JPYAUD trade ideas

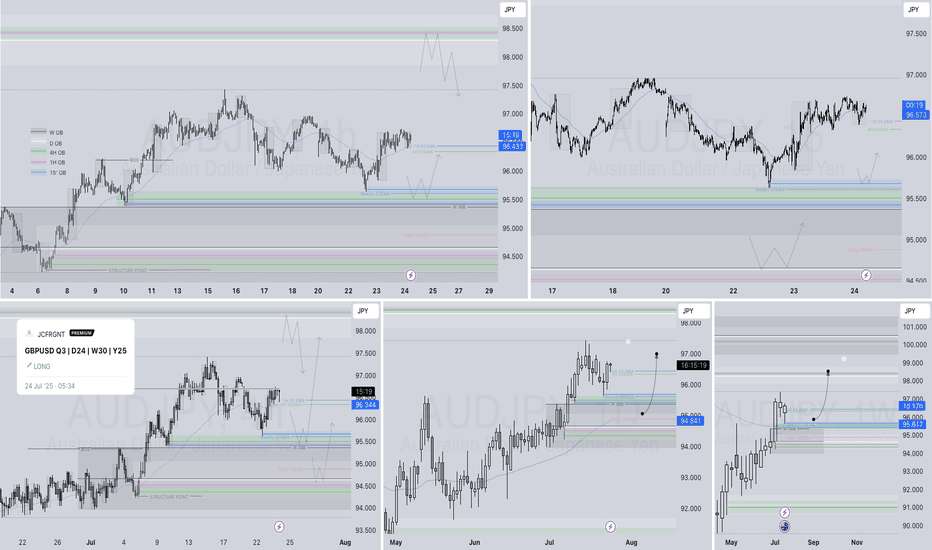

AUDJPY Q3 | D24 | W30 | Y25📊AUDJPY Q3 | D24 | W30 | Y25

Daily Forecast🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT

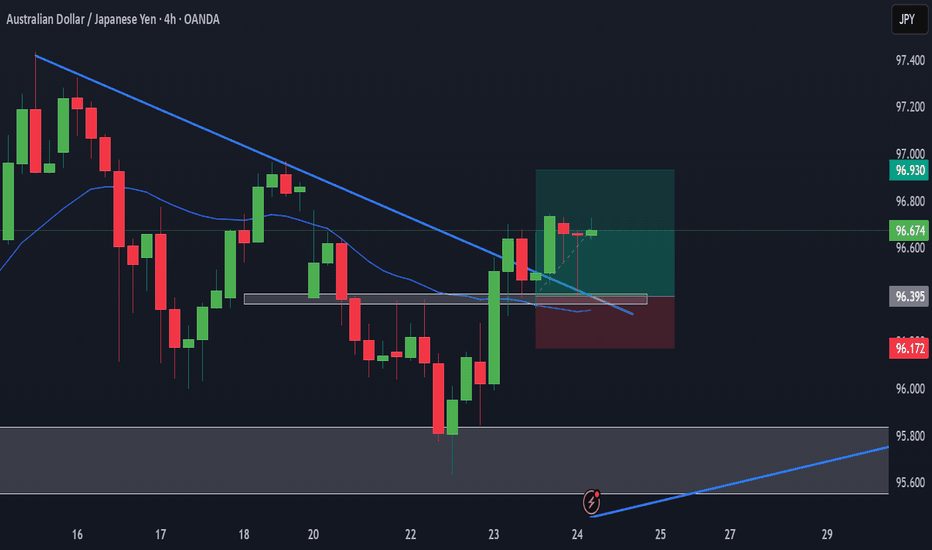

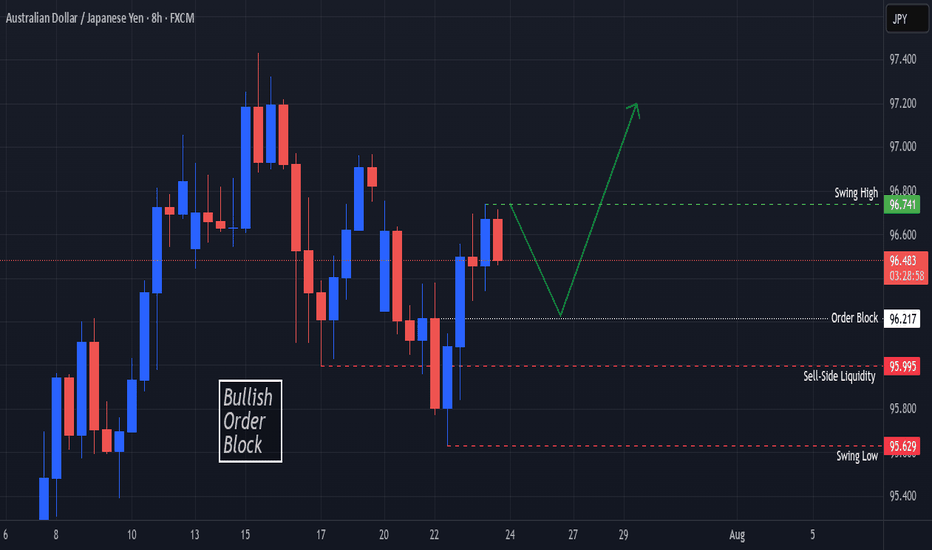

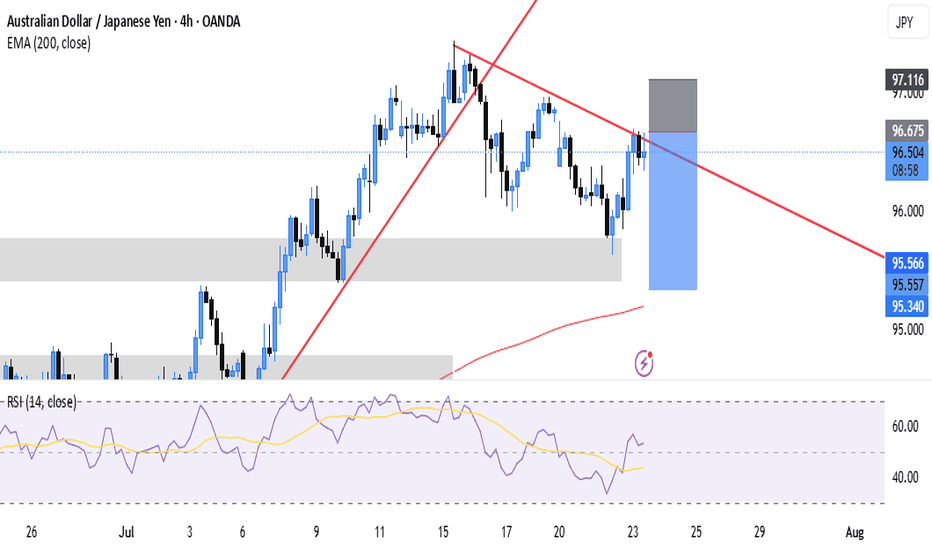

AUDJPY Bullish Order Block In SightOANDA:AUDJPY Price finds Support at the Swing Low @ 95.629 and creates a Swing High @ 96.741!

Based on the ICT Method, the Swing Low broke Sell-Side Liquidity @ 95.995 and opened up a Bullish Order Block Opportunity @ 96.217!

Price is currently working down from 96.49 at the time of publishing but once Price visits the Order Block, this could deliver Long Opportunities!!

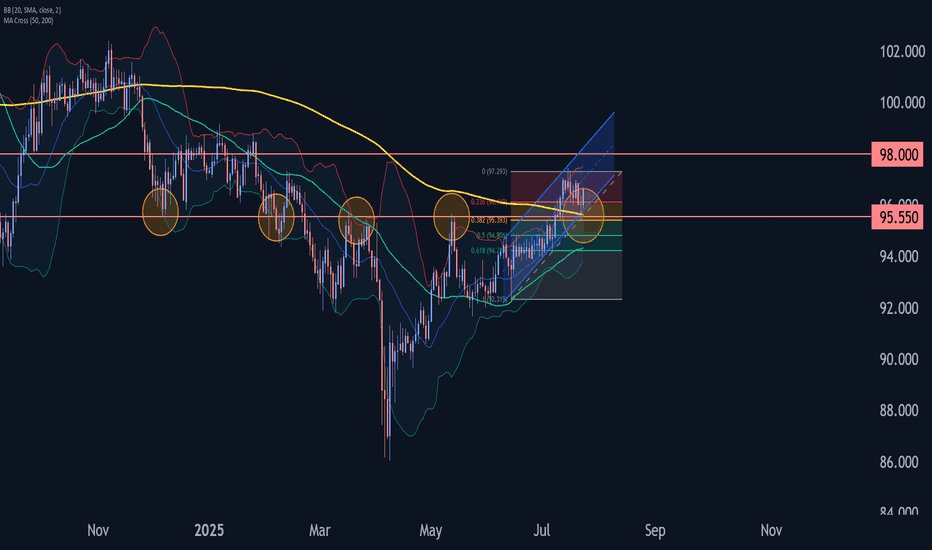

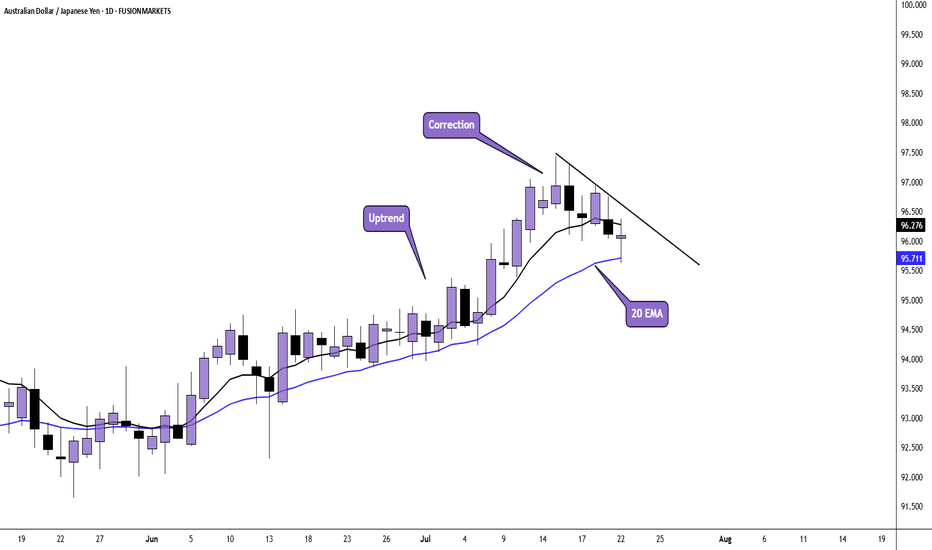

AUDJPY Wave Analysis – 23 July 2025- AUDJPY reversed from support zone

- Likely to rise to resistance level 97.40

AUDJPY currency pair recently reversed up from the support zone located between the pivotal support level 95.55 (former monthly high from March and May), 20-day moving average and support trendline of the daily up channel from May.

This support zone was further strengthened by the 38.2% Fibonacci correction of the upward impulse from June.

AUDJPY currency pair can be expected to rise to the next resistance level 97.40, former monthly high from February, which also stopped the earlier impulse wave earlier this month.

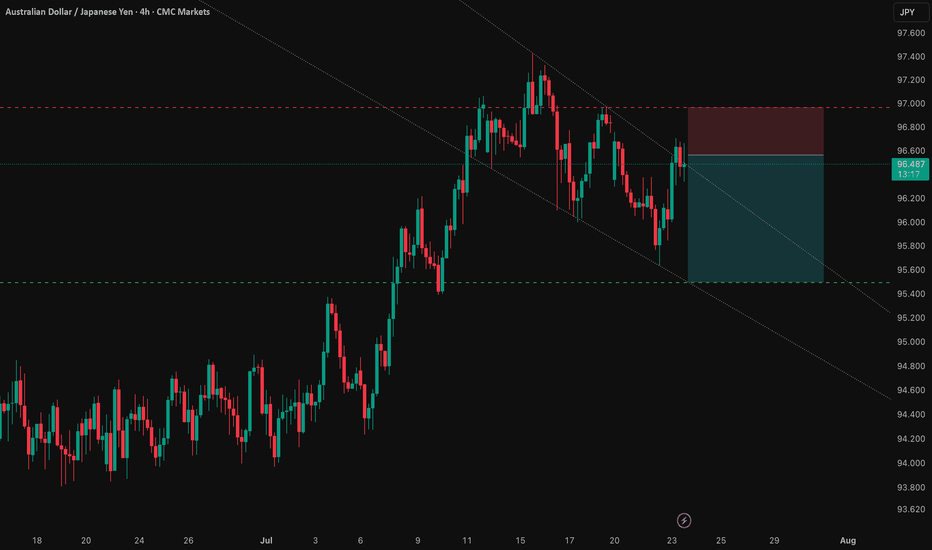

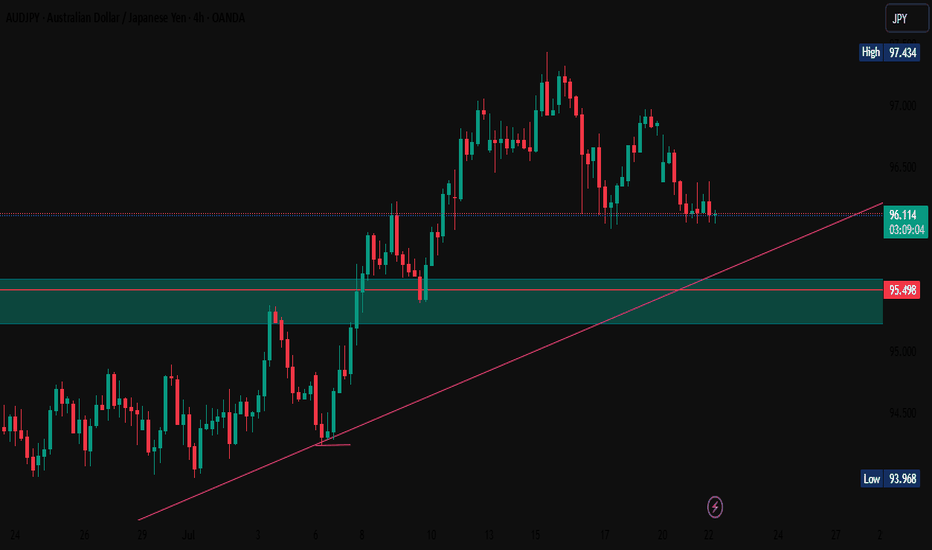

AUD/JPY: Capitalizing on the RBA-BoJ Monetary Policy GapThis analysis outlines a compelling short opportunity in AUD/JPY, driven by a powerful confluence of fundamental and technical factors. The trade is strategically positioned ahead of a key catalyst that could unlock significant downside potential.

1️⃣ The Core Thesis: A Clear Policy Divergence

The primary driver behind this trade is the stark and widening gap in monetary policy between the Reserve Bank of Australia (RBA) and the Bank of Japan (BoJ). The RBA is signaling a clear dovish pivot amid a weakening labor market, making an interest rate cut imminent. Conversely, the BoJ is in a tightening phase, creating a fundamental headwind for the AUD relative to the JPY. This divergence underpins the strategic bearish bias.

2️⃣ The Confirmation: Technical Alignment

This fundamental view is supported by a clear technical picture. The pair is in a well-defined downtrend and is currently testing a critical support level. This alignment of fundamental and technical factors presents a clear short opportunity, with the entry positioned for a breakdown below this key juncture.

3️⃣ The Catalyst: The RBA Bulletin

The immediate catalyst for this trade is the upcoming RBA Bulletin on July 24, 2025. Any dovish language from the RBA concerning Australia's economic outlook will likely reinforce expectations for a rate cut and accelerate the downward move in AUD/JPY.

The Trade Setup ✅

Here is the recommended trade setup:

📉 Trade: SHORT AUD/JPY

👉 Entry: 96.56200

⛔️ Stop Loss: 96.96386

🎯 Take Profit: 95.49900

🧠 Risk/Reward Ratio: 2.65

This setup offers a compelling risk-reward profile, capitalizing on a clear and powerful macroeconomic theme. The trade is designed to perform should the expected catalyst confirm the underlying bearish fundamentals.

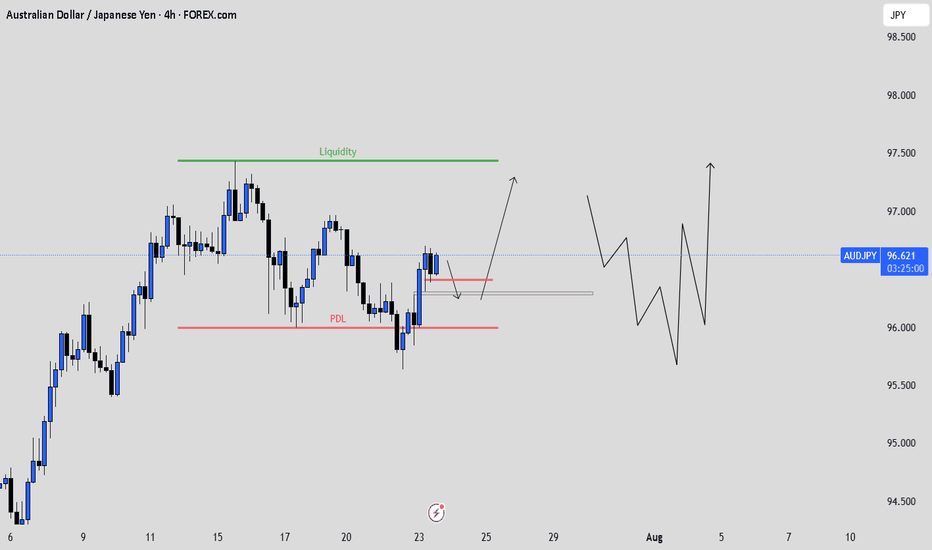

AUDJPY: Waiting to BUYIn this video I walk through my full thought process on how I plan to approach this setup. I’m not rushing in or trying to predict what price will do. Instead, I’m staying reactive. I’ve identified a clean FVG that price is currently approaching, and my plan is to wait patiently for price to tap into that zone.

But tapping the FVG alone is not enough for me to jump in. What I really want to see is a clear bullish reaction, something like a strong bullish engulfing candle or a shift in structure that confirms the buyers are stepping in. If that happens, then I’ll look to take a long position targeting another liquidy zone.

This isn’t about guessing the bottom. It’s about letting price tell the story and only acting when there’s a clear signal. That’s the discipline behind this trade.

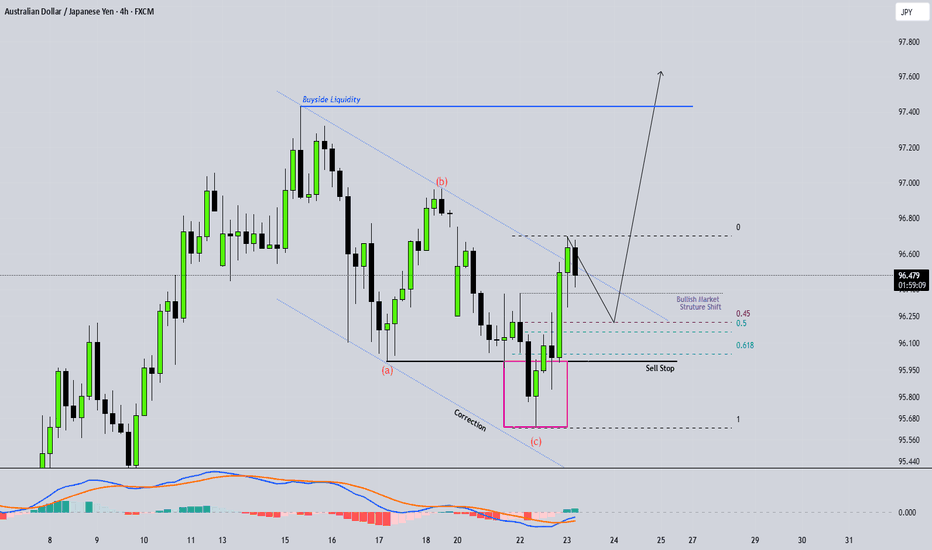

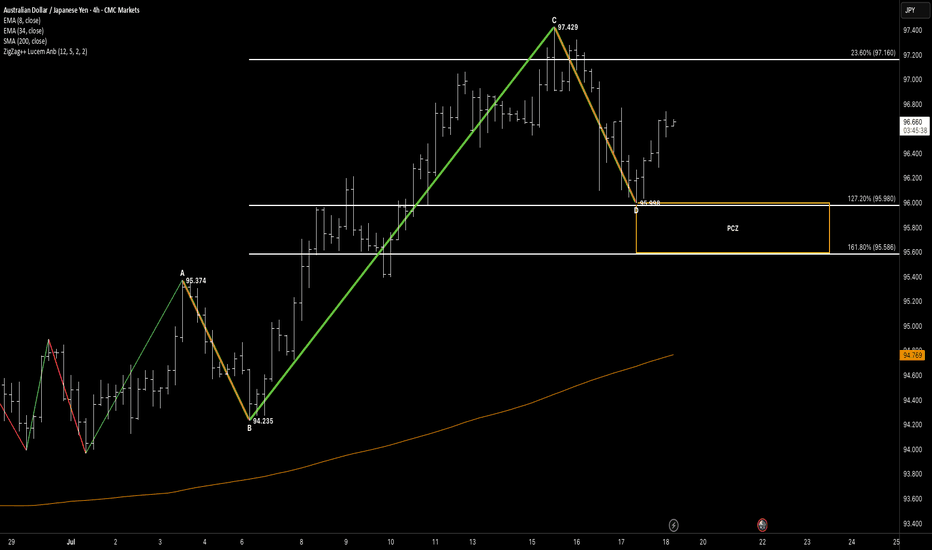

SYMMETRYHello awesome traders! 👋

Hope you’ve managed to grab some solid pips from the markets this week. As we head into the weekend, I’m wrapping things up by dropping a few clean chart setups for you to review and reflect on.

Enjoy the weekend, recharge well — and I’ll see you sharp and ready next week for more structure-led opportunities.

📌 Pattern Breakdown

We had a beautiful AB=CD symmetry setup, with a slight twist:

🔹 AB = CD structure extended slightly beyond traditional symmetry

🔹 CD stretched into the 127.2% fib projection — a known trap zone

🔹 Price tagged 95.980 and reacted with strong bullish momentum from the PCZ (95.98–95.58)

🔹 This zone also aligned with 161.8% fib extension support = strong confluence

🎯 Target Structure

Following the rejection, price is now rotating upward, moving toward:

✅ Target 1:

• 23.6% = 97.16

• 61.8% = 97.972

📍 Partial TP booked at 23.6%

🧭 Watching price behavior here before deciding whether to continue toward…

🔄 Target 2 Zone:

• 78.6% = 98.508

🧠 Key Concepts in Play

✅ AB=CD symmetry extended to 127.2%

✅ Valid PCZ rejection from confluence zone

✅ Partial profit taken at TP1

✅ Measured continuation play in motion

✅ Structure-led management with clear invalidation

🗝 Final Thoughts

AUDJPY gave us a clean extended symmetry rejection — and now we’re in the follow-through phase. The reaction off the 127% extension shows that even stretched patterns can hold when structure aligns.

We’ve locked some gains at the 23.6% zone and will let the rest play out or reassess early next week depending on price behavior around the 61.8% mark.

“Even when symmetry stretches — the reaction reveals the conviction.”

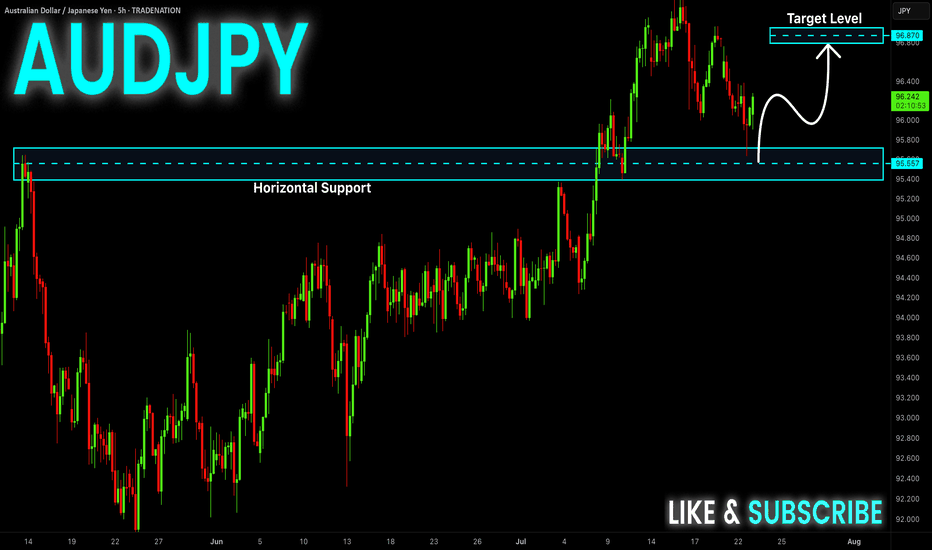

AUD-JPY Will Grow! Buy!

Hello,Traders!

AUD-JPY already made a

Bullish rebound from the

Strong horizontal support

Of 95.610 and as we are

Bullish biased we will be

Expecting a further bullish

Move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

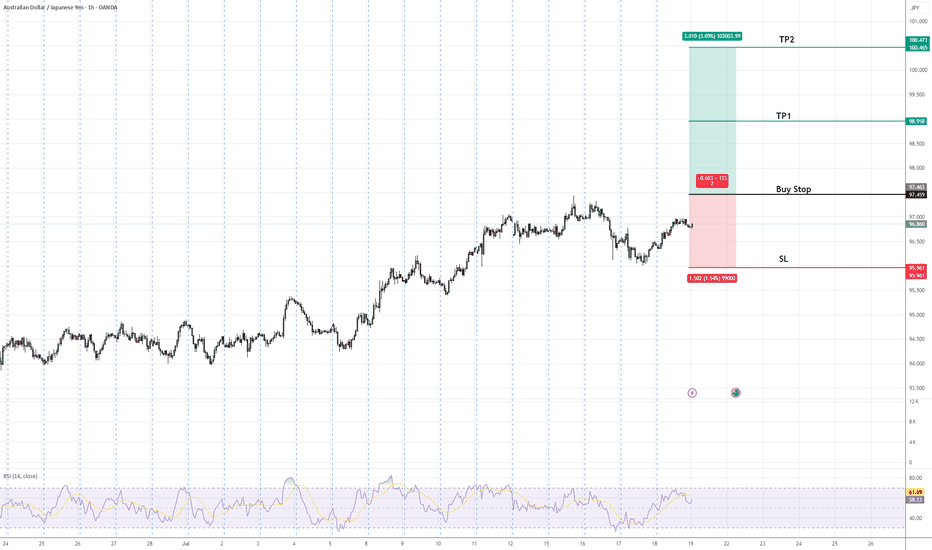

AUDJPY Buy Stop Setup | Trend Continuation in FocusAUDJPY is in an established uptrend, forming higher highs and higher lows. A buy stop is positioned above the recent swing high to confirm bullish continuation. The setup includes a defined stop-loss below the previous higher low to manage risk and two target profit levels (TP1 & TP2) aligned with key resistance zones. This approach favors trend-following traders seeking confirmation of upward momentum before entry.

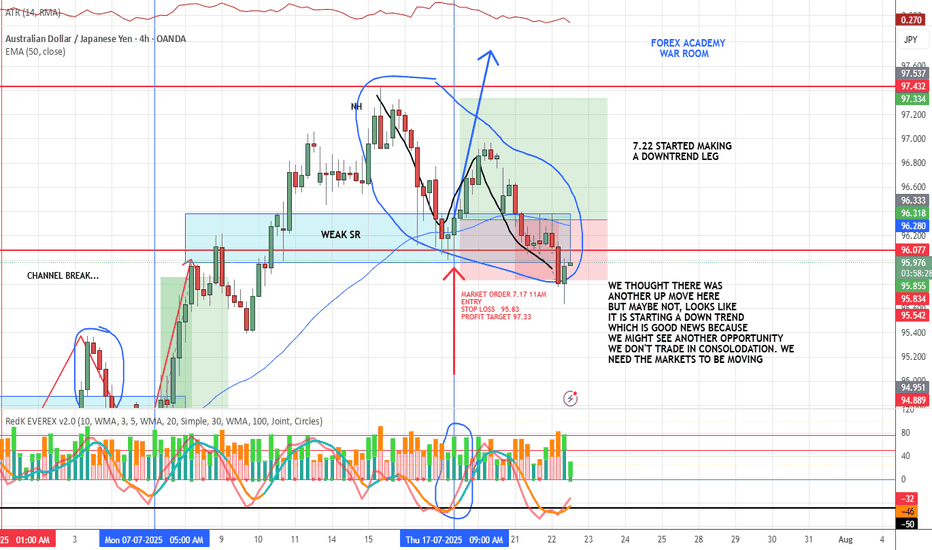

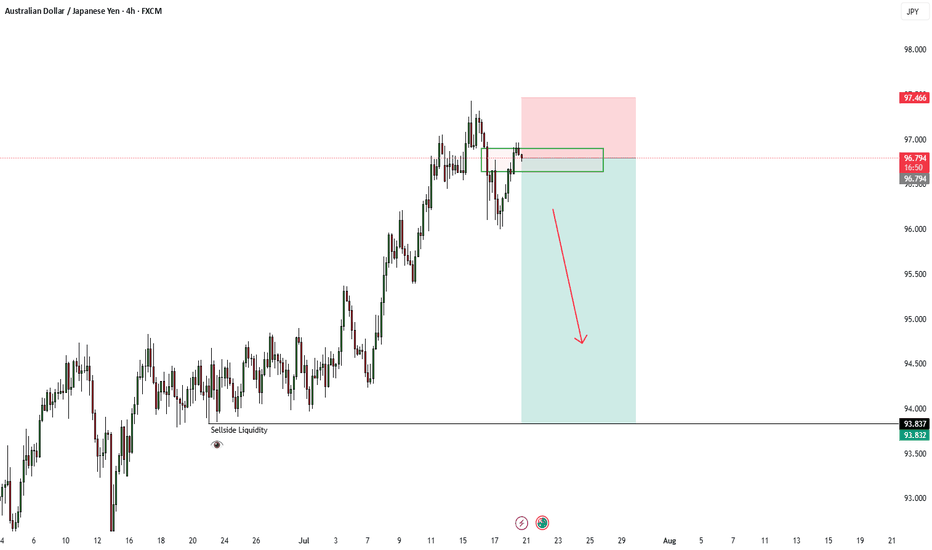

AUD/JPY LOSS❌ AUD/JPY Loss – Market Shifting

We anticipated another move up on AUD/JPY, but price had other plans.

Looks like a new downtrend may be starting—which is actually good news.

We don’t trade in consolidation.

We wait for structure, direction, and alignment.

📌 Movement = opportunity. And we might have a new one setting up soon.

Losses are part of the process. The VMS strategy keeps us focused, patient, and ready for the next valid setup.

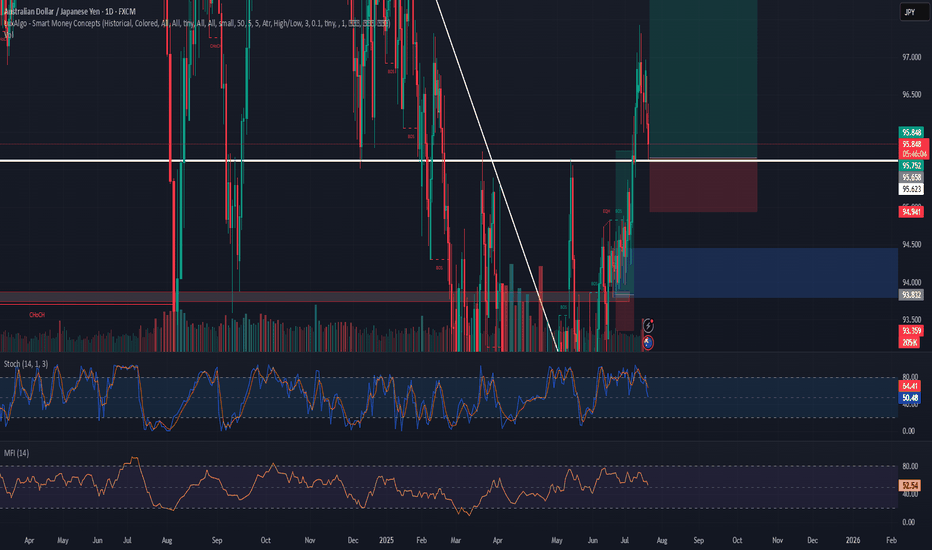

Bullish Momentum Builds: Long Setup on AUD/JPYThe AUD/JPY pair has recently broken out of a long-term descending trendline, signaling a strong shift in market structure. This breakout was supported by multiple bullish BOS (Break of Structure) and ChoCH (Change of Character) signals, indicating institutional buying interest. Price has since retested the breakout zone and is showing signs of continuation, now consolidating just below a key supply zone. With momentum building and previous resistance flipping to support, I’ve entered a long position at 95.65, aiming for a clean push toward the next major resistance at 98.13.

This trade setup aligns with the overall bullish sentiment supported by strong volume during recent rallies and the current market structure. The stop loss is set at 94.94, just below a key demand zone, allowing room for healthy retracement without invalidating the setup. MFI remains neutral, giving the pair more upside potential, while the Stochastic suggests short-term consolidation may be nearing completion. If momentum continues to build, a breakout toward the target is highly probable.

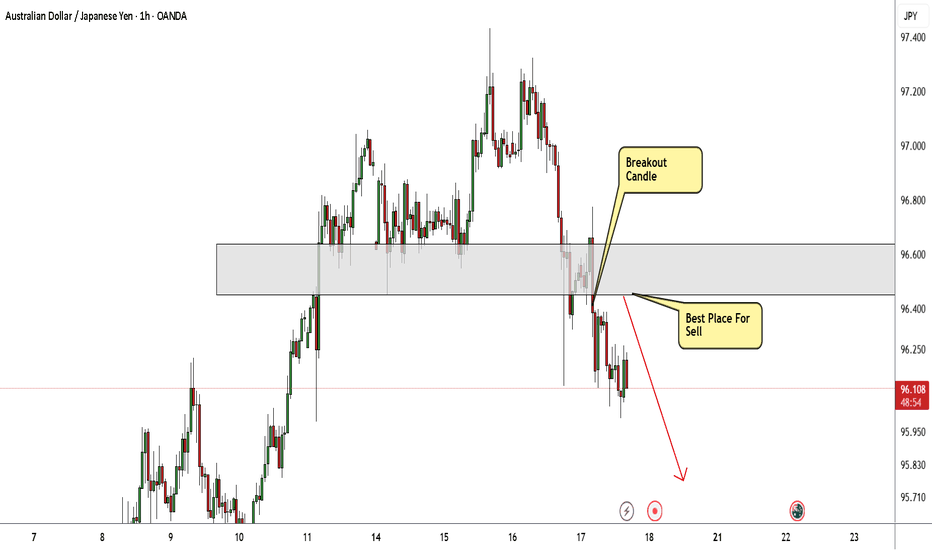

AUD/JPY Finally Decided To Go Down , Don`t Miss This 150 Pips !Here is my 1H Chart on AUD/JPY , And my opinion is we have a very clear breakout and the price will go down a little to make a retracement after this huge movement to upside without any correction , so i`, waiting the price to retest my broken supp and new Res and then we can enter a sell trade and targeting 100 : 150 pips . if the price go up again and closed above my res area with daily candle then this idea will not be valid anymore.

Market analysis 7/22/2025Today we look in to AUD and JPY and discuss their fundamentals and also their relative strength. With strength and activity not matching the fundamentals outlined from this weeks and last weeks.

after review it did not appear that fundamentals were being followed currently. We have to respect this and continue to wait for our opportunity.

Bye for now.

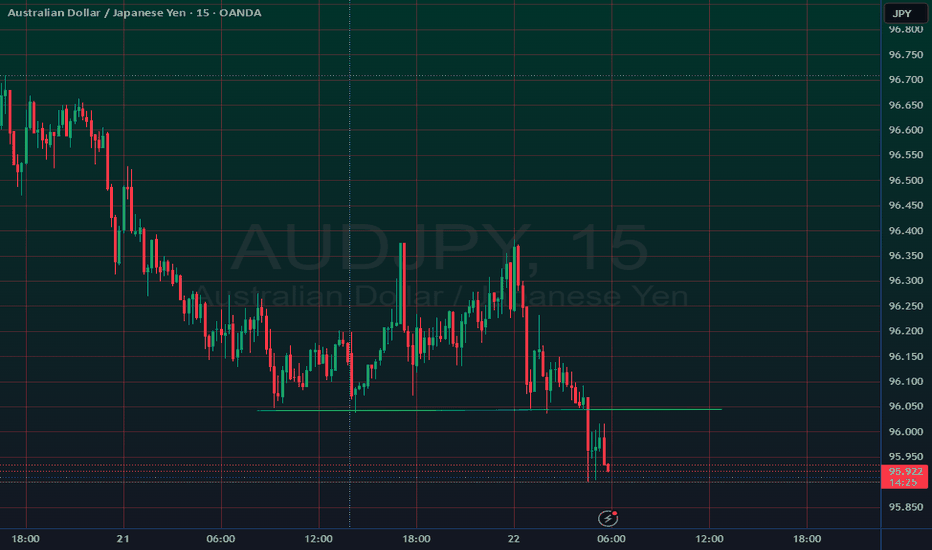

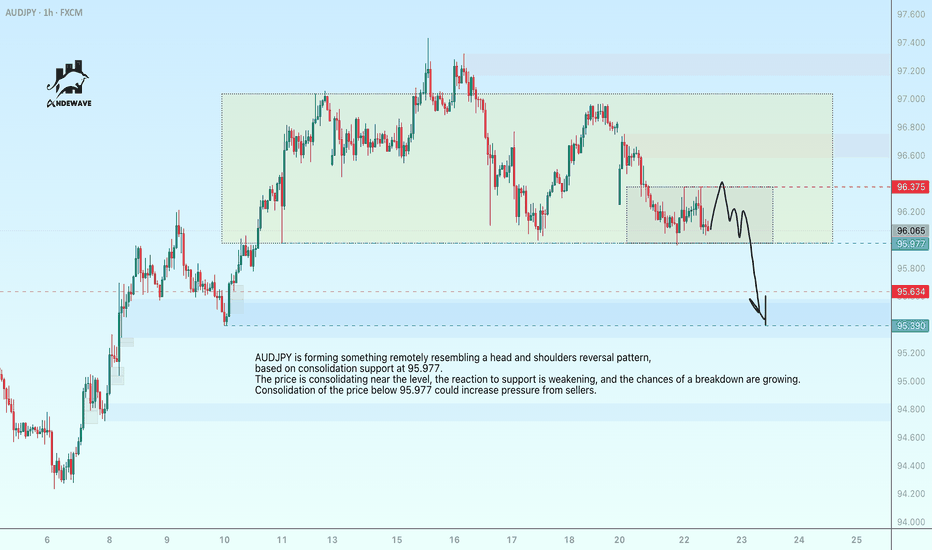

AUDJPY may reverse its upward trendAUDJPY is forming something remotely resembling a head and shoulders reversal pattern, based on consolidation support at 95.977. The price is consolidating near the level, the reaction to support is weakening, and the chances of a breakdown are growing. Consolidation of the price below 95.977 could increase pressure from sellers.

In addition, the fall of the dollar is causing the Japanese yen to strengthen, which could lead to a fall in the AUDJPY currency pair.

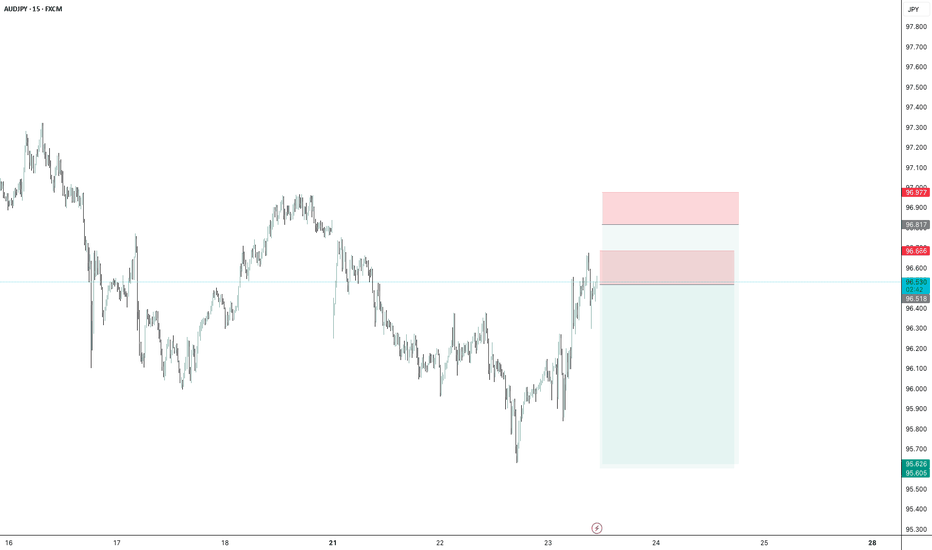

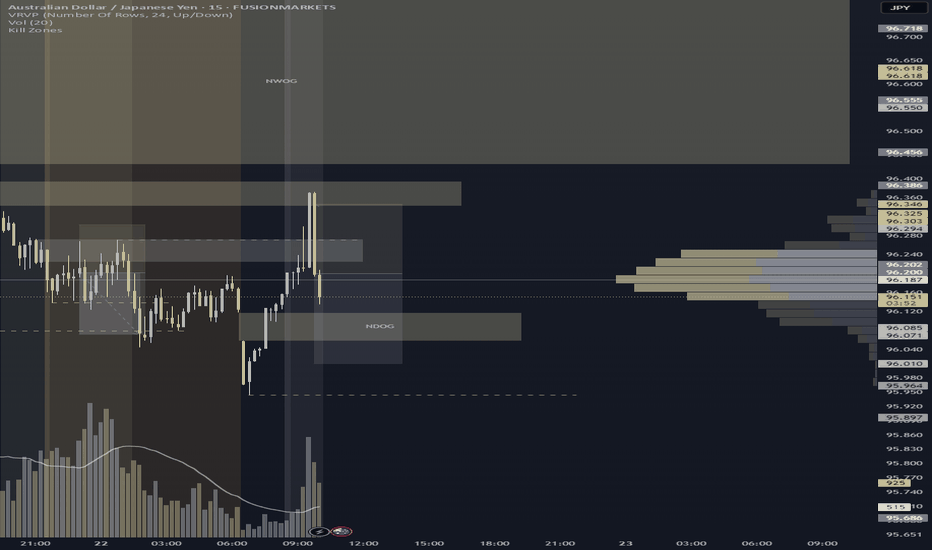

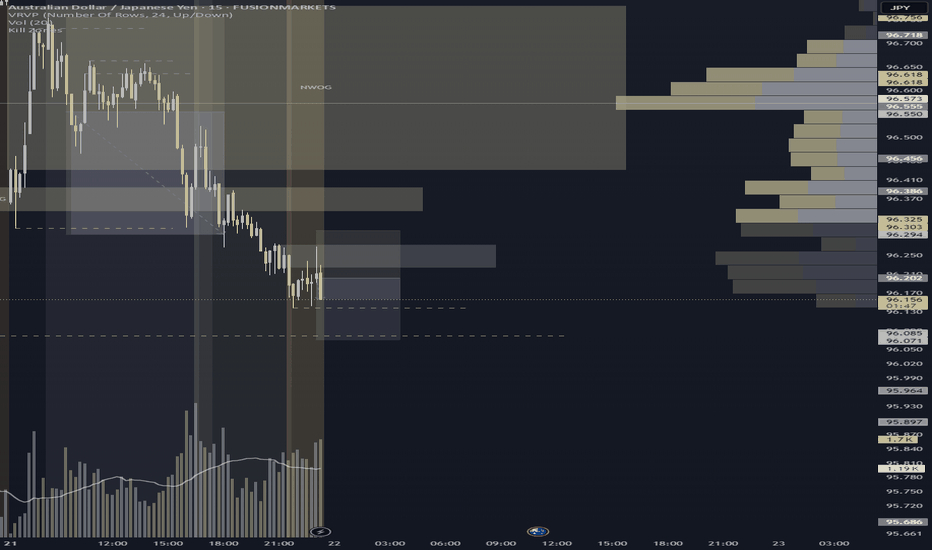

AUDJPY – Resistance Rejection Short Into Sellside Draw

Identified a key resistance zone at 96.224–96.273, with price showing rejection and wicking behavior after sweeping buyside liquidity at 96.271. Entered short following a decisive reaction candle. Trade is structured with stop loss above the swing at 96.303 and TP set at 96.010, targeting a clean overshoot of today’s NDOG (95.944).

🔹 Setup: Resistance rejection + liquidity sweep

🔹 Bias: Short into engineered sellside draw

🔹 SL: 96.303 | TP: 96.010

🔹 Narrative: Trap-to-draw execution with structure-backed confirmation

A disciplined short campaign rooted in polarity logic and session magnet flow. Let the market walk its choreography. 🩶

AUDJPY – Resistance Rejection at 96.224–96.273

Executed a disciplined short off the 96.224–96.273 resistance zone, which aligned with bearish structure and rejection candle confirmation. Entry followed lower high formation, with stops placed above the recent swing at 96.303 to allow for volatility breathing room. Target set at 96.079, aligning with a clean sellside draw. Price showed momentum alignment and polarity flip reaction off resistance.

🔹 Strategy: Trap-to-draw execution

🔹 Entry: Post-rejection confirmation

🔹 SL: Above 96.303 swing

🔹 TP: Into 96.079 liquidity magnet

A precise, structure-backed short targeting engineered liquidity