DOW trade ideas

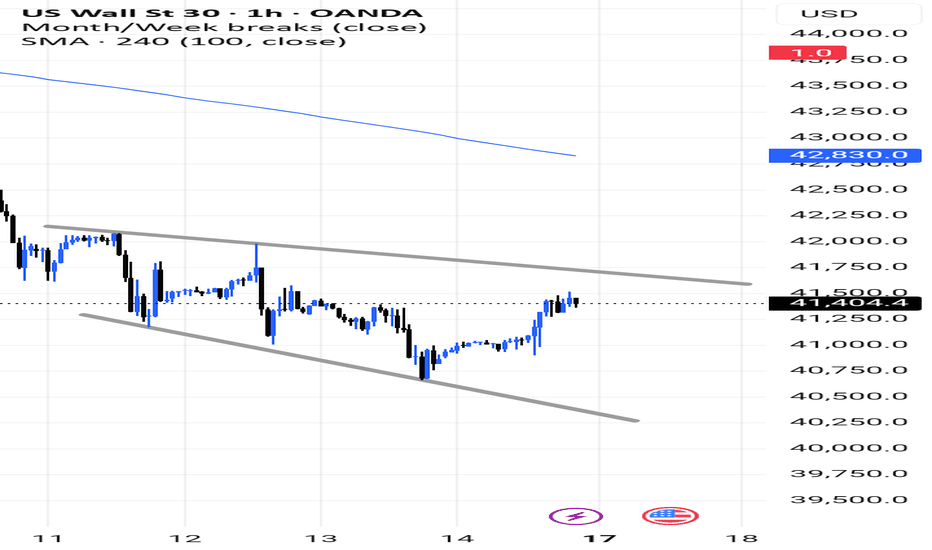

US30 Falling Wedge Breakout Setup – Bullish Momentum Building?📊 US30 (Dow Jones) Falling Wedge | Bullish Breakout Incoming? 🚀

🔍 Chart Analysis:

US30 is currently trading within a falling wedge pattern on the 1-hour timeframe. This formation typically signals a potential bullish breakout as selling pressure weakens.

📈 Key Levels to Watch:

✅ Breakout Zone: ~41,600 (upper wedge resistance)

✅ Next Resistance: 42,830 (100 SMA on 4H timeframe)

✅ Support: 40,800 (lower wedge support)

🎯 Trade Idea:

A confirmed breakout above 41,600 with strong volume could push price toward 42,830 and beyond.

Failure to break out may result in further consolidation within the wedge before a breakout attempt.

📢 What’s Your Take?

Do you see a breakout happening soon, or will US30 remain stuck in this wedge a bit longer? Drop your thoughts in the comments!

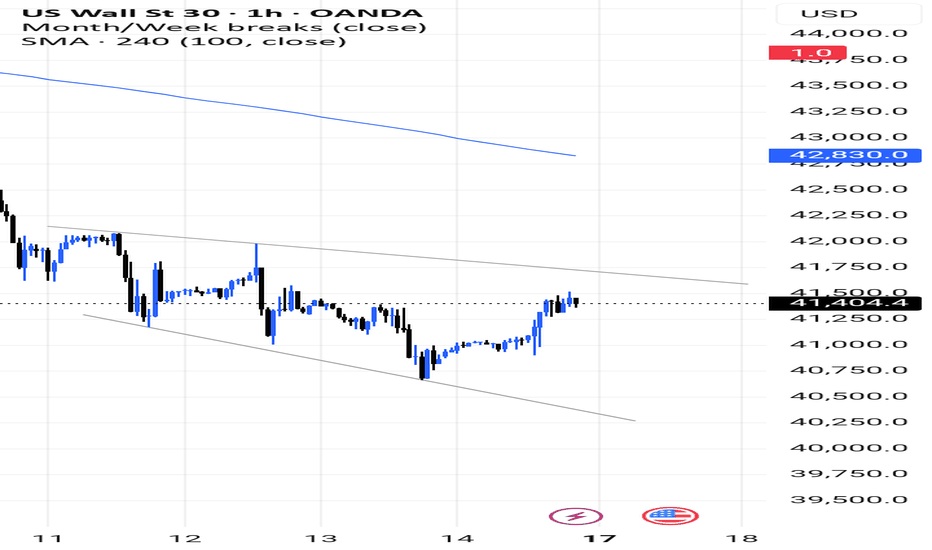

US30 Falling Wedge Breakout Setup – Bullish Momentum Building?📊 US30 (Dow Jones) Falling Wedge | Bullish Breakout Incoming? 🚀

🔍 Chart Analysis:

US30 is currently trading within a falling wedge pattern on the 1-hour timeframe. This formation typically signals a potential bullish breakout as selling pressure weakens.

📈 Key Levels to Watch:

✅ Breakout Zone: ~41,600 (upper wedge resistance)

✅ Next Resistance: 42,830 (100 SMA on 4H timeframe)

✅ Support: 40,800 (lower wedge support)

🎯 Trade Idea:

A confirmed breakout above 41,600 with strong volume could push price toward 42,830 and beyond.

Failure to break out may result in further consolidation within the wedge before a breakout attempt.

📢 What’s Your Take?

Do you see a breakout happening soon, or will US30 remain stuck in this wedge a bit longer? Drop your thoughts in the comments!

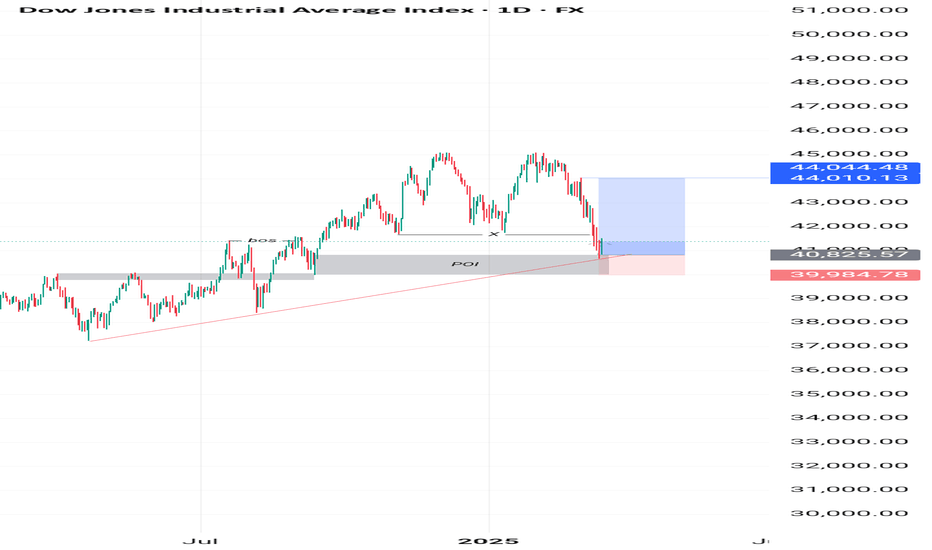

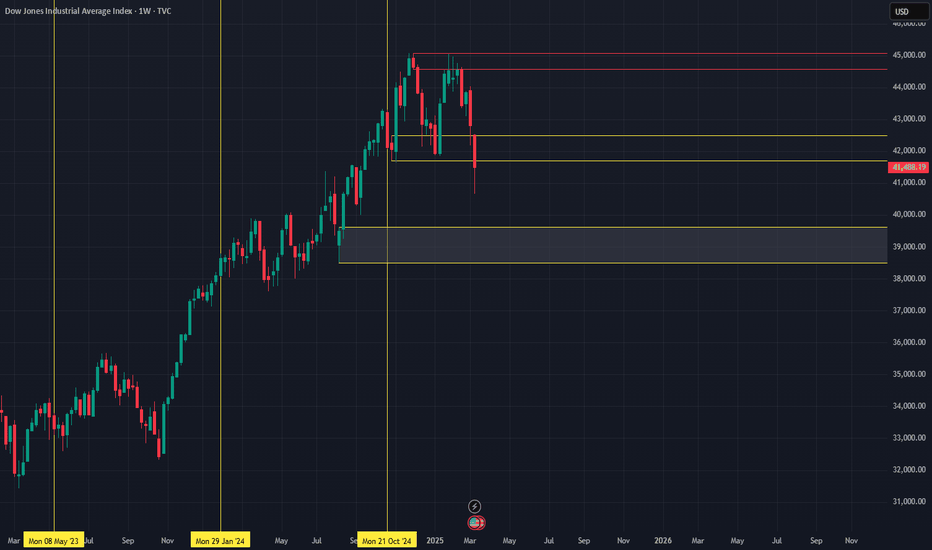

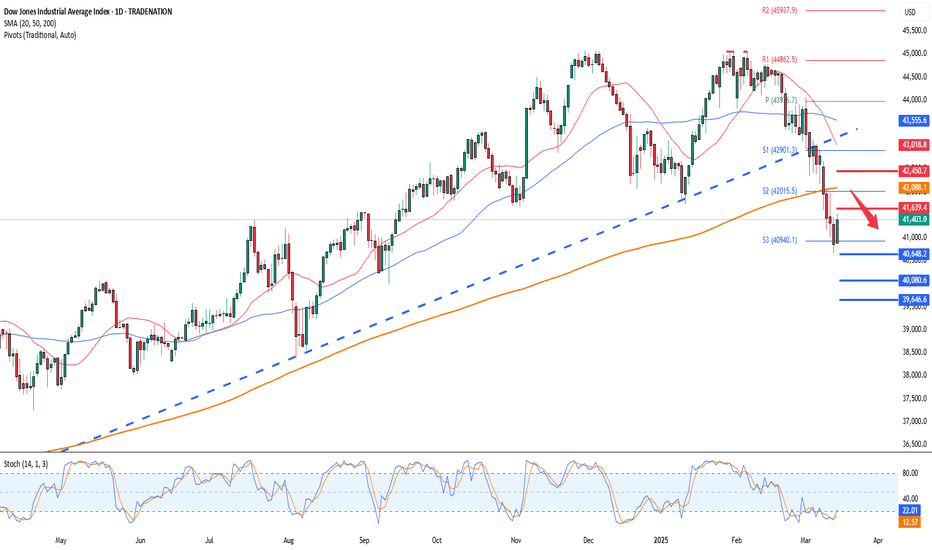

Dow JonesDOW JONES SPOT PRICE

MTF Analysis Price Time Frame Trend

Dow JonesYearly Demand 37,779 HTF UP

Dow Jones 6 Month Demand 36,952 HTF UP

Dow JonesQtrly Demand BUFL 40,077 HTF UP

38,269

Dow JonesMonthly Demand 40,077 MTF Down

Dow JonesWeekly Demand 39,628 MTF Down

Dow JonesDaily Demand DMIP 40,077 MTF Down

39,927

Dow Jones 240 M 39,027 LTF Down

Dow Jones 180 M 38,704 LTF Down

Dow Jones 120 M LTF Down

Dow Jones 60 M LTF Down

38,866

39,021

ENTRY -1 Long 39,628

SL 39,021

RISK 607

Target as per Entry 44,575

RR 8

Last High 44,575

Last Low 37,612

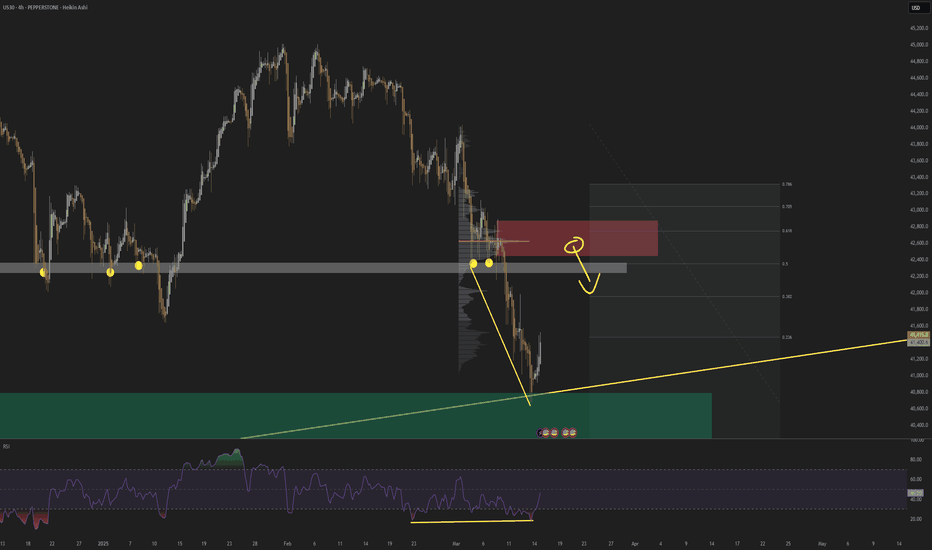

US30; Heikin Ashi Trade IdeaPEPPERSTONE:US30

In this video, I’ll be sharing my analysis of US30, using my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

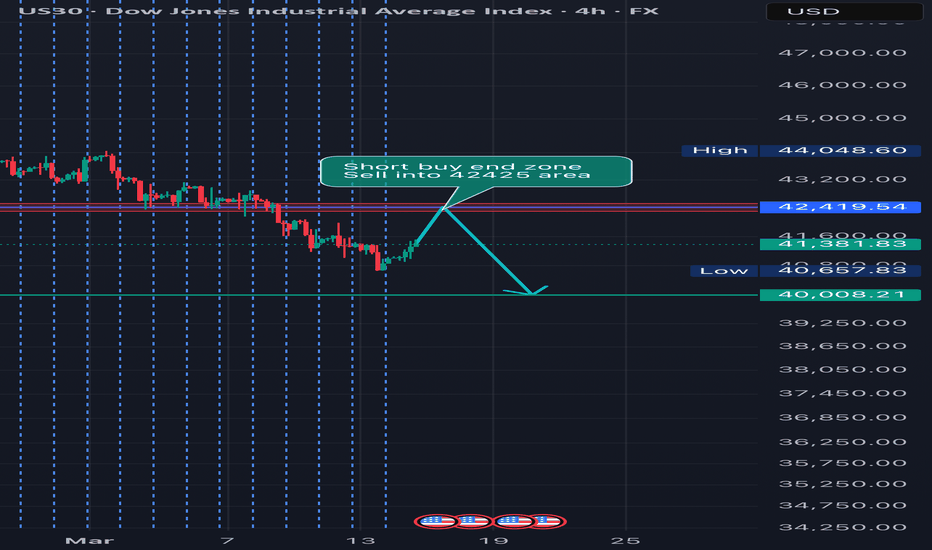

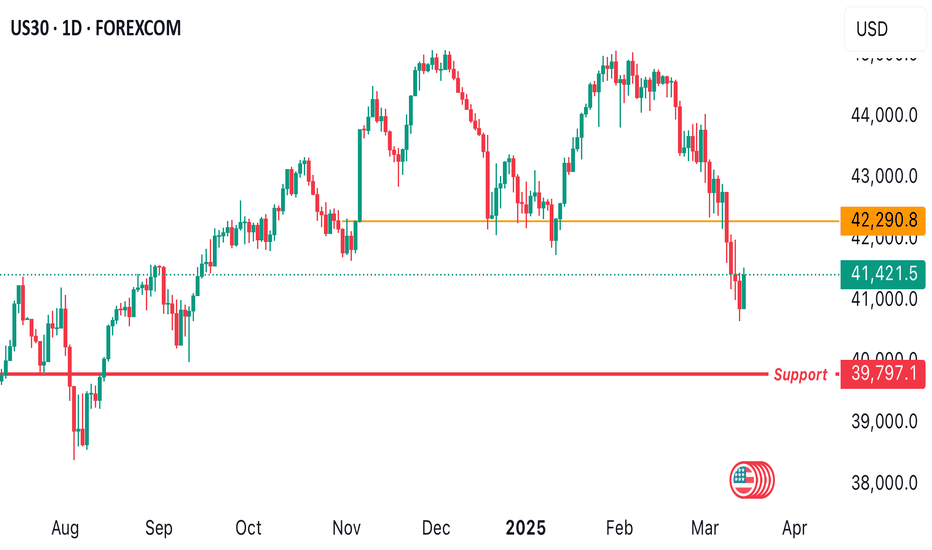

US30 BULLS WILL DOMINATE THE MARKET|LONG

US30 SIGNAL

Trade Direction: long

Entry Level: 41,378.4

Target Level: 43,046.4

Stop Loss: 40,263.5

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

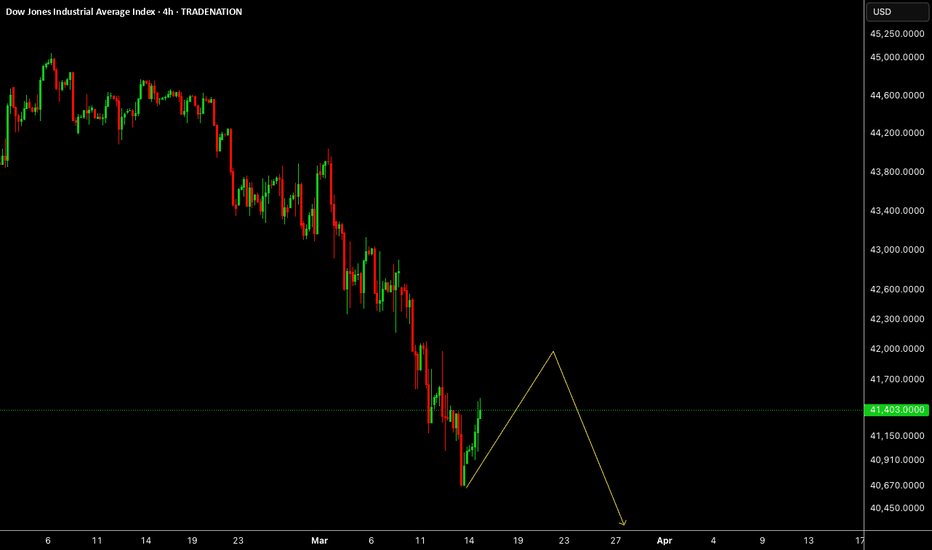

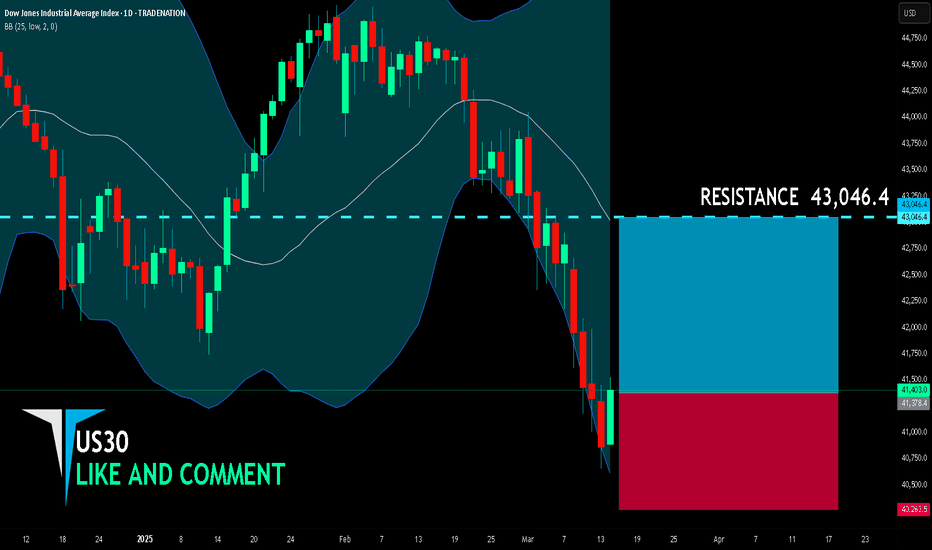

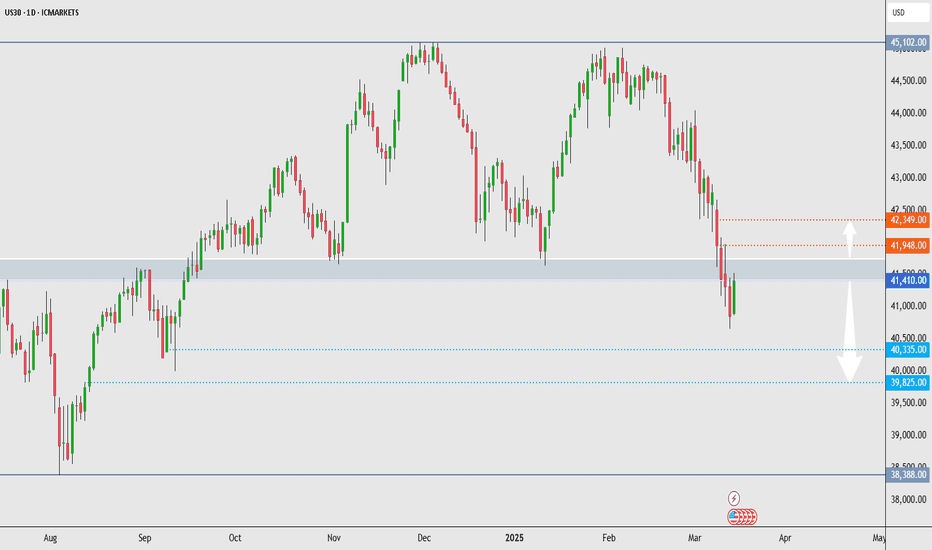

US3O 4H #DOWJONES – Key Levels & Trade Setups

🔻 Sell Setup: If price fails to hold above resistance, targeting 39400.

🔹 Risky Buy: If no lower low forms, possible buy with reduced size.

🚀 Bullish Confirmation: Break & retest of 41760 activates 42800 → 43000 → 44300.

⚡ Market conditions favor quick reactions—stay sharp!

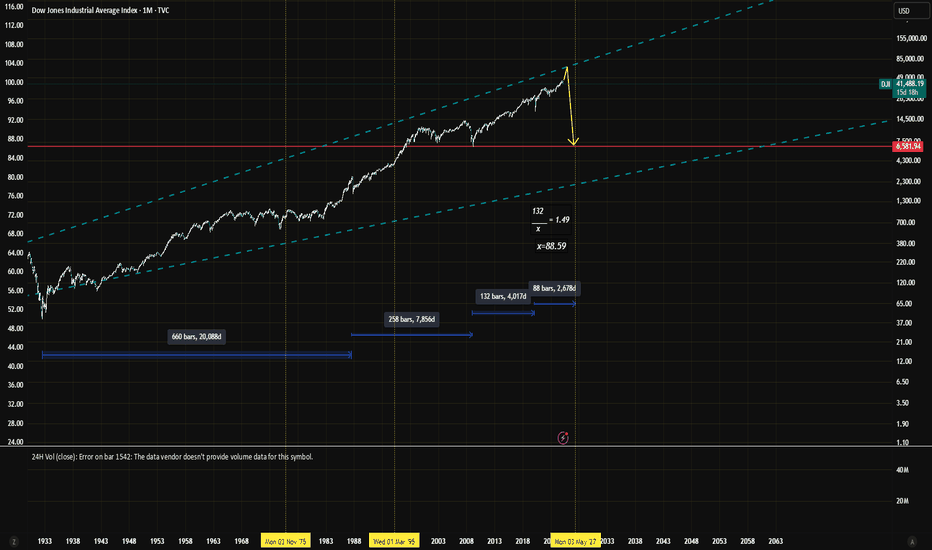

Major Correction $DJI 2027Using previous dates of major market corrections to try and determine the next market correction (crash). Using major crashes I concluded the amount of bars it took from one correction to the next, and created a regression equation to conclude the next predicted market crash.

660/258 = 2.55

258/132 = 1.95

132/x = x

2.55

1.95

≈0.7647

1.95×0.7647≈1.49

132/x = 1.49

x≈88.59

x= 88 Bars +-1

= Monday May 3rd 2027

This is just an idea, does not hold much weight, just thought I would publish to keep a record of my idea.

appreciate any thoughts or comments.

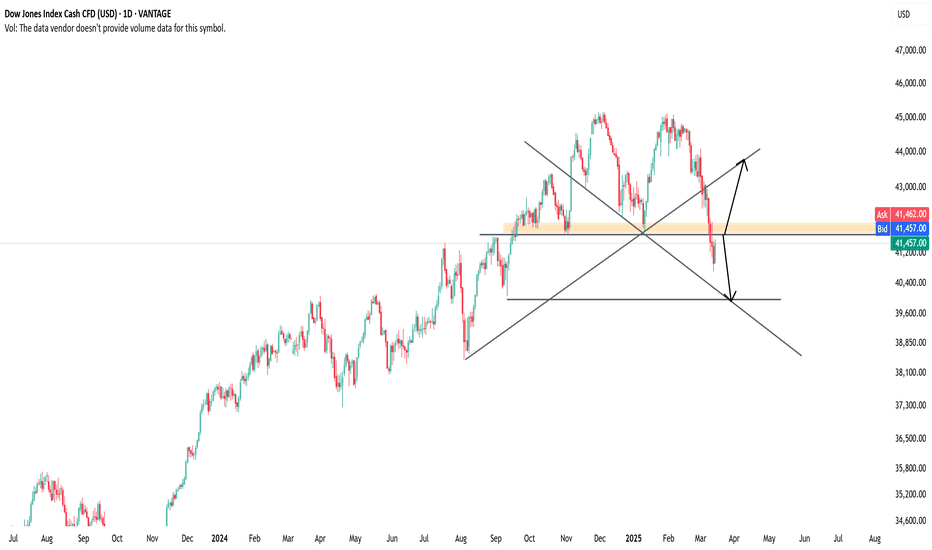

US30 - Testing Key Resistance.How I see it:

US30 is testing a key confluence of resistance.

A break and hold above key resistance-

Potential "LONG" Targets:

TP 1 = 41948.00

TP 2 = 42349.00

Rejections @ key resistance-

Potential "SHORT" Targets:

TP 1 = 40335.00

TP 2 = 39825.00

Thank you for taking the time to study my analysis.

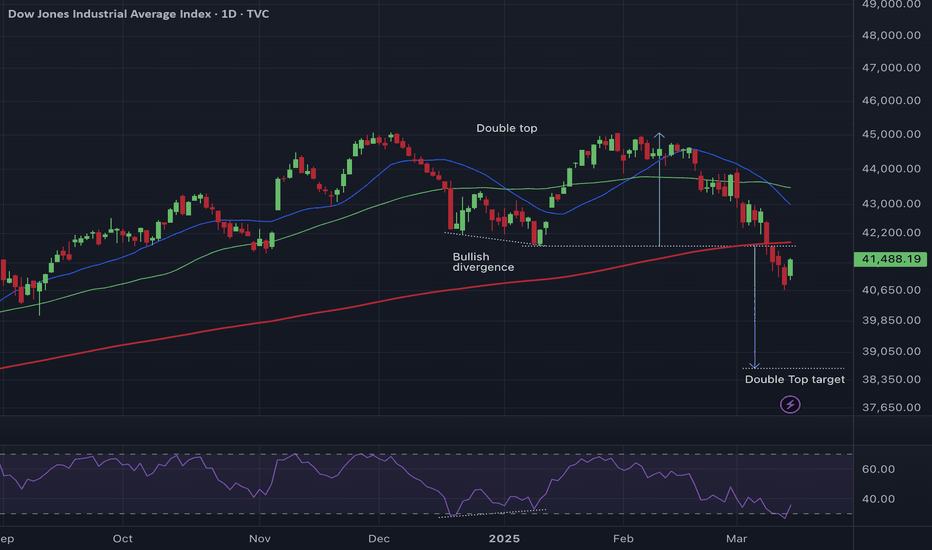

$DJI with rear green dayRear green day for the Industrial Average. Weekly charts are at crucial support trend line since 2020 low. The daily chart printed green day on Friday, but the Double Top target is further down. If we don't see a meaningful reversal in the next couple of days, the bleeding will continue

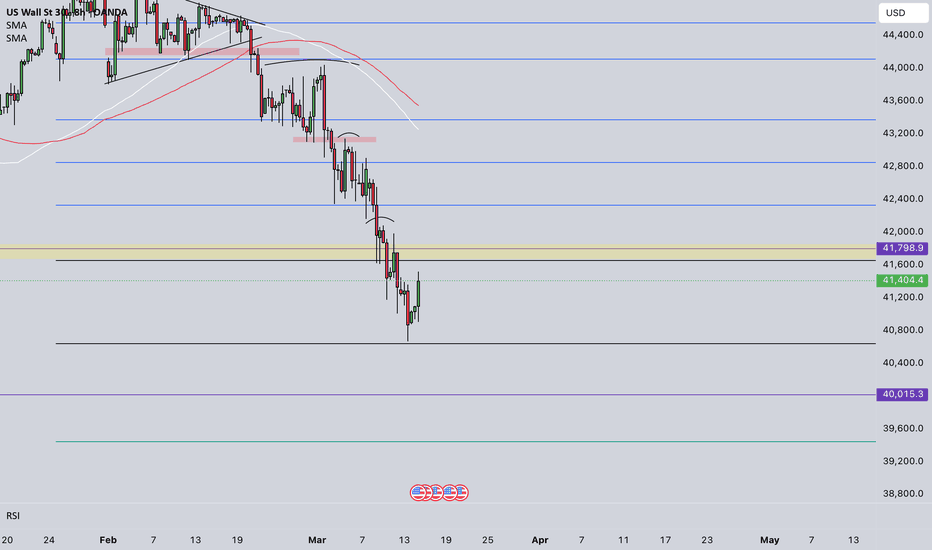

DowJones The Week Ahead 17th March '25Dow INTRADAY bearish & oversold capped by resistance at 200 DMA

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.