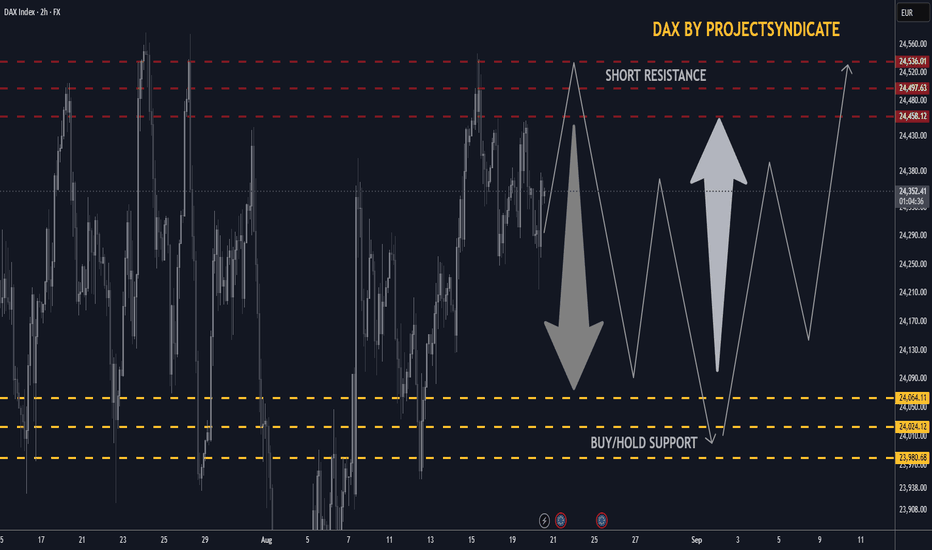

DAX/GER30 SHORT/LONG sequence Swing Trade +500/+500 points 🔸Hello traders, let’s review the 2hour chart for GER30/DAX. Strong recovery from recent lows, however price testing key resistance and support zones where major reactions are expected.

🔸Speculative setup defined by resistance at 24,500 and key S/R demand zone at 24,000. Both zones have recently bee

Related indices

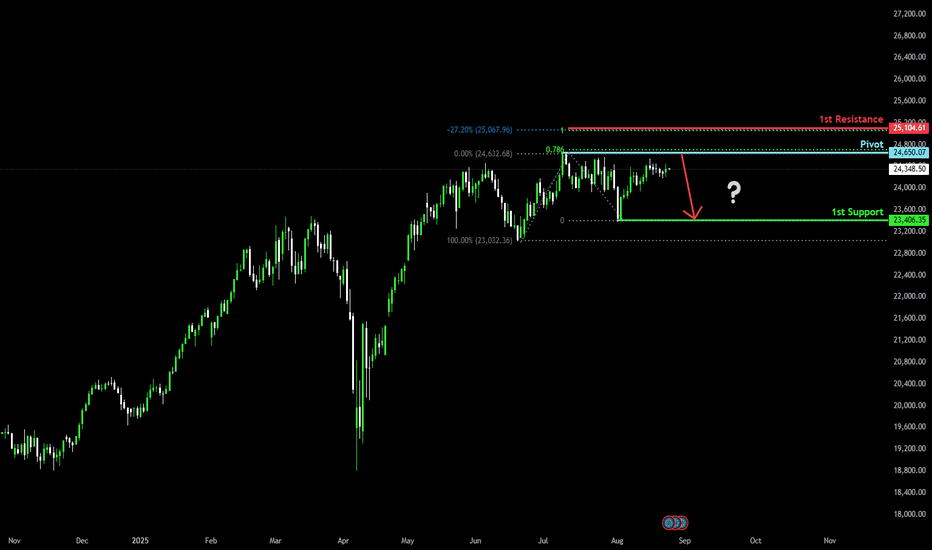

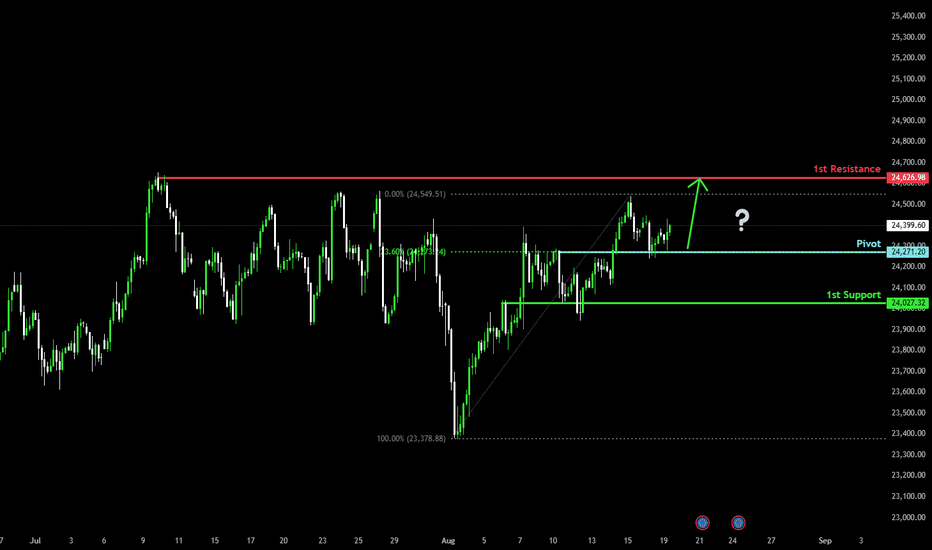

Could the price reverse from here?DAX40 (DE40) is rising towards the pivot, which is a multi swing high resistance and could reverse to the 1st support, which acts as a pullback support.

Pivot: 24,650.07

1st Support: 23,406.35

1st Resistance: 25,104.61

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your cap

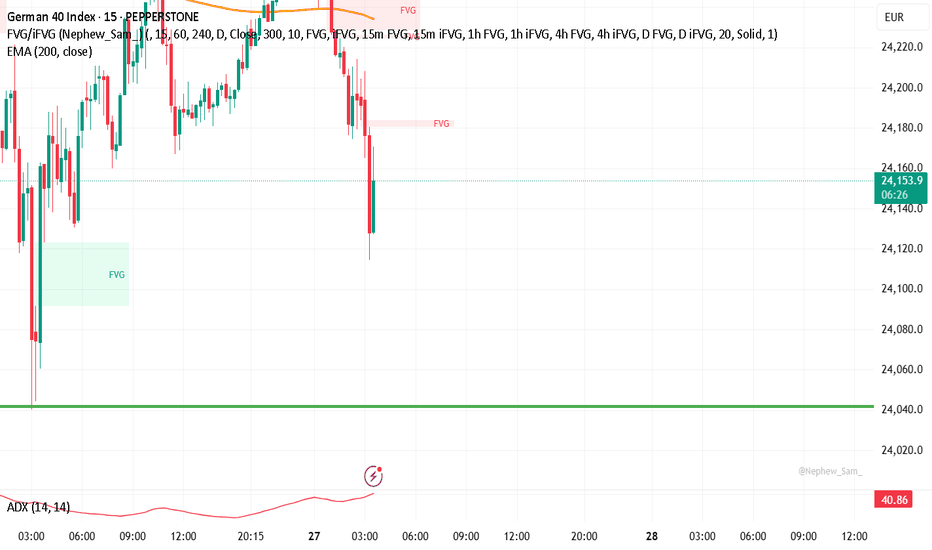

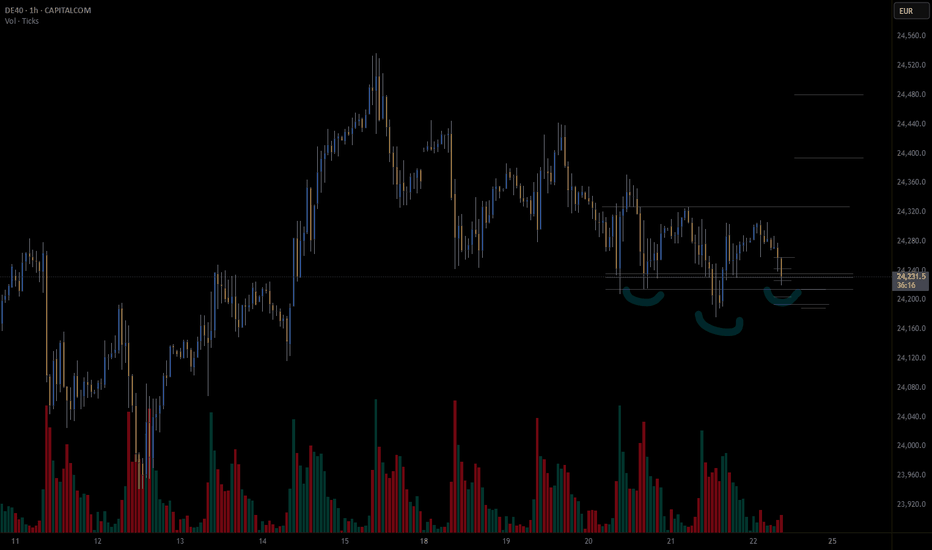

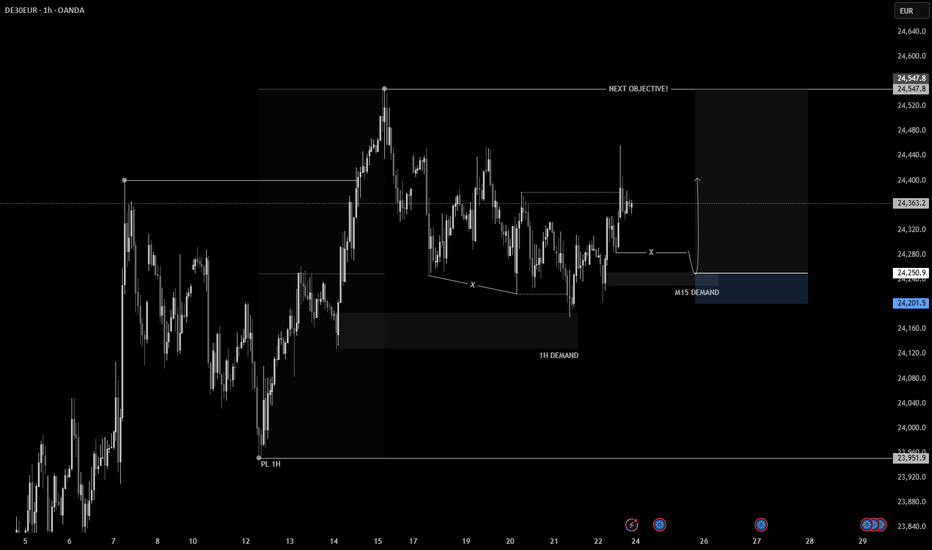

Title: London Session Outlook – Push Up Before Down

We are currently pushing off a 1H gap that has been respected. For the London session, I expect price to push up first to grab liquidity before continuing down. Watching closely for rejection around resistance to confirm the downside move.

Price reacting to respected I HR Gap

Expecting an initial

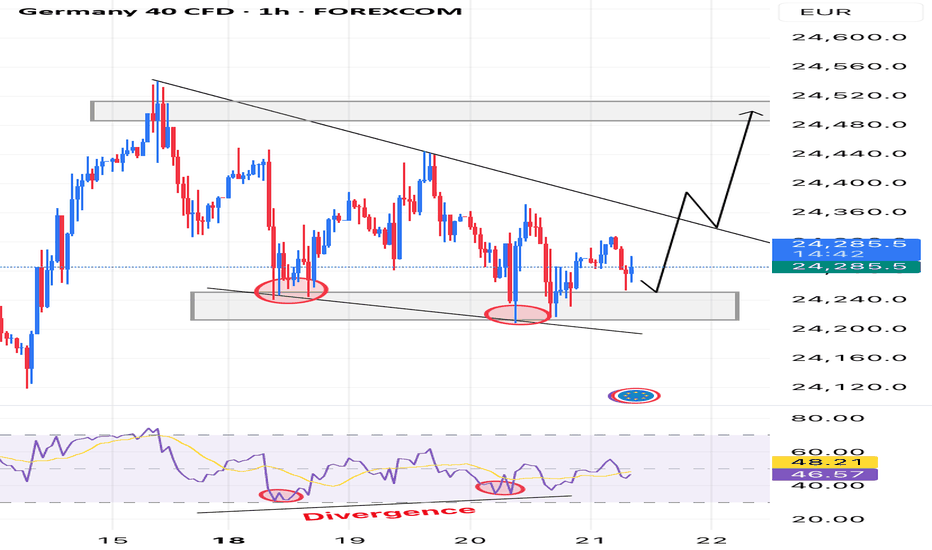

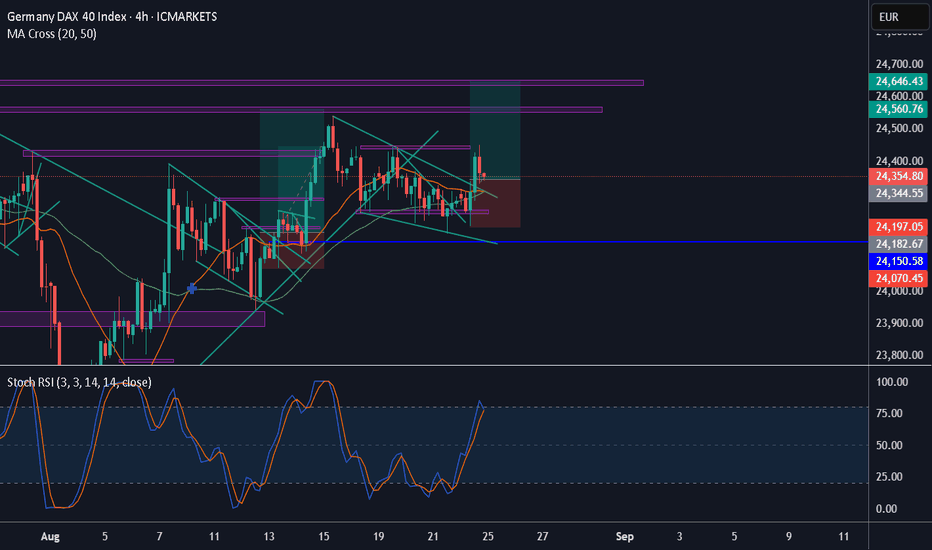

DAX40 - Buy trade Idea 📊 GER40 (Germany 40) – 1H Analysis

I’m currently watching a potential bullish continuation setup forming on the Germany 40 index.

🔎 Key Observation:

1. Support Zone: Price has tested the 24,240 – 24,260 support area multiple times (highlighted with circles), showing strong demand. Each rejection

GTradingMethod | GER40CASH (DE40) LONG SETUPI’m watching a possible inverse head & shoulders forming on the hourly chart and looking for a long entry if confirmed.

It will also be a good time for reversal with Europe markets opening at the close of this hour.

That gives it liquidity it needs to push up aggressively.

Some of the variables I

Bullish bounce off?DAX40 (DE40) has bounced off the pivot which has been identified as a pullback support, and could potentially rise to the 1st resistance, which is a swing high resistance.

Pivot: 24,271.20

1st Support: 24,027.32

1st Resistance: 24,626.98

Risk Warning:

Trading Forex and CFDs carries a high level

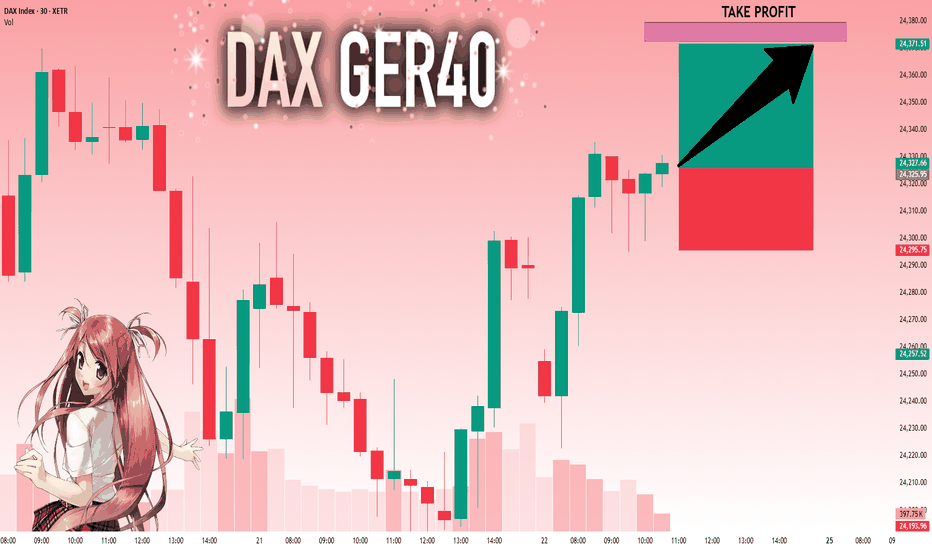

DAX: Move Up Expected! Long!

My dear friends,

Today we will analyse DAX together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 24,325.95 will confirm the new direction upwards with the target being the next key level of 24,372.55 and a reconvened placement of

Ger30 1H:📌 The 1-hour structure on German30 clearly reflects a bullish trend, with price action confirming higher highs and higher lows. After a healthy retracement into the discount zone, price tapped into a well-defined 1H demand zone, validating demand strength. Following that, the internal structure has

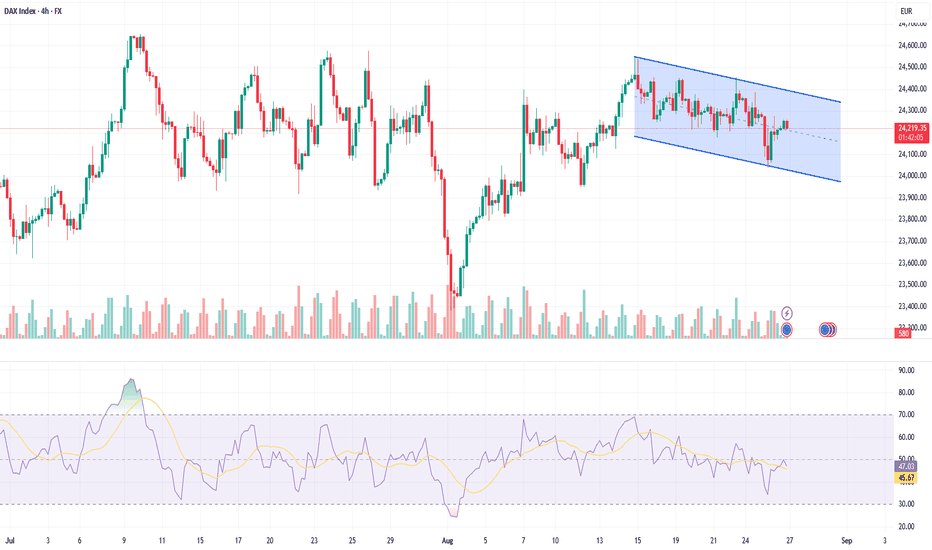

GER30Trend:** Trading inside a **downward sloping channel** → short-term bearish bias.

Resistance:** 24,350 – 24,500 (channel top).

Support:** 24,100 – 23,900 (channel bottom).

RSI:** \~47 → below neutral, showing mild bearish momentum.

Volume:** Flat overall, sellers slightly stronger on down moves.

**

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

DAX PERFORMANCE-INDEX is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy DAX PERFORMANCE-INDEX futures or funds or invest in its components.