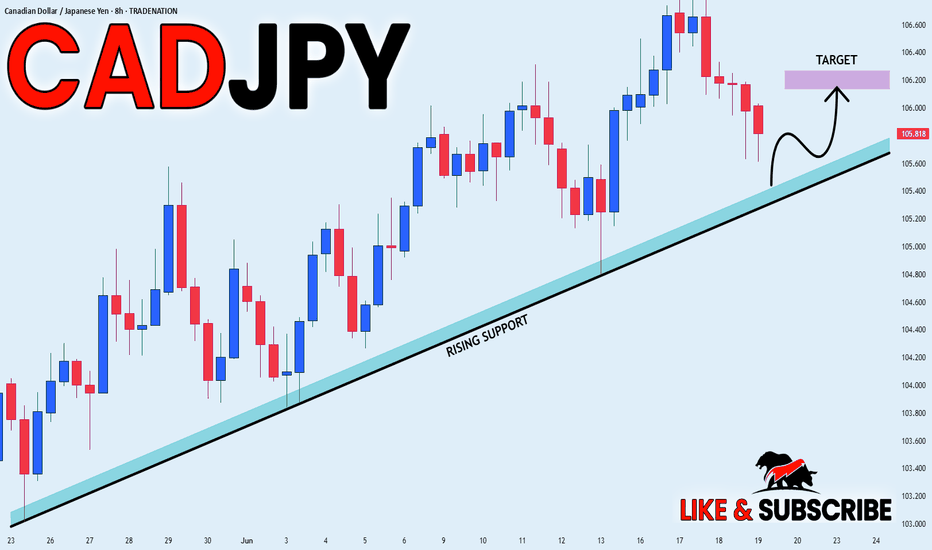

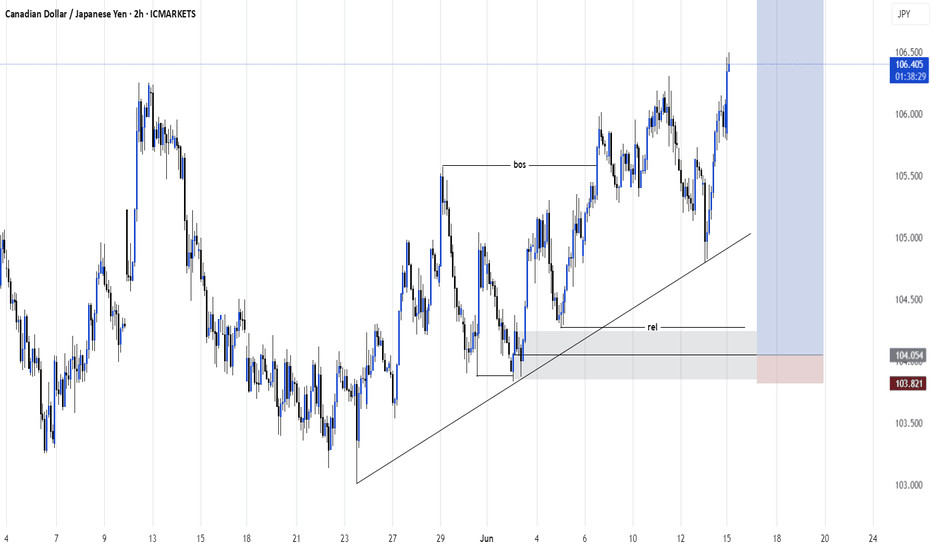

CAD_JPY WILL GROW|LONG|

✅CAD_JPY will soon hit

A rising support line and

As we are bullish biased

On the pair overall we will

Be expecting a local bullish

Rebound and a bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

JPYCAD trade ideas

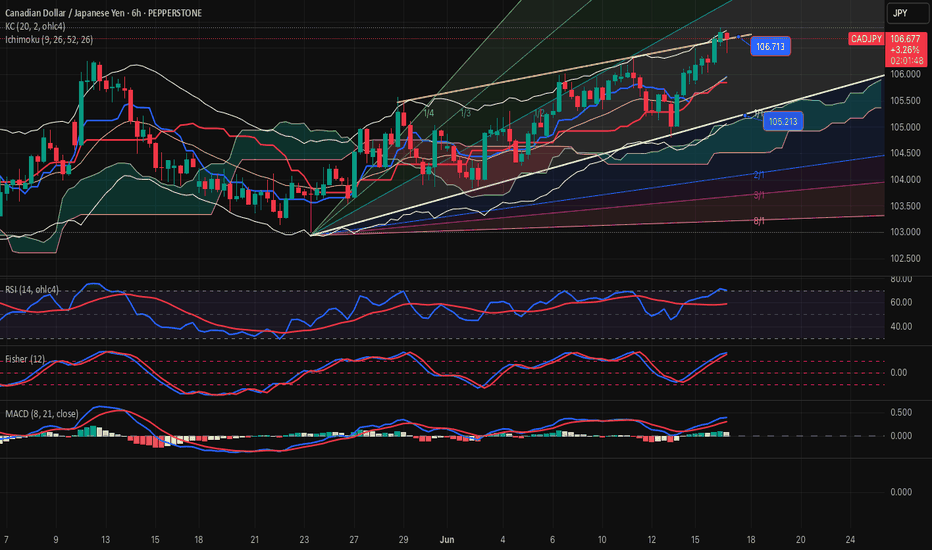

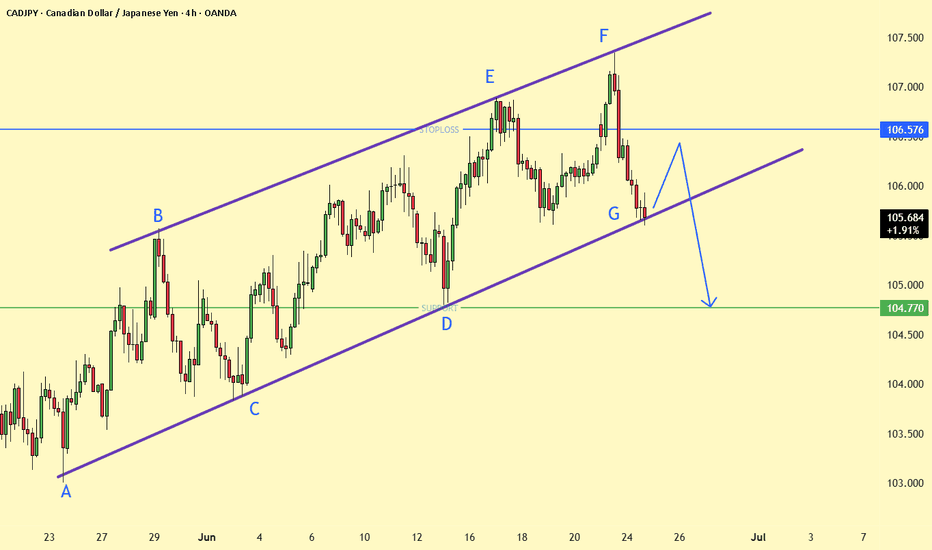

CADJPY-SELL strategy 6 hourly chart GANNThe pair is overbought, and we are trading around a resistance line 106.73. The indicators are not as yet negative, but considering the pattern, and also how much is has moved higher, the chances are seeing a decline in the coming sessions.

Strategy SELL @ 106.50-106.90 and take profit near 105.17 for now.

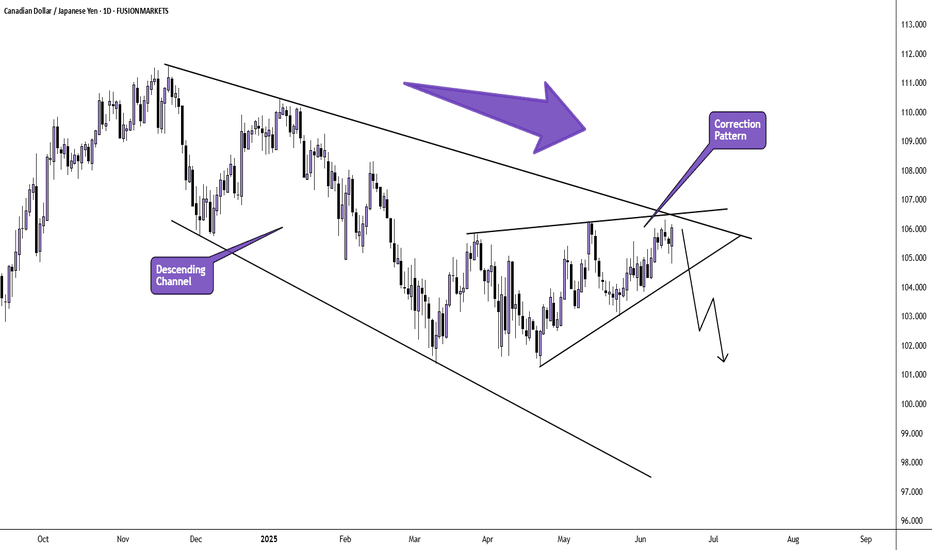

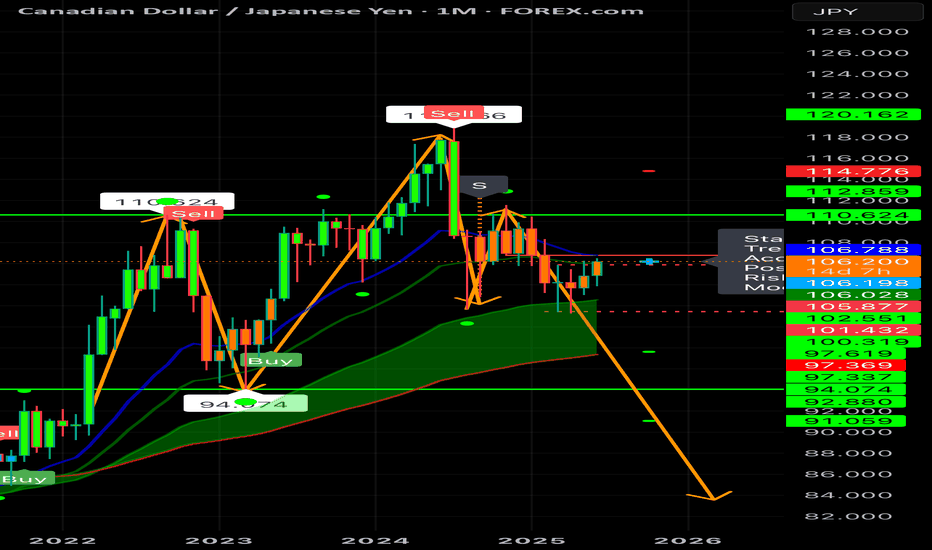

CAD/JPY Daily AnalysisZooming out, we can see that price is being dominated by the sellers as price moves within a bearish channel.

The most recent price action is printing in the shape of a triangle which can often be a correction pattern in a trending market.

Look for price to test the top of the triangle and see if it reverses (or we could potentially see a false break).

Then look for a break below the triangle if the bearish momentum continues further.

If you agree with the analysis, look for opportunities to trade that meet your own strategy rules and always use good risk management.

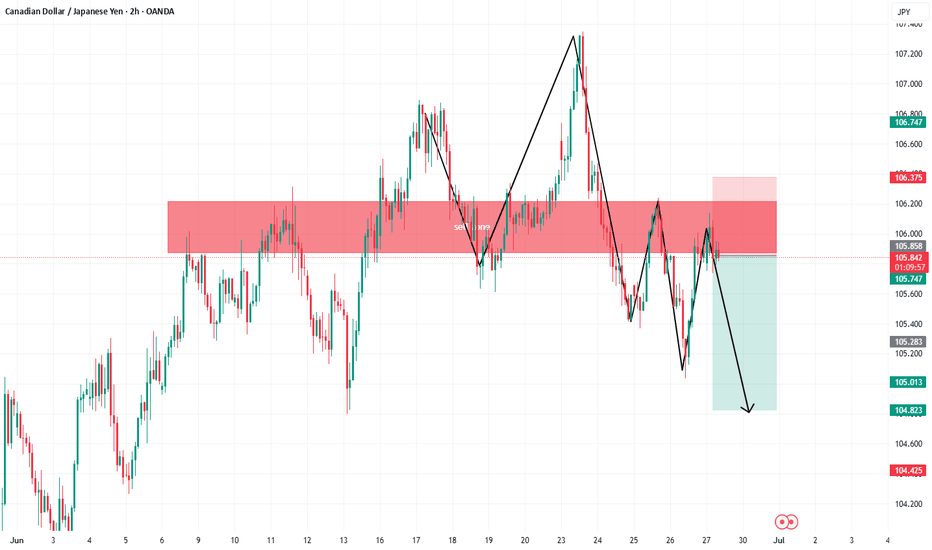

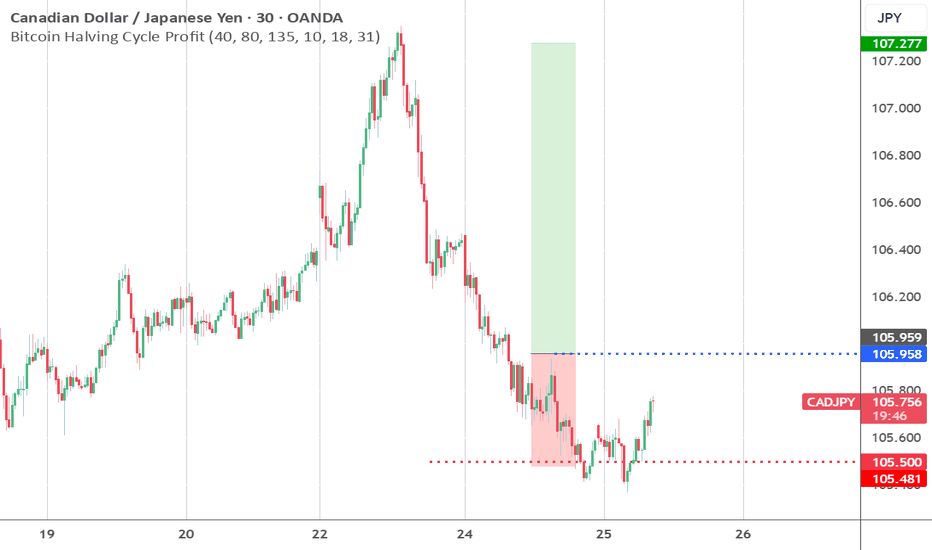

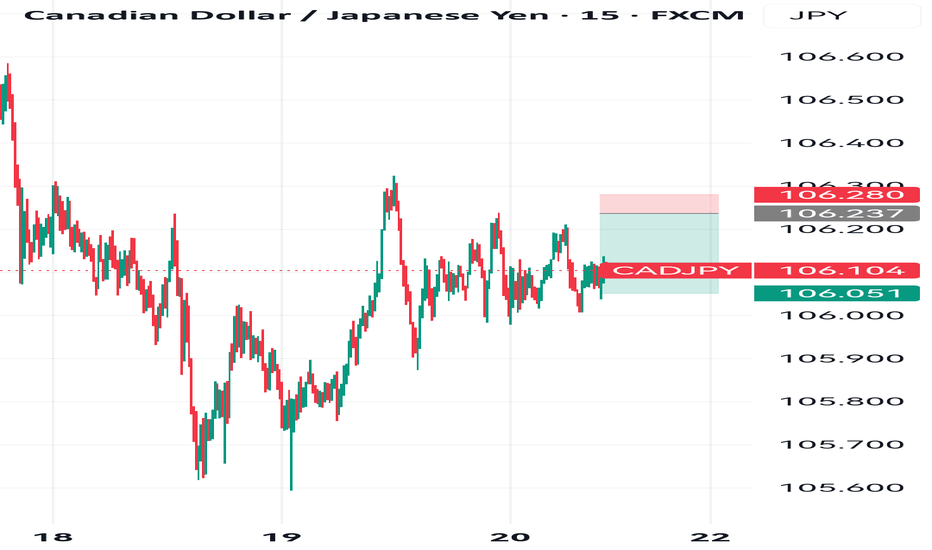

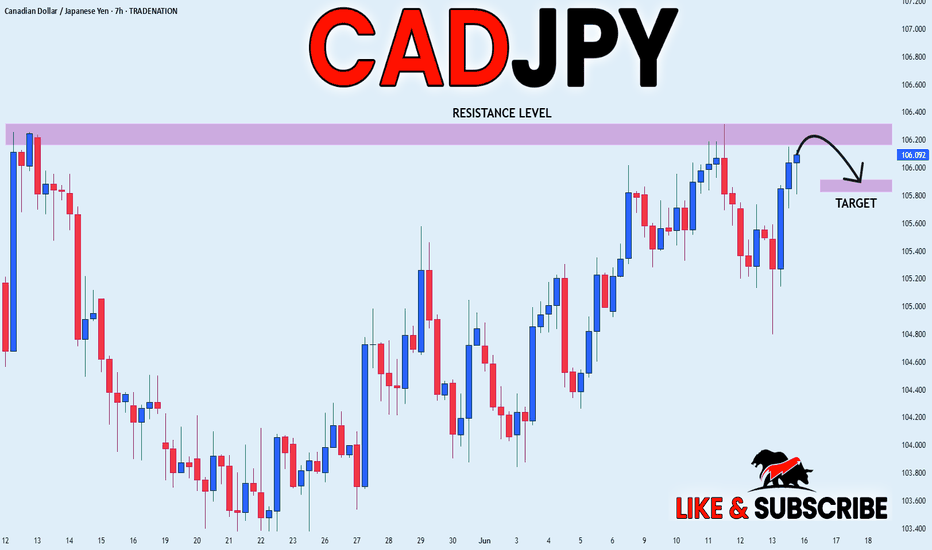

CAD-JPY Free Signal! Sell!

Hello,Traders!

CAD-JPY went up sharply

But the pair failed to break

A strong horizontal resistance

Of 106.266 from where we

Can enter a short trade with

The Take Profit of 105.768

And the Stop Loss of 106.326

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

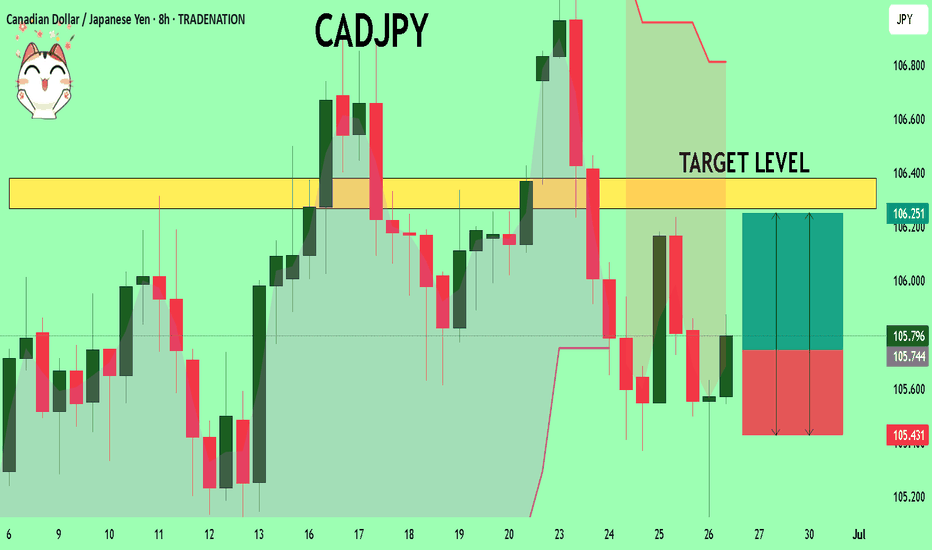

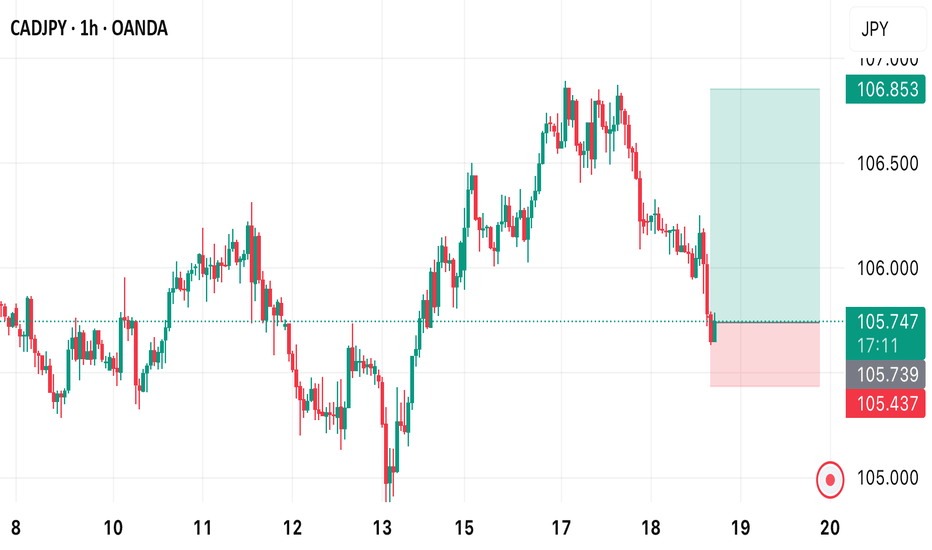

CADJPY What Next? BUY!

My dear friends,

Please, find my technical outlook for CADJPY below:

The instrument tests an important psychological level 105.74

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 106.26

Recommended Stop Loss - 105.43

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

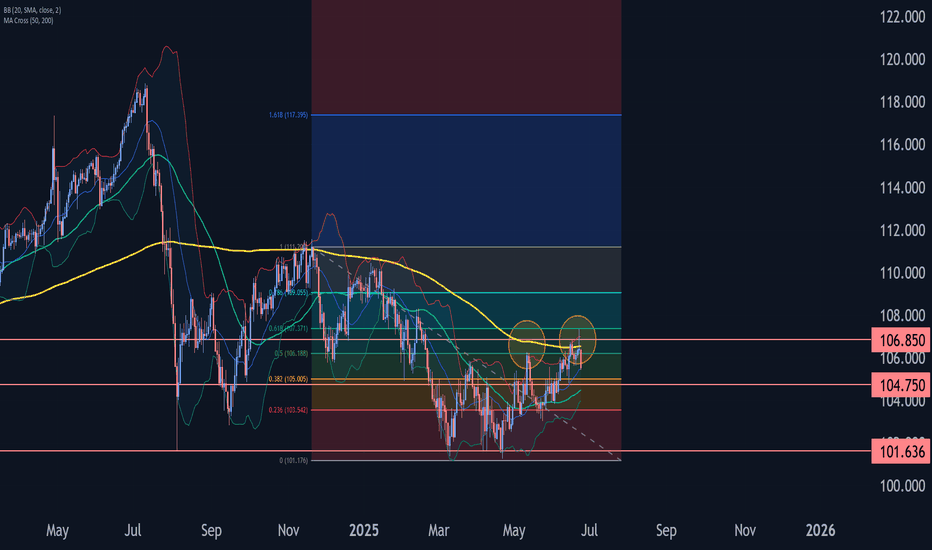

CADJPY Wave Analysis – 24 June 2025- CADJPY reversed from the resistance area

- Likely to fall to support level 104.75

CADJPY currency pair recently reversed down from the resistance area between the resistance level 106.85, the upper daily Bollinger Band and the 50% Fibonacci correction of the extended downward impulse from November.

The downward reversal from this resistance area created the daily Japanese candlesticks reversal pattern Shooting Star, which stopped the previous minor impulse wave 3.

Given the strength of the resistance level 106.85, CADJPY currency pair can be expected to fall to the next support level 104.75 (which reversed the pair earlier this month).

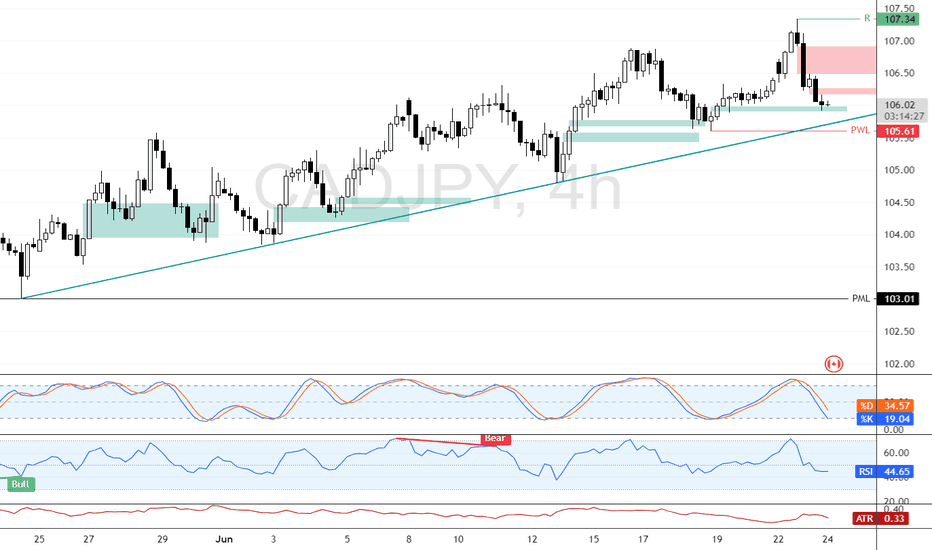

CAD/JPY Holds Trendline Support with Bullish Bias IntactFenzoFx—CAD/JPY dipped from 107.34, finding support at a bullish FVG while staying above the ascending trendline.

The Stochastic Oscillator signals oversold, suggesting a potential reversal. The outlook remains bullish above 105.61, targeting a retest of 107.35. A break below 105.61 would invalidate the bullish scenario.

Trade Idea: Sell CADJPY (Short-Term Risk-Off Play) **📉 Trade Idea: Sell CADJPY (Short-Term Risk-Off Play)**

**Bias:** 🔻 Bearish (Short-Term) | ⚖️ Medium-Term Neutral

**Idea:** Yen getting a safety bid, CAD softening — charts hint a cool-off is coming

---

### **💡 Why Sell?**

**🇯🇵 JPY Getting Support:**

* Risk-off tone is helping the yen hold ground 🛡️

* Inflation still above 3.5% = not as soft as BoJ sounds 🧯

* Yen tends to perk up in uncertainty — and we’re not short of that globally 🌍

* Traders cautious = safe-haven flows quietly leaning JPY’s way 🕊️

**🇨🇦 CAD Facing Pressure:**

* Oil pulling back = bad for CAD 🛢️📉

* BoC leaning dovish → interest rate edge fading 🎈

* Global risk jitters + soft data could dent CAD short-term 🧊

---

### **📊 Technical Feel (Objective & Intuitive):**

* **Price looks overextended:** Big moves lately — but candles are losing momentum 🛑

* **Stalling near recent highs:** Feels like buyers ran out of fuel just short of a breakout ⛽

* **RSI cooling off:** Not screaming reversal, but clearly backing off the highs 📉

* **MACD histogram shrinking:** Momentum tapering — not collapsing, just softening 🔻

* **Lower highs forming on intraday charts:** Nothing aggressive — just cracks showing 📉

* **Bearish rejection wicks starting to stack:** Subtle signs of hesitation at the top 🕯️

---

### **⚠️ Invalidation Clue:**

> If price snaps higher with strength and breaks structure — bulls still in control 🔼

> Until then, short-term correction looks likely

---

### **🎯 Summary:**

CADJPY looks due for a breather. Yen is quietly gaining on risk-off, and CAD’s not convincing right now.

Momentum’s fading — and sellers may get a **short-term edge** before trend resumes or stalls.

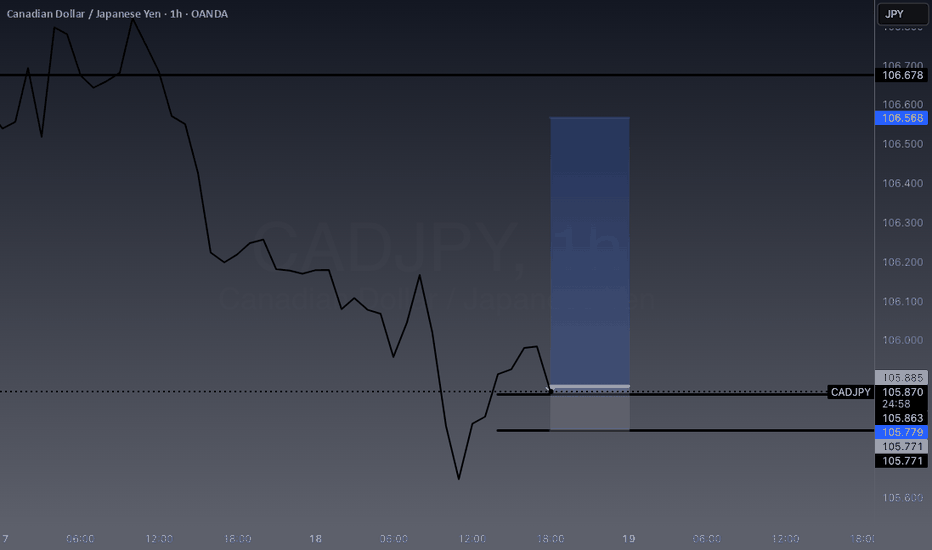

CAD/JPY Forecast tight Sl

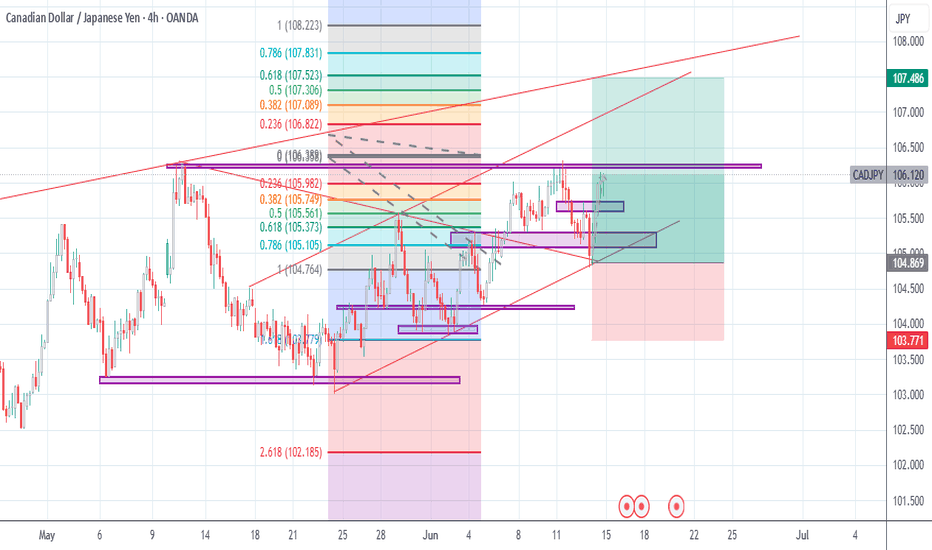

Price Structure & Key Levels

1. Resistance Zone:

- 106.000–106.122: Strong resistance cluster.

- 106.122 (swing high) and 106.000 (psychological barrier) are critical.

- Price rejection here suggests bearish pressure.

2. Immediate Support:

- 105.800–105.900: Near-term demand area.

- A break below 105.800 opens downside toward 105.600 (next support).

3. Critical Floor:

- 105.600: Major support.

- Loss of this level could accelerate declines toward 105.300–105.400.

Market Sentiment & Momentum

- Bearish Bias:

- Lower highs (106.122 → 106.000 → 105.900) indicate selling momentum.

- Price trading below 106.000 (psychological pivot) reinforces downside control.

Tactical Trade Setups

- Short Entries:

- Ideal near 106.000–106.122 (stop-loss above 106.200).

- Target: 105.600→ 105.300.

- Long Entries:

- Only if price holds 105.600 with reversal signals (e.g., bullish pin bar).

- Target: Scalping toward 105.900–106.000.

Always confirm with volume/RSI divergence and economic calendars. Trade safe! 🚀

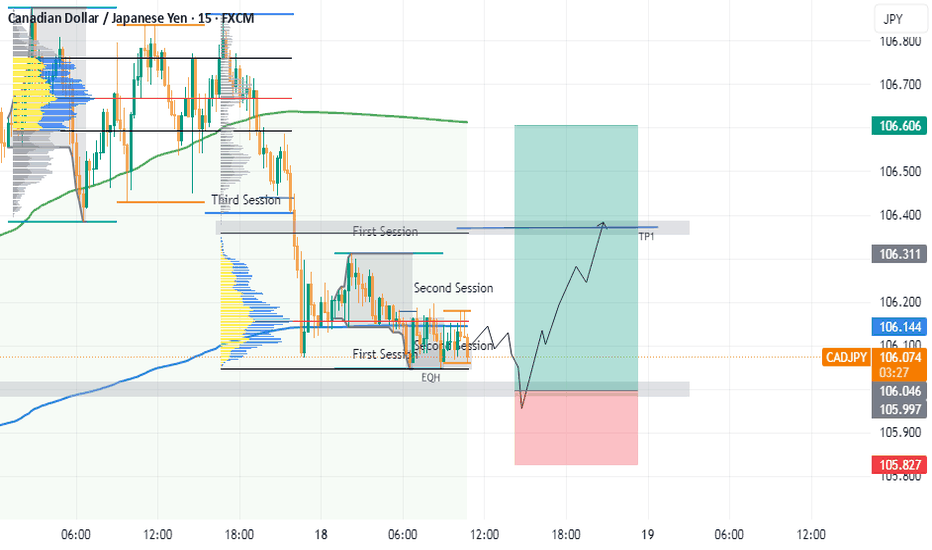

Short trade

📍 Pair: CADJPY

📅 Date: Tuesday, June 17, 2025

🕒 Time: 3:00 PM (NY Session PM)

⏱ Time Frame: 1 Hour

📈 Direction: Sell-side

📊 Trade Breakdown:

Entry Price 106.484

Profit Level 106.029 (0.43%)

Stop Loss 106.603 (0.11%)

Risk-Reward Ratio 3.82

🧠 Context / Trade Notes:

1H Structure-Based Entry:

Trade was observed on the 1-hour chart, and sell-side trade was undertaken due to a clear bearish market structure in play.

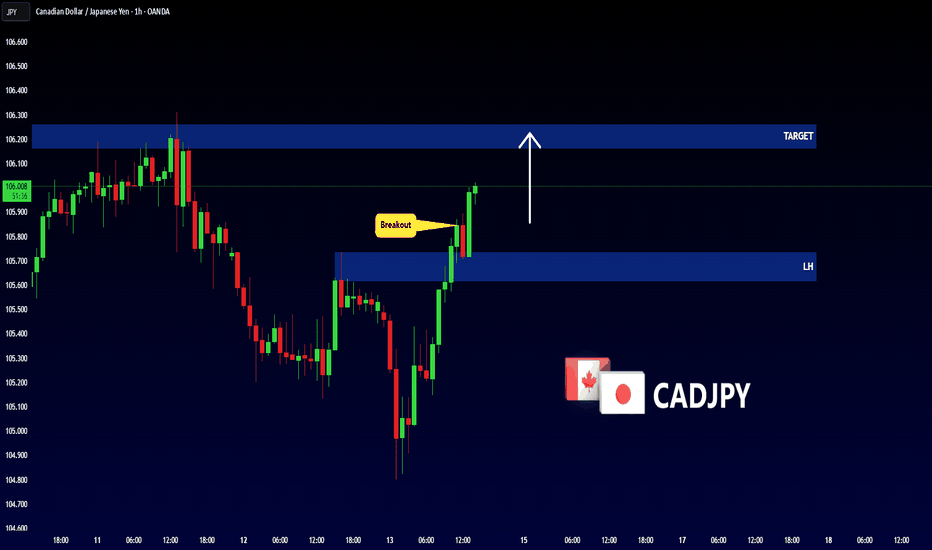

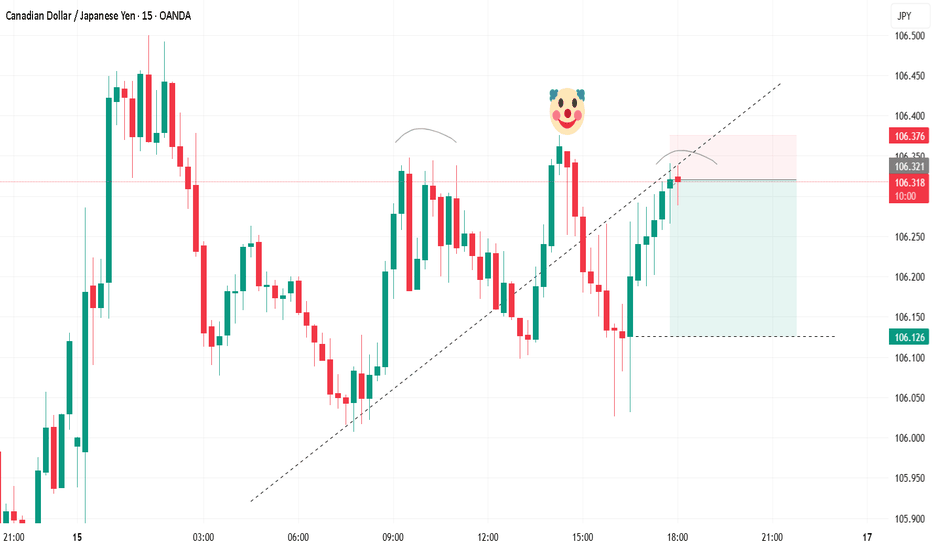

CAD_JPY RISKY SHORT|

✅CAD_JPY is going up now

But a strong resistance level is ahead at 106.318

Thus I am expecting a pullback

And a move down towards the target of 105.917

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.