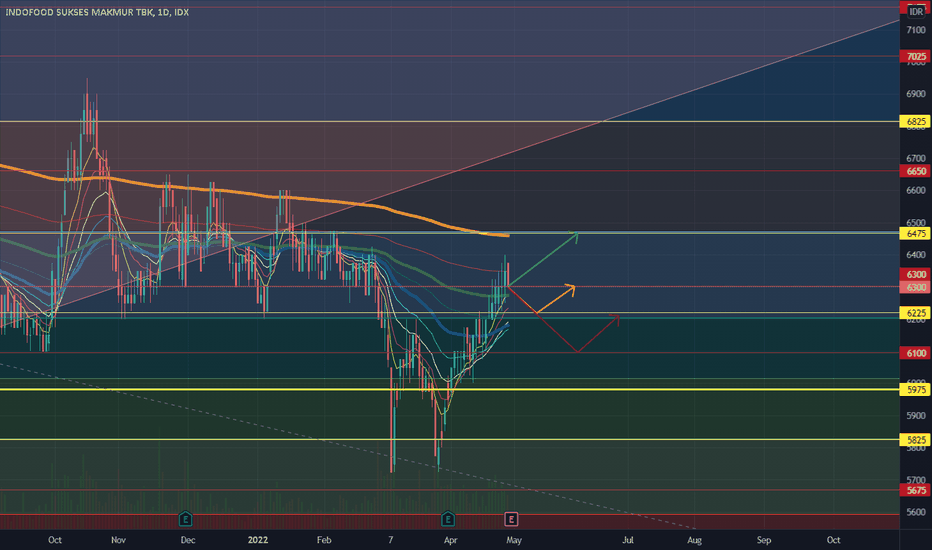

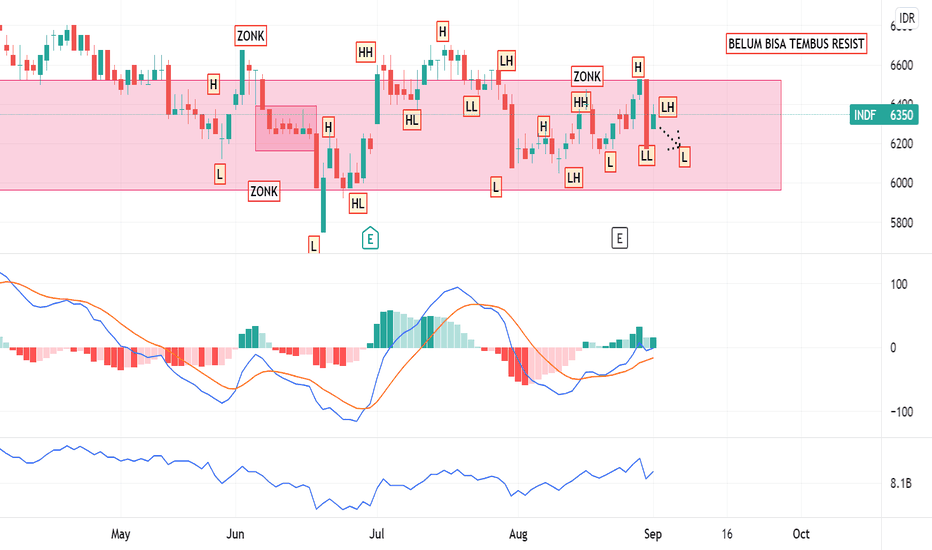

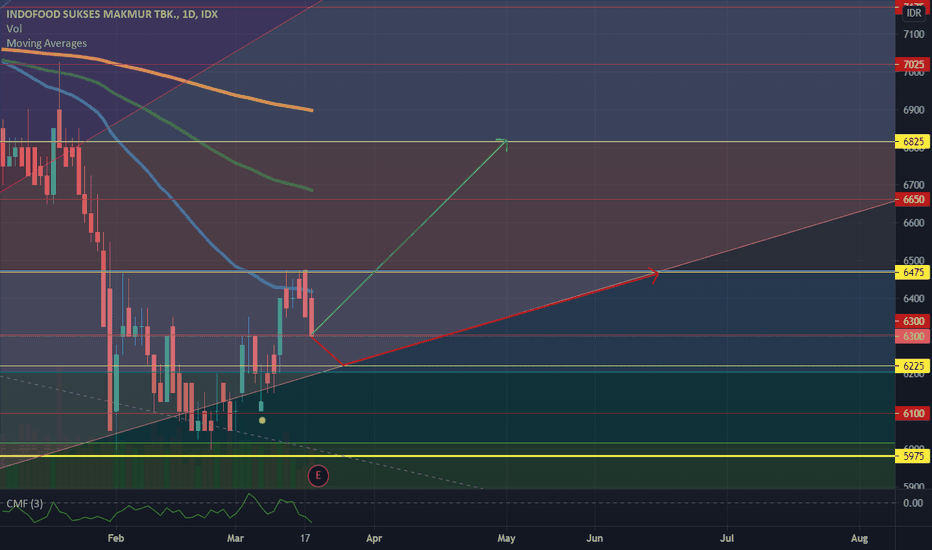

IDX: INDF FOR MAY 2022weak support at 6300

medium resistance at 6475

I Prefer green trading plan

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

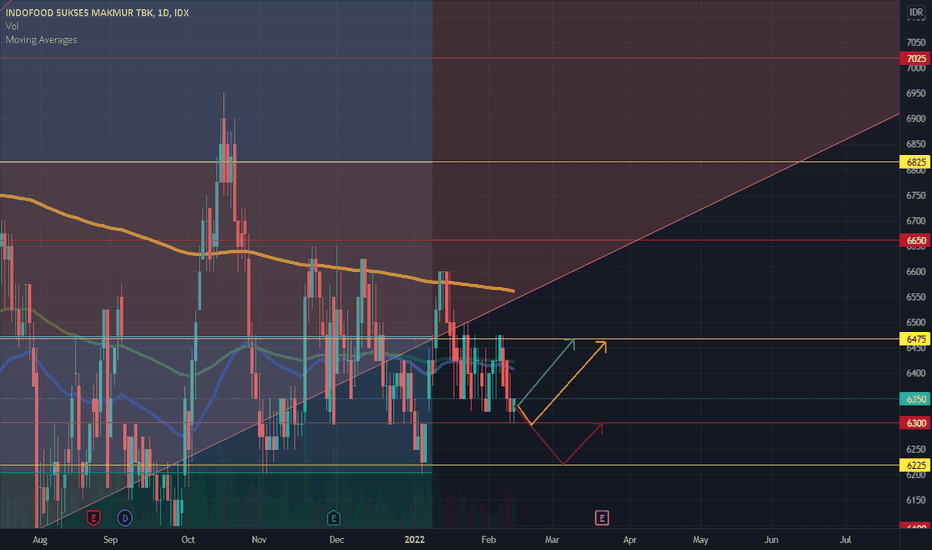

IDX: INDF FOR NEXT WEEK 14-18 FEB 2022weak support at 6300

Medium resistance at 6475

I Prefer green trading plan

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

IDX: INDF FOR NEXT WEEK 06-10 DEC 2021MEDIUM RESISTANCE AT 6475

WEAK SUPPORT AT 6300

I PREFER YELLOW TRADING PLAN

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

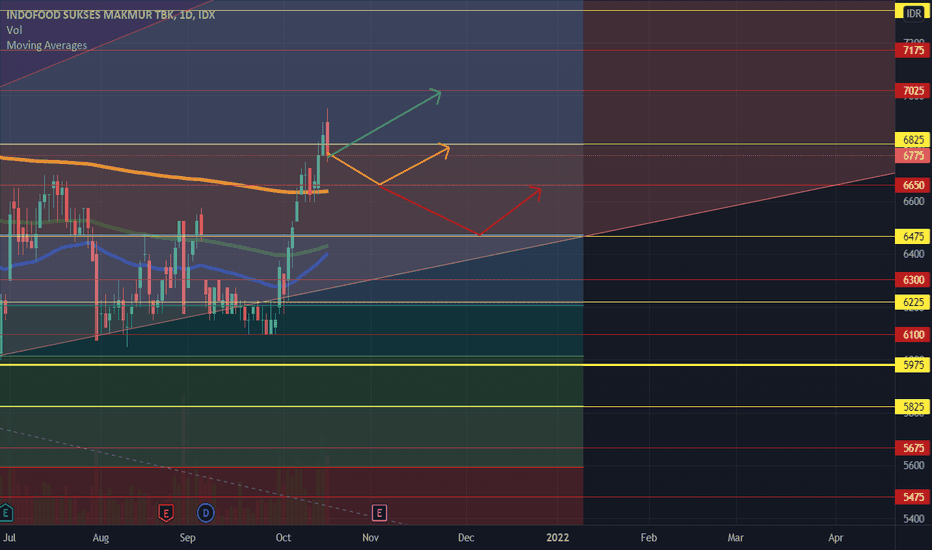

IDX: INDF FOR NEXT WEEK 18 - 22 OCT 21MEDIUM RESISTANCE AT 6825

WEAK SUPPORT 6650

I PREFER YELLOW TRADING PLAN

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

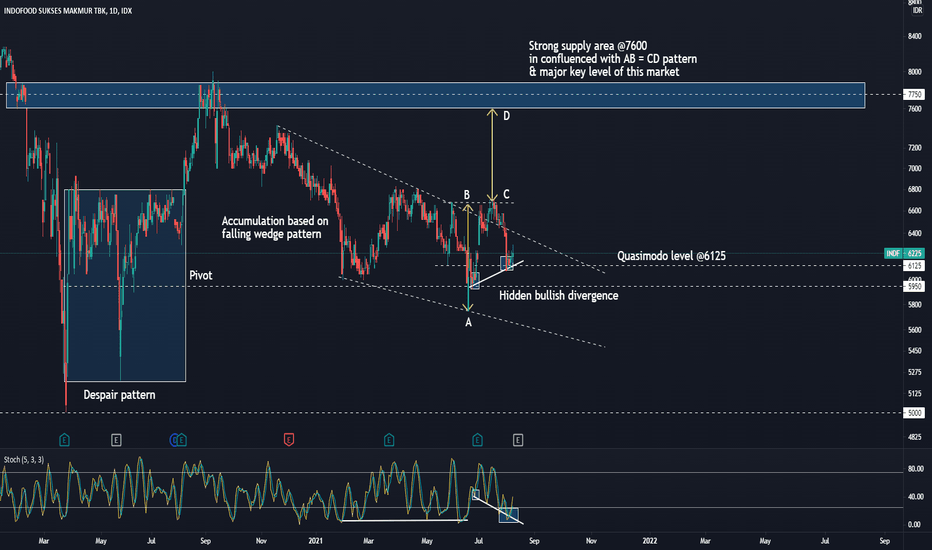

Bullish Bias on INDFI got an idea of this market since we could see a long accumulation based on falling wedge pattern and others confluence that we have. 6700 would be a sweet spot target based on several reason from the chart. Buy on weakness should be your consideration and 5600 would be an invalidation value

IDX: INDF CLOSE AT CRITICAL POINTWeak support at 6300

medium suport at 6225

medium resistance at 6475

market close at 6300. this is critical point. some how , if market go up, green trading plan will be delicius.

I prefer red trading plan

have a nice trading.

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

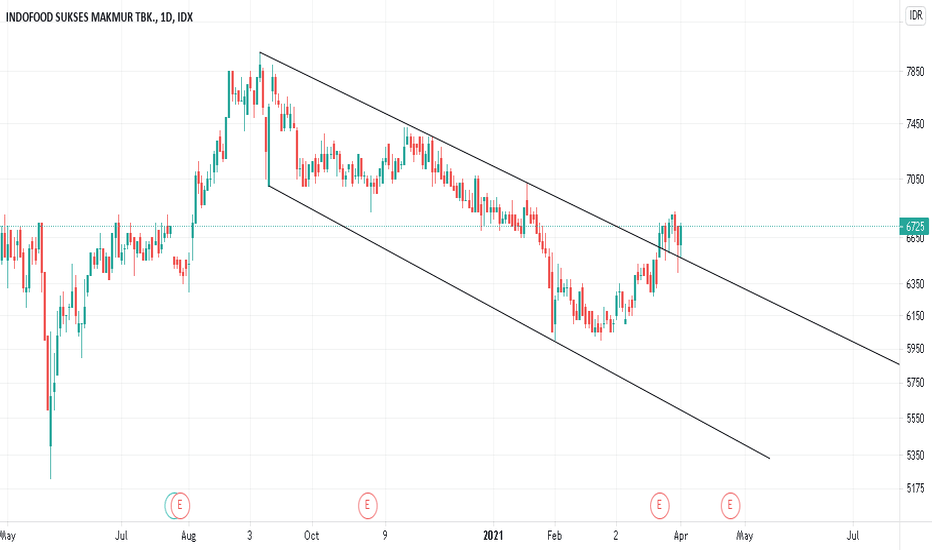

-4 march 2021 trading analysis INDF-4 march 2021

trading analysis INDF

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

long possition because rebound from strong support 6050 and go to next resistane 6400

let's see

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

good luck, and happy profit

see you for next update

#keep learning bakkarianz metode