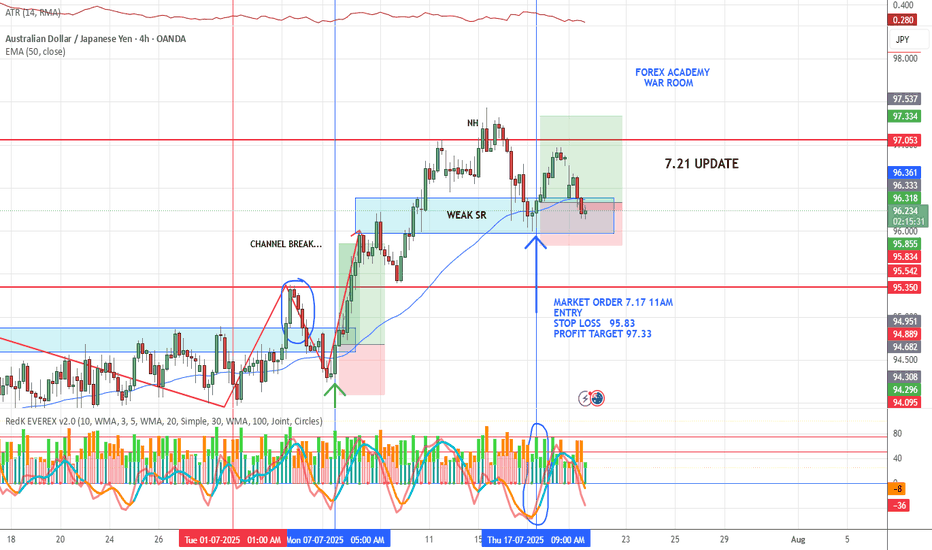

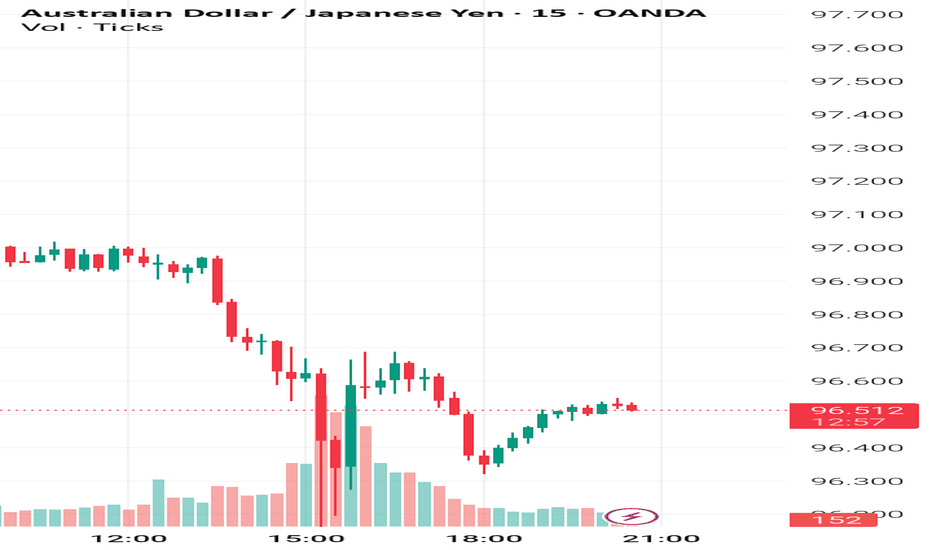

AUD/JPY LIVE TRADE UPDATESwing Trade Update – Gap Down Open

We entered this trade last Thursday based on our VMS swing setup.

When the market opened Sunday, price gapped down against us.

Now we’re watching for:

*Price to find support at this level

*A potential bounce and continuation in trade direction

📌 The gap doesn’t break the setup—structure will tell the truth. Patience required.

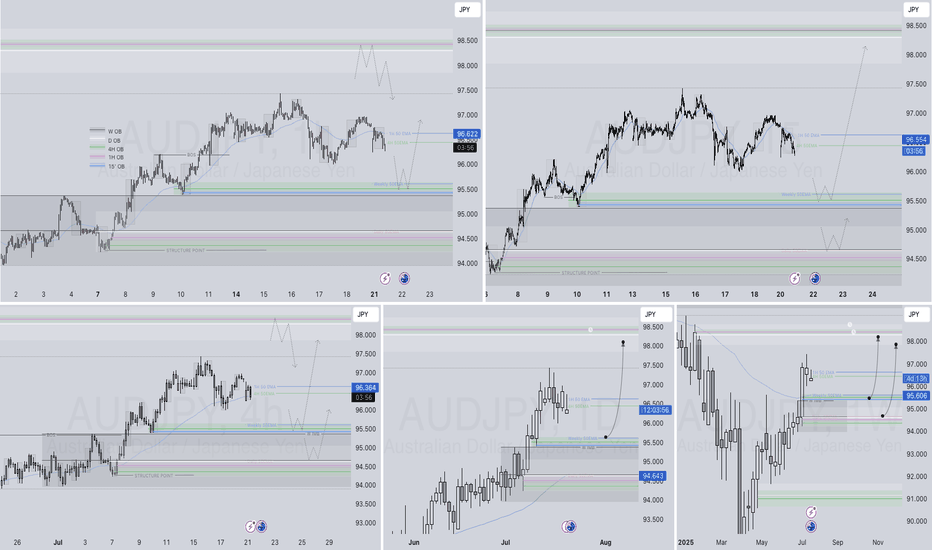

JPYAUD trade ideas

AUDJPY Q3 | D21 | W30 | Y25📊AUDJPY Q3 | D21 | W30 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT 📊

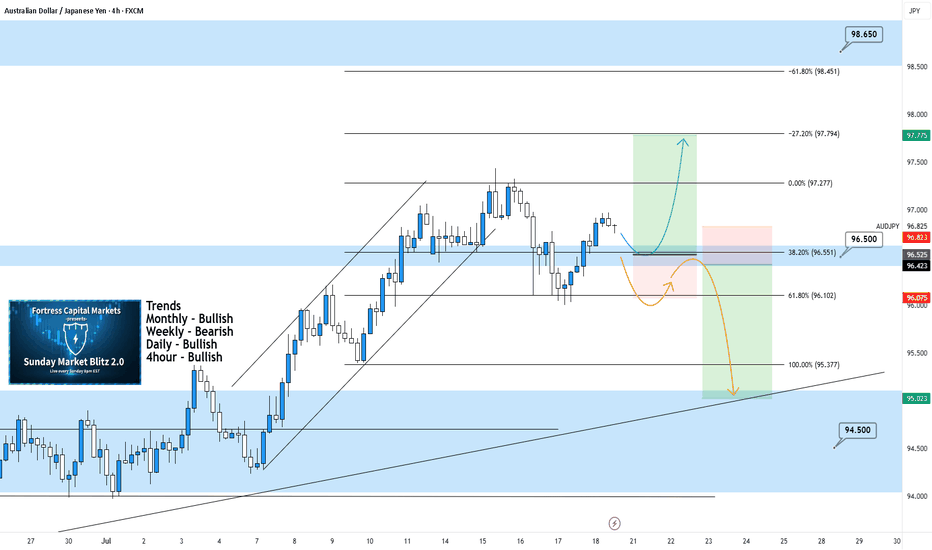

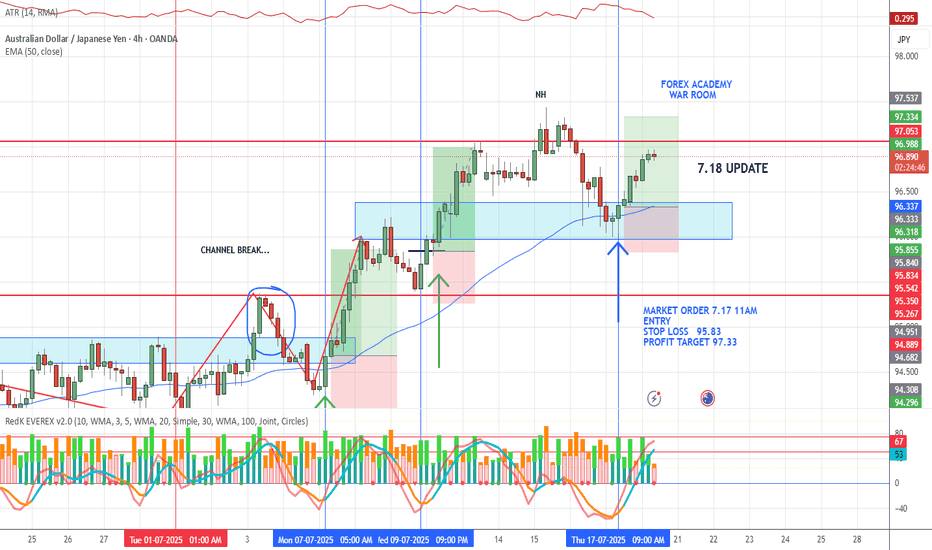

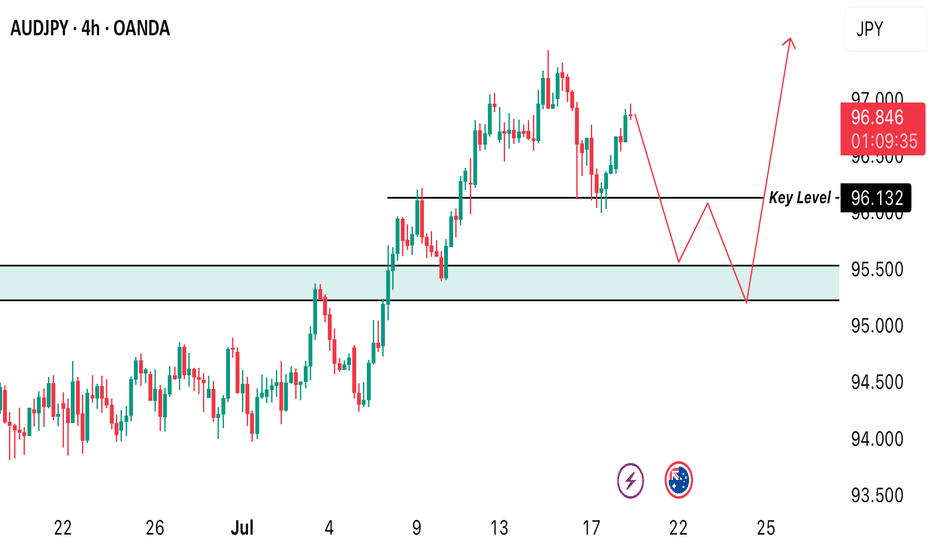

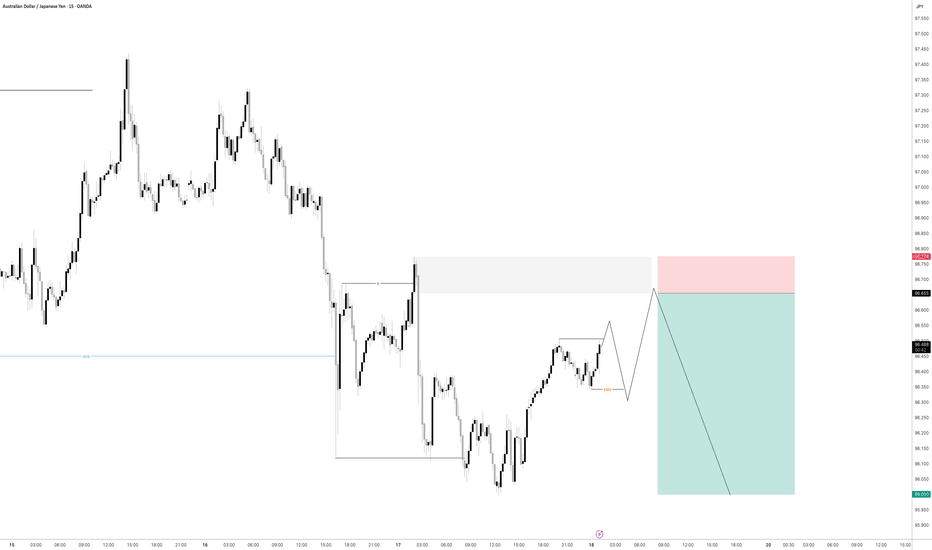

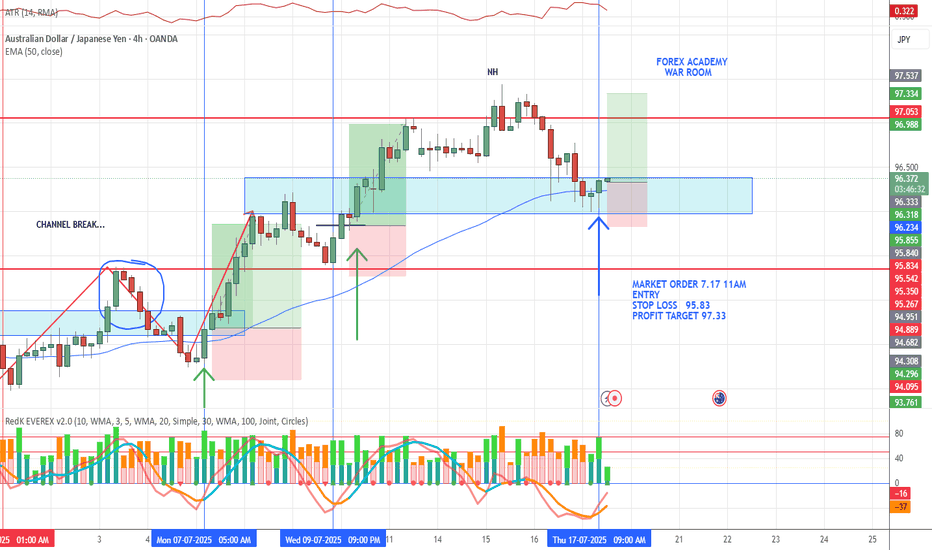

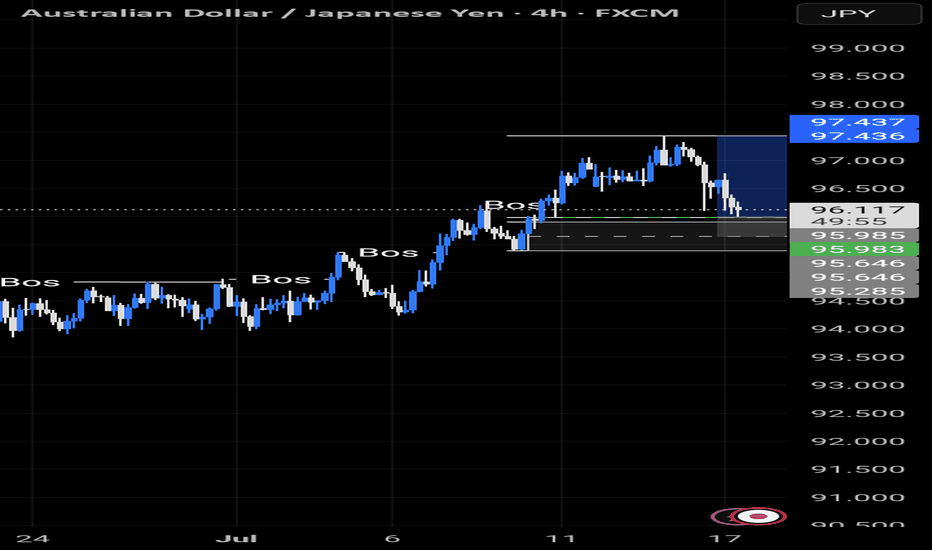

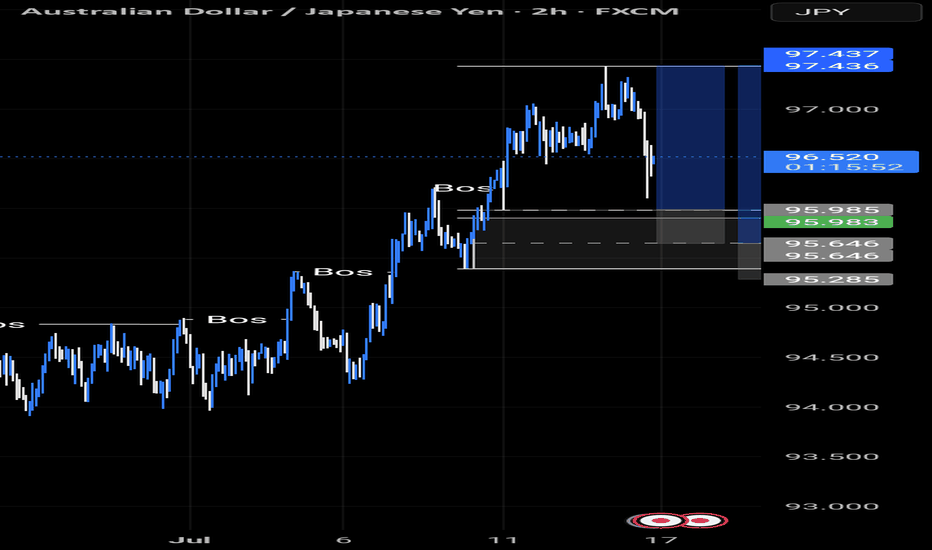

AUDJPY 4Hour TF - July 20th,2025AUDJPY 7/20/2025

AUDJPY 4hour Bullish Idea

Monthly - Bullish

Weekly - Bearish

Dailly - Bullish

4hour - Bullish

We’re looking mostly bullish on AJ going into this week but will this 96.500 hold as support? Let’s take a look at two potential scenarios for the week ahead:

Bullish Continuation - This is the most likely for AU this week according to the trends in play. For us to get confident in long scenarios, we would like to see strong bullish rejection from support around 96.500. If this happens look to target higher toward our negative fib levels and key resistance.

Bearish Reversal - For us to consider AJ bearish for the week, we would need to see some bearish pressure step in and push us below 96.500. If this happens we only need confirmation in the form of a lower high below 96.500.

Look to target lower toward major support levels like 94.500 area if this happens.

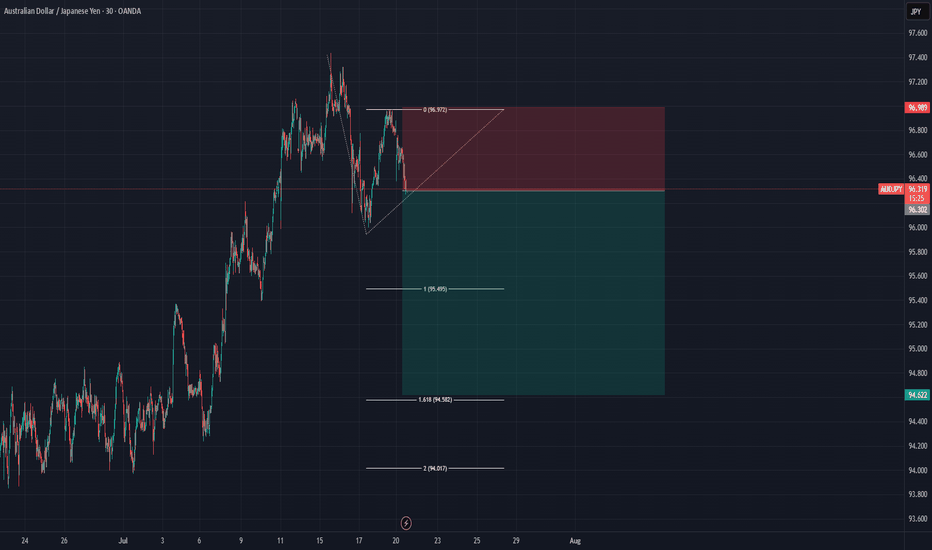

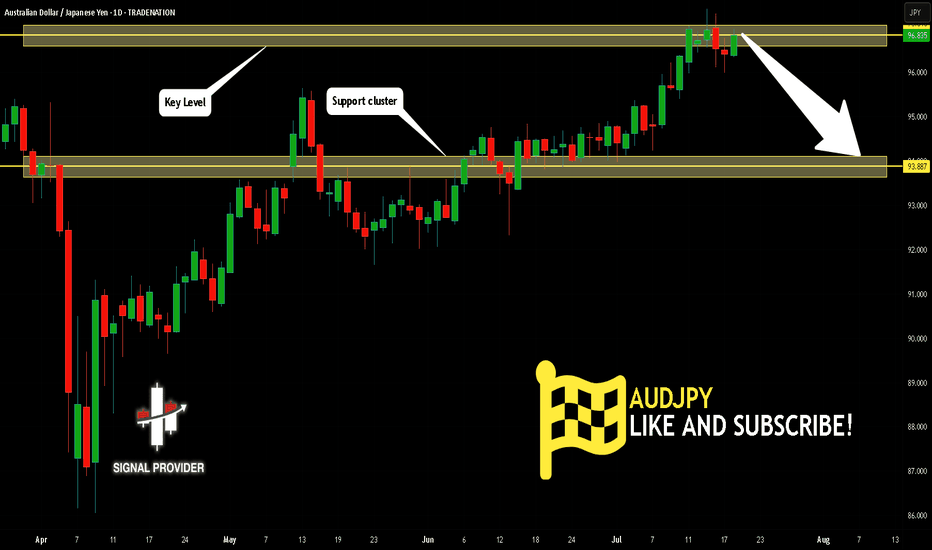

AUDJPY Will Go Lower From Resistance! Sell!

Please, check our technical outlook for AUDJPY.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 96.835.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 93.887 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

AUDJPY H4 MARKET OUTLOOK. Looking at how price reacted this week, we’re anticipating a new buy opportunity in this market from the H4 timeframe but before then, we’re waiting for proper confirmation before we buy. We’re waiting for price to test the major support level of 95.222 so we can spot a good deal.

AUDJPY - POTENTIAL?USDJPY is getting super interesting.

If we can get some bearish intent to try and induce the early sellers to the downside creating some buyside liquidity then i will be all over this for a trade.

Lets see how price has moved by the morning as it does need a bit more development before we can consider entering for a short position

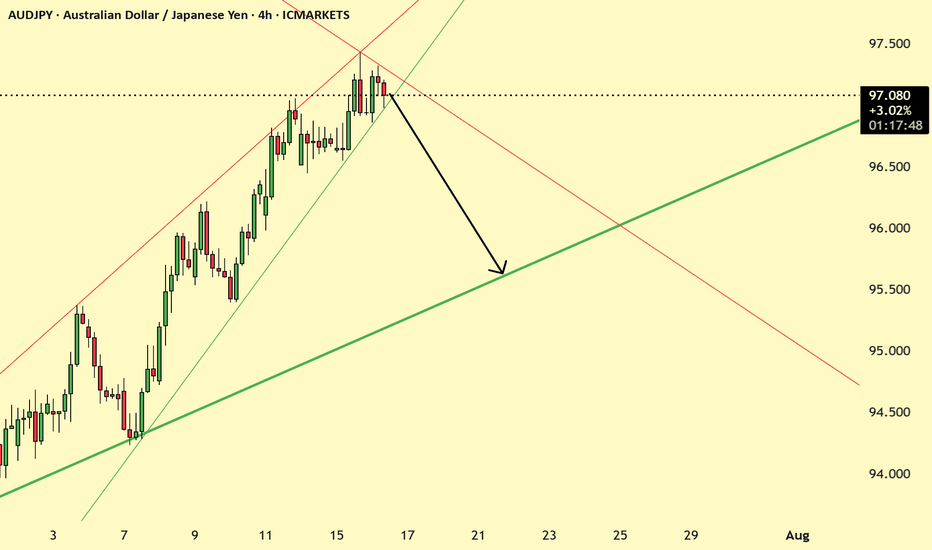

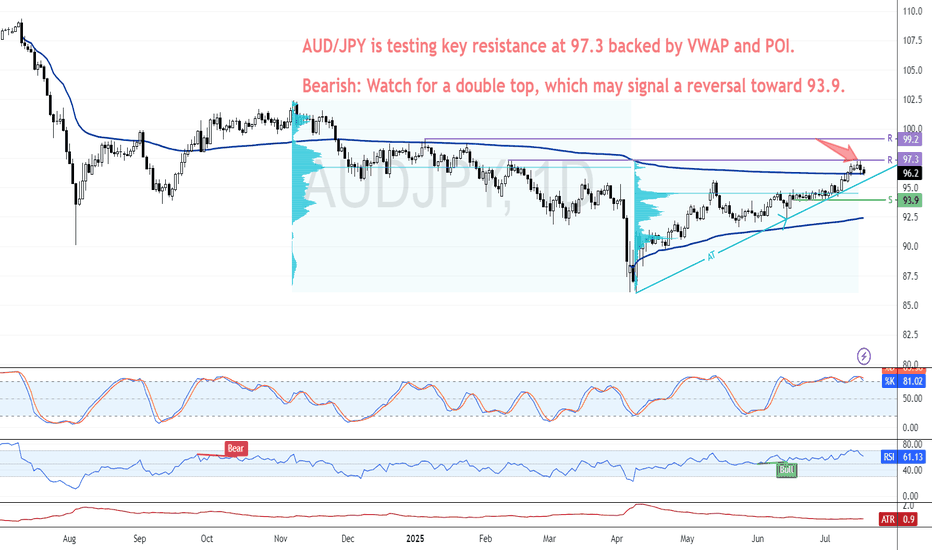

Unique Bearish Setup Emerges for AUD/JPY This QuarterFenzoFx—AUD/JPY is bullish, currently testing the critical resistance and order block at 97.3. This level coincides with the VWAP and volume profile point of interest. Bears are interested in adding short positions at the 97.3 price level.

Since this level is highly important and has the potential to change the trend, it is necessary to form a double top at this price, which has not happened before.

From a technical perspective, if a double top pattern forms at 97.3 and this level holds, a new bearish trend will likely emerge. In this scenario, the 93.9 level is likely to be targeted.

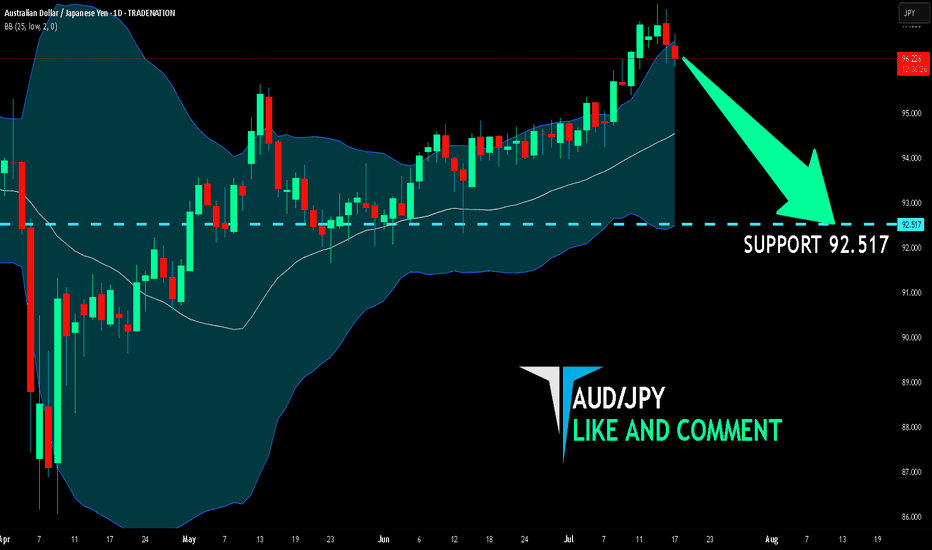

AUD/JPY SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

We are going short on the AUD/JPY with the target of 92.517 level, because the pair is overbought and will soon hit the resistance line above. We deduced the overbought condition from the price being near to the upper BB band. However, we should use low risk here because the 1W TF is green and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

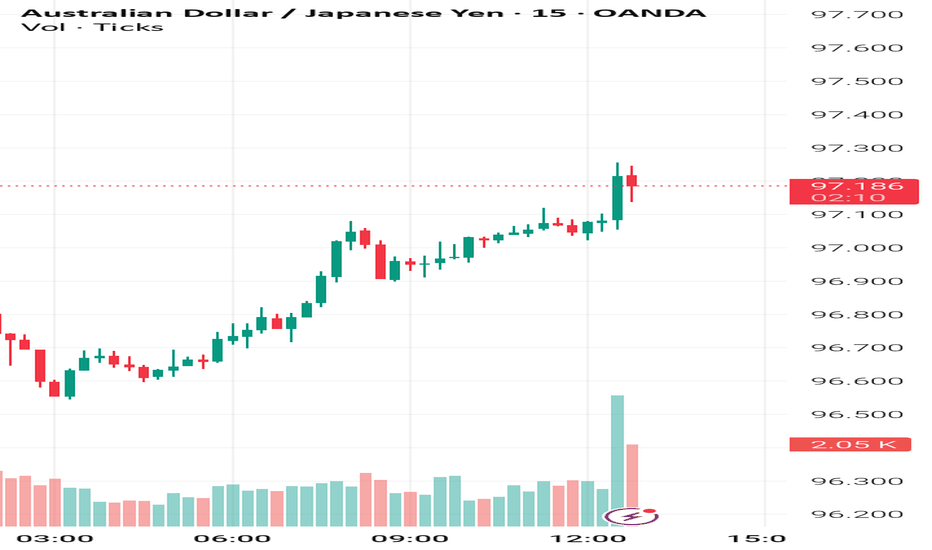

Trump v Powell: Round 6A day that looked like it was drifting into a 'summer lull' kind of day, suddenly had bouts of volatility when the TRUMP / POWELL SAGA re-emerged. Which is making it difficult to hold an opinion at the moment. If the president wins the battle and the FED cut rates more than expected, the USD (should) weaken. If Mr Powell (and the FED board) remain steadfast and keep the wait and see narrative, the USD (should) remain bouyed.

Yesterday's AUD JPY trade stopped out when the market ultimately decided the data didn't move the dial for potential rate cuts. It turned out that 'USD JPY long' would have been the optimal trade. And that's the risk you take when placing a trade 'post data' but 'pre US open'.

Of course, the risk to waiting for the US open is that the opportunity could have passed. It's a conundrum I don't think will ever have a clear answer.

Ultimately, I don't regret yesterday's trade given the information I had at that moment.

Inflation remains 'sticky' in the UK and a lot of emphasis is being put on Thursday's employment data. A 'soft' number will put the BOE in a bind of needing rate cuts to stimulate the economy, but unable to cut due to high inflation.

We also have upcoming AUD employment data, an improvement on last month is forecast, which should see the RBA remain hawkish. And I continue to hold my view that 'fundamentally' AUD JPY long is a good trade. It's just a case of waiting for the right moment. I have read that this week's JPY strength could be attributed to profit taking following recent weakness and ahead of elections in Japan this coming weekend.

Currently, it's a case of staying patient, maintaing a narrative. And trade when you feel like momentum backs up bias. If you only feel comfortable with a 1.2:1 risk reward, I would suggest that could be wise for the time being.

Tricky times, please feel free offervthoughtd or questions:

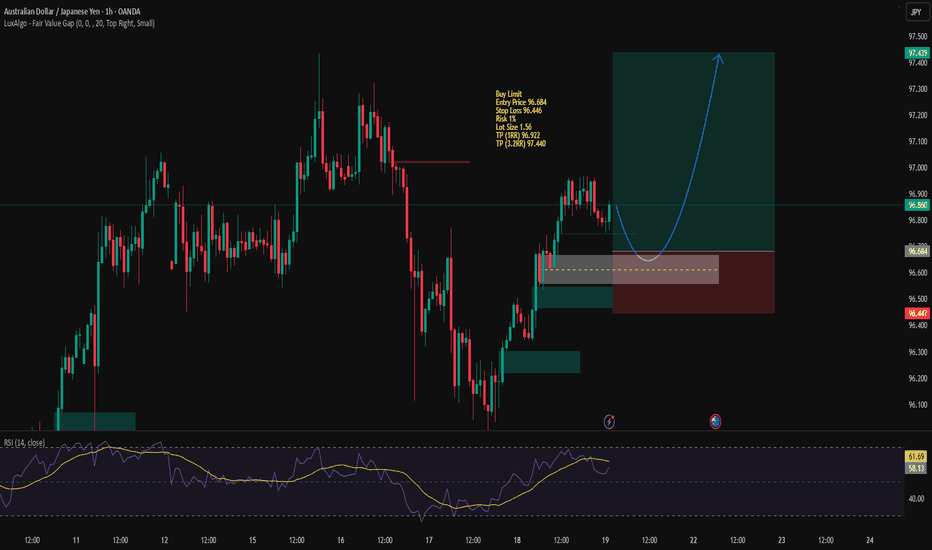

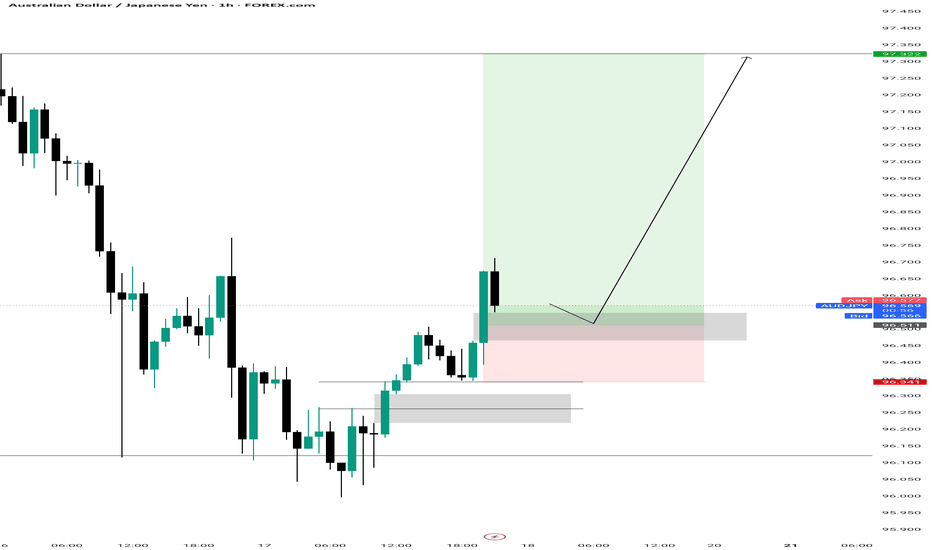

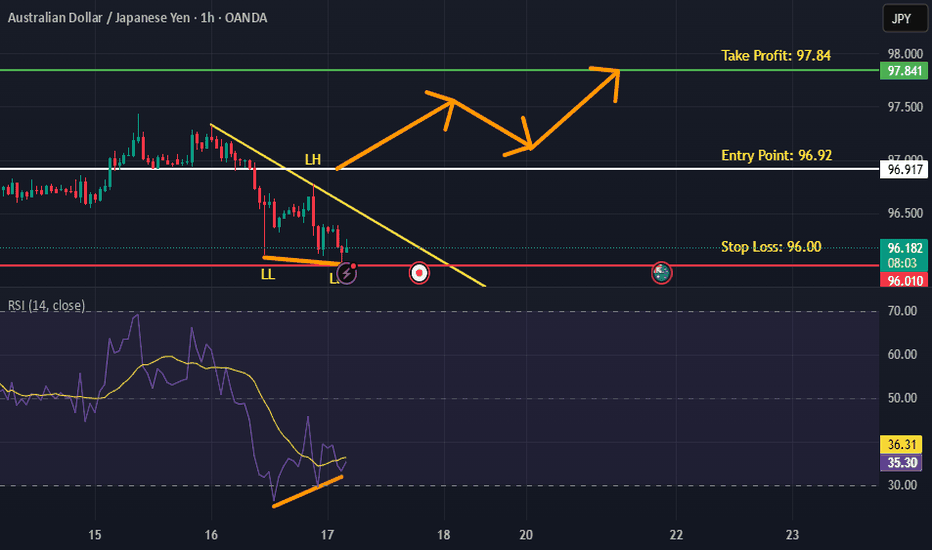

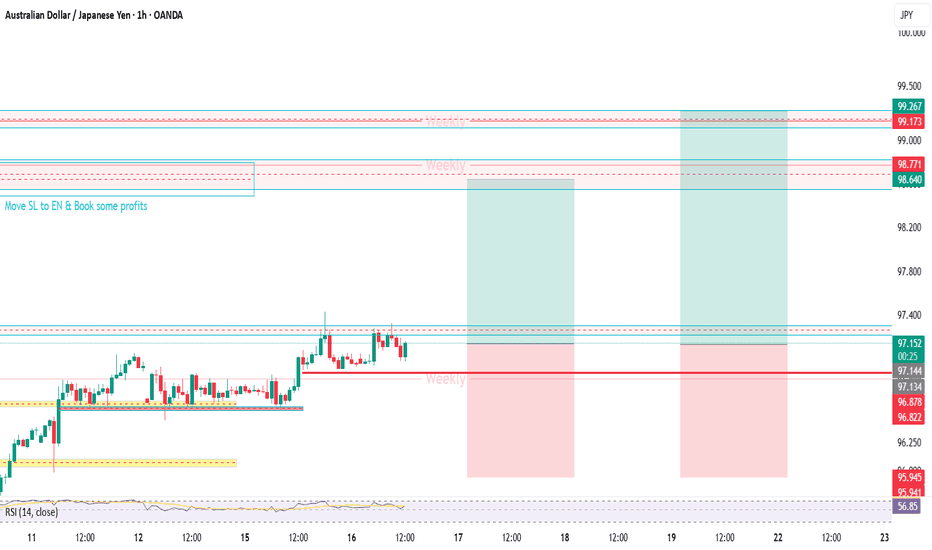

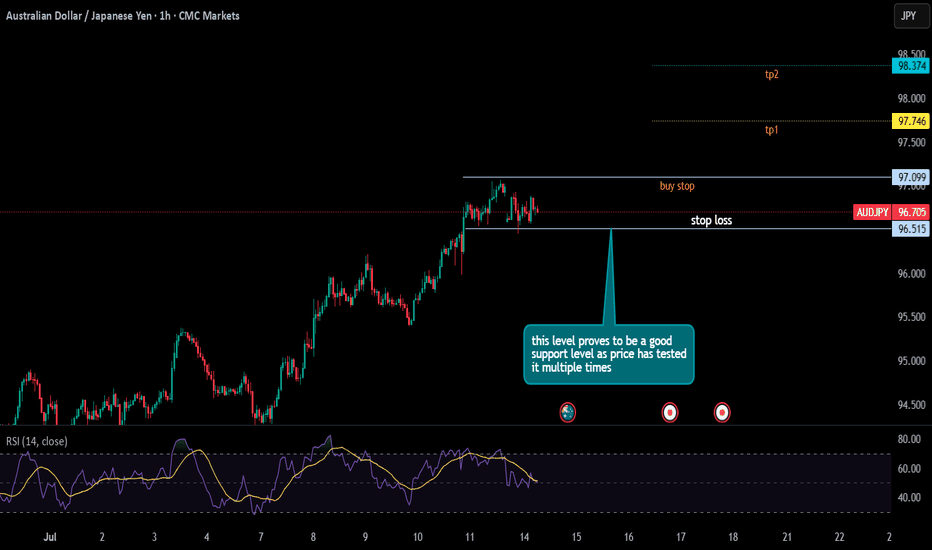

AUD/JPY Long Setup – Anticipating Continuation to Daily ResistanTimeframe: 1H

Bias: Bullish

Entry Zone: ~96.75

SL: Below PDH/POC region

TP1 (1R): 97.36

TP2 (2R): 97.93

Final Target: Daily resistance zone ~98.86

Idea Breakdown:

Price has been forming higher highs and higher lows, respecting both 50EMA and AVWAP on the hourly. After a solid breakout above recent structure and BOS confirmation, I’m looking to buy into a retracement toward the 0.382 fib level and low-volume node (96.70–96.75 region).

This zone also aligns with:

Previous breakout structure

PDH/PWH region

Value area low

EMA support

If price pulls back into this zone and holds, I expect bullish continuation targeting the next major resistance zones above.

Risk: Entry just above PDH with a stop below PDL and key structure

Reward: Clear path to 2R and higher with limited resistance overhead after breakout

Please note i am a amateur logging my own trades for reference and should not be copied

AUD JPY long. Entry: 97.13The market appears to like the month on month below forecast US CPI data.

The JPY is currently the weakest, I've therefore entered a straightforward 'risk on' AUD JPY catalyst trade.

It's a 20 pip stop loss with 30 pip profit target.

The risk to the trade is if the market changes its mind, or simply negative sentiment at the US open.